Professional Documents

Culture Documents

ACTBFAR Pro-Forma Statements - Accounting For Manufacturing-1

Uploaded by

Gabrielle Brianna ChuaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACTBFAR Pro-Forma Statements - Accounting For Manufacturing-1

Uploaded by

Gabrielle Brianna ChuaCopyright:

Available Formats

ACTBFAR

Pro-Forma Financial Statements (Manufacturing Concern)

(Source: Basic Financial Accounting and Reporting by Dela Cruz, Rabo, & Tugas)

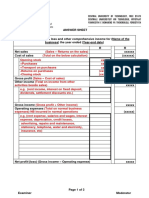

Functional-form Income Statement:

XYZ MANUFACTURING

Income Statement

For the fiscal year ended January 31, 2021

Note

Net sales revenue 1 ₱ xxx

Cost of sales 2 ( xx)

Gross profit ₱ xxx

Interest Income xx*

Total income ₱ xxx

Operating expenses:

Distribution costs 3 ₱ xx

Administrative expenses 4 xx ( xx)

NET INCOME (NET LOSS) ₱ xx

*Since there is only one account under this category, it is not required to provide a supporting

note; Preparers may immediately change the category name to the account title.

Statement of Changes in Equity:

XYZ MANUFACTURING

Statement of Changes in Equity

For the fiscal year ended January 31, 2021

Owner, Capital, February 1, 2020 ₱ xxx

Net income xx*

Sub-total ₱ xxx

Owner, Drawing ( xx)

OWNER, CAPITAL, JANUARY 31, 2021 ₱ xxx

*This assumes that operations during the year resulted to a net income. If there was a net loss,

this will be deducted from Owner, Capital, beginning balance to get ending balance.

Report-form Statement of Financial Position:

XYZ MANUFACTURING

Statement of Financial Position

January 31, 2021

Note

ASSETS

Current Assets:

Cash ₱ xx

Investments in Trading Securities xx

Trade and other receivables 5 xx

Inventories 6 xx

Prepaid expenses 7 xx

Total current assets ₱ xxx

Non-current Assets:

Property, plant, and equipment 8 xx

TOTAL ASSETS ₱ xxx

LIABILITIES AND OWNER’S EQUITY

Current Liabilities:

Trade and other payables 9 ₱ xx

Non-current Liabilities

Notes Payable – due in three years xxx

Total liabilities ₱ xxx

Owner’s equity

Owner, Capital xxx

TOTAL LIABILITIES AND OWNER’S EQUITY ₱ xxx

Notes to Financial Statements (In this document, notes refer to supporting schedules and

the numbering starts from the income statement to the statement of financial position) :

Note 1 – Net sales revenue

Sales ₱ xxx

Less: Sales Returns and Allowances ₱ xx

Sales Discount xx xx

NET SALES REVENUE ₱ xxx

Note 2 – Cost of sales

Cost of direct materials used:

Raw Materials Inventory, beginning ₱ xx

Add: Cost of raw materials purchases xxx

Total cost of raw materials available for use ₱ xxx

Less: Raw Materials Inventory, end xx ₱ xxx

Direct labor cost xx

Manufacturing overhead cost – applied at _________ xx*

Total manufacturing costs ₱ xxx

Add: Work-in-Process Inventory, beginning xx

Total cost of goods placed into process ₱ xxx

Less: Work-in-Process Inventory, end xx

Cost of goods manufactured ₱ xxx

Add: Finished Goods Inventory, beginning xx

Cost of goods available for sale ₱ xxx

Less: Finished Goods Inventory, end xx

COST OF SALES ₱ xx

*This assumes normal cost system and therefore manufacturing overhead cost should be

applied based on an activity. Examples of activity base are direct labor hours, direct labor cost,

and machine hours. For actual cost system, the actual manufacturing overhead costs are listed

down preferably according to magnitude in order to easily identify the highest overhead costs

and make certain decisions based on this information. The cost of sales would then be as

follows (see next page):

Note 2 – Cost of sales

Cost of direct materials used:

Raw Materials Inventory, beginning ₱ xx

Add: Cost of raw materials purchases xxx

Total cost of raw materials available for use ₱ xxx

Less: Raw Materials Inventory, end xx ₱ xxx

Direct labor cost xx

Manufacturing overhead cost*:

Indirect labor cost ₱ xx

Factory utilities xx

Factory rent xx

Depreciation on factory equipment xx

Cost of indirect materials used xx

Other factory costs xx xx

Total manufacturing costs ₱ xxx

Add: Work-in-Process Inventory, beginning xx

Total cost of goods placed into process ₱ xxx

Less: Work-in-Process Inventory, end xx

Cost of goods manufactured ₱ xxx

Add: Finished Goods Inventory, beginning xx

Cost of goods available for sale ₱ xxx

Less: Finished Goods Inventory, end xx

COST OF SALES ₱ xx

*These are arranged from highest to lowest, except miscellaneous or other factory costs.

