Professional Documents

Culture Documents

Document 6

Document 6

Uploaded by

Ira SyahirahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Document 6

Document 6

Uploaded by

Ira SyahirahCopyright:

Available Formats

me B

FEB 2022

question 2(A)

=>

a) i. NP

=

RM980 x 0.95:RM931

I = 61. xRM1,000 =

RM6O

mr= 1.2x RM1,000 =

RM1,200

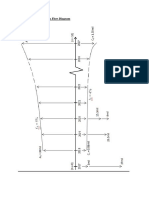

year Cash FlOW Discount Factor (6.) pr Discount Factor (9%) pV

O 1931) 1.008 (931) 1.000 (931)

1-10 60 7.3681 441.61 6.4177 385.06

10 1,200 0.5584 670.88 8.4224 506.88

NPV:180.69 Nor: (39.06)

kd 6 +

Ix(9. I

=

61) 8.47%

-

=

180.69 + 39.06

Id (after tax) =

8.47 1.x (1-04): 6.44

ii.kp= Rm7/(RM95 x0.93): 7.76%.

iii. Ke: t+0.03) + 0.03: 7.9%

RM8.7

iv. kne = 0.24(1+0.03) + 0.03: 8.22:1

8.7X0.9

b) Maximum capex: am1sm/(30m + 81m) /180): RM27,692, 307.69

I retained earnings is sufficient to finance; new project of Rmism. Therefore, no new share will

be issue to a public. WACC of CO is;

component of capital cost of capital-aftertax weight of Financing weighted cost

kd 6.441. 45m/180m =

251. 1.6

kp 7.76%. 18m/180 m

=

101. 0.776

Ke 7.91. 136 +817m/180m 651 3.135

=

WMCC 521

7

C) No of new bond to be issued

Bond financing: 023xRM15M =

RM3, 750,000

No of new bond:RM3,750,000 / RM931: 4,028 units

B. Step 1

(1.52x0.75)/10.75+0.25(1 -0.24)):1.2128

=

Ba

Step 2

Be

=

1.2128 x (0.7 +(0.3x0.76))/0.7=1.6078

Step 3

Ri= 31. + 1.6078(121. -3%)

Ke = 17-4702:

component of capital cost of capital aftertax

-

weight of Financing weighted cost

Va 3X(1

7

-

0.24):5.7 0.3 17/

ve 17.4702 0.7 12.23

WACC =

13.94%

You might also like

- PFN1223 - Set A - MSDocument8 pagesPFN1223 - Set A - MSalya farhanaNo ratings yet

- Libby 10e Chap001 PPT AccessibleDocument37 pagesLibby 10e Chap001 PPT Accessible許妤君No ratings yet

- P4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesDocument5 pagesP4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesRisky Fernando67% (3)

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Accounting HomeworkDocument6 pagesAccounting HomeworkGavin Ramos100% (2)

- Maf 603 July 2022 Q2 Syahirah Binti MayasinDocument2 pagesMaf 603 July 2022 Q2 Syahirah Binti MayasinIra SyahirahNo ratings yet

- Maf603 Pya Coc - July 21Document2 pagesMaf603 Pya Coc - July 21WAN MOHAMAD ANAS WAN MOHAMADNo ratings yet

- Solution Maf603 Feb 2021 PDFDocument10 pagesSolution Maf603 Feb 2021 PDFHadi DahalanNo ratings yet

- Answer 1. The Correct Answers Are A and BDocument9 pagesAnswer 1. The Correct Answers Are A and BBadihah Mat SaudNo ratings yet

- 11042024154808Document15 pages11042024154808agarwalpawan1No ratings yet

- IPF Assignment 4Document12 pagesIPF Assignment 4Nitesh MehlaNo ratings yet

- Name: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureDocument8 pagesName: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureErick KinotiNo ratings yet

- W391 Kianbun May18-Cert 014 (PDF) Ongoing PDFDocument39 pagesW391 Kianbun May18-Cert 014 (PDF) Ongoing PDFCCSNo ratings yet

- Solution Set 1 Maf603 Feb 2022 Bedah Ahmad 1Document10 pagesSolution Set 1 Maf603 Feb 2022 Bedah Ahmad 1Aina SaffiyahNo ratings yet

- Assignment Chapter 6Document15 pagesAssignment Chapter 6Nicolas ErnestoNo ratings yet

- Solutions - Chapter 11Document3 pagesSolutions - Chapter 11sajedulNo ratings yet

- Subject CT1 - Financial Mathematics. Core Technical.: Xaminers EportDocument11 pagesSubject CT1 - Financial Mathematics. Core Technical.: Xaminers EportfeererereNo ratings yet

- Solutions Chapter 10,11,12,13,14Document15 pagesSolutions Chapter 10,11,12,13,14affan ashfaqNo ratings yet

