Professional Documents

Culture Documents

Statement of Profit or Loss and Other Comprehensive Income and Retained Earnings

Uploaded by

Mixx MineCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement of Profit or Loss and Other Comprehensive Income and Retained Earnings

Uploaded by

Mixx MineCopyright:

Available Formats

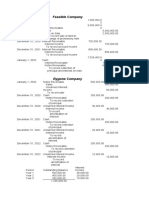

Statement of Profit or Loss and Other Comprehensive Income and

Retained Earnings

ABC Inc. XYZ Inc.

Year ended Dec.31, 2020 Year ended Sept.30. 2020

Profit before income tax 2,000,000 1,200,000

Income tax expense -600,000 -360,000

Profit after income tax 1,400,000 840,000

Retained earnings,beg. 2,600,000 1,260,000

Retained earnings, end 4,000,000 2,100,000

Statement of Financial Position

ABC Inc. XYZ Inc.

As of Dec.31, 2020 As of Sept.30,2020

Investment in XYZ Inc. 6,000,000 -

Other Assets 8,000,000 6,100,000

14,000,000 6,100,000

Share Capital 10,000,000 4,000,000

Retained Earnings 4,000,000 2,100,000

14,000,000 6,100,000

Solution:

1)The first way to consolidate the financial statements of XYZ, Inc. is to adjust its financial

statements (for consolidation purposes only) so that its year end coincides with the year end of

ABC, Inc. In this case, the profit for the first quarter of its 2020 financial year (i.e. October 2019 to

December 2019) shall be deducted while the profit for the first quarter of its 2021 financial year

(i.e. October 2020-March 2021) shall be added. For the financial position, however, the assets and

liabilities as of Sept.30,2020 shall be adjusted invidually for their movements up to Dec.31, 2020

so that their net increase is equal to the net profit for the first quarter of the 2021 financial year.

2) The other way is to consolidate the financial statements of XYZ, Inc. as they stand. The results of

operations of XYZ, Inc. would be included in the consolidated statement of profit or loss and other

comprehensive income with effect from Jan.1,2020 to Sept.30,2020.

You might also like

- Chapter 7 Accounting For Foreign Currency TransactionsDocument5 pagesChapter 7 Accounting For Foreign Currency TransactionsMixx MineNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- Accounting For Income Tax QuizDocument5 pagesAccounting For Income Tax QuizTorico BryanNo ratings yet

- Acct52 Buisness Combination QuizesDocument24 pagesAcct52 Buisness Combination QuizesCzarmae DumalaonNo ratings yet

- Chapter 1 Practice Test - Problems (Answers)Document12 pagesChapter 1 Practice Test - Problems (Answers)anonymousNo ratings yet

- LQ 1 - Set A SolutionDocument14 pagesLQ 1 - Set A SolutionChristina Jazareno64% (11)

- Accounting Research Methods - Midterm CoverageDocument16 pagesAccounting Research Methods - Midterm CoverageMixx Mine100% (1)

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- 25.code of Ethics For Professional AccountantsDocument11 pages25.code of Ethics For Professional Accountantsbuxtone67% (3)

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- Accounting For Special Transactions Partnership AccountingDocument15 pagesAccounting For Special Transactions Partnership AccountingJessaNo ratings yet

- Name: - Yr. and SectionDocument4 pagesName: - Yr. and SectionClarisse AlimotNo ratings yet

- Arias, Kyla Kim B. - Midterm Project October 8,2021Document6 pagesArias, Kyla Kim B. - Midterm Project October 8,2021Kyla Kim AriasNo ratings yet

- Quiz 2 AnswersDocument7 pagesQuiz 2 AnswersAlyssa CasimiroNo ratings yet

- PT 3 - Statement of Changes in Equity - IncomeDocument2 pagesPT 3 - Statement of Changes in Equity - IncomeIrene QuilatanNo ratings yet

- Cash Accrual Practice SetDocument2 pagesCash Accrual Practice SetMa. Trixcy De VeraNo ratings yet

