Professional Documents

Culture Documents

Module 3 Cost of Capital Part-1

Uploaded by

pranali prajapatiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 3 Cost of Capital Part-1

Uploaded by

pranali prajapatiCopyright:

Available Formats

GTU MBA II Sem Financial management

Chapter Objectives

Cost of Debt

Chapter - 9

Cost of Preference Capital

The Cost of Capital

Cost of Equity Capital

WACC

Financial Management, Ninth Edition © I M Pandey 2

Vikas Publishing House Pvt. Ltd.

Cost of Capital FUND

Discount rate

Target rate

Hurdle rate

Opportunity cost of capital

Minimum required rate of return

Cut-off rate

Financial Management, Ninth Edition © I M Pandey 3 Financial Management, Ninth Edition © I M Pandey 4

Vikas Publishing House Pvt. Ltd. Vikas Publishing House Pvt. Ltd.

Sources of funds

Equity shareholders

Preference shareholders To procure funds, the firm must pay

Debt holders this return to the investor.

These investors provide funds to the firm So, the proposal must earn at least

They expect a minimum return from the firm. that much, which is sufficient to pay to

This minimum return depends upon the risk. the investors.

Financial Management, Ninth Edition © I M Pandey 5 Financial Management, Ninth Edition © I M Pandey 6

Vikas Publishing House Pvt. Ltd. Vikas Publishing House Pvt. Ltd.

Dr. Sarika Srivastava 1

GTU MBA II Sem Financial management

Introduction

The project’s cost of capital is the

minimum required rate of return on funds

committed to the project, which depends

on the riskiness of its cash flows.

The firm’s cost of capital will be the

overall, or average, required rate of

return on the aggregate of investment

projects.

Financial Management, Ninth Edition © I M Pandey 7

Vikas Publishing House Pvt. Ltd.

Explicit and Implicit Cost of Capital

Significance of the Cost of Capital Explicit COC: Interest or dividend that the firm

has to pay to the suppliers of funds.

It is useful as a standard for:

(Payment by the firm)

Evaluating investment decisions (NPV, IRR)

Implicit COC: Retained earnings does not

involve any payment.

Designing a firm’s debt policy, and

The implicit cost of the retained earnings is the

return which could have been earned by the

Appraising the financial performance of top

investors, had the profit been distributed to them

management. (they could have invested these funds

Financial Management, Ninth Edition © I M Pandey 9

elsewhere.) Financial Management, Ninth Edition © I M Pandey 10

Vikas Publishing House Pvt. Ltd. Vikas Publishing House Pvt. Ltd.

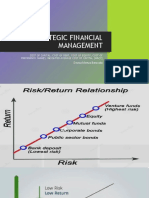

The Concept of the Opportunity Cost General Formula for the Opportunity

of Capital Cost of Capital

The opportunity cost is the rate of return Opportunity cost of capital is given by the

following formula:

foregone on the next best alternative

investment opportunity of comparable risk. C1 C2 Cn

I0

(1 k ) (1 k ) 2 (1 k ) n

where Io is the capital supplied by

investors in period 0 (it represents a net

cash inflow to the firm),

Ct are returns expected by investors

(they represent cash outflows to the firm)

k is the required rate of return or the

cost of capital.

Financial Management, Ninth Edition © I M Pandey 11 Financial Management, Ninth Edition © I M Pandey 12

Vikas Publishing House Pvt. Ltd. Vikas Publishing House Pvt. Ltd.

Dr. Sarika Srivastava 2

GTU MBA II Sem Financial management

Cost of Capital Weighted Average Cost of Capital Vs. Specific

Costs of Capital

The cost of capital of each source of capital

is known as component, or specific, cost

of capital.

The overall cost is also called the weighted

average cost of capital (WACC).

13 Financial Management, Ninth Edition © I M Pandey 14

Vikas Publishing House Pvt. Ltd.

Cost of Debt

It is the rate of return required by lenders.

15 Financial Management, Ninth Edition © I M Pandey 16

Vikas Publishing House Pvt. Ltd.

Financial Management, Ninth Edition © I M Pandey 17 Financial Management, Ninth Edition © I M Pandey 18

Vikas Publishing House Pvt. Ltd. Vikas Publishing House Pvt. Ltd.

