Professional Documents

Culture Documents

General Reference Real Estate Transactions

General Reference Real Estate Transactions

Uploaded by

JD MaiConOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General Reference Real Estate Transactions

General Reference Real Estate Transactions

Uploaded by

JD MaiConCopyright:

Available Formats

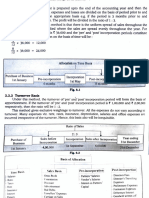

COMPUTATION OF CHARGES RATE WHO PAYS REMARKS

SELLER:

CAPITAL GAINS TAX (for Individuals) 6.00% SELLER

WITHHOLDING TAX (for Corporations) 6.00% SELLER

BROKER'S COMMISSION (Basedon Selling Price per Deed of Sale) 5.00% SELLER SELLER'S BROKER

NOTARY FOR THE DEED OF SALE 1.00% SELLER

INCIDENTAL & MISCELLANEOUS EXPENSES RECEIPTED & UNRECEIPTED CHARGES SELLER

REAL ESTATE TAXES SELLER ACTUAL AMOUNT DUE TO UPDATE PAYMENT UNTIL BEFORE SALE

ASSOCIATION / CONDO DUES SELLER ACTUAL AMOUNT DUE TO UPDATE PAYMENT UNTIL BEFORE SALE

BUYER:

DOCUMENTARY STAMP TAX 1.50% BUYER

TRANSFER TAX 0.5% - 1.0% BUYER

REGISTRATION FEE 0.25% - 0.75% BUYER

BROKER'S COMMISSION (Basedon Selling Price per Deed of Sale) 5.00% BUYER BUYER'S BROKER

INCIDENTAL & MISCELLANEOUS EXPENSES RECEIPTED & UNRECEIPTED CHARGES BUYER

RECEIPTED & UNRECEIPTED CHARGES:

RECEIPTED:

CERTIFICATION FEES

CTC FEES

UNRECEIPTED:

PHOTOCOPY

FARE & MEALS

FACILITATION

BASIS FOR COMPUTATION OF CHARGES:

Comparison of SP vs ZV vs FMV, whichever is higher

BASIC REQUIREMENTS:

ORIGINAL TITLE

CERTIFIED TRUE COPY OF THE TITLE

NOTARIZED DEED OF SALE (6 SETS)

ORIGINAL TAX DECLARATION (OWNER'S COPY)

CERTIFIED TRUE COPY OF THE TAX DECLARATION

ORIGINAL OFFICIAL RECEIPT OF REAL PROPERTY TAX PAYMENT

SKETCH PLAN

CERTIFICATES OF LANDHOLDING & IMPROVEMENTS OR CERTIFICATE OF NO LANDHOLDING & IMPROVEMENT FROM OWN CITY OR MUNICIPALITY & NEARBY CITIES & MUNICIPALITIES

CERTIFICATE AUTHORIZING REGISTRATION (CAR) FROM BIR

CLEAR COPIES OF 2 GOVERNMENT ISSUED IDENTIFICATION CARDS WITH SPECIMEN SIGNATURES & CLEAR PHOTOS

AUTHORIZATION LETTER

NOTARIZED SPECIAL POWER OF ATTORNEY

TAX IDENTIFICATION NUMBERS FOR ALL PARTIES

COPY OF LATEST CEDULA FROM PLACE OF RESIDENCY

OTHERS:

BARC CERTIFICATION

DENR APPROVAL

SURVEY PLAN

TECHNICAL DESCRIPTION

OTHERS THAT MAY FURTHER BE REQUIRED

SURVEY FEES:

Per Hectare (10,000 sqm) Php 20K - Php 30K net

You might also like

- ACCT6174-Tugas Kelompok 3-W8-S12-R1Document3 pagesACCT6174-Tugas Kelompok 3-W8-S12-R1Iden PratamaNo ratings yet

- Truth-in-Lending Disclosures Annual Percentage Rate Finance ChargeDocument6 pagesTruth-in-Lending Disclosures Annual Percentage Rate Finance ChargeHuy HuynhNo ratings yet

- Ncnda & ImfpaDocument9 pagesNcnda & ImfpaZhangNo ratings yet

- Bootstrapping Spot RateDocument37 pagesBootstrapping Spot Ratevirgoss8100% (1)

- DCF Presentation Ahemdabad 20 01 2018Document33 pagesDCF Presentation Ahemdabad 20 01 2018pre.meh21No ratings yet

- Late Charge. Additional InformationDocument6 pagesLate Charge. Additional InformationnicholasiraNo ratings yet

- Poa - AcmDocument3 pagesPoa - AcmJasio Adrian MuñozNo ratings yet

- Business Verification Report: - ConfidentialDocument2 pagesBusiness Verification Report: - ConfidentialNatasha BAl-utNo ratings yet

- PNB Electronic Dealer Scheme (PNB E-Dealer) For Indian Oil Corporation (Iocl)Document3 pagesPNB Electronic Dealer Scheme (PNB E-Dealer) For Indian Oil Corporation (Iocl)ndfpwnuteNo ratings yet

- Import Export TermsDocument23 pagesImport Export TermsAbdi NegassaNo ratings yet

- GFCBJJVDFBKKDocument1 pageGFCBJJVDFBKKHare KrishnaNo ratings yet

- Task State Delivery Approved Delivery Date Penalty Penalty Date PaymentDocument2 pagesTask State Delivery Approved Delivery Date Penalty Penalty Date Paymentjulio arroyoNo ratings yet

- Buyer's Estimated Closing ExpenseDocument1 pageBuyer's Estimated Closing ExpenseKenisha NatividadNo ratings yet

- Capital Gains Tax - Class DiscussionDocument15 pagesCapital Gains Tax - Class DiscussionChristopher SantosNo ratings yet

- Business Valuation: Ten Things You Need To Know: by Jim Turner, CPA, CVA, CMEADocument21 pagesBusiness Valuation: Ten Things You Need To Know: by Jim Turner, CPA, CVA, CMEAJim-Sandra TurnerNo ratings yet

- Brochure Tender BiddingDocument8 pagesBrochure Tender Biddingjignesh prajapatiNo ratings yet

- Crypto - Coins Spa - Vii.1 Escrowproc Calcapp BTC Xxbuyxoeg Xxsellanton - V3 240423Document17 pagesCrypto - Coins Spa - Vii.1 Escrowproc Calcapp BTC Xxbuyxoeg Xxsellanton - V3 240423semih karakuşNo ratings yet

- Transfer of Shares - Taxguru - inDocument4 pagesTransfer of Shares - Taxguru - inRamesh MandavaNo ratings yet

- Chapter 17Document12 pagesChapter 17Ngọc DươngNo ratings yet

- Franchisee IncentiveDocument1 pageFranchisee IncentiveAditya KinariwalaNo ratings yet

- CLIENT VERIFICATION FORM As of Jan 18 2021Document1 pageCLIENT VERIFICATION FORM As of Jan 18 2021Latrell Abuso TurcoNo ratings yet

- 2021MREA Bus Plan Clinic Oct XcelDocument10 pages2021MREA Bus Plan Clinic Oct XcelnikolaNo ratings yet

- Tender - Doc - Optimized 2022 09 20 01 - 56 - 51Document60 pagesTender - Doc - Optimized 2022 09 20 01 - 56 - 51Sukalyan BasuNo ratings yet

- International Trade Training: Make It HappenDocument19 pagesInternational Trade Training: Make It HappenVikram SuranaNo ratings yet

- Revenue Recognition Case - Blender King - FinalDocument5 pagesRevenue Recognition Case - Blender King - FinalHassan B. IzharNo ratings yet

- Authoritative Guide On Real Estate Transfer TaxesDocument37 pagesAuthoritative Guide On Real Estate Transfer TaxesJames ReyesNo ratings yet

- Factoring 1Document24 pagesFactoring 1ParthNo ratings yet

- Leveraged Buyout ModelDocument31 pagesLeveraged Buyout ModelmilosevNo ratings yet

- Fabian & Associates, CPAs-TRAIN-Transfer Tax, Doc Stamp, PassiveDocument21 pagesFabian & Associates, CPAs-TRAIN-Transfer Tax, Doc Stamp, PassiveHomer GaangNo ratings yet

- Blco Tto Spa. Gril - Ail. 25042011Document23 pagesBlco Tto Spa. Gril - Ail. 25042011Gabriel MorkaNo ratings yet

- Vendor Program 001 - Cooperation Program With VIMIDDocument3 pagesVendor Program 001 - Cooperation Program With VIMIDBach TruongNo ratings yet

- Comparison of Various PPP Models in Road Sector: Commented (NA1) : CheckDocument3 pagesComparison of Various PPP Models in Road Sector: Commented (NA1) : CheckPragadeesh SathiyanarayananNo ratings yet

- BMV 3774Document1 pageBMV 3774LEAHNo ratings yet

- Confirmation Exercise - 4Document3 pagesConfirmation Exercise - 4Md. Hasan ForhadNo ratings yet

- Chart FlowDocument1 pageChart FlowFirdausNo ratings yet

- Tariff SheetDocument1 pageTariff SheetSahil SharmaNo ratings yet

- Problems On Profit Prior To IncorporationDocument18 pagesProblems On Profit Prior To Incorporationcsneha0803No ratings yet

- 03 - Claims For Excise Tax Refund InquiryDocument5 pages03 - Claims For Excise Tax Refund InquiryAhyz DyNo ratings yet

- Asialink Disclosure Statement 2019Document3 pagesAsialink Disclosure Statement 2019i-ka-hayashiNo ratings yet

- BBAW2103 - Tutorial 3Document59 pagesBBAW2103 - Tutorial 3M THREE THOUSAND RESOURCESNo ratings yet

- HYS AUDI QuoteDocument1 pageHYS AUDI QuoteJovel RocafortNo ratings yet

- Tariff Sheet: Capital MarketDocument1 pageTariff Sheet: Capital MarketAVINASH MESHRAMNo ratings yet

- Kfs Sheet IDEP874184698182I8AP 925567482114388Document5 pagesKfs Sheet IDEP874184698182I8AP 925567482114388DK ForeverGaminGNo ratings yet

- How Much Does It Cost To Transfer A Land Title in The PhilippinesDocument5 pagesHow Much Does It Cost To Transfer A Land Title in The PhilippinesDebra BraciaNo ratings yet

- Car Finance NotesDocument1 pageCar Finance NotesarqumcNo ratings yet

- Accounting Work Sheet No.01-1 PDFDocument3 pagesAccounting Work Sheet No.01-1 PDFTaskeen AliNo ratings yet

- Closing Costs - SellerDocument1 pageClosing Costs - SellergdaynycNo ratings yet

- Leave A Message Then Pass It On!!Document43 pagesLeave A Message Then Pass It On!!May RamosNo ratings yet

- Simple LBO ModelDocument23 pagesSimple LBO ModeldhruvNo ratings yet

- Tally Ledger List in PDF Format TeachooDocument10 pagesTally Ledger List in PDF Format Teachoothakur731011No ratings yet

- At The Time of Purchase by Dealer at The Time of Resale by DealerDocument8 pagesAt The Time of Purchase by Dealer at The Time of Resale by Dealerjhanvi1992No ratings yet

- Kfs Sheet IDEP782188813627SZDW 511629824784788Document5 pagesKfs Sheet IDEP782188813627SZDW 511629824784788dhirendrapradhan372No ratings yet

- Expressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDocument3 pagesExpressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDGNo ratings yet

- Tally Under GroupDocument7 pagesTally Under GroupAkash DhibarNo ratings yet

- Lessee's Per Procedure AnalysisDocument4 pagesLessee's Per Procedure AnalysisShafiq0% (1)

- Solution 4-5-6Document4 pagesSolution 4-5-6ShafiqUr RehmanNo ratings yet

- Reg668 PDFDocument1 pageReg668 PDFManny TileNo ratings yet

- S8 45MM (Cell)Document6 pagesS8 45MM (Cell)tyger ndaNo ratings yet

- Direct Tax Summary NotesDocument19 pagesDirect Tax Summary NotesSabitriDeviChakraborty50% (2)

- Revenue Recognition - Ind As 18Document9 pagesRevenue Recognition - Ind As 18User PuppyNo ratings yet

- The Mortgage Encyclopedia: The Authoritative Guide to Mortgage Programs, Practices, Prices and Pitfalls, Second EditionFrom EverandThe Mortgage Encyclopedia: The Authoritative Guide to Mortgage Programs, Practices, Prices and Pitfalls, Second EditionNo ratings yet

- Revealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieFrom EverandRevealed From A Top Realtor: The Fastest Way To Sell Properties Like Crazy In Real Estate - Even If You Are A Complete NewbieNo ratings yet

- JP Morgan DLFDocument6 pagesJP Morgan DLFshahpreetiNo ratings yet

- Principles of Marketing - MariottDocument18 pagesPrinciples of Marketing - Mariottssk1250No ratings yet

- Business Plan Example A 1Document27 pagesBusiness Plan Example A 1ASHANTANo ratings yet

- DipIFR Answers June-2015Document7 pagesDipIFR Answers June-2015Soňa SlovákováNo ratings yet

- Benchmarking & Research Reports Catalog by Best Practices, LLC (Aug-2015)Document104 pagesBenchmarking & Research Reports Catalog by Best Practices, LLC (Aug-2015)Best Practices, LLC50% (2)

- Stratetgies For Entrepreneurial VentureCDocument26 pagesStratetgies For Entrepreneurial VentureCSushil Kumar PantNo ratings yet

- Baliuag University: It Is Not Enough That We Do Our Best Sometimes We Must Do What Is Required. - Winston ChurchillDocument7 pagesBaliuag University: It Is Not Enough That We Do Our Best Sometimes We Must Do What Is Required. - Winston ChurchillAj de CastroNo ratings yet

- MBAT 312 FIM - Unit 1 Part 1Document153 pagesMBAT 312 FIM - Unit 1 Part 1Nivesh GurungNo ratings yet

- FCFF and FcfeDocument23 pagesFCFF and FcfeSaurav Vidyarthi100% (1)

- Starbucks-Delivering Customer SatisfactionDocument43 pagesStarbucks-Delivering Customer SatisfactionManish SinghNo ratings yet

- Challenges On Debt Management in Developing CountriesDocument18 pagesChallenges On Debt Management in Developing CountriesAsian Development Bank - Event DocumentsNo ratings yet

- MoneyLion Investor Presentation VFinalDocument42 pagesMoneyLion Investor Presentation VFinalJ ANo ratings yet

- 02 Options, Rights and WarrantsDocument16 pages02 Options, Rights and WarrantsAlloysius ParilNo ratings yet

- Vision Statement of MacdonaldDocument2 pagesVision Statement of MacdonaldlalirisyaNo ratings yet

- Guide To Floating Rate NotesDocument12 pagesGuide To Floating Rate NotesharoonkhanNo ratings yet

- Star CaseDocument1 pageStar CaseRazvan GhitaNo ratings yet

- Purchasing MethodsDocument5 pagesPurchasing MethodsAnil YellumahanthiNo ratings yet

- Chapter 5 IS-LM Curves UpdatedDocument24 pagesChapter 5 IS-LM Curves Updatedshivam kumarNo ratings yet

- Revenue Curves Under Different Markets (With Diagram)Document12 pagesRevenue Curves Under Different Markets (With Diagram)Mathew Abraham0% (1)

- Ep Ns Module II Ga Dec 20Document89 pagesEp Ns Module II Ga Dec 20aditya singhNo ratings yet

- S1600101 - Umactt-15-M Advanced Corporate ReportingDocument20 pagesS1600101 - Umactt-15-M Advanced Corporate Reportingshahumulla sajidNo ratings yet

- Chapter 6 Lecture H-9Document8 pagesChapter 6 Lecture H-9ryanhuNo ratings yet

- Beans N Cream Café: "Satisfy Your Caffeine Fix and Give Your Day A New Lift."Document13 pagesBeans N Cream Café: "Satisfy Your Caffeine Fix and Give Your Day A New Lift."Hyakkimura GamingNo ratings yet

- SE AssignmentAsPerSPPUDocument2 pagesSE AssignmentAsPerSPPUkedarNo ratings yet

- Updates On Buy Back Offer (Company Update)Document55 pagesUpdates On Buy Back Offer (Company Update)Shyam SunderNo ratings yet

- Stock ExchangesDocument28 pagesStock ExchangesAnubha DwivediNo ratings yet

- Chap-04 Cultural Dynamics in Assessing Global Markets ' 13eDocument71 pagesChap-04 Cultural Dynamics in Assessing Global Markets ' 13eMirza420No ratings yet

- Afm Chapter 6 Cogs Fifo Lifo MergeDocument126 pagesAfm Chapter 6 Cogs Fifo Lifo MergeSarah Shahnaz IlmaNo ratings yet