Professional Documents

Culture Documents

CLASS TEST-I ACCOUNTANCY EXAM REVIEW

Uploaded by

shaurya kapoorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CLASS TEST-I ACCOUNTANCY EXAM REVIEW

Uploaded by

shaurya kapoorCopyright:

Available Formats

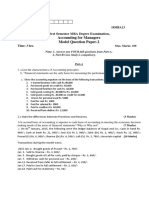

CLASS TEST-I

CH-BASIC ACC TERMS, BASIS OF ACC,

JOURNAL,ACC EQUATION, LEDGER, CASH BOOK,

SUBSIDIARY BOOKS, TRIAL BALANCE

XI- ACCOUNTANCY

TIME:2HRS M:M:50

SR.N QUESTIONS M

O.

1 Which of the following is not objective of accounting: 1

(a) To assist the management

(b) To ascertain profit or loss

(c) To provide information to various parties

(d) To measure business transaction in terms of money

2 ------------------- are those Non- Current assets which are held for use in the 1

business and are not meant for resale.

3 Journal proper records……………….. 1

I. All transactions

II. All cash transactions

III. All credit transactions

All transactions not recorded in any of subsidiary books.

4 Identify the principle due to which the proprietor of a business is treated as 1

creditor to the extent of his capital:

(a) Money measurement principle

(b) Dual aspect concept

(c) Going concern concept

(d) Business entity principle

5 Define GAAP. 1

6 Amount withdrawn for personal use by proprietor will……………… cash 1

and capital.

(a) Decrease

(b) Increase

(c) Not change

(d) None of the above

7 According to modern approach Purchases Account is an………….. Account. 1

8 Why the following parties are interested in accounting information: 3

(a) Owners

(b) Government

(c) Public

9 Distinguish between Revenue and Capital expenditure. 3

10 3

11 classify the following Accounts into Personal, Real and Nominal Accounts: 3

(i) Interest paid

(ii) Accrued interest

(iii) Loan account

(iv) Motor vehicle

(v) Sales account

(vi) Bad debts

12 Write down three points of difference between Cash Basis and Accrual Basis 3

of Accounting.

13 Give specimen/format of the Purchase book and Sales return book. 3

14 What is stock or inventory? Discuss types of inventory in case of 4

manufacturing unit.

OR

Prepare CASH , PURCHASES, SALES AND CAPITAL Ledger Accounts

for following transactions:

Mar 01, Started business with Cash Rs. 3,00,000.

Mar 03, Purchased furniture in cash Rs. 50,000.

Mar 05, Bought goods for cash Rs.20,000 from Tarun Traders.

Mar 10, Paid rent Rs. 1,500.

Mar 13, Sold goods for Rs. 30,000 in cash.

Mar 20 Sold goods to Rupa Traders Rs. 42,000 on credit.

15 Verma Bros., Kolkata carry on business as wholesale cloth dealer. From the 4

following write up their Purchases Book for January, 2018:

Date Transactions

Jan, Purchased on credit from M/s. Birla Mills, Kolkata:

03 100 pieces long cloth @ R. 800 each.

50 pieces shirting @ Rs. 500 each.

CGST AND SGST PAYABLE @6% EACH.

Jan , Purchased for cash from M/s. Ambika Mills Ahmadabad:

08 50 pieces Muslin @ Rs. 1,000 each.

IGST payable @12%.

Jan , Purchased on credit from M/s. Arvind Mills, Ahmedabad:

15 20 pieces coating @ Rs. 2,000 each.

10 pieces shirting @ Rs. 500 each.

IGST payable @12%.

Jan , Purchased on credit from M/s. Bharat Typewriters Ltd., Kolkata:

20 5 typewriters’ @ Rs. 1,400 each.

CGST AND SGST payable @ 6% each.

16 From the following particulars prepare Analytical Petty Cash Book on 4

imprest system of Sunrise Ltd.

Date Particulars

2017

Feb. 02 Cash received from head cashier Rs. 2,000.

Feb. 05 Paid for postage Rs. 100.

Feb. 08 Paid for Bus fare Rs. 240.

Feb. 10 Paid for Refreshment Rs. 120.

Feb. 12 Paid for repairs Rs. 270.

Feb. 13 Paid for cartage Rs. 130

Feb. 15 Paid for stationery Rs. 220.

Feb. 18 Paid for Conveyance Rs. 280.

