Professional Documents

Culture Documents

Land Building and Machinery Activity

Uploaded by

Gee Lysa Pascua Vilbar0 ratings0% found this document useful (0 votes)

104 views4 pagesLand Building and Machinery Activity

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLand Building and Machinery Activity

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

104 views4 pagesLand Building and Machinery Activity

Uploaded by

Gee Lysa Pascua VilbarLand Building and Machinery Activity

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

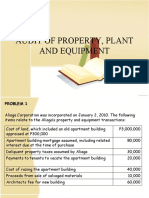

CHAPTER 26

ACTIVITY: LAND, BUILDING AND MACHINERY

DEADLINE: NOVEMBER 30, 2021 @ 11:59PM

PROBLEM 1

On December 31, 2020, the ABC Co. shows the following account

for machinery it had assembled for its own use during 2020:

Account: MACHINERY

Item Debit Credit Balance

Cost of dismantling old 144,800 144,800

machine

Cash proceeds from sale of 120,000 24,800

old machine

RM used in construction of 760,000 784,800

new machine

Labor in construction of new 490,000 1,274,800

machine

Cost of installation 112,000 1,386,800

Materials spoiled in machine 24,000 1,410,800

trial runs

Profit on construction 240,000 1,650,800

Purchase of machine tools 130,000 1,780,800

An analysis of the details in the account disclosed the

following:

a. The old machine, which was removed before the installation of

the new one, had been fully depreciated.

b. Cash discounts received on the payments for materials used in

construction totaled P30,000 and these were reported in the

purchase discounts account.

c. The factory overhead account shows a balance of P2,920,000

for the year ended December 31, 2020; this balance exceeds

normal overhead on regular plant activities by approximately

P169,000 and is attributable to machine construction.

d. A profit was recognized on construction for the difference

between costs incurred and the price at which the machine could

have been purchased.

INSTRUCTIONS:

1. Determine the machinery and machine tools balances as of

December 31, 2020.

2. Give the individual journal entries necessary to correct the

accounts as of December 31, 2020, assuming that the nominal

accounts are still open.

PROBLEM 2

Gibbs Manufacturing Co. was incorporated on 1/2/12 but was

unable to begin manufacturing activities until 8/1/12 because

new factory facilities were not completed until that date. The

Land and Buildings account at 12/31/12 per the books was as

follows:

Date Item Amount

1/31/12 Land and dilapidated building 200,000

2/28/12 Cost of removing building 4,000

4/1/12 Legal Fees 6,000

5/1/12 Fire Insurance premium payment 5,400

5/1/12 Special tax assessment for streets 4,500

Partial payment of new building

5/1/12 construction 170,000

8/1/12 Final payment on building construction 170,000

8/1/12 General expenses 30,000

12/31/12 Asset write-up 75,000

664,900

Additional information:

1. To acquire the land and building on 1/31/12, the company

paid $100,000 cash and 1,000 shares of its common stock

(par value = $100/share) which is very actively traded and

had a fair value per share of $140.

2. When the old building was removed, Gibbs paid Kwik

Demolition Co. $4,000, but also received $1,500 from the

sale of salvaged material.

3. Legal fees covered the following:

Cost of organization 2,500

Examination of title covering purchase of land 2,000

Legal work in connection with the building construction 1,500

6,000

4. The fire insurance premium covered premiums for a three-

year term beginning May 1, 2012.

5. General expenses covered the following for the period

1/2/12 to 8/1/12.

President's salary 20,000

Plant superintendent covering supervision of new building 10,000

30,000

6. Because of the rising land costs, the president was sure

that the land was worth at least $75,000 more than what it

cost the company.

Instruction:

Determine the proper balances as of 12/31/12 for a separate land

account and a separate buildings account.

PROBLEM 3

On January 1, 2020, ABC Corporation purchased a tract of land (site

number 101) with a building for P1,800,000. Additionally, ABC

paid a real state broker’s commission of P108,000, legal fees of

P18,000 and title guarantee insurance of P54,000. The closing

statement indicated that the land value was P1,500,000 and the

building value was P300,000. Shortly after acquisition, the

building was razed at a cost of P225,000.

ABC entered into a P9,000,000 fixed-price contract with XYZ Inc.