- CA Inter FM SM A MTP 2 May 2024 Castudynotes ComDocument19 pagesCA Inter FM SM A MTP 2 May 2024 Castudynotes ComsanjanavijjapuNo ratings yet

- F9 Mock Exam June 2020 - Answers PDFDocument9 pagesF9 Mock Exam June 2020 - Answers PDFNguyễn Quốc TuấnNo ratings yet

- Assignment Solution 9Document3 pagesAssignment Solution 9nzb1234No ratings yet

- Inclass Solutions 5Document2 pagesInclass Solutions 5AceNo ratings yet

- Solution Risk and Return JULY 2020Document2 pagesSolution Risk and Return JULY 2020Zoe McKenzieNo ratings yet

- Chapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocument21 pagesChapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesJITIN ARORANo ratings yet

- 660 Final Assignment (Maruf)Document29 pages660 Final Assignment (Maruf)Maruf ChowdhuryNo ratings yet

- Chapter 22 - Teacher's Manual - Far Part 1bDocument13 pagesChapter 22 - Teacher's Manual - Far Part 1bPacifico HernandezNo ratings yet

- Fin 254 - Final - Done With ShehzinaDocument5 pagesFin 254 - Final - Done With ShehzinaSheikh Roshnee 1731695No ratings yet

- Business Finance Decisions: The After Tax Cost of Debt Is Therefore 6.48% On The Bank LoanDocument13 pagesBusiness Finance Decisions: The After Tax Cost of Debt Is Therefore 6.48% On The Bank Loanmuhammad osamaNo ratings yet

- BCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMEDocument5 pagesBCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMERukshani RefaiNo ratings yet

- Submission 2Document2 pagesSubmission 2lxNo ratings yet

- Tarea CircularDocument1 pageTarea CircularMarco LazaroNo ratings yet

- GDV: TDC:: Per PeriodDocument9 pagesGDV: TDC:: Per PeriodM. HfizzNo ratings yet

- Assignment 2 - Ester Intan - 11190002Document8 pagesAssignment 2 - Ester Intan - 11190002esterNo ratings yet

- Principles of Foundation Engineering Ch03Document12 pagesPrinciples of Foundation Engineering Ch03Lee Jia HoeNo ratings yet

- Quo000c50 Anas Cons Rev CDocument1 pageQuo000c50 Anas Cons Rev Cmoij iokNo ratings yet

- 6 Verification On Loading: References CalculationsDocument1 page6 Verification On Loading: References CalculationsAzahar Bin HashimNo ratings yet

- Dividend Growth ModelDocument3 pagesDividend Growth ModelkkrayushNo ratings yet

- Revise - CostingDocument13 pagesRevise - CostingMgr. Accounts Dex-IntlNo ratings yet

- BA 2802 - Principles of Finance Solutions To Problems For Recitation #5Document7 pagesBA 2802 - Principles of Finance Solutions To Problems For Recitation #5Eda Nur EvginNo ratings yet

- Pres 230809Document33 pagesPres 230809VD MHNo ratings yet

- FINANCIAL MANAGEMENT Sesi 5Document4 pagesFINANCIAL MANAGEMENT Sesi 5hestiyaaNo ratings yet

- Dwnload Full Principles of Foundation Engineering Si Edition 7th Edition Das Solutions Manual PDFDocument36 pagesDwnload Full Principles of Foundation Engineering Si Edition 7th Edition Das Solutions Manual PDFwelked.gourami8nu9d100% (10)

- Time Value of Money NotesDocument22 pagesTime Value of Money NotesBeatrice Anne CanapiNo ratings yet

- 660 Final Assignment M-1Document16 pages660 Final Assignment M-1Maruf ChowdhuryNo ratings yet

- SOLUTION MAF603 - JAN 2018 Without TickDocument8 pagesSOLUTION MAF603 - JAN 2018 Without Tickanis izzatiNo ratings yet

- Ebit Capex Change in WC FCF: Risk Free Rate 1.67% Market Return (S&P 500) 9.30% Beta 1.13Document5 pagesEbit Capex Change in WC FCF: Risk Free Rate 1.67% Market Return (S&P 500) 9.30% Beta 1.13Paul GhanimehNo ratings yet

- Test - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswersDocument10 pagesTest - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswerswinNo ratings yet

- PDFDocument2 pagesPDFHina SaharNo ratings yet

- FM II Assignment 17 Solution 19Document3 pagesFM II Assignment 17 Solution 19RaaziaNo ratings yet

- Advance Financial Management A151 (Answser)Document10 pagesAdvance Financial Management A151 (Answser)Fatin FathihahNo ratings yet

- Solution To Convexity QuestionDocument2 pagesSolution To Convexity QuestionnatashaNo ratings yet

- Question 1: Draft of Cash Flow DiagramDocument9 pagesQuestion 1: Draft of Cash Flow DiagramYoong KiaNo ratings yet

- Assignment 1, FIN 643, Capital Investment Decision, Summer 2021Document30 pagesAssignment 1, FIN 643, Capital Investment Decision, Summer 2021Mashfequl EhsanNo ratings yet

- Time Value Compiled DocsDocument12 pagesTime Value Compiled DocsaprilNo ratings yet

- Valuation TemplateDocument16 pagesValuation TemplateFakeNo ratings yet

- 4.EF232.FIM (IL-II) Solution CMA 2023 January ExamDocument6 pages4.EF232.FIM (IL-II) Solution CMA 2023 January ExamnobiNo ratings yet

- Finance Student 8Document14 pagesFinance Student 8yany kamalNo ratings yet

- AA - Project Financial ReportDocument23 pagesAA - Project Financial ReportSteve UkohaNo ratings yet

- ICAEW Financial ManagementDocument20 pagesICAEW Financial Managementcima2k15No ratings yet

- Formula Base Case Formula Best CaseDocument2 pagesFormula Base Case Formula Best CaseJaneNo ratings yet

- Instructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYFrom EverandInstructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYNo ratings yet

- Jungheinrich AG: Germany - EngineeringDocument8 pagesJungheinrich AG: Germany - EngineeringSwagata DharNo ratings yet

- CH 19Document29 pagesCH 19Emey CalbayNo ratings yet

- Accounts and Finance Interview QuestionsDocument4 pagesAccounts and Finance Interview QuestionsZeeshan Haider AwanNo ratings yet

- FIN 308-Chapter 3 (With Notes)Document59 pagesFIN 308-Chapter 3 (With Notes)rNo ratings yet

- Current Assets: Liabilities and Stockholders' EquityDocument9 pagesCurrent Assets: Liabilities and Stockholders' EquityIrakli SaliaNo ratings yet

- SAP Revenue RecognitionDocument25 pagesSAP Revenue RecognitionDeepak Gupta100% (4)

- Tata Motors Limited: Detailed ReportDocument15 pagesTata Motors Limited: Detailed Reportb0gm3n0tNo ratings yet

- ch20 (改)Document21 pagesch20 (改)林義哲No ratings yet

- Chapter 11,12,13Document20 pagesChapter 11,12,13Nikki GarciaNo ratings yet

- Financial Ratios - Top 28 Financial Ratios (Formulas, Type)Document7 pagesFinancial Ratios - Top 28 Financial Ratios (Formulas, Type)farhadcse30No ratings yet

- ACCTGDocument13 pagesACCTGCabardo Maria RegilynNo ratings yet

- Vimal Dairy MbaDocument81 pagesVimal Dairy MbaViral Chaudhari0% (1)

- Basic Accounting Terms QuestionDocument7 pagesBasic Accounting Terms QuestionMadhurima GuptaNo ratings yet

- Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsDocument9 pagesChapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsShaharyar AsifNo ratings yet

- Chapter 4 Cash Flow and Financial Planning: Principles of Managerial Finance, 14e (Gitman/Zutter)Document36 pagesChapter 4 Cash Flow and Financial Planning: Principles of Managerial Finance, 14e (Gitman/Zutter)chinyNo ratings yet

- Intermediate+Financial+Accounting+I+-+Chapter+2+ SDocument21 pagesIntermediate+Financial+Accounting+I+-+Chapter+2+ SNeil Stechschulte100% (1)

- Zica t1 Financial AccountingDocument363 pagesZica t1 Financial Accountinglord100% (2)

- Preparation of Master BudgetDocument43 pagesPreparation of Master Budgetsaran_16100% (1)

- Dileep PreboardDocument10 pagesDileep PreboardmktknpNo ratings yet

- ACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionDocument14 pagesACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionXiaoying XuNo ratings yet

- Icaew Accounting Mock (Pilot Test) : 1. EmailDocument13 pagesIcaew Accounting Mock (Pilot Test) : 1. EmailSteve IdnNo ratings yet

- DepreciationDocument54 pagesDepreciationJane Atendido100% (4)

- PT Bank Syariah Indonesia TBK 31dec2021 Final FullDocument431 pagesPT Bank Syariah Indonesia TBK 31dec2021 Final FullOnly GameNo ratings yet

- 15 Sample Papers Accountancy 2019-20Document119 pages15 Sample Papers Accountancy 2019-20hardik50% (2)

- 8 Financial StatementDocument11 pages8 Financial StatementLin Latt Wai AlexaNo ratings yet

- Ch04 Completing The Accounting CycleDocument68 pagesCh04 Completing The Accounting CycleGelyn CruzNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet