Professional Documents

Culture Documents

Notes

Notes

Uploaded by

Black Jack RythmsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes

Notes

Uploaded by

Black Jack RythmsCopyright:

Available Formats

INCORPORATION OF COMPANY & MATTERS

INCIDENTAL THERETO 2.3

1. INTRODUCTION TO INCORPORATION OF

COMPANIES

A company is a separate legal entity with perpetual succession for lawful purpose.

Development of this concept is equally significant in economic terms as invention

of steam engine is for the industrial revolution.

Persons who initiate promotion of a company are known as promoters. All persons

who take steps for the registration of a company e.g., those associated with the

preparation of a prospectus or in drawing up the Memorandum of Association of

the company and assisting in its registration are regarded as promoters.

The Companies Act, 2013 defines the term “Promoter” under section 2(69) which

means a person—

(a) who has been named as such in a prospectus or is identified by the company

in the annual return referred to in section 92; or

(b) who has control over the affairs of the company, directly or indirectly whether

as a shareholder, director or otherwise; or

(c) in accordance with whose advice, directions or instructions the Board of

Directors of the company is accustomed to act.

However, a person who is acting merely in a professional Capacity, shall not be

regarded as promoter [under (c)], e.g., the solicitor, banker, accountant etc. are not

regarded as promoters.

2. FORMATION OF COMPANY (SECTION 3)

Companies are broadly of below types:

Company

Private (Including One Person

Public

Company)

Ltd. by Ltd. by Ltd. by

Unlimited Ltd. by Shares Unlimited

Shares Guarantee Guarantee

with capital with capital with captial with captial

without without without without

capital capital capital capital

© The Institute of Chartered Accountants of India

2.4 CORPORATE AND OTHER LAWS

As you can observe in above chart that companies could be with limited liability

(by shares or guarantee) or with unlimited liability. 1&2

Note: For Government Companies, suffix “Pvt. Ltd / Ltd.” not required

(Notification dated 5th June 2015). This exception shall be applicable to a

government company which has not committed a default in filing its financial

statements under section 137 or annual return under section 92 with the Registrar

of companies [Notification dated 13th June 2017].

Section 3 of the Companies Act, 2013 deals with the basic requirement with respect

to the constitution of the company. In the case of a public company with or without

limited liability, any 7 or more persons (i.e. minimum number of shareholders) can

form a company for any lawful purpose by subscribing their names to

memorandum and complying with the requirements of this Act in respect of

registration. In exactly the same way, 2 or more persons can form a private company

and 1 person where company to be formed is one person company (OPC).

However, that one person company (OPC) need to specify the name of one

nominee in the Memorandum of Association (MOA) who would take his place in

case of his death or his incapacity to contract. The nominee could be changed as

per the process and this will not attract process for alteration of the Memorandum

of Association.

Formation of Company [Section 3]

(1) A company may be formed for any lawful purpose by—

(a) 7 or more persons, where the company to be formed is to be a public

company;

(b) 2 or more persons, where the company to be formed is to be a private

company; or

(c) 1 person, where the company to be formed is to be One Person Company

that is to say, a private company,

by subscribing their names or his name to a memorandum and complying with the

requirements of this Act in respect of registration.

1

Provided that a Specified IFSC public or Specified IFSC Private company shall be formed only

as a company limited by shares.

2

IFSC company means a company incorporated in any International Financial Services Center in

India, like in Gujarat International Finance Tec-City.

© The Institute of Chartered Accountants of India

INCORPORATION OF COMPANY & MATTERS

INCIDENTAL THERETO 2.5

Public Company Private Company One Person Company

7 or more 2 or more 1

Persons Persons Person

The memorandum of One Person Company shall indicate the name of the other

person (i.e. Nominee), with his prior written consent in the prescribed form, who

shall, in the event of the subscriber's death or his incapacity to contract become

the member of the company and the written consent of such person shall also be

filed with the Registrar at the time of incorporation of the One Person Company

along with its memorandum and articles.

However, such other person may withdraw his consent in such manner as may be

prescribed.

The member of One Person Company (OPC) may at any time change the name of

Nominee by giving notice in such manner as may be prescribed.

It shall be the duty of the member of One Person Company (OPC) to intimate the

company the change, if any, in the name of the other person nominated by him by

indicating in the memorandum or otherwise within such time and in such

manner as may be prescribed, and the company shall intimate the Registrar any

such change within such time and in such manner as may be prescribed.

However, any such change in the name of the person shall not be deemed to be an

alteration of the memorandum.

(2) A company formed under sub-section (1) may be either—

(a) a company limited by shares; or

(b) a company limited by guarantee; or

(c) an unlimited company.

