Professional Documents

Culture Documents

Annual-Report-FML-30-June-2020-23-Vol 3

Uploaded by

Bluish Flame0 ratings0% found this document useful (0 votes)

13 views2 pagesThis document provides notes to the financial statements for Feroze1888 Mills Limited for the year ended June 30, 2020. It includes information on the company and its operations such as geographical locations. It also provides details on the statement of changes in equity including profit/loss, dividends paid, and balances as of June 30, 2019 and 2020. Additionally, it discusses the impact of the COVID-19 pandemic on the financial statements.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides notes to the financial statements for Feroze1888 Mills Limited for the year ended June 30, 2020. It includes information on the company and its operations such as geographical locations. It also provides details on the statement of changes in equity including profit/loss, dividends paid, and balances as of June 30, 2019 and 2020. Additionally, it discusses the impact of the COVID-19 pandemic on the financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesAnnual-Report-FML-30-June-2020-23-Vol 3

Uploaded by

Bluish FlameThis document provides notes to the financial statements for Feroze1888 Mills Limited for the year ended June 30, 2020. It includes information on the company and its operations such as geographical locations. It also provides details on the statement of changes in equity including profit/loss, dividends paid, and balances as of June 30, 2019 and 2020. Additionally, it discusses the impact of the COVID-19 pandemic on the financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

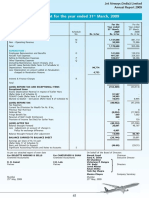

STATEMENT OF CHANGES IN EQUITY NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2020 FOR THE YEAR ENDED JUNE 30, 2020

Capital reserve Revenue reserve

Share Amalgamation Share Revaluation Accumulated Total 1. THE COMPANY AND ITS OPERATIONS

capital reserve premium surplus on pro fi t

property, plant Feroze1888 Mills Limited (the Company) was incorporated in Pakistan in October, 1972 as a public

and equipment

limited company. The shares of the Company are quoted on Pakistan Stock Exchange Limited. The

-------------------------------------------------- Rupees in ‘000 --------------------------------------------------

Company is principally engaged in production and export of towels.

Balance as at June 30, 2018 3,768,009 543,413 215,250 1,499,008 10,141,524 16,167,204

1.1 Geographical location and address of business units

Profit after taxation - - - - 5,989,810 5,989,810 Registered Office H-23/4-A, Scheme # 3, Landhi Industrial Area,

Other comprehensive income - - - - - -

Total comprehensive income for the year - - - - 5,989,810 5,989,810 Karachi Office Building Plot # 160, Bangalore Town, Shahrah-e-Faisal Road,

Darwaish Colony, Karachi

Final cash dividend for the year ended

June 30, 2018 @ Rs.2.45 per share - - - - (923,162) (923,162)

Mill and Production Plant Plot # H-23/4-A and H-23-/4-B, Scheme # 3, Landhi Industrial

Area, Landhi, Karachi

Interim cash dividend for the year ended

B-4/A, SITE, Karachi Plot

June 30, 2019 @ Rs.3 per share - - - - (1,130,403)

# A-5, SITE, Karachi

(1,130,403)

Plot # C-3, SITE, Karachi

Plot # C-31 SITE, Karachi

Balance as at June 30, 2019 3,768,009 543,413 215,250 1,499,008 14,077,769 20,103,449

Plot # F-89, SITE, Karachi

Plot # F-125, SITE, Karachi

Profit after taxation - - - - 2,937,221 2,937,221

Plot # F-342, SITE, Karachi

Other comprehensive income - - - - 28,073 28,073

Plot # D-202, SITE, Karachi

Total comprehensive income for the year - - - - 2,965,294 2,965,294

Plot # 342/A, Haroonabad, SITE, Karachi

Survey # 81, 242, 72 to 75, 165, 166, 171, 172, 176 to 181, 186 to 190, 156,

Final cash dividend for the year ended

210, 211, 243, Deh Moachko, Tapo Gabopat, Keamari Town, Karachi

June 30, 2019 @ Rs.3.35 per share - - - - (1,262,283) (1,262,283)

Plot # D-12 to D-17, K-1 to K-3, M-34, HITE, Hub, Lasbela, Baluchistan

Interim cash dividend for the year ended

1.2 Impact of COVID-19 pandemic on these fi nancial statements

June 30, 2020 @ Rs.1.75 per share - - - - (659,402) (659,402)

The COVID-19 pandemic caused signi ficant and unprecedented curtailment in economic and

Transfer of revaluation surplus on disposal of property,

social activities during the period from March 2020 in line with the directives of the Government. This

plant and equipment - - - (12,746) 12,746 -

situation posed a range of business and financial challenges to the businesses globally and across

various sectors of the economy in Pakistan. The lockdown, however, excluded companies involved

Balance as at June 30, 2020 3,768,009 543,413 215,250 1,486,262 15,134,124 21,147,058

in the business of necessary consumer supplies. Complying with the lockdown, the Company

temporarily suspended operations.

The annexed notes from 1 to 43 form an integral part of these financial statements.

The lockdown was subsequently relaxed from the month of May, and the Company resumed

operations, after implementing all the necessary Standard Operating Procedures (SOPs) to ensure

safety of employees. The management has ensured all necessary steps to ensure smooth and

adequate continuation of its business in order to maintain business performance despite slowed

down economic activity.

The Company’s operations were disrupted due to the circumstances arising from COVID-19

including the suspension of production, sales and operations in certain divisions. Due to this, the

management has assessed the accounting implications of these developments on these financial

statements, including but not limited to expected credit losses under IFRS 9, ‘Financial Instruments’,

the impairment of tangible and intangible assets under IAS 36, ‘Impairment of non-financial assets’,

the net realisable value of inventory under IAS 2, ‘Inventories’, provisions and contingent liabilities

under IAS 37, ‘Provisions, Contingent Liabilities and Contingent Assets’ and going concern assumption

used for the preparation of these financial statements.

According to management’s assessment, there are no material implications of COVID-19 that require

specific disclosure in these financial statements.

JAVERIA SIDDIQUI REHAN RAHMAN NASIM HYDER

CHIEF FINANCIAL OFFICER CHIEF EXECUTIVE DIRECTOR

00 00

You might also like

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Financial Statement of GPH Ispat Ltd. As On 30.06.2018Document39 pagesFinancial Statement of GPH Ispat Ltd. As On 30.06.2018OMAR FARUQNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- TRG Financial ResultsDocument2 pagesTRG Financial ResultsMuhammad Raheel AnwarNo ratings yet

- International Taxation Question PaperDocument7 pagesInternational Taxation Question PaperVigneshNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Annual Report 2019 20Document107 pagesAnnual Report 2019 20SandeepNo ratings yet

- Tayo RollsDocument7 pagesTayo RollsAkhil ChaudharyNo ratings yet

- GH SCB Ghana Full Year Financial Statement For Year 2021Document1 pageGH SCB Ghana Full Year Financial Statement For Year 2021Fuaad DodooNo ratings yet

- Annual Report 2019-20Document252 pagesAnnual Report 2019-20sk jhaNo ratings yet

- 2020 21 H1 30.09.2020Document12 pages2020 21 H1 30.09.2020wekepix890No ratings yet

- TRG FinancialsDocument2 pagesTRG FinancialsArsalanNo ratings yet

- Jet Airways Financial Report-2008Document2 pagesJet Airways Financial Report-2008RKMNo ratings yet

- (Aa35) Corporate and Personal Taxation: Association of Accounting Technicians of Sri LankaDocument8 pages(Aa35) Corporate and Personal Taxation: Association of Accounting Technicians of Sri LankaSujan SanjayNo ratings yet

- Exchange-Plaza,: The LeelaDocument133 pagesExchange-Plaza,: The LeelaSUNIDHI VERMANo ratings yet

- 219680Document22 pages219680wajahatwajahat07No ratings yet

- Test Series: April, 2018 Mock Test Paper - 2 Final (Old) Course: Group - I Paper - 1: Financial ReportingDocument10 pagesTest Series: April, 2018 Mock Test Paper - 2 Final (Old) Course: Group - I Paper - 1: Financial ReportingBharathNo ratings yet