On March 1, 2020 for the construction of an office building on the

land site 101. The building was completed and occupied on

September 30, 2021. Additional construction costs were incurred

as follows:

Plans, specifications and blueprints P 36,000

Architect’s fees for design and supervision 285,000

The building is estimated to have a forty-year life from date of

completion and will be depreciated using the 150%-declining-

balance method.

To finance the construction cost, ABC borrowed P9,000,000 on March

1, 2020. The loan is payable in ten annual installments of

P900,000 plus interest at the rate of 14%. ABC used part of the

loan proceeds for working capital requirements. ABC’s average

amounts of accumulated building construction expenditures were as

follows:

For the period March 1 to December 31, 2020 P2,700,000

For the period January 1 to September 31,2021 6,900,000

ABC is using the allowed alternative treatment for borrowing cost.

Instruction:

Determine the following:

1. Cost of land site number 101

2. Cost of office building

3. Depreciation of office building for 2006

You might also like

- Notes and Loans Receivable c8 ValixDocument6 pagesNotes and Loans Receivable c8 ValixJames Patrick Antonio75% (12)

- Audit of Property, Plant and Equipment CostsDocument26 pagesAudit of Property, Plant and Equipment CostsJoseph SalidoNo ratings yet

- Assessment Tasks 6Document4 pagesAssessment Tasks 6hahahahaNo ratings yet

- PPEDocument18 pagesPPECarl Yry BitzNo ratings yet

- Audit of PPE accounts and related valuationDocument8 pagesAudit of PPE accounts and related valuationAlyna JNo ratings yet

- The Good LifeDocument48 pagesThe Good LifeGee Lysa Pascua VilbarNo ratings yet

- CPA Review School Audit ProblemsDocument18 pagesCPA Review School Audit ProblemsAbigail Ann PasiliaoNo ratings yet

- Answers of Cash and Cash Equivalents AssignmentDocument4 pagesAnswers of Cash and Cash Equivalents AssignmentGee Lysa Pascua Vilbar50% (2)

- AralPan8 - Q4 - Wk8 - ANG UNITED NATIONS AT IBA PANG PANDAIGDIGANG ORGANISASYON, PANGKAT AT ALYANSA - WINNIE S. BALUDEN - CONNIE TULAN-1Document14 pagesAralPan8 - Q4 - Wk8 - ANG UNITED NATIONS AT IBA PANG PANDAIGDIGANG ORGANISASYON, PANGKAT AT ALYANSA - WINNIE S. BALUDEN - CONNIE TULAN-1Jaiz Cadang100% (1)

- Acco 30053 - Audit of Ppe - MarpDocument10 pagesAcco 30053 - Audit of Ppe - MarpBanna SplitNo ratings yet

- Ex. 10-135-Nonmonetary ExchangeDocument4 pagesEx. 10-135-Nonmonetary ExchangeCarlo ParasNo ratings yet

- Quiz No 1 AuditingDocument11 pagesQuiz No 1 AuditingrylNo ratings yet

- Cost of Land, Buildings, Equipment for Aliaga CorporationDocument4 pagesCost of Land, Buildings, Equipment for Aliaga CorporationLeisleiRagoNo ratings yet

- Cpa Review School of The PhilippinesDocument12 pagesCpa Review School of The PhilippinesPJ PoliranNo ratings yet

- Audit Problems 1 - PPE and IntangiblesDocument10 pagesAudit Problems 1 - PPE and IntangiblesPaula De RuedaNo ratings yet

- Audit of Ppe, Int. AssetsDocument5 pagesAudit of Ppe, Int. AssetsJon SagabayNo ratings yet

- AP - LiabilitiesDocument7 pagesAP - LiabilitiesJasmin NgNo ratings yet

- Ppe 2Document13 pagesPpe 2Jerome BaluseroNo ratings yet

- A. Property, Plant and Equipment:: Current Appraised Value Seller's Original CostDocument3 pagesA. Property, Plant and Equipment:: Current Appraised Value Seller's Original CostNORLYN CINCONo ratings yet

- Lecture Problems - Ppe and IntangiblesDocument8 pagesLecture Problems - Ppe and IntangiblesRendered HoleNo ratings yet

- Property, Plant and Equipment Sample Problems: Problem 1Document10 pagesProperty, Plant and Equipment Sample Problems: Problem 1Mark Gelo Winchester0% (1)

