Professional Documents

Culture Documents

Statement of Accounts - 180201062

Uploaded by

Wesley RajaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement of Accounts - 180201062

Uploaded by

Wesley RajaCopyright:

Available Formats

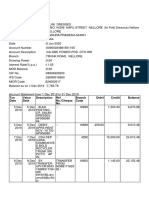

ACCOUNT STATEMENT HOME

Generated Electronically as on 14 December, 2022

WESLYRAJAIAH W

Room No 205 Sarvodaya Chawl

90 Feet Road Dharavi

Mumbai - 400017

916-717-4515

wesleyanbuu@gmail.com

Summary of Loan Account

A/C No Products EMI Amount Remaining EMI(s) Principal Outstanding EMI(s) Overdue Charges Overdue

64400544 Personal Loan 8,474 38 2,24,637 0 0

* To know principal outstanding for loan against property / home loans please get in touch with our customer service please call 1860-258-2000

Please note that a charge of Rs 400 will be levied against your account in case of EMI bouncing due to insufficient balance. Please maintain sufficient

balance in your account by 1st of every month to avoid EMI Bounce charges. A second attempt to recover EMI will be made 2-3 working days after the first

presentation of every month. If sufficient balance is not maintained by this second attempt, a further bounce charge of Rs 400 will be levied. Please also

note that non-payment of EMI within the calendar month will result in a penal charge of 2% of the unpaid EMI or Rs 300 whichever is higher. For any

clarifications of charges applicable to your account, consult our schedule of charges.

All charges mentioned in the statement are exclusive of GST. GST will be charged as per the applicable rules and regulations.

DISCLAIMER: This is a system generated Account Statement and does not require signature. In case of any discrepancy in this Account Statement, please

call 1860-258-2000 or visit nearest IDFC FIRST Bank branch within 10 (TEN) days from the date of last entry made in this statement, failing which, this

Account Statement will be deemed to be accepted by you (the borrower).

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

PERSONAL LOAN HOME

LOAN EMI PAYMENTS & CHARGES

A/C No 64400544 EMI Amount ` 8,474.00 Last Payment Date 02 December 2022

Loan Amount ` 2,60,738.00 EMI Start Month March 2022 Last Payment Amount ` 8,474.00

Net Tenure 48 Months EMI End Month February 2026 Payment Mode Others

Gross Tenure 48 Months EMI Due On 02 of every month EMI Overdue ` 0.00

STATUS Active Remaining EMI(s) 38 Bounce Charges Overdue ` 0.00

Disbursed Date 07 Feb, 2022 Penalty Charges Overdue ` 0.00

Other charges ` 0.00

Unadjusted Payments ` 0.00

Pay

Transaction Details

March 2022

Date Particular Remark Debit Credit

02-03-2022 Due For Instalment 1 - 8,474.00 0.00

02-03-2022 Payment Received NACH No.:Z64400544/1 Receipt No.---- ( N.A.) 0.00 8,474.00

April 2022

Date Particular Remark Debit Credit

02-04-2022 Due For Instalment 2 - 8,474.00 0.00

02-04-2022 Payment Received NACH No.:Z64400544/2 Receipt No.---- ( N.A.) 0.00 8,474.00

May 2022

Date Particular Remark Debit Credit

02-05-2022 Due For Instalment 3 - 8,474.00 0.00

02-05-2022 Payment Received NACH No.:Z64400544/3 Receipt No.---- ( N.A.) 0.00 8,474.00

June 2022

Date Particular Remark Debit Credit

02-06-2022 Due For Instalment 4 - 8,474.00 0.00

02-06-2022 Payment Received NACH No.:Z64400544/4 Receipt No.---- ( N.A.) 0.00 8,474.00

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

PERSONAL LOAN HOME

Transaction Details

July 2022

Date Particular Remark Debit Credit

02-07-2022 Due For Instalment 5 - 8,474.00 0.00

02-07-2022 Payment Received NACH No.:Z64400544/5 Receipt No.---- ( N.A.) 0.00 8,474.00

