Professional Documents

Culture Documents

تلخيص لغة تانيه 20233

Uploaded by

magdy kamelOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

تلخيص لغة تانيه 20233

Uploaded by

magdy kamelCopyright:

Available Formats

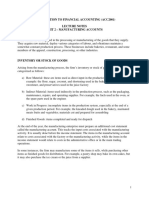

Statement of cash flow is computed as follow:

Net cash provided (used) by operating activities xxx

+ Net cash provided (used) by investing activities xxx

+ Net cash provided (used) by financing activities xxx

= Net increase or (decrease) in cash ……………….. xxx

)+( beginning cash …………………………………………… xxx

= Cash at end of period ………………………………………. Xxx

under indirect method

net cash provided (used) by operating activities

Net income ………………………………… xxxx

Adjustment to reconcile net income

Accounts receivable To net cash provided by operating activities

Notes receivable Depreciation expense

Inventory

Patent amortization expense (+) Add

Prepaid expense

Supplies

Depletion expense

Increase in current asset (-) Deduct

Accounts payable Decrease in current asset (+) Add

Income tax payable

Accrual expense payable Increase in current liabilities (+) Add

Decrease in current liabilities (-) deduct

Land

building

Gain on sale of fixed assets (-) deduct

Equipment

Furniture Loss on sale of fixed assets (+) Add

Machine Net cash provided (used) by operating activities

Tools

xxxx

Vehicles

1 | Page Dr.Magdy Kamel

Net cash flows from investing activities

Availiable for sale Sale of long term assets

securities Sale of long term investment (+) add

Excluded

Collection of long term loan

Trading securities

Purchase of long term assets

Purchase of long term investment (-) deduct

Make a loan

Lending money

Net cash provided (used) by investing activities xxx

net cash provided by financing activities

Issuance or sale of common stock

Issuance or sale of preferred stock

Issuance of bonds payable add

increase of notes payable

Repaid of notes payable

Redemption of bonds payable

Payment of cash dividends deduct

Payback long term loans

Purchase of treasury stock

Net cash provided by financing activities xxx

Notes

Receipt of interest and dividends are classified as operating activities.

Collection of loan or to make a loan are classified investing activities

Loan borrowed from abnk by signing note are classified as financing activities

2 | Page Dr.Magdy Kamel

under direct method

(-) Bad debt expense

Cash from operating activities

بطرحها ان وجدت فى المسالة

Cash receipts (+) Decrease of accounts receivable

Sales

from customers = or

Revenue

(-) increase of accounts receivable

Cash payment (+) increase in inventory (+) dercrease in A/P

1. To supplies = Cost of or or

Goods Sold (-) Decrease in inventory (-) increase in A/P

cash payment (+) increase in (+) decrease in accrued

Operating prepaid expense expenses payable

2. for operating expense = Expenses

(-) decrease in (-) increase in accrued

Prepaid expense expenses payable

excluded

(-) Bad debt expense

Depreciation expense بطرحها ان وجدت فى المسالة

Or bad debt expense

Cash payment

Interest

3. for interest expense =

expenses

Cash payment (+) decrease in income taxes payable

4. For income taxes = Income tax or

Expense (-) increase in income taxes payable

3 | Page Dr.Magdy Kamel

Some rules :

1. Retained earnings

Retained earning , jan 1 xx

Net income ………………………. xx

(-) payment of cash dividends xx

Retained earnings , dec 31 xx

2. to compute gain or loss on sales of fixed assets

Sales of fixed assets xx

(-) book value of fixed assets (xx)

= Gain or loss on sales of fixed assets xxx

4. depreciation expense

Change increase or decrease in accumulated depreciation

(+) accumulated depreciation = cost – book value

4 | Page Dr.Magdy Kamel

You might also like

- Cash FlowsDocument4 pagesCash FlowsGelai BatadNo ratings yet

- Cash Flow Statement FormateDocument3 pagesCash Flow Statement FormatesatyaNo ratings yet

- Cash Flow Statement Examples As Per Direct Method: Report Name Sap Report T-CodeDocument6 pagesCash Flow Statement Examples As Per Direct Method: Report Name Sap Report T-Codejainendra100% (1)

- Ias 7 Cash Flow Statement ContinuedDocument8 pagesIas 7 Cash Flow Statement ContinuedMichael Bwire100% (1)

- Dr. Ajay Dwivedi Professor Department of Financial StudiesDocument16 pagesDr. Ajay Dwivedi Professor Department of Financial StudiesKaran Pratap Singh100% (1)

- Cashflow ExampleDocument6 pagesCashflow ExamplecoolyouhiNo ratings yet

- Ias 7 Statement of Cashflows (F2)Document7 pagesIas 7 Statement of Cashflows (F2)Tawanda Tatenda Herbert100% (1)

- More Statement of Cash Flow Exercises-1Document8 pagesMore Statement of Cash Flow Exercises-1Juliana CaroNo ratings yet

- Exam Revision - Chapter 17Document6 pagesExam Revision - Chapter 17Vũ Thị NgoanNo ratings yet

- Cash Flow Statement Format 2021Document5 pagesCash Flow Statement Format 2021VV MusicNo ratings yet

- HANDOUT 2 Cash Flow AnalysisDocument2 pagesHANDOUT 2 Cash Flow AnalysisJayson Bautista RicoNo ratings yet

- Cash Flow AccountingDocument17 pagesCash Flow AccountingPrabir Kumer RoyNo ratings yet

- Lesson 04 - Cash Flow StatementDocument5 pagesLesson 04 - Cash Flow Statementpulitha kodituwakkuNo ratings yet

- Operating Activities Are The Transactions From The Revenue Generating ActivitiesDocument3 pagesOperating Activities Are The Transactions From The Revenue Generating ActivitiesRaym FelixNo ratings yet

- Module 2: Conceptual Framework For Financial ReportingDocument5 pagesModule 2: Conceptual Framework For Financial Reportingmonsta x noona-yaNo ratings yet

- 1-Cash Flow StatementDocument21 pages1-Cash Flow StatementOvais Zia100% (1)

- Cash Flow StatementDocument16 pagesCash Flow StatementSagnik Sharangi100% (1)

- Cash Flow Statement Notes.12Document12 pagesCash Flow Statement Notes.12Sarthak PatilNo ratings yet

- 8.1 Cash FlowsDocument1 page8.1 Cash FlowsHasif YusofNo ratings yet

- Cash Flow StatementDocument5 pagesCash Flow StatementDebaditya SenguptaNo ratings yet

- Cash Flow Statement in A NutshellDocument2 pagesCash Flow Statement in A NutshellJuan SalazarNo ratings yet

- FABM 2 Finals ReviewerDocument10 pagesFABM 2 Finals ReviewerHerzens brecherNo ratings yet

- Non-Current AssetsDocument4 pagesNon-Current AssetsIsraa IsamNo ratings yet

- Chapter 22 - Statement of Cash FlowsDocument17 pagesChapter 22 - Statement of Cash Flowsprasad guthiNo ratings yet

- Vertical Format: Format of Income Statement ParticularsDocument4 pagesVertical Format: Format of Income Statement ParticularsAnjali Betala Kothari100% (1)

- Statement of Cash FlowDocument6 pagesStatement of Cash FlowNhel AlvaroNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 3Document6 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 3Renee WongNo ratings yet

- Cash Flow StatementDocument22 pagesCash Flow Statementshrestha.aryxnNo ratings yet

- Chapter 11 Lecture 2018Document62 pagesChapter 11 Lecture 2018Johnny Sins100% (1)

- CashFlowZadani28 3 2022Document10 pagesCashFlowZadani28 3 2022Nguyen GiangNo ratings yet

- Topic 7 MFRS 107 Statement of Cash FlowsDocument21 pagesTopic 7 MFRS 107 Statement of Cash Flowsaisyahinafaryanis14No ratings yet

- Cashflow Template Cashflow From Operating Activities: Total Cash Ending Balance 1+2+3Document1 pageCashflow Template Cashflow From Operating Activities: Total Cash Ending Balance 1+2+3Tenghour LyNo ratings yet

- Cash Flow StatementDocument17 pagesCash Flow StatementanuhyaextraNo ratings yet

- Pre Reading Material For Session 17 FA (Cash Flow)Document10 pagesPre Reading Material For Session 17 FA (Cash Flow)Rohit Roy100% (1)

- Format of Cash Flow Statement: Liabilities Rs. Assets Rs. Balance SheetDocument3 pagesFormat of Cash Flow Statement: Liabilities Rs. Assets Rs. Balance SheetVineet tiwariNo ratings yet

