Professional Documents

Culture Documents

A Small Business

A Small Business

Uploaded by

MarkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Small Business

A Small Business

Uploaded by

MarkCopyright:

Available Formats

Cre

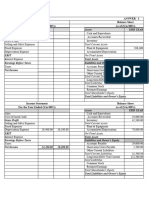

EntYour Company name Balance sheet

AssAssets

EntCurrent assets: Previous year Current year Current assets will likely be converted into cash within one year

Cash 46.00 18.00

Investments - -

Inventories - -

Accounts receivable 16.00 -

Pre-paid expenses (e.g. insurance) 2.00 -

Other - -

Total current assets 64.00 18.00

EntFixed assets: Previous year Current year

Property and equipment 32.00 32.00 Capitalizing the asset (stand and land)

Leasehold improvements - -

Equity and other investments - -

Less accumulated depreciation - 5.00 - 5.00

Total fixed assets 27.00 27.00

EntOther assets: Previous year Current year

Goodwill - -

Total other assets - -

TotTotal assets 91.00 45.00

LiaLiabilities and owner’s equity

EntCurrent liabilities: Previous year Current year

Accounts payable 32.00 - goods or services short term

Notes payable - - cash long term interests

Accrued wages - -

Accrued compensation - -

Income tax payable 14.00 -

Unearned revenue - -

Other - -

Total current liabilities 46.00 -

EntLong-term liabilities: Previous year Current year

Mortgage payable - -

Total long-term liabilities - - 13.5

EntOwner’s equity: Previous year Current year

Investment capital 5.00 5.00

Accumulated retained earnings 40.00 40.00

Earnings year to date - Earnings = Net Profit on I/S

Total owner’s equity 45.00 45.00

TotTotal liabilities and owner’s equity 91.00 45.00

Pre Balance - -

Capitalize something that lasts longer than a year

Expense insignificant items, even if it lasts longer than a year (e.g. trash can)

>> A company can pick a set threshhold amount for expensing/capitalizing (i.e. $500)

Net book value: purchase price (of fixed assets) minus depriciation Depreciation is a non-cash expense

Cash runs the business, not profits!

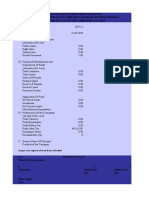

Company name

Income Statement

For the year that ended [enter date]

Income

Gross sales £ 50.00

Less: Sales returns and allowances

Net sales £ 50.00

Cost of goods sold

Beginning inventory £ 10.00

Add: Purchases £ 30.00 (sugar2, lemons10)

Direct labour

Indirect expenses

Inventory available £ 40.00

Less: Ending inventory £ 10.00

Cost of goods sold £ 30.00

Gross profit (Loss) £ 20.00

Expenses

Glass rental fee £ -

Advertising £ -

Rent of space £ -

Wages & Direct Cost £ 4.00

Commissions £ -

Supplies £ -

Marketing £ -

Logistics £ -

Repairs and maintenance £ -

Miscellaneous £ -

Depreciation £ 4.00

Insurance*

Bad debt*

Interest £ -

Total expenses £ 8.00

Net operating income £ 12.00

Other income

Gain (loss) on sale of assets

Interest income (tAx) -£ 3.00

Total other income -£ 3.00

Net income (Loss) £ 9.00

*I/S connects the beginning BS and the ending BS

I/S Doesn't include capitalized investments (i.e. fixed assets)

Company name

Income Statement

For the year that ended [enter date]

Income

Gross sales

Less: Sales returns and allowances

Net sales £ -

Cost of goods sold

Beginning inventory £ 10.00

Add: Purchases

Direct labou £ -

Indirect expenses

Inventory available £ 10.00

Less: Ending inve £ -

Cost of goods sold £ 10.00

Gross profit (Loss) -£ 10.00

Expenses

Glass rental fee £ -

Advertising £ -

Rent of space £ -

Wages & Direct Cost £ -

Commissions £ -

Supplies £ -

Marketing £ -

Logistics £ -

Repairs and maintenanc £ -

Miscellaneous £ -

Depreciation £ -

Insurance* £ -

Bad debt* £ -

Interest £ -

Total expenses £ -

Net operating income -£ 10.00

Other income

Gain (loss) on sale of as £ -

Interest income

Total other income £ -

Net income (Loss) -£ 10.00

Company Name

Cash Flow

Forecast

Starting cash on hand £ 59.00 Starting date Feb 2023 Cash minimum balance alert £ -

February 2023 March 2023 April 2023 May 2023 June 2023 July 2023 August 2023 ### October 2023 ### ### January 2024

Total

Cash on hand (beginning of month £ 59.00 £ 41.00 £ - £ - £ - £ - £ - £ - £ - £ - £ - £ -

Cash Receipts

Cash sales £ 40.00 £ 50.00 £ - £ - £ - £ - £ - £ - £ - £ - £ - £ - £ 90.00

Returns and allowances £ - £ -

Collections on accounts receivable £ 5.00 £ 5.00

Interest, other income £ -

Loan proceeds £ -

Owner contributions £ -

Other receipts £ -

Total Cash Receipts £ 45.00 £ 50.00 £ - £ - £ - £ - £ - £ - £ - £ - £ - £ - £ 95.00

Total Cash Available £ 104.00 £ 91.00 £ - £ - £ - £ - £ - £ - £ - £ - £ - £ -

Cash Paid Out

Advertising £ - £ -

Commissions and fees £ - £ - £ - £ - £ - £ - £ - £ - £ - £ - £ - £ - £ -

Contract work £ - £ - £ - £ - £ - £ - £ -

Employee benefit schemes £ -

Insurance £ - £ - £ - £ - £ -

Interest expenses £ 27.00 £ 27.00

Materials and supplies (in COGS) £ 24.00 £ 21.00 £ - £ - £ - £ - £ - £ - £ - £ - £ - £ - £ 45.00

Meals and entertainment £ -

Mortgage interest £ -

Office expenses £ -

Other interest expense £ -

Pension and profit-sharing plan £ -

Purchases for resale £ -

Rent or lease £ -

Rent or lease: vehicles, equipment £ -

Repairs and maintenance £ 2.00 £ 2.00

Supplies (not in COGS) £ -

Taxes and licences £ -

Travel £ -

Utilities £ -

Wages (less emp. credits) £ -

Other expenses £ -

Other expenses £ -

Other expenses £ -

Miscellaneous £ -

Subtotal £ 53.00 £ 21.00 £ - £ - £ - £ - £ - £ - £ - £ - £ - £ - £ 74.00

Loan principal payment £ -

Capital purchases -£ 10.00 -£ 20.00 -£ 30.00

Other start-up costs £ -

To reserve and/or escrow £ -

Owners’ withdrawal -£ 4.00 -£ 4.00

Total Cash Paid Out £ 63.00 £ 45.00 £ - £ - £ - £ - £ - £ - £ - £ - £ - £ - £ 40.00

Cash on hand (end of month) £ 41.00 £ 46.00 £ - £ - £ - £ - £ - £ - £ - £ - £ - £ -

Other Operating Data

Sales volume (pounds)

Accounts receivable balance

Bad debt balance

Inventory on hand

Accounts payable balance

Depreciation

You might also like

- Uber Case Study Answers To QuestionsDocument3 pagesUber Case Study Answers To QuestionsLuis Quinones80% (5)

- Building Contract For A Home Owner Occupier Who Has Not Appointed A Consultant To Oversee The WorkDocument34 pagesBuilding Contract For A Home Owner Occupier Who Has Not Appointed A Consultant To Oversee The WorkAhsan MustaqeemNo ratings yet

- Cash Flow and Financial Planning Assignment - HM SampoernaDocument11 pagesCash Flow and Financial Planning Assignment - HM SampoernaReynaldi DimasNo ratings yet

- SCF AnswerDocument6 pagesSCF AnswerLynssej Barbon100% (1)

- DepEd Order No. 8 S. 2007 Canteen Report Format 1Document16 pagesDepEd Order No. 8 S. 2007 Canteen Report Format 1EUDOLFO FLORESNo ratings yet

