Professional Documents

Culture Documents

Payslip For Period 3, Da Dasala 5022276

Uploaded by

Dian DasalaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payslip For Period 3, Da Dasala 5022276

Uploaded by

Dian DasalaCopyright:

Available Formats

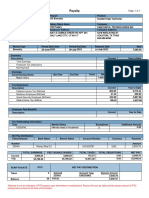

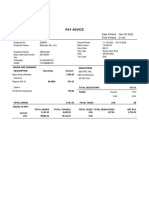

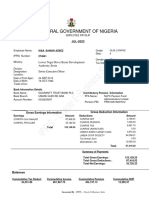

Pay date: 23/06/2023

Mr DA Dasala

Tax Ref: 321/61773

159 Chiswick Village

Tax Period: 3

Hounslow Employee Ref No: 5022276

London Tax Code/Basis: 1257L

W4 3DG NI No/Code: SW376187D / A

Pay and

Allowances Deductions Balances

Occ Sick Payment 197.56 Income Tax 458.80 TAXBLE PAY YTD 9,593.62

Occ Sick Contra -197.56 Nat Insurance 271.29 TAX YTD 1,289.60

Basic Pay 3,004.58 JM PENS YTD 0.00

Supplement 50.00 NI YTD EEs 761.84

FlexiHol: 2 * 14.6855 -29.37 NI YTD ERs 996.18

Hol Supp: 3 * 20.9821 62.95 JMEPS SMART YTD 270.42

O/T 2.0: 9 * 37.4792 337.31 BENEFITS 21.12

JMEPS CrA -90.14 SHAREMATCH YTD 75.11

MediPlus Benefit 7.04

HomeTech No2 -26.58

Taxable pay 3,342.37 Other deductions 0.00

Net pay

Total pay 3,308.75 Total deductions 730.09 2,578.66

Payment will be made to your bank account via BACS. If your details change or you have a query about

your pay, please contact your local HR team.

elements.matthey.com

You might also like

- SSPOFADVDocument1 pageSSPOFADVKaren OHareNo ratings yet

- Global Cash Card - Paystub Detail PDFDocument1 pageGlobal Cash Card - Paystub Detail PDFVerónica Del RioNo ratings yet

- UntitledDocument1 pageUntitleddefxsoulNo ratings yet

- IYYSCP007870400100 R 19125 DA6 E1 E3621Document1 pageIYYSCP007870400100 R 19125 DA6 E1 E3621Genesis De La Rosa SibajaNo ratings yet

- Earnings Statement: For Inquiries On This Statement Please Call: 419-252-5500Document2 pagesEarnings Statement: For Inquiries On This Statement Please Call: 419-252-5500CeceliaNo ratings yet

- PayStatement D0655147Document1 pagePayStatement D0655147Anonymous O61KvPgNo ratings yet

- Dec 5Document1 pageDec 5Marvin DavidNo ratings yet

- Kennedy Paystub 2Document1 pageKennedy Paystub 2Hannah RobinsonNo ratings yet

- Ub23m03 689321Document1 pageUb23m03 689321RachitNo ratings yet

- Advice of Deposit - Non-NegotiableDocument1 pageAdvice of Deposit - Non-NegotiableMolina VaneNo ratings yet

- Payslip 46044522Document2 pagesPayslip 46044522Steve OrtonNo ratings yet

- Phillips Enitan Akintunde - Jun - 2022Document1 pagePhillips Enitan Akintunde - Jun - 2022Anna LollyNo ratings yet

- Earnings StatementDocument1 pageEarnings Statementkrmita OrtizNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Payslip - Payslip-SOMIGLI212-20230228Document1 pagePayslip - Payslip-SOMIGLI212-20230228Luca SomigliNo ratings yet

- UntitledDocument1 pageUntitledDanny WeahNo ratings yet

- Epayslip 2022-09-26 30909149Document1 pageEpayslip 2022-09-26 30909149Det LaurenteNo ratings yet

- Payslip PendingDocument1 pagePayslip PendingJesna JesudasNo ratings yet

- ONPSLIP UN 1011202311555 8025192RcsDocument1 pageONPSLIP UN 1011202311555 8025192RcsjohnsonmarielouiseNo ratings yet

- Form (12) Payslip For JNR ExDocument1 pageForm (12) Payslip For JNR Exnikhil kumarNo ratings yet

- Invitation LetterDocument32 pagesInvitation LetterPRASENJIT DENo ratings yet

- Nhiel - Serentas Payroll PayslipSelfService ExternalPayslipPDFProcessPHDocument1 pageNhiel - Serentas Payroll PayslipSelfService ExternalPayslipPDFProcessPHnhiel anthony SerentasNo ratings yet

- Payslip For Period 5, Da Dasala 5022276Document1 pagePayslip For Period 5, Da Dasala 5022276Dian DasalaNo ratings yet

- Payslip For Period 4, Da Dasala 5022276Document1 pagePayslip For Period 4, Da Dasala 5022276Dian DasalaNo ratings yet