August 2022

Date Particular Remark Debit Credit

02-08-2022 Due For Instalment 6 - 8,474.00 0.00

02-08-2022 Payment Received NACH No.:Z64400544/6 Receipt No.---- ( N.A.) 0.00 8,474.00

September 2022

Date Particular Remark Debit Credit

02-09-2022 Due For Instalment 7 - 8,474.00 0.00

02-09-2022 Payment Received NACH No.:Z64400544/7 Receipt No.---- ( N.A.) 0.00 8,474.00

October 2022

Date Particular Remark Debit Credit

02-10-2022 Due For Instalment 8 - 8,474.00 0.00

02-10-2022 Payment Received NACH No.:Z64400544/8 Receipt No.---- ( N.A.) 0.00 8,474.00

November 2022

Date Particular Remark Debit Credit

02-11-2022 Due For Instalment 9 - 8,474.00 0.00

02-11-2022 Payment Received NACH No.:Z64400544/9 Receipt No.---- ( N.A.) 0.00 8,474.00

December 2022

Date Particular Remark Debit Credit

02-12-2022 Due For Instalment 10 - 8,474.00 0.00

02-12-2022 Payment Received NACH No.:Z64400544/10 Receipt No.---- ( N.A.) 0.00 8,474.00

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

ACCOUNT STATEMENT HOME

Generated Electronically as on 14 December, 2022

Products/Type of charges Personal Loan

EMI Bounce charges per presentation* 400

Late payment/Penal charges/ Default interest/Overdue (per month) 2% of the unpaid EMI or Rs 300 whichever is higher

Cheque Swap charges (per swap)* 500

10000 within 30 days of disbursement or 1st EMI presentation whichever is

Cancellation & Rebooking charges earlier. Post 30 days or 1st EMI presentation request for cancellation will be

treated as foreclosure

Foreclosure / Prepayment charges* 5% of principle outstanding amount

Loan re scheduling charges (per re scheduling) NA

Duplicate No Objection Certificate Issuance Charges* 500

Physical Repayment Schedule * 500

Physical Statement of Account* 500

Document retrieval charges (per retrieval)* 500

Stamping Charges As per actuals

Processing fees Up to 3.5% of the total loan amount

List of Documents NA

Part Payment charges Part Payment is not allowed

Initial Money Deposit/ Application Fees (Non-refundable) NA

EBC Replacement Fee (if EBC Applicable)

Easy Buy Card Replacement Fee (If Easy Buy Card Applicable)

EBC & Push Card fee(if applicable)

EMI Pickup/ Collection Charges* 350

Admin Charges (If Applicable)

Pre EMI

* To know principal outstanding for loan against property / home loans please get in touch with our customer service please call 1860-258-2000

Please note that a charge of Rs 400 will be levied against your account in case of EMI bouncing due to insufficient balance. Please maintain sufficient

balance in your account by 1st of every month to avoid EMI Bounce charges. A second attempt to recover EMI will be made 2-3 working days after the first

presentation of every month. If sufficient balance is not maintained by this second attempt, a further bounce charge of Rs 400 will be levied. Please also

note that non-payment of EMI within the calendar month will result in a penal charge of 2% of the unpaid EMI or Rs 300 whichever is higher. For any

clarifications of charges applicable to your account, consult our schedule of charges.

All charges mentioned in the statement are exclusive of GST. GST will be charged as per the applicable rules and regulations.

DISCLAIMER: This is a system generated Account Statement and does not require signature. In case of any discrepancy in this Account Statement, please

call 1860-258-2000 or visit nearest IDFC FIRST Bank branch within 10 (TEN) days from the date of last entry made in this statement, failing which, this

Account Statement will be deemed to be accepted by you (the borrower).

