Professional Documents

Culture Documents

Portfolio & Booking Mix Mei 2020

Uploaded by

wartini suwarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio & Booking Mix Mei 2020

Uploaded by

wartini suwarCopyright:

Available Formats

2020

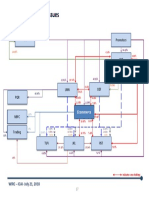

Portfolio & Booking Mix

Region II Sumatera – 31 Mei 2020

Retail Credit SME Banking Mortgage Micro Banking Credit Card

Region Sumatera 2 Palembang 2

Portfolio Mix - SME

s.d Mei 2020

2019

14.24%

30.49%

22.54%

10.02%

1.84%

20.88%

2020

14.44%

13.97%

33.24%

“ s.d Mei 2020 Portfolio Mix SME didominasi oleh debitur Prima 35.08%

17.32%

dengan baki debet sebesar 1,2 T atau sebesar 35,08 % dari total baki 17.57%

debet SME sebesar 3,4 T. “

18.88% 14.58%

18.06%

1.54%

13.52%

1.79%

Prima Value Chain Koperasi NTB ETB KAD

Region Sumatera 2 Palembang 3

Booking Mix - SME

s.d Mei 2020

2019

11.17%

2.13%

3.05% 28.74%

0.67%

54.24%

2020

14.44%

8.43%

18.84%

33.24%

“ s.d Mei 2020 (YtD) Booking Mix SME didominasi oleh debitur Value 2.73%

17.32%

Chain dengan baki debet sebesar 619 M atau sebesar 65,14% dari

3.89%

total baki debet yang di booking sebesar 950 M.“ 0.98%

18.88% 14.58%

1.54%

65.14%

Prima Value Chain Koperasi NTB ETB KAD

Region Sumatera 2 Palembang 4

Non Performing Loan (NPL) - SME

s.d Mei 2020

History Realisasi

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20 “ s.d Mei 2020 NPL SME secara

TOTAL 2.51% 1.89% 4.62% 3.93% 3.42% 0.91% persentase sebesar 3,42 % memburuk

Prima 0.02% 0.20% 0.29% 0.11% 0.04% 0.02% secara YoY dan YtD. Perlu perhatian untuk

Value Chain 1.82% 1.35% 2.98% 2.93% 2.91% 1.09% % NPL di New to Bank (NTB) dan Eksisting

Koperasi 0.14% 0.13% 0.26% 0.26% 0.38% 0.25% to Bank (ETB) karena masing-masing

NTB 3.89% 6.24% 12.75% 10.42% 10.46% 6.57% %NPL masih cukup besar yaitu sebesar

ETB 6.70% 2.54% 9.15% 8.77% 6.36% -0.34% 10,46% dan 6,36% “

KAD 0.00% 0.00% 0.00% 0.19% 0.00% 0.00%

13.81%

10.46%

9.52%

6.68% 6.24% 6.36%

6.18% 4.53%

2.54% 2.91%

3.82%

1.35%

0.00% 0.00%

Prima VC Koperasi NTB ETB KAD

Region Sumatera 2 Palembang 6

Retail Credit SME Banking Mortgage Micro Banking Credit Card

Portfolio New Mix - Mortgage

s.d Mei 2020

History Realisasi 2019

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20

TOTAL 3,077,031 3,036,478 2,956,697 2,930,846 2,908,672 (168,359)

Employee Payroll 529,137 657,315 671,487 671,017 667,398 138,260 13.59% 17.20%

% Port Mix 17.20% 21.65% 22.71% 22.89% 22.95% 5.75%

Emp Non Payroll & Prof 1,375,237 1,287,618 1,258,204 1,251,584 1,248,044 (127,193) 15.10%

% Port Mix 44.69% 42.40% 42.55% 42.70% 42.91% -1.79%

SE - Priority 289,909 248,300 227,094 223,768 220,704 (69,205)

