Professional Documents

Culture Documents

Worksheet Roe

Uploaded by

Jaijeet SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Worksheet Roe

Uploaded by

Jaijeet SinghCopyright:

Available Formats

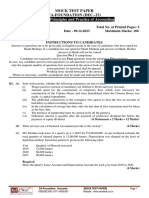

NEW ERA PUBLIC SCHOOL, SECTOR – 25, DWARKA

WORKSHEET – RECTIFICATION OF ERRORS

1. While trying to close his books for the year ended 31st March, 20 22, Mahesh found that the trial balance

did not agree. He traced the following error. Rectify:

(1) The Purchases Book was undercast by ₹500.

(2) The Sales Book was overcast by ₹ 100.

(3) ₹620 received from Mohan were posted to the debit of his A/c.

(4) The total of the credit of Bhushan’s A/c has been overadded by ₹ 800.

(5) A discount of ₹282 allowed to a customer has been credited to his account as ₹228.

(6) Goods for ₹ 1,200 returned to Kundan Lal, though entered in the Return Book has not been

posted to his account.

2. Rectify the following errors assuming that a suspense account was opened.

(a) Credit sales to Arun ₹7,000 were posted to the credit of his account.

(b) Credit purchases from Brij ₹9,000 were posted to the debit of his account as ₹6,000.

(c) Goods returned to Charu ₹4,000 were posted to the credit of her account.

(d) Goods returned from Deepika ₹ 1,000 were posted to the debit of her account as ₹2,000.

(e) Cash sales ₹2,000 were posted to the debit of sales account as ₹5,000.

[Ans. Total of Suspense A/c ₹ 25,000; Op. Balance ₹3,000]

3. Give Journal entries to rectify the following errors using Suspense Account, where necessary :—

(1) A credit purchase of ₹2,800 was passed through the Sales Day Book.

(2) Goods of the value of ₹2,000 returned by Mr. Gupta were entered in the Sales Day Book and posted

therefrom to the credit of his account.

(3) ₹2,600 stolen by an ex-employee stood debited to Suspense A/c.

(4) ₹3,000 received from a customer as an advance against order was credited to Sales A/c.

(5) A sum of ₹800 written off as depreciation on Machinery, were not posted to Depreciation A/c.

(6) Purchase of a Scooter was debited to conveyance account ₹ 16,000. Firm charges 10% depreciation

on vehicles.

(7) Payment of ₹500 to Mohan and ₹600 to Sohan was made but Mohan was debited with ₹600

and Sohan with ₹500.

(8) Sales to X ₹500 were posted to P’s Account.

4. Pass the rectification entries and show the suspense account in the books of a partnership firm, from the

following particulars :

(a) The total of sales return day book was over-cast by ₹ 1,000.

(b) Purchase of equipment, from Raj Mohan & Co., worth ₹2,000, in cash, was entered through the purchase

day book and accordingly, credited to the supplier’s account.

(c) Discount ₹500 allowed by P. Sahoo, a creditor, has not been entered in the books of account.

(d) ₹350 paid for carriage on sale of goods was credited to carriage inward account when posted from the

cash book.

(e) Bill receivable worth ₹ 1,800 received from a debtor was entered in the bills payable book though

correctly entered in the debtor’s account.

(f) A sum of ₹2,500 collected from Suraj Singh, a debtor, whose dues were already written off as bad

debt, was posted to the credit side of Suraj Singh account.

5. You are presented with a trial balance showing a difference, which has been carried to Suspense Account

and the following errors are revealed :

(a) ₹350 paid in Cash for a typewriter was charged to Office Expenses A/c.

(b) Goods amounting to ₹ 660 sold to W, were correctly entered in the Sales Book but posted to JFs Account

as ₹760. The total sales for the month were overcast by ₹ 1,000.

(c) Goods worth ₹ 130 returned by G, were entered in the Sales Book and posted therefrom to the credit of

G’s personal account.

(d) Goods sold for ₹ 1,240 and debited on 20th March to C, were returned by him on 23rd and taken into

stock on 31st March, no entries being made in the books for return.

