Professional Documents

Culture Documents

General Instructions For Preparation of Balance Sheet

Uploaded by

Neville BuhariwallaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General Instructions For Preparation of Balance Sheet

Uploaded by

Neville BuhariwallaCopyright:

Available Formats

GENERAL INSTRUCTIONS FOR PREPARATION OF BALANCE SHEET

1. An asset shall be classified as current when it satisfies any of the following criteria:

—

(a) it is expected to be realised in, or is intended for sale or consumption in,

the company’s normal operating cycle;

(b) it is held primarily for the purpose of being traded;

(c) it is expected to be realised within twelve months after the reporting date;

or

(d) it is cash or cash equivalent unless it is restricted from being exchanged or

used to settle a liability for at least twelve months after the reporting date.

All other assets shall be classified as non-current.

2. An operating cycle is the time between the acquisition of assets for processing and

their realisation in cash or cash equivalents. Where the normal operating cycle cannot

be identified, it is assumed to have a duration of twelve months.

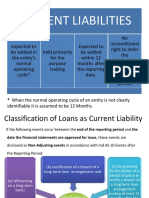

3. A liability shall be classified as current when it satisfies any of the following

criteria:—

(a) it is expected to be settled in the company’s normal operating cycle;

(b) it is held primarily for the purpose of being traded;

(c) it is due to be settled within twelve months after the reporting date; or

(d) the company does not have an unconditional right to defer settlement of

the liability for at least twelve months after the reporting date. Terms of a

liability that could, at the option of the counterparty, result in its settlement by

the issue of equity instruments do not affect its classification. All other

liabilities shall be classified as non-current.

4. A receivable shall be classified as a “trade receivable” if it is in respect of the

amount due on account of goods sold or services rendered in the normal course of

business.

5. A payable shall be classified as a “trade payable” if it is in respect of the amount

due on account of goods purchased or services received in the normal course of

business.

You might also like

- General Instructions For Balance SheetDocument3 pagesGeneral Instructions For Balance Sheetabhishek dalwaniNo ratings yet

- Master NoteDocument9 pagesMaster NoteCA Paramesh HemanathNo ratings yet

- 2 Statement of Financial PositionDocument7 pages2 Statement of Financial Positionreagan blaireNo ratings yet

- (Acctg 112) Pas 1, 2, 7Document7 pages(Acctg 112) Pas 1, 2, 7Mae PandoraNo ratings yet

- Classifying Current LiabilitiesDocument1 pageClassifying Current LiabilitiesCindy The GoddessNo ratings yet

- SFP SciDocument28 pagesSFP SciAcads PurpsNo ratings yet

- Comprehensive Accounting Review CenterDocument3 pagesComprehensive Accounting Review Centerlinkin soyNo ratings yet

- Definition of AssetDocument14 pagesDefinition of AssetKasey PastorNo ratings yet

- Lesson 2: Statement of Financial Position (Pas1)Document15 pagesLesson 2: Statement of Financial Position (Pas1)Reymark TalaveraNo ratings yet

- Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29102023Document28 pagesFinancial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29102023mnbvcxzqwerNo ratings yet

- 3.3 Statement of Financial Position (Balance Sheet)Document12 pages3.3 Statement of Financial Position (Balance Sheet)Brier Jaspin AguirreNo ratings yet

- Accounting Policies - Study Group 4IDocument24 pagesAccounting Policies - Study Group 4ISatish Ranjan PradhanNo ratings yet

- Financial StatementDocument10 pagesFinancial StatementJessica100% (1)

- Current LiabDocument24 pagesCurrent LiabSamantha Marie ArevaloNo ratings yet

- Section 4 IDocument22 pagesSection 4 ISatish Ranjan PradhanNo ratings yet

- Schedule III of Companies Act 2013 in Excel Format-2Document48 pagesSchedule III of Companies Act 2013 in Excel Format-2divya shindeNo ratings yet

- Chapte 1Document27 pagesChapte 1Mary Ann Alegria MorenoNo ratings yet

- Probiotec Annual Report 2022 6Document8 pagesProbiotec Annual Report 2022 6楊敬宇No ratings yet

- Lesson 2Document37 pagesLesson 2Lurissa CabigNo ratings yet

- Introduction To LiabilitiesDocument16 pagesIntroduction To LiabilitiesAllene MontemayorNo ratings yet

- IFRS Study Notes - Day 1Document76 pagesIFRS Study Notes - Day 1Obisike EmeziNo ratings yet

- Acc102 - Module 3BDocument12 pagesAcc102 - Module 3BPatricia CarreonNo ratings yet

- Aaa Standards by BeingaccaDocument9 pagesAaa Standards by Beingaccakshama3102100% (1)

- 07-03 - IASB ED - IAS 1 - Classification of Liabilities As Current or Non-Current (For Background Only) - EFRAG TEG 20-03-04Document14 pages07-03 - IASB ED - IAS 1 - Classification of Liabilities As Current or Non-Current (For Background Only) - EFRAG TEG 20-03-04almazwmbashiraNo ratings yet

- Conceptual Framework Module 7Document12 pagesConceptual Framework Module 7Jaime LaronaNo ratings yet

- Kit AnswersDocument33 pagesKit AnswersHarshNo ratings yet

- Key-Terms and Chapter Summary-1Document11 pagesKey-Terms and Chapter Summary-1Neel DudhatNo ratings yet

- Current Liabilities Provisions and Contingencies TheoriesDocument12 pagesCurrent Liabilities Provisions and Contingencies TheoriesKristine Trisha Anne SabornidoNo ratings yet

- Basic Accounting TermsDocument8 pagesBasic Accounting Termsjosephinemusopelo1No ratings yet

- L6a - MFRS 9 Financial InstrumentsDocument55 pagesL6a - MFRS 9 Financial InstrumentsandyNo ratings yet

- Chapter 2 NOTES PAYABLE SUMMARY & PROBLEMSDocument12 pagesChapter 2 NOTES PAYABLE SUMMARY & PROBLEMSellyzamae quiraoNo ratings yet

- Module 4 Loans and ReceivablesDocument55 pagesModule 4 Loans and Receivableschuchu tvNo ratings yet

- Revised Schedule VI RequirementsDocument23 pagesRevised Schedule VI RequirementsBharadwaj GollapudiNo ratings yet

- Financial Instruments FINALDocument40 pagesFinancial Instruments FINALShaina DwightNo ratings yet

- Module 2Document29 pagesModule 2Althea mary kate MorenoNo ratings yet

- Ts GrewalDocument92 pagesTs GrewalShyamal NarangNo ratings yet

- T.S. Grewal Book Part 3Document189 pagesT.S. Grewal Book Part 3Thami K96% (23)

- BookDocument190 pagesBookAnonymous e4KPPyl100% (1)

- Module 4 COMPONENTS OF FINANCIAL STATEMENTS PDFDocument15 pagesModule 4 COMPONENTS OF FINANCIAL STATEMENTS PDFErmelyn GayoNo ratings yet

- Lecture 4 FSADocument36 pagesLecture 4 FSAvuthithuylinh9a007No ratings yet

- IFRS 5 Ts - Noncurrent Assets Held For Sale and Discontinued OperationsDocument2 pagesIFRS 5 Ts - Noncurrent Assets Held For Sale and Discontinued OperationsJed DíazNo ratings yet

- PAS 1 Presentation of Financial Statements 2020Document30 pagesPAS 1 Presentation of Financial Statements 2020Jilian Kate Alpapara BustamanteNo ratings yet

- Accounting 1 - Module 7Document38 pagesAccounting 1 - Module 7CATHNo ratings yet

- Probiotec Annual Report 2021 6Document8 pagesProbiotec Annual Report 2021 6楊敬宇No ratings yet

- Module 6 - LiabilitiesDocument11 pagesModule 6 - LiabilitiesLuiNo ratings yet

- Lesson 11Document13 pagesLesson 11shadowlord468No ratings yet

- Caballero Ba53 Chap 2Document32 pagesCaballero Ba53 Chap 2Drew BooNo ratings yet

- Financial StatementsDocument13 pagesFinancial StatementsAbhijay AnoopNo ratings yet

- Current Liabilities: When The Normal Operating Cycle of An Entity Is Not ClearlyDocument9 pagesCurrent Liabilities: When The Normal Operating Cycle of An Entity Is Not Clearlysispita dashNo ratings yet

- Actgia3 Ch02 Statement of Financial PositionDocument68 pagesActgia3 Ch02 Statement of Financial PositionKrizah Marie CaballeroNo ratings yet

- Problem 2-2 Multiple Choice (PAS 1)Document2 pagesProblem 2-2 Multiple Choice (PAS 1)Coleen BiocalesNo ratings yet

- Financial Accountinng 3Document10 pagesFinancial Accountinng 3Nami2mititNo ratings yet

- Quiz in IA-8Document1 pageQuiz in IA-8sofiaNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryROMAR A. PIGANo ratings yet

- Chapter9 - Noncurrentassetsheldforsale2008 - Gripping IFRS 2008 by ICAPDocument22 pagesChapter9 - Noncurrentassetsheldforsale2008 - Gripping IFRS 2008 by ICAPFalah Ud Din SheryarNo ratings yet

- Lesson 11Document7 pagesLesson 11Jamaica bunielNo ratings yet

- Financial Instrument - (NEW)Document11 pagesFinancial Instrument - (NEW)AS Gaming100% (1)

- Combining Multiple Worksheets in To Single SheetDocument3 pagesCombining Multiple Worksheets in To Single SheetNeville BuhariwallaNo ratings yet

- Unspent Amount of CSRDocument1 pageUnspent Amount of CSRNeville BuhariwallaNo ratings yet

- Taxation of MFDocument1 pageTaxation of MFNeville BuhariwallaNo ratings yet

- Standards On Auditing Checklist SWDocument144 pagesStandards On Auditing Checklist SWNeville BuhariwallaNo ratings yet