Professional Documents

Culture Documents

FBP-Car Fuel

Uploaded by

John FedricOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FBP-Car Fuel

Uploaded by

John FedricCopyright:

Available Formats

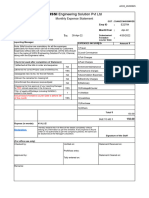

CMPSS India Tech LLP

Details of Car Fuel & Maintenance Expenses Incurred From 1st April 2022 To 31st March 2023

Name of the Employee

Employee Code

Car Name & CC (Copy of RC is to be attached)

Period From / / To / /

S. No. Particular Bill No Date Amount

1

2

3

6

7

8

9

10

11

12

13

14

15

16

Total

(Note : Please submit all the bills in original. The bills should be dated 01st April 2022 to 31 st March 2023.)

• If employee Joined mid year, reimbursement bills will be consider from joining date

• Receipts should be for the period with the current employer only

Date

Place (Signature of the Employee)

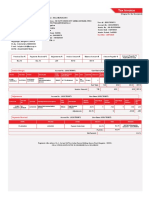

If car is used wholly for private purpose then entire reimbursements paid are taxable.

However, if car is used for both private and official purpose, then taxable amount is calculated on the basis of the following :

* Value used for official purpose is calculated on the basis of cubic capacity of a car.

If cubic capacity of the car is below 1.6 liters i.e. 1600CC, expenses for use of the car are considered at the rate of Rs. 1,800/- p.m. for Exemption

If cubic capacity of the car is above 1.6 liters i.e. 1600CC, expenses for use of the car are considered at the rate of Rs. 2,400/- p.m. for Exemption

You might also like

- Offshore Expenses Incurred Can Be Claimed Using This Form: TELEPHONE EXPENSES - Sub Total: 400.00 (INR)Document2 pagesOffshore Expenses Incurred Can Be Claimed Using This Form: TELEPHONE EXPENSES - Sub Total: 400.00 (INR)devendraNo ratings yet

- Pend InvDocument4 pagesPend Invcetl.mantNo ratings yet

- LOA Issued 124Document10 pagesLOA Issued 124Siddharth vaibhavNo ratings yet

- Offshore Expenses Incurred Can Be Claimed Using This Form: Travel Self and Family - Sub Total: 1416.00 (INR)Document1 pageOffshore Expenses Incurred Can Be Claimed Using This Form: Travel Self and Family - Sub Total: 1416.00 (INR)chrreddyNo ratings yet

- WR Cleaning ContractDocument9 pagesWR Cleaning Contractabhimanyutiwari1234No ratings yet

- NoticeDocument3 pagesNoticevarun.vsconstructionNo ratings yet

- Your Bid ID DatedDocument19 pagesYour Bid ID DatedDHARMENDRANo ratings yet

- Details of Participant - Maklumat Peserta: E-JadualDocument3 pagesDetails of Participant - Maklumat Peserta: E-JadualMohd HedzriNo ratings yet

- 127Document1 page127yuvrajsinh jadejaNo ratings yet

- Indian Institute of Technology, MandiDocument2 pagesIndian Institute of Technology, MandiNilay GandhiNo ratings yet

- 2021 22 SARS ELogbookDocument17 pages2021 22 SARS ELogbookBlack Snow ServicesNo ratings yet

- CA Inter Taxation Question BankDocument425 pagesCA Inter Taxation Question BankvisshelpNo ratings yet

- Project: Project Location:Baroda Date Period FromDocument7 pagesProject: Project Location:Baroda Date Period FromchepurthiNo ratings yet

- 2023-15 LOA NetworkDocument10 pages2023-15 LOA Networksr.vijay.pandeyNo ratings yet

- Barara - Financial Status April To October 2023Document4 pagesBarara - Financial Status April To October 2023verma.mukesh16No ratings yet

- RajasthanDocument5 pagesRajasthanrahul srivastavaNo ratings yet

- Ecert TMCP0532292 PDFDocument4 pagesEcert TMCP0532292 PDFScarlet RubyNo ratings yet

- DocsDocument26 pagesDocsakshat.kapoor.9599No ratings yet

- Go 67 - GSTDocument4 pagesGo 67 - GSTPrabhakar PothunuriNo ratings yet

- Tendernotice 1Document2 pagesTendernotice 1Prashant SinghNo ratings yet

- Monthly Commercial Report:: Emmar Properties (PJSC)Document9 pagesMonthly Commercial Report:: Emmar Properties (PJSC)Yasser Elsalhy100% (1)

- Details of Participant - Maklumat Terperinci Peserta: E-JadualDocument4 pagesDetails of Participant - Maklumat Terperinci Peserta: E-Jadualمحمد زواويNo ratings yet

- CRS3 - Claim Form For Other ReimbursementDocument1 pageCRS3 - Claim Form For Other Reimbursement2ways62No ratings yet

