Professional Documents

Culture Documents

Income Payments Subject To CWT

Uploaded by

Kez0 ratings0% found this document useful (0 votes)

7 views1 pageIncome payments made for services rendered or rentals are subject to creditable withholding tax (CWT) at various rates depending on the amount and type of income. Professional fees, talent fees, and commissions are subject to CWT of 5-15% depending on if the payee is an individual or corporation and the amount of annual gross income. Rentals of real property, personal property, poles, satellites, and other items are subject to 5% CWT. Certain contractors receive 2% CWT on gross payments.

Original Description:

Original Title

Income Payments subject to CWT

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIncome payments made for services rendered or rentals are subject to creditable withholding tax (CWT) at various rates depending on the amount and type of income. Professional fees, talent fees, and commissions are subject to CWT of 5-15% depending on if the payee is an individual or corporation and the amount of annual gross income. Rentals of real property, personal property, poles, satellites, and other items are subject to 5% CWT. Certain contractors receive 2% CWT on gross payments.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageIncome Payments Subject To CWT

Uploaded by

KezIncome payments made for services rendered or rentals are subject to creditable withholding tax (CWT) at various rates depending on the amount and type of income. Professional fees, talent fees, and commissions are subject to CWT of 5-15% depending on if the payee is an individual or corporation and the amount of annual gross income. Rentals of real property, personal property, poles, satellites, and other items are subject to 5% CWT. Certain contractors receive 2% CWT on gross payments.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

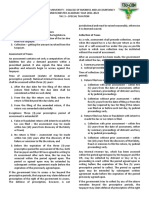

INCOME PAYMENTS SUBJECT TO CREDITABLE WITHHOLDING TAX (CWT) (9) Fees of directors who are not employees of the

re not employees of the company paying such

fees, whose duties are confined to attendance at and participation in

(A) Professional fees, talent fees, etc. for services rendered – On the gross

the meetings of the board of directors;

professional, promotional, and talent fees or any other form of

(10) Income Payments to certain brokers and agents – on gross

remuneration for the services rendered by the following:

commissions of customs, insurance, stock, immigration and

Individual payee: commercial brokers, fees of agents of professional entertainers and

- If gross income for the current year did not exceed ₱3M - Five percent real estate service practitioners (RESPs), (i.e. real estate consultants,

(5%); real estate appraisers and real estate brokers) who failed or did not

- If gross income is more than ₱3M - Ten percent (10%) take up the licensure examination given by and not registered with the

Real Estate Service under the Professional Regulations Commission.

Non-individual payee: (11) Commissions of independent and/or exclusive sales representatives,

- If gross income for the current year did not exceed ₱720,000-Ten and marketing agents of companies [formerly under letter – on gross

percent (10%); commissions, rebates, discounts and other similar considerations

- If gross income exceeds ₱720,000 - Fifteen percent (15%) paid/granted to independent and/or exclusive sales representatives

and marketing agents and sub-agents of companies, including multi-

(1) Those individually engaged in the practice of profession or callings; level marketing companies, on their sale of goods and services by way

lawyers; certified public accountants; doctors of medicine; architects; of direct selling or similar arrangements where there is no transfer of

civil, electrical, chemical, mechanical, structural, industrial, mining, title over the goods from the seller to the agent/sales representative.

sanitary, metallurgical and geodetic engineers; marine surveyors;

doctors of veterinary science; dentist; professional appraisers; (B) Rentals

connoisseurs of tobacco; actuaries; interior decorators, designers, real (1) Real Properties - On gross rental for the continued use or possession

estate service practitioners (RESP), (i.e. real estate consultants, real of real property used in business which the payor or obligor has not

estate appraisers and real estate brokers) requiring government taken or is not taking title, or in which he has no equity – Five

licensure examination given by the Real Estate Service pursuant to percent (5%)

Republic Act No. 9646 and all other profession requiring government (2) Personal Properties – On gross rental or lease in excess of Ten

licensure examination regulated by the Professional Regulations Thousand Pesos (₱10,000) annually for the continued use or

Commission, Supreme Court, etc. possession - Five percent (5%)

(2) Professional entertainers, such as, but not limited to, actors and (3) Poles, satellites and transmission facilities - Five percent (5%)

actresses, singers, lyricists, composers and emcees. (4) Billboards - Five percent (5%)

(3) Professional athletes including basketball players, pelotaris and (5) Cinematographic film rentals and other payments - Five percent

jockeys; (5%)

(4) All directors and producers involved in movies, stage, radio, (C) Income payments to certain contractors – On gross payments to the

television and musical productions; following contractors, whether individual or corporate — Two percent

(5) Insurance agents and insurance adjusters; (2%)

(6) Management and technical consultants;

(7) Bookkeeping agents and agencies;

(8) Other recipients of talent fees;

You might also like

- Withholding Tax at Source OR Expanded Withholding Tax (EWT)Document32 pagesWithholding Tax at Source OR Expanded Withholding Tax (EWT)rickmortyNo ratings yet

- Creditable Tax ReportDocument131 pagesCreditable Tax ReportJieve Licca G. FanoNo ratings yet

- Digest RR 11-2018Document38 pagesDigest RR 11-2018Mo MuNo ratings yet

- RR No. 6-2001 (Digest) PDFDocument1 pageRR No. 6-2001 (Digest) PDFFrancis GuinooNo ratings yet

- Topic 2 Expanded Withholding TaxesDocument26 pagesTopic 2 Expanded Withholding TaxesTeresa AlbertoNo ratings yet

- CDC Investors Guide - Annex ADocument13 pagesCDC Investors Guide - Annex ARalph Ronald CatipayNo ratings yet

- Taxing Powers (Imposition of Taxes)Document18 pagesTaxing Powers (Imposition of Taxes)Nichelle De RamaNo ratings yet

- RR 2 98Document1 pageRR 2 98Bianca UgayNo ratings yet

- List of Income Payments Subject To EWTDocument4 pagesList of Income Payments Subject To EWTYuri SheenNo ratings yet

- Percentage Tax Excise Tax Documentary Stamp: Taxation LawDocument23 pagesPercentage Tax Excise Tax Documentary Stamp: Taxation LawB-an JavelosaNo ratings yet

- Income Payment Subject To Creditable Withholding TaxDocument2 pagesIncome Payment Subject To Creditable Withholding TaxChelsea Anne VidalloNo ratings yet

- RR No. 11-2018Document47 pagesRR No. 11-2018lilorbitsbatscityNo ratings yet

- RR No. 11-2018Document47 pagesRR No. 11-2018Micah Adduru - RoblesNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307Document5 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307i1958239No ratings yet

- RR 11-18Document55 pagesRR 11-18Cuayo JuicoNo ratings yet

- Services Exports From India Scheme ("SEIS") : Comprehensive Solutions For Complex MattersDocument13 pagesServices Exports From India Scheme ("SEIS") : Comprehensive Solutions For Complex MattersRajdeep SharmaNo ratings yet

- RR No. 11-2018Document90 pagesRR No. 11-2018Leticia TaclasNo ratings yet

- Deloitte On Sri Lanka BudgetDocument42 pagesDeloitte On Sri Lanka BudgetJehanNo ratings yet

- Withholding of Percentage TaxesDocument17 pagesWithholding of Percentage TaxesNilda Sahibul BaclayanNo ratings yet

- Final TDS and Tax ExemptionsDocument4 pagesFinal TDS and Tax Exemptionsdpak bhusalNo ratings yet

- Other Percentage Taxes: Prof. Jeanefer Reyes CPA, MPADocument29 pagesOther Percentage Taxes: Prof. Jeanefer Reyes CPA, MPAmark anthony espirituNo ratings yet