- Audit of PpeDocument8 pagesAudit of PpeCPANo ratings yet

- Audit PPE Transactions and Calculate Land and Building AccountsDocument4 pagesAudit PPE Transactions and Calculate Land and Building AccountsZeeNo ratings yet

- Intermediate Accounting 2Document5 pagesIntermediate Accounting 2Kristine Lara100% (3)

- Exercise property acquisitions and construction costsDocument1 pageExercise property acquisitions and construction costsCristine ClarinNo ratings yet

- Property Plant and Equipment AuditDocument7 pagesProperty Plant and Equipment AuditKristine Jewel MirandaNo ratings yet

- SEATWORK-LBM 1st2324 STUDENTSDocument3 pagesSEATWORK-LBM 1st2324 STUDENTSpadayonmhieNo ratings yet

- Audit of PPE-2Document2 pagesAudit of PPE-2Josha Mae PerezNo ratings yet

- Dado BpsDocument6 pagesDado BpsmcannielNo ratings yet

- Acctg 2 quiz covers depreciation, depletionDocument3 pagesAcctg 2 quiz covers depreciation, depletionArjay CarolinoNo ratings yet

- Ac20 Quiz 4 - DGCDocument8 pagesAc20 Quiz 4 - DGCMaricar PinedaNo ratings yet

- Auditing Problems Test Banks - PPE Part 2Document5 pagesAuditing Problems Test Banks - PPE Part 2Alliah Mae ArbastoNo ratings yet

- ias16Document3 pagesias16Christian TanzoNo ratings yet

- AE121 - PPE Lecture ProblemsDocument4 pagesAE121 - PPE Lecture ProblemsGero MarinasNo ratings yet

- Auditing Problems Finals Exam 2020Document9 pagesAuditing Problems Finals Exam 2020VictorioLazaro0% (1)

- ENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 2022Document9 pagesENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 202202Adibah Seila NafazaNo ratings yet

- Acquisition Costs of Realty and Asset AnalysisDocument7 pagesAcquisition Costs of Realty and Asset AnalysisIwel NetriNo ratings yet

- Assignment-1-MidtermDocument2 pagesAssignment-1-MidtermjadecondinoNo ratings yet

- Northern CPA Review Co. (NCPAR) : Practical Accounting Problems 1Document15 pagesNorthern CPA Review Co. (NCPAR) : Practical Accounting Problems 1Sherri BonquinNo ratings yet

- Accounting for Property, Plant and Equipment (ProblemsDocument4 pagesAccounting for Property, Plant and Equipment (ProblemsMina ChouNo ratings yet

- Audit of Ppe and Intangible Assets - SeatworkDocument6 pagesAudit of Ppe and Intangible Assets - Seatworkderry0% (1)

- 06 - PpeDocument4 pages06 - PpeLloydNo ratings yet

- SELF TEST 7 PROPERTY, PLANT AND EQUIPMENTDocument4 pagesSELF TEST 7 PROPERTY, PLANT AND EQUIPMENTJose Conrad Nupia BagonNo ratings yet

- Topic 1: Conceptual FrameworkDocument16 pagesTopic 1: Conceptual FrameworkHuỳnh Như PhạmNo ratings yet

- Aud Application 2 - Handout 2 Borrowing Cost (UST)Document2 pagesAud Application 2 - Handout 2 Borrowing Cost (UST)RNo ratings yet

- Construction FranchiseDocument7 pagesConstruction FranchisetheresaazuresNo ratings yet

- Mini-Lecpa Quiz: JPIA-UNC Chapter 2021-2022Document7 pagesMini-Lecpa Quiz: JPIA-UNC Chapter 2021-2022James CantorneNo ratings yet

- Midterm INTACC 2 examDocument6 pagesMidterm INTACC 2 examMac b IBANEZNo ratings yet

- AP-5903 - PPE & Intangibles PDFDocument19 pagesAP-5903 - PPE & Intangibles PDFkayeNo ratings yet

- 11.11.2017 Audit of PPEDocument9 pages11.11.2017 Audit of PPEPatOcampoNo ratings yet

- Prelims QuizDocument12 pagesPrelims QuizJanine TupasiNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- Contract BBADocument4 pagesContract BBAAsif RezviNo ratings yet

- Investment PropertyDocument14 pagesInvestment PropertyJerome BaluseroNo ratings yet