Feb. 25 Paid for Speed post Rs. 200.

Feb. 28 Paid for Office tea/ coffee Rs. 190.

17 Present the following transactions in the form of Accounting Equation. 5

(i) Manoj started business with Cash Rs. 90,000, Goods Rs. 20,000

(ii) Loss of cash by theft Rs. 1,000.

(iii) Sold goods costing Rs. 8,000 for Rs. 10,000. Only 60% amount

received in cash.

(iv) Goods costing Rs. 10,000 bought at 10% trade discount on credit.

(v) Purchased cycle of Rs. 2,000 for his son.

(vi) Paid Rent Rs. 12,000 which includes Rs. 2,000 for next year

OR

Prepare Trial Balance as on 31st march, 2018 from the following ledger

balances of Shri Ram Shankar:

Particulars Amount Particulars Amount

(Rs) (Rs.)

Sundry creditors 1,36,500 Interest on Loan 10,000

Sundry debtors 79,300 Conveyance 200

Rent received 6,300 Goodwill 30,000

Miscellaneous Expenses 3,200 Commission 4,000

Plant and Machinery 7,98,750 Loan from ICICI bank 90,000

Creditor for furniture 30,000 Outstanding expenses 20,800

Opening stock 40,000 Drawings 15,000

Discount (cr.) 9,900 Salaries and wages 25900

Furniture 36,500 Discount Allowed 5,500

Buildings 9,81,000 Capital 5,00,000

Rent 12,000 Purchases 3,13,450

Loan (cr.) 10,00,000 Sales 5,61,300

Input IGST A/C 2,500 Input SGST A/C 1,000

Input CGST A/C 1,000 Output IGST A/C 4,500

18 Pass Journal Entries for the following transactions in proper formats: 8

(i) Mr. Ajay started business with Cash Rs. 50,000, and brought

personal furniture for rs. 80,000 and personal vehicles rs. 1,50,000 for

office use.

(ii) Charge interest on drawings @10%p.a for 6 months.(Drawings Rs.

10,000)

(iii) Bought goods from Amit for Rs. 2,00,000 at 5% cash discount and

20% trade discount. Paid ¾ th amount in cash at the time of

purchase. (CGST @9%, SGST@9%.

(iv) Goods worth Rs. 10,000 damaged by fire and Insurance Co. accepted

a claim of Rs. 8,000.

(v) A new Machinery of Rs. 2,00,000 was purchased from Mr. X in

exchange of an old machinery valued Rs. 40,000. He gave a cheque

for the balance amount.

(vi) Received an order of Rs. 1,00,000 from Customer and 10% of the

amount received in advance.

(vii) Goods worth Rs. 5,000 and cash Rs. 2,000 withdrew for personal use.

(viii) Paid Rent of Building Rs. 6,000. Half of building is used by

proprietor for residential purpose.

You might also like

- Sample Paper Xi Acc 2022 23Document7 pagesSample Paper Xi Acc 2022 23rehankatyal05No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- 11 Sample Papers Accountancy 2Document10 pages11 Sample Papers Accountancy 2AvcelNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 3Document10 pages11 Sample Papers Accountancy 2020 English Medium Set 3Joshi DrcpNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Question Bank BKDocument8 pagesQuestion Bank BKVivek JaiswarNo ratings yet

- 11 AccDocument6 pages11 AccPushpinder KumarNo ratings yet

- 4 MarksDocument4 pages4 MarksEswari GkNo ratings yet

- Accountancy QP XiDocument4 pagesAccountancy QP XiMohammedNo ratings yet

- Class 11th Final TestDocument7 pagesClass 11th Final TestmenekyakiaNo ratings yet

- BM102TDocument25 pagesBM102TMariamma KuriakoseNo ratings yet

- Practice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsDocument4 pagesPractice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsSNPS BhadraNo ratings yet

- Accounting For Managers - QBDocument6 pagesAccounting For Managers - QBIm CandlestickNo ratings yet

- 11th BK Final Exam Quesiton Paper March 2021Document5 pages11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- Nava Bharath National School Annur Annual Examination - 2021 AccountancyDocument5 pagesNava Bharath National School Annur Annual Examination - 2021 AccountancypranavNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Session Ending Examination 2019Document7 pagesSession Ending Examination 2019madhudevi06435No ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- Class 11 Accounts Half Yearly SPDocument9 pagesClass 11 Accounts Half Yearly SPRakesh AgarwalNo ratings yet

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- SAMPLE PAPER - (Solved) : For Examination March 2017Document13 pagesSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- JAI ACADEMY I-TERM EXAMDocument4 pagesJAI ACADEMY I-TERM EXAMUmang AgarwalNo ratings yet

- (Final) Accountancy Class XiDocument4 pages(Final) Accountancy Class XiUmang AgarwalNo ratings yet

- Class 11 Accountancy Worksheet - 2023-24Document17 pagesClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNo ratings yet

- 2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Document4 pages2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Best ThingsNo ratings yet

- 2015 Accountancy Question PaperDocument4 pages2015 Accountancy Question PaperJoginder SinghNo ratings yet

- NCERT solutions, CBSE sample papers, notes for classes 6 to 12Document4 pagesNCERT solutions, CBSE sample papers, notes for classes 6 to 12NameNo ratings yet

- 11 Accountancy SP 2Document17 pages11 Accountancy SP 2Vikas Chandra BalodhiNo ratings yet

- ACCOUNTANCY XI SAMPLE PAPERDocument13 pagesACCOUNTANCY XI SAMPLE PAPERpriyaNo ratings yet

- 11th Accountancy Practice PaperDocument5 pages11th Accountancy Practice PaperPrachi RustagiNo ratings yet

- Vidya Mandir Public School Accountancy QuestionsDocument4 pagesVidya Mandir Public School Accountancy QuestionsPatanjal kumarNo ratings yet

- FA Question Bank TT1-1Document14 pagesFA Question Bank TT1-1rock SINGHALNo ratings yet

- Fundamentals of Accounting 2019Document4 pagesFundamentals of Accounting 2019sreehari dineshNo ratings yet

- Class Xi SP 1Document17 pagesClass Xi SP 1Priya NasaNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- Question Bank For AccountsDocument12 pagesQuestion Bank For AccountsSwati DubeyNo ratings yet

- XI ACCOUNTING SET 3Document6 pagesXI ACCOUNTING SET 3aashirwad2076No ratings yet

- Accountancy: Class: XiDocument8 pagesAccountancy: Class: XiSanskarNo ratings yet

- D.K.M. College For Women (Autonomous), Vellore - 1 Semester Examinations November - 2018 15CCO1A/CCO1A Financial Accounting - IDocument8 pagesD.K.M. College For Women (Autonomous), Vellore - 1 Semester Examinations November - 2018 15CCO1A/CCO1A Financial Accounting - IChandu Raju0% (1)

- Corporate Accounting Ii 2020Document4 pagesCorporate Accounting Ii 2020joe josephNo ratings yet

- Amardeep XI First TermDocument8 pagesAmardeep XI First TermAnahita GuptaNo ratings yet

- Accountancy Sample PaperDocument6 pagesAccountancy Sample PaperDevansh BawejaNo ratings yet

- Sample Paper 11 Term 1 - ACCOUNTANCY 2023 Grade 11Document12 pagesSample Paper 11 Term 1 - ACCOUNTANCY 2023 Grade 11Suhaim SahebNo ratings yet

- 202AF13A Financial AccountingDocument14 pages202AF13A Financial AccountingkalpanaNo ratings yet

- P.U.C. Mid-Term Examination Accountancy QuestionsDocument10 pagesP.U.C. Mid-Term Examination Accountancy QuestionsBest ThingsNo ratings yet

- Question Paper 11 Accounts Time: 3Hrs Max Marks: 80Document5 pagesQuestion Paper 11 Accounts Time: 3Hrs Max Marks: 80manish jangidNo ratings yet

- Financial Accounts Questoin Paper UNOM 2019Document4 pagesFinancial Accounts Questoin Paper UNOM 2019lucy artemisNo ratings yet

- MB-104-–BASICS-OF-ACCOUNTING-AND-FINANCE (1)Document3 pagesMB-104-–BASICS-OF-ACCOUNTING-AND-FINANCE (1)rajeshpatnaikNo ratings yet

- ACC XI SEE QP For RevisionDocument31 pagesACC XI SEE QP For Revisionvarshitha reddyNo ratings yet

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- 18U1CM01Document8 pages18U1CM01Manoj MJNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Accountancy Question Bank for Class XIDocument9 pagesAccountancy Question Bank for Class XIlasyaNo ratings yet

