Professional Documents

Culture Documents

Ans Ass 3

Uploaded by

Muffet LkrOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ans Ass 3

Uploaded by

Muffet LkrCopyright:

Available Formats

1. P9 = $12 / 15% = $80 => P0= PV = $80 / [ (1 + 15%)9 = $22.

74

2. Po = $12,000 / 500 = $24 and Di = $2.00 x (1+20%) = $2.40 => ks = (Di / Po ) + g =

($2.40 / $24) + 10% = 30%

3. Each share needs to be sold at $20. Since ks = 25%, this requires that D = $20 x

ks = $5. // If investors believe that CF would grow @10% per, then we should

have P = $20 = Di / (25% -10%) => Di = $3, D2 = $3.30, D3 = $3.63, and so on

4. We can calculate that µ x =8%, x = 8.51% (9.83% if we, divide by N-l), µy

=8%,y = 8.22% (9.49% if we divide by N-l), ρxy= 0.583. // If we have to invest

in only one stock, we would choose stock Y, since it has the same ERR as X,

but a lower variance (standard deviation). // In that case, the return on our

portfolio would be 8% and the risk as measured by standard-deviation would be

8.22% (9.49% if use N-l). // If we are allowed to put our money in both the

stocks, then we will put 45.73% in X and 54.27% in Y, giving us a portfolio

with the ERR equal to 8% and standard-deviation 7.43% (8.58% if N-l).

5. It is given that RF = 8%; from data, we get average historical-spread kM - RF =

5% => βLB= 0.64 => RRRLB = 8% + (0.64 x 5%) = 11.2% Similarly, βHB = 1.4

=> RRRLB = 8% + (1.4 x 5%) = 15.0%

6. βHumors = (50% x βJoke)+ (50% x βLaughter) = (50% x 1.2) + (50% X 0.8) = 1.00 =>

COC Humors = RRR Humors = kM = 12%

βJoke = 1.2 > 1.0 => KJoke > kM = 12% => NPVproject = ($6000 / ) / KJoke) - $50,000 < 0

βexpansion = (3/4 x βJoke ) + (1/4 x βLaughter ) = (3/4 X 1.2) + (1/4 X 0.8) = 1.1

As kM = 12% & kM - RF = 5%, we get RF = 7% => Kexpansion = 7% + (1.1 x

5%) = 12.5% => NPVexpansion = ($2200/12.5%) - $20,000 = -$2,400 => Don't

go for the expansion

You might also like

- Optimal Risky PortfoliosDocument13 pagesOptimal Risky PortfoliosChristan LambertNo ratings yet

- Solution Manual For Investment Science by David LuenbergerDocument94 pagesSolution Manual For Investment Science by David Luenbergerkoenajax96% (28)

- Instructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYFrom EverandInstructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYNo ratings yet

- Matlab Programme in Ship DynamicsDocument4 pagesMatlab Programme in Ship Dynamicspramod1989No ratings yet

- Agreement For Sub-LeaseDocument18 pagesAgreement For Sub-LeaseMuffet LkrNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Ch7 9 SolutionDocument16 pagesCh7 9 Solutionluxmean50% (2)

- Assignment 2: Name: Saif Ali Momin Erp Id: 08003 Course: Business Finance IIDocument39 pagesAssignment 2: Name: Saif Ali Momin Erp Id: 08003 Course: Business Finance IISaif Ali MominNo ratings yet

- Final Exam 4 November AnswerDocument9 pagesFinal Exam 4 November AnswerosamaNo ratings yet

- Risk and Return AnswersDocument11 pagesRisk and Return AnswersmasterchocoNo ratings yet

- Sample Exam SolutionsDocument7 pagesSample Exam SolutionsrichardNo ratings yet

- Cfin 3 3rd Edition Besley Solutions ManualDocument36 pagesCfin 3 3rd Edition Besley Solutions Manualgarrywolfelsjftl100% (11)

- Capital Asset Pricing Model in Mathcad PDFDocument13 pagesCapital Asset Pricing Model in Mathcad PDFOleg PashininNo ratings yet

- Act7 3Document6 pagesAct7 3Helen B. EvansNo ratings yet

- HW Chapter 11Document3 pagesHW Chapter 11ndthtbbNo ratings yet

- Answer 3Document7 pagesAnswer 3Quân LêNo ratings yet

- Chapter 22 Solution To Problems 1Document3 pagesChapter 22 Solution To Problems 1Jayvee M FelipeNo ratings yet

- Tut5 - With MemoDocument6 pagesTut5 - With Memoapi-370823186% (7)

