Professional Documents

Culture Documents

revision كورس سنه تانية اخير

Uploaded by

Magdy KamelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

revision كورس سنه تانية اخير

Uploaded by

Magdy KamelCopyright:

Available Formats

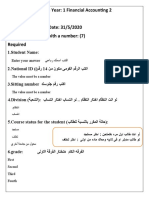

Jeff and Kristie, partners in the J & K partnership, have capital balances of $100,000 and

$40,000 and share income in a ratio of 4:1, respectively. Brad is to be admitted into the

partnership with a 20 percent interest in the business

1. if the Brad invests $60,000 , the brad’s capital is ………..

a. 40,000

b. 30,000

c. 20,000

d. 16,000

2. in the previous example, the bonus to old partners is ………….

a. 40,000 b. 30,000

c. 20,000 d. 16,000

3. in the previous example, the capital balance of partnership after admission brad

is…

jeff Kristie brad

a. 116,000 44,000 30,000

b. 116,000 44,000 40,000

c. 116,000 40,000 40,000

d. 100,000 40,000 40,000

4. if the brad purchases 20% of partnership , the capital of brad account is …………

a. 28,000

b. 46,000

c. 62,000

d. 64,000

5. in the same example of 4, the jeff’s capital balance after admission brad is …………..

a. 80,000

b. 32,000

c. 28,000

d. none of these

6. if Brad invests $32,000, the Kristie, capital balance after admission brad is …………….

a. 98,080

b. 39,520

c. 34,400

d. none of these.

1 | Page Dr. Magdy Kamel

The partnership of Ace, Jack, and spade has been in business for 25 years. On

decemer 31, 2008 spade decide to retire from the partnership. The partnership balance

sheet reported the following capital balances for each partner at December 31, 2008.

Ace, capital 150,000 Jack, capital 200,000 Spade, capital 120,000

7. if spade was given 60,000 of cash and partnership land, with a fair value of

120,000 the carrying amount of the land on the partnership books was 100,000

The revaluation of land is -----------------

a. 20,000

b. (20,000)

c. 30,000

d. none of these

8. in the previous example, the capital of spade after revaluation is …………….

a. 120,000

b. 150,000

c. 130,000

d. none of these

9. in the previous example, the Ace’s capital balance of partnership after withdrawal

spade is ………………………

a. 150,000

b. 154,000

c. 134,000

d. none of these

10. in the previous example, the Jack’s capital balance of partnership after

withdrawal spade is ………………………

a. 200,000

b. 206,000

c. 176,000

d. none of these

11. in the previousthe total capital of partnership after withdrawal spade is ……………

a. 350,000

b. 370,000

c. 310,000

d. none of these.

2 | Page Dr. Magdy Kamel

You might also like

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Reviewer On Partnership AccountingDocument27 pagesReviewer On Partnership AccountingannegelieNo ratings yet

- Alagos & Bayona - Advanced Accounting 1-6 MCQDocument24 pagesAlagos & Bayona - Advanced Accounting 1-6 MCQLouise Battung100% (1)

- P2 Exam ParCor Questionnaire 1Document7 pagesP2 Exam ParCor Questionnaire 1peter pakerNo ratings yet

- Soal Akl1Document7 pagesSoal Akl1Khazanah UmiNo ratings yet

- MCQ Quiz With Answers PDFDocument10 pagesMCQ Quiz With Answers PDFMary Lourdine BernabeNo ratings yet

- Acca 205 Partnership Multiple Choice QuestionsDocument10 pagesAcca 205 Partnership Multiple Choice QuestionsCyrus SantosNo ratings yet

- Acct 559Document11 pagesAcct 559nidal charaf eddine100% (1)

- Quiz 3 Partnership DissolutionDocument6 pagesQuiz 3 Partnership DissolutionWenjun100% (1)

- NSBZDocument6 pagesNSBZKenncy100% (4)

- Partnership and Corp Liquid TestbankDocument288 pagesPartnership and Corp Liquid TestbankWendelyn Tutor80% (5)

- Part A: Multiple Choice Questions (20 Marks)Document18 pagesPart A: Multiple Choice Questions (20 Marks)Anonymous f5ZhkfZmk9100% (1)

- Test: 1 Topic: Fundamental, Goodwill, Change in Profit Sharing RatioDocument4 pagesTest: 1 Topic: Fundamental, Goodwill, Change in Profit Sharing RatioHigreeve SrudhiNo ratings yet

