Professional Documents

Culture Documents

Class 11 Accountancy Chapter-10 Revision Notes

Uploaded by

Badal singh ThakurOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class 11 Accountancy Chapter-10 Revision Notes

Uploaded by

Badal singh ThakurCopyright:

Available Formats

Revision Notes

Class 11 Accountancy

Chapter 10 - Financial Statements Part- 2

Need for Adjustments:

Adjustments are required because sometimes payments and receipts made in the

current year may relate to previous or future years. So, these items must be adjusted

so that the objectives of financial statements can be achieved i.e., they depict true

and fair financial performance of the business.

Adjustments are required in the following items:

1. Closing stock: It is the stock of goods at the end of the accounting year. The

adjustment for the closing stock is done by

a. By posting it to the credit side of the Trading and Profit and Loss account

b. By posting it to the asset side of the Balance Sheet.

The journal entry that is passed is:

Closing Stock A/c………. Dr.

To Trading A/c

2. Outstanding expenses: These are those unpaid expenses that the businesses

haven’t paid in the present accounting period and are due. The adjustment entry

passed is:

Concerned Expense A/c……… Dr.

To Outstanding Expenses A/c

The outstanding expenses are added to a particular expense head in the Trading

and Profit and Loss account and are shown in the liabilities side of the Balance

Sheet.

3. Prepaid expenses: These are those expenses that are paid in advance by the

businesses that have not been due. The benefits of these expenses are not

Class XI Accountancy www.vedantu.com 1

received in the present accounting year but in the next years. The adjustment

entry that is passed is:

Prepaid Expenses A/c……….Dr.

To Concerned expense A/c

The prepaid expenses are subtracted from the particular expense head in the

Trading and Profit and Loss A/c and are shown on the asset side of the balance

sheet.

4. Accrued income: These are those incomes that are accrued but not yet

received. The adjustment entry passed is:

Accrued income A/c…………..Dr.

To Concerned income A/c

The accrued income is added to the concerned income head in the Trading and

Profit and Loss account and is shown in the asset side of the Balance Sheet.

5. Income received in advance: This is that income which is received in advance

but not yet accrued. The adjustment entry passed is:

Concerned income A/c……Dr

To Income received in advance A/c

The income received in advance is deducted from the respective income head

in the Trading and Profit and Loss Account and is shown in the liabilities side

of the balance sheet.

6. Depreciation: Depreciation is the decline in the book value of the fixed asset

because of regular wear and tear and passage of time. The adjustment entry

that is passed is:

Class XI Accountancy www.vedantu.com 2

Depreciation A/c ………. Dr.

To Concerned asset A/c

It is debited to the Profit and Loss Account and in the balance sheet the asset is

shown at cost minus depreciation.

7. Bad debts: This is that amount that can not be recovered from debtors. This is

regarded as loss and the adjustment entry passed is:

Bad debts A/c ……….Dr.

To Debtors A/c

It is shown as an expense on the debit side of the Trading and Profit and Loss

Account and in the balance sheet debtors are shown at book value less bad

debts.

8. Provision for doubtful debts: Sometimes we make a provision for some

amount of Debtors that may not realise in future such provisions are called

provisions for doubtful debts. That Adjustment entry that is passed is:

Profit and Loss A/c ………Dr.

To Provision for doubtful debts A/c

The provision for doubtful debts are shown as an expense In the debit side of

the trading and profit and loss account and in the balance sheet the amount of

debtors are shown at book value less provision for doubtful debts.

9. Provision for discount on debtors: Sometimes the businesses allow some

discount on the amount to be received from debtors. For this there is a provision

made for discount on debtors which is an expense for the business. The

provision for discount is always made on good debtors which are book value

less bad debts. The adjustment entry that is passed is:

Profit and loss A/c………. Dr.

Class XI Accountancy www.vedantu.com 3

To Provision for discount on debtors A/c

This provision is an expense and is shown on the debit side of the trading and

profit and loss account and in the balance sheet the debtors amount is reduced

by the amount of provision for discount on debtors.

10. Manager’s commission: This is that commission which the manager gets on

the net profit of the company. This percentage of commission can be in the

form of either percentage before charging such commission or after charging

such commission. And in case nothing is mentioned in the question it is

assumed that commission is paid before charging such commission.

In case of commission charged on profit before charging such commission.

Commission= Profit before charging such commission X Rate of

commission/100

In case of commission charged on profit after charging such commission

Commission= Profit before charging such commission X Rate of

commission/(100+ Rate of commission)

The adjustment entry that is passed is:

Profit and loss A/c ………Dr.

To Manager’s commission A/c

11. Interest on capital: It is the interest that is paid on the capital of the

proprietor. This interest is payable on the capital that was at the beginning of

the accounting year. And in case of any additional capital brought in by the

proprietor the interest is charged from the date it is brought. The adjustment

entry that is passed is:

Profit and loss A/c………. Dr.

To Manager’s commission A/c

Class XI Accountancy www.vedantu.com 4

It is an expense and hence it is shown on the debit side of the profit and loss

account and in the balance sheet it is added to the capital.

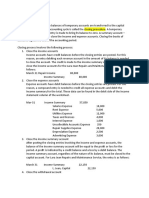

Illustration:1

From the following information prepare Trading and Profit and Loss Account

and Balance Sheet for the year ended 31st March, 2021.

Account Amount Account Amount

Capital 7,20,000 Salaries 1,20,000

Machinery 1,40,000 General Expenses 40,000

Sales 16,40,000 Rent 1,00,000

Purchases 8,00,000 Purchases Return 10,000

Sales Return 20,000 Debtors 6,00,000

Opening Stock 2,00,000 Cash 80,000

Drawings 80,000 Carriage Outwards 40,000

Wages 2,00,000 Advertising 40,000

Carriage Inwards 10,000 Creditors 1,00,000

Adjustments:

1. Closing Stock was valued at Rs. 4,00,000.

2. Outstanding salaries amounting to be Rs. 20,000

3. Rent includes prepaid rent of Rs. 30,000.

4. Bad debts amount to Rs. 50,000.

Ans: Trading and Profit and Loss Account

for the year ended 31st March, 2021

Particulars Amount Particulars Amount

Opening Stock 2,00,000 Closing Stock 4,00,000

Add: Purchases 8,00,000 Sales 16,40,000

Less: Purchase (10,000) 7,90,000 Less: Sales 16,20,000

Returns (20,000)

Wages 2,00,000 Return

Class XI Accountancy www.vedantu.com 5

Carriage Inwards 10,000

Gross Profit c/d 8,20,000

20,20,000 20,20,000

Salaries 1,20,000 Gross Profit b/d 8,20,000

Add:Outstanding (20,000) 1,40,000

Salary

General Expenses 40,000

Rent 1,00,000

Less: Prepaid Rent 70,000

(30,000) 40,000

Carriage outwards 40,000

Advertising 50,000

Bad Debts 4,40,000

Net Profit (transferred to 8,20,000 8,20,000

Capital account)

Balance Sheet

as on 31st March, 2021

Liabilities Amount Assets Amount

Capital 7,20,000 Fixed Assets:

Less: Drawings Machinery 1,40,000

(80,000) 10,80,000 Current Assets:

Add: Net Profit Debtors (600000- 5,50,000

4,40,000 50000) 80,000

1,00,000 Cash 4,00,000

Current Liabilities 20,000 Closing Stock 30,000

Creditor Prepaid rent

Outstanding Salary

Class XI Accountancy www.vedantu.com 6

12,00,000 12,00,000

Class XI Accountancy www.vedantu.com 7

You might also like

- NC-III Bookkeeping ReviewerDocument33 pagesNC-III Bookkeeping ReviewerNovelyn Gamboa92% (53)

- Accounting Assignment PDFDocument18 pagesAccounting Assignment PDFMohammed SafwatNo ratings yet

- Income Statement TaskDocument5 pagesIncome Statement Taskiceman2167No ratings yet

- Chapter 7 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Document152 pagesChapter 7 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi50% (4)

- Railway Establishment RulesDocument127 pagesRailway Establishment Rulesjijina100% (1)

- Chapter 1: Overview of AccountingDocument79 pagesChapter 1: Overview of AccountingJayar80% (5)

- Statement of Cash Flows & Notes To Financial StatementsDocument17 pagesStatement of Cash Flows & Notes To Financial StatementsMiriee Joy SshiNo ratings yet

- Basic Acc ReviewerDocument7 pagesBasic Acc ReviewerReign PangilinanNo ratings yet

- Reminder: Use Your Official Answer Sheet: Universidad de ManilaDocument25 pagesReminder: Use Your Official Answer Sheet: Universidad de ManilaMarcellana ArianeNo ratings yet

- Quiz 18: Use The Following Information For Questions 3 To 5Document4 pagesQuiz 18: Use The Following Information For Questions 3 To 5CrisNo ratings yet

- Horngrens Accounting 12th Edition Nobles Solutions ManualDocument35 pagesHorngrens Accounting 12th Edition Nobles Solutions Manualserenadinhmzi100% (16)

- Financial Performance Metrics - Financial RatiosDocument98 pagesFinancial Performance Metrics - Financial RatiosAjmal SalamNo ratings yet

- Financial Statements II Class 11 Notes CBSE Accountancy Chapter 10 PDF 1Document7 pagesFinancial Statements II Class 11 Notes CBSE Accountancy Chapter 10 PDF 1Parth PahwaNo ratings yet

- Final Account (Satyanath Mohapatra)Document38 pagesFinal Account (Satyanath Mohapatra)smrutiranjan swainNo ratings yet

- Sole Traders Final Account-QuestionsDocument11 pagesSole Traders Final Account-QuestionsHarsh VoraNo ratings yet

- Indirect MethodDocument34 pagesIndirect MethodHacker SKNo ratings yet

- FABM2 1stqtr UploadDocument4 pagesFABM2 1stqtr Uploadjay reamonNo ratings yet

- MCQ - Practice Sheet - A&F - RevisedDocument27 pagesMCQ - Practice Sheet - A&F - Revisedgeorgiana tesoiNo ratings yet

- Cash FlowsDocument15 pagesCash FlowsAkshat DwivediNo ratings yet

- Pinnacle Far Preweek May 2022Document32 pagesPinnacle Far Preweek May 2022Miguel ManagoNo ratings yet

- Accounts From Incomplete Records Class 11 NotesDocument32 pagesAccounts From Incomplete Records Class 11 Notesrbking15081999No ratings yet

- Ac1 Reviewer FinalsDocument5 pagesAc1 Reviewer FinalsMark Christian BrlNo ratings yet

- Questions Related To Project Segment ReportDocument14 pagesQuestions Related To Project Segment ReportOm Prakash Sharma100% (1)

- ACCOUNTDocument7 pagesACCOUNTgamer rocker landNo ratings yet

- Acctg1205 - Chapter 8Document48 pagesAcctg1205 - Chapter 8Elj Grace BaronNo ratings yet

- 2.preparation of Financial StatementsDocument5 pages2.preparation of Financial StatementsAshutosh MhatreNo ratings yet

- Class 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIDocument70 pagesClass 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIPathan KausarNo ratings yet

- Solution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Document10 pagesSolution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Shaindra SinghNo ratings yet

- Financial Accounting Libby Short 7th Edition Test BankDocument122 pagesFinancial Accounting Libby Short 7th Edition Test BankJennifer Winslow100% (28)

- Chapter 2 Abm 3Document9 pagesChapter 2 Abm 3Joan Mae Angot - Villegas50% (2)

- Final Accounts - That's It BatchDocument16 pagesFinal Accounts - That's It BatchKunika PimparkarNo ratings yet

- Ratio AnalysisDocument17 pagesRatio AnalysisPGNo ratings yet

- Preparation & Analysis of Cash Flow StatementsDocument27 pagesPreparation & Analysis of Cash Flow StatementsAniket PanchalNo ratings yet