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

ACCOUNT STATEMENT HOME

Generated Electronically as on 14 December, 2022

Products/Type of charges Personal Loan

Security Post Dated Cheque Waiver

Legal/Collections/ Repossession & Incidental Charges

PDD charges

Valuation Charges (If applicable)

Admin Fee (if applicable)

Other Charges (if applicable)

__Valuation Charges Used Tractor__

*Charges above are exclusive of GST

Please note

1) First Presentation will be done on the 2nd or 5th each month. Kindly ensure your account is funded with sufficient funds by 1st or 4th each month to

avoid levy of charges

2) If the EMI for the month bounces and payment against the same is not received in the same month, late payment charges will be applicable. These will

be charged every month on a recurring basis till the payment is received

3) Above charges are exclusive of GST

4) Non-payment of any of the charges levied will be reported to the Credit information company (including CIBIL) and will affect the credit score.

5) * incase a company, firm, etc. is a part of the loan structure; foreclosure charges/ penalty/levy can be levied as stated in the sanction conditions will be

Applicable.

6) Schedule of charges are subject to change as per company's discretion from time to time. The company reserves the right to introduce any new charges

or fees, as it may deem appropriate. Please visit "www.idfcfirstbank.com" to view the updated loan charges.

* To know principal outstanding for loan against property / home loans please get in touch with our customer service please call 1860-258-2000

Please note that a charge of Rs 400 will be levied against your account in case of EMI bouncing due to insufficient balance. Please maintain sufficient

balance in your account by 1st of every month to avoid EMI Bounce charges. A second attempt to recover EMI will be made 2-3 working days after the first

presentation of every month. If sufficient balance is not maintained by this second attempt, a further bounce charge of Rs 400 will be levied. Please also

note that non-payment of EMI within the calendar month will result in a penal charge of 2% of the unpaid EMI or Rs 300 whichever is higher. For any

clarifications of charges applicable to your account, consult our schedule of charges.

All charges mentioned in the statement are exclusive of GST. GST will be charged as per the applicable rules and regulations.

DISCLAIMER: This is a system generated Account Statement and does not require signature. In case of any discrepancy in this Account Statement, please

call 1860-258-2000 or visit nearest IDFC FIRST Bank branch within 10 (TEN) days from the date of last entry made in this statement, failing which, this

Account Statement will be deemed to be accepted by you (the borrower).

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

You might also like

- Money - Buying, Selling, PayingDocument1 pageMoney - Buying, Selling, Payingsave1407No ratings yet

- CIMB Islamic Bank BHD V LCL Corp BHD & AnorDocument20 pagesCIMB Islamic Bank BHD V LCL Corp BHD & Anormuhammad amriNo ratings yet

- Bank Audit Check List & Procedure (Concurrent Audit) : IndexDocument12 pagesBank Audit Check List & Procedure (Concurrent Audit) : IndexCA Jay ThakurNo ratings yet

- Bank StatementDocument5 pagesBank StatementAshwani KumarNo ratings yet

- Dewa Documents PDFDocument23 pagesDewa Documents PDFAnil RajNo ratings yet

- Aglibot Vs SantiaDocument1 pageAglibot Vs SantiaAlexylle Garsula de Concepcion100% (1)

- Finacle Menu.1400 MenusDocument30 pagesFinacle Menu.1400 MenusSudip SahaNo ratings yet

- Accounting Entries in SAP FICODocument4 pagesAccounting Entries in SAP FICOPranavPatel100% (1)

- Open Strategy (Archive of Openstrate - Gy)Document46 pagesOpen Strategy (Archive of Openstrate - Gy)Santosh mudaliarNo ratings yet

- 5 154 1Document22 pages5 154 1Econometric AnalysisNo ratings yet

- B) Policies To Correct Balance of Payments DisequilibriumDocument3 pagesB) Policies To Correct Balance of Payments DisequilibriumSameera ShahzadNo ratings yet

- Unit IVDocument130 pagesUnit IVbabu hakkemNo ratings yet

- Account - Statement - 011022 - 311022Document17 pagesAccount - Statement - 011022 - 311022Anjani DeviNo ratings yet

- Re 1 WalkthroughDocument120 pagesRe 1 WalkthroughAmryNo ratings yet

- Budget 224: PremiumDocument25 pagesBudget 224: PremiumHiralal patilNo ratings yet