Note 3 – Distribution costs

Sales Salaries and Commission ₱ xx

Utilities Expense – store xx

Rent Expense – store xx

Depreciation Expense – Store Equipment xx

Store Supplies Used xx

Miscellaneous Distribution Costs xx

TOTAL DISTRIBUTION COSTS ₱ xx

Note 4 – Administrative expenses

Office Salaries Expense ₱ xx

Utilities Expense – office xx

Rent Expense – office xx

Depreciation Expense – Office Equipment xx

Office Supplies Used xx

Taxes and Licenses Expense xx

Doubtful Accounts Expense xx

Miscellaneous Administrative Expenses xx

TOTAL ADMINISTRATIVE EXPENSES ₱ xx

Note 5 – Trade and other receivables

Accounts Receivable ₱ xx

Less: Allowance for Doubtful Accounts xx ₱ xx

Notes Receivable xx

TOTAL TRADE AND OTHER RECEIVABLES ₱ xx

Note 6 – Inventories

Raw Materials Inventory ₱ xx

Work-in-Process Inventory xx

Finished Goods Inventory xx

TOTAL INVENTORIES ₱ xx

Note 7 – Prepaid expenses

Prepaid Rent Expense ₱ xx

Office Supplies Unused xx

Store Supplies Unused xx

TOTAL PREPAID EXPENSES ₱ xx

Note 8 – Property, plant, and equipment

Factory Equipment ₱ xx

Less: Accumulated Depreciation – Factory Equipment xx ₱ xx

Store Equipment ₱ xx

Less: Accumulated Depreciation – Store Equipment xx xx

Office Equipment ₱ xx

Less: Accumulated Depreciation – Office Equipment xx xx

TOTAL CARRYING AMOUNT ₱ xx

Note 9 – Trade and other payables

Accounts Payable ₱ xx

Salaries Payable xx

TOTAL TRADE AND OTHER PAYABLES ₱ xx

You might also like

- Chart of Accounts and DefinitionsDocument17 pagesChart of Accounts and Definitionsvictorpw100% (1)

- Manufacturing AccountsDocument3 pagesManufacturing AccountsSimba MuhondeNo ratings yet

- IBPS Interview PrepDocument33 pagesIBPS Interview Prepmevrick_guyNo ratings yet

- Shoe Guru Business PlanDocument23 pagesShoe Guru Business Planapi-491240823100% (2)

- Business Combi and Conso HandoutDocument16 pagesBusiness Combi and Conso HandoutKarlo Jude Acidera100% (2)

- P1-Single Entry FormulasDocument3 pagesP1-Single Entry FormulasJohn Yrick EraNo ratings yet

- PAS 1 Financial Statement: Income Statement and Comprehensive IncomeDocument21 pagesPAS 1 Financial Statement: Income Statement and Comprehensive Incomepanda 1100% (2)

- Group StatementsDocument8 pagesGroup StatementsZance JordaanNo ratings yet

- FSs For CompaniesDocument9 pagesFSs For CompaniesFarid UddinNo ratings yet

- Preparation of Financial Statements-Manufacturing AccountsDocument7 pagesPreparation of Financial Statements-Manufacturing AccountsHeavens MupedzisaNo ratings yet

- Business Finance: Session 3: Financial StatementsDocument45 pagesBusiness Finance: Session 3: Financial StatementsXia AlliaNo ratings yet

- A2 Accounting Revision Kit (1)Document135 pagesA2 Accounting Revision Kit (1)Waniya AmirNo ratings yet

- ACCOUNTINGDocument2 pagesACCOUNTINGMarie OrbetaNo ratings yet

- Chapter 3 - Statement of Comprehensive IncomeDocument7 pagesChapter 3 - Statement of Comprehensive IncomeKarylle EntinoNo ratings yet

- Chargeable ExpensesDocument33 pagesChargeable ExpensesMahmud MugdhoNo ratings yet

- WatatapsDocument29 pagesWatatapsjessa mae zerdaNo ratings yet

- Financial Statements New Format 1Document9 pagesFinancial Statements New Format 1alyanna paladaNo ratings yet

- Manufacturing AccountsDocument4 pagesManufacturing AccountsShaikh Ghassan AbidNo ratings yet

- Video Description 1565 2019-02-27 151226 PDFDocument169 pagesVideo Description 1565 2019-02-27 151226 PDFADITYA JAINNo ratings yet

- Income Statement FormatDocument3 pagesIncome Statement Formatsorayukiforger13No ratings yet

- ACC Topic 5.1 Statement of Comprehensive Income Financial Position (Notes)Document16 pagesACC Topic 5.1 Statement of Comprehensive Income Financial Position (Notes)Romzy RahmatNo ratings yet

- Classroom Notes 6393 and 6394Document2 pagesClassroom Notes 6393 and 6394Mary Grace Galleon-Yang OmacNo ratings yet

- Statement of Comprehensive Income SummaryDocument9 pagesStatement of Comprehensive Income SummaryMaryrose SumulongNo ratings yet

- .Manufacturing Accounts 1707462151000Document5 pages.Manufacturing Accounts 1707462151000noahtarus21No ratings yet

- Chapter 2 (Mapping)Document3 pagesChapter 2 (Mapping)Zakirah ZakariaNo ratings yet

- Preparation of Financial Statements-Sole TradersDocument5 pagesPreparation of Financial Statements-Sole TradersHeavens Mupedzisa100% (1)

- Unit Costing: Nitin PatelDocument20 pagesUnit Costing: Nitin Patelmegh418100% (1)

- Actg101 Fs Prepa TemplateDocument16 pagesActg101 Fs Prepa TemplateJaira ClavoNo ratings yet

- Transfer and Business Taxation Accounting Methods and PeriodsDocument5 pagesTransfer and Business Taxation Accounting Methods and PeriodsApril Joy Padua SimonNo ratings yet

- Key financial ratios and break-even analysisDocument4 pagesKey financial ratios and break-even analysisEhab hobaNo ratings yet

- Chapter 7 - Intro To Regular Income Taxation (RIT)Document5 pagesChapter 7 - Intro To Regular Income Taxation (RIT)claritaquijano526No ratings yet

- By Via Samantha de Austria: (Down Payment) (Face Value of Note) (Substantially Performed) (No Substantial Performance)Document6 pagesBy Via Samantha de Austria: (Down Payment) (Face Value of Note) (Substantially Performed) (No Substantial Performance)Via Samantha de AustriaNo ratings yet

- Chapter 5: Job Order Costing System: Characteristics of Production ProcessDocument3 pagesChapter 5: Job Order Costing System: Characteristics of Production ProcessANo ratings yet

- 2 Assignment For Midterm - Merchandising Business: (Periodic System)Document4 pages2 Assignment For Midterm - Merchandising Business: (Periodic System)Lisa PalermoNo ratings yet

- Manufacturing Account LESSON NOTESDocument11 pagesManufacturing Account LESSON NOTESKourtnee Francis100% (2)

- Cost Accounting: An IntroductionDocument24 pagesCost Accounting: An IntroductionAritra DeyNo ratings yet

- Vertical Income Statement: FormatDocument5 pagesVertical Income Statement: FormatHermann Schmidt EbengaNo ratings yet

- WK 2 Manufacturing AccountsDocument32 pagesWK 2 Manufacturing AccountsmensahshadrachnyarkoNo ratings yet

- Manufacturing AccountsDocument5 pagesManufacturing AccountsADEYANJU AKEEMNo ratings yet

- Company Final Accounts ChapterDocument13 pagesCompany Final Accounts Chaptershanthala mNo ratings yet

- Accounting for manufacturing financial statementsDocument7 pagesAccounting for manufacturing financial statementsAlyx Gabrielle GocoNo ratings yet

- FormulasDocument5 pagesFormulasKezNo ratings yet

- Strategic Cost ManagementDocument6 pagesStrategic Cost ManagementMa. Elizabeth PaglicawanNo ratings yet

- Cost Accounting: An IntroductionDocument38 pagesCost Accounting: An IntroductionSwastik SahooNo ratings yet

- Vertical Income Statement TemplateDocument2 pagesVertical Income Statement TemplateForam VasaniNo ratings yet

- Cost Accounting PDFDocument22 pagesCost Accounting PDFLaiba Javed Javed IqbalNo ratings yet

- Profit Loss StatementDocument3 pagesProfit Loss StatementSimphiwe NandoNo ratings yet

- AFAR FORMULAS EXPLAINEDDocument53 pagesAFAR FORMULAS EXPLAINEDEmma Mariz GarciaNo ratings yet

- Proforma Statement of Comprehensive Income Including NotesDocument8 pagesProforma Statement of Comprehensive Income Including NotesAldrin ZolinaNo ratings yet

- Accounting 2 (FMI) 2024 DR - Mohiy Samy LectureDocument9 pagesAccounting 2 (FMI) 2024 DR - Mohiy Samy LectureAmr HassanNo ratings yet

- Presented By:: Sugam Magar Dinesh Basnet Saroj Shrestha Nyima Lama Suman KarkiDocument9 pagesPresented By:: Sugam Magar Dinesh Basnet Saroj Shrestha Nyima Lama Suman KarkiSaroj ShresthaNo ratings yet

- Cost SheetDocument21 pagesCost SheetSmriti SahuNo ratings yet

- Cost Sheet / Cost StatementDocument2 pagesCost Sheet / Cost StatementMd Alamger KhanNo ratings yet

- Consolidated Financial Statement ExerciseDocument4 pagesConsolidated Financial Statement ExerciseAnonymous OzWtUONo ratings yet

- Final Accounts of SoletradersDocument9 pagesFinal Accounts of SoletradersShanavaz AsokachalilNo ratings yet

- Note 1: Cash Cash EquivalentsDocument2 pagesNote 1: Cash Cash Equivalentspongs123No ratings yet

- MT1 Ch29Document12 pagesMT1 Ch29api-3725162No ratings yet

- 13 Consolidated Financial StatementDocument5 pages13 Consolidated Financial StatementabcdefgNo ratings yet

- Preparation of financial statements for limited companiesDocument9 pagesPreparation of financial statements for limited companiesHeavens MupedzisaNo ratings yet

- Week 02 - Manufacturing AccountsDocument7 pagesWeek 02 - Manufacturing AccountsTeresa ManNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- CCD CasestudyDocument12 pagesCCD CasestudyBhumikaNo ratings yet

- BHEL Financial Statement AnalysisDocument10 pagesBHEL Financial Statement Analysisashish_verma_22No ratings yet

- Capital Structure - 1Document25 pagesCapital Structure - 1bakhtiar2014No ratings yet

- Accounting MasterclassDocument9 pagesAccounting MasterclassJemal SeidNo ratings yet

- Solution Manual For Financial Management Theory and Practice 14th Edition by BrighamDocument28 pagesSolution Manual For Financial Management Theory and Practice 14th Edition by BrighamKennethOrrmsqi100% (43)

- United-Guardian 1st Quarter 2021 Letter To StockholdersDocument4 pagesUnited-Guardian 1st Quarter 2021 Letter To StockholdersMatt EbrahimiNo ratings yet

- Lecture 8Document48 pagesLecture 8Zixin GuNo ratings yet

- Balance Sheet & Ratio AnalysisDocument24 pagesBalance Sheet & Ratio AnalysisPayal PatnaikNo ratings yet

- Reliance Industries Training PresentationDocument31 pagesReliance Industries Training PresentationMahesh KumarNo ratings yet

- Acc406 Exam GuideDocument35 pagesAcc406 Exam GuidePANASHE MARTIN MASANGUDZA0% (1)

- WildFinMan8e Ch01 PPTDocument60 pagesWildFinMan8e Ch01 PPTWaqar AmjadNo ratings yet

- Translating Foreign Currency Financial StatementsDocument32 pagesTranslating Foreign Currency Financial StatementsAnh Nguyen MinhNo ratings yet

- CFS Session 2 Equity FinancingDocument42 pagesCFS Session 2 Equity Financingaudrey gadayNo ratings yet

- Financial ManagementDocument145 pagesFinancial Managementmanuj_uniyal89No ratings yet

- CPU - Financial Acctg & Reporting II - CHAPTER 3Document17 pagesCPU - Financial Acctg & Reporting II - CHAPTER 3Princess Jonabelle BaylonNo ratings yet

- Elegant Beauty Salon Transactions Chart of AccountsDocument17 pagesElegant Beauty Salon Transactions Chart of AccountsTherese Noelle R. ARMADANo ratings yet

- Financial Reporting Conceptual Framework of Financial Accounting KeyDocument13 pagesFinancial Reporting Conceptual Framework of Financial Accounting KeySteffNo ratings yet

- Research Paper - EVA Indian Banking SectorDocument14 pagesResearch Paper - EVA Indian Banking SectorAnonymous rkZNo8No ratings yet

- Evervantage Consulting Services OverviewDocument15 pagesEvervantage Consulting Services OverviewChandra ShekarNo ratings yet

- Raman BSDocument4 pagesRaman BSYenkee Adarsh AroraNo ratings yet

- sumu.com.docxDocument35 pagessumu.com.docxnageena aNo ratings yet

- H05. Statement of Changes in EquityDocument3 pagesH05. Statement of Changes in EquityMaryrose SumulongNo ratings yet

- Integ Case 1 FsDocument7 pagesInteg Case 1 FsIra BenitoNo ratings yet

- Im Acco 01bc Fundamentals of Accounting Part 1Document110 pagesIm Acco 01bc Fundamentals of Accounting Part 1Mikaella Del Rosario100% (1)

- Exercises w3Document6 pagesExercises w3hqfNo ratings yet

- Hindenburgresearch Com AdaniDocument20 pagesHindenburgresearch Com AdaniOmkar KambleNo ratings yet