- 12th Sample Paper 6Document8 pages12th Sample Paper 6Amit ChaudhryNo ratings yet

- Partnership Dissolution Name: Date: Professor: Section: Score: QuizDocument5 pagesPartnership Dissolution Name: Date: Professor: Section: Score: QuizNahwi KimpaNo ratings yet

- Partnership Accounting PDFDocument4 pagesPartnership Accounting PDFPamela BugarsoNo ratings yet

- Reviewer in Partnership Corporation MycDocument22 pagesReviewer in Partnership Corporation MycScwythle65% (20)

- QuizDocument4 pagesQuizKaren GarciaNo ratings yet

- Template - QE - Advance AccountingDocument18 pagesTemplate - QE - Advance AccountingJykx SiaoNo ratings yet

- LONG-PAPER - FORMATION AnswersDocument8 pagesLONG-PAPER - FORMATION Answerstooru oikawaNo ratings yet

- Assignment 1 - Partnership DissolutionDocument7 pagesAssignment 1 - Partnership DissolutionchxrlttxNo ratings yet

- ANSWER Assessment ExamDocument21 pagesANSWER Assessment ExamJazzy Mercado100% (1)

- Accounting For Special Transactions Prelim Examination: Use The Following Information For The Next Two QuestionsDocument24 pagesAccounting For Special Transactions Prelim Examination: Use The Following Information For The Next Two QuestionsArtisan82% (11)

- 1 Partnership AccountingDocument10 pages1 Partnership AccountingMarynelle Labrador SevillaNo ratings yet

- Far - SfeDocument6 pagesFar - SfeAdrian ManongdoNo ratings yet

- Diagnostic Exam Advanced AccountingDocument12 pagesDiagnostic Exam Advanced AccountingNhajNo ratings yet

- محاسبة 2Document12 pagesمحاسبة 2Rawan HamamrahNo ratings yet

- AFAR Assessment October 2020Document8 pagesAFAR Assessment October 2020FelixNo ratings yet

- Name: Date: Professor: Section: Score: Quiz No.3Document4 pagesName: Date: Professor: Section: Score: Quiz No.3Clint Agustin M. RoblesNo ratings yet

- Activity 1 Partnership Formation and OperationDocument8 pagesActivity 1 Partnership Formation and OperationRoyceNo ratings yet

- C1 Framework TestDocument11 pagesC1 Framework TestSteeeeeeeephNo ratings yet

- Multiple Choice Questions Compilation by de Jesus and Galgo ACCTG 112 Chapter 1 Theories (Jeter and Chaney Advanced Accounting 3 Ed.)Document34 pagesMultiple Choice Questions Compilation by de Jesus and Galgo ACCTG 112 Chapter 1 Theories (Jeter and Chaney Advanced Accounting 3 Ed.)Kenneth Joshua Cinco NaritNo ratings yet

- Problem 1-8Document11 pagesProblem 1-8JPIA-UE Caloocan '19-20 AcademicsNo ratings yet

- Partnership DissolutionDocument7 pagesPartnership DissolutionAngel Frolen B. RacinezNo ratings yet

- Practical Accounting 2 SIR SALVADocument243 pagesPractical Accounting 2 SIR SALVAVirgo CruzNo ratings yet

- Practice Qs Chap 13HDocument4 pagesPractice Qs Chap 13HSuy YanghearNo ratings yet

- MC Problems QuesDocument11 pagesMC Problems QuesJustine Mae AgapitoNo ratings yet

- 1b CH 12 Quiz&ansDocument9 pages1b CH 12 Quiz&ansMonique CabreraNo ratings yet

- Quiz - Chapter 1 - Partnership Formation - 2021 EditionDocument5 pagesQuiz - Chapter 1 - Partnership Formation - 2021 EditionYam SondayNo ratings yet

- FAR Assessment-ExamDocument15 pagesFAR Assessment-ExamJazzy MercadoNo ratings yet

- ACC 311 Ass#2Document7 pagesACC 311 Ass#2Justine Reine CornicoNo ratings yet

- Fundamentals of Abm 2.2Document6 pagesFundamentals of Abm 2.2Jasmine ActaNo ratings yet

- Quiz - Chapter 1 - Partnership Formation - 2021 EditionDocument5 pagesQuiz - Chapter 1 - Partnership Formation - 2021 EditionNahwi KimpaNo ratings yet

