Professional Documents

Culture Documents

Loans Receivable

Uploaded by

Gee Lysa Pascua VilbarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loans Receivable

Uploaded by

Gee Lysa Pascua VilbarCopyright:

Available Formats

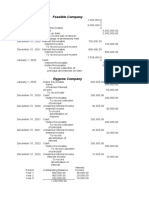

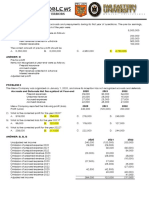

Problem 7-2 (IFRS)

Required:

1. Compute the carrying amount of the loan receivable on January 1, 2020.

Principal amount 4,000,000

Add: Direct origination cost 61,500

Less: Origination fee received from borrower ( 350,000)

Carrying amount of loan 3,711,500

2. Prepare a table of amortization for the loan receivable.

Date Interest Received Interest Income Amortization Carrying Amount

Jan. 1, 2020 3,711,500.00

Dec. 31, 2020 400,000 445,380.00 45,380.00 3,756,880.00

Dec. 31, 2021 400,000 450,825.60 50,825.60 3,807,705.60

Dec. 31, 2022 400,000 456,924.67 56,924.67 3,864,630.27

Dec. 31, 2023 400,000 463,755.63 63,755.63 3,928,385.90

Dec. 31, 2024 400,000 471,614.10 71,614.10 4,000,000.00

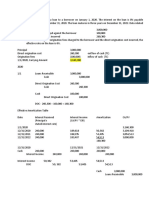

3. Prepare journal entries for 2020 and 2021.

Journal Entries

Jan. 2020

Loan receivable 4,000,000.00

Cash 4,000,000.00

Cash 350,000.00

Unearned interest income 350,000.00

Unearned interest income 61,500.00

Cash 61,500.00

Dec. 2020

Cash 400,000.00

Interest income 400,000.00

Unearned interest income 45,380.00

Interest income 45,380.00

Dec. 2021

Cash 400,000.00

Interest income 400,000.00

Unearned interest income 50,825.60

Interest income 50,825.60

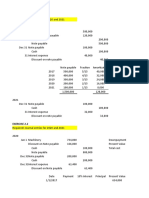

Problem 7-3 (IFRS)

Required:

1. Prepare journal entries for 2020, 2021, and 2022.

Journal Entries

Jan. 2020

Loan receivable 3,000,000

Cash 3,000,000

Cash 260,300

Unearned interest income 260,300

Unearned interest income 100,000

Cash 100,000

Dec. 2020

Cash 240,000

Interest income 240,000

Unearned interest income 50,382

Interest income 50,382

Dec. 2021

Cash 240,000

Interest income 240,000

Unearned interest income 53,405

Interest income 53,405

Dec. 2022

Cash 240,000

Interest income 240,000

Unearned interest income 56,513

Interest income 56,513

Cash 3,000,000

Loan receivable 3,000,000

2. Present the loan receivable on December 31, 2020.

December 31, 2020

Interest received 240,000

Interest income 189,618

Amortization 50,382

Carrying amount – January 1, 2020 3,160,300

Carrying amount – December 31, 2020 3,109,918

You might also like

- Nasty Bank Date Debit Credit 2020Document18 pagesNasty Bank Date Debit Credit 2020AnonnNo ratings yet

- Bonds Payable Part IIDocument6 pagesBonds Payable Part IIJoefrey Pujadas BalumaNo ratings yet

- Notes ReceivableDocument2 pagesNotes ReceivableGee Lysa Pascua VilbarNo ratings yet

- ACC101 Notes ReceivableDocument3 pagesACC101 Notes ReceivableJoan GujeldeNo ratings yet

- Chapter 7Document18 pagesChapter 7Raven Vargas DayritNo ratings yet

- Chapter 7Document13 pagesChapter 7El AgricheNo ratings yet

- Problem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueDocument11 pagesProblem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueJane Carla GarbidaNo ratings yet

- IntAcc GroupingsDocument4 pagesIntAcc GroupingsNikka BigtasNo ratings yet

- Loan Receivable ProblemsDocument6 pagesLoan Receivable ProblemsKathleen Frondozo100% (1)

- Intermediate Accounting Chapter 7 Exercises - ValixDocument26 pagesIntermediate Accounting Chapter 7 Exercises - ValixAbbie ProfugoNo ratings yet

- T8 - Exam Revision 2 - SDocument4 pagesT8 - Exam Revision 2 - Skst-26024No ratings yet

- IA 1 - Chapter 7 Loan Receivable ProblemsDocument5 pagesIA 1 - Chapter 7 Loan Receivable ProblemsJohn CentinoNo ratings yet

