Professional Documents

Culture Documents

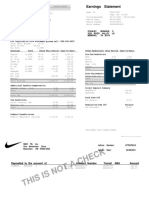

Hours Wages Rate This Check Year-To-Date Year-To-Date This Check Deductions and Taxes Amount Amount Amount Amount

Uploaded by

jgfOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hours Wages Rate This Check Year-To-Date Year-To-Date This Check Deductions and Taxes Amount Amount Amount Amount

Uploaded by

jgfCopyright:

Available Formats

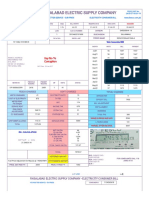

WORKSITE INFORMATION

RAE Group Holdings, Inc 10757 Cutten Rd Building 1 Houston, TX 77066 Ph:281-440-3434

EMPLOYEE NAME COMPANY NAME CLIENT ID EMPL ID SOCIAL SECURITY CHECK DATE CHECK No.

Caceres, Yon A RAE Group Holdings, Inc 5072 34 xxx-xx-8003 3/18/2016 93177

PAY PERIOD NET PAY DIR DEPOSIT CHECK AMT

2/28/2016 thru 3/12/2016 4,595.56 4,595.56 0.00

AMOUNT AMOUNT AMOUNT AMOUNT

WAGES HOURS RATE THIS CHECK YEAR-TO-DATE DEDUCTIONS AND TAXES THIS CHECK YEAR-TO-DATE

Holiday Pay 808.32 Fed Income Tax 1,075.88 6,047.73

Per Diem - Non Tax 770.00 3,960.00 Social Security 392.30 2,246.28

Offshore Hourly 80.0000 29.7300 2,378.40 15,326.00 Medicare 91.75 525.34

Offshore Overtime 92.0000 44.5950 4,102.74 21,018.30 MS State W/H 252.00 744.00

Total Earnings 7,251.14 41,112.62 Total Taxes 1,811.93 9,563.35

Non Cash Items HSA MMH2* 135.72 814.32

Group Term Life Insurance 0.92 5.52 Voluntary Life 26.79 160.74

Disability Gross Up Opt 3.84 23.04 Client Dental* 8.69 52.14

Total Non Cash Items 4.76 28.56 Vision Plan* 1.81 10.86

401K Plan** 389.15 2,230.87

Accident Pre-Tax* 12.24 73.44

401K Loan Repayment 269.25 1,615.50

Total Deductions 843.65 4,957.87

* Exempt from Federal W/H,FICA and Medicare

** Exempt from Federal W/H

Employer Contributions SAVINGS Acct:****1186 150.00

HSA MMH2 542.87 3,257.22 CHECKING Acct:****5024 4,445.56

Life Insurance 5.54 33.24 Total Direct Deposits 4,595.56

Long Term Disability 3.84 23.04

Client Dental 34.78 208.68

Vision Plan 7.20 43.20

Total Employer Contributions 594.23 3,565.38

You might also like

- Earnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Document1 pageEarnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Miquel JonesNo ratings yet

- 9:30:22Document1 page9:30:22Rosa Medina AlbarránNo ratings yet

- SSPOFADVDocument1 pageSSPOFADVKaren OHareNo ratings yet

- Global Cash Card - Paystub Detail PDFDocument1 pageGlobal Cash Card - Paystub Detail PDFVerónica Del RioNo ratings yet

- Bwi North America, Inc. Abhishek Inchal: Expenserei GTL LTD RegularDocument1 pageBwi North America, Inc. Abhishek Inchal: Expenserei GTL LTD RegularSandra BenjaminNo ratings yet

- Pay Stub 4022018-4152018Document1 pagePay Stub 4022018-4152018lilian hutsilNo ratings yet

- IYYSCP007870400100 R 19125 DA6 E1 E3621Document1 pageIYYSCP007870400100 R 19125 DA6 E1 E3621Genesis De La Rosa SibajaNo ratings yet

- File 1831Document1 pageFile 183176xzv4kk5vNo ratings yet

- 02475792798Document1 page02475792798Edwin Zamora PastorNo ratings yet

- PayStatement D0655147Document1 pagePayStatement D0655147Anonymous O61KvPgNo ratings yet

- E-Statement 20131018 00027Document1 pageE-Statement 20131018 00027Renee0430100% (1)

- Pay Stub 2Document2 pagesPay Stub 2Antionette JewelNo ratings yet

- Civilian Leave and Earnings Statement LesDocument1 pageCivilian Leave and Earnings Statement LesStefhanie ClaireNo ratings yet

- 87 FC 2402Document1 page87 FC 2402AmaryNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Payslip To Print 04 29 2017 PDFDocument1 pagePayslip To Print 04 29 2017 PDFDoraNo ratings yet

- Advice of Deposit - Non-NegotiableDocument1 pageAdvice of Deposit - Non-NegotiableMolina VaneNo ratings yet