Dr. Sarika Srivastava 3

GTU MBA II Sem Financial management

Example:

Cost of Preference Capital

Financial Management, Ninth Edition © I M Pandey 19 Financial Management, Ninth Edition © I M Pandey 20

Vikas Publishing House Pvt. Ltd. Vikas Publishing House Pvt. Ltd.

Example:

Weighted Average Cost of Capital

Financial Management, Ninth Edition © I M Pandey 21 Financial Management, Ninth Edition © I M Pandey 22

Vikas Publishing House Pvt. Ltd. Vikas Publishing House Pvt. Ltd.

Ko= k1w1 + k2w2 + k3w3 + …….

Financial Management, Ninth Edition © I M Pandey 23 24

Vikas Publishing House Pvt. Ltd.

Dr. Sarika Srivastava 4

GTU MBA II Sem Financial management

Financial Management, Ninth Edition © I M Pandey 25

Vikas Publishing House Pvt. Ltd.

Dr. Sarika Srivastava 5

You might also like

- Mutual Fund 700questions and Answers PDFDocument36 pagesMutual Fund 700questions and Answers PDFAishwarya Kumar Pandey82% (22)

- 60 Second Binary Options Strategy The Complete Guide PDFDocument15 pages60 Second Binary Options Strategy The Complete Guide PDFGaro Ohanoglu100% (1)

- Cfa ImportantDocument70 pagesCfa ImportantSairaNo ratings yet

- Cost of CapitalDocument28 pagesCost of Capitalmeakki1100% (3)

- Chapter One: The Investment EnvironmentDocument30 pagesChapter One: The Investment Environmentkaylakshmi8314100% (1)

- Smart Protect Wealth MaxDocument21 pagesSmart Protect Wealth MaxSiaw Sing ChiengNo ratings yet

- Chapter - 10: Determining Cash Flows For Investment AnalysisDocument15 pagesChapter - 10: Determining Cash Flows For Investment Analysispalak bansalNo ratings yet

- CH 28Document11 pagesCH 28rameshmba100% (1)

- Chapter - 15: Capital Structure Theory and PolicyDocument32 pagesChapter - 15: Capital Structure Theory and Policywelcome2jungleNo ratings yet

- Ifrs 9Document42 pagesIfrs 9Muhammad AliNo ratings yet

- Chapter 16 - Capital StructureDocument50 pagesChapter 16 - Capital StructureInga ȚîgaiNo ratings yet

- Cost of CapitalDocument31 pagesCost of CapitalSimarpreetNo ratings yet

- Cost of Capital PDFDocument37 pagesCost of Capital PDFBala RanganathNo ratings yet

- Topics (Tentative) : Pre-Readings (BD Chapters) : Stock ValuationDocument14 pagesTopics (Tentative) : Pre-Readings (BD Chapters) : Stock Valuationsasidhar naidu SiripurapuNo ratings yet

- Chapter 7Document40 pagesChapter 7CFANo ratings yet

- P6a CA Inter Financial ManagementDocument356 pagesP6a CA Inter Financial Managementjaya sreeNo ratings yet

- CH - 08 Cap BudgetingDocument54 pagesCH - 08 Cap BudgetingfoglaabhishekNo ratings yet

- Chapter - 8: Capital Budgeting DecisionsDocument44 pagesChapter - 8: Capital Budgeting DecisionsAmisha SinghNo ratings yet

- Cost of Capital ExplainedDocument31 pagesCost of Capital ExplainedMerlin Gey BlessingsNo ratings yet

- Chapter 5Document6 pagesChapter 5Azi LheyNo ratings yet

- AL Debt Fund - One Pager - v3Document2 pagesAL Debt Fund - One Pager - v3kanikaNo ratings yet

- UnlockedDocument45 pagesUnlockedmanojNo ratings yet

- Ifrs9 For Corporates PDFDocument64 pagesIfrs9 For Corporates PDFeunice chungNo ratings yet

- Capital Budgeting DecisionsDocument17 pagesCapital Budgeting DecisionsTas MimaNo ratings yet