- Chapter6 BuenaventuraDocument11 pagesChapter6 BuenaventuraAnonnNo ratings yet

- Problem 6-5 & 6Document2 pagesProblem 6-5 & 6Micah April SabularseNo ratings yet

- IA 1 - Chapter 6 Notes Receivable Problems Part 1Document6 pagesIA 1 - Chapter 6 Notes Receivable Problems Part 1John CentinoNo ratings yet

- 7 3 BuenaventuraDocument2 pages7 3 BuenaventuraAnonnNo ratings yet

- Chapter 20-Effective Interest Rate: PROBLEM 20-1 Requirement 1Document41 pagesChapter 20-Effective Interest Rate: PROBLEM 20-1 Requirement 1Jodie Ann PajacNo ratings yet

- Chapter 2 Problems - IADocument8 pagesChapter 2 Problems - IAKimochi SenpaiiNo ratings yet

- 3.3.1 Notes and Loans Receivable Receivable FinancingDocument14 pages3.3.1 Notes and Loans Receivable Receivable FinancingJan Nelson BayanganNo ratings yet

- Activity Notes ReceivableDocument2 pagesActivity Notes ReceivableBernadeth Adelaine DomingoNo ratings yet

- Loans Receivable ProblemsDocument16 pagesLoans Receivable ProblemsPeter Piper33% (3)

- Assignment 5.3 Note PayableDocument4 pagesAssignment 5.3 Note PayableJohn Williever GonzalezNo ratings yet

- Chapter 20Document26 pagesChapter 20GONZALES, MICA ANGEL A.No ratings yet

- IA 2 Chapter 6 ActivitiesDocument14 pagesIA 2 Chapter 6 ActivitiesShaina TorraineNo ratings yet

- Cash Accrual Practice SetDocument2 pagesCash Accrual Practice SetMa. Trixcy De VeraNo ratings yet

- Accounting LesseeDocument7 pagesAccounting Lesseeangelian bagadiongNo ratings yet

- IA Chap7Document13 pagesIA Chap7Patrick Jayson VillademosaNo ratings yet

- Problem 7-1: 1. Origination Fee Received From The Borrower Direct Origination CostDocument4 pagesProblem 7-1: 1. Origination Fee Received From The Borrower Direct Origination CostSarah Joy Piamonte EstradaNo ratings yet

- Accountancy & Auditing-IDocument4 pagesAccountancy & Auditing-Izaman virkNo ratings yet

- HW On Sinking Fund C Solutions and AnswersDocument5 pagesHW On Sinking Fund C Solutions and AnswersAmjad Rian MangondatoNo ratings yet

- Lessor AccountingDocument4 pagesLessor AccountingShinny Jewel VingnoNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- Mini Exercise Answer KeyDocument3 pagesMini Exercise Answer KeyKaren TumabiniNo ratings yet

- Chapter20 BuenaventuraDocument23 pagesChapter20 BuenaventuraAnonnNo ratings yet

- Chapter 4-Book ExercisesDocument3 pagesChapter 4-Book ExercisesRita Angela DeLeonNo ratings yet

- Installment Sales MethodDocument25 pagesInstallment Sales MethodAngerica BongalingNo ratings yet

- EA6Document54 pagesEA6Chris TVNo ratings yet

- Auditing Problems: Ap - 01: Correction of ErrorsDocument15 pagesAuditing Problems: Ap - 01: Correction of ErrorsPrinces100% (2)

- Note Receivable Problem 6 1 To 6 5Document11 pagesNote Receivable Problem 6 1 To 6 5Jewel Mercano PabalinasNo ratings yet

- Purchase 66,000 Freight-In 1,400 Accounts Payable 67,400Document7 pagesPurchase 66,000 Freight-In 1,400 Accounts Payable 67,400Rhea OraaNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Lobrigas Unit3 Topic2 AssessmentDocument6 pagesLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Name: - Yr. and SectionDocument4 pagesName: - Yr. and SectionClarisse AlimotNo ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- Cea - Notes ReceivableDocument10 pagesCea - Notes ReceivableAnaluz Cristine B. CeaNo ratings yet

- ACCOUNTS RECEIVABLES 7-8 - Sheet1-2Document3 pagesACCOUNTS RECEIVABLES 7-8 - Sheet1-2Astrid AboitizNo ratings yet

- SCM Budget BSA2ADocument3 pagesSCM Budget BSA2AKaymark Lorenzo0% (2)

- Assignment 4 - Financial Accounting - February 11Document4 pagesAssignment 4 - Financial Accounting - February 11Ednalyn PascualNo ratings yet

- Problem 1: ComputationsDocument6 pagesProblem 1: ComputationsClarissa BorbonNo ratings yet

