Professional Documents

Culture Documents

2021 12 December - 71000700

Uploaded by

Pablo BarónOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021 12 December - 71000700

Uploaded by

Pablo BarónCopyright:

Available Formats

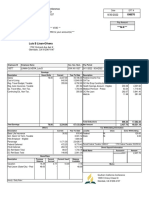

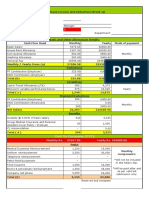

STATEMENTS OF EARNINGS AND DEDUCTIONS

Employee ID: 71000700 BU/Dept: UNFPA /42900 Contract Type: FTA

Empl Rcd: 0 Location: 6890/Maputo Grade/Step: P4/8

Name: RESTREPO MEJIA,Diana Pension No: 722069

Pay Date: 31/12/2021 Currency: USD Pension Remun: 192,889.00

Pay Period: 01/12/2021 to 31/12/2021 Net Base Salary: 7,193.67 Dependent Spouse: Y

Dependent Children: 2

Current Month Retroactive Adjustments Total

EARNINGS

Gross Salary 9,145.75 9,145.75

Post Adjustment ( 38.90%) 2,798.34 2,798.34

Dependent Child Allowance 488.17 488.17

Hardship Allowance 592.50 592.50

Spouse Allowance (6%) 599.52 599.52

Total Earnings 13,624.28 13,624.28

DEDUCTIONS

Staff Assessment 1,952.08 1,952.08

CIGNA Medical Deduction 388.71 388.71

Pension Contribution 1,269.85 1,269.85

Total Deductions 3,610.64 3,610.64

NET PAY 10,013.64 10,013.64

EMPLOYER CONTRIBUTION

Employer Medical Cigna 208.29 208.29

Employer Pension Contribution 2,539.71 2,539.71

Total Employer Contribution 2,748.00 2,748.00

Amount In Amount In Exchange

Payment Mode Name Of Bank/Third Party Base Curr Disbur. Curr Rate

Transfer United Nations Federal Credit Union 9,012.28 USD 9,012.28 USD 1.0000

Transfer STANDARD BANK, SARL 1,001.36 USD 1,001.36 USD 1.0000

Estimated Annual Leave Balance 29.00

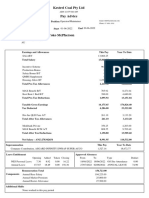

STATEMENTS OF EARNINGS AND DEDUCTIONS

Year To Date Payments for the period from : 1st January 2021 to 31 December 2021

Employee ID: 71000700 BU/Dept: UNFPA /42900

Empl Rcd: 0 Name: RESTREPO MEJIA,Diana LOCATION: Maputo

EARNINGS Year To Date DEDUCTIONS Year To Date

Gross Salary 108,002.28 Staff Assessment 22,900.71

Post Adjustment 32,681.04 CIGNA Medical Deduction 4,581.96

Dependent Child Allowance 5,858.04 Pension Contribution 14,991.72

Hardship Allowance 7,110.00

Spouse Allowance 7,066.98

Home Leave Travel Allowance 18,325.50

Total Earnings 179,043.84 Total Deductions 42,474.39

EMPLOYER CONTRIBUTION Year To Date

Employer Medical CIGNA 2,582.04

Employer Pension Contribution 29,983.56

Total Employer Contribution 32,565.60

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Payslip 46044522Document2 pagesPayslip 46044522Steve OrtonNo ratings yet

- Pay Slip: DetailDocument1 pagePay Slip: DetailRama AfandiNo ratings yet

- Sept 2nd PayoutDocument1 pageSept 2nd PayoutJohn HenryNo ratings yet

- Pay StubDocument1 pagePay Stubnurulamin00023No ratings yet

- PayslipDocument1 pagePayslipchloeNo ratings yet

- Elijah Jayie: Rate Hours Amount Amount YTD Hours YTD Amount YTD AmountDocument1 pageElijah Jayie: Rate Hours Amount Amount YTD Hours YTD Amount YTD Amountmdyafi8084No ratings yet

- SalarySlip 8484236Document1 pageSalarySlip 8484236Vikram MaanNo ratings yet

- PansDocument1 pagePansVee-kay Vicky KatekaniNo ratings yet

- 9:30:22Document1 page9:30:22Rosa Medina AlbarránNo ratings yet

- March 2021 Payslip CPSDocument41 pagesMarch 2021 Payslip CPSWjz WjzNo ratings yet

- Invitation LetterDocument32 pagesInvitation LetterPRASENJIT DENo ratings yet

- 45Document1 page45Nicola LendersNo ratings yet

- Francisca Da Silva Costa 72 Teme Road Worcester: Grupo Antolin (Droitwich) Head OfficeDocument1 pageFrancisca Da Silva Costa 72 Teme Road Worcester: Grupo Antolin (Droitwich) Head Officefranciscasilvacosta2No ratings yet