- Earnings Statement: Netjets Aviation, Inc. 4111 Bridgeway Ave Columbus Oh 43219Document1 pageEarnings Statement: Netjets Aviation, Inc. 4111 Bridgeway Ave Columbus Oh 43219sch44029No ratings yet

- Sukhvinder Singh - ES LoblawsDocument1 pageSukhvinder Singh - ES LoblawsLily NguyenNo ratings yet

- Payslip To Print - Report Design 10-01-2020Document1 pagePayslip To Print - Report Design 10-01-2020martin avinaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- GR-TWC1-7211-5202 (Cost Evaluation Summary)Document4 pagesGR-TWC1-7211-5202 (Cost Evaluation Summary)Sulist N WahyudieNo ratings yet

- I. The Three Great Powers of The Government: Corporation v. City of Manila (2009)Document44 pagesI. The Three Great Powers of The Government: Corporation v. City of Manila (2009)Jiyeon Choi100% (1)

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of IndiaRugved RajpurkarNo ratings yet

- A Project On Ratio Analysis of Financial Statements & Working Capital Management at HVTL, Tata Motors, JamshedpurDocument88 pagesA Project On Ratio Analysis of Financial Statements & Working Capital Management at HVTL, Tata Motors, Jamshedpurgopalagarwal238780% (30)

- Invitation LetterDocument32 pagesInvitation LetterPRASENJIT DENo ratings yet

- Economic Impact of TourismDocument22 pagesEconomic Impact of TourismFabforyou Collectionz100% (2)

- Yejide Porter Recent StubDocument1 pageYejide Porter Recent StubMalinda ShortNo ratings yet

- Paystub For Oct 2020Document1 pagePaystub For Oct 2020bahadarkhan591No ratings yet

- Payslip-03 10 2023Document1 pagePayslip-03 10 2023wireNo ratings yet

- PS01 Mary RogersDocument1 pagePS01 Mary Rogersbahadarkhan591No ratings yet

- Davita Payslip To Print - Report Design 03-06-2024Document1 pageDavita Payslip To Print - Report Design 03-06-2024addae.fredrickNo ratings yet

- Checkstub For Kenny Cullison - 12 - 29 - 2022Document1 pageCheckstub For Kenny Cullison - 12 - 29 - 2022kbcullison61No ratings yet

- Octubre 20Document1 pageOctubre 20dakpi479No ratings yet

- Septiembre 8Document1 pageSeptiembre 8dakpi479No ratings yet

- Check Stub 1Document1 pageCheck Stub 1raheemtimo1No ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- Capital One Services, LLC 1680 Capital One Drive Mclean, Va 22102-3407 +1 (888) 376-8836Document1 pageCapital One Services, LLC 1680 Capital One Drive Mclean, Va 22102-3407 +1 (888) 376-8836AmaryNo ratings yet

- Payslip For Period 4, Da Dasala 5022276Document1 pagePayslip For Period 4, Da Dasala 5022276Dian DasalaNo ratings yet

- Ch-3 Finance Department Trading & P&L AccountDocument4 pagesCh-3 Finance Department Trading & P&L AccountMit MehtaNo ratings yet

- Consolidated Profit CanarabankDocument1 pageConsolidated Profit CanarabankMadhav LuthraNo ratings yet

- Fedex Stub 110323Document1 pageFedex Stub 110323emilyrichards201731No ratings yet

- INT187b - Payroll Result For Payroll Result As of Sub Period End Date - Payslip Self Service Report 10 09 2023Document1 pageINT187b - Payroll Result For Payroll Result As of Sub Period End Date - Payslip Self Service Report 10 09 2023andy.r.escobarNo ratings yet

- Gizmo Pay 2Document2 pagesGizmo Pay 2rafa perezNo ratings yet

- Your Pay Advice For Pay Ending 30 06 2022Document2 pagesYour Pay Advice For Pay Ending 30 06 2022iqbal.shahid0374No ratings yet

- Telecon Format - Project EngineerDocument1 pageTelecon Format - Project EngineerLily NguyenNo ratings yet

- Payslip For Period 3, Da Dasala 5022276Document1 pagePayslip For Period 3, Da Dasala 5022276Dian DasalaNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsJoydeep GoraiNo ratings yet

- Jet AirwaysDocument5 pagesJet AirwaysKarthik SrmNo ratings yet

- TSU - Public AdminDocument45 pagesTSU - Public AdminaileenrconcepcionNo ratings yet

- Check 1Document1 pageCheck 1luv meNo ratings yet

- Krishan AccountDocument6 pagesKrishan Accountkrishan jindalNo ratings yet

- Payback Period (In Months)Document4 pagesPayback Period (In Months)Reyy ArbolerasNo ratings yet