- P&L Vs OCIDocument2 pagesP&L Vs OCIRujean Salar AltejarNo ratings yet

- Cash and Accrual Basis - ExercisesDocument2 pagesCash and Accrual Basis - ExercisesTrisha Mae AlburoNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument171 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionRengeline LucasNo ratings yet

- Financial Accounting Assignment 2Document6 pagesFinancial Accounting Assignment 2kirubelNo ratings yet

- FAR Exercise1Document16 pagesFAR Exercise1Warren Carlo G. ManulatNo ratings yet

- Quiz 1 Final PeriodDocument10 pagesQuiz 1 Final PeriodCmNo ratings yet

- InvestDocument5 pagesInvestJesselle H. BANAWOLNo ratings yet

- Chapter 2 Problems - IADocument8 pagesChapter 2 Problems - IAKimochi SenpaiiNo ratings yet

- Installment Sales MethodDocument25 pagesInstallment Sales MethodAngerica BongalingNo ratings yet

- ACC101 Notes ReceivableDocument3 pagesACC101 Notes ReceivableJoan GujeldeNo ratings yet

- Quiz - Consolidated FS Part 2Document3 pagesQuiz - Consolidated FS Part 2skyieNo ratings yet

- Accounting For Taxes 6Document7 pagesAccounting For Taxes 6charlene kate bunaoNo ratings yet

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Document5 pagesJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNo ratings yet

- TAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersDocument9 pagesTAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersMohammad FaridNo ratings yet

- 5Document11 pages5shayn delapenaNo ratings yet

- Chapter 19 Assignment IAF410 Excel SheetDocument14 pagesChapter 19 Assignment IAF410 Excel SheetTati AnaNo ratings yet

- Investment in AssociateDocument5 pagesInvestment in AssociateLorence Patrick LapidezNo ratings yet

- Soal Bab 12 InvestmentsDocument5 pagesSoal Bab 12 InvestmentsGogo LinaNo ratings yet

- Financial AspectDocument3 pagesFinancial AspectPeachyNo ratings yet

- EXERCISE Cashflow of The CompanyDocument41 pagesEXERCISE Cashflow of The CompanyDev lakhaniNo ratings yet

- Growl Company Statement of Changes in Equity For The Year Ended December 31, 2023 Share Capital Share Premium Revaluation Surplus Gain - OCI (Debt)Document4 pagesGrowl Company Statement of Changes in Equity For The Year Ended December 31, 2023 Share Capital Share Premium Revaluation Surplus Gain - OCI (Debt)Jian CarlNo ratings yet

- Buscom DiscussionDocument3 pagesBuscom DiscussionLorie Grace LagunaNo ratings yet

- HI5020 Final AssessmentDocument15 pagesHI5020 Final AssessmentTauseef AhmedNo ratings yet

- LQ 1 - Set A Solution PDF Bonds (Finance) ADocument2 pagesLQ 1 - Set A Solution PDF Bonds (Finance) AeaeNo ratings yet

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaDocument17 pages(In Lakhs) : © The Institute of Chartered Accountants of Indiaarihant bokdiaNo ratings yet

- Unit 1 2018 Paper 2Document9 pagesUnit 1 2018 Paper 2Pettal BartlettNo ratings yet

- Loans ReceivableDocument3 pagesLoans ReceivableGee Lysa Pascua VilbarNo ratings yet

- AFAR 3 - Quiz On Intercompany TransactionsDocument1 pageAFAR 3 - Quiz On Intercompany TransactionsPanda ErarNo ratings yet

- Far-Single Entry PDFDocument7 pagesFar-Single Entry PDFJanica June FiscalNo ratings yet

- Appendix D Accounting For Deferred Income TaxesDocument2 pagesAppendix D Accounting For Deferred Income TaxesLan Hương Trần ThịNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- AJE Yr End - 725106223Document20 pagesAJE Yr End - 725106223Nichole TanNo ratings yet

- Chapter6 BuenaventuraDocument11 pagesChapter6 BuenaventuraAnonnNo ratings yet

- Agabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cDocument7 pagesAgabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cJasmine Cate JumillaNo ratings yet

- Xii AccDocument3 pagesXii Accantonytreesa8No ratings yet

- Mini Exercise Answer KeyDocument3 pagesMini Exercise Answer KeyKaren TumabiniNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- Assignment 3Document2 pagesAssignment 3Ahmed AwedNo ratings yet

- PARALEL QUIZ - Introduction of AccountingDocument5 pagesPARALEL QUIZ - Introduction of AccountingCut Farisa MachmudNo ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- Investment in Associate ExercisesDocument7 pagesInvestment in Associate ExercisesJo KeNo ratings yet

- Exercise LiabilitiesDocument2 pagesExercise LiabilitiesAlaine Milka GosycoNo ratings yet

- SEMISDocument2 pagesSEMISEg CachaperoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- AR Problems P 2Document3 pagesAR Problems P 2Mixx MineNo ratings yet

- FC Transactions Derivatives Hedge AcctgDocument11 pagesFC Transactions Derivatives Hedge AcctgMixx MineNo ratings yet

- Accounts and Notes Receivable P 3Document2 pagesAccounts and Notes Receivable P 3Mixx MineNo ratings yet

- What Is A Likert Scale ExplanationDocument5 pagesWhat Is A Likert Scale ExplanationMixx Mine100% (1)

- ASSIGNMENTDocument1 pageASSIGNMENTMixx MineNo ratings yet

- Special Accounting Topics For Business CombinationDocument4 pagesSpecial Accounting Topics For Business CombinationMixx MineNo ratings yet

- Hi in This Video I Will Help You ChooseDocument7 pagesHi in This Video I Will Help You ChooseMixx MineNo ratings yet

- Chapter 6Document19 pagesChapter 6Mixx MineNo ratings yet

- Foreign Currency Transactions-HedgingDocument2 pagesForeign Currency Transactions-HedgingMixx MineNo ratings yet

- Pre1 Completing The AuditDocument8 pagesPre1 Completing The AuditMixx MineNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesMixx MineNo ratings yet

- Chapter 1Document2 pagesChapter 1Mixx MineNo ratings yet

- Chapter 4 Consolidated Financial Statements-Date of AcquisitionDocument3 pagesChapter 4 Consolidated Financial Statements-Date of AcquisitionMixx MineNo ratings yet

- Seatwork Code of EthicsDocument7 pagesSeatwork Code of EthicsMixx MineNo ratings yet

- Chapter 4Document4 pagesChapter 4Mixx MineNo ratings yet

- Chapter 3 The Research ProcessDocument7 pagesChapter 3 The Research ProcessMixx MineNo ratings yet

- Phil Accountancy Act of 2004Document8 pagesPhil Accountancy Act of 2004Mixx MineNo ratings yet

- Chapter 2 Research ClassificationDocument10 pagesChapter 2 Research ClassificationMixx MineNo ratings yet

- Seatwork Phil Accountancy Act of 2004Document9 pagesSeatwork Phil Accountancy Act of 2004Mixx MineNo ratings yet

- Pre 1 Intro To AuditingDocument14 pagesPre 1 Intro To AuditingMixx MineNo ratings yet

- Pre 1 Fundamentals of Assurance EngagementsDocument9 pagesPre 1 Fundamentals of Assurance EngagementsMixx MineNo ratings yet

- Module 1-3 in Financial MarketsDocument34 pagesModule 1-3 in Financial MarketsMixx MineNo ratings yet

- Business Combination Accounted For Under The Equity MethodDocument4 pagesBusiness Combination Accounted For Under The Equity MethodMixx MineNo ratings yet

- Chapter 5 Consolidated Financial Statements - Subsequent To Date of AcquisitionDocument5 pagesChapter 5 Consolidated Financial Statements - Subsequent To Date of AcquisitionMixx MineNo ratings yet

- Module 1-5 in Financial MarketsDocument55 pagesModule 1-5 in Financial MarketsMixx MineNo ratings yet

- Business Combination-Intercompany Sale of InventoriesDocument2 pagesBusiness Combination-Intercompany Sale of InventoriesMixx MineNo ratings yet

- Accounting For Loss of ControlDocument2 pagesAccounting For Loss of ControlMixx MineNo ratings yet