Professional Documents

Culture Documents

Barclays Bank UK PLC Pillar 3 Report

Uploaded by

taohausCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Barclays Bank UK PLC Pillar 3 Report

Uploaded by

taohausCopyright:

Available Formats

Barclays Bank UK PLC

Q3 2022 Pillar 3 Report

30 September 2022

Table of Contents

Pillar 3 Page

Summary

UK KM1 - Key metrics 3

Risk weighted assets (RWA)

RWAs by risk type 5

OV1 - Overview of RWAs by risk type and capital requirements 6

CR8 - RWA flow statement of credit risk exposures under the advanced IRB approach 7

Liquidity

LIQ1 - Liquidity Coverage ratio 8

Notes

Forward-looking statements 10

Barclays Bank UK PLC 2

Summary

1 2

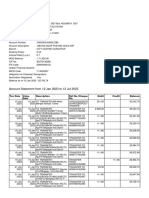

Table 1: UK KM1 - Key metrics (KM1 / IFRS9-FL / Article 468-FL / UK LR 2) - Part 1

This table shows key regulatory metrics and ratios as well as related components like own funds, RWAs, capital ratios, additional

requirements based on Supervisory Review and Evaluation Process (SREP), capital buffer requirements, leverage ratio and liquidity

coverage ratio.

Barclays Bank UK Group’s capital, RWAs and leverage is calculated applying transitional relief for IFRS9, no other transitional provisions in

CRR as amended by CRR II are applicable. The table below therefore represents both transitional and fully loaded capital metrics which is

equal to transitional capital and capital as if IFRS9 or analogous ECLs transitional arrangements had not been applied. Part 2 of this table

further includes all UK LR2 components which are required to be reported with a quarterly frequency as per Article 433a(4).

As at As at As at As at

KM1 IFRS9- 30.09.22 30.06.22 31.03.22 31.12.21

ref FL ref £m £m £m £m

Available own funds (amounts)

3

1 1 Common Equity Tier 1 (CET1) capital 10,662 10,536 10,641 10,828

4

1a 2 Fully loaded common Equity Tier 1 (CET1) capital 10,581 10,455 10,583 10,572

3

2 3 Tier 1 capital 13,222 13,096 13,201 13,388

4

2a 4 Fully loaded tier 1 capital 13,141 13,015 13,143 13,132

3

3 5 Total capital 15,993 15,877 16,037 16,442

4

3a 6 Fully loaded total capital 15,912 15,844 16,028 16,359

Risk-weighted exposure amounts

3

4 7 Total risk-weighted exposure amount 72,014 71,088 71,220 71,213

4

4a 8 Fully loaded total risk-weighted exposure amount 71,981 71,055 71,244 71,116

Capital ratios (as a percentage of risk-weighted exposure

amount)

3

5 9 Common Equity Tier 1 ratio (%) 14.8% 14.8% 14.9% 15.2%

4

5a 10 Fully loaded common Equity Tier 1 ratio (%) 14.7% 14.7% 14.9% 14.9%

3

6 11 Tier 1 ratio (%) 18.4% 18.4% 18.5% 18.8%

4

6a 12 Fully loaded tier 1 ratio (%) 18.3% 18.3% 18.4% 18.5%

3

7 13 Total capital ratio (%) 22.2% 22.3% 22.5% 23.1%

4

7a 14 Fully loaded total capital ratio (%) 22.1% 22.3% 22.5% 23.0%

Additional own funds requirements based on SREP (as a

percentage of risk-weighted exposure amount)

UK 7a Additional CET1 SREP requirements (%) 2.4% 2.4% 2.4%

UK 7b Additional AT1 SREP requirements (%) 0.8% 0.8% 0.8%

UK 7c Additional T2 SREP requirements (%) 1.0% 1.1% 1.1%

UK 7d Total SREP own funds requirements (%) 12.2% 12.2% 12.2%

Combined buffer requirement (as a percentage of risk-

weighted exposure amount)

8 Capital conservation buffer (%) 2.5% 2.5% 2.5% 2.5%

9 Institution specific countercyclical capital buffer (%) 0.0% 0.0% 0.0% 0.0%

UK 10a Other Systemically Important Institution buffer 1.0% 1.0% 1.0% 1.0%

11 Combined buffer requirement (%) 3.5% 3.5% 3.5% 3.5%

UK 11a Overall capital requirements (%) 15.7% 15.7% 15.7%

12 CET1 available after meeting the total SREP own funds 7.9% 7.9% 8.0%

requirements (%)

Notes

1. From 1 January 2018, Barclays Bank UK Group elected to apply the IFRS 9 transitional arrangements of the CRR. The transitional relief on the “day 1” impact

on adoption of IFRS 9 and on increases in non-defaulted provisions between “day 1” and 31 December 2019 is phased out over a 5 year period with 25%

applicable for 2022 and with no transitional relief from 2023. On 27 June 2020, CRR was amended to extend the transitional period by two years and to

introduce a new modified calculation. The transitional relief for increases in non-defaulted provisions between 1 January 2020 and the reporting date is also

phased out over a 5 year period with 75% applicable for 2022; 50% for 2023; 25% for 2024 and with no transitional relief from 2025.