9.42%

% Port Mix 9.42% 8.18% 7.68% 7.63% 7.59% -1.83%

44.69%

SE - Regular - KPR Primary 464,482 465,070 452,214 444,594 439,012 (25,470)

% Port Mix 15.10% 15.32% 15.29% 15.17% 15.09% 0.00%

SE - Regular - KPR Secondary - Multiguna 418,266 378,174 347,697 339,884 333,515 (84,751)

% Port Mix 13.59% 12.45% 11.76% 11.60% 11.47% -2.13%

2020

11.47%

22.95%

“ s.d Mei 2020 Portfolio Mix Mortgage didominasi oleh debitur

15.09%

Employee Non Payroll & Prof dengan baki debet sebesar 1,2 T atau

sebesar 42,91 % dari total baki debet Mortgage sebesar 2,9 T. “ 7.59%

14.18% 15.74%

42.91%

Employee Payroll

15.56% Emp Non Payroll - Prof

SE - Priority

SE - Regular - KPR Primary

10.38%

44.14% SE - Regular - KPR Secondary - Multiguna

* Data di luar Portfolio KKP Region Sumatera 2 Palembang 8

Booking New Mix - Mortgage

s.d Mei 2020

History Realisasi 2019

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20

TOTAL 212,658 519,203 81,341 99,099 112,699 (82,053)

Employee Payroll 48,750 126,117 22,559 26,237 28,722 (20,029) 3.15%

% Booking Mix 22.92% 24.29% 27.73% 26.48% 25.49% 2.56% 12.95% 22.92%

Emp Non Payroll & Prof 129,670 288,970 44,255 56,182 67,297 (62,373) 0.00%

% Booking Mix 60.98% 11 55.66% 54.41% 56.69% 59.71% -1.26%

SE - Priority - 1,000 349 349 349 349

% Booking Mix 0.00% 0.19% 0.43% 0.35% 0.31% 0.31%

SE - Regular - KPR Primary 27,549 81,145 12,512 12,906 12,906 (14,643)

% Booking Mix 12.95% 15.63% 15.38% 13.02% 11.45% -1.50% 60.98%

SE - Regular - KPR Secondary - Multiguna 6,689 21,971 1,667 3,425 3,425 (3,264)

% Booking Mix 3.15% 4.23% 2.05% 3.46% 3.04% -0.11%

2020

3.04%

11.45%

0.31% 25.49%

“ s.d Mei 2020 (YtD) Booking Mix Mortgage didominasi oleh debitur

Employee Non Payroll & Prof dengan baki debet sebesar 67,3 M

atau sebesar 59,71 % dari total baki debet Mortgage yang

dibooking sebesar 112,7 M. “ 14.18% 15.74%

59.71%

Employee Payroll

15.56% Emp Non Payroll - Prof

SE - Priority

SE - Regular - KPR Primary

10.38%

44.14% SE - Regular - KPR Secondary - Multiguna

* Data di luar Portfolio KKP Region Sumatera 2 Palembang 9

Non Performing Loan (NPL) - Mortgage

s.d Mei 2020

“ s.d Mei 2020 NPL Mortgage secara persentase sebesar 5,00 % memburuk secara YoY & YtD. Perlu

perhatian untuk % NPL di SE – Regular-KPR Secondary-Multiguna sebesar 15,88% dan SE- Regular-KPR

Primary sebesar 7,76%.