- Cash FlowDocument6 pagesCash FlowKhaneik KingNo ratings yet

- Chapter 2-The Accounting EquationDocument132 pagesChapter 2-The Accounting EquationAmr HassanNo ratings yet

- B203B - Accounting and Finance (Part BDocument32 pagesB203B - Accounting and Finance (Part Bahmed helmyNo ratings yet

- Unit 2 - Manufacturing Accounts Lecture NotesDocument9 pagesUnit 2 - Manufacturing Accounts Lecture Noteslashy123booNo ratings yet

- 8.1 Cash Flows - Format - Solution - Part 3Document51 pages8.1 Cash Flows - Format - Solution - Part 3Hasif YusofNo ratings yet

- Corporate Unit 3Document497 pagesCorporate Unit 3bhavu aryaNo ratings yet

- Cashflow StatementDocument16 pagesCashflow StatementJames NdegwaNo ratings yet

- Cash Flow Statement - ProformaDocument1 pageCash Flow Statement - ProformaReyaan VatsNo ratings yet

- Statement of Cash Flow (Indirect Method)Document7 pagesStatement of Cash Flow (Indirect Method)RazaAminNo ratings yet

- Ind As 7: Statement of Cash Flows: Key PointsDocument5 pagesInd As 7: Statement of Cash Flows: Key PointsDinesh KumarNo ratings yet

- Topic 7 OF ACCONTINGDocument11 pagesTopic 7 OF ACCONTINGCharlesNo ratings yet

- Materi Chapter 23 Cash FlowDocument2 pagesMateri Chapter 23 Cash FlowM Reza andriantoNo ratings yet

- Cash Flow Statement 1220159910575245 9Document17 pagesCash Flow Statement 1220159910575245 9duyphung1234No ratings yet

- CFS Baf 1 CpaDocument6 pagesCFS Baf 1 CpaErnest NyangiNo ratings yet

- Cash Flows StatementsDocument4 pagesCash Flows StatementsMae-shane SagayoNo ratings yet

- Diya 1Document4 pagesDiya 1Vipul I PanchasarNo ratings yet

- STUDYDocument10 pagesSTUDYkerniaserieuxxNo ratings yet

- Balance Sheet (Statement of Financial Position) : Non Current AssetsDocument5 pagesBalance Sheet (Statement of Financial Position) : Non Current Assetsmohamed almougtabaNo ratings yet

- F1 Chapter 4 PDFDocument20 pagesF1 Chapter 4 PDFAchiek JamesNo ratings yet

- Cash Flow Problems and SolutionsDocument23 pagesCash Flow Problems and SolutionsSangetaSinghNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash FlowsBryle Jay LapeNo ratings yet

- Financial Accounting: Accounting - Process of Identifying, Measuring, and Communicating EconomicDocument7 pagesFinancial Accounting: Accounting - Process of Identifying, Measuring, and Communicating EconomicKyle Daniel PimentelNo ratings yet

- Cash Flow Statement NotesDocument6 pagesCash Flow Statement NotesChe DivineNo ratings yet

- General Purpose Financial StatementDocument10 pagesGeneral Purpose Financial Statementfaith olaNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- sheet 5 E1 ازهرDocument9 pagessheet 5 E1 ازهرmagdy kamelNo ratings yet

- Sheet 4 E1 ازهرDocument13 pagesSheet 4 E1 ازهرmagdy kamelNo ratings yet

- تلخيص سنه اولىDocument1 pageتلخيص سنه اولىmagdy kamelNo ratings yet

- Sales RevenueDocument1 pageSales Revenuemagdy kamelNo ratings yet

- sheet (6) ازهر E1Document10 pagessheet (6) ازهر E1magdy kamelNo ratings yet

- ch (14) جامعه الازهرDocument26 pagesch (14) جامعه الازهرmagdy kamelNo ratings yet

- Cost Accounting Sheet (5) Part (2) Chapter (3) Costing and Control of Materials and LaborDocument11 pagesCost Accounting Sheet (5) Part (2) Chapter (3) Costing and Control of Materials and Labormagdy kamelNo ratings yet

- Sheet (8) Intermediate Accounting: InventoriesDocument12 pagesSheet (8) Intermediate Accounting: Inventoriesmagdy kamelNo ratings yet