- BSc Computer Accounting ExamDocument12 pagesBSc Computer Accounting ExamK0140 Jeevanantham.SNo ratings yet

- TUE-THURS MMD 2020 Adjusting Entries and Financial StatementsDocument45 pagesTUE-THURS MMD 2020 Adjusting Entries and Financial StatementsArmin NoblesNo ratings yet

- Contact With The BuyerDocument2 pagesContact With The Buyeraleena raviNo ratings yet

- Marketing Systems Analytics Director in Boston MA Resume Sean PrestonDocument3 pagesMarketing Systems Analytics Director in Boston MA Resume Sean PrestonSeanPrestonNo ratings yet

- MDF Supplemental SlidesDocument25 pagesMDF Supplemental SlidesMayuri DhodapkarNo ratings yet

- POEA Block ListedDocument2 pagesPOEA Block ListedMarlon LauriagaNo ratings yet

- Estate Agency in GhanaDocument4 pagesEstate Agency in GhanaJona Zinzi0% (1)

- Philippine Money - MicsDocument9 pagesPhilippine Money - MicsMichaela VillanuevaNo ratings yet

- B555 RoadmapDocument7 pagesB555 Roadmapvico1982No ratings yet

- Eight Keys To Creating A Customer Service CultureDocument4 pagesEight Keys To Creating A Customer Service CultureLABASBAS, Alexidaniel I.No ratings yet

- Franchise ContractDocument3 pagesFranchise Contractariel camusNo ratings yet

- (A) The Main Objects To Be Pursued by The Company On Its IncorporationDocument1 page(A) The Main Objects To Be Pursued by The Company On Its IncorporationTikoo AdityaNo ratings yet

- Tata InternationalDocument2 pagesTata InternationalLuvkush RulesNo ratings yet

- MS 15 Investors That MatterDocument2 pagesMS 15 Investors That MatterZerohedgeNo ratings yet

- C Statment - Ivan Maleakhi - Des 2020Document4 pagesC Statment - Ivan Maleakhi - Des 2020Budi ArtantoNo ratings yet

- Audit Report Summary for Barzan Onshore ProjectDocument3 pagesAudit Report Summary for Barzan Onshore Projectboen jaymeNo ratings yet

- Starting Small Family BusinessDocument4 pagesStarting Small Family BusinessMJ BenedictoNo ratings yet

- Enterprise Resource Planning and Supply Chain ManagementDocument3 pagesEnterprise Resource Planning and Supply Chain ManagementMahendra TantuwayNo ratings yet

- Tuazon v. Heirs of Bartolome RamosDocument2 pagesTuazon v. Heirs of Bartolome RamosAngelica Abalos100% (1)

- Microsoft V CHS ComplaintDocument23 pagesMicrosoft V CHS ComplaintHLMeditNo ratings yet

- FMW 11gr1certmatrixDocument112 pagesFMW 11gr1certmatrixnarukullaNo ratings yet

- Globalization processes and impactsDocument16 pagesGlobalization processes and impactsYANAH GRACE LLOVITNo ratings yet

- IAS 8 Accounting Policies Changes Estimates Errors (38Document1 pageIAS 8 Accounting Policies Changes Estimates Errors (38Tin BatacNo ratings yet

- Case Study 6 AccentureDocument3 pagesCase Study 6 AccentureYash BansalNo ratings yet

- Coconut Oil Project with 46% ROIDocument6 pagesCoconut Oil Project with 46% ROIhunky11100% (1)

- Case Study of HRMDocument6 pagesCase Study of HRMDrRahul ChopraNo ratings yet

- Educational Course / Tutorialoutlet Dot ComDocument35 pagesEducational Course / Tutorialoutlet Dot Comjorge0047No ratings yet

- Lean and Six Sigma - Not For AmateursDocument6 pagesLean and Six Sigma - Not For AmateursmsasgesNo ratings yet

- Indian Aviation IndustryDocument53 pagesIndian Aviation IndustryMandar Chari60% (5)

- Accounting 25th Edition Warren Solutions Manual 1Document36 pagesAccounting 25th Edition Warren Solutions Manual 1edwardharrisontqdrjcogix100% (21)

- How To Find A Million Dollar Amazon ProductDocument78 pagesHow To Find A Million Dollar Amazon ProductSergiuFuiorNo ratings yet