2. As at 30 September 2022, Barclays Bank UK PLC had not elected to apply the temporary treatment specified in Article 468 of the CRR, amended by

Regulation EU 2020/873, resulting in the capital and leverage ratios reflecting the full impact of unrealised gains and losses measured at fair value through

other comprehensive income.

3. Transitional capital and RWAs are calculated applying the IFRS 9 transitional arrangements of the CRR as amended by CRR II.

4. Fully loaded capital and RWAs are calculated without applying the IFRS 9 transitional arrangements of the CRR as amended by CRR II.

CET1 ratio decreased by c140bps to 14.8% (December 2021: 15.2%) as CET1 capital decreased by £0.2bn and RWA increased by £0.8bn

The CET1 capital decrease reflects profits for the period which were more than offset by regulatory foreseeable dividends, decreases in the

fair value through other comprehensive income reserve and a decrease in IFRS9 transitional relief

RWAs increased by £0.8bn to £72.0bn (December 2021: £71.2bn) primarily driven by mortgage growth and implementation of IRB

roadmap changes. This was partially offset by the benefit in mortgages from an increase in the House Price Index (HPI) and maturity of

reverse repo trades

Barclays Bank UK PLC 3

Summary

Table 1: UK KM1 - Key metrics (KM1 / IFRS9-FL/ Article 468-FL / UK LR 2) - Part 2

As at As at As at As at

IFRS9 - LR 2 30.09.22 30.06.22 31.03.22 31.12.21

KM1 ref

FL ref Ref

£m £m £m £m

Leverage ratio

13 15 UK 24b Total exposure measure excluding claims on central 249,298 248,241 241,491 241,173

14 16 25 Leverage ratio excluding claims on central banks 5.3% 5.3% 5.5% 5.6%

Additional leverage ratio disclosure requirements

UK 14a 17 UK 25a Fully loaded ECL accounting model leverage ratio 5.3% 5.2% 5.4%

3

excluding claims on central banks (%)

2

UK 14b UK 25c Leverage ratio including claims on central banks (%) 4.2% 4.2% 4.1%

UK 14c UK 33 Average leverage ratio excluding claims on central 5.3% 5.3% 5.5% 5.5%

UK 14d UK 34 Average leverage ratio including claims on central 4.2% 4.2% 4.2%

UK 14e UK 27b Countercyclical leverage ratio buffer (%) 0.0% 0.0% 0.0%

UK 14f UK 27 Leverage ratio buffer (%) 0.4% 0.4% 0.4%

Liquidity Coverage Ratio

15 Total high-quality liquid assets (HQLA) (Weighted 82,528 81,548 80,530 77,863

5

UK 16a value)

Cash outflows - Total weighted value 44,584 43,766 42,837 42,339

UK 16b Cash inflows - Total weighted value 1,401 1,432 1,472 1,371

4

16 Total net cash outflows (adjusted value) 43,183 42,334 41,365 40,968

5

17 Liquidity coverage ratio (%) 191% 193% 195% 190%

17a Liquidity coverage ratio (%) (period end) 182% 185% 187% 204%

Notes

1. Transitional UK leverage ratios are calculated applying the IFRS 9 transitional arrangements of the CRR as amended by CRR II.

2. Fully loaded UK leverage ratio is calculated without applying the IFRS9 transitional arrangements of the CRR as amended by CRR II.

3. Average UK leverage ratio uses capital based on the last day of each month in the quarter and an exposure measure for each day in the quarter.

4. Prior period comparatives have been updated to reflect the average measures as amended by CRR II.

5. Liquidity Coverage Ratio computed as a trailing average of 12 month-end observations to the reporting date

The leverage ratio decreased to 5.3% (December 2021: 5.6%) primarily due to an increase in the leverage exposure of £8.1bn largely as a

result of an increase in loans and advances and other assets.

Barclays Bank UK PLC 4

Risk weighted assets

Table 2: RWAs by risk type

This table shows RWAs by risk type.