- Alison Krauss CompanyDocument3 pagesAlison Krauss Companymagdy kamelNo ratings yet

- Case Study - Stock Pitch GuideDocument7 pagesCase Study - Stock Pitch GuideMuyuchen Shi100% (1)

- May 2023 RSI ReportDocument4 pagesMay 2023 RSI ReportBernewsAdminNo ratings yet

- University of Liberal Arts Bangladesh: Project Report OnDocument48 pagesUniversity of Liberal Arts Bangladesh: Project Report OnMR Trade InternationalNo ratings yet

- Constant Capital Ghana Inflation Index UpdateDocument2 pagesConstant Capital Ghana Inflation Index UpdateKofikoduahNo ratings yet

- Statistik Perusahaan Pergadaian Indonesia - Januari 2023Document16 pagesStatistik Perusahaan Pergadaian Indonesia - Januari 2023math.daringNo ratings yet

- A Shared Purpose Can Have Enormously Powerful EffectsDocument4 pagesA Shared Purpose Can Have Enormously Powerful EffectsDe Leoz ImrNo ratings yet

- Calculating BenefitsDocument2 pagesCalculating Benefitsஅபூ மூபஸ்ஸராNo ratings yet

- Key Intellectual Property Concepts PDFDocument4 pagesKey Intellectual Property Concepts PDFflatraNo ratings yet

- Organizational Study On VolvoDocument33 pagesOrganizational Study On Volvoಬಿ ಆರ್ ವೇಣು ಗೋಪಾಲ್No ratings yet

- Piecemeal DistributionDocument5 pagesPiecemeal DistributionYashfeen HakimNo ratings yet

- Shoreline Equity Partners Finder Fee EngagementDocument5 pagesShoreline Equity Partners Finder Fee EngagementMarius AngaraNo ratings yet

- Nike FY05 06 CR Report CDocument162 pagesNike FY05 06 CR Report CShehzad Ashraf100% (1)

- Online Shoping With ShopeeDocument7 pagesOnline Shoping With ShopeeXII MM1Reiza Fauzan FirdausNo ratings yet

- Nikon Report 2021Document44 pagesNikon Report 2021NikonRumorsNo ratings yet

- ICAAP ContentsDocument14 pagesICAAP ContentsDagobert RugwiroNo ratings yet

- Cash Deposit Machine ListDocument32 pagesCash Deposit Machine ListSunil MahantyNo ratings yet

- First Warning - SyihaDocument1 pageFirst Warning - SyihamenonshyaminiNo ratings yet

- Conversion RetiroDocument1 pageConversion RetiroLissa PerezNo ratings yet

- Dividend Policy at FPL: GROUP 20:assignment 1Document12 pagesDividend Policy at FPL: GROUP 20:assignment 1Priyanka AzadNo ratings yet

- 5S Routine Audit Form: SO RTDocument1 page5S Routine Audit Form: SO RTShahid RazaNo ratings yet

- Finmene Angelyca NatasyaDocument4 pagesFinmene Angelyca NatasyaANGELYCA LAURANo ratings yet

- 10.1007@978 3 319 32543 9 - NoRestriction PDFDocument386 pages10.1007@978 3 319 32543 9 - NoRestriction PDFJuan José María MartínezNo ratings yet

- Quick Check-Chapter 6: Skechers Famous FootwearDocument2 pagesQuick Check-Chapter 6: Skechers Famous FootwearJannette Treviño RamosNo ratings yet

- Current Liabilities and ContingenciesDocument12 pagesCurrent Liabilities and ContingenciesLu CasNo ratings yet

- Shruthi H S Assistance ProfessorDocument8 pagesShruthi H S Assistance Professorshanthala mNo ratings yet

- 949pm12.deepakshi Saxena & Natasha KuldeepDocument6 pages949pm12.deepakshi Saxena & Natasha KuldeepMeraNo ratings yet

- Chester Levings RobosignerDocument1 pageChester Levings RobosignerBradley WalkerNo ratings yet

- Managerial Economics - Chapter01Document22 pagesManagerial Economics - Chapter01Ayman Al-HuzaifiNo ratings yet

- Central Bank of Malta ActDocument29 pagesCentral Bank of Malta ActcikkuNo ratings yet

- Coefficient of Variation : Standard Deviation Expected EPSDocument2 pagesCoefficient of Variation : Standard Deviation Expected EPSJPNo ratings yet