History Realisasi

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20

TOTAL 4.11% 4.28% 4.77% 4.77% 5.00% 0.89%

Employee Payroll 0.55% 0.64% 1.15% 0.96% 1.17% 0.63%

Emp Non Payroll & Prof 2.68% 2.55% 3.02% 3.14% 3.70% 1.02%

SE - Priority 4.11% 4.31% 1.95% 1.97% 2.00% -2.10%

SE - Regular - KPR Primary 5.51% 6.33% 7.29% 7.71% 7.76% 2.24%

SE - Regular - KPR Secondary - Multiguna 11.80% 13.91% 16.68% 16.24% 15.88% 4.08%

* Data di luar Portfolio KKP

Region Sumatera 2 Palembang 10

Kolektibilitas 2 - Mortgage

s.d Mei 2020

“ s.d Mei 2020 Kol 2 Mortgage secara persentase sebesar 9,34 % memburuk secara YoY & YtD. Perlu

perhatian untuk % NPL di SE – Priority sebesar 12,88%.

Bade Kol 2

History Realisasi

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20

TOTAL 322,670 318,738 336,568 387,832 271,587 (51,083)

Employee Payroll 23,052 32,761 32,488 34,079 30,254 7,202

Emp Non Payroll & Prof 146,170 136,638 152,751 186,977 129,350 (16,820)

SE - Priority 22,597 19,632 42,894 36,787 28,427 5,830

SE - Regular - KPR Primary 75,112 66,774 60,759 71,589 53,445 (21,667)

SE - Regular - KPR Secondary - Multiguna 55,738 62,933 47,675 58,400 30,111 (25,627)

% Kol 2

History Realisasi

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20

TOTAL 10.49% 10.50% 11.38% 13.23% 9.34% -1.15%

Employee Payroll 4.36% 4.98% 4.84% 5.08% 4.53% 0.18%

Emp Non Payroll & Prof 10.63% 10.61% 12.14% 14.94% 10.36% -0.26%

SE - Priority 7.79% 7.91% 18.89% 16.44% 12.88% 5.09%

SE - Regular - KPR Primary 16.17% 14.36% 13.44% 16.10% 12.17% -4.00%

SE - Regular - KPR Secondary - Multiguna 13.33% 16.64% 13.71% 17.18% 9.03% -4.30%

* Data di luar Portfolio KKP

Region Sumatera 2 Palembang 11

Retail Credit SME Banking Mortgage Micro Banking Credit Card

Portfolio New Mix – New KSM

s.d Mei 2020

“ s.d Mei 2020 Portfolio Mix New KSM didominasi oleh debitur Government Payroll dengan baki debet

sebesar 2,25 T atau sebesar 30,14 % dari total baki debet New KSM sebesar 7,5 T. “

History Realisasi

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20

TOTAL 7,035,456 7,840,737 7,756,398 7,612,516 7,480,585 445,130

GOVERNMENT PAYROLL 2,484,904 2,317,687 2,323,222 2,287,985 2,254,337 (230,568)

% Port Mix 35.32% 29.56% 29.95% 30.06% 30.14% -5.18%

GOVERNMENT NON PAYROLL 2,240,918 2,433,501 2,333,273 2,288,620 2,252,902 11,984

% Port Mix 31.85% 31.04% 30.08% 30.06% 30.12% -1.74%

SELECTED SWASTA B2B PAYROLL 1,050,372 1,641,850 1,790,147 1,760,532 1,730,390 680,018

% Port Mix 14.93% 20.94% 23.08% 23.13% 23.13% 8.20%

NON SELECTED SWASTA B2B PAYROLL INCOME ≥ Rp. 4 Juta 374,162 598,530 539,108 526,389 514,410 140,248

% Port Mix 5.32% 7.63% 6.95% 6.91% 6.88% 1.56%

SWASTA B2C Payroll Plafond 557,592 519,137 467,089 455,491 444,018 (113,574)

% Port Mix 7.93% 6.62% 6.02% 5.98% 5.94% -1.99%

NON SELECTED SWASTA B2B PAYROLL INCOME < Rp. 4 Juta 215,430 248,284 234,848 228,189 222,041 6,612

% Port Mix 3.06% 3.17% 3.03% 3.00% 2.97% -0.09%

SWASTA B2C PAYROLL NON PLAFOND / NON PAYROLL 112,077 81,748 68,712 65,310 62,487 (49,590)