- 1t Chan Activity2Document14 pages1t Chan Activity2irish chanNo ratings yet

- Week 6 Topic Tutorial Solutions CB2100 - 1920ADocument6 pagesWeek 6 Topic Tutorial Solutions CB2100 - 1920ALily TsengNo ratings yet

- PPE1&2Document3 pagesPPE1&2Kailah CalinogNo ratings yet

- September 18Document16 pagesSeptember 18Danica JaneNo ratings yet

- UntitledDocument2 pagesUntitledJULES RINGGO AGUILARNo ratings yet

- SbaDocument4 pagesSbaahyenn cabello100% (1)

- Assignment 5.2 Note PayableDocument2 pagesAssignment 5.2 Note PayableKate HerederoNo ratings yet

- Lecture 2 - Practice QuestionsDocument2 pagesLecture 2 - Practice Questionsdonkhalif13No ratings yet

- Extra Questions - A LevelDocument8 pagesExtra Questions - A LevelMUSTHARI KHANNo ratings yet

- Fs-Buntis Bilis 2023 - 2027Document10 pagesFs-Buntis Bilis 2023 - 2027John SsyNo ratings yet

- BIODIVERSITYDocument80 pagesBIODIVERSITYGee Lysa Pascua VilbarNo ratings yet

- The Good LifeDocument48 pagesThe Good LifeGee Lysa Pascua VilbarNo ratings yet

- The Chinese Mestizo in Philippine HistoryDocument42 pagesThe Chinese Mestizo in Philippine HistoryGee Lysa Pascua VilbarNo ratings yet

- Answer The Following Items. (2 Points Each) : Quiz 2 (TGL)Document38 pagesAnswer The Following Items. (2 Points Each) : Quiz 2 (TGL)Gee Lysa Pascua VilbarNo ratings yet

- The Chinese Mestizo in Philippine HistoryDocument40 pagesThe Chinese Mestizo in Philippine HistoryCherie Diaz50% (2)

- Intellectual Revolutions of 2020Document80 pagesIntellectual Revolutions of 2020Gee Lysa Pascua VilbarNo ratings yet

- Contracts ActivityDocument2 pagesContracts ActivityGee Lysa Pascua VilbarNo ratings yet

- Chinese CivilizationDocument20 pagesChinese CivilizationGee Lysa Pascua VilbarNo ratings yet

- Database Management Systems OutlineDocument5 pagesDatabase Management Systems OutlineGee Lysa Pascua VilbarNo ratings yet

- Land Building and Machinery ActivityDocument4 pagesLand Building and Machinery ActivityGee Lysa Pascua VilbarNo ratings yet

- CBMETrue or FalseDocument2 pagesCBMETrue or FalseGee Lysa Pascua VilbarNo ratings yet

- How Does Your Self-Image Enhance Your Self-Efficiency?Document2 pagesHow Does Your Self-Image Enhance Your Self-Efficiency?Gee Lysa Pascua VilbarNo ratings yet

- AP Ppe Quizzer QDocument28 pagesAP Ppe Quizzer Qkimberly bumanlagNo ratings yet

- Cpa Reviewer PDFDocument18 pagesCpa Reviewer PDFAbigail Ann PasiliaoNo ratings yet

- Activity: Depreciation DEADLINE: December 2, 2021 at 11:59AM Problem 1Document4 pagesActivity: Depreciation DEADLINE: December 2, 2021 at 11:59AM Problem 1Gee Lysa Pascua VilbarNo ratings yet

- Loans ReceivableDocument3 pagesLoans ReceivableGee Lysa Pascua VilbarNo ratings yet

- Receivables Quiz (ARNR) AK PDFDocument5 pagesReceivables Quiz (ARNR) AK PDFNeil Vincent Boco86% (7)

- Notes and Loans Receivable c8 ValixDocument6 pagesNotes and Loans Receivable c8 ValixJames Patrick Antonio75% (12)

- Answers of Proof of Cash AssignmentDocument2 pagesAnswers of Proof of Cash AssignmentGee Lysa Pascua VilbarNo ratings yet

- Answers of Cash and Cash Equivalents AssignmentDocument4 pagesAnswers of Cash and Cash Equivalents AssignmentGee Lysa Pascua Vilbar50% (2)

- Answer Cash and Cash EquivalentsDocument2 pagesAnswer Cash and Cash EquivalentsGee Lysa Pascua VilbarNo ratings yet

- Answers of Doubtful Accounts AssignmentDocument4 pagesAnswers of Doubtful Accounts AssignmentGee Lysa Pascua VilbarNo ratings yet

- Cash and Cash Equivalents Sample ProblemsDocument3 pagesCash and Cash Equivalents Sample ProblemsGee Lysa Pascua VilbarNo ratings yet