- Epza 642-678Document45 pagesEpza 642-678samara.altafNo ratings yet

- Annual Report of IOCL 185Document1 pageAnnual Report of IOCL 185Nikunj ParmarNo ratings yet

- Manufacturers Hydraulic Equipment CO.: India An of Oil Collaboration Kogyo Japan. 6-CDocument6 pagesManufacturers Hydraulic Equipment CO.: India An of Oil Collaboration Kogyo Japan. 6-CShawn SabuNo ratings yet

- Tutorial 3 (1) Q1,2,4,5Document9 pagesTutorial 3 (1) Q1,2,4,5Shan JeefNo ratings yet

- Egyptian International Pharmaceutical Industries Company (EIPICO)Document1 pageEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryNo ratings yet

- KB 3 Model QuestionDocument3 pagesKB 3 Model QuestionVinthuja Murukes100% (1)

- Liquidation Basis AccountsDocument18 pagesLiquidation Basis AccountsUsman AliNo ratings yet

- Engineering: Reliance Naval and Limited (Formerly Limited)Document5 pagesEngineering: Reliance Naval and Limited (Formerly Limited)gowtham raju buttiNo ratings yet

- Annual Report of IOCL 131Document1 pageAnnual Report of IOCL 131Nikunj ParmarNo ratings yet

- Annual Report of IOCL 110Document1 pageAnnual Report of IOCL 110Nikunj ParmarNo ratings yet

- Suggested Answers CAP III - Dec 2018 PDFDocument144 pagesSuggested Answers CAP III - Dec 2018 PDFsarojdawadiNo ratings yet

- TF Hyg PVT LTD Accounts June 2023 Draft 3A (2) (Final Ready For Submission)Document23 pagesTF Hyg PVT LTD Accounts June 2023 Draft 3A (2) (Final Ready For Submission)YAWAR HAYATNo ratings yet

- BSE Limited National Stock Exchange of India LimitedDocument2 pagesBSE Limited National Stock Exchange of India Limitedvirupakshudu kodiyalaNo ratings yet

- Extract of Balance SheetDocument2 pagesExtract of Balance SheetBIPIN KUMAR SAHOONo ratings yet

- Independent Auditors' Report: Olympic Industries Limited As at and For The Year Ended 30 Fune ?OLBDocument46 pagesIndependent Auditors' Report: Olympic Industries Limited As at and For The Year Ended 30 Fune ?OLBTop Five ProductsNo ratings yet

- History of The CompanyDocument5 pagesHistory of The CompanyAkshata HadimaniNo ratings yet

- Financial Results For Q4 and Year Ended On 31.03.2018Document9 pagesFinancial Results For Q4 and Year Ended On 31.03.2018Shaik KhalanderNo ratings yet

- T3 Ans 1,2,4 (RA - DD)Document8 pagesT3 Ans 1,2,4 (RA - DD)MinWei1107No ratings yet

- AAFR Topic-Wise Test Regards Awais ALIDocument34 pagesAAFR Topic-Wise Test Regards Awais ALIUmmar FarooqNo ratings yet

- Q 2 Financial Results 18Document13 pagesQ 2 Financial Results 18bhupendra investorNo ratings yet

- L&T Fi PDFDocument127 pagesL&T Fi PDFkaran pawarNo ratings yet

- Gandhara Nissan 2008Document47 pagesGandhara Nissan 2008Farah Yasser100% (1)

- HOEC - Peer Graded Assignment PDFDocument5 pagesHOEC - Peer Graded Assignment PDFrezanur rahat100% (1)

- HEPL Financials v1.9Document16 pagesHEPL Financials v1.9A YoungNo ratings yet

- CA Final Direct Tax Suggested Answer Nov 2020 OldDocument25 pagesCA Final Direct Tax Suggested Answer Nov 2020 OldBhumeeka GargNo ratings yet

- Financial Result For Q2 Ended On 30.09.2023Document22 pagesFinancial Result For Q2 Ended On 30.09.2023Hari K NeelambariNo ratings yet

- MSA 1 Winter 2018Document17 pagesMSA 1 Winter 2018Faisal Abbas MB-19-47No ratings yet

- ANNUAL REPORT - 2017-18: 1. Notice of AGM 2. Director's ReportDocument52 pagesANNUAL REPORT - 2017-18: 1. Notice of AGM 2. Director's ReportShaileshNo ratings yet

- INDUS MOTOR COMPANY LIMITED First Quarter Report September 2020Document24 pagesINDUS MOTOR COMPANY LIMITED First Quarter Report September 2020Haider JuttNo ratings yet

- Profit and Loss Account For The Year Ended 31 March, 2009: ST STDocument2 pagesProfit and Loss Account For The Year Ended 31 March, 2009: ST STRanjan DasguptaNo ratings yet

- Tutorial 2 (1) Q1 - Q4Document8 pagesTutorial 2 (1) Q1 - Q4Shan JeefNo ratings yet

- Terraform Realstate LimitedDocument5 pagesTerraform Realstate Limitednaresh kayadNo ratings yet

- Annual Report of IOCL 170Document1 pageAnnual Report of IOCL 170Nikunj ParmarNo ratings yet

- SG Nov 23Document35 pagesSG Nov 23himanshu narangNo ratings yet

- July 0 8, 2020 To, BSE Limited, National Stock Exchange of India LTDDocument17 pagesJuly 0 8, 2020 To, BSE Limited, National Stock Exchange of India LTDdNo ratings yet

- Pelaburan 1986Document4 pagesPelaburan 1986Ken ChiaNo ratings yet

- Annual Report of Singapore Airlines in 2018/2019Document237 pagesAnnual Report of Singapore Airlines in 2018/2019天锁斩月No ratings yet

- Tata Pow FY20Document433 pagesTata Pow FY20Partha SahaNo ratings yet

- We Enclose Herewith A Copy of The Earnings Presentation' in Respect of The UnauditedDocument26 pagesWe Enclose Herewith A Copy of The Earnings Presentation' in Respect of The UnauditedAjay SinghNo ratings yet

- Tax Nov Dec 2023 - QuestionDocument6 pagesTax Nov Dec 2023 - QuestionMd HasanNo ratings yet

- Brugg Cables (India) Private LimitedDocument6 pagesBrugg Cables (India) Private LimitedVIJAYNo ratings yet

- Happy Forgings Limited - IPO NotexbdjdjdjdjDocument9 pagesHappy Forgings Limited - IPO NotexbdjdjdjdjAnkit VyasNo ratings yet

- 160 80-mr1Document1 page160 80-mr1Bluish FlameNo ratings yet

- Annual-Report-FML-30-June-2020-23 Vol 2Document1 pageAnnual-Report-FML-30-June-2020-23 Vol 2Bluish FlameNo ratings yet

- TORQUE CONVERTER (2) TURBINE SHAFT AND STATOR D135A-1 S - N 10001-UP Komatsu Part CatalogDocument1 pageTORQUE CONVERTER (2) TURBINE SHAFT AND STATOR D135A-1 S - N 10001-UP Komatsu Part CatalogBluish FlameNo ratings yet

- Thermal Edge Thermal MGMT Guide Ebook FINAL 021016Document13 pagesThermal Edge Thermal MGMT Guide Ebook FINAL 021016Bluish FlameNo ratings yet

- TORQUE CONVERTER 3TURBINE SHAFT AND STATOR D135A-1 S - N 10001-UP Komatsu Part CatalogDocument1 pageTORQUE CONVERTER 3TURBINE SHAFT AND STATOR D135A-1 S - N 10001-UP Komatsu Part CatalogBluish FlameNo ratings yet

- Corporate Briefing Session 2020Document23 pagesCorporate Briefing Session 2020Bluish FlameNo ratings yet

- Annual-Report-FML-30-June-2020 Vol 1Document1 pageAnnual-Report-FML-30-June-2020 Vol 1Bluish FlameNo ratings yet