% Port Mix 1.59% 1.04% 0.89% 0.86% 0.84% -0.76%

1 2 3 4 5 6 7

Region Sumatera 2 Palembang 13

Booking New Mix – New KSM

s.d Mei 2020

“ s.d Mei 2020 Portfolio Mix New KSM didominasi oleh debitur Government Payroll dengan baki debet

yang dibooking sebesar 185,3 M atau sebesar 31,44 % dari total baki debet New KSM yang dibooking

sebesar 589,4 M. “

History Realisasi

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20

TOTAL 1,410,984 3,955,687 588,058 589,364 589,364 (821,620)

GOVERNMENT PAYROLL 558,232 1,531,634 184,412 185,318 185,318 (372,913)

% Port Mix 39.56% 38.72% 31.36% 31.44% 31.44% -8.12%

GOVERNMENT NON PAYROLL 341,828 1,075,609 137,674 137,674 137,674 (204,154)

% Port Mix 24.23% 27.19% 23.41% 23.36% 23.36% -0.87%

Jan-00

SELECTED SWASTA B2B PAYROLL 309,248 872,099 180,649 181,049 181,049 (128,199)

% Port Mix 21.92% 22.05% 30.72% 30.72% 30.72% 8.80%

NON SELECTED SWASTA B2B PAYROLL INCOME ≥ Rp. 4 Juta 142,137 342,833 58,034 58,034 58,034 (84,103)

% Port Mix 10.07% 8.67% 9.87% 9.85% 9.85% -0.23%

SWASTA B2C Payroll Plafond - - - - - -

% Port Mix 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

NON SELECTED SWASTA B2B PAYROLL INCOME < Rp. 4 Juta 58,315 128,333 26,839 26,839 26,839 (31,476)

% Port Mix 4.13% 3.24% 4.56% 4.55% 4.55% 0.42%

SWASTA B2C PAYROLL NON PLAFOND / NON PAYROLL 1,225 5,178 450 450 450 (775)

% Port Mix 0.09% 0.13% 0.08% 0.08% 0.08% -0.01%

1 2 3 4 5 6 7

Region Sumatera 2 Palembang 14

Booking New Mix – New KSM

s.d Mei 2020

“ s.d Mei 2020 NPL New KSM secara persentase sebesar 1,37 % memburuk secara YoY. Perlu perhatian

untuk % NPL di Non Selected Swasta B2B Payroll Income ≥ Rp. 4 juta karena %NPL sebesar 5,36% .

History Realisasi

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20

TOTAL 0.63% 0.79% 1.05% 1.10% 1.37% 0.74%

GOVERNMENT PAYROLL 0.17% 0.31% 0.43% 0.40% 0.52% 0.35%

GOVERNMENT NON PAYROLL 0.22% 0.20% 0.27% 0.35% 0.41% 0.20%

0.00%

SELECTED SWASTA B2B PAYROLL 0.69% 0.97% 1.27% 1.39% 1.48% 0.79%

NON SELECTED SWASTA B2B PAYROLL INCOME ≥ Rp. 4 Juta 1.84% 2.00% 3.48% 3.61% 5.36% 3.52%

SWASTA B2C Payroll Plafond 2.58% 2.36% 2.84% 3.00% 3.48% 0.90%

NON SELECTED SWASTA B2B PAYROLL INCOME < Rp. 4 Juta 1.81% 3.27% 3.50% 3.34% 4.58% 2.77%

SWASTA B2C PAYROLL NON PLAFOND / NON PAYROLL 2.65% 2.45% 3.11% 3.24% 4.10% 1.45%

1 2 3 4 5 6 7

Region Sumatera 2 Palembang 15

Portfolio New Mix – KUM

s.d Mei 2020

“ s.d Mei 2020 Portfolio Mix KUM didominasi oleh debitur KUM ETB dengan baki debet sebesar 1,22 T

atau sebesar 66,89 % dari total baki debet KUM sebesar 1,8 T. “

Realisasi

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20

TOTAL 1,995,203 2,010,759 1,952,980 1,878,576 1,817,049 (148,800)