- Audit of Property, Plant and Equipment (PPE) : Auditing Problems AP.0102Document8 pagesAudit of Property, Plant and Equipment (PPE) : Auditing Problems AP.0102Mae0% (1)

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32Ruchira Sanket KaleNo ratings yet

- PAS 16 - Initial Recognition and Measurement of PPEDocument3 pagesPAS 16 - Initial Recognition and Measurement of PPEDEX MAYNo ratings yet

- Bai Tap CMQT clc59Document20 pagesBai Tap CMQT clc59Hải AnhNo ratings yet

- AUD02 - 10 - Audit of Other Assests - Illustrative ProblemsDocument3 pagesAUD02 - 10 - Audit of Other Assests - Illustrative ProblemsRenelyn FiloteoNo ratings yet

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryFrom EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNo ratings yet

- Contracts ActivityDocument2 pagesContracts ActivityGee Lysa Pascua VilbarNo ratings yet

- Chinese CivilizationDocument20 pagesChinese CivilizationGee Lysa Pascua VilbarNo ratings yet

- The Chinese Mestizo in Philippine HistoryDocument40 pagesThe Chinese Mestizo in Philippine HistoryCherie Diaz50% (2)

- Biodiversity: Biological Wealth and Ecosystem BenefitsDocument80 pagesBiodiversity: Biological Wealth and Ecosystem BenefitsGee Lysa Pascua VilbarNo ratings yet

- Freudian Revolution in PsychologyDocument80 pagesFreudian Revolution in PsychologyGee Lysa Pascua VilbarNo ratings yet

- Answer The Following Items. (2 Points Each) : Quiz 2 (TGL)Document38 pagesAnswer The Following Items. (2 Points Each) : Quiz 2 (TGL)Gee Lysa Pascua VilbarNo ratings yet

- Database Management Systems OutlineDocument5 pagesDatabase Management Systems OutlineGee Lysa Pascua VilbarNo ratings yet

- Loans ReceivableDocument3 pagesLoans ReceivableGee Lysa Pascua VilbarNo ratings yet

- Activity: Depreciation DEADLINE: December 2, 2021 at 11:59AM Problem 1Document4 pagesActivity: Depreciation DEADLINE: December 2, 2021 at 11:59AM Problem 1Gee Lysa Pascua VilbarNo ratings yet

- Answer Cash and Cash EquivalentsDocument2 pagesAnswer Cash and Cash EquivalentsGee Lysa Pascua VilbarNo ratings yet

- The Chinese Mestizo in Philippine HistoryDocument42 pagesThe Chinese Mestizo in Philippine HistoryGee Lysa Pascua VilbarNo ratings yet

- CBMETrue or FalseDocument2 pagesCBMETrue or FalseGee Lysa Pascua VilbarNo ratings yet

- Answers of Doubtful Accounts AssignmentDocument4 pagesAnswers of Doubtful Accounts AssignmentGee Lysa Pascua VilbarNo ratings yet

- AP Ppe Quizzer QDocument28 pagesAP Ppe Quizzer Qkimberly bumanlagNo ratings yet

- Receivables Quiz (ARNR) AK PDFDocument5 pagesReceivables Quiz (ARNR) AK PDFNeil Vincent Boco86% (7)

- Cash and Cash Equivalents Sample ProblemsDocument3 pagesCash and Cash Equivalents Sample ProblemsGee Lysa Pascua VilbarNo ratings yet

- King Issues Proclamation for Cloves TradeDocument2 pagesKing Issues Proclamation for Cloves TradeGee Lysa Pascua VilbarNo ratings yet

- Answers of Bank Reconciliation AssignmentDocument3 pagesAnswers of Bank Reconciliation AssignmentGee Lysa Pascua VilbarNo ratings yet

- Answers of Proof of Cash AssignmentDocument2 pagesAnswers of Proof of Cash AssignmentGee Lysa Pascua VilbarNo ratings yet

- Notes ReceivableDocument2 pagesNotes ReceivableGee Lysa Pascua VilbarNo ratings yet

- Loans ReceivableDocument3 pagesLoans ReceivableGee Lysa Pascua VilbarNo ratings yet

- Bigotry Company Proof of CashDocument4 pagesBigotry Company Proof of CashGee Lysa Pascua VilbarNo ratings yet

- Answer For PCF ActivityDocument1 pageAnswer For PCF ActivityGee Lysa Pascua VilbarNo ratings yet

- Reyes Trial BalanceDocument1 pageReyes Trial BalanceGee Lysa Pascua VilbarNo ratings yet

- Account Titles and Explanations RF Date Debit CreditDocument1 pageAccount Titles and Explanations RF Date Debit CreditGee Lysa Pascua VilbarNo ratings yet

- JRD TataDocument17 pagesJRD TataDILIP VISHWAKARMANo ratings yet

- Case 1 For PrintDocument8 pagesCase 1 For PrintRichardDinongPascualNo ratings yet

- Ateneo Law JournalDocument58 pagesAteneo Law JournalCiara De LeonNo ratings yet

- IBT-MODULE 10... Ba - MKTGDocument8 pagesIBT-MODULE 10... Ba - MKTGRamil VillacarlosNo ratings yet

- Statement Nov 2022Document25 pagesStatement Nov 2022Josué SoteloNo ratings yet

- Loan AgreementDocument2 pagesLoan Agreementgidraphgathuku2022No ratings yet

- tổng hợp đề KTQT 2Document43 pagestổng hợp đề KTQT 2Ly BùiNo ratings yet

- Executive Summary:: The Bank of PunjabDocument40 pagesExecutive Summary:: The Bank of PunjabLucifer Morning starNo ratings yet

- Case Stdy OPM545 (Boys and Boden)Document15 pagesCase Stdy OPM545 (Boys and Boden)wasab negiNo ratings yet

- Beyond Empirical New: Comparative AdvantageDocument20 pagesBeyond Empirical New: Comparative AdvantageAnjali sharmaNo ratings yet

- MealKit4U Stats Student-1Document14 pagesMealKit4U Stats Student-1s3976142No ratings yet

- Seminar 2 Presentation QuestionsDocument17 pagesSeminar 2 Presentation QuestionsJennifer YoshuaraNo ratings yet

- Fundamentals of Marketing Chapter 5Document6 pagesFundamentals of Marketing Chapter 5Tracy Mason MediaNo ratings yet

- Instant Download Ebook PDF Ethics in Marketing International Cases and Perspectives 2nd Edition PDF ScribdDocument29 pagesInstant Download Ebook PDF Ethics in Marketing International Cases and Perspectives 2nd Edition PDF Scribdchester.whelan111100% (42)

- Introduction To GSTDocument22 pagesIntroduction To GSTSowmya KRNo ratings yet

- Assignment February 2021:: There Is One (1) Page of Question, Excluding This PageDocument17 pagesAssignment February 2021:: There Is One (1) Page of Question, Excluding This PageSujeewa LakmalNo ratings yet

- ICICI BankDocument17 pagesICICI BankMehak SharmaNo ratings yet

- Pop Quiz For AccountingDocument2 pagesPop Quiz For AccountingダニエルNo ratings yet

- LOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepDocument4 pagesLOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepElla Marie LopezNo ratings yet

- Dilg-Lgu Lupon: Statement of AccountDocument4 pagesDilg-Lgu Lupon: Statement of AccountDilg LuponNo ratings yet

- T3 2004 - Dec - QDocument8 pagesT3 2004 - Dec - QVinh Ngo NhuNo ratings yet

- Caso 1 - Airbnb in 2020 - Sobreviviendo A La Pandemia OriginalDocument18 pagesCaso 1 - Airbnb in 2020 - Sobreviviendo A La Pandemia OriginalArmando GarzaNo ratings yet

- Inventory ControlDocument26 pagesInventory ControlShweta Dixit100% (1)

- Fnbslw444 - Case StudyDocument5 pagesFnbslw444 - Case Studyinfobrains05No ratings yet

- Multistate Complaint PRC 1Document44 pagesMultistate Complaint PRC 1Michael JamesNo ratings yet

- Ahmed Villas, Kacha Shahab Pura, ., Sialkot Sialkot Arifa MamoonaDocument4 pagesAhmed Villas, Kacha Shahab Pura, ., Sialkot Sialkot Arifa MamoonaZeeshan Haider RizviNo ratings yet

- C.MGT Relevant of Chapter 2 STBCDocument12 pagesC.MGT Relevant of Chapter 2 STBCNahum DaichaNo ratings yet

- Talon IV sari-sari stores listDocument4 pagesTalon IV sari-sari stores listIan SantosNo ratings yet