- TORQUE CONVERTER 4) TURBINE SHAFT AND STATOR D135A-1 S - N 10001-UP Komatsu Part CatalogDocument1 pageTORQUE CONVERTER 4) TURBINE SHAFT AND STATOR D135A-1 S - N 10001-UP Komatsu Part CatalogBluish FlameNo ratings yet

- UNIVERSAL JOINT D135A-1 S - N 10001-UP Komatsu Part CatalogDocument3 pagesUNIVERSAL JOINT D135A-1 S - N 10001-UP Komatsu Part CatalogBluish Flame0% (1)

- TORQUE CONVERTER (1 - 4) CASE D135A-1 S - N 10001-UP Komatsu Part Catalog5Document2 pagesTORQUE CONVERTER (1 - 4) CASE D135A-1 S - N 10001-UP Komatsu Part Catalog5Bluish FlameNo ratings yet

- The Great Book of Stupidity Part 2Document1 pageThe Great Book of Stupidity Part 2Bluish FlameNo ratings yet

- Timing Gear Case and Flywheel Housing:: Engine LubricationDocument1 pageTiming Gear Case and Flywheel Housing:: Engine LubricationBluish FlameNo ratings yet

- TORQUE CONVERTER (1 - 4) CASE D135A-1 S - N 10001-UP Komatsu Part1 CatalogDocument1 pageTORQUE CONVERTER (1 - 4) CASE D135A-1 S - N 10001-UP Komatsu Part1 CatalogBluish FlameNo ratings yet

- CRANK ASSEMBLY CD230 S - N 370720051 - Up Komatsu Part CatalogDocument1 pageCRANK ASSEMBLY CD230 S - N 370720051 - Up Komatsu Part CatalogBluish FlameNo ratings yet

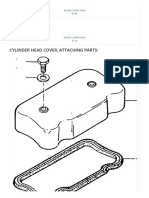

- CYLINDER HEAD COVER, ATTACHING PARTS CD230 S - N 370720051 - Up Komatsu Part CatalogDocument1 pageCYLINDER HEAD COVER, ATTACHING PARTS CD230 S - N 370720051 - Up Komatsu Part CatalogBluish FlameNo ratings yet

- TIMING GEAR CASE AND FLYWHEEL HOUSING CD230 S - N 370720051 - Up Komatsu Part Catalog1Document1 pageTIMING GEAR CASE AND FLYWHEEL HOUSING CD230 S - N 370720051 - Up Komatsu Part Catalog1Bluish FlameNo ratings yet

- GASKET KIT, CYLINDER HEAD CD230 S - N 370720051 - Up Komatsu Part Catalog2Document1 pageGASKET KIT, CYLINDER HEAD CD230 S - N 370720051 - Up Komatsu Part Catalog2Bluish FlameNo ratings yet

- GASKET KIT, CYLINDER HEAD CD230 S - N 370720051 - Up Komatsu Part Catalog1Document1 pageGASKET KIT, CYLINDER HEAD CD230 S - N 370720051 - Up Komatsu Part Catalog1Bluish FlameNo ratings yet

- Timing Gear Case and Flywheel HousingDocument1 pageTiming Gear Case and Flywheel HousingBluish FlameNo ratings yet

- KOMATSU 125 Series Engine Manuals & Parts Catalogs4Document2 pagesKOMATSU 125 Series Engine Manuals & Parts Catalogs4Bluish FlameNo ratings yet

- KOMATSU 125 Series Engine Manuals & Parts Catalogs5Document2 pagesKOMATSU 125 Series Engine Manuals & Parts Catalogs5Bluish FlameNo ratings yet

- KOMATSU 125 Series Engine Manuals & Parts Catalogs3Document2 pagesKOMATSU 125 Series Engine Manuals & Parts Catalogs3Bluish Flame0% (1)

- Sources of Recruitment 2Document3 pagesSources of Recruitment 2oscarNo ratings yet

- Leea Question and Answer 2cDocument3 pagesLeea Question and Answer 2cYAKUBU A. AROGENo ratings yet

- Full PFRS vs. PFRS For Medium Entities vs. PFRS For Small EntitiesDocument101 pagesFull PFRS vs. PFRS For Medium Entities vs. PFRS For Small EntitiesMark Gelo WinchesterNo ratings yet