- RR No. 11-2018 SummaryDocument6 pagesRR No. 11-2018 SummaryCaliNo ratings yet

- Percentage TaxesDocument8 pagesPercentage TaxesTokha YatsurugiNo ratings yet

- Quarterly Percentage Tax Rates Table: Taxable Base Tax RateDocument4 pagesQuarterly Percentage Tax Rates Table: Taxable Base Tax RateKathrine CruzNo ratings yet

- RR 6-01Document15 pagesRR 6-01matinikkiNo ratings yet

- EWT RatesDocument6 pagesEWT RatesBobby Olavides SebastianNo ratings yet

- How Do You See It?: East Africa Quick Tax Guide 2012Document11 pagesHow Do You See It?: East Africa Quick Tax Guide 2012Zimbo KigoNo ratings yet

- Lecture 7 - Other Percentage TaxDocument3 pagesLecture 7 - Other Percentage TaxJeffrey BionaNo ratings yet

- TRAIN (Changes) ???? Pages 2, 5 - 7Document4 pagesTRAIN (Changes) ???? Pages 2, 5 - 7blackmail1No ratings yet

- Withholding Tax (WHT)Document16 pagesWithholding Tax (WHT)Nyaba NaimNo ratings yet

- Final Tax 2Document25 pagesFinal Tax 2rickmortyNo ratings yet

- EwtDocument5 pagesEwtKobe BullmastiffNo ratings yet

- OPTDocument4 pagesOPTMarie MAy MagtibayNo ratings yet

- Percentage Tax Description: Under Sections 116 To 126 of The Tax Code, As AmendedDocument4 pagesPercentage Tax Description: Under Sections 116 To 126 of The Tax Code, As AmendedAndrea TanNo ratings yet

- Kinds of DeductionsDocument3 pagesKinds of DeductionsMeghan Kaye LiwenNo ratings yet

- RMC 04-2003 - Gross Income On Services For MCIT PurposesDocument7 pagesRMC 04-2003 - Gross Income On Services For MCIT PurposesjtilloNo ratings yet

- Anscor Container Corp. v. CIR and CTADocument8 pagesAnscor Container Corp. v. CIR and CTAkimoymoy7No ratings yet

- Special CorporationsDocument12 pagesSpecial CorporationsDinah BaluyutNo ratings yet

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross IncomeNoroNo ratings yet

- Opt HandoutDocument4 pagesOpt HandoutjulsNo ratings yet

- 3.0 Taxation Other Statutory Compliance Requirements For The Public Sector CPA SululuDocument42 pages3.0 Taxation Other Statutory Compliance Requirements For The Public Sector CPA SululuREJAY89No ratings yet

- BusinessDocument59 pagesBusinessKenncy70% (10)

- Business Tax SummaryDocument10 pagesBusiness Tax SummaryJohn Raymond MarzanNo ratings yet

- W14 Module 12withholding TaxesDocument7 pagesW14 Module 12withholding Taxescamille ducutNo ratings yet

- TAXATION 2 Chapter 8 Percentage Tax PDFDocument4 pagesTAXATION 2 Chapter 8 Percentage Tax PDFKim Cristian MaañoNo ratings yet

- 2073rr14 02Document10 pages2073rr14 02lustrejadineNo ratings yet

- FinalDocument2 pagesFinalJessica FordNo ratings yet

- Withholding TaxDocument20 pagesWithholding TaxAngela CanayaNo ratings yet

- The Income Tax Act PDFDocument15 pagesThe Income Tax Act PDFvuv2bav6No ratings yet

- Tax Table Corporations 2022Document4 pagesTax Table Corporations 2022Xandredg Sumpt LatogNo ratings yet

- Summary of Final Tax Under The Nirc, As Amended Individual Citizen AlienDocument16 pagesSummary of Final Tax Under The Nirc, As Amended Individual Citizen AlienXiaoyu KensameNo ratings yet

- Tax Guide - 2011: Kantilal Patel & CoDocument0 pagesTax Guide - 2011: Kantilal Patel & Coanpuselvi125No ratings yet

- Analia Tax Notes-2011Document23 pagesAnalia Tax Notes-2011Butch MaatNo ratings yet

- J.K. Lasser's Small Business Taxes 2019: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2019: Your Complete Guide to a Better Bottom LineNo ratings yet

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineFrom EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineNo ratings yet

- Excise TaxDocument7 pagesExcise TaxKezNo ratings yet

- RPT - CollectionDocument3 pagesRPT - CollectionKezNo ratings yet

- Operations Auditing QuizDocument3 pagesOperations Auditing QuizKezNo ratings yet

- PREFERENTIAL TAXATION - MAGNA CARTA FOR PWDsDocument1 pagePREFERENTIAL TAXATION - MAGNA CARTA FOR PWDsKezNo ratings yet

- Tax Remedies - Remedies of The GovernmentDocument4 pagesTax Remedies - Remedies of The GovernmentKezNo ratings yet

- Research Capabilityof Teachers Its Correlates Determinantsand Implicationsfor Continuing Professional DevelopmentDocument12 pagesResearch Capabilityof Teachers Its Correlates Determinantsand Implicationsfor Continuing Professional DevelopmentKezNo ratings yet

- LGT - CollectionDocument3 pagesLGT - CollectionKezNo ratings yet

- Corporate Income TaxationDocument3 pagesCorporate Income TaxationKezNo ratings yet

- Real Property TaxationDocument4 pagesReal Property TaxationKezNo ratings yet

- Deductions From Gross IncomeDocument3 pagesDeductions From Gross IncomeKezNo ratings yet

- Deductions ExamplesDocument25 pagesDeductions ExamplesKezNo ratings yet

- Preferential Taxation - Senior Citizens LawDocument2 pagesPreferential Taxation - Senior Citizens LawKezNo ratings yet

- Preferential Taxation - Barangay Micro Business EnterprisesDocument1 pagePreferential Taxation - Barangay Micro Business EnterprisesKezNo ratings yet

- Preferential Taxation - Double Taxation AgreementDocument3 pagesPreferential Taxation - Double Taxation AgreementKezNo ratings yet

- A5 Audit of Ppe Part 1Document10 pagesA5 Audit of Ppe Part 1KezNo ratings yet

- A8 Audit of Prepayments, Ip and Other NciDocument7 pagesA8 Audit of Prepayments, Ip and Other NciKezNo ratings yet

- A3 Inventory EstimationDocument3 pagesA3 Inventory EstimationKezNo ratings yet

- A7 Audit of Intangible AssetsDocument4 pagesA7 Audit of Intangible AssetsKezNo ratings yet

- Afar 2 Module CH 7Document12 pagesAfar 2 Module CH 7KezNo ratings yet

- A9 Audit of LiabilitiesDocument7 pagesA9 Audit of LiabilitiesKezNo ratings yet

- Subsequent Events and Cash and Acrrual BasisDocument14 pagesSubsequent Events and Cash and Acrrual BasisKezNo ratings yet

- A6 Audit of Ppe Part 2Document5 pagesA6 Audit of Ppe Part 2KezNo ratings yet

- MODULE 2 Midterm FAR 3 Income TaxDocument1 pageMODULE 2 Midterm FAR 3 Income TaxKezNo ratings yet

- Problems Bonds-PayableDocument8 pagesProblems Bonds-PayableKezNo ratings yet

- MODULE Midterm FAR 3 Share BasedDocument17 pagesMODULE Midterm FAR 3 Share BasedKezNo ratings yet

- MODULE 1 Midterm FAR 3 LeasesDocument31 pagesMODULE 1 Midterm FAR 3 LeasesKezNo ratings yet

- PROBLEMS Part1Document21 pagesPROBLEMS Part1KezNo ratings yet

- PROBLEMS - Part 2Document16 pagesPROBLEMS - Part 2KezNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsKezNo ratings yet

- FormulasDocument5 pagesFormulasKezNo ratings yet

- Implementasi Analisis Swot Pada Strategi Marketing Penerbit Buku Di Kota Medan Azhari Akmal TariganDocument16 pagesImplementasi Analisis Swot Pada Strategi Marketing Penerbit Buku Di Kota Medan Azhari Akmal TariganAndreas DhimasNo ratings yet