- Payslip May 2021 State Bank of India: DMIPK3947MDocument1 pagePayslip May 2021 State Bank of India: DMIPK3947MArjun KumarNo ratings yet

- IYYSCP007870400100 R 19125 DA6 E1 E3621Document1 pageIYYSCP007870400100 R 19125 DA6 E1 E3621Genesis De La Rosa SibajaNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Your Pay Advice For Pay Ending 30 06 2022Document2 pagesYour Pay Advice For Pay Ending 30 06 2022iqbal.shahid0374No ratings yet

- Payslip For Period 3, Da Dasala 5022276Document1 pagePayslip For Period 3, Da Dasala 5022276Dian DasalaNo ratings yet

- Payslip For Period 4, Da Dasala 5022276Document1 pagePayslip For Period 4, Da Dasala 5022276Dian DasalaNo ratings yet

- Medhavi Giri-payslip-Dec-2023Document1 pageMedhavi Giri-payslip-Dec-2023prateek gangwaniNo ratings yet

- Phillips Enitan Akintunde - Jun - 2022Document1 pagePhillips Enitan Akintunde - Jun - 2022Anna LollyNo ratings yet

- PayslipDocument1 pagePayslipOnayimisNo ratings yet

- Adobe Scan Nov 23, 2021Document4 pagesAdobe Scan Nov 23, 2021Addy mamatNo ratings yet

- Candy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)Document1 pageCandy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)mcocampo2No ratings yet

- Payslip 5430 10052023 10202023 11012023 091526Document1 pagePayslip 5430 10052023 10202023 11012023 091526Pat AgustinNo ratings yet

- Global Cash Card - Paystub Detail PDFDocument1 pageGlobal Cash Card - Paystub Detail PDFVerónica Del RioNo ratings yet

- April 1st Bi-Weekly PayoutDocument1 pageApril 1st Bi-Weekly PayoutJohn HenryNo ratings yet

- Payslip 1010437564Document1 pagePayslip 1010437564Leojrsalvador MabaquiaoNo ratings yet

- Employee Name - (EE & ER) - PDOC-Date Paid-2024-03-28Document2 pagesEmployee Name - (EE & ER) - PDOC-Date Paid-2024-03-28RileyNo ratings yet

- 87 FC 2402Document1 page87 FC 2402AmaryNo ratings yet

- FormDocument1 pageFormRahul GaurNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Your Pay Advice For Pay Ending 30 09 2022Document2 pagesYour Pay Advice For Pay Ending 30 09 2022iqbal.shahid0374No ratings yet

- ODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFDocument1 pageODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFOluwayemisi EbijimiNo ratings yet

- SalarySlip 6774210Document1 pageSalarySlip 6774210GANINo ratings yet

- Payslip 5430 11212023 12042023 12182023 222023Document1 pagePayslip 5430 11212023 12042023 12182023 222023Pat AgustinNo ratings yet

- Combine PDFDocument3 pagesCombine PDFKaye ApostolNo ratings yet

- OLORUNTOBA OPEYEMI MAUTIN - Mar - 2023Document1 pageOLORUNTOBA OPEYEMI MAUTIN - Mar - 2023Oloruntoba opeyemiNo ratings yet

- CTC BreakupDocument2 pagesCTC BreakupbaluNo ratings yet

- PayStatement D0655147Document1 pagePayStatement D0655147Anonymous O61KvPgNo ratings yet

- $valueseptDocument1 page$valueseptashok sahooNo ratings yet

- Heim 030010293631122022001Document1 pageHeim 030010293631122022001sindiswapinkynkosiNo ratings yet

- 4Document1 page4Victoria MrrNo ratings yet

- Security Rate For Security GuardsDocument1 pageSecurity Rate For Security GuardsengelNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLrajkannamdu100% (1)

- SLIP GAJI DANDI Des Jan FebDocument3 pagesSLIP GAJI DANDI Des Jan Febharun chandraNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- PFIM031007420731072023001Document1 pagePFIM031007420731072023001Angie SekhuniNo ratings yet

- Sspofadv 4Document1 pageSspofadv 4Antoni Zelaya0% (1)

- Year Financial Report 2018 in USDDocument2 pagesYear Financial Report 2018 in USDDylan HoffmannNo ratings yet

- Valve Adj.Document1 pageValve Adj.Antoni ZelayaNo ratings yet

- File 1831Document1 pageFile 183176xzv4kk5vNo ratings yet

- Dec 1st Bi-Weekly PayoutDocument1 pageDec 1st Bi-Weekly PayoutJohn HenryNo ratings yet

- Yejide Porter Recent StubDocument1 pageYejide Porter Recent StubMalinda ShortNo ratings yet

- Payslip For Period 5, Da Dasala 5022276Document1 pagePayslip For Period 5, Da Dasala 5022276Dian DasalaNo ratings yet

- July SlipDocument1 pageJuly SlipNILAMANI SAHOONo ratings yet

- Supply Curve of LabourDocument3 pagesSupply Curve of LabourTim InawsavNo ratings yet

- Assignment No 1Document8 pagesAssignment No 1manesh1234No ratings yet

- International Trade PoliciesDocument12 pagesInternational Trade Policieskateangel ellesoNo ratings yet

- United Respublic of Tanzania Business Registrations and Licensing AgencyDocument2 pagesUnited Respublic of Tanzania Business Registrations and Licensing AgencyGreen MakwareNo ratings yet

- Lehman Brothers Holdings Inc V Jpmorgan Chase Bank Na Amended Counterclaims of Jpmorgan Chase BankDocument69 pagesLehman Brothers Holdings Inc V Jpmorgan Chase Bank Na Amended Counterclaims of Jpmorgan Chase BankForeclosure FraudNo ratings yet

- Growth and Prospects of Odisha Tourism An Empirical StudyDocument4 pagesGrowth and Prospects of Odisha Tourism An Empirical StudyAshis Kumar MohapatraNo ratings yet

- Itc14 mcp23Document8 pagesItc14 mcp23Lee TeukNo ratings yet

- VP Commercial Real Estate Finance in NYC Resume Todd BakerDocument2 pagesVP Commercial Real Estate Finance in NYC Resume Todd BakerToddBaker1No ratings yet

- Unfair Trade PracticesDocument29 pagesUnfair Trade PracticesVasudha FulzeleNo ratings yet

- AFM Module 1Document8 pagesAFM Module 1santhosh GowdaNo ratings yet

- Lesson 2 ONLINEDocument10 pagesLesson 2 ONLINEFrancis Dave Nagum Mabborang IINo ratings yet

- Macs SPDocument52 pagesMacs SPAviR14No ratings yet

- Canada Autos (DSC) (Panel)Document15 pagesCanada Autos (DSC) (Panel)Frontyardservices Uganda limitedNo ratings yet

- National Models of HRM: Europe and USADocument31 pagesNational Models of HRM: Europe and USAKwiz MichaelNo ratings yet

- HRM in ChinaDocument50 pagesHRM in ChinaNirav BrahmbhattNo ratings yet

- 42 42 Characteristics of Working CapitalDocument22 pages42 42 Characteristics of Working Capitalpradeepg8750% (2)

- Aurangabad New Profile 2019-20Document16 pagesAurangabad New Profile 2019-20Gas GaminGNo ratings yet

- Globalization's Wrong TurnDocument8 pagesGlobalization's Wrong TurnAna TamaritNo ratings yet

- Sinking FundDocument11 pagesSinking FundSrit MechNo ratings yet

- Capital Asset Pricing ModelDocument10 pagesCapital Asset Pricing Modeljackie555No ratings yet

- Full Set PMTH001 Q Set 2Document14 pagesFull Set PMTH001 Q Set 2L YNo ratings yet

- Audit of PPE 2Document2 pagesAudit of PPE 2Raz MahariNo ratings yet

- Fundamentals of Power System Economics: Daniel Kirschen Goran StrbacDocument5 pagesFundamentals of Power System Economics: Daniel Kirschen Goran StrbacGurdeep singh BaliNo ratings yet

- Agreement For Liquidation Auction ServicesDocument3 pagesAgreement For Liquidation Auction ServicesNeelamgaNo ratings yet

- Corporate Social ResponsibilityDocument8 pagesCorporate Social ResponsibilityJustin Miguel IniegoNo ratings yet

- Taxation Law CIA 1 (B) Salary AnalysisDocument3 pagesTaxation Law CIA 1 (B) Salary Analysisawinash reddyNo ratings yet

- Entrepreneurship-11 12 Q2 SLM WK2Document6 pagesEntrepreneurship-11 12 Q2 SLM WK2MattNo ratings yet

- Industry Analysis On Cloud ServicesDocument12 pagesIndustry Analysis On Cloud ServicesBaken D DhungyelNo ratings yet

- IELTS Task 1Document12 pagesIELTS Task 1saidur183No ratings yet

- Motivation of The Project Team As A Key Performance of The Project SuccessDocument8 pagesMotivation of The Project Team As A Key Performance of The Project SuccessGogyNo ratings yet