Credit risk Counterparty credit risk Market risk

Operational Total

Settlement risk RWAs

Std A-IRB Std A-IRB risk CVA Std IMA

As at 30 September 2022 £m £m £m £m £m £m £m £m £m £m

Barclays Bank UK PLC 5,313 55,0381 272 — 0 203 256 — 10,932 72,014

As at 31 December 2021

Barclays Bank UK PLC 5,326 53,687 829 — — 379 100 — 10,892 71,213

Barclays Bank UK PLC 5

Risk weighted assets

Table 3: OV1 - Overview of risk weighted exposure amounts

The table shows RWEAs and minimum capital requirement by risk type and approach

Risk weighted exposure amounts

Total own funds requirements

(RWEAs)

As at As at As at As at As at As at

1 1

30.09.22 30.06.22 31.12.21 30.09.22 30.06.22 31.12.21

£m £m £m £m £m £m

1 Credit risk (excluding CCR) 58,898 58,043 57,745 4,712 4,643 4,619

Of which the standardised 4,520 4,733 4,647 362 378 372

2

approach

4 Of which: slotting approach 489 489 500 39 39 40

Of which the advanced IRB (AIRB) 53,889 52,821 52,598 4,311 4,226 4,207

5

approach

6 Counterparty credit risk - CCR 475 529 1,208 38 42 97

Of which the standardised 206 193 244 16 15 20

7

approach

UK 8a Of which exposures to a CCP 41 37 198 3 3 16

Of which credit valuation 203 235 379 16 19 30

UK 8b

adjustment - CVA

9 Of which other CCR 25 64 387 2 5 31

15 Settlement risk 0 0 — — 0 —

Securitisation exposures in the non- 1,453 1,348 1,268 116 108 101

16

trading book (after the cap)

17 Of which SEC-IRBA approach 660 589 589 53 47 47

Of which SEC-ERBA (including — — 123 — — 10

18

IAA)

19 Of which SEC-SA approach 793 759 556 63 61 44

UK 19a Of which 1250%/ deduction — — — — — —

Position, foreign exchange and 256 236 100 20 19 8

20

commodities risks (Market risk)

Of which the standardised 256 236 100 20 19 8

21

approach

23 Operational risk 10,932 10,932 10,892 875 875 871

UK 23b Of which standardised approach 10,932 10,932 10,892 875 875 871

24 Amounts below the thresholds for 2,721 2,707 2,764 218 217 221

deduction (subject to 250% risk

weight) (For information)

29 Total 72,014 71,088 71,213 5,761 5,687 5,696

Overall RWAs increased £0.9bn to £72.0bn (June 2022: £71.1bn) primarily driven by:

• Credit risk RWAs increased £0.9bn to £58.9bn primarily driven by mortgage growth and implementation of IRB roadmap

changes. This was partially offset by the benefit in mortgages from an increase in the HPI and a reduction in carrying value of

2

ESHLA due to rising interest rates

Notes

1. Prior period comparatives have been updated to reflect the new CRR II requirements

2. Education, Social Housing and Local Authority

Barclays Bank UK PLC 6

Risk weighted assets

Table 4: CR8 - RWEA flow statements of credit risk exposures under the AIRB approach

The total in this table shows the contribution of credit risk RWAs under the AIRB approach and will not directly reconcile

to the CR AIRB RWAs in table 2.

Three months Nine months

ended ended

30 September 30 September

1

2022 2022

£m £m

1 Risk weighted exposure amount as at the end of the previous reporting period 50,110 49,853

2 Asset size 658 1,469

3 Asset quality (204) (2,488)

4 Model updates — —

5 Methodology and policy 799 2,684

6 Acquisitions and disposals (192) (347)

7 Foreign exchange movements — —

8 Other — —

9 Risk weighted exposure amount as at the end of the reporting period 51,171 51,171

Note

1. Opening balance has been updated to exclude Securitisation and non-credit obligation assets as per CRR II guidelines.

Three months ended advanced credit risk RWAs increased £1.1bn to £51.2bn primarily driven by:

• A £0.7bn increase in asset size primarily driven by mortgage growth

• A £0.8bn increase in methodology and policy primarily relating to implementation of IRB roadmap changes

Nine months ended advanced credit risk RWAs increased £1.3bn to £51.2bn primarily driven by:

• A £1.5bn increase in asset size primarily driven by mortgage growth

• A £2.5bn decrease in asset quality primarily driven by the benefit in mortgages from an increase in the HPI

• A £2.7bn increase in methodology and policy primarily relating to implementation of IRB roadmap changes

Barclays Bank UK PLC 7

Liquidity

Table 5: LIQ1 - Liquidity Coverage ratio

This table shows the level and components of the Liquidity Coverage Ratio prepared in accordance with the

requirements set out in the Annex XIV ‘Instructions on Liquidity requirements’ under Article 451a(2) CRR.