- Chapter - 31: Working Capital FinanceDocument13 pagesChapter - 31: Working Capital Financepalak bansalNo ratings yet

- Investment Management: CAFTA WebinarDocument38 pagesInvestment Management: CAFTA WebinarAryan PandeyNo ratings yet

- Capital BudgetingDocument61 pagesCapital BudgetingEyael ShimleasNo ratings yet

- Capital Budgeting Techniques: NPV, IRR, PaybackDocument12 pagesCapital Budgeting Techniques: NPV, IRR, PaybackPUSHKAL AGGARWALNo ratings yet

- Timothy - Chap 9Document33 pagesTimothy - Chap 9Chaeyeon Jung0% (1)

- Week 05 Risk ManagementDocument26 pagesWeek 05 Risk ManagementChristian Emmanuel DenteNo ratings yet

- Chapter - 6: Beta Estimation and The Cost of EquityDocument14 pagesChapter - 6: Beta Estimation and The Cost of EquityInnocentNo ratings yet

- Chapter - 1: Nature of Financial ManagementDocument16 pagesChapter - 1: Nature of Financial Managementdreamer4077No ratings yet

- Chapter 8 - Part ADocument22 pagesChapter 8 - Part AKwan Kwok AsNo ratings yet

- Financial Mng. 1Document8 pagesFinancial Mng. 1ABHISHEK JADONNo ratings yet

- Icai CocDocument50 pagesIcai CocHarsha OjhaNo ratings yet

- SOV 22100108 B.com Financial ManagementDocument11 pagesSOV 22100108 B.com Financial Managementvaparna12345No ratings yet

- Chapter 1 - Introduction To Corporate Finance - NewDocument26 pagesChapter 1 - Introduction To Corporate Finance - NewZoe McKenzieNo ratings yet

- 365 Fact Sheet 2014Document2 pages365 Fact Sheet 2014Kiho KimuraNo ratings yet

- Cost of CapitalDocument114 pagesCost of CapitalNamra ImranNo ratings yet

- Captial StructureDocument51 pagesCaptial Structurepragyaan classesNo ratings yet

- ValuationDocument24 pagesValuationAkhil BansalNo ratings yet

- 46793bosinter p8 Seca cp5 PDFDocument42 pages46793bosinter p8 Seca cp5 PDFIsavic AlsinaNo ratings yet

- Scope and Objectives of Financial ManagementDocument23 pagesScope and Objectives of Financial ManagementAnkit KumarNo ratings yet

- F D C S: Inancing Ecisions Apital TructureDocument54 pagesF D C S: Inancing Ecisions Apital TructurePrabhatiNo ratings yet

- Performance of Equity Available To Shareholders:-Particulars AmountDocument8 pagesPerformance of Equity Available To Shareholders:-Particulars Amountdevluciferrocker6944No ratings yet

- Basics of Financial ManagementDocument10 pagesBasics of Financial ManagementAbdul KhanNo ratings yet

- MS11 - Capital BudgetingDocument8 pagesMS11 - Capital BudgetingElsie GenovaNo ratings yet

- NISM Paper 1 To 5 MOCK Test - Vry ImpDocument26 pagesNISM Paper 1 To 5 MOCK Test - Vry ImpKumarGaurav50% (2)

- Cost of CapitalDocument10 pagesCost of CapitalAyush MishraNo ratings yet

- Capital Structure TheoriesDocument13 pagesCapital Structure Theoriesಮಂಜುನಾಥ್ ರಂಪುರೆ ಎಸ್No ratings yet

- Working CaptioalDocument9 pagesWorking CaptioalItsmebroNo ratings yet

- Cost of CapitalDocument20 pagesCost of CapitalShiv KothariNo ratings yet

- FM Revision Notes-CS ExeDocument39 pagesFM Revision Notes-CS ExeAman Gutta100% (1)

- Strategic Financial ManagementDocument28 pagesStrategic Financial ManagementDayana MasturaNo ratings yet

- Chapter - 1: Nature of Financial ManagementDocument16 pagesChapter - 1: Nature of Financial Managementgosaye desalegnNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Raising Venture Capital for the Serious EntrepreneurFrom EverandRaising Venture Capital for the Serious EntrepreneurRating: 3 out of 5 stars3/5 (4)

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Integrated Communication ToolDocument26 pagesIntegrated Communication Toolpranali prajapatiNo ratings yet

- Managing Marketing Information To Gain Customer InsightsDocument36 pagesManaging Marketing Information To Gain Customer Insightspranali prajapatiNo ratings yet

- RetailingDocument42 pagesRetailingpranali prajapatiNo ratings yet

- Module 3 Capital - Structure NI 2022Document5 pagesModule 3 Capital - Structure NI 2022pranali prajapatiNo ratings yet

- UoT Jamaica Corporate Finance tutorial cash flowDocument3 pagesUoT Jamaica Corporate Finance tutorial cash flowPrincessCC20No ratings yet

- 19 390 Final Settlement Prices For Cash Settled FuturesDocument4 pages19 390 Final Settlement Prices For Cash Settled FuturesAmer ZamanNo ratings yet

- Lecture 4 - CAPM ProofDocument5 pagesLecture 4 - CAPM ProofShashank GuptaNo ratings yet

- Contents:: The "Triple Rebound" StrategyDocument8 pagesContents:: The "Triple Rebound" StrategyRàví nikezim 100No ratings yet

- Risk and Return FundamentalsDocument60 pagesRisk and Return FundamentalsasmaNo ratings yet

- Megawide Construction Corporation SEC Form 17-Q for H1 2022Document79 pagesMegawide Construction Corporation SEC Form 17-Q for H1 2022Mc Jim Thaddeus MasayonNo ratings yet

- Chapter 1 Introduction To Accounting Standards PDFDocument29 pagesChapter 1 Introduction To Accounting Standards PDFVikash AnandNo ratings yet

- 17 Best Investment Vehicles For Filipinos - 1Document58 pages17 Best Investment Vehicles For Filipinos - 1Jewelyn CioconNo ratings yet

- AddDocument227 pagesAddStar LordNo ratings yet

- Assignment 1 - Fin242 Set 2Document4 pagesAssignment 1 - Fin242 Set 22022328009No ratings yet

- e-StatementBRImo 018201035263506 Apr2023 20230703 143056Document2 pagese-StatementBRImo 018201035263506 Apr2023 20230703 143056NONO MULYANANo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument34 pagesFinancial Statement Analysis: K R Subramanyam John J WildAgus Tina100% (1)

- Learnforexpsychological LevelDocument9 pagesLearnforexpsychological Levellewgraves33No ratings yet

- IL&FS liquidity crisis explainedDocument2 pagesIL&FS liquidity crisis explainedAbhay KumarNo ratings yet

- Group 2 - Business PlanDocument14 pagesGroup 2 - Business PlanPipito FportNo ratings yet

- Chapter Four Discounting and Alternative Investment CriteriaDocument22 pagesChapter Four Discounting and Alternative Investment CriteriaYusuf HusseinNo ratings yet

- Crc-Ace Review School, Inc.: Management Accounting Services (1-40)Document8 pagesCrc-Ace Review School, Inc.: Management Accounting Services (1-40)LuisitoNo ratings yet

- Graham CriteriaDocument7 pagesGraham CriteriakamtzompingNo ratings yet

- Discover The Power of PitchBook PDFDocument11 pagesDiscover The Power of PitchBook PDFwpairoNo ratings yet

- IFRS 5 Non-Current Assets Held for SaleDocument12 pagesIFRS 5 Non-Current Assets Held for SalemnhammadNo ratings yet

- London International Financial Futures and Options ExchangeDocument4 pagesLondon International Financial Futures and Options Exchangemdsabbir100% (1)

- An Overview of Financial SystemDocument4 pagesAn Overview of Financial SystemYee Sin MeiNo ratings yet

- M&a Pitch 2Document6 pagesM&a Pitch 2kashish khediaNo ratings yet

- Ranabir Sanyal: To, The Executive DirectorDocument13 pagesRanabir Sanyal: To, The Executive DirectorAbhilash KamtiNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Takeover - ICSI CR PDFDocument41 pagesTakeover - ICSI CR PDFMystNo ratings yet