- Essay AAS Supporting StatementsDocument2 pagesEssay AAS Supporting StatementsMartinho Savio Gonzaga SarmentoNo ratings yet

- Tutorial 8 - CIT Problems - Sample AnswerDocument13 pagesTutorial 8 - CIT Problems - Sample Answerhien cungNo ratings yet

- Hydrate Balance Sheet: AssetsDocument2 pagesHydrate Balance Sheet: AssetsMarco Thaddeus AlabaNo ratings yet

- Balance SheetDocument3 pagesBalance SheetIrfan GulNo ratings yet

- Venus Restaurant: Balance SheetDocument2 pagesVenus Restaurant: Balance SheetAbinash AgrawalNo ratings yet

- Axis Bank 1Document3 pagesAxis Bank 1Mayank RelanNo ratings yet

- Financial Projections TemplateDocument11 pagesFinancial Projections TemplatecarmendrwfNo ratings yet

- Company Name: (In Rs CRS) (In Rs CRS)Document9 pagesCompany Name: (In Rs CRS) (In Rs CRS)DineshNo ratings yet

- Financial Ratio Analysis Case StudyDocument10 pagesFinancial Ratio Analysis Case StudyGracel Joy VicenteNo ratings yet

- Audit Report 2020-2021Document10 pagesAudit Report 2020-2021Mirza AsadNo ratings yet

- Start-Up Expenses Year 1 (Starting Balance Sheet) : Fixed Assets Amount Notes Depreciation (Years)Document1 pageStart-Up Expenses Year 1 (Starting Balance Sheet) : Fixed Assets Amount Notes Depreciation (Years)Anthony Burson-ThomasNo ratings yet

- Assessment 3Document11 pagesAssessment 3Vinay SehrawatNo ratings yet

- Schedule III Financial StatementsDocument21 pagesSchedule III Financial StatementsKunal DixitNo ratings yet

- Annex III - Model Historical Financial StatementsDocument2 pagesAnnex III - Model Historical Financial StatementsING_PUICONNo ratings yet

- Balance SheetDocument3 pagesBalance SheetHarold Kent MendozaNo ratings yet

- Financial StatementsDocument5 pagesFinancial Statementskl2304013112No ratings yet

- Balance Sheet Template SimpleDocument2 pagesBalance Sheet Template SimpleYamini SultanaNo ratings yet

- EMBA2021 Corp. Statement of Financial PositionDocument10 pagesEMBA2021 Corp. Statement of Financial PositionhelloNo ratings yet

- Coffember Budget Control: Income SourceDocument7 pagesCoffember Budget Control: Income SourceMarco Thaddeus AlabaNo ratings yet

- Business Analysis and Valuation Quiz (10%)Document6 pagesBusiness Analysis and Valuation Quiz (10%)Evelyn AngNo ratings yet

- Self-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachDocument2 pagesSelf-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachTeodorico PelenioNo ratings yet

- Business Analysis and Valuation Quiz (10%)Document6 pagesBusiness Analysis and Valuation Quiz (10%)Evelyn AngNo ratings yet

- Balance-Sheet 2022Document1 pageBalance-Sheet 2022Misbah SajidNo ratings yet

- Blank FSDocument13 pagesBlank FSIndians Are RandiNo ratings yet

- Your Company Name Balance Sheet: AssetsDocument2 pagesYour Company Name Balance Sheet: AssetsMatessa AnneNo ratings yet

- Balance Sheet, ProjectedDocument3 pagesBalance Sheet, ProjectedaakichipsNo ratings yet

- Teamwork Assignment - Financial statement analysisDocument3 pagesTeamwork Assignment - Financial statement analysisthuqta22410No ratings yet

- Balance-Sheet 2017Document1 pageBalance-Sheet 2017Misbah SajidNo ratings yet

- Vertical Analysis ExerciseDocument8 pagesVertical Analysis ExerciseEloise April G BalasabasNo ratings yet

- Cma DataDocument7 pagesCma Datasandeep thakurNo ratings yet

- Report of Condition Total AssetsDocument8 pagesReport of Condition Total AssetsJohn Joshua S. GeronaNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementamarrcNo ratings yet