- Aditya Birla Capital Limited Statement of Consolidated Unaudited Results For The Quarter Ended 30Th June 2019Document6 pagesAditya Birla Capital Limited Statement of Consolidated Unaudited Results For The Quarter Ended 30Th June 2019Bhavesh PatelNo ratings yet

- 2021 12 December - 71000700Document2 pages2021 12 December - 71000700Pablo BarónNo ratings yet

- 07 15 2018 PayDocument2 pages07 15 2018 PayB.ShivaniNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisEashaa SaraogiNo ratings yet

- Workday 1Document1 pageWorkday 1raheemtimo1No ratings yet

- Company Info - Print Financials2Document2 pagesCompany Info - Print Financials2rojaNo ratings yet

- Financial Analysis (HAL) FinalDocument22 pagesFinancial Analysis (HAL) FinalAbhishek SoniNo ratings yet

- SSPCNADVDocument1 pageSSPCNADVChristopher WongNo ratings yet

- Financials Plaza Del PradoDocument14 pagesFinancials Plaza Del PradoSteve WilliamNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Pay Details: Earnings Deductions Code Description Quantity Amount Code Description AmountDocument1 pagePay Details: Earnings Deductions Code Description Quantity Amount Code Description AmountVee-kay Vicky KatekaniNo ratings yet

- TN Comptroller Final Report On The Shelby County Clerk's OfficeDocument9 pagesTN Comptroller Final Report On The Shelby County Clerk's OfficeLydian CoombsNo ratings yet

- Ashiyan Price List 19-Jul-22Document1 pageAshiyan Price List 19-Jul-22love sharmaNo ratings yet

- Invoice 1553736Document1 pageInvoice 1553736yashuNo ratings yet

- Cta PDFDocument3 pagesCta PDFSonjo SinNo ratings yet

- YourekaDocument18 pagesYourekaKanwaljeet SinghNo ratings yet

- Income Tax ActDocument711 pagesIncome Tax ActPikinisoNo ratings yet

- Springtek Mattress InvoiceDocument1 pageSpringtek Mattress InvoiceRavi kumar BhukyaNo ratings yet

- Tax3211 Estate Tax 220318 130404Document17 pagesTax3211 Estate Tax 220318 130404MOTC INTERNAL AUDIT SECTIONNo ratings yet

- 02 Fundamentals of TallyDocument18 pages02 Fundamentals of TallyVelayudham Chennai S100% (1)

- Mccia Ar Final CompressedDocument78 pagesMccia Ar Final Compressedgoten25No ratings yet

- CIR v. Mirant Pagbilao Corp.Document21 pagesCIR v. Mirant Pagbilao Corp.AronJamesNo ratings yet

- Chapter 13Document120 pagesChapter 13yongNo ratings yet

- Case Study - Guidelines & Template Mac 2021Document30 pagesCase Study - Guidelines & Template Mac 2021AdrinaG-bNo ratings yet

- Benguet Corp. v. CBAADocument8 pagesBenguet Corp. v. CBAAEmma Ruby Aguilar-ApradoNo ratings yet

- D D D D D P: 1+r + (1+r) + (1+r) + (1+r) + (1+r) + (1+r) 1+g) (Document3 pagesD D D D D P: 1+r + (1+r) + (1+r) + (1+r) + (1+r) + (1+r) 1+g) (Shien Angel Delos ReyesNo ratings yet

- M/s Shiv Vani Oil & Gas Exploration Services LTD Vs Income Tax Office (ITO)Document21 pagesM/s Shiv Vani Oil & Gas Exploration Services LTD Vs Income Tax Office (ITO)rupesh.srivastavaNo ratings yet

- Assignment Sourcing and CostingDocument12 pagesAssignment Sourcing and CostingShivani JayanthNo ratings yet

- Sanghamitra Exp Third Ac (3A)Document1 pageSanghamitra Exp Third Ac (3A)akssharmamobileNo ratings yet

- Tally9 - List of LedgersDocument2 pagesTally9 - List of LedgersSubash_SaradhaNo ratings yet

- Susquehanna Medical Center Computation of Break-Even Point in Patient-Days: Pediatrics For The Year Ended June 30, 20X6Document6 pagesSusquehanna Medical Center Computation of Break-Even Point in Patient-Days: Pediatrics For The Year Ended June 30, 20X6EdTan RagadioNo ratings yet

- Tax Q and A 1Document2 pagesTax Q and A 1Marivie UyNo ratings yet

- BCG Back To MesopotamiaDocument15 pagesBCG Back To MesopotamiaZerohedgeNo ratings yet

- AFAR Part 1 Page 1-20Document2 pagesAFAR Part 1 Page 1-20Tracy Ann AcedilloNo ratings yet

- Fesco Online BillDocument2 pagesFesco Online BillMueen HassanNo ratings yet

- Database of Xcess BooksDocument88 pagesDatabase of Xcess BooksypamechaNo ratings yet