0% found this document useful (0 votes)

2K views2 pages09 Log Book Format

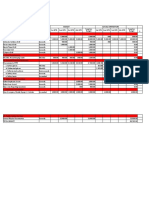

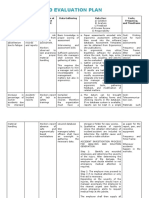

This document outlines the log book format for claiming conveyance reimbursement. It includes sections to record the vehicle details, odometer readings at the beginning and end of the month, total kilometers covered, fuel consumption, and details of official trips including dates, mileage, and purpose. Expenses incurred can be claimed including fuel bills, maintenance costs, toll charges, and driver's salary. The employee must declare the accuracy of the claim and supporting documents, and the employer must certify the expenses were for official use.

Uploaded by

venkyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views2 pages09 Log Book Format

This document outlines the log book format for claiming conveyance reimbursement. It includes sections to record the vehicle details, odometer readings at the beginning and end of the month, total kilometers covered, fuel consumption, and details of official trips including dates, mileage, and purpose. Expenses incurred can be claimed including fuel bills, maintenance costs, toll charges, and driver's salary. The employee must declare the accuracy of the claim and supporting documents, and the employer must certify the expenses were for official use.

Uploaded by

venkyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Vehicle Usage Form: This section contains a form layout related to official use of a personal vehicle for company business, including fields for details and approvals.

- Declaration: Includes a declaration statement by an employee regarding vehicle use, along with spaces for signatures and authorization.