Liquidity coverage ratio (period end) Total period end value

30.09.22 30.06.22 31.03.22 31.12.21

£m £m £m £m

Liquidity buffer 81,750 83,201 81,140 85,092

Total net cash outflows 44,802 44,872 43,411 41,690

Liquidity coverage ratio (%) (period end) 182% 185% 187% 204%

LIQ1 - Liquidity coverage ratio (average)

Total unweighted value (average) Total weighted value (average)

UK-1a

30.09.22 30.06.22 31.03.22 31.12.21 30.09.22 30.06.22 31.03.22 31.12.21

UK-1b Number of data points used in calculation of 12 12 12 12 12 12 12 12

1

averages

High-quality liquid assets £m £m £m £m £m £m £m £m

1 Total high-quality liquid assets (HQLA) 82,528 81,548 80,530 77,863

Cash outflows

2 Retail deposits and deposits from small business

customers, of which: 223,600 223,823 223,497 221,275 17,246 17,089 16,863 16,512

3 Stable deposits 139,543 139,616 139,543 138,702 6,977 6,981 6,977 6,935

4 Less stable deposits 82,119 80,841 79,130 76,856 10,256 10,097 9,875 9,568

5 Unsecured wholesale funding, of which: 38,807 37,792 36,489 35,634 18,203 17,436 16,622 16,399

6 Operational deposits (all counterparties) and

deposits in networks of cooperative banks 6,945 6,764 6,647 6,529 1,596 1,551 1,522 1,496

2

7 Non-operational deposits (all counterparties) 27,229 26,877 26,220 25,193 11,974 11,734 11,478 10,991

8 Unsecured debt 4,633 4,151 3,623 3,912 4,633 4,151 3,623 3,912

9 Secured wholesale funding 74 74 73 4

10 Additional requirements, of which: 12,869 16,517 19,112 19,343 4,904 5,249 5,526 5,525

11 Outflows related to derivative exposures and other

collateral requirements 4,057 4,195 4,317 4,472 4,057 4,195 4,317 4,472

12 Outflows related to loss of funding on debt products 264 264 264 83 264 264 264 83

13 Credit and liquidity facilities 8,548 12,057 14,530 14,788 583 790 944 970

14 Other contractual funding obligations 353 288 243 219 21 — — —

15 Other contingent funding obligations 49,017 45,712 44,159 47,881 4,137 3,919 3,753 3,899

16 Total cash outflows 44,584 43,766 42,837 42,339

Cash inflows

17 Secured lending (e.g. reverse repos) 1,979 3,004 3,106 2,738 — — — —

18 Inflows from fully performing exposures 1,438 1,636 1,811 1,870 745 826 911 939

3

19 Other cash inflows 2,467 2,359 2,234 2,009 657 606 561 432

UK-19a (Difference between total weighted inflows and

total weighted outflows arising from transactions in

third countries where there are transfer restrictions

or which are denominated in non-convertible — — — —

UK-19b currencies)

(Excess inflows from a related specialised credit — — — —

20 institution)

Total cash inflows 5,883 6,999 7,151 6,617 1,401 1,432 1,472 1,371

UK-20a Fully exempt inflows — — — — — — — —

UK-20b Inflows subject to 90% cap — — — — — — — —

UK-20c Inflows subject to 75% cap 5,883 6,999 7,151 6,617 1,401 1,432 1,472 1,371

UK-21 Liquidity buffer 82,528 81,548 80,530 77,863

22 Total net cash outflows 43,183 42,334 41,365 40,968

23 Liquidity coverage ratio (%) (average) 191% 193% 195% 190%

Notes

1. Trailing average of 12 month-end observations to the reporting date.

2. Non-operational deposits in row 7 include excess deposits as defined in the Delegated Act Article 27(4).

3. Difference between total weighted inflows and total weighted outflows arising from transactions in third countries where there is transfer restrictions or

which are denominated in non-convertible currencies.

Barclays Bank UK PLC 8

Liquidity

The liquidity pool as at 30 September 2022 was £83bn (December 2021: £86bn) and the liquidity coverage ratio (LCR)

remained significantly above the 100% regulatory requirement at 182% (December 2021: 204%), equivalent to a surplus of

£37bn (December 2021: £43bn). The decrease in the liquidity pool was driven by loan growth and wholesale funding

maturities in the first quarter of 2022. A slight increase in net stress outflows, related to higher short term commercial paper

balances, resulted in a reduction in the LCR surplus. The trailing 12 month-end average LCR to 30 September 2022

remained broadly stable at 191% (December 2021: 190%).

The composition of the liquidity pool is subject to limits set by the Board and the independent liquidity risk, credit risk and

market risk functions. In addition, the investment of the liquidity pool is monitored for concentration risk by issuer, currency

and asset type. Given the returns generated by these highly liquid assets, the risk and reward profile is continuously

managed.