- Account Titles and Explanations RF Date Debit CreditDocument1 pageAccount Titles and Explanations RF Date Debit CreditGee Lysa Pascua VilbarNo ratings yet

- Bigotry Company Proof of CashDocument4 pagesBigotry Company Proof of CashGee Lysa Pascua VilbarNo ratings yet

- Answers of Bank Reconciliation AssignmentDocument3 pagesAnswers of Bank Reconciliation AssignmentGee Lysa Pascua VilbarNo ratings yet

- Answer For PCF ActivityDocument1 pageAnswer For PCF ActivityGee Lysa Pascua VilbarNo ratings yet

- Reyes Trial BalanceDocument1 pageReyes Trial BalanceGee Lysa Pascua VilbarNo ratings yet

- Demonio - A QuedaDocument4 pagesDemonio - A QuedaAnderson AugustoNo ratings yet

- Alex Schiffer - Joe Cell - Experimenters Guide To The Joe CellDocument130 pagesAlex Schiffer - Joe Cell - Experimenters Guide To The Joe CellAnonymous UwXe23xNo ratings yet

- Brand Ambassadors and BrandsDocument36 pagesBrand Ambassadors and BrandsSahilJainNo ratings yet

- Evening PrayerDocument3 pagesEvening PrayerVinz B. SalmazanNo ratings yet

- George D. Jackson JR - Comintern and Peasant in East Europe 1919-1930Document360 pagesGeorge D. Jackson JR - Comintern and Peasant in East Europe 1919-1930BoSSul De BOSSNo ratings yet

- Gladys PDFDocument4 pagesGladys PDFUNEXPECTEDNo ratings yet

- SWOT ANALYSIS Dumaguin Ralph Justine B.Document3 pagesSWOT ANALYSIS Dumaguin Ralph Justine B.Edmarkmoises ValdezNo ratings yet

- Happy Hookers - Findings From An International Study Exploring The PDFDocument24 pagesHappy Hookers - Findings From An International Study Exploring The PDFNur Amalia MajidNo ratings yet

- Coolen ComplaintDocument4 pagesCoolen ComplaintKSTPTVNo ratings yet

- Concept-Paper-LP FINALDocument18 pagesConcept-Paper-LP FINALJodelyn Mae Singco CangrejoNo ratings yet

- CRPC Bail PresentationDocument8 pagesCRPC Bail PresentationDishant ThakkarNo ratings yet

- مذكرات كافر مغربي PDF - PDFDocument1 pageمذكرات كافر مغربي PDF - PDFYassin MejNo ratings yet

- CS408 Assignment No.2Document5 pagesCS408 Assignment No.2Sana YasinNo ratings yet

- Why This App? How Educators Choose A Good Educational AppDocument17 pagesWhy This App? How Educators Choose A Good Educational AppTien ELNo ratings yet

- Solution:: Problem 22 - HydraulicsDocument14 pagesSolution:: Problem 22 - HydraulicsJan Vindhya Jopson PradesNo ratings yet

- Indemnity Bond For Lost Document by Borrower To HDFCDocument1 pageIndemnity Bond For Lost Document by Borrower To HDFCAdarsh PandeyNo ratings yet

- Comparative Study of CNC Controllers Used in CNC Milling MachineDocument9 pagesComparative Study of CNC Controllers Used in CNC Milling MachineAJER JOURNALNo ratings yet

- Oct 8Document9 pagesOct 8crisNo ratings yet

- Science, Technology and Society ExamDocument3 pagesScience, Technology and Society ExamEliseo Ponting JrNo ratings yet

- Whats The Weather LikeDocument3 pagesWhats The Weather Likechristian sosaNo ratings yet

- Oral Roberts - Attack Your LackDocument162 pagesOral Roberts - Attack Your LackCrAzYMaN10100% (10)

- How To Pick Up Bitches.A5Document26 pagesHow To Pick Up Bitches.A5Tobias BlassNo ratings yet

- Rules of DebateDocument2 pagesRules of DebateTom MendiolaNo ratings yet

- 1 - Final PDFDocument26 pages1 - Final PDFRabia SajjadNo ratings yet

- Fundamentals IKS SyllabusDocument2 pagesFundamentals IKS Syllabuspurushotampandit1No ratings yet

- Oif Uni 01.0Document126 pagesOif Uni 01.0Marco SurcaNo ratings yet

- Graphite PropertiesDocument42 pagesGraphite PropertiesAnnisa Puspa MustikaNo ratings yet

- Montage As Perceptual Experience: Mario SluganDocument256 pagesMontage As Perceptual Experience: Mario SluganAnja VujovicNo ratings yet

- Module 0 - Introduction To Agile 2023Document95 pagesModule 0 - Introduction To Agile 2023maiyomarionneNo ratings yet