KUM NTB (New - Kawan Lama - Take Over) 796,694 711,586 657,154 627,017 601,655 (200,447)

% Port Mix 39.93% 35.39% 33.65% 33.38% 33.11% -7.69%

KUM ETB (Ex KUR - Refill - Top Up) 1,198,509 1,299,173 1,295,826 1,251,559 1,215,394 51,647

% Port Mix 60.07% 64.61% 66.35% 66.62% 66.89% 7.69%

Region Sumatera 2 Palembang 16

Booking New Mix – KUM

s.d Mei 2020

“ s.d Mei 2020 Portfolio Mix KUM didominasi oleh debitur KUM ETB dengan baki debet yang dibooking

sebesar 212,5 M atau sebesar 72,03 % dari total baki debet KUM yang dibooking sebesar 295,0 M. “

Realisasi

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20

TOTAL 660,780 1,759,891 294,972 295,047 295,047 (221,375)

KUM NTB (New - Kawan Lama - Take Over) 210,465 539,283 82,527 82,527 82,527 (82,229)

% Port Mix 31.85% 30.64% 27.98% 27.97% 27.97% -3.93%

KUM ETB (Ex KUR - Refill - Top Up) 450,315 1,220,608 212,444 212,519 212,519 (139,146)

% Port Mix 68.15% 69.36% 72.02% 72.03% 72.03% 3.93%

Region Sumatera 2 Palembang 17

Booking New Mix – KUM

s.d Mei 2020

“ s.d Mei 2020 NPL KUM secara persentase sebesar 2,73 % memburuk secara YoY. Perlu perhatian untuk

% NPL di KUM NTB karena %NPL sebesar 3,84% .

Realisasi

Keterangan YoY

May-19 Dec-19 Mar-20 Apr-20 May-20

TOTAL 2.14% 2.02% 2.53% 3.05% 2.73% 0.66%0

KUM NTB (New - Kawan Lama - Take Over) 2.73% 2.69% 3.58% 4.34% 3.84% 1.21%

KUM ETB (Ex KUR - Refill - Top Up) 1.75% 1.65% 2.00% 2.40% 2.18% 0.50%

Region Sumatera 2 Palembang 18

You might also like

- CCVO TemplateDocument1 pageCCVO Templatejohnopigo95% (19)

- Managerial Economics & Business Strategy: The Organization of The FirmDocument23 pagesManagerial Economics & Business Strategy: The Organization of The Firmdawar ameerNo ratings yet

- Financial Analyst or Senior Economist or Senior Risk AnalystDocument3 pagesFinancial Analyst or Senior Economist or Senior Risk Analystapi-77399063No ratings yet

- Acb - HSCDocument10 pagesAcb - HSCSeoNaYoungNo ratings yet

- 2nd PresentationDocument6 pages2nd Presentationie.magicNo ratings yet

- Betterfly GROUP 2Document7 pagesBetterfly GROUP 2marikakhulordava0No ratings yet

- Samriddhi Factsheet Dec2020Document1 pageSamriddhi Factsheet Dec2020DerickNo ratings yet

- 3rd PresentationDocument7 pages3rd PresentationMd. Monirozzaman MonirNo ratings yet

- 5th PresentationDocument6 pages5th Presentationie.magicNo ratings yet

- 3rd PresentationDocument6 pages3rd Presentationie.magicNo ratings yet

- The Effect of "Buy Now, Pay Later" Mode On Impulsive Buying BehaviorDocument8 pagesThe Effect of "Buy Now, Pay Later" Mode On Impulsive Buying BehaviorIjbmm JournalNo ratings yet

- Team Evolvers - CFA RCDocument10 pagesTeam Evolvers - CFA RCSUMAN SUMANNo ratings yet