Members severally liable in certain cases [Section 3A]

• If at any time the number of members of a company is reduced,

in the case of a public company, below 7,

in the case of a private company, below 2,

and the company carries on business for more than six months while the

number of members is so reduced, then

© The Institute of Chartered Accountants of India

2.6 CORPORATE AND OTHER LAWS

• every person who is a member of the company during the time that it so

carries on business after those six months and is cognizant (aware) of the fact

that it is carrying on business with less than seven members or two members,

as the case may be,

• shall be severally liable for the payment of the whole debts of the company

contracted during that time (after six months) and may be severally sued

therefore.

3. INCORPORATION OF COMPANY [SECTION 7]

I. INCORPORATION OF COMPANY: Section 7 of the Companies Act, 2013

provides for the procedure to be followed for incorporation of a company.

•STEPS FOR INCORPORATION

•Reservation of name by filing e- apllication

1.

•Drafting & signing of MOA & AOA and its submission to ROC. These

2. documents have to be e-filed and e-stamped

•Consent of persons nominated as directors to act as directors to be

3. submittted electronically

•Submission of statutory declaration of compliances and other

4. declarations

•Pay fees & amount of stamp duty electonically

5.

•Obtain certificate of incorporation digitally signed by ROC

6.

7. •File declaration about address of Registered office

Note: New requirement of submitting declaration that all subscribers have paid

the value of shares agreed to be taken by him and verification of Registered office

has been filed. This requirement is needed to be complied with before the

commencement of business.

© The Institute of Chartered Accountants of India

INCORPORATION OF COMPANY & MATTERS

INCIDENTAL THERETO 2.7

(1) Filing of the documents and information with the registrar: For the

registration of the company following documents and information are required to

be filed with the registrar within whose jurisdiction the registered office of the

company is proposed to be situated—

♦ the memorandum of association and articles of association of the company

duly signed by all the subscribers to the memorandum.

♦ a declaration by person who is engaged in the formation of the company (an

advocate, a chartered accountant, cost accountant or company secretary in

practice) and by a person named in the articles (director, manager or

secretary of the company), that all the requirements of this act and the rules

made thereunder in respect of registration and matters precedent or

incidental thereto have been complied with.

♦ a declaration from each of the subscribers to the memorandum and from

persons named as the first directors, if any, in the articles stating that—

he is not convicted of any offence in connection with the promotion,

formation or management of any company, or

he has not been found guilty of any fraud or misfeasance or of any

breach of duty to any company under this Act or any previous company

law during the last five years,

and that all the documents filed with the Registrar for registration of

the company contain information that is correct and complete and true

to the best of his knowledge and belief;

♦ the address for correspondence till its registered office is established;

♦ the particulars (names, including surnames or family names, residential

address, nationality) of every subscriber to the memorandum along with

proof of identity, and in the case of a subscriber being a body corporate, such

particulars as may be prescribed.

♦ the particulars (name, including surname or family name, the Director

Identification Number (DIN), residential address, nationality) of the persons

mentioned in the articles as the first directors and such other particulars

including proof of identity as may be prescribed; and

♦ the particulars of the interests of the persons mentioned in the articles as the first

directors of the company in other firms or bodies corporate along with their

consent to act as directors of the company in such form and manner as may be

prescribed.

© The Institute of Chartered Accountants of India

2.8 CORPORATE AND OTHER LAWS

(2) Issue of certificate of incorporation on registration: The Registrar on the

basis of documents and information filed, shall register all the documents and

information in the register and issue a certificate of incorporation in the prescribed

form to the effect that the proposed company is incorporated under this Act.

(3) Allotment of Corporate Identity Number (CIN): On and from the date

mentioned in the certificate of incorporation, the Registrar shall allot to the

company a corporate identity number, which shall be a distinct identity for the

company and which shall also be included in the certificate.

(4) Maintenance of copies of all documents and information: The company

shall maintain and preserve at its registered office copies of all documents and

information as originally filed, till its dissolution under this Act.

(5) Furnishing of false or incorrect information or suppression of material

fact at the time of incorporation (i.e. during incorporation process): If any

person furnishes any false or incorrect particulars of any information or suppresses

any material information, of which he is aware in any of the documents filed with

the Registrar in relation to the registration of a company, he shall be liable for

action for fraud under section 447.

(6) Company already incorporated by furnishing any false or incorrect

information or representation or by suppressing any material fact (i.e. post

Incorporation): Where, at any time after the incorporation of a company, it is proved

that the company has been got incorporated by furnishing any false or incorrect

information or representation or by suppressing any material fact or information in

any of the documents or declaration filed or made for incorporating such company, or

by any fraudulent action, the promoters, the persons named as the first directors of

the company and the persons making declaration under this section shall each be

liable for action for fraud under section 447.