The strong deposit franchise is a primary funding source for Barclays Bank UK PLC. Barclays Bank UK PLC continued to issue

in the shorter-term markets and maintain capacity to issue from secured funding programmes. This funding capacity

enables Barclays Bank UK PLC to maintain its stable and diversified funding base.

Barclays Bank UK PLC also supports various central bank monetary initiatives, such as the Bank of England’s Term Funding

Scheme with additional incentives for SMEs (TFSME). These are reported under ‘repurchase agreements and other similar

secured borrowing’ on the balance sheet.

Barclays Bank UK PLC 9

Notes

Barclays Bank UK PLC is a wholly-owned subsidiary of Barclays PLC. The consolidation of Barclays Bank UK PLC and its

subsidiaries is referred to as the Barclays Bank UK Group. The term Barclays refers to Barclays PLC and Barclays Group refers

to Barclays PLC, together with its subsidiaries. The abbreviations ‘£m’ and ‘£bn’ represent millions and thousands of

millions of Pounds Sterling respectively.

There are a number of key judgement areas, for example impairment calculations, which are based on models and which

are subject to ongoing adjustment and modifications. Reported numbers reflect best estimates and judgements at the given

point in time.

Relevant terms that are used in this document but are not defined under applicable regulatory guidance or International

Financial Reporting Standards (IFRS) are explained in the results glossary that can be accessed at home.barclays/investor-

relations/reports-and-events/latest-financial-results.

Forward-looking statements

This document contains certain forward-looking statements with respect to the Barclays Bank UK Group. Barclays cautions

readers that no forward-looking statement is a guarantee of future performance and that actual results or other financial

condition or performance measures could differ materially from those contained in the forward-looking statements.

Forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-

looking statements sometimes use words such as ‘may’, ‘will’, ‘seek’, ‘continue’, ‘aim’, ‘anticipate’, ‘target’, ‘projected’,

‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’, ‘believe’, ‘achieve’ or other words of similar meaning. Forward-looking statements

can be made in writing but also may be made verbally by members of the management of the Barclays Bank UK Group

(including, without limitation, during management presentations to financial analysts) in connection with this document.

Examples of forward-looking statements include, among others, statements or guidance regarding or relating to the

Barclays Bank UK Group’s future financial position, income levels, assets and liabilities, impairment charges, provisions,

capital, leverage and other regulatory ratios, capital distributions (including dividend pay-out ratios and expected payment

strategies), projected levels of growth in banking and financial markets, projected expenditures, costs or savings, any

commitments and targets (including, without limitation, environmental, social and governance (ESG) commitments and

targets), business strategy, plans and objectives for future operations, group structure, International Financial Reporting

Standards (IFRS) impacts and other statements that are not historical or current facts. By their nature, forward-looking

statements involve risk and uncertainty because they relate to future events and circumstances. Forward-looking

statements speak only as at the date on which they are made. Forward-looking statements may be affected by a number of

factors, including, without limitation: changes in legislation, regulation and the interpretation thereof, the development of

IFRS and other accounting standards, including evolving practices with regard to the interpretation and application of

accounting standards, emerging and developing ESG reporting standards, the outcome of current and future legal

proceedings and regulatory investigations and any related impact on provisions, the policies and actions of governmental

and regulatory authorities, the Barclays Bank UK Group’s ability along with governments and other stakeholders to

measure, manage and mitigate the impacts of climate change effectively, environmental, social and geopolitical risks and

incidents or similar events beyond the Barclays Bank UK Group’s control, and the impact of competition. In addition, factors

including (but not limited to) the following may have an effect: capital, leverage and other regulatory rules applicable to

past, current and future periods; macroeconomic and business conditions in the UK and in any systemically important

economy which impacts the UK; volatility in credit and capital markets; market related risks such as changes in interest

rates and foreign exchange rates; changes in valuation of credit market exposures; changes in valuation of issued securities;

changes in credit ratings of any entity within the Barclays Bank UK Group or any securities issued by such entities; changes

in counterparty risk; changes in consumer behaviour; the direct and indirect consequences of the Russia-Ukraine War on

European and global macroeconomic conditions, political stability and financial markets; direct and indirect impacts of the

coronavirus (COVID-19) pandemic; instability as a result of the UK’s exit from the European Union (EU), the effects of the

EU-UK Trade and Cooperation Agreement and the disruption that may subsequently result in the UK; the risk of cyber-

attacks, information or security breaches or technology failures on the Barclays Bank UK Group’s reputation, business or

operations; the Barclays Bank UK Group’s ability to access funding; and the success of acquisitions, disposals and other

strategic transactions. A number of these influences and factors are beyond the Barclays Bank UK Group’s control. As a

result, the Barclays Bank UK Group’s actual financial position, future results, capital distributions, capital, leverage or other

regulatory ratios or other financial and nonfinancial metrics or performance measures or ability to meet commitments and

targets may differ materially from the statements or guidance set forth in the Barclays Bank UK Group’s forward-looking

statements. Additional risks and factors which may impact the Barclays Bank UK Group’s future financial condition and

performance are identified in the Barclays Bank UK PLC’s 2021 Annual Report, which is available on home.barclays.

Subject to Barclays’ obligations under the applicable laws and regulations of any relevant jurisdiction, (including, without

limitation, the UK), in relation to disclosure and ongoing information, we undertake no obligation to update publicly or

revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Barclays Bank UK PLC 10

You might also like

- Barclays PLC Pillar 3 ReportDocument13 pagesBarclays PLC Pillar 3 ReporttaohausNo ratings yet

- 19 A1 (1)-107-115Document9 pages19 A1 (1)-107-115thelilskywalkerNo ratings yet

- Pillar 3 Report 2021 - 931174233Document62 pagesPillar 3 Report 2021 - 931174233Sophiya RanaNo ratings yet

- Calculation of CAR After 20% PayoutDocument1 pageCalculation of CAR After 20% PayoutUmair IqbalNo ratings yet

- 2019 Westpac Group Full Year TablesDocument25 pages2019 Westpac Group Full Year TablesAbs PangaderNo ratings yet

- Deutsche Bank - 4Q2016 Results: 02 February 2017Document49 pagesDeutsche Bank - 4Q2016 Results: 02 February 2017ovitrNo ratings yet

- PL M18 FM Student Mark Plan WebDocument9 pagesPL M18 FM Student Mark Plan WebIQBAL MAHMUDNo ratings yet

- Midland WACC CalculationsDocument19 pagesMidland WACC CalculationsRyan Domke50% (2)

- ESG - Port Optim + DCF Adjustments (Shcheglova Mariia)Document27 pagesESG - Port Optim + DCF Adjustments (Shcheglova Mariia)Мария ЩегловаNo ratings yet

- UGG ValuationDocument7 pagesUGG ValuationPritam KarmakarNo ratings yet

- ch19 B Cash-Flow-To-Equity ModelDocument11 pagesch19 B Cash-Flow-To-Equity ModelLuiz F ReisNo ratings yet

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDocument4 pagesMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniNo ratings yet

- fm4chapter03 기업가치평가Document45 pagesfm4chapter03 기업가치평가quynhnhudang5No ratings yet

- Chapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocument21 pagesChapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesJITIN ARORANo ratings yet

- Fma17 Bericht enDocument192 pagesFma17 Bericht enjamesNo ratings yet

- Company Equity Enterprise Value Sales Gross Profit: Market Valuation LTM Financial StatisticsDocument34 pagesCompany Equity Enterprise Value Sales Gross Profit: Market Valuation LTM Financial StatisticsRafał StaniszewskiNo ratings yet

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocument5 pagesIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNo ratings yet

- Measuring Banks Performance 1606494463Document3 pagesMeasuring Banks Performance 1606494463Syed Tanvir AhmedSHUVI ShuvoNo ratings yet

- Ashu 7Document16 pagesAshu 7Mansi ParmarNo ratings yet

- Fin 3B LAO 2017 FinalDocument14 pagesFin 3B LAO 2017 Final221103909No ratings yet

- Cost of War Through March 31, 2018Document76 pagesCost of War Through March 31, 2018CNBC.comNo ratings yet

- Ratio Analysis-Overview Ratios:: CaveatsDocument14 pagesRatio Analysis-Overview Ratios:: CaveatsEng abdifatah saidNo ratings yet

- Q2 2020 Earnings Presentation American Tower CorporationDocument25 pagesQ2 2020 Earnings Presentation American Tower CorporationKenya ToledoNo ratings yet

- Lindsell Train 2020 Q1 LetterDocument2 pagesLindsell Train 2020 Q1 LetterpatientbioinvestNo ratings yet

- FCFF Valuation of Coal Mining Company PTBADocument16 pagesFCFF Valuation of Coal Mining Company PTBACOKDEHNo ratings yet

- Lloyds Banking Group PLC 2017 Q1 RESULTSDocument33 pagesLloyds Banking Group PLC 2017 Q1 RESULTSsaxobobNo ratings yet

- CalculatingtheWACC 911bb13Document5 pagesCalculatingtheWACC 911bb13Live ExpertNo ratings yet