- Income Statement AnalysisDocument4 pagesIncome Statement Analysismanik.sharmaNo ratings yet

- BMRI 2023 Q4 PresentationDocument103 pagesBMRI 2023 Q4 PresentationIwan AgusNo ratings yet

- B E A P S BD: Usiness Laboration Ction LAN OuthDocument16 pagesB E A P S BD: Usiness Laboration Ction LAN OuthShamsul ArefinNo ratings yet

- YO! Inves Partnership ProposalDocument28 pagesYO! Inves Partnership ProposalFathia NahdaNo ratings yet

- How India Celebrates Report Dec 2021Document21 pagesHow India Celebrates Report Dec 2021Krish PatelNo ratings yet

- Costa Rica - Central America and The Caribbean - RE - SPDocument4 pagesCosta Rica - Central America and The Caribbean - RE - SPAqua ManNo ratings yet

- NT 2024 01 17 NIP 5 - 07 6fab2e 11032024104633 UxzDocument1 pageNT 2024 01 17 NIP 5 - 07 6fab2e 11032024104633 UxzKrishi Vigyan Kendra BhadradriNo ratings yet

- Poland: Inflation Rate From 1986 To 2026 (Compared To The Previous Year)Document8 pagesPoland: Inflation Rate From 1986 To 2026 (Compared To The Previous Year)Linh Chi HoangNo ratings yet

- Disclosure Ulip Feb-2020Document60 pagesDisclosure Ulip Feb-2020pankarvi6No ratings yet

- Indonesia Jakarta Retail 2Q23Document2 pagesIndonesia Jakarta Retail 2Q23Allison Almathea WijayaNo ratings yet

- Jharkhand: Economic SnapshotDocument1 pageJharkhand: Economic SnapshotVinit KumarNo ratings yet

- Securities Market in VietnamDocument19 pagesSecurities Market in Vietnamhungbui0107No ratings yet

- Book 1Document10 pagesBook 1c2698694No ratings yet

- Presentation of Indonesia MPA Outlook and ProgressDocument10 pagesPresentation of Indonesia MPA Outlook and ProgressRizqikha Hanung CiptayukasNo ratings yet

- 1 M&a and Valuation 17Document1 page1 M&a and Valuation 17Pankaj Kumar Gautam SirNo ratings yet

- Uttarakhand Infographic June 2020Document1 pageUttarakhand Infographic June 2020Bharat KumarNo ratings yet

- Bihar Infographic March 2021Document1 pageBihar Infographic March 2021nikhilNo ratings yet

- Kajian Integrasi Binsis RN-MRB-GI 01122022Document17 pagesKajian Integrasi Binsis RN-MRB-GI 01122022Siti Nurul AzizahNo ratings yet

- Summer Placement Report PGP 2022 24Document7 pagesSummer Placement Report PGP 2022 24Naman ChadhaNo ratings yet

- SPS 2023 Deal Origination Benchmark Report - Summary StatisticsDocument15 pagesSPS 2023 Deal Origination Benchmark Report - Summary StatisticsmarianoveNo ratings yet

- Resource Allocation ReqdocDocument2 pagesResource Allocation Reqdochimabindu07No ratings yet

- Stock Market Investment PowerPoint TemplatesDocument49 pagesStock Market Investment PowerPoint TemplatesajiNo ratings yet

- Weekly NewsletterDocument1 pageWeekly NewsletterShanky AgarwalNo ratings yet

- LogisticsDocument6 pagesLogisticsRoopa Datta MedathatiNo ratings yet

- AMER Retail Media Networks Research IASDocument24 pagesAMER Retail Media Networks Research IASkzc96hhzn5No ratings yet

- Indonesia Morning CuppaDocument8 pagesIndonesia Morning CuppaPT SKSNo ratings yet