(7) Order of the Tribunal 3 : Where a company has been got incorporated by

furnishing false or incorrect information or representation or by suppressing any

material fact or information in any of the documents or declaration filed or made

for incorporating such company or by any fraudulent action, the Tribunal may, on

an application made to it, on being satisfied that the situation so warrants—

3

“Tribunal” means the National Company Law Tribunal (NCLT) constituted under section 408

of the Companies Act, 2013. The NCLT is a quasi- judicial body in India that adjudicates issues

relating to companies in India. The NCLT was established under the Companies Act, 2013 and

was constituted on 1st June, 2016.

© The Institute of Chartered Accountants of India

INCORPORATION OF COMPANY & MATTERS

INCIDENTAL THERETO 2.15

9. Exceptions:

(i) Can call its general meeting by giving a clear 14 days notice instead of

21 days.

(ii) Requirement of minimum number of directors, independent directors

etc. does not apply.

(iii) Need not constitute Nomination and Remuneration Committee and

Shareholders Relationship Committee.

Formation

•To promote Charitable objects

Application of profits

•To promote its objectives

•No payment of dividends out of profits

Type of Co.

•Limited Liabilty

•Without the addition of words "Ltd." or "Pvt Ltd."

How status is granted

•The CG can grant such status

•However, CG has delegated the power to grant licence to ROC

Revocation of licence

•CG may revoke licence

•If conditions of section 8 are contravened, or

•affairs of the company are conducted fraudulently, or prejudicial to

public interest

Effect of revocation of licence

•Co. has to use words "Ltd." or "Pvt Ltd."

6. EFFECT OF REGISTRATION [SECTION 9]

Section 9 of the Companies Act, 2013 provides for the effect of registration of a

company.

According to section 9, from the date of incorporation (mentioned in the certificate

of incorporation), the subscribers to the memorandum and all other persons, who

may from time to time become members of the company, shall be a body corporate

by the name contained in the memorandum. Such a registered company shall be

© The Institute of Chartered Accountants of India

2.16 CORPORATE AND OTHER LAWS

capable of exercising all the functions of an incorporated company under this Act

and having perpetual succession with power to acquire, hold and dispose of

property, both movable and immovable, tangible and intangible, to contract and

to sue and be sued, by the said name.

From the date of incorporation mentioned in the certificate, the company becomes

a legal person separate from the incorporators; and there comes into existence a

binding contract between the company and its members as evidenced by the

Memorandum and Articles of Association [Hari Nagar Sugar Mills Ltd. vs. S.S.

Jhunjhunwala]. It has perpetual existence until it is dissolved by liquidation or struck

out of the register. A shareholder who buys shares, does not buy any interest in the

property of the company but in certain cases a writ petition will be maintainable by

a company or its shareholders.

A legal personality emerges from the moment of registration of a company and

from that moment the persons subscribing to the MOA and other persons joining

as members are regarded as a body corporate or a corporation in aggregate and

the legal person begins to function as an entity. A company on registration acquires

a separate existence and the law recognizes it as a legal person separate and

distinct from its members [State Trading Corporation of India vs. Commercial Tax

Officer].

It may be noted that under the provisions of the Act, a company may purchase

shares of another company and thus become a controlling company. However,

merely because a company purchases all shares of another company, it will not

serve as a means of putting an end to the corporate character of another company

and each company is a separate juristic entity [Spencer & Co. Ltd. Madras vs. CWT

Madras].

As stated above, the law recognizes such a company as a juristic person separate

and distinct from its members. The mere fact that the entire share capital has been

contributed by the Central Government and all its shares are held by the President

of India and other officers of the Central Government does not make any difference

in the position of registered company and it does not make a company an agent

either of the President or the Central Government [Heavy Electrical Union vs. State

of Bihar].

© The Institute of Chartered Accountants of India

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Laudon Mis17 PPT Ch10Document39 pagesLaudon Mis17 PPT Ch10muaaz gill100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- EthiopiaDocument249 pagesEthiopiaparintelemaxim87% (15)

- Lesson 1 Audit Question BankDocument1 pageLesson 1 Audit Question BankBlack Jack RythmsNo ratings yet

- CMA BookletDocument9 pagesCMA BookletBlack Jack Rythms0% (1)

- Information Technology in Accounting 1Document16 pagesInformation Technology in Accounting 1Black Jack RythmsNo ratings yet

- PDF 20230104 235719 0000Document3 pagesPDF 20230104 235719 0000Black Jack RythmsNo ratings yet

- Khatabook Customer Transactions 03.01.2023 04.22.35.PMDocument1 pageKhatabook Customer Transactions 03.01.2023 04.22.35.PMBlack Jack RythmsNo ratings yet

- Khatabook Customer Transactions 03.01.2023 04.21.45.PMDocument1 pageKhatabook Customer Transactions 03.01.2023 04.21.45.PMBlack Jack RythmsNo ratings yet

- Delhi SultanateDocument2 pagesDelhi SultanateSandeep KumarNo ratings yet

- Endangered Artforms: Sahana MDocument23 pagesEndangered Artforms: Sahana MHEMANTH CHANDRASHEKARNo ratings yet

- Dock Identification Is WorthlessDocument17 pagesDock Identification Is WorthlessAgustino BatistaNo ratings yet

- Carl Miller Taxation k216Document26 pagesCarl Miller Taxation k216TRISTARUSANo ratings yet

- Research Paper Military LeadershipDocument7 pagesResearch Paper Military Leadershipupvipbqlg100% (1)

- Planning and Managing Inventories in A Supply ChainDocument20 pagesPlanning and Managing Inventories in A Supply ChainPerla Pascua100% (1)

- Directions Prepositions and Maps Worksheet - 86591Document1 pageDirections Prepositions and Maps Worksheet - 86591Jahayra Céspedes Uceda100% (2)

- Income Tax Department Rule 11UADocument3 pagesIncome Tax Department Rule 11UASourabh GargNo ratings yet

- Alberta Mental Health Act SummaryDocument5 pagesAlberta Mental Health Act Summarypmerta11No ratings yet

- Position Description - 41708 VPS 5 Business Analyst, Information ManagementDocument4 pagesPosition Description - 41708 VPS 5 Business Analyst, Information ManagementrahacseNo ratings yet

- Bill 13 - Uganda Constitutional Amendment Bill 2017Document4 pagesBill 13 - Uganda Constitutional Amendment Bill 2017The Independent Magazine50% (2)

- Functions and Role of The Advertising AgencyDocument43 pagesFunctions and Role of The Advertising AgencyRahul PandeyNo ratings yet

- Arhitectura TraditionalaDocument229 pagesArhitectura TraditionalaMihaiNo ratings yet

- 12 AdminOrder 91Document3 pages12 AdminOrder 91Joseph Raymund BautistaNo ratings yet

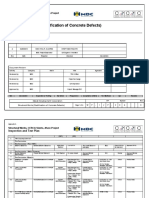

- Structural Works (Rectification of Concrete Defects) : Inspection and Test PlanDocument4 pagesStructural Works (Rectification of Concrete Defects) : Inspection and Test Planace DeclaNo ratings yet

- ProfileDocument4 pagesProfileShin_SpiegelNo ratings yet

- Energy Analysis in Turning and Millling-Tese ManchesterDocument168 pagesEnergy Analysis in Turning and Millling-Tese ManchesterRenan Cavalcante100% (1)

- November 10Document16 pagesNovember 10rogeliodmngNo ratings yet

- A Multivocal Literature Review of Decentralized Finance: Current Knowledge and Future Research AvenuesDocument37 pagesA Multivocal Literature Review of Decentralized Finance: Current Knowledge and Future Research Avenuesnofeh84660No ratings yet

- Cs Executive Notes EclDocument44 pagesCs Executive Notes EclSheetal ThakarNo ratings yet

- Strategic RelationshipDocument4 pagesStrategic RelationshipLester GenisisNo ratings yet

- Geddes Ex Hib 04 WebDocument15 pagesGeddes Ex Hib 04 Webpooh1992No ratings yet

- Fintech Entry Firm Financial Inclusion and Macroeconomic Dynamics in Emerging EconomiesDocument66 pagesFintech Entry Firm Financial Inclusion and Macroeconomic Dynamics in Emerging EconomiesChevossquiNo ratings yet

- KEMIC ProfileDocument10 pagesKEMIC ProfileNguyen Ha PhuongNo ratings yet

- Pantaloons Loyalty ProgramDocument5 pagesPantaloons Loyalty ProgramJiya Kanoo0% (1)

- Lyric Tearliner - Einfuhlung (Cheese in The Trap OST Part 2) - KPop-LyricsDocument4 pagesLyric Tearliner - Einfuhlung (Cheese in The Trap OST Part 2) - KPop-LyricsAnna leeNo ratings yet

- Ads653 Simen 123 DraftDocument7 pagesAds653 Simen 123 DraftJESSIE TANNo ratings yet

- Diego Maradona Was The Greatest Player of All TimeDocument2 pagesDiego Maradona Was The Greatest Player of All TimegivemebookNo ratings yet