Professional Documents

Culture Documents

2nd Page Computation FY 20-21

Uploaded by

naveen kumar0 ratings0% found this document useful (0 votes)

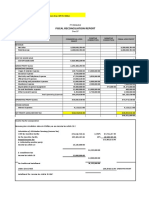

12 views2 pagesThis document contains the computation of total income and tax payable for Madhuri Yelakanti for the assessment year 2021-22. It details her income from business/profession of Rs. 640,155 and other sources of Rs. 2,158, totaling gross income of Rs. 642,313. Allowable deductions under Chapter VI-A total Rs. 158,917, leaving taxable income of Rs. 483,396. With a tax rebate applied, the total tax payable is Rs. 0.

Original Description:

Computation

Original Title

2nd Page Computation FY 20-21

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains the computation of total income and tax payable for Madhuri Yelakanti for the assessment year 2021-22. It details her income from business/profession of Rs. 640,155 and other sources of Rs. 2,158, totaling gross income of Rs. 642,313. Allowable deductions under Chapter VI-A total Rs. 158,917, leaving taxable income of Rs. 483,396. With a tax rebate applied, the total tax payable is Rs. 0.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pages2nd Page Computation FY 20-21

Uploaded by

naveen kumarThis document contains the computation of total income and tax payable for Madhuri Yelakanti for the assessment year 2021-22. It details her income from business/profession of Rs. 640,155 and other sources of Rs. 2,158, totaling gross income of Rs. 642,313. Allowable deductions under Chapter VI-A total Rs. 158,917, leaving taxable income of Rs. 483,396. With a tax rebate applied, the total tax payable is Rs. 0.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

COMPUTATION OF TOTAL INCOME AND TAX PAYABLE FOR THE ASSESSMENT YEAR 2021-22

Name of Assesse MADHURI YELAKANTI ASSESSMENT

2021-22

Home Address H.No: 4-4-80, YEAR

Gandhi Colony,

Vikarabad Town,

Vikarabad District-501101

Status Individual

Date of Birth 05/08/1992

PAN AONPY8698B

COMPUTATION OF TOTAL INCOME

A) INCOME FROM BUSINESS OR PROFESSION :

Gross Turnover declared under section 44AD 1,612,496.00

8% presumptive Income under section 44AD 129,000.00

Actual Income offered 640,155.00 640,155.00

B) INCOME FROM OTHER SOURCES

Interest received 2,158.00

GROSS TOTAL INCOME 642,313.00

DEDUCTIONS UNDER CHAPTER VI-A

Deductions under sec.80C

LIC & Educational Expenses 110,417.00

Allowable Deduction under sec.80C - .

Deduction under sec.80D -

Deducion under sec.80GG -

Rent Paid 48,500.00

Total Deductions under Chapter VI-A 158,917.00

TAXABLE INCOME 483,396.00

Rounded off under sec.288A 483,400.00

COMPUTATION OF TAX PAYABLE

Gross Tax on Taxable Income 11,670.00

Less: Tax Rebate under sec.87 (11,670.00)

Gross Tax Payable -

Add: Educational Cess & Higher Educational Cess -

Tax Payable -

Less: TDS Deducted -

Total Tax payable -

Add:Interest & Fees -

Total Tax, Interest and Fee paid -

You might also like

- Profits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoDocument2 pagesProfits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoSatyasheel ChandaneNo ratings yet

- 12 13 2021 DebitcardsDocument4 pages12 13 2021 DebitcardsRajesh BaswarajuNo ratings yet

- C R Das (Income Comp) - 2021-2022Document1 pageC R Das (Income Comp) - 2021-2022vijayrobin.tiggaNo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- ITDECDocument2 pagesITDECDipak SahaNo ratings yet

- HTML ReportsDocument2 pagesHTML Reportsdpkch4141No ratings yet

- JAN FEB MAR Projected Amount Total Amount: EarningsDocument2 pagesJAN FEB MAR Projected Amount Total Amount: EarningsSubhankarNo ratings yet

- Akansha ChourasiaDocument1 pageAkansha Chourasiaakanksha skyNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- HTML ReportsDocument8 pagesHTML Reportsdpkch4141No ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument2 pagesEPF Universal Account Number: LIC ID / Policy IDBiswajit DasNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- FormDocument1 pageFormRahul GaurNo ratings yet

- Malarmangai 2021-2022Document10 pagesMalarmangai 2021-2022Karthick KumarNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- Vinod Singh Computation Revised-3Document4 pagesVinod Singh Computation Revised-3vinodNo ratings yet

- Ay 22-23 Dattatri Kadam With Sign & StampDocument13 pagesAy 22-23 Dattatri Kadam With Sign & StampRAJESH DNo ratings yet

- $RN8C7G2Document3 pages$RN8C7G2akxerox47No ratings yet

- Computation of Income: Income Under Head Other SourcesDocument1 pageComputation of Income: Income Under Head Other SourcesCA Devanshu N. SinhaNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLrajkannamdu100% (1)

- Axis Bank LTD Payslip For The Month of August - 2019Document3 pagesAxis Bank LTD Payslip For The Month of August - 2019Venkateswarlu KamaniNo ratings yet

- Profits and Gains of Business or ProfessionDocument3 pagesProfits and Gains of Business or ProfessionKumar GajulaNo ratings yet

- Axis Bank LTD Payslip For The Month of April - 2021: Leave DetailsDocument2 pagesAxis Bank LTD Payslip For The Month of April - 2021: Leave Detailssalma saifiNo ratings yet

- Book 1Document1 pageBook 1gras2007No ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Computation ITRDocument1 pageComputation ITRsuneetbansalNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Mar 2023Document1 pageMar 2023gaurav sharmaNo ratings yet

- Financials 2021 2022Document4 pagesFinancials 2021 2022Divya PadigelaNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- Financial Aspect FinalDocument12 pagesFinancial Aspect Finalmelvanne tamboboyNo ratings yet

- Draft Computation SheetDocument3 pagesDraft Computation Sheettax advisorNo ratings yet

- Chaganti Maheswara Reddy 21-22Document5 pagesChaganti Maheswara Reddy 21-22cherrylucky81No ratings yet

- Mashood K ITR COMPUTATION AY 2022-23Document3 pagesMashood K ITR COMPUTATION AY 2022-23sidvikventuresNo ratings yet

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- Aamir 22-23 Income StatementDocument1 pageAamir 22-23 Income StatementMohammed MoizNo ratings yet

- Aug PDFDocument1 pageAug PDFRNo ratings yet

- Comp Anubhav Garg 21 - 22Document1 pageComp Anubhav Garg 21 - 22prateek gangwaniNo ratings yet

- Itr2022 23Document7 pagesItr2022 23Chithralekha AnanthNo ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- Mitali Garg E01392Document1 pageMitali Garg E01392Mitali GargNo ratings yet

- Ilovepdf MergedDocument7 pagesIlovepdf MergedRavi ChristoNo ratings yet

- Dec Payslip - Rekrut IndiaDocument1 pageDec Payslip - Rekrut IndiafkadirNo ratings yet

- Ponugoti Manga Itr 2022Document4 pagesPonugoti Manga Itr 2022Neduri Kalyan SrinivasNo ratings yet

- Salary Slip - Quess)Document1 pageSalary Slip - Quess)gamersingh098123No ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- Revision TXDocument26 pagesRevision TXFatemah MohamedaliNo ratings yet

- TAX Quiz 2Document10 pagesTAX Quiz 2Ednalyn CruzNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Income Tax Form 2020 IDocument1 pageIncome Tax Form 2020 ISuvashreePradhanNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 22100700034128CNRB ChallanReceiptDocument1 page22100700034128CNRB ChallanReceiptnaveen kumarNo ratings yet

- Form PDF 768656890080722Document10 pagesForm PDF 768656890080722naveen kumarNo ratings yet

- 1st Page ITRV FY 20-21Document1 page1st Page ITRV FY 20-21naveen kumarNo ratings yet

- Ajwpm1056h 2020Document4 pagesAjwpm1056h 2020naveen kumarNo ratings yet

- I Sec Solutions Private Limited-175 11 MonthDocument1 pageI Sec Solutions Private Limited-175 11 Monthnaveen kumarNo ratings yet

- I Sec Solutions Private Limited-176 12 TH MonthDocument1 pageI Sec Solutions Private Limited-176 12 TH Monthnaveen kumarNo ratings yet