- KRG Consultants Private Limited: Group PresentationDocument25 pagesKRG Consultants Private Limited: Group PresentationSajid SarwarNo ratings yet

- Study Id56017 Start-Ups-WorldwideDocument28 pagesStudy Id56017 Start-Ups-WorldwideemilioNo ratings yet

- Grenada - Central America and The Caribbean - RE - SPDocument4 pagesGrenada - Central America and The Caribbean - RE - SPMark NabongNo ratings yet

- BMRI 2023 Q4 PresentationDocument104 pagesBMRI 2023 Q4 PresentationJoko SusiloNo ratings yet

- Análisis PDT Comprension LectoraDocument3 pagesAnálisis PDT Comprension LectoraDaniela Aravena BrionesNo ratings yet

- CAPITAL ADEQUECY GraphDocument2 pagesCAPITAL ADEQUECY GraphRupkatha Podder (181011114)No ratings yet

- Sistema FinancieroDocument17 pagesSistema FinancieroDayanara DelherNo ratings yet

- Malaysian Palm Oil Industry-Sime-Darby-DocumentDocument12 pagesMalaysian Palm Oil Industry-Sime-Darby-Documentpreliminary primeNo ratings yet

- Cars24 Building Indians Largest Auto CompanyDocument16 pagesCars24 Building Indians Largest Auto CompanymohamedNo ratings yet

- Mi EamuDocument14 pagesMi Eamuwowexo4683No ratings yet

- 05 Printables - Com Competitor - Analysis - April - 2023Document3 pages05 Printables - Com Competitor - Analysis - April - 2023Justin TanNo ratings yet

- 2022 - 25 March Indocement Public Expose - FinalDocument35 pages2022 - 25 March Indocement Public Expose - FinalDecky PrayogaNo ratings yet

- ENEL Cyber Security PDFDocument49 pagesENEL Cyber Security PDFInu SamNo ratings yet

- Strategic: Srmist - Edu.in Amrita - Edu Lpu - in Manipal - Edu Vit - Ac.inDocument2 pagesStrategic: Srmist - Edu.in Amrita - Edu Lpu - in Manipal - Edu Vit - Ac.inRama Krishna SaraswatiNo ratings yet

- Brac BankDocument14 pagesBrac BankShurovi UrmiNo ratings yet

- Task 3 Mallika KalleDocument1 pageTask 3 Mallika KalleMallika KalleNo ratings yet

- Morocco Africa RE SPDocument4 pagesMorocco Africa RE SPMaro GueniariNo ratings yet

- Pakistan Economic Survey - 2020-21Document19 pagesPakistan Economic Survey - 2020-21ZeeshanNo ratings yet

- Benchmarks 2018 Vs 2019-Google-AdsDocument15 pagesBenchmarks 2018 Vs 2019-Google-AdsSanket Gandhi100% (1)

- Project On - MRF Madras Rubber FactoryDocument2 pagesProject On - MRF Madras Rubber Factorymrinal koulNo ratings yet

- PDF Report Halal Cosmetics and Skin Care Survey 10992Document21 pagesPDF Report Halal Cosmetics and Skin Care Survey 10992Bintoro Joyo100% (1)

- Visa Retail 2020 Singles MobileDocument15 pagesVisa Retail 2020 Singles MobileSharjahmanNo ratings yet

- UTI Infrastructure Equity FundDocument16 pagesUTI Infrastructure Equity FundArmstrong CapitalNo ratings yet

- Liquid Detergent 2 Gondola Sewa GGDocument8 pagesLiquid Detergent 2 Gondola Sewa GGKodok BuncitNo ratings yet

- Sr. No. Name Contact Number Vendor: Kartik TanwarDocument8 pagesSr. No. Name Contact Number Vendor: Kartik TanwarAbhigyan MaityNo ratings yet

- Blinder-Is There A Core of Practical Macro We Should BelieveDocument7 pagesBlinder-Is There A Core of Practical Macro We Should BelieveSantiagoNo ratings yet