- Details of Participant - Maklumat Peserta: E-JadualDocument3 pagesDetails of Participant - Maklumat Peserta: E-JadualsadabahmadNo ratings yet

- Legislation Bid DataDocument15 pagesLegislation Bid DataNeymar AravindaNo ratings yet

- The Fastest Way To Beat Queues HDFC Bank's Fastag: Enjoy Automatic and Cashless Toll Payments in 3 Easy StepsDocument3 pagesThe Fastest Way To Beat Queues HDFC Bank's Fastag: Enjoy Automatic and Cashless Toll Payments in 3 Easy Stepsrohan chettyNo ratings yet

- 02 2022 E22784 Allenraj April Monthly StatementDocument4 pages02 2022 E22784 Allenraj April Monthly Statementprobal nandyNo ratings yet

- Total Amount PayableDocument3 pagesTotal Amount PayableBhanu GillNo ratings yet

- IT Certificate 667366184Document1 pageIT Certificate 667366184RajanNo ratings yet

- CGG TOO RehostingDocument2 pagesCGG TOO RehostingMega rani RNo ratings yet

- Details of Participant - Maklumat Terperinci Peserta: E-JadualDocument4 pagesDetails of Participant - Maklumat Terperinci Peserta: E-JadualAlam DewataNo ratings yet

- GeM Bidding 3576608Document6 pagesGeM Bidding 3576608VISION ENT RANCHINo ratings yet

- Tendernotice 1Document2 pagesTendernotice 1ATMA SALESNo ratings yet

- GO Ms 381 GST 26112018Document4 pagesGO Ms 381 GST 26112018hussainNo ratings yet

- Directorate General of ShippingDocument1 pageDirectorate General of ShippingdevNo ratings yet

- 1534 - 2015 11 02 11 49 00 - 1446445141 PDFDocument134 pages1534 - 2015 11 02 11 49 00 - 1446445141 PDFFareha RiazNo ratings yet

- KTPS Vehicle TendersDocument2 pagesKTPS Vehicle TendersS UDAY KUMARNo ratings yet

- Inv-Ka-B1-33590396-102017859871-1st July-2020 To 13TH July 2020Document2 pagesInv-Ka-B1-33590396-102017859871-1st July-2020 To 13TH July 2020CLS AKNo ratings yet

- E20 CVL Work OrderDocument151 pagesE20 CVL Work OrderEr. TK SahuNo ratings yet

- E - Payment Status Report: Settlement Results and Cost AssignmentDocument1 pageE - Payment Status Report: Settlement Results and Cost Assignmentreeet87No ratings yet

- E-Way BillDocument1 pageE-Way BillPayal BhanjaNo ratings yet

- Nit CT 99 FVDocument1 pageNit CT 99 FVMonish MNo ratings yet

- Amenity VehicleDocument11 pagesAmenity VehiclegenxarmyNo ratings yet

- E-Procurement FormetDocument2 pagesE-Procurement FormetMuhammad Zakir AttariNo ratings yet

- Payment Schedule For Road Tax Payment by Giro For Vehicle Sjw2705YDocument2 pagesPayment Schedule For Road Tax Payment by Giro For Vehicle Sjw2705YIndra ChanNo ratings yet

- 1.USSOR Letter For AdoptionDocument2 pages1.USSOR Letter For Adoptioncdm tptyNo ratings yet

- U&M Department: Tender No: U&M/TS/QTN/R2/IAC/COMM./22 Dated: 10.08.2022Document6 pagesU&M Department: Tender No: U&M/TS/QTN/R2/IAC/COMM./22 Dated: 10.08.2022JOEL JOHN REJINo ratings yet

- Daite PLC Fu Sep 15,2021Document20 pagesDaite PLC Fu Sep 15,2021Melak YizengawNo ratings yet

- HT2419I000190445Document4 pagesHT2419I000190445Anugyan DasNo ratings yet

- Relay Test Kit Po SR Railway 8 2 2024Document2 pagesRelay Test Kit Po SR Railway 8 2 2024Nagi Reddy ChintakuntaNo ratings yet

- It 000139444749 2022 00Document1 pageIt 000139444749 2022 00WajehNo ratings yet

- 2023-15 LOA NetworkDocument11 pages2023-15 LOA Networksr.vijay.pandeyNo ratings yet

- + Zero Fee: RewardsDocument2 pages+ Zero Fee: RewardsSuraj personalNo ratings yet

- 5207166Document1 page5207166kunmunswn462No ratings yet

- Letter of AcceptanceDocument3 pagesLetter of AcceptanceRinchen DorjiNo ratings yet

- 27 Useful Charts of Service Tax 2016 17 PDFDocument24 pages27 Useful Charts of Service Tax 2016 17 PDFJosef AnthonyNo ratings yet

- Maintenance Accounting VoucherDocument1 pageMaintenance Accounting VoucherAyan DeyNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet