Professional Documents

Culture Documents

Final Quiz 1

Uploaded by

Dianna Lynn MolinaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Quiz 1

Uploaded by

Dianna Lynn MolinaCopyright:

Available Formats

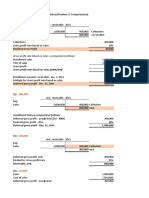

Problem A

Alcantara acquired an equipment on June 25, 20x1 for P1,000,000. The equipment is estimated to have a useful life

of 5 years and residual value of P50,000.

Required: Prepare the depreciation table from 20x1 – 20x6 using the following depreciation methods. (Present the

computation of annual depreciation, SYD rate and double declining rate.

1) Straight line method

2) Sum-of-the-years’ digits method

3) Double declining balance method

1) Straight-line Method

Date Depreciation Accumulated Depreciation Carrying Amount

2) SYD

Depreciable SYD

Date Amount Rate Depreciation

Date Depreciation Accumulated Depreciation Carrying Amount

3) Double Declining Balance

Date Depreciation

Date Depreciation Accumulated Depreciation Carrying Amount

Problem B

Use the information in the preceding problem, except that the machine was estimated to have a total service life of

25,000 hours and a total productive capacity of 950,000 units. Information on actual usage and production are as

follows:

Year Manufacturing Hours Units Produced

20x1 3,500 125,000

20x2 7,000 250,000

20x3 5,000 200,000

20x4 4,500 150,000

20x5 3,000 135,000

20x6 2,000 90,000

Required:

Compute for the depreciation rate using based on input and based on output then prepare the depreciation table.

1. Based on Input (Manufacturing Hours)

Date Depreciation Accumulated Depreciation Carrying Amount

2. Based on Output (Nu mber of units produced)

Date Depreciation Accumulated Depreciation Carrying Amount

You might also like

- For Reg 1Document7 pagesFor Reg 1Shynne MabantaNo ratings yet

- Intermediate Accounting 2 (Chapter 16 Answers)Document30 pagesIntermediate Accounting 2 (Chapter 16 Answers)Jamaica FloresNo ratings yet

- Assignment For Accounting Policies, Estimate and Errors: Problem 3Document3 pagesAssignment For Accounting Policies, Estimate and Errors: Problem 3Fria Mae Aycardo AbellanoNo ratings yet

- Unit 3 Overheads - Tutorial SheetDocument4 pagesUnit 3 Overheads - Tutorial SheetJust for Silly UseNo ratings yet

- Notes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsDocument13 pagesNotes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsPaula Bautista100% (2)

- UntitledDocument15 pagesUntitledemielyn lafortezaNo ratings yet

- Use The Following Information For The Next Four Cases:: Depreciation Methods Fact PatternDocument6 pagesUse The Following Information For The Next Four Cases:: Depreciation Methods Fact PatternPRESCIOUS JOY CERALDENo ratings yet

- Class Exercise CH 10Document5 pagesClass Exercise CH 10Iftekhar AhmedNo ratings yet

- Unit 4 Lecture Activity 1 Depreciation Methods SolutionDocument5 pagesUnit 4 Lecture Activity 1 Depreciation Methods SolutionMisu NguyenNo ratings yet

- Chapter 5 Limiting Factors and Throughput Accounting: Answer 1Document10 pagesChapter 5 Limiting Factors and Throughput Accounting: Answer 1DOODGE CHIDHAKWANo ratings yet

- Overhead HWDocument2 pagesOverhead HWTheint Myat KyalsinNo ratings yet

- Quiz - Chapter 10 - Installment Sales Method - 2021 EditionDocument5 pagesQuiz - Chapter 10 - Installment Sales Method - 2021 EditionYam SondayNo ratings yet

- Problem 27 5Document20 pagesProblem 27 5Cjezerei Dangue VerdaderoNo ratings yet

- Adobe Scan 01 Jul 2023Document5 pagesAdobe Scan 01 Jul 2023Faisal NawazNo ratings yet

- In Class File Chapter 11Document17 pagesIn Class File Chapter 11kathleen fajardoNo ratings yet

- PPE - Part - 2. CHAPTER16Document36 pagesPPE - Part - 2. CHAPTER16Ms Vampire100% (1)

- Accounting PoliciesDocument10 pagesAccounting PoliciesHohohoNo ratings yet

- Sol. Man. - Chapter 7 - Notes (Part 1)Document13 pagesSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNo ratings yet

- 3acc0809 Introduction To Management Accounting Tutorial 7: (ACCA, F5, BPP)Document2 pages3acc0809 Introduction To Management Accounting Tutorial 7: (ACCA, F5, BPP)Sarah RanduNo ratings yet

- Cost Last 5 Attempt PapersDocument146 pagesCost Last 5 Attempt PapersYashJainNo ratings yet

- TXZWE 2018 Dec ADocument9 pagesTXZWE 2018 Dec AKAH MENG KAMNo ratings yet

- Unit 2 - Question BankDocument34 pagesUnit 2 - Question BankTamaraNo ratings yet

- Bíñüäpü Báárwüúwæ A®Üáwüá - Êýx Gçýé Ë Ýwüwüúwæ Eñü Äôä. ®Ý® & Æäåàwýåêæáà Ç Pýâæárçæàoã Õ E Üáãàxóü Öüá ÜáDocument8 pagesBíñüäpü Báárwüúwæ A®Üáwüá - Êýx Gçýé Ë Ýwüwüúwæ Eñü Äôä. ®Ý® & Æäåàwýåêæáà Ç Pýâæárçæàoã Õ E Üáãàxóü Öüá ÜáSudhir SoudagarNo ratings yet

- INTACC2 - Chapter 30Document2 pagesINTACC2 - Chapter 30Shane TabunggaoNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 5: Advanced Management AccountingDocument8 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 5: Advanced Management AccountingHarshawardhan GuptaNo ratings yet

- Unit 5 - Depreciation - Chat Session 8 (Spring 2020)Document5 pagesUnit 5 - Depreciation - Chat Session 8 (Spring 2020)RealGenius (Carl)No ratings yet

- Exercise On CVP - CB PDFDocument3 pagesExercise On CVP - CB PDFqwertNo ratings yet

- Ru PG SM Question PaperDocument3 pagesRu PG SM Question PaperbalajiNo ratings yet

- WK4 Abc Ii HMWRK QDocument1 pageWK4 Abc Ii HMWRK QFungaiNo ratings yet

- Giải bài PPE IAS 16Document22 pagesGiải bài PPE IAS 16Ngô Thị Thu HàNo ratings yet

- Cost Classification: Total Product/ ServiceDocument21 pagesCost Classification: Total Product/ ServiceThureinNo ratings yet

- Chapter 40 - Teacher's ManualDocument8 pagesChapter 40 - Teacher's ManualHohohoNo ratings yet

- Solution.: ST ND RD THDocument4 pagesSolution.: ST ND RD THhaggaiNo ratings yet

- Cost FM 2 PDFDocument276 pagesCost FM 2 PDFYogesh ThakurNo ratings yet

- T5 - Activity-Based Costing - Open Book TeamDocument3 pagesT5 - Activity-Based Costing - Open Book TeamSujib BarmanNo ratings yet

- Questions 2021Document7 pagesQuestions 2021Bridgett BeeNo ratings yet

- Chapter 16 ExcelDocument12 pagesChapter 16 ExcelKiminosunoo LelNo ratings yet

- DAC503 ILLUSTRATIVE QUESTION - Cost Accumulation & PricingDocument3 pagesDAC503 ILLUSTRATIVE QUESTION - Cost Accumulation & PricingDavidNo ratings yet

- Chapter 16 ExcelDocument13 pagesChapter 16 ExcelKiminosunoo LelNo ratings yet

- MBA 620 Week 3 HW SolutionsDocument5 pagesMBA 620 Week 3 HW SolutionsphoebeNo ratings yet

- InstallmentDocument10 pagesInstallmentNiki DimaanoNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- Combinepdf 2Document6 pagesCombinepdf 2saisandeepNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument15 pagesFinal Examination: Suggested Answers To QuestionsidealNo ratings yet

- Paper19 - Set2 Question Cma FinalDocument5 pagesPaper19 - Set2 Question Cma Finalrehaliya15No ratings yet

- Ca - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursDocument7 pagesCa - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursPROFESSIONAL WORK ROHITNo ratings yet

- 11-11-21... 4060 GR I... Ni-3124... Costing... QueDocument4 pages11-11-21... 4060 GR I... Ni-3124... Costing... QueVimal Shroff55No ratings yet

- Installment Sales MethodDocument11 pagesInstallment Sales MethodJanella Umieh De UngriaNo ratings yet

- Acc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long QuizDocument5 pagesAcc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long Quizemielyn lafortezaNo ratings yet

- Rev 003 Midterm - Short QuizDocument2 pagesRev 003 Midterm - Short QuizJames LuoNo ratings yet

- Chapter 4 CB Problems - IDocument11 pagesChapter 4 CB Problems - IRoy YadavNo ratings yet

- Cost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyDocument16 pagesCost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyAnkit2020No ratings yet

- Illustration Problem & SolutionDocument4 pagesIllustration Problem & SolutionClauie BarsNo ratings yet

- Data Regarding Units Are As Follows:: CaseacasebcasecDocument4 pagesData Regarding Units Are As Follows:: CaseacasebcasecJessalyn DaneNo ratings yet

- Answer All Questions. Each Question Carries 2 MarksDocument3 pagesAnswer All Questions. Each Question Carries 2 MarksAthul RNo ratings yet

- Bacc232 .309 Management Accounting Assignment 1Document13 pagesBacc232 .309 Management Accounting Assignment 1TarusengaNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Mechanical Properties and Performance of Engineering Ceramics and Composites X: A Collection of Papers Presented at the 39th International Conference on Advanced Ceramics and CompositesFrom EverandMechanical Properties and Performance of Engineering Ceramics and Composites X: A Collection of Papers Presented at the 39th International Conference on Advanced Ceramics and CompositesDileep SinghNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- A220 - Midterm RequirementDocument7 pagesA220 - Midterm RequirementDianna Lynn MolinaNo ratings yet

- Anatomy of Anti-Hero by Nick JoaquinDocument18 pagesAnatomy of Anti-Hero by Nick JoaquinDianna Lynn MolinaNo ratings yet

- A220 MTRequirement ReflectionPaperDocument6 pagesA220 MTRequirement ReflectionPaperDianna Lynn MolinaNo ratings yet

- MOLINA, DiannaLynn - BSA 2 4 - A220 ReflectionPaperDocument7 pagesMOLINA, DiannaLynn - BSA 2 4 - A220 ReflectionPaperDianna Lynn MolinaNo ratings yet

- A220 PrelimRequirement ReflectionPaperDocument6 pagesA220 PrelimRequirement ReflectionPaperDianna Lynn MolinaNo ratings yet

- A.journey Abroad Rizal in Europe and Asia B.rizal's Romantic RelationshipDocument25 pagesA.journey Abroad Rizal in Europe and Asia B.rizal's Romantic RelationshipDianna Lynn MolinaNo ratings yet

- 2ND RIZAL TRIP (Journey Abroad Rizal in Europe and Asia)Document19 pages2ND RIZAL TRIP (Journey Abroad Rizal in Europe and Asia)Dianna Lynn MolinaNo ratings yet

- A220 FinalQuiz1Document3 pagesA220 FinalQuiz1Dianna Lynn MolinaNo ratings yet

- A.jose Rizal A Biographical Sketch by Teofilo H. MontemayorDocument16 pagesA.jose Rizal A Biographical Sketch by Teofilo H. MontemayorDianna Lynn MolinaNo ratings yet

- A220 FinalRequirement ReflectionPaperDocument7 pagesA220 FinalRequirement ReflectionPaperDianna Lynn MolinaNo ratings yet

- Uncle Tom's CabinDocument3 pagesUncle Tom's CabinDianna Lynn MolinaNo ratings yet

- Homeless To HarvardDocument1 pageHomeless To HarvardDianna Lynn MolinaNo ratings yet

- Chapter 16 Problem 3Document2 pagesChapter 16 Problem 3Dianna Lynn MolinaNo ratings yet

- GEE4 GlobalCitizenship Act#4 Paet HerbertDocument1 pageGEE4 GlobalCitizenship Act#4 Paet HerbertDianna Lynn MolinaNo ratings yet

- MolinaDiannaLynn A220 Chapter 16 Problem 3Document4 pagesMolinaDiannaLynn A220 Chapter 16 Problem 3Dianna Lynn MolinaNo ratings yet

- Written Output Group9Document17 pagesWritten Output Group9Dianna Lynn MolinaNo ratings yet

- Water PollutionDocument1 pageWater PollutionDianna Lynn MolinaNo ratings yet

- GROUP-9 - Historical Development of ArtDocument9 pagesGROUP-9 - Historical Development of ArtDianna Lynn MolinaNo ratings yet

- Midterm Activity - Frequency Distribution Table - Measures of Central Tendency and LocationDocument5 pagesMidterm Activity - Frequency Distribution Table - Measures of Central Tendency and LocationDianna Lynn MolinaNo ratings yet

- Group 9 Art AppreciationDocument71 pagesGroup 9 Art AppreciationDianna Lynn MolinaNo ratings yet

- Chapter 5 - Far - Journalizing and PostingDocument85 pagesChapter 5 - Far - Journalizing and PostingDianna Lynn MolinaNo ratings yet

- Assignment No. 3 - A023-Entrep1aDocument2 pagesAssignment No. 3 - A023-Entrep1aDianna Lynn MolinaNo ratings yet

- Common Type of Business Letters: by Group 5Document21 pagesCommon Type of Business Letters: by Group 5Dianna Lynn MolinaNo ratings yet

- Biodiversity and A Healthy Society: Group 2Document14 pagesBiodiversity and A Healthy Society: Group 2Dianna Lynn MolinaNo ratings yet

- A023-Entrep 1A: Mid DQ 6: Submitted By: Dianna Lynn L. Molina (BSA-1-3) Submitted To: Sir Arly N. VisperasDocument2 pagesA023-Entrep 1A: Mid DQ 6: Submitted By: Dianna Lynn L. Molina (BSA-1-3) Submitted To: Sir Arly N. VisperasDianna Lynn MolinaNo ratings yet

- Internal Noise - Confined Within The Psychological and Sociological Nature ofDocument12 pagesInternal Noise - Confined Within The Psychological and Sociological Nature ofDianna Lynn MolinaNo ratings yet