- BCBP - ILOILO - Financial Report - SEP - 2021Document164 pagesBCBP - ILOILO - Financial Report - SEP - 2021Angelo ManlangitNo ratings yet

- FP922 - Human BehaviourDocument181 pagesFP922 - Human Behaviouraditijaswal25No ratings yet

- Tutorial 5 - Contract Terms and The Law of Agency (Student)Document4 pagesTutorial 5 - Contract Terms and The Law of Agency (Student)DibyeshNo ratings yet

- Acct Statement - XX6782 - 23012024Document5 pagesAcct Statement - XX6782 - 23012024Thejesh tejuNo ratings yet

- PDFDocument7 pagesPDFNikhilreddy SingireddyNo ratings yet

- Leading Across Cultures Michelin (A)Document6 pagesLeading Across Cultures Michelin (A)Antonia SNo ratings yet

- Common Mistakes of Students To Financial Activities: FL - Erudition Free Webinar by Abm 12Document38 pagesCommon Mistakes of Students To Financial Activities: FL - Erudition Free Webinar by Abm 12Larisha Frixie M. DanlagNo ratings yet

- Explain The Practical Implication of Various Elasticity of DemandDocument5 pagesExplain The Practical Implication of Various Elasticity of DemandVivek Chaudhary50% (2)

- Foundations of Financial Management 16th Edition Block Test BankDocument35 pagesFoundations of Financial Management 16th Edition Block Test Bankwinifredholmesl39o6z100% (25)

- Company Profile: /shega InteriorsDocument25 pagesCompany Profile: /shega Interiorsabey.mulugetaNo ratings yet

- Business PlanDocument3 pagesBusiness PlanPenninah MainaNo ratings yet

- Traffic Impact Analysis of Urban Construction Projects Based On Traffic SimulationDocument5 pagesTraffic Impact Analysis of Urban Construction Projects Based On Traffic SimulationSasi KumarNo ratings yet

- When Did Globalisation StartDocument4 pagesWhen Did Globalisation StartGeraldine PinedoNo ratings yet

- Chap 1 Intro of BookkeepDocument14 pagesChap 1 Intro of BookkeepTan Shu YuinNo ratings yet

- Balloon Refilling KitDocument2 pagesBalloon Refilling KitSmartTradersNo ratings yet

- Chapter 11: Standard Costs and Variance Analysis: True / FalseDocument31 pagesChapter 11: Standard Costs and Variance Analysis: True / Falsejerome de guzman100% (1)

- Airport Transfer Booking Form: D D M M Y Y Y YDocument1 pageAirport Transfer Booking Form: D D M M Y Y Y YPankaj PoudyalNo ratings yet

- KCSE 2008 Agriculture P1 EDocument5 pagesKCSE 2008 Agriculture P1 EUrex ZNo ratings yet

- PO Pembelan Air Minum Des20Document1 pagePO Pembelan Air Minum Des20faris nadhifNo ratings yet

- T.252 - 44012-Men-Aur-01-S-Tl-Dw-AaDocument7 pagesT.252 - 44012-Men-Aur-01-S-Tl-Dw-AaAditya AjiNo ratings yet

- FPB 22.03 - Steam Turbines and Axial Turbo Expanders Observation of Hexavalent Chromium On Equipment During OutagesDocument5 pagesFPB 22.03 - Steam Turbines and Axial Turbo Expanders Observation of Hexavalent Chromium On Equipment During Outageswaqar ahmadNo ratings yet

- 3BS (G)Document7 pages3BS (G)Vijay KrishnaNo ratings yet

- Tyler GalpinDocument26 pagesTyler GalpinRose100% (4)

- Operations ManagementDocument50 pagesOperations ManagementasprillaNo ratings yet

- Y11 MAA SL-Venn DiagramDocument9 pagesY11 MAA SL-Venn DiagramKezia TjandraNo ratings yet