- Score Financial Spreadsheet TemplateDocument29 pagesScore Financial Spreadsheet TemplateMohamed Shaffaf Ali RasheedNo ratings yet

- Bittnet ROIC 2017Document4 pagesBittnet ROIC 2017antics20No ratings yet

- Cash FlowDocument10 pagesCash FlowAmani AltarefeNo ratings yet

- Subroscon Consultants Balance Sheet Assets 2017 2018Document2 pagesSubroscon Consultants Balance Sheet Assets 2017 2018Alisha PaulNo ratings yet

- Workshop 1 - Accounting Statements and Posting Entries Solution v2Document12 pagesWorkshop 1 - Accounting Statements and Posting Entries Solution v2Karina BenítezNo ratings yet

- Seat Foodie Financial StatementsDocument6 pagesSeat Foodie Financial Statementsapi-542433757No ratings yet

- Chapter 2 Discussion Questions Rev 0Document6 pagesChapter 2 Discussion Questions Rev 0Hayley SNo ratings yet

- 02 08 PPE CapEx Depreciation BeforeDocument6 pages02 08 PPE CapEx Depreciation BeforeShaheer AhmedNo ratings yet

- Cash Flow ModuleDocument5 pagesCash Flow ModuleEmzNo ratings yet

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocument4 pagesProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNo ratings yet

- About This TemplateDocument4 pagesAbout This TemplatePortia McNaughtonNo ratings yet

- FINS1613: Business Finance: Semester 1, 2017 Section III: Capital Budgeting The Indirect MethodDocument7 pagesFINS1613: Business Finance: Semester 1, 2017 Section III: Capital Budgeting The Indirect MethodHoward QinNo ratings yet

- Your Company Name: Balance Sheet Projection - Quaterly Fiscal Year End DateDocument10 pagesYour Company Name: Balance Sheet Projection - Quaterly Fiscal Year End DateVochariNo ratings yet

- FinancialPlan BalanceSheetDocument1 pageFinancialPlan BalanceSheetmkyxxNo ratings yet

- Thormyon Publication Pvt. LTD.: Battishputali, Kathmandu Balance - Sheet As at End of 32nd Ashadh, 2077Document8 pagesThormyon Publication Pvt. LTD.: Battishputali, Kathmandu Balance - Sheet As at End of 32nd Ashadh, 2077sudhakar ShakyaNo ratings yet

- Two-Year Balance Sheet With Instructions1Document3 pagesTwo-Year Balance Sheet With Instructions1Baljeet SinghNo ratings yet

- Basic Balance SheetDocument3 pagesBasic Balance SheetJean Marc LouisNo ratings yet

- Tarea - 3 Bis - Caso Dyaton Products - Formato ADocument8 pagesTarea - 3 Bis - Caso Dyaton Products - Formato AMiguel VázquezNo ratings yet

- Summary and Self-Test: AccountingDocument1 pageSummary and Self-Test: AccountingNAZMUL HAQUENo ratings yet

- Template For Financial ProjectionDocument32 pagesTemplate For Financial ProjectionRussel Jess HeyranaNo ratings yet

- Trust FP1Document1 pageTrust FP1Shaira May Dela CruzNo ratings yet

- Overview Financial Statements With Ration AnalysisDocument13 pagesOverview Financial Statements With Ration AnalysisPamela Abegail MonsantoNo ratings yet

- Smart Accounting PowerpointDocument36 pagesSmart Accounting PowerpointwanmustaffaNo ratings yet

- (Company Name) : Balance SheetDocument4 pages(Company Name) : Balance SheetSoban MajeedNo ratings yet

- Accounting Insights Into Entrepreneurial FinanceDocument49 pagesAccounting Insights Into Entrepreneurial FinanceJa takNo ratings yet

- Capistrano's Shape Up Center Balance Sheet: As of January 31, 2020Document2 pagesCapistrano's Shape Up Center Balance Sheet: As of January 31, 2020Ryan CapistranoNo ratings yet

- Accounting For PPEDocument4 pagesAccounting For PPEMaureen Derial PantaNo ratings yet