- OM Assignment Sec 2grp 3 Assgn2Document24 pagesOM Assignment Sec 2grp 3 Assgn2mokeNo ratings yet

- Examining Direct and Interactive Marketing Applications in Variety of SectorsDocument31 pagesExamining Direct and Interactive Marketing Applications in Variety of SectorsPrecious Mole Tipas ES AnnexNo ratings yet

- G11 Organization Management Q1 L4Document4 pagesG11 Organization Management Q1 L4Cherry CieloNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- Sop PDFDocument15 pagesSop PDFpolikopil0No ratings yet

- Module Session 10 - CompressedDocument8 pagesModule Session 10 - CompressedKOPERASI KARYAWAN URBAN SEJAHTERA ABADINo ratings yet

- Managing Brands GloballyDocument13 pagesManaging Brands GloballySonam SinghNo ratings yet

- Banking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andDocument10 pagesBanking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andgalilleagalillee100% (1)

- Smart Manufacturing Market - Innovations & Competitive Analysis - Forecast - Facts and TrendsDocument2 pagesSmart Manufacturing Market - Innovations & Competitive Analysis - Forecast - Facts and Trendssurendra choudharyNo ratings yet

- Critical Work Day Memo - Comp Intel (July)Document1 pageCritical Work Day Memo - Comp Intel (July)AL KenNo ratings yet

- What Are Commercial BanksDocument3 pagesWhat Are Commercial BanksShyam BahlNo ratings yet

- Marketing Strategy of K-BeautyDocument8 pagesMarketing Strategy of K-BeautyMahmudul_Islam_duNo ratings yet

- Starbucks MissionDocument2 pagesStarbucks MissionMine SayracNo ratings yet

- Ashish Chugh Reveals Top Secrets To Finding Multibagger StocksDocument10 pagesAshish Chugh Reveals Top Secrets To Finding Multibagger StocksSreenivasulu E NNo ratings yet

- Chief Financial Officer Job DescriptionDocument8 pagesChief Financial Officer Job Descriptionfinancemanagement702No ratings yet

- Maneco ReviewerDocument6 pagesManeco ReviewerKristine PunzalanNo ratings yet

- (Routledge International Studies in Money and Banking) Dirk H. Ehnts - Modern Monetary Theory and European Macroeconomics-Routledge (2016)Document223 pages(Routledge International Studies in Money and Banking) Dirk H. Ehnts - Modern Monetary Theory and European Macroeconomics-Routledge (2016)Felippe RochaNo ratings yet

- Nicolas - 8 - 1Document10 pagesNicolas - 8 - 1Rogelio GoniaNo ratings yet

- 爭議帳款聲明書Document2 pages爭議帳款聲明書雞腿No ratings yet

- Limits of Authority Policy 2018 FINALDocument8 pagesLimits of Authority Policy 2018 FINALVivek SaraogiNo ratings yet

- 1 8 - PestelDocument2 pages1 8 - PestelMai HươngNo ratings yet

- NPI Hotel OverviewDocument6 pagesNPI Hotel OverviewxusorcimNo ratings yet

- Economics For Managers - Session 06Document14 pagesEconomics For Managers - Session 06Abimanyu NNNo ratings yet

- Interest Rate Swaptions: DefinitionDocument2 pagesInterest Rate Swaptions: DefinitionAnurag ChaturvediNo ratings yet

- Project Management ConceptsDocument8 pagesProject Management ConceptsAnkita RautNo ratings yet

- IPRDocument25 pagesIPRsimranNo ratings yet

- Sap TutorialDocument72 pagesSap TutorialSurendra NaiduNo ratings yet

- Eclectica Agriculture Fund Feb 2015Document2 pagesEclectica Agriculture Fund Feb 2015CanadianValueNo ratings yet

- All ZtcodeDocument4 pagesAll Ztcodetamal.me1962100% (1)