- Case 1 - Midland WACC - Team 8Document3 pagesCase 1 - Midland WACC - Team 8Fath DiwirjaNo ratings yet

- Arab Bank SwitzerlandDocument7 pagesArab Bank Switzerlandumar sohailNo ratings yet

- Transport CSX-Q1-2021-Earnings-Presentation - FINALDocument18 pagesTransport CSX-Q1-2021-Earnings-Presentation - FINALIan TanNo ratings yet

- Fixed Income Investor PresentationDocument15 pagesFixed Income Investor PresentationHieu Nguyen MinhNo ratings yet

- Boeing CaseDocument7 pagesBoeing CaseMengdi ZhangNo ratings yet

- 2023 q1 Earnings Results PresentationDocument14 pages2023 q1 Earnings Results PresentationZerohedgeNo ratings yet

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018Document32 pagesBanco Santander Chile 3Q18 Earnings Report: October 31, 2018manuel querolNo ratings yet

- Calculation of Return and WACC: Wacc E D+ E × + D D+E × RDDocument3 pagesCalculation of Return and WACC: Wacc E D+ E × + D D+E × RDTamim ChowdhuryNo ratings yet

- Corporate Valuation ConceptsDocument810 pagesCorporate Valuation ConceptsSupplies DepotNo ratings yet

- FY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Document1 pageFY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Divyank JyotiNo ratings yet

- Midlands Case StudyDocument5 pagesMidlands Case Studyjvbd dsvsdvNo ratings yet

- PI Industries Ratios Analysis: ROA, Margins, Debt RatiosDocument5 pagesPI Industries Ratios Analysis: ROA, Margins, Debt RatiosRehan TyagiNo ratings yet

- Trade-Off Between Risk & ReturnDocument23 pagesTrade-Off Between Risk & Returnmarlon ventulanNo ratings yet

- The Presentation Materials 3Q22Document36 pagesThe Presentation Materials 3Q22ZerohedgeNo ratings yet

- CitiRepaying TARPDocument20 pagesCitiRepaying TARPychartsNo ratings yet

- Lancaster Engineering IncDocument2 pagesLancaster Engineering IncMamunoor RashidNo ratings yet

- Karnataka Bank LimitedDocument9 pagesKarnataka Bank LimitedDhanusha RajuNo ratings yet

- Supply Chain Customer Consignment Update AECDocument46 pagesSupply Chain Customer Consignment Update AECEnrique MoralesNo ratings yet

- Corporate Finance 4b WACCDocument25 pagesCorporate Finance 4b WACCMeghana ErapagaNo ratings yet

- WACC and CAPM analysis of Wockhardt and FortisDocument2 pagesWACC and CAPM analysis of Wockhardt and FortisYYASEER KAGDINo ratings yet

- WACC Analysis Submission FormDocument1 pageWACC Analysis Submission Formdawson.ber2zNo ratings yet

- Gudang Garam (IDX GGRM) Financial Statement Forecasting and Discount Cash Flow (DCF) Valuation ModelDocument2 pagesGudang Garam (IDX GGRM) Financial Statement Forecasting and Discount Cash Flow (DCF) Valuation ModelAndi ErnandaNo ratings yet

- Capitec Bank - Valuation Looks Steep But Growth Outlook Is The Differentiating Factor - FinalDocument54 pagesCapitec Bank - Valuation Looks Steep But Growth Outlook Is The Differentiating Factor - FinalMukarangaNo ratings yet

- Appendix 1 Conservative Approach: (In FFR Million)Document6 pagesAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaNo ratings yet

- c19b - Cash Flow To Equity - ModelDocument6 pagesc19b - Cash Flow To Equity - ModelaluiscgNo ratings yet

- 543L7 2 (Wacc 2)Document9 pages543L7 2 (Wacc 2)Äyušheë TŸagïNo ratings yet

- NBP Government Securities Liquid Fund (NGSLF)Document1 pageNBP Government Securities Liquid Fund (NGSLF)Sohail AhmedNo ratings yet

- JPM Q3 2019 PresentationDocument13 pagesJPM Q3 2019 PresentationZerohedgeNo ratings yet

- Company Valuation and Sensitivity Analysis TableDocument5 pagesCompany Valuation and Sensitivity Analysis TableKhushi singhalNo ratings yet

- Solution For Case 10 Valuation of Common StockDocument8 pagesSolution For Case 10 Valuation of Common StockHello100% (1)

- Metalloinvest Ifrs 2018 Presa EngDocument28 pagesMetalloinvest Ifrs 2018 Presa EngVlad KremerNo ratings yet

- BE Aerospace Case SolutionDocument31 pagesBE Aerospace Case SolutionFaima AkterNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Barclays Q322 GlossaryDocument24 pagesBarclays Q322 GlossarytaohausNo ratings yet

- Barclays Q322 Analyst Call TranscriptDocument14 pagesBarclays Q322 Analyst Call TranscripttaohausNo ratings yet

- Barclays Q322 Results Analyst and Investor Conference Call QA TranscriptDocument12 pagesBarclays Q322 Results Analyst and Investor Conference Call QA TranscripttaohausNo ratings yet

- Barclays Q322 Management SpeechDocument14 pagesBarclays Q322 Management SpeechtaohausNo ratings yet

- Barclays Q322 Results PresentationDocument37 pagesBarclays Q322 Results PresentationtaohausNo ratings yet

- BPLC Q322 RaDocument61 pagesBPLC Q322 RataohausNo ratings yet

- Hedging Strategy Using Long Futures HedgeDocument5 pagesHedging Strategy Using Long Futures Hedgenur izzatiNo ratings yet

- Hilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Document2 pagesHilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Shelvya ReeseNo ratings yet

- Acumen's Vision for the Future of Impact InvestingDocument51 pagesAcumen's Vision for the Future of Impact InvestingBassel HassanNo ratings yet

- Bes 104 - MarrDocument4 pagesBes 104 - MarrMahusay Neil DominicNo ratings yet

- NAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsDocument2 pagesNAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsRoss John JimenezNo ratings yet

- 01 Quiz 1Document3 pages01 Quiz 1Emperor SavageNo ratings yet

- Ekonomi MakroDocument24 pagesEkonomi MakroNovi NurainiNo ratings yet

- Satyam CaseDocument9 pagesSatyam CaseGaurav Agarwal0% (1)

- RECONCILING THE BANK ACCOUNTDocument8 pagesRECONCILING THE BANK ACCOUNTSyed Adnan HossainNo ratings yet

- CASE STUDY INSTRUCTIONS 2019 T5 NewDocument10 pagesCASE STUDY INSTRUCTIONS 2019 T5 NewSunil SharmaNo ratings yet

- Walter's Model and Gordon's Theory on Dividend PolicyDocument15 pagesWalter's Model and Gordon's Theory on Dividend PolicyEviya Jerrin KoodalyNo ratings yet

- Summar Training ReportDocument35 pagesSummar Training ReportSuruli Ganesh100% (1)

- SFO Feb11Document96 pagesSFO Feb11AbgreenNo ratings yet

- Auditing Lecture 8 VouchingDocument40 pagesAuditing Lecture 8 VouchingMr BalochNo ratings yet

- Cra Dispute Letter 1Document1 pageCra Dispute Letter 1KNOWLEDGE SOURCE100% (2)

- Turning Point Brands: Release Date: 10 July 2019Document24 pagesTurning Point Brands: Release Date: 10 July 2019Anonymous 2nAj0N9MxqNo ratings yet

- IB PPT-1 (ReplDocument12 pagesIB PPT-1 (ReplKunal M CNo ratings yet

- Memo of Part SatisfactnDocument5 pagesMemo of Part SatisfactnVandhiya ThevanNo ratings yet

- Circular Entitled RN Lax And: LocalDocument6 pagesCircular Entitled RN Lax And: Localjoseph iii goNo ratings yet

- NATWESTDocument25 pagesNATWESTfaguobaozhuangfa2No ratings yet

- Financial Statement Analysis For IbmDocument4 pagesFinancial Statement Analysis For Ibmapi-260434320No ratings yet

- 102A - Principles of AccountingDocument38 pages102A - Principles of AccountingMuhammad Arslan Usman0% (1)

- Account Statement From 12 Jan 2023 To 12 Jul 2023Document10 pagesAccount Statement From 12 Jan 2023 To 12 Jul 2023SouravDeyNo ratings yet

- Invoice 4325298377Document1 pageInvoice 4325298377Vikash GuptaNo ratings yet

- Commercial Footprint Plots in Yeida CityDocument24 pagesCommercial Footprint Plots in Yeida Cityvaibhavrai2255No ratings yet

- INSEAD Master in Finance Curriculum PDFDocument25 pagesINSEAD Master in Finance Curriculum PDFLeslie Cheetah LamNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument2 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii83% (40)

- Deed of Reconstitution PartnershipDocument11 pagesDeed of Reconstitution Partnershipvinodkshahca_4744486No ratings yet

- 26ASDocument4 pages26ASSatyam MaramNo ratings yet

- X Macey Slonaker Crystal L Slonaker 292-84-7018: U.S. Individual Income Tax ReturnDocument12 pagesX Macey Slonaker Crystal L Slonaker 292-84-7018: U.S. Individual Income Tax ReturnjonathanNo ratings yet