- SL - No Period Topics To Be Covered Teaching Aid Date Engaged Remarks Course Objectives Course OutcomesDocument10 pagesSL - No Period Topics To Be Covered Teaching Aid Date Engaged Remarks Course Objectives Course Outcomespavithra paviNo ratings yet

- Final Draft Business Envirnment Assignment Iman HaseebDocument23 pagesFinal Draft Business Envirnment Assignment Iman HaseebimanNo ratings yet

- Resources Global IPO Product SheetDocument12 pagesResources Global IPO Product SheetTony LeongNo ratings yet

- CFW 51 W 119Document2 pagesCFW 51 W 119Sales HBS SolutionsNo ratings yet

- Chapter 10 Kalakota UASDocument38 pagesChapter 10 Kalakota UASBramantiyo Eko PutroNo ratings yet

- Summary of SA 570 - Going ConcernDocument2 pagesSummary of SA 570 - Going ConcerngbcadminNo ratings yet

- Thesis Paper Acknowledgement SampleDocument4 pagesThesis Paper Acknowledgement Sampledwbeqxpb100% (1)

- Download Accounting Principles 9Th Canadian Edition Vol 1 Jerry J Weygandt online ebook texxtbook full chapter pdfDocument69 pagesDownload Accounting Principles 9Th Canadian Edition Vol 1 Jerry J Weygandt online ebook texxtbook full chapter pdfmary.franklin534100% (10)

- Your Ticket: Merwan BourknaDocument1 pageYour Ticket: Merwan BourknaMerwan BourknaNo ratings yet

- 23 March 2022 One PlusDocument1 page23 March 2022 One PlusVikas VermaNo ratings yet

- First Namelast Name Title Company: Rudri LTD Chief Executive Officer C-LevelDocument12 pagesFirst Namelast Name Title Company: Rudri LTD Chief Executive Officer C-LevelkhanmujahedNo ratings yet

- Simple InterestDocument44 pagesSimple InterestAlecs ContiNo ratings yet

- Tender Document - Mega Projects (Ready For Take Off)Document48 pagesTender Document - Mega Projects (Ready For Take Off)david selekaNo ratings yet

- Financial Management, Principles and ApplicationsDocument15 pagesFinancial Management, Principles and ApplicationsOsama SaleemNo ratings yet

- Af302 Semester 1 - 2017 Mid-Test Solutions: Question 1 Multiple Choice SolutionsDocument9 pagesAf302 Semester 1 - 2017 Mid-Test Solutions: Question 1 Multiple Choice SolutionsChand DivneshNo ratings yet

- SWOT Analysis of Telecom Sector in IndiaDocument28 pagesSWOT Analysis of Telecom Sector in IndiaBhakti AgarwalNo ratings yet

- List of Properties and Status: Total Transfer Tax Payment: 2,420.00Document18 pagesList of Properties and Status: Total Transfer Tax Payment: 2,420.00JessiePatronNo ratings yet

- Choosing The Right Business StructureDocument2 pagesChoosing The Right Business Structuresky wingNo ratings yet

- Contoh Tugasan AccountDocument20 pagesContoh Tugasan AccountMuhammad IddinNo ratings yet

- Impact of Social Media On Consumer Behaviour: June 2020Document26 pagesImpact of Social Media On Consumer Behaviour: June 2020Shamol EuNo ratings yet

- Chilime Annual Report 2078-79Document92 pagesChilime Annual Report 2078-79Arun LuitelNo ratings yet

- 7 Techniques For Increasing Motivation: 1. Create A Positive Work EnvironmentDocument2 pages7 Techniques For Increasing Motivation: 1. Create A Positive Work EnvironmentNabeel YaqubNo ratings yet

- Footwear IndustryDocument50 pagesFootwear IndustryShraddha MaheshwariNo ratings yet

- FNSACC513 Assignment PDFDocument11 pagesFNSACC513 Assignment PDF陈功No ratings yet

- Analysis Information For Cross-Company Transactions (Delivery)Document7 pagesAnalysis Information For Cross-Company Transactions (Delivery)ambar10No ratings yet