- 12.2 - Cash Flows From Operating Activities: Treatment of Interest ReceivedDocument9 pages12.2 - Cash Flows From Operating Activities: Treatment of Interest ReceivedSrikiran RajNo ratings yet

- Entrepreneurship - Quarter 2 Week 9Document8 pagesEntrepreneurship - Quarter 2 Week 9SHEEN ALUBANo ratings yet

- Bba F&a Notes & ProbDocument5 pagesBba F&a Notes & ProbMouly ChopraNo ratings yet

- Work Book M5 AFMDocument5 pagesWork Book M5 AFMNaimeesha MattaparthiNo ratings yet

- Review Notes #2 PDFDocument9 pagesReview Notes #2 PDFJha Ya100% (3)

- Fundamentals of Accounting 1 BDocument6 pagesFundamentals of Accounting 1 BAle EalNo ratings yet

- MB0041-Finance & Management Accounting Mba 1 Semester Assignment Set - 1Document12 pagesMB0041-Finance & Management Accounting Mba 1 Semester Assignment Set - 1Abhinav TelidevaraNo ratings yet

- KTTC Quiz 1 & 2Document15 pagesKTTC Quiz 1 & 2nhuphan31221021135No ratings yet

- CMA Module 3 - MBA I Sem - Financial Statements Preparation, Analysis and Interpretation (Useful For MBA 1st & BBA 1st)Document100 pagesCMA Module 3 - MBA I Sem - Financial Statements Preparation, Analysis and Interpretation (Useful For MBA 1st & BBA 1st)YOGESH KUMARNo ratings yet

- Financial Statements and Adjustments Word ReportDocument11 pagesFinancial Statements and Adjustments Word ReportDigvijay ChauhanNo ratings yet

- Financial Accounting and AnalysisDocument8 pagesFinancial Accounting and AnalysisDurvank PatilNo ratings yet

- Financial Accounting and AnalysisDocument8 pagesFinancial Accounting and AnalysisDurvank PatilNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- FRAV Individual Assignment - Pranjali Silimkar - 2016PGP278Document12 pagesFRAV Individual Assignment - Pranjali Silimkar - 2016PGP278pranjaligNo ratings yet

- Lesson 1 - Handout 2 - The Financial Statements and Accounting EquationDocument5 pagesLesson 1 - Handout 2 - The Financial Statements and Accounting EquationccgomezNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document58 pagesFundamentals of Accountancy, Business and Management 2Carmina Dongcayan100% (1)

- Financial Statements - II: 360 AccountancyDocument65 pagesFinancial Statements - II: 360 AccountancyshantX100% (1)

- Chapter 01 - Financial Statements and Business DecisionsDocument31 pagesChapter 01 - Financial Statements and Business DecisionsKisNo ratings yet

- Service Tax EntriesDocument8 pagesService Tax Entriesgaykar2009No ratings yet

- Financial Accounting & Analysis AssignmentDocument4 pagesFinancial Accounting & Analysis AssignmentDhanshree Thorat AmbavleNo ratings yet

- Financial Accounting & Analysis - N (1A)Document10 pagesFinancial Accounting & Analysis - N (1A)Tajinder MatharuNo ratings yet

- Cash Flow AssignmentDocument39 pagesCash Flow AssignmentMUHAMMAD HASSANNo ratings yet

- PRELIM-EXAMS 2223 with-ANSWERDocument5 pagesPRELIM-EXAMS 2223 with-ANSWERbrmo.amatorio.uiNo ratings yet

- 123doc Questions and Answers For Financial Accounting 1Document16 pages123doc Questions and Answers For Financial Accounting 1Minh PhươngNo ratings yet

- CASH TO ACCRUAL SINGLE ENTRY With ANSWERSDocument8 pagesCASH TO ACCRUAL SINGLE ENTRY With ANSWERSRaven SiaNo ratings yet

- Financial AnalysisDocument47 pagesFinancial Analysis20B81A1235cvr.ac.in G RUSHI BHARGAVNo ratings yet

- Chapter 8Document14 pagesChapter 8Tshering DemaNo ratings yet

- MODULE 7 and 8 ACCDocument3 pagesMODULE 7 and 8 ACCnorie jane pacisNo ratings yet

- VU Lesson 8Document5 pagesVU Lesson 8ranawaseem100% (1)

- Chapter 7 - Trial Balance, Financial Reports and StatementsDocument11 pagesChapter 7 - Trial Balance, Financial Reports and StatementsAdan EveNo ratings yet

- Happy Camper Park Case StudyDocument24 pagesHappy Camper Park Case StudyKathleen BuneNo ratings yet

- FYJC Book Keeping and Accuntancy Topic Final AccountDocument4 pagesFYJC Book Keeping and Accuntancy Topic Final AccountRavichandraNo ratings yet

- Understanding Business Accounting For DummiesFrom EverandUnderstanding Business Accounting For DummiesRating: 3.5 out of 5 stars3.5/5 (8)

- Problem 1Document23 pagesProblem 1Kearn CercadoNo ratings yet

- Accounting Cycle GuideDocument18 pagesAccounting Cycle GuideKarysse Arielle Noel JalaoNo ratings yet

- 2022 12 01 Answer Key Additional M6 M7Document15 pages2022 12 01 Answer Key Additional M6 M7Niger RomeNo ratings yet

- Chapter 4 Virtual ClassDocument24 pagesChapter 4 Virtual ClassMariola AlkuNo ratings yet

- Abdul Razak.A S/O Moosa 632 (733) 12, POST MANGALPADY Uppala KasargodDocument10 pagesAbdul Razak.A S/O Moosa 632 (733) 12, POST MANGALPADY Uppala Kasargodabdul razzakNo ratings yet

- 05 Task Performance 1Document1 page05 Task Performance 1Alexandra JamesNo ratings yet

- Guru99 Payment TestDocument2 pagesGuru99 Payment TestbiswajitNo ratings yet

- Partnerships: Igcse - Accounting (9-1) - Mahdi SamdaniDocument5 pagesPartnerships: Igcse - Accounting (9-1) - Mahdi SamdaniNasif KhanNo ratings yet

- ACC 108 Notes PayableDocument4 pagesACC 108 Notes Payablemkrisnaharq99No ratings yet

- Enquiry Proceedings Order - Grishma Securities Private LimitedDocument35 pagesEnquiry Proceedings Order - Grishma Securities Private LimitedShyam SunderNo ratings yet

- Answers and Solutions To Exercises and ProblemsofpartnershipDocument25 pagesAnswers and Solutions To Exercises and ProblemsofpartnershipDanicaEsponilla67% (6)

- Home Office Branch and Agency Accounting AnswersDocument25 pagesHome Office Branch and Agency Accounting AnswersJamaica DavidNo ratings yet

- Sap SDDocument29 pagesSap SDneelakantaNo ratings yet

- AB Hospitality BusinessDocument15 pagesAB Hospitality BusinessAfrin rahman miliNo ratings yet

- 5 15Document8 pages5 15Indra PramanaNo ratings yet

- Grade 11 March 2023 Control Test QPDocument6 pagesGrade 11 March 2023 Control Test QPfiercestallionofficialNo ratings yet

- Journal Entries RemarksDocument5 pagesJournal Entries RemarksAl Shane Lara CabreraNo ratings yet

- SAP Tickets-999 FicoDocument198 pagesSAP Tickets-999 FicoKingpinNo ratings yet

- Accounting Principles: The Recording ProcessDocument55 pagesAccounting Principles: The Recording ProcessSayed Farrukh AhmedNo ratings yet

- Tally Work BookDocument32 pagesTally Work BooklittlemagicpkNo ratings yet

- CashBook and Petty CashBookDocument22 pagesCashBook and Petty CashBookNabiha KhanNo ratings yet

- Tugas Pra UAS PA 1Document14 pagesTugas Pra UAS PA 1Fazrina Hasna Raihan IskandarNo ratings yet