- PDF Afar Week1 Compiled Questions CompressDocument78 pagesPDF Afar Week1 Compiled Questions CompressIo AyaNo ratings yet

- Chapter c4Document44 pagesChapter c4bobNo ratings yet

- Chapter 15 Test BankDocument31 pagesChapter 15 Test BankNadi HoodNo ratings yet

- Ac 16 MidtermDocument20 pagesAc 16 MidtermMarjorie AmpongNo ratings yet

- Quiz - Formation and Operations (Answers)Document8 pagesQuiz - Formation and Operations (Answers)Angel Frolen B. RacinezNo ratings yet

- Disso and LiquiDocument9 pagesDisso and LiquiDexell Mar MotasNo ratings yet

- Midterm Exam Part1 DFCM Act SPCL Trans 2020 Edition Feb 2020Document19 pagesMidterm Exam Part1 DFCM Act SPCL Trans 2020 Edition Feb 2020calliemozartNo ratings yet

- Partnership AcctgDocument14 pagesPartnership AcctgcessbrightNo ratings yet

- FIL 124 - Final TestDocument16 pagesFIL 124 - Final TestChavey Jean V. RenidoNo ratings yet

- Dwnload Full Accounting For Corporate Combinations and Associations Australian 7th Edition Arthur Test Bank PDFDocument36 pagesDwnload Full Accounting For Corporate Combinations and Associations Australian 7th Edition Arthur Test Bank PDFdietzbysshevip813100% (16)

- HahahahaDocument3 pagesHahahahaTyrelle Dela Cruz100% (1)

- Adv 1 - Dept 2010Document16 pagesAdv 1 - Dept 2010Aldrin100% (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Real Estate License Exam Calculation Workbook: 250 Calculations to Prepare for the Real Estate License Exam (2023 Edition)From EverandReal Estate License Exam Calculation Workbook: 250 Calculations to Prepare for the Real Estate License Exam (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Financial Reporting and Accounting Standards: Chapter Learning ObjectivesDocument12 pagesFinancial Reporting and Accounting Standards: Chapter Learning ObjectivesMagdy KamelNo ratings yet

- Barclays Reveals2014-QuestionDocument10 pagesBarclays Reveals2014-QuestionMagdy KamelNo ratings yet

- Final Revision Part 2 Language (2st)Document21 pagesFinal Revision Part 2 Language (2st)Magdy KamelNo ratings yet

- Exam StatDocument11 pagesExam StatMagdy KamelNo ratings yet

- solution of math first امتحانDocument8 pagessolution of math first امتحانMagdy KamelNo ratings yet

- Sheet (3) : Corporations: Dividends, Retained Earnings, and Income ReportingDocument28 pagesSheet (3) : Corporations: Dividends, Retained Earnings, and Income ReportingMagdy KamelNo ratings yet

- Faculty of Commerce Year: Statistics May 2020 Time: Three Hours - Date: 31/5/2020 The Questions Start With A Number: (7) RequiredDocument12 pagesFaculty of Commerce Year: Statistics May 2020 Time: Three Hours - Date: 31/5/2020 The Questions Start With A Number: (7) RequiredMagdy KamelNo ratings yet

- Going Concern AssumptionDocument1 pageGoing Concern AssumptionMagdy KamelNo ratings yet

- Public Administration - ExamDocument6 pagesPublic Administration - ExamMagdy KamelNo ratings yet

- Intermediate Accounting Test Bank Chapter 18Document3 pagesIntermediate Accounting Test Bank Chapter 18Magdy Kamel33% (3)

- Second 22Document11 pagesSecond 22Magdy KamelNo ratings yet

- O o o o o o o O: 11) John Maynard KeynesDocument17 pagesO o o o o o o O: 11) John Maynard KeynesMagdy KamelNo ratings yet

- ResourceDocument7 pagesResourceMagdy KamelNo ratings yet

- O False o FalseDocument9 pagesO False o FalseMagdy KamelNo ratings yet

- Second Semester 2020 Second Year University of Assuit Faculty of Commerce English Program " Corporation" "Test Bank"Document10 pagesSecond Semester 2020 Second Year University of Assuit Faculty of Commerce English Program " Corporation" "Test Bank"Magdy KamelNo ratings yet

- Assiut University - Faculty of CommerceDocument17 pagesAssiut University - Faculty of CommerceMagdy KamelNo ratings yet

