Professional Documents

Culture Documents

Contract BBA

Uploaded by

Asif RezviOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contract BBA

Uploaded by

Asif RezviCopyright:

Available Formats

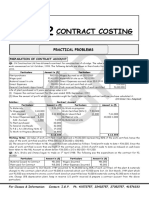

Chapter-7

Contract Costing, BBA

1.(N.U.-BBA-2006, 2017,2020)

A construction company obtained a contract and commenced work on 1st May 2007. On

31st December 2007 the following information was obtained in respect of the contract:

Materials purchased for the contract. 3,11,000

Materials issued from store. 1,04,960

Wages paid. 1,15,300

Direct expense 9,400

Indirect exp. 38,200

Plant purchased. 86,000

Installation cost of plant 2,000

Wages accrued. 6,500

Architects’ fees 2,500

th

The certified value of work done up to 30 November was tk. 5,50,000. Materials at site

on 31st December were valued at tk. 14,500. Materials costing tk. 9,000 were damaged

and were sold at a nominal value of tk. 1,200. The plant was revalued at tk. 65,000 on 31 st

December.

Complete the contract account and ascertain profit to be credited to profit and loss

account.

2.(N.U.BBA-2008)

Builders Ltd. signed a contract for tk. 1,50,000 from 1st January 2007. The following

information is obtained in respect of the contract for year ended 31 st December 2007:

Materials issued 27,000

Wages 41,250

General exp. 1,500

Plant installed. 7,500

Materials at site 1,500

Wages accrued 1,275

General exp. accrued 255

Work certified 75,000

Cash required on work certified 56,250

Works completed but not certified 2,250

The plant was installed on the commencing date of the contract and the depreciation is

calculated at 10% per annum. Complete the contract account and show how much profits

should be credited to the profit and loss account for the year.

3. (N.U.-BBA 2009)

On 1st March, 2008 Road construction Ltd. started contract no. 1216- a duel carriageway

bypass road for a contract price of tk. 9,50,000 with completion schedule for 31 st

December 2009. The budgeted cost of the contract was tk. 8,75,000. Road construction

Ltd. has a financial year end at 31st December. On 31st December, 2008 the figures in the

company’s books were :

Materials issued to site from store 98,000

Materials bought direct at site 1,09,000

Materials returned to store from site 14,000

Wages paid at site 1,49,000

Plant at cost 1.3.08 70,000

Hire of plant 1.3.08 to 31.12.08 76,000

Supervisory salaries 27,000

Share of head office costs 42,000

Paid to sub contractors 18,000

Wages due on 31.12.08 4,000

Due to sub contractors 5,000

Value of work certified 31.12.08 6,50,000

Cost of work completed but not yet certified 35,000

Cash received relating to work certified (balance retention money) 5,85,000

Value of materials on site 31.12.08 18,000

Depreciation on plant should be provided at 20% per annum on cost.

Required: To show the contract account in full with the amount you would recommend to

be taken to the company’s profit and loss account for the year to 31.12.08 and the work in

progress figure.

4.(N.U.BBA-2012)

Builders Ltd. was awarded a contract to build an office block in Dhaka and works

commenced at the site on 1st May, 2012:

During the period to 28th February, 2013 the expenditure on the contract was as follows:

Materials issued from stores. 94,110

Materials purchased. 2,80,700

Direct expenses 61,490

Wages 1,84,930

Charge made by the company for administration exp. 21,460

st

Plant and machinery purchased on 1 May, 2012 for use at site tk. 1,21,800.

On 28th February, 2013, the stock of materials at the site amounted to tk. 21,460 and there

were amounts outstanding for wages tk. 3,660 and direct expenses tk. 490. Builders Ltd.

has received on account the sum of tk. 6,41,700 which represents the amount of

certificate number 1 issued by architects in respect of work completed to 28 th February,

2013, after deducting 10% retention money.

The following relevant information is also available.

(a) The plant and machinery has an effective life of 5 years with no residual value.

(b)The company only takes credit for two-thirds of the profit on work certified as

reduced proportionately on realized basis.

You are required:

(i) To prepare a contract account for the period to 28 Th February, 2013, and

(ii) To show your calculation of the profit to be taken to the credit of the company’s

profit And loss account in respect of the work covered by certificate number 1.

5. (N.U.BBA- 2014)

The following particulars were obtained in respect of a contract for the period ending on

December 31, 2014 :

Materials purchased 1,62,400

Materials issued from stores 72,000

Materials supplied by the contractee 42,300

Wages 1,54,700

Direct expense 27,500

Sub contract 30,000

Plant which has been used in other contract 25,000

Addition plant purchased 8,000

Other expenses 12,600

st

The contract which has been started on 1 January, 2014 was for tk. 6,00,000. The

amount received tk. 4,00,000 being 80% of the work certified. Materials worth tk. 4,000

were sold at site for tk. 3,500. Materials at site at the closing date were valued at tk.

17,000 up to December, 2014. The contract account was debited with tk. 6,300 as

depreciation.

Prepare the contract account which the amount of profit to be transferred to profit and

loss account.

6. (N.U.-2015)

A building contractor undertook to construct a building for which the following details

are supplied:

Materials purchased 1,42,800

Materials issued from stores 72,000

Materials returned from sites to stores 5,000

Materials supplied by the contractee 52,500

Wages 1,34,700

Direct expense 25,300

Sub contract 32,000

Plant which has been used in other contract 28,000

Addition plant purchased 18,000

Other expenses 10,600

st

The contract which has been started on 1 January, 2009 was for tk. 6,50,000. The

amount received tk. 4,12,000 being 80% of the work certified. Cost of work uncertified is

tk. 13,000. Materials worth tk. 3,000 were sold at site for tk. 2,500. Materials at site at the

closing date were valued at tk. 16,000 up to December, 2009. The contract account was

debited with tk. 5,200 as depreciation.

Prepare the contract account which the amount of profit to be transferred to profit and

loss account.

You might also like

- Acca F6 UkDocument60 pagesAcca F6 Ukm2mlckNo ratings yet

- Worksheet PDFDocument4 pagesWorksheet PDFNaomi Baker82% (22)

- Accounting PpeDocument7 pagesAccounting PpeJomar Sevilla Rabia100% (1)

- Quiz 3Document3 pagesQuiz 3Arjay CarolinoNo ratings yet

- Manufacturing AccountsDocument11 pagesManufacturing Accountslukamasia100% (1)

- Contract Costing: Practical ProblemsDocument28 pagesContract Costing: Practical ProblemsHarshit Aggarwal79% (14)

- Construction Contracts Seatwork PDFDocument13 pagesConstruction Contracts Seatwork PDFaccounting prob100% (1)

- Orca Share Media1577676574590Document7 pagesOrca Share Media1577676574590Jayr BV100% (1)

- Cost Attemptwise PPDocument317 pagesCost Attemptwise PPHassnain SardarNo ratings yet

- Q3 - PPE and Government Grant Problem Solving: SolutionDocument8 pagesQ3 - PPE and Government Grant Problem Solving: SolutionLyka Nicole DoradoNo ratings yet

- At.3213 - Application of Audit Process To Transaction Cycles Part 1Document9 pagesAt.3213 - Application of Audit Process To Transaction Cycles Part 1Denny June CraususNo ratings yet

- Government Accounting - PPEDocument4 pagesGovernment Accounting - PPEEliyah JhonsonNo ratings yet

- Project Report For TWS3000 Semi Auto Bagasse Tableware LineDocument19 pagesProject Report For TWS3000 Semi Auto Bagasse Tableware LineHarsh Goyal50% (4)

- A Contractor's Guide to the FIDIC Conditions of ContractFrom EverandA Contractor's Guide to the FIDIC Conditions of ContractNo ratings yet

- Property, Plant and Equipment Sample Problems: Problem 1Document10 pagesProperty, Plant and Equipment Sample Problems: Problem 1Mark Gelo Winchester0% (1)

- PPEDocument1 pagePPEExcelsia Grace A. Parreño0% (1)

- Compre 3Document7 pagesCompre 3casio3627No ratings yet

- Problems On Contract CostingDocument11 pagesProblems On Contract CostingRoguewolfx VFX50% (2)

- Contract CostingDocument11 pagesContract CostingMalayaranjan PanigrahiNo ratings yet

- CHP 2. Contract Costing SumsDocument59 pagesCHP 2. Contract Costing SumsUchit MehtaNo ratings yet

- Unit 1 - Contract Costing - ProblemsDocument8 pagesUnit 1 - Contract Costing - ProblemsJoshua StarkNo ratings yet

- Unit 4 Contract Account2016-17Document15 pagesUnit 4 Contract Account2016-17yogeshNo ratings yet

- Contract CostingDocument3 pagesContract CostingRuchita JanakiramNo ratings yet

- Contract Costing - SumsDocument9 pagesContract Costing - Sumskushgarg627No ratings yet

- CA Vipin Bohra Job and Contract Costing 1649246144Document14 pagesCA Vipin Bohra Job and Contract Costing 1649246144paarthaggarwal418No ratings yet

- Contract CostingDocument14 pagesContract Costinglakshayajasuja2No ratings yet

- Contract CostingDocument4 pagesContract Costinghugebtsarmy0108No ratings yet

- Contract CostingDocument9 pagesContract CostingrajangargcaNo ratings yet

- CA Inter Costing QuestionsDocument15 pagesCA Inter Costing QuestionsJoshua A JamesNo ratings yet

- Contract CostingDocument12 pagesContract Costingvivek rajakNo ratings yet

- Job & Contract Costing NEPDocument8 pagesJob & Contract Costing NEPUnknown 1No ratings yet

- Audit of PpeDocument8 pagesAudit of PpeCPANo ratings yet

- Contract Costing (Unsolved)Document6 pagesContract Costing (Unsolved)ArnavNo ratings yet

- The Institute of Chartered Accountants of PakistanDocument4 pagesThe Institute of Chartered Accountants of PakistanShehrozSTNo ratings yet

- Assignment # 2: Two Accounting Questions & Solutions (Due Date Tuesday, 21 December, 2021)Document3 pagesAssignment # 2: Two Accounting Questions & Solutions (Due Date Tuesday, 21 December, 2021)Faroo wazirNo ratings yet

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Notes - Audit of PpeDocument4 pagesNotes - Audit of PpeLeisleiRagoNo ratings yet

- Problems On Cost Sheet: ST THDocument6 pagesProblems On Cost Sheet: ST THSouhardya MondalNo ratings yet

- 15 Job and Contract CostingDocument6 pages15 Job and Contract CostingLakshay SharmaNo ratings yet

- Tutorial Manufacturing AccountDocument4 pagesTutorial Manufacturing AccountAina ZainiNo ratings yet

- Accounting For Manufctuirng - PQ)Document6 pagesAccounting For Manufctuirng - PQ)usama sarwerNo ratings yet

- Paper - 1: Accounting: © The Institute of Chartered Accountants of IndiaDocument32 pagesPaper - 1: Accounting: © The Institute of Chartered Accountants of IndiaSanchit GargNo ratings yet

- AUD QuizesDocument9 pagesAUD QuizesDanielNo ratings yet

- Commerce Bba Semester 2 2022 November Basics of Cost Accounting 2019 PatternDocument4 pagesCommerce Bba Semester 2 2022 November Basics of Cost Accounting 2019 PatternDhaval BakliwalNo ratings yet

- Acco 30053 - Audit of Ppe - MarpDocument10 pagesAcco 30053 - Audit of Ppe - MarpBanna SplitNo ratings yet

- Audit of Noncurrent Assets UploadDocument4 pagesAudit of Noncurrent Assets Uploadandreamrie0% (2)

- 7 July 2021Document32 pages7 July 2021Aditya PrajapatiNo ratings yet

- Paper 1 Financial AccountingDocument10 pagesPaper 1 Financial AccountingTuryamureeba JuliusNo ratings yet

- Cost Sheet QuestionsDocument7 pagesCost Sheet QuestionsGurpreet Singh100% (1)

- Diy-Problems (Questionnaire)Document10 pagesDiy-Problems (Questionnaire)May RamosNo ratings yet

- 11.11.2017 Audit of PPEDocument9 pages11.11.2017 Audit of PPEPatOcampoNo ratings yet

- Assignment FarDocument5 pagesAssignment FarALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- Financial Accounting and Reporting - JA-2022 - QuestionDocument5 pagesFinancial Accounting and Reporting - JA-2022 - Question1793 Taherul IslamNo ratings yet

- 06 - PpeDocument4 pages06 - PpeLloydNo ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Contract Costing1Document3 pagesContract Costing1Anu RaneNo ratings yet

- Assignment 1 2022Document4 pagesAssignment 1 2022FESTUS MUTINDANo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaJayaprakash VenkatesanNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- Tutorial With Guided Explanation - MFRS116 StudentDocument19 pagesTutorial With Guided Explanation - MFRS116 StudentDont RushNo ratings yet

- Problem 1: InvestmentsDocument7 pagesProblem 1: InvestmentsEsse ValdezNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- Cost 1st Summative AssessmentDocument13 pagesCost 1st Summative AssessmentApas Pel Joshua M.No ratings yet

- Costing IPCCCDocument40 pagesCosting IPCCCAmith KumarNo ratings yet

- Chapter 2 - 1 - IllustrationDocument6 pagesChapter 2 - 1 - IllustrationYonas BamlakuNo ratings yet

- Contract CostingDocument9 pagesContract CostingprdyumnNo ratings yet

- Assignment # 1 - ManufacturingDocument1 pageAssignment # 1 - ManufacturingSyed Zohaib WarisNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Xii AccDocument4 pagesXii AccSanjayNo ratings yet

- SMO 3 Financial ManagementDocument651 pagesSMO 3 Financial Managementasg10No ratings yet

- R17 Understanding Income Statements IFT NotesDocument21 pagesR17 Understanding Income Statements IFT Notessubhashini sureshNo ratings yet

- HDMFDocument5 pagesHDMFJett LabillesNo ratings yet

- 2021 Annual Audit ReportDocument62 pages2021 Annual Audit ReportGabrielle OlaesNo ratings yet

- Cfab 2022 Ag AnswersDocument23 pagesCfab 2022 Ag AnswersShirah ShahrilNo ratings yet

- Hac - Manual Holcim Asset-Code: Cement Plant Coding and Base For Asset Management SystemsDocument122 pagesHac - Manual Holcim Asset-Code: Cement Plant Coding and Base For Asset Management SystemsGopi KrishnaNo ratings yet

- Industry Automotive IFRS AnalysisDocument11 pagesIndustry Automotive IFRS AnalysisHafeel MohamedNo ratings yet

- Intangible MCDocument49 pagesIntangible MCAnonymous zpUO2SNo ratings yet

- House PropertyDocument36 pagesHouse PropertyRahul Tanver0% (1)

- T - Codes (Sap-Fico)Document5 pagesT - Codes (Sap-Fico)AJNo ratings yet

- Basics in FinanceDocument7 pagesBasics in FinanceAshraf S. Youssef100% (1)

- Financial Management Chapter 02 IM 10th EdDocument21 pagesFinancial Management Chapter 02 IM 10th EdDr Rushen SinghNo ratings yet

- Financial Reporting Practices of Dutch Bangla Bank Ltd.-A Case StudyDocument42 pagesFinancial Reporting Practices of Dutch Bangla Bank Ltd.-A Case StudyKhairul Islam0% (2)

- Andiam: January 2, 2019Document5 pagesAndiam: January 2, 2019Avox EverdeenNo ratings yet

- Class 26 - Depreciation and Income TaxesDocument19 pagesClass 26 - Depreciation and Income TaxesPruthvi PrakashaNo ratings yet

- Example Mid TermDocument7 pagesExample Mid TermvelusnNo ratings yet

- Leasing Solution Ca-Final SFM (Full)Document32 pagesLeasing Solution Ca-Final SFM (Full)Pravinn_Mahajan80% (5)

- Prmg90 Cce Question Sec 1,2,3Document31 pagesPrmg90 Cce Question Sec 1,2,3bomyboomNo ratings yet

- Credit Memo Ok Debit Memo Ok Debit MemoDocument22 pagesCredit Memo Ok Debit Memo Ok Debit MemoVea Canlas CabertoNo ratings yet

- All MCQ For Thompson 5eDocument47 pagesAll MCQ For Thompson 5eLindaLindyNo ratings yet

- Pen PPRDocument29 pagesPen PPRVijay RaiyaniNo ratings yet