- MTP Soln 1Document14 pagesMTP Soln 1Anonymous 8wg4eowIdzNo ratings yet

- Solution Manual For Cfin2 2nd Edition by BesleyDocument5 pagesSolution Manual For Cfin2 2nd Edition by BesleyAmandaHarrissftia100% (79)

- Portfoilo Management FormulasDocument9 pagesPortfoilo Management FormulasAl-Imran Bin Khodadad100% (1)

- Cfin 3 3rd Edition Besley Solutions ManualDocument5 pagesCfin 3 3rd Edition Besley Solutions Manualcleopatrasang611py100% (23)

- Homework IPM March 2016Document11 pagesHomework IPM March 2016Berry FransNo ratings yet

- SECURITY AND PORTFOLIO ANALYSIS ASSIGNMENTDocument8 pagesSECURITY AND PORTFOLIO ANALYSIS ASSIGNMENTPulkitTyaggiNo ratings yet

- 3 - FS - Exercises - Answer 2Document3 pages3 - FS - Exercises - Answer 2mikheal beyberNo ratings yet

- Pset 03 Spring2020 SolutionsDocument15 pagesPset 03 Spring2020 Solutionsjoshua arnettNo ratings yet

- Bkm9e Answers Chap007Document12 pagesBkm9e Answers Chap007AhmadYaseenNo ratings yet

- Huzaima Jamal-1Document11 pagesHuzaima Jamal-1Fatima ZehraNo ratings yet

- 14 - Dividend Policy SumsDocument17 pages14 - Dividend Policy SumsRISHA SHETTYNo ratings yet

- Chapter 8 Emba 503Document6 pagesChapter 8 Emba 503Arifur NayeemNo ratings yet

- Chapter 10 Stock Valuation Problems SolutionDocument3 pagesChapter 10 Stock Valuation Problems SolutionsaniyahNo ratings yet

- Solutions To Class Problems - Portfolio TheoryDocument7 pagesSolutions To Class Problems - Portfolio TheoryVivek MandalNo ratings yet

- Risk and Return For PortfolioDocument5 pagesRisk and Return For PortfolioferuzbekNo ratings yet

- ProblemSet9 Solutions v1Document7 pagesProblemSet9 Solutions v1s4mlauNo ratings yet

- HW 11 SolutionDocument5 pagesHW 11 SolutionPepe BufordNo ratings yet

- Assignment 2 Group 6:: Student ID Full NameDocument9 pagesAssignment 2 Group 6:: Student ID Full NameQuynh Chau TranNo ratings yet

- 10 CHAP PERCENTAGE - Doc-1Document10 pages10 CHAP PERCENTAGE - Doc-1yash maneNo ratings yet

- Stat 330 Homework 4 Solution Probability Mass Functions Expected Values VariancesDocument3 pagesStat 330 Homework 4 Solution Probability Mass Functions Expected Values VariancesPei JingNo ratings yet

- Assignment Solution Mangerial EconomicsDocument8 pagesAssignment Solution Mangerial EconomicsRocky the HaCkeR.....No ratings yet

- Extra Practice Exam 2 SolutionsDocument9 pagesExtra Practice Exam 2 SolutionsSteve SmithNo ratings yet

- CORRECTION DE LA SERIE 3 Marchés Financiers Et Évaluation Des Actifs #1Document8 pagesCORRECTION DE LA SERIE 3 Marchés Financiers Et Évaluation Des Actifs #1sihemNo ratings yet

- COV and CAPM calculations for finance assignmentDocument6 pagesCOV and CAPM calculations for finance assignmentSaif Ali MominNo ratings yet

- Kwame Nkrumah University of Science and Technololgy College of Arts and Social Sciences School of BusinessDocument5 pagesKwame Nkrumah University of Science and Technololgy College of Arts and Social Sciences School of BusinessYAKUBU ISSAHAKU SAIDNo ratings yet

- Introduction to Risk, Return, and The Opportunity Cost of Capital Answers to Practice QuestionsDocument9 pagesIntroduction to Risk, Return, and The Opportunity Cost of Capital Answers to Practice QuestionsShireen QaiserNo ratings yet

- Engineering Economy Project AnalysisDocument10 pagesEngineering Economy Project AnalysisXuân ThànhNo ratings yet

- Ch7 9 SolutionDocument16 pagesCh7 9 SolutionMinzaNo ratings yet

- Calculating Probabilities Using CDFsDocument10 pagesCalculating Probabilities Using CDFsmiguelNo ratings yet

- Risk Management Solution To Chapter 15Document3 pagesRisk Management Solution To Chapter 15BombitaNo ratings yet

- Lahore School of Economics Financial Management I The Cost of Capital - 2 Assignment 15 SolutionDocument3 pagesLahore School of Economics Financial Management I The Cost of Capital - 2 Assignment 15 SolutionoctaviaNo ratings yet

- Self Attempt Questions - SolutionsDocument5 pagesSelf Attempt Questions - SolutionsShermaine WanNo ratings yet

- ch14 SolDocument16 pagesch14 SolAnsleyNo ratings yet

- Return and Risk On Two Assets PortfolioDocument24 pagesReturn and Risk On Two Assets PortfolioHarsh GuptaNo ratings yet

- Optimal dimensions for minimizing cost of rectangular containerDocument18 pagesOptimal dimensions for minimizing cost of rectangular containerMoin Uddin SiddiqueNo ratings yet

- Wacc SolutionsDocument8 pagesWacc SolutionssrassmasoodNo ratings yet

- Lahore School of Economics Financial Management I Assignment 11 Solution Risk and Rates of Return - 3Document4 pagesLahore School of Economics Financial Management I Assignment 11 Solution Risk and Rates of Return - 3octaviaNo ratings yet

- Cost of CaptialDocument16 pagesCost of Captialbhushandhu12No ratings yet

- Lecture 5Document25 pagesLecture 5tse maNo ratings yet

- Ans Ass 2Document1 pageAns Ass 2Muffet LkrNo ratings yet

- Ans Ass1Document1 pageAns Ass1Muffet LkrNo ratings yet

- DFS Limited CaseDocument3 pagesDFS Limited CaseSach SehgalNo ratings yet

- Grade ExplanationDocument1 pageGrade ExplanationMuffet LkrNo ratings yet

- Q3 FY21 Investor PresentationDocument33 pagesQ3 FY21 Investor PresentationMuffet LkrNo ratings yet

- Birla - Alokhya - Services Ageement With Loyalie - FM Review - 14.12.2019Document24 pagesBirla - Alokhya - Services Ageement With Loyalie - FM Review - 14.12.2019Muffet LkrNo ratings yet

- 2015 CFA Level 2 Study NoteBook5Document272 pages2015 CFA Level 2 Study NoteBook5Muffet LkrNo ratings yet

- Balance Sheet BasicsDocument67 pagesBalance Sheet BasicsZab Jaan100% (1)

- Expression of Interest Sop: Date of Issue Process Owner Approved byDocument6 pagesExpression of Interest Sop: Date of Issue Process Owner Approved byMuffet LkrNo ratings yet

- CFI Accountingfactsheet-1499721167572 PDFDocument1 pageCFI Accountingfactsheet-1499721167572 PDFMuffet LkrNo ratings yet

- GD TopicsDocument6 pagesGD TopicsMuffet LkrNo ratings yet

- Rationale: 1 I Godrej I Title of Presentation I DateDocument3 pagesRationale: 1 I Godrej I Title of Presentation I DateMuffet LkrNo ratings yet

- RD FD Maturity Value Cum Growth ChartsDocument18 pagesRD FD Maturity Value Cum Growth ChartsdantroliyaNo ratings yet

- Case Analysis - Exploring RelationshipsDocument16 pagesCase Analysis - Exploring RelationshipsMuffet LkrNo ratings yet

- Assessor Model NPDDocument0 pagesAssessor Model NPDMuffet LkrNo ratings yet

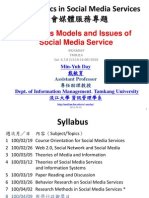

- Social media services business modelsDocument28 pagesSocial media services business modelsMuffet LkrNo ratings yet

- Student Resources PDFDocument943 pagesStudent Resources PDFMuffet Lkr100% (3)

- Bank One - Discussion QuestionsDocument1 pageBank One - Discussion QuestionsMuffet LkrNo ratings yet

- Agreement For SaleDocument8 pagesAgreement For SaleMuffet LkrNo ratings yet

- Agreement For SaleDocument8 pagesAgreement For SaleMuffet LkrNo ratings yet

- EMailDocument1 pageEMailMuffet LkrNo ratings yet

- Forecasting Problem Set - SolutionsDocument8 pagesForecasting Problem Set - SolutionsRajaram IyengarNo ratings yet

- Brand Naming AssignmentDocument1 pageBrand Naming AssignmentMuffet LkrNo ratings yet

- LIME 5 Case Study TIGI PDFDocument6 pagesLIME 5 Case Study TIGI PDFsatish230289No ratings yet

- About Unitech GroupDocument2 pagesAbout Unitech GroupMuffet LkrNo ratings yet

- Biopure FinalDocument22 pagesBiopure FinalMuffet LkrNo ratings yet

- Gera Pune Realty Report July13Document10 pagesGera Pune Realty Report July13Muffet LkrNo ratings yet

- 01 Reliability and ValidityDocument17 pages01 Reliability and ValidityMuffet LkrNo ratings yet