- Fiqh of Zakat: Mufti Faraz Adam Amanah AdvisorsDocument49 pagesFiqh of Zakat: Mufti Faraz Adam Amanah AdvisorsRendiNurcahyoNo ratings yet

- Curriculum CSE DraftDocument112 pagesCurriculum CSE DraftindgokNo ratings yet

- MAS For External Network & Hydrant Valves Rev - 01Document110 pagesMAS For External Network & Hydrant Valves Rev - 01Aneesh ConstantineNo ratings yet

- Digested Journal#6Document4 pagesDigested Journal#6Jay Raymond DelfinNo ratings yet

- Model Answer - CanvasDocument21 pagesModel Answer - Canvasnash kentNo ratings yet

- Clat Mock 20 CompleteDocument28 pagesClat Mock 20 CompleteNandan PatilNo ratings yet

- Aptitude Test For Accounting AssistantDocument5 pagesAptitude Test For Accounting AssistantJayvilyn ArendelaNo ratings yet

- (DAILY CALLER OBTAINED) - 3.17.22 Letter To Mayor BowserDocument5 pages(DAILY CALLER OBTAINED) - 3.17.22 Letter To Mayor BowserHenry RodgersNo ratings yet

- Addendum To AePS Fraud Liability Guideline Feb 2022Document10 pagesAddendum To AePS Fraud Liability Guideline Feb 2022Abhishek MasterNo ratings yet

- Theory 3Document21 pagesTheory 3Luis EduardoNo ratings yet

- Activity 2: Lozano, Mary Dyan I. Bsit 4Document6 pagesActivity 2: Lozano, Mary Dyan I. Bsit 4Lozano RegieNo ratings yet

- LoRa Based Smart Water Meter SystemDocument3 pagesLoRa Based Smart Water Meter SystemEditor IJTSRDNo ratings yet

- DL StatusDocument1 pageDL StatusSunya JavkarNo ratings yet

- VN CapticalDocument90 pagesVN CapticalPhuongNo ratings yet

- Who Vacination Requirments and Health AdviceDocument100 pagesWho Vacination Requirments and Health AdviceHasancan YavaşNo ratings yet

- PPG - PDS - Vigor ZN 302 SR - EnglishDocument15 pagesPPG - PDS - Vigor ZN 302 SR - EnglisherwinvillarNo ratings yet

- Pulse of Cotton 24-01-2023Document8 pagesPulse of Cotton 24-01-2023J.SathishNo ratings yet

- Program Evaluation RubricsDocument10 pagesProgram Evaluation RubricsHuzaifa LiaquatNo ratings yet

- Help2Pay Deposit Integration Specification Ver 1.1.10 1Document19 pagesHelp2Pay Deposit Integration Specification Ver 1.1.10 1Sunny AliNo ratings yet

- Summary BRM PidiliteDocument2 pagesSummary BRM PidiliteNikhil GuptaNo ratings yet

- Document 1312021 53807 AM ZrAxTn7pDocument8 pagesDocument 1312021 53807 AM ZrAxTn7pGisselle RodriguezNo ratings yet

- Detailed Technology Profile PDFDocument54 pagesDetailed Technology Profile PDFAlfred Joseph ZuluetaNo ratings yet

- SAIL JO Manual 2022 - Industry & Company AwarnessDocument102 pagesSAIL JO Manual 2022 - Industry & Company AwarnessT V KANNANNo ratings yet

- Acctstmt LDocument6 pagesAcctstmt LNew Age InvestmentsNo ratings yet

- AF Delivery RafaelSaraiva-FINAL 3Document42 pagesAF Delivery RafaelSaraiva-FINAL 3Rafael AlexandrinoNo ratings yet

- EST I - Literacy 1 - December 2021Document15 pagesEST I - Literacy 1 - December 2021Hamza WaleedNo ratings yet

- Module 3 - Topic3Document3 pagesModule 3 - Topic3Venus Rovie Chato LaqueNo ratings yet

- Eaton Emergency Lighting SC Exit - Safety Zeta4 Apr2018 DatasheetDocument4 pagesEaton Emergency Lighting SC Exit - Safety Zeta4 Apr2018 DatasheetShahzil AhmedNo ratings yet

- 2021 Principal-Agent Problems in Decarbonizing Container Shipping A Panel Data AnalysisDocument13 pages2021 Principal-Agent Problems in Decarbonizing Container Shipping A Panel Data AnalysisQingji ZhouNo ratings yet

- GSC3610 QigDocument25 pagesGSC3610 QigRishab SharmaNo ratings yet

- Bizjet World Tour 2021 Aircraft ListingDocument1 pageBizjet World Tour 2021 Aircraft ListingMateo AristizabalNo ratings yet

- Business FinanceDocument71 pagesBusiness FinanceAbdul Rahim Qadri RazviNo ratings yet

- Joining WTO Is A Very Important Event For The Development of China at The Beginning of The 21st CenturyDocument9 pagesJoining WTO Is A Very Important Event For The Development of China at The Beginning of The 21st CenturyMaaz KhanNo ratings yet

- FFRTC LogDocument196 pagesFFRTC LogTu locaNo ratings yet

- CTN ApplicationDocument3 pagesCTN Applicationabhishek joshiNo ratings yet

- Cfi PDFDocument1 pageCfi PDFAmit KambojNo ratings yet

- It 12 DecDocument15 pagesIt 12 DecPuja PandaNo ratings yet

- Reduction of Nox Emission in Diesel Engine Using Exhaust Gas RecirculationDocument37 pagesReduction of Nox Emission in Diesel Engine Using Exhaust Gas Recirculationdawit amsaluNo ratings yet

- Date: 11 March 2021 MR Rahul Sharma Rze2 Mahavi Enclave New Delhi New Delhi 110045 Delhi Policy No.: 16811926 Mobile No.: Xxxxxx3693Document6 pagesDate: 11 March 2021 MR Rahul Sharma Rze2 Mahavi Enclave New Delhi New Delhi 110045 Delhi Policy No.: 16811926 Mobile No.: Xxxxxx3693Rahul SharmaNo ratings yet

- The Impact of Rural Banking On Poverty and Employment in IndiaDocument64 pagesThe Impact of Rural Banking On Poverty and Employment in IndiaKunal BagdeNo ratings yet

- NR7200276390150276 InvoiceDocument1 pageNR7200276390150276 InvoiceBsj VsheNo ratings yet

- Sample PDF of STD 12th Board Question With Solutions PCMB Sampel ContentDocument20 pagesSample PDF of STD 12th Board Question With Solutions PCMB Sampel ContentSujata ChavanNo ratings yet

- Hybrid Heuristics For A Short Sea Inventory Routing Problem2014European Journal of Operational ResearchDocument12 pagesHybrid Heuristics For A Short Sea Inventory Routing Problem2014European Journal of Operational Researchmajid yazdaniNo ratings yet

- 67-3 Ex. 3 Letter From Chase & Purchase AgreementDocument9 pages67-3 Ex. 3 Letter From Chase & Purchase Agreementlarry-612445No ratings yet

- Park Avenuue - BrochureDocument12 pagesPark Avenuue - BrochureAmith LakshmanNo ratings yet

- Welcome LetterDocument3 pagesWelcome Letterhariharasudhan hariharasudhanNo ratings yet

- Introduction To Production Systems: Prof. Sayak RoychowdhuryDocument21 pagesIntroduction To Production Systems: Prof. Sayak Roychowdhurybrahma2deen2chaudharNo ratings yet

- JHDL202301201208062785Document1 pageJHDL202301201208062785ELECTION KHUNTINo ratings yet

- Implementation of Secure Authentication Technologies For DFS 1 1 PDFDocument66 pagesImplementation of Secure Authentication Technologies For DFS 1 1 PDFdavidNo ratings yet

- Identify An Enterprise and Give The Snapshot of The Company Websites With LinksDocument8 pagesIdentify An Enterprise and Give The Snapshot of The Company Websites With LinksAbbas KhanNo ratings yet

- General Guidelines For Spreading Financial StatementsDocument8 pagesGeneral Guidelines For Spreading Financial StatementsChandan Kumar ShawNo ratings yet

- The Plant Fairy: These Notes Are For Learning and Not To Be Written in NotebookDocument4 pagesThe Plant Fairy: These Notes Are For Learning and Not To Be Written in NotebookStepping PebblesNo ratings yet

- Statement of Accounts - 151903563Document5 pagesStatement of Accounts - 151903563Yuvraj Singh 2》No ratings yet

- Salomon JulinisaceDocument4 pagesSalomon JulinisaceWesley RajaNo ratings yet

- WesleyDocument4 pagesWesleyWesley RajaNo ratings yet

- Je BastinDocument3 pagesJe BastinWesley RajaNo ratings yet

- CA Inter Accounts QP May2022 @canotes IpccDocument16 pagesCA Inter Accounts QP May2022 @canotes IpccWesley RajaNo ratings yet

- Repayment Schedule 165239664Document2 pagesRepayment Schedule 165239664Wesley RajaNo ratings yet

- CA Inter May 2022 FM Eco Question PaperDocument12 pagesCA Inter May 2022 FM Eco Question PaperWesley RajaNo ratings yet

- Deletion of Name in Ration Card Goa StateDocument1 pageDeletion of Name in Ration Card Goa StateWesley RajaNo ratings yet

- FINAL AMS FlexAbility Press Relase 12julyDocument2 pagesFINAL AMS FlexAbility Press Relase 12julyWesley RajaNo ratings yet

- XStxoo 7 AE1 JJYZ5 IDocument2 pagesXStxoo 7 AE1 JJYZ5 Inani santhuNo ratings yet

- Application Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Document5 pagesApplication Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Prabhu KnNo ratings yet

- MPBF - Tandon CommitteeDocument1 pageMPBF - Tandon Committeeneeteesh_nautiyal100% (5)

- Jaysasuman ResumeDocument5 pagesJaysasuman ResumeJay SasumanNo ratings yet

- Print ChalanDocument2 pagesPrint ChalanfarhanNo ratings yet

- Sample Report: Consumer InformationDocument3 pagesSample Report: Consumer Informationadandreev100% (2)

- BankWise Performance 2021-22Document3 pagesBankWise Performance 2021-22sgrfgrNo ratings yet

- InvestmentDocument6 pagesInvestmentSaurav soniNo ratings yet

- PDIC Law PDFDocument10 pagesPDIC Law PDFVernadette De GuzmanNo ratings yet

- Metro-Score PPI: Customer Credit ReportDocument5 pagesMetro-Score PPI: Customer Credit ReportPastor Roy Onyancha CyberNo ratings yet

- Chapter 2: Overview of The Financial SystemDocument43 pagesChapter 2: Overview of The Financial Systememre kutayNo ratings yet

- Payment Process Request Status ReportDocument1 pagePayment Process Request Status ReportNishant RanaNo ratings yet

- Banking Sector Reforms FULL REPORT - 1 - Commerce Seminar TopicsDocument2 pagesBanking Sector Reforms FULL REPORT - 1 - Commerce Seminar TopicsAvishek NandiNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument5 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalancedileepNo ratings yet

- Divorce & CreditDocument15 pagesDivorce & CreditFredPahssenNo ratings yet

- Abhishek Sarkar SipDocument3 pagesAbhishek Sarkar SipAbhishek SarkarNo ratings yet

- Wa0024.Document1 pageWa0024.Sultan AdvertisingNo ratings yet

- Credit Management of Nabil BankDocument46 pagesCredit Management of Nabil BankNijan Jyakhwo100% (1)

- Bank CRG ScoreSheetDocument3 pagesBank CRG ScoreSheetMd. Zubaer100% (1)

- Debt Reduction CalculatorDocument17 pagesDebt Reduction Calculatoroo271110No ratings yet

- DocxDocument358 pagesDocxAina AguirreNo ratings yet