- Strategic Management-Louis VuittonDocument4 pagesStrategic Management-Louis VuittonPhclivran67% (3)

- Henry Foyal's Principle of Management With Reference ToDocument13 pagesHenry Foyal's Principle of Management With Reference ToSushant YadavNo ratings yet

- National High Speed Rail Corporation Limited V Montecarlo Limited and Anr 408672Document82 pagesNational High Speed Rail Corporation Limited V Montecarlo Limited and Anr 408672Namira AhmedNo ratings yet

- Reiteration of Arta-Dti-Dilg-Dict JMC No. 01 S. of 2021Document4 pagesReiteration of Arta-Dti-Dilg-Dict JMC No. 01 S. of 2021LGU KALAMANSIG BPLONo ratings yet

- Basic Saving Account With Complete KYCDocument2 pagesBasic Saving Account With Complete KYCVarsha100% (1)

- Role of Merchant Banking in Portfolio Management and Issue Management'Document85 pagesRole of Merchant Banking in Portfolio Management and Issue Management'Rinkesh SutharNo ratings yet

- New Balance Athletic Shoe Inc PresentationDocument23 pagesNew Balance Athletic Shoe Inc Presentationbhagas_arga100% (20)

- Afar IcpaDocument6 pagesAfar IcpaAndrea Lyn Salonga CacayNo ratings yet

- NCERT Solutions For CBSE Class 10 Science Chapter 3 Metals and Non MetalsDocument10 pagesNCERT Solutions For CBSE Class 10 Science Chapter 3 Metals and Non MetalsHari PrasadNo ratings yet

- Construction Pre PlanningDocument52 pagesConstruction Pre PlanningAPIC100% (3)

- Whitepaper ConsumerInsights Trends2024Document44 pagesWhitepaper ConsumerInsights Trends2024riyagupta10122000No ratings yet

- Hyper CompetitionDocument27 pagesHyper Competitiondilip15043No ratings yet

- Consumer Buying BehaviorDocument18 pagesConsumer Buying BehaviorAda Araña DiocenaNo ratings yet

- Business Case Study Report ENT300Document16 pagesBusiness Case Study Report ENT300rozanah abu100% (2)

- Principles of Cost Accounting Vanderbeck 15th Edition Solutions ManualDocument9 pagesPrinciples of Cost Accounting Vanderbeck 15th Edition Solutions ManualStephenJohnsontbnc100% (42)

- Banking and The Management of Financial InstitutionsDocument60 pagesBanking and The Management of Financial InstitutionsMinh TiếnNo ratings yet

- Dutta Biprajit - Resume-2Document2 pagesDutta Biprajit - Resume-2Ayan SahaNo ratings yet

- DaburDocument16 pagesDaburUma BhartiNo ratings yet

- Implementation of ISO/IEC 17025:2017 at National Institute of Biology (NIB)Document19 pagesImplementation of ISO/IEC 17025:2017 at National Institute of Biology (NIB)roneldo asasNo ratings yet

- On Eve of IndependenceDocument4 pagesOn Eve of IndependenceHarini BNo ratings yet

- LD Best Practices White Paper FinalDocument11 pagesLD Best Practices White Paper FinalVeronicaNo ratings yet

- SafetyToolkit 5whysDocument4 pagesSafetyToolkit 5whysFaisal AbdoNo ratings yet

- Collection ProceduresDocument8 pagesCollection Proceduresfilfam4545No ratings yet

- Basic Accounting Quiz 2.0Document4 pagesBasic Accounting Quiz 2.0Jensen Rowie PasngadanNo ratings yet

- Bally's - Chicago Public Presentation (12!16!21)Document55 pagesBally's - Chicago Public Presentation (12!16!21)Ann DwyerNo ratings yet

- JIT Graduation Day Paper Ad 16 X 25 v1 - 2608Document1 pageJIT Graduation Day Paper Ad 16 X 25 v1 - 2608Viber VasânthNo ratings yet

- Workers & Its ClassificationDocument9 pagesWorkers & Its Classificationasif OahidNo ratings yet