(e) Sales return book was overcast by ₹ 100.

Journalise the necessary corrections and raise Suspense Account, assuming that there are no other erro₹

NEW ERA PUBLIC SCHOOL, SECTOR – 25, DWARKA

[Ans. Total of Suspense A/c ₹ 1260; Op. Balance ₹1,060]

6. A Book-keeper prepared a Trial balance on 31st March, 2022, which showed a difference of ₹2,715. The

difference was placed to the Debit of a Suspense A/c. The under mentioned errors were subsequently

discovered :—

1. ₹710, the total of Sales Return Book has been posted to the credit of the Purchases Return Account.

2. An item of ₹626 written off as a bad-debt from Chanderkant has not been debited to Bad-Debts A/c.

3. Goods sold to X and Y for ₹ 1,600 and ₹ 1,200 respectively, but were recorded in the Sales Book as to A

₹ 1,200 and Y as ₹ 1,600.

4. Goods of ₹850 were returned to Bhardwaj. It was recorded in Purchase Book as ₹580.

5. An amount of ₹675 for a Credit Sale to Govind, although correctly entered in the Sales Book, has been

wrongly posted as ₹756.

6. A sum of ₹375 owed by Ravi has been included in the list of Sundry Credito₹

7. An amount of ₹750 spent on the repairs of an old machinery has been debited to ‘Repairs A/c’.

Pass Journal entries to rectify the errors and prepare a Suspense Account.

[Ans. Total of Suspense A/c ₹2,796; Op. Balance ₹2,715]

7. Rectify the following errors assuming that suspense account was opened.

(a) Furniture purchased for ₹ 10,000 wrongly debited to Purchase Account as ₹4,000.

(b) Machinery purchased on credit from Raman for ₹20,000 recorded through Purchases Book as

₹6,000.

(c) Repairs on Machinery ₹ 1,400 debited to Machinery account as ₹2,400.

(d) Repairs on overhauling of second hand machinery purchased ₹2,000 was debited to Repairs account

as ₹200.

(e) Sale of old machinery at book value ₹3,000 was credited to Sales Account as ₹5,000.

[Ans. Total of Suspense A/c ₹9,800; Op. Balance ₹ 8,800]

8. Trial balance of Baishali did not agree and showed an excess debit of ₹ 16,300. He put the difference to

Suspense Account and discovered the following errors :

(a) Cash received from Rajat ₹5,000 was posted to the debit of Kamal as ₹6,000.

(b) Salaries paid to an employee ₹2,000 were debited to his personal account as ₹ 1,200.

(c) Goods withdrawn by proprietor for personal use ₹ 1,000 were credited to Sales Account as ₹ 1,600.

(d) Depreciation provided on Machinery ₹3,000 was posted to Machinery Account as ₹300.

(e) Sale of old car for ₹ 10,000 was credited to Sales Account as ₹6,000. Rectify the errors and prepare

Suspense Account. [Ans. Total of Suspense A/c ₹17,700; Op. Balance ₹ 16,300]

9. Trial Balance of SKY did not agree. He put the difference to Suspense Account and discovered the

following errors :

(a) Credit sales to Manas ₹ 16,000 were recorded in the Purchases Book as ₹ 10,000 and posted to the

debit of Manas as ₹ 1,000.

(b) Furniture purchased from Noor ₹6,000 was recorded through purchases book as ₹5,000 and posted

to the debit of Noor ₹2,000.

(c) Goods returned to Rai ₹3,000 recorded through the Sales Book as ₹ 1,000.

(d) Old machinery sold for ₹2,000 to Maneesh recorded through Sales Book as ₹ 1,800 and posted to

the credit of Maneesh as ₹1,200.

(e) Total of Returns Inwards Book ₹2,800 posted to Purchase Account.

Rectify the above errors and prepare Suspense Account to ascertain the difference in Trial Balance.

[Ans. Total of Suspense A/c ₹ 18,000; Op. Balance ₹ 15,000]

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Rectification of ErrorDocument2 pagesRectification of ErrorHARDIK SINGHVINo ratings yet

- Assignment 3Document2 pagesAssignment 3Sudhir SinhaNo ratings yet

- SuspenseDocument2 pagesSuspenseDipankar MallickNo ratings yet

- 8 Rectification of Error 08-2022 RegularDocument5 pages8 Rectification of Error 08-2022 RegularVasanta ParateNo ratings yet

- 28 Days Accounts Challenge-1Document13 pages28 Days Accounts Challenge-1krishnaeatpute777No ratings yet

- Ch-2, Unit-6, Rectification of ErrorDocument6 pagesCh-2, Unit-6, Rectification of ErrorAFTAB KHANNo ratings yet

- Module - 7 Problems On Rectification of ErrorsDocument2 pagesModule - 7 Problems On Rectification of ErrorsYash PratapNo ratings yet

- 54103bos43406 p1Document31 pages54103bos43406 p1Aman GuptaNo ratings yet

- XI Pre-BoardDocument7 pagesXI Pre-BoardSamar Singh Rathore0% (1)

- Accountancy XI Half Yearly WorksheetDocument8 pagesAccountancy XI Half Yearly WorksheetDeivanai K CSNo ratings yet

- CAFC - Accountancy - Revision NotesDocument19 pagesCAFC - Accountancy - Revision Notesrmercy323No ratings yet

- TS Grewal Solutions For Class 11 Accountancy Chapter 13 - Rectification of ErrorsDocument57 pagesTS Grewal Solutions For Class 11 Accountancy Chapter 13 - Rectification of ErrorsDhruv ThakkarNo ratings yet

- Class 11 Final MTSSDocument7 pagesClass 11 Final MTSSPranshu AgarwalNo ratings yet

- Qus. MTP Accounts - 09.12.23Document5 pagesQus. MTP Accounts - 09.12.23karann021003No ratings yet

- Uspense Account DRDocument4 pagesUspense Account DRYousaf JamalNo ratings yet

- Accountancy Sample PaperDocument6 pagesAccountancy Sample PaperDevansh BawejaNo ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- Accounts RTP Foundation Nov 2020Document25 pagesAccounts RTP Foundation Nov 2020Jayasurya MuruganathanNo ratings yet

- Ambience Acdmy: STD 11 Commerce AccountDocument3 pagesAmbience Acdmy: STD 11 Commerce AccountMenu GargNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- 40 Marks Test I BRS & ROE I CTC ClassesDocument4 pages40 Marks Test I BRS & ROE I CTC Classesbhuvannagarwal.pktNo ratings yet

- 11th Accounts Mock Paper-1Document2 pages11th Accounts Mock Paper-1Aliasgar ZaverNo ratings yet

- Time: 55 Mins. Accountancy-Xi MM: 25Document2 pagesTime: 55 Mins. Accountancy-Xi MM: 25Sudhanshu guptaNo ratings yet

- A1757587756 - 23892 - 20 - 2019 - Rectification of ErrorsDocument27 pagesA1757587756 - 23892 - 20 - 2019 - Rectification of ErrorsGaurav AnandNo ratings yet

- Errors That Can Be Revealed by A Trial Balance-Exercise 1Document1 pageErrors That Can Be Revealed by A Trial Balance-Exercise 1nyashamutumbwaNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Fe - Accountancy Xi Set ADocument6 pagesFe - Accountancy Xi Set AAntariksh SainiNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument25 pagesPaper - 1: Principles & Practice of Accounting Questions True and Falsegargee thakareNo ratings yet

- Error of CorrectionDocument8 pagesError of CorrectionTeo Yu XuanNo ratings yet

- Vidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"Document5 pagesVidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"sonubudsNo ratings yet

- Acc Xi See QP With BP, MS-31-43Document13 pagesAcc Xi See QP With BP, MS-31-43Sanjay PanickerNo ratings yet

- Session Ending Examination 2019Document7 pagesSession Ending Examination 2019madhudevi06435No ratings yet

- AtibhaDocument7 pagesAtibhaAangry VermaNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- Practice PaperDocument13 pagesPractice PaperArush BlagganaNo ratings yet

- Acc Xi See QP With BP, Ms-31-43Document13 pagesAcc Xi See QP With BP, Ms-31-43AmiraNo ratings yet

- Term 1 QP XI - Subjective Paper 40 MarksDocument3 pagesTerm 1 QP XI - Subjective Paper 40 MarksAditiNo ratings yet

- Rectification of Error1Document4 pagesRectification of Error1Typical GamerNo ratings yet

- Class 11 Accounts SP 1Document6 pagesClass 11 Accounts SP 1UdyamGNo ratings yet

- FINANCIAL ACCOUNITNG B.com-I Rizwan AnjumDocument2 pagesFINANCIAL ACCOUNITNG B.com-I Rizwan AnjumsajidNo ratings yet

- Doe Paper 2Document6 pagesDoe Paper 2prince bhatiaNo ratings yet

- Test 4Document6 pagesTest 4Jayant MittalNo ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- MCQs Financial AccountingDocument12 pagesMCQs Financial AccountingPervaiz ShahidNo ratings yet

- CA Foundation Accounts RTP Nov22Document29 pagesCA Foundation Accounts RTP Nov22adityatiwari122006No ratings yet

- Worksheet - Rectification of ErrorsDocument3 pagesWorksheet - Rectification of ErrorsRajni Sinha VermaNo ratings yet

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocument4 pagesSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanNo ratings yet

- Accounting Final Sendup 2013Document3 pagesAccounting Final Sendup 2013Mozam MushtaqNo ratings yet

- ACC XI SEE QP For RevisionDocument31 pagesACC XI SEE QP For Revisionvarshitha reddyNo ratings yet

- Exam 3Document5 pagesExam 3MahediNo ratings yet

- Kendriya Vidyalaya Sangathan, Mumbai Region Term-II Examination 2021-22 Accountancy (055) Set-Iii XIDocument5 pagesKendriya Vidyalaya Sangathan, Mumbai Region Term-II Examination 2021-22 Accountancy (055) Set-Iii XIIRSHAD HUSSAINNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalsePiyush GoyalNo ratings yet

- 07 - Mock Paper 1Document6 pages07 - Mock Paper 1monster gamerNo ratings yet

- Asm 2670Document3 pagesAsm 2670Pushkar MittalNo ratings yet

- Fall 2009 Past PaperDocument4 pagesFall 2009 Past PaperKhizra AliNo ratings yet

- RTP Dec2023 p1Document32 pagesRTP Dec2023 p1Vaibhav M S100% (1)

- 438Document6 pages438Rehan AshrafNo ratings yet

- Abm 1-W6.M3.T1.L3Document21 pagesAbm 1-W6.M3.T1.L3mbiloloNo ratings yet

- Group - 3 - Assignment (Term Paper)Document13 pagesGroup - 3 - Assignment (Term Paper)Biniyam YitbarekNo ratings yet

- Unit 4: Indian Accounting Standard 23: Borrowing Costs: After Studying This Unit, You Will Be Able ToDocument31 pagesUnit 4: Indian Accounting Standard 23: Borrowing Costs: After Studying This Unit, You Will Be Able ToSri KanthNo ratings yet

- 04 Understanding Balance Sheets & Cash Flow Statements PDFDocument58 pages04 Understanding Balance Sheets & Cash Flow Statements PDFLIMANo ratings yet

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of Accountschristine anglaNo ratings yet

- Banking Regulation Act 1949Document23 pagesBanking Regulation Act 1949Preety LataNo ratings yet

- Accounting Cycle ProblemDocument13 pagesAccounting Cycle Problemapi-300305341No ratings yet

- The Balance Sheet Items For CIBDocument1 pageThe Balance Sheet Items For CIBKhalid Al SanabaniNo ratings yet

- PARCOR DiscussionDocument6 pagesPARCOR DiscussionSittiNo ratings yet

- Case Study - : The Chubb CorporationDocument6 pagesCase Study - : The Chubb Corporationtiko bakashviliNo ratings yet

- Closing Fixed Assets in R12 WPDocument6 pagesClosing Fixed Assets in R12 WPKelly WilkinsonNo ratings yet

- Answer: A Cash in Bank - Tsunami Bank P432,710 Petty Cash Fund 10,250 Time Deposit 1,000,000Document8 pagesAnswer: A Cash in Bank - Tsunami Bank P432,710 Petty Cash Fund 10,250 Time Deposit 1,000,000Live LoveNo ratings yet

- CA Inter FM Xpress Revision NotesDocument48 pagesCA Inter FM Xpress Revision NotesRaghav PrajapatiNo ratings yet

- BMW Vs APPLE - IFRS PDFDocument4 pagesBMW Vs APPLE - IFRS PDFbernardocampeloNo ratings yet

- Chapter 1 and DIYDocument8 pagesChapter 1 and DIYJymldy EnclnNo ratings yet

- MGT101 Quiz 1 Solved Spring 2021Document12 pagesMGT101 Quiz 1 Solved Spring 2021Sipra SaibNo ratings yet

- SPRING 2018 BUS 498 EXIT ASSESSMENT TEST Questions - NSUDocument8 pagesSPRING 2018 BUS 498 EXIT ASSESSMENT TEST Questions - NSURafina Aziz 1331264630No ratings yet

- Region IX, Zamboanga Peninsula Burgos ST., Molave, Zamboanga Del Sur 7023 Tel No. (062) 2251 507/ School ID No. 303797Document7 pagesRegion IX, Zamboanga Peninsula Burgos ST., Molave, Zamboanga Del Sur 7023 Tel No. (062) 2251 507/ School ID No. 303797Charlyn CastroNo ratings yet

- FABM2 Q1 Module 4 Statement of Cash Flows - editEDDocument19 pagesFABM2 Q1 Module 4 Statement of Cash Flows - editEDJanmark GatchalianNo ratings yet

- Tugas 13 - C17 - Working Capital ManagementDocument10 pagesTugas 13 - C17 - Working Capital ManagementIqbal BaihaqiNo ratings yet

- A Study On Comparative Analysis of PCARD and DCC Bank at Primary Co-Operative and Agriculture Rural Development BankDocument72 pagesA Study On Comparative Analysis of PCARD and DCC Bank at Primary Co-Operative and Agriculture Rural Development BankDiva U SNo ratings yet

- Introduction To Princple Financial Accounting PDFDocument11 pagesIntroduction To Princple Financial Accounting PDFMardhiah RamlanNo ratings yet

- Tugas AKL 1 TM 9Document8 pagesTugas AKL 1 TM 9Dila PujiNo ratings yet

- Budgeting 101: By: Limheya Lester Glenn National University-ManilaDocument42 pagesBudgeting 101: By: Limheya Lester Glenn National University-ManilaXXXXXXXXXXXXXXXXXXNo ratings yet

- Financial Management Notes: Note:The Information Provided Here Is Only For Reference - It May Vary The OriginalDocument68 pagesFinancial Management Notes: Note:The Information Provided Here Is Only For Reference - It May Vary The OriginalNittala SandeepNo ratings yet

- Financial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusDocument29 pagesFinancial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusHanabusa Kawaii IdouNo ratings yet

- FIN 600 Assignment - FormattedDocument20 pagesFIN 600 Assignment - FormattedNeha Bhagat0% (1)

- Supplemental Guide: Module 4: Reporting & TroubleshootingDocument75 pagesSupplemental Guide: Module 4: Reporting & TroubleshootingEdward DubeNo ratings yet

- DELL LBO Model Part 1 CompletedDocument45 pagesDELL LBO Model Part 1 CompletedascentcommerceNo ratings yet

- Ringkasan Kinerja Perusahaan TercatatDocument3 pagesRingkasan Kinerja Perusahaan TercatatDian PrasetyoNo ratings yet