- 1Document42 pages1Magdy KamelNo ratings yet

- Dr. Nagla Shalaby Please Choose The Correct AnswerDocument3 pagesDr. Nagla Shalaby Please Choose The Correct AnswerMagdy KamelNo ratings yet

- ExDocument5 pagesExMagdy KamelNo ratings yet

- 104Document8 pages104Magdy Kamel100% (1)

- 多益一路通模擬試題解答p406 449Document4 pages多益一路通模擬試題解答p406 449楊俊賢No ratings yet

- ACC 101 Chapter 4 - Part 1 (Closing Entires)Document5 pagesACC 101 Chapter 4 - Part 1 (Closing Entires)Qais KhaledNo ratings yet

- ComprobanteBOA 1ssccDocument6 pagesComprobanteBOA 1ssccAL3X Z3NT3NONo ratings yet

- Logo ContractDocument2 pagesLogo ContractRhonmar CastroNo ratings yet

- Uhuru Candle Company LTD.Document10 pagesUhuru Candle Company LTD.LoraNo ratings yet

- RevenueDocument181 pagesRevenueKrishna Chaitanya V S0% (2)

- Register of Concrete MixesDocument27 pagesRegister of Concrete MixesGeraldNo ratings yet

- Spelling Bee WordsDocument9 pagesSpelling Bee WordsMUHAMMAD FAHIMNo ratings yet

- Hollow Metal CatalogueDocument72 pagesHollow Metal CatalogueMohamed ZafonNo ratings yet

- HTD Shcs 12.9 T TorqueDocument1 pageHTD Shcs 12.9 T TorqueChandru Vel100% (1)

- Lesson 3, Topic 1 - Global Divides Locating The Global SouthDocument5 pagesLesson 3, Topic 1 - Global Divides Locating The Global SouthAirish Joyce Benoza100% (1)

- Astm-D3647 2009 961068721531Document2 pagesAstm-D3647 2009 961068721531Malik AzeemNo ratings yet

- Starbox PDFDocument2 pagesStarbox PDFAdrian SetyadharmaNo ratings yet

- Four Phases of Dev. Arvind PanagariyaDocument19 pagesFour Phases of Dev. Arvind PanagariyaAnupriya GuptaNo ratings yet

- Deed of Absolute Sale of Road Right of WayDocument2 pagesDeed of Absolute Sale of Road Right of Waylovely sarceno100% (2)

- Solved The Demand For Good X Is Given by QDX 1200Document1 pageSolved The Demand For Good X Is Given by QDX 1200M Bilal SaleemNo ratings yet

- NTA NET Economics 30 September 2020 Evening Shift Part 1Document4 pagesNTA NET Economics 30 September 2020 Evening Shift Part 1Ulaganathan SNo ratings yet

- Company Formation Germany 2023Document11 pagesCompany Formation Germany 2023arsalanghuralgtNo ratings yet

- Petronas Structure SystemDocument11 pagesPetronas Structure SystemRim ZreikaNo ratings yet

- Micro 1 1st Test 2021Document5 pagesMicro 1 1st Test 2021Lemi GonfaNo ratings yet

- SIM WS2022-23 Lec8Document16 pagesSIM WS2022-23 Lec8CarolinaNo ratings yet

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocument1 pagePrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsLearning WebsiteNo ratings yet

- BTMS Lead 15.06.2022Document2 pagesBTMS Lead 15.06.2022Sajib BhowmikNo ratings yet

- Microeconomics For Managers - 2013 PDFDocument4 pagesMicroeconomics For Managers - 2013 PDFmayur2510.200886620% (1)

- QSM EXTRUDER 2019 09 - WebDocument6 pagesQSM EXTRUDER 2019 09 - WebNgọc Trần MinhNo ratings yet

- Module 3 Job Order CostingDocument17 pagesModule 3 Job Order CostingPhebieon MukwenhaNo ratings yet

- Bic - LifecycleDocument1 pageBic - LifecycledesmonNo ratings yet

- Mepco Online BillDocument2 pagesMepco Online BillMuhammad Shehar Yar UE MULTAM CAMPUSNo ratings yet

- Bs ProjectDocument5 pagesBs ProjectVaibhav ThakkarNo ratings yet

- Bai Tap Ias36Document25 pagesBai Tap Ias36Thiện PhátNo ratings yet