- March 2021 Payslip CPSDocument41 pagesMarch 2021 Payslip CPSWjz WjzNo ratings yet

- Epayslip 2022-07-25 10369847Document1 pageEpayslip 2022-07-25 10369847aida.bungcasan.2020No ratings yet

- December 2023Document1 pageDecember 2023innoozokoNo ratings yet

- PayslipDocument1 pagePayslipblackson knightsonNo ratings yet

- 2021 12 December - 71000700Document2 pages2021 12 December - 71000700Pablo BarónNo ratings yet

- SALNONEXEMPT 20221105 366924 PayslipDocument1 pageSALNONEXEMPT 20221105 366924 PayslipMarie LizaNo ratings yet

- Salary 11-2023Document1 pageSalary 11-2023Van DaoNo ratings yet

- Nett Pay 4222.87Document1 pageNett Pay 4222.87sacNo ratings yet

- Payslip-03 10 2023Document1 pagePayslip-03 10 2023wireNo ratings yet

- November 2023Document1 pageNovember 2023innoozokoNo ratings yet

- PAYSLIP - 4738 From Fortnightly Payroll JFDocument1 pagePAYSLIP - 4738 From Fortnightly Payroll JFEdward NickyNo ratings yet

- Yejide Porter Recent StubDocument1 pageYejide Porter Recent StubMalinda ShortNo ratings yet

- Epayslip 2024-01-26 11319801Document1 pageEpayslip 2024-01-26 11319801Anthony Balaba MabaoNo ratings yet

- Payslip 1010437564Document1 pagePayslip 1010437564Leojrsalvador MabaquiaoNo ratings yet

- PS01 Mary RogersDocument1 pagePS01 Mary Rogersbahadarkhan591No ratings yet

- Francisca Da Silva Costa 72 Teme Road Worcester: Grupo Antolin (Droitwich) Head OfficeDocument1 pageFrancisca Da Silva Costa 72 Teme Road Worcester: Grupo Antolin (Droitwich) Head Officefranciscasilvacosta2No ratings yet

- LastthreemonthPayslip 11Document7 pagesLastthreemonthPayslip 11delicata.benNo ratings yet

- Your Pay Advice For Pay Ending 30 06 2022Document2 pagesYour Pay Advice For Pay Ending 30 06 2022iqbal.shahid0374No ratings yet

- LastthreemonthPayslip 12Document7 pagesLastthreemonthPayslip 12delicata.benNo ratings yet

- Hours Wages Rate This Check Year-To-Date Year-To-Date This Check Deductions and Taxes Amount Amount Amount AmountDocument1 pageHours Wages Rate This Check Year-To-Date Year-To-Date This Check Deductions and Taxes Amount Amount Amount AmountjgfNo ratings yet

- PansDocument1 pagePansVee-kay Vicky KatekaniNo ratings yet

- March 15 PayslipDocument1 pageMarch 15 PayslipGrey Del PilarNo ratings yet

- 2023 12 31 PayslipDocument2 pages2023 12 31 PayslipSami SayyedNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Ippis Payslip by Ministry July 2023 Part337Document1 pageIppis Payslip by Ministry July 2023 Part337Issa AzeezNo ratings yet

- SALNONEXEMPT 20221020 366924 PayslipDocument1 pageSALNONEXEMPT 20221020 366924 PayslipMarie LizaNo ratings yet

- ONPSLIP RT 7320241981 807909ORCzDocument1 pageONPSLIP RT 7320241981 807909ORCzcosaraluminita2000No ratings yet

- Paystub For Oct 2020Document1 pagePaystub For Oct 2020bahadarkhan591No ratings yet

- LastthreemonthPayslip 9Document7 pagesLastthreemonthPayslip 9delicata.benNo ratings yet

- Anore April 30 Payslip Previous Self 2309Document1 pageAnore April 30 Payslip Previous Self 2309Cherie Magne AnoreNo ratings yet

- April 1st Bi-Weekly PayoutDocument1 pageApril 1st Bi-Weekly PayoutJohn HenryNo ratings yet

- Epayslip 2022-10-26 25018077Document1 pageEpayslip 2022-10-26 25018077saintpalmers2012No ratings yet

- IT Computation Kiran Kidiyappa Shivakumar FY 2022-23 V2Document6 pagesIT Computation Kiran Kidiyappa Shivakumar FY 2022-23 V2Kiran Kidiyappa ShivakumarNo ratings yet

- Pay Details: Earnings Deductions Code Description Quantity Amount Code Description AmountDocument1 pagePay Details: Earnings Deductions Code Description Quantity Amount Code Description AmountVee-kay Vicky KatekaniNo ratings yet

- Khalil Ahmed 140 Rochfords Coffee Hall Milton Keynes Mk6 5DlDocument2 pagesKhalil Ahmed 140 Rochfords Coffee Hall Milton Keynes Mk6 5DlSayyid SheeNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet