Professional Documents

Culture Documents

PL M18 FM Student Mark Plan Web

Uploaded by

IQBAL MAHMUDOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PL M18 FM Student Mark Plan Web

Uploaded by

IQBAL MAHMUDCopyright:

Available Formats

Professional Level – Financial Management - March 2018

MARK PLAN AND EXAMINER’S COMMENTARY

The marking plan set out below was that used to mark this question. Markers were encouraged to use

discretion and to award partial marks where a point was either not explained fully or made by implication. In

many cases, more marks were available than could be awarded for each requirement. This allowed credit to

be given for a variety of valid points which were made by candidates.

Question 1

Total marks: 35

General comments

This question was generally answered well and a good majority of candidates achieved a “pass” standard.

This was a four-part question that tested the candidates’ understanding of the financing options element of

the syllabus and there was also a small section with an ethics element to it.

In the scenario a UK-listed bakery company was planning to open a number of retail outlets across the

UK. This investment would cost the company £17 million, which would be raised in such a way as to not

alter its existing gearing ratio. In part 1.1, for sixteen marks, candidates were required to calculate the

company’s current WACC from the information given, based on (1) the dividend growth model and (2) the

CAPM. Part 1.2 was worth six marks and required candidates to respond to recent comments made by

three of the company’s directors about the best discount rate to use when appraising the £17 million

investment. Part 1.3, for ten marks, tested the candidates’ understanding of (and the need for) de-gearing

and re-gearing beta within the CAPM calculation in the given scenario. Part 1.4 was worth three marks

and examined the Ethical Guide, with particular reference to the issue of confidentiality.

1.1(a)

Cost of equity (ke)

Dividend growth rate = £1.716m = 1.093 over 3 yrs so 1.0931/3-1 = 3% pa

£1.570m

Latest dividend (d0) = £1.716m £0.26

6.6m

Ex div market value per share = (£3.46 - £0.26) £3.20

Cost of equity (ke) (d1) +g (£0.26 x 1.03) + 3% 11.36%

MV (£3.20)

Cost of preference shares (k p) d £0.07 5.19%

MV £1.35

Cost of irredeemable debt (k di) (i-t) (£6 x 83%) 4.70%

MV £106

Cost of redeemable debt (kdr)

Year Cash Flow 5% factor PV 6% factor PV

0 (96) 1.000 (96.000) 1.000 (96.000)

1-3 4 2,723 10.892 2.673 10.692

1000.864 86.400 0.840 84.000

NPV 1.292 NPV (1.308)

IRR = 5% + (1.292/(1.292 + 1.308)) = 5.50%

less: Tax at 17% (5.50% x 83%) = 4.57%

Copyright © ICAEW 2018. All rights reserved. Page 1 of 9

Professional Level – Financial Management - March 2018

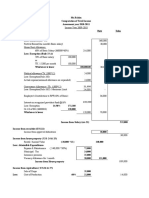

WACC

Total MV’s

£m £m Cost x weighting WACC

Equity (6.6m x £3.20) 21.120 11.36% x 21.120/25.470 9.42%

Pref. Shares (1m x £1.35) 1.350 5.19% x 1.35/25.470 0.28%

Irredeemable debt (£1.2m x 1.06) 1.272 4.70% x 1.272/25.470 0.23%

Redeemable debt (£1.8m x 0.96) 1.728 4.57% x 1.728/25.470 0.31%

4.350 0.82%

Total market value 25.470 10.24%

The majority of candidates did really well in part 1.1(a) and many scored full marks (14/14). Typical errors

made were (1) incorrect number of years used in the dividend growth calculation (2) not adjusting the

cum-div and cum-int market prices (3) forgetting the tax adjustment in the cost of debt and (4) not using

market values in the WACC calculation.

Total possible marks 14

Maximum full marks 14

1.1(b)

Cost of equity (ke) using the CAPM

Expected market return 10.8%

less: Expected risk-free return (2.4%)

Expected risk premium 8.4%

Applying Wells’ beta to the risk premium 1.25 x 8.4% 10.5%

plus: Expected risk-free return 2.4%

Cost of equity (ke) 12.9%

WACC

Total MV’s

£m £m Cost x weighting WACC

Equity (6.6m x £3.20) 21.120 12.90% x 21.120/25.470 10.70%

Pref. Shares (1m x £1.35) 1.350 5.19% x 1.35/25.470 0.28%

Irredeemable debt (£1.2m x 1.06) 1.272 4.70% x 1.272/25.470 0.23%

Redeemable debt (£1.8m x 0.96) 1.728 4.57% x 1.728/25.470 0.31%

4.350 0.82%

Total market value 25.470 11.52%

Part 1.1(b) was, as expected, done well by most candidates.

Total possible marks 2

Maximum full marks 2

1.2

Phil Turner – to use the cost of preference shares would be completely wrong. It’s only one element of the

firm’s total long-term finance and 7% is the coupon rate, not the current cost.

Alana Clarke and Alison Hughes – ordinary shares (cost of equity) should be taken into account. It would

make sense to use Wells’ current WACC figure for the investment appraisal if:

(1) the historical proportions of debt and equity are not to be changed

(2) the systematic business risk of the firm is not to be changed and

(3) the new finance is not project-specific.

Regarding the above, the bank borrowing will not change the gearing i.e. sufficient equity will be raised to

maintain the gearing at its current level. The systematic business risk of the firm is likely to change as it’s

moving into a different market. The finance is not project-specific e.g. cheap government loan.

Copyright © ICAEW 2018. All rights reserved. Page 2 of 9

Professional Level – Financial Management - March 2018

Overall, candidates’ answers to part 1.2 were disappointing. The comments made were rather general and

so marks will have been lost. Too few scripts considered the conditions that need to apply for the current

WACC to be used, i.e. gearing % and systematic risk to remain unchanged and any new finance is not

project-specific.

Total possible marks 7

Maximum full marks 6

1.3

New market geared beta = 1.80

New market ungeared beta = (1.80 x 77) (1.80 x 77) 1.44

(77 + (23 x 83%)) 96.09

Wells’ geared beta = 1.44 x (£21.12m + £1.35m + (£3m x 83%)) 1.70

£21.12m

So, cost of equity = (1.70 x (10.80% - 2.40%)) + 2.40 = 16.7%

Cost of debt = 8.5% x 83% 7.06%

WACC = (16.70% x £21.12m/25.47m) + (7.06% x £4.35m/£25.47m)) = 15.05%

It would be unwise to use the existing WACC as Wells’ plan involves diversification and therefore a

change in the level of systematic risk (beta rises from 1.25 to 1.70). Thus a new WACC must be

calculated. Systematic risk is accounted for by taking into account the beta of the retail bakery market and

this is then adjusted to eliminate the financial risk (level of gearing) in that market. The resultant ungeared

beta is then “re-geared” by taking into account the level of gearing of the new funds being raised.

Cost of new debt (which is higher than existing because of the increased systematic risk discussed above)

is used.

Using this, the new WACC can be calculated.

It was good to see that the numerical and discursive elements of part 1.3 were both done well by a good

number of candidates. Where candidates scored badly, it was clear from their calculations that many did

not understand the logic of de-gearing and then re-gearing. Also many were unable to explain the theory

underpinning for those calculations. This is an area of the syllabus that has been examined regularly

recently.

Total possible marks 10

Maximum full marks 10

1.4

You work for Wells and are party to confidential information which, if made public, could influence the

market price of Wells’ shares.

An ICAEW Chartered Accountant should assume that all unpublished information about a prospective,

current or previous client’s or employer’s affairs, however gained, is confidential.

That information should then:

Be kept confidential

Not disclosed, even inadvertently such as in a social environment

Not be used to obtain personal advantage

Part 1.4 was, as expected, done well by most candidates.

Total possible marks 3

Maximum full marks 3

Copyright © ICAEW 2018. All rights reserved. Page 3 of 9

Professional Level – Financial Management - March 2018

Question 2

Total marks: 30

General comments

This question was had the highest percentage mark on the paper. A large majority of candidates reached

a “pass” standard in the question.

This was a six-part question which tested the candidates’ understanding of the risk management element

of the syllabus.

This question was based on a UK manufacturer of timber products. The first half of the scenario

considered the company’s need to borrow £4.5 million of short-term finance via a bank loan and its plan to

hedge the interest costs of that loan. In the second half of the question the company had agreed to

purchase €1.7 million of timber from a Finnish supplier. Candidates had to investigate the foreign

exchange risk implications of this contract for the company. In part 2.1(a) of the question, for eight marks,

candidates were required to calculate the cost to the company if it used traded sterling interest rate futures

to hedge its interest rate risk. Part 2.1(b), for three marks, required candidates to calculate the cost to the

company if it used OTC interest rate options to hedge the risk. Part 2.1(c) was worth two marks and asked

candidates to conclude, based on their calculations, which of the hedging methods should be chosen. Part

2.2(a) for seven marks asked candidates to calculate the (sterling equivalent) payment to the Finnish

supplier if (1) there was a weakening of sterling and (2) two hedging techniques were employed. In part

2.2(b), also for seven marks, candidates were required to advise the company’s board whether it should

hedge the euro payment. Finally, part 2.2(c), for three marks, asked candidates to identify the differences

between traded currency options and OTC currency options.

2.1

(a) Futures

Sell June futures

No of contracts: £4,500,000 x 6/3 = 18

£500,000

(a) (b) (c)

Interest rate 7.50% 8.00% 5.50%

Opening rate 93.2 93.2 93.2

Closing rate 92.2 91.8 94.1

Movement 1.0 1.4 (0.9)

P/L on futures 18 x £500,000 x 3/12 2,250,000 2,250,000 2,250,000

x x x

1.0% 1.4% (0.9%)

= = =

Profit/(Loss) on futures £22,500 £31,500 (£20,250)

Interest cost = £4.5m x 6/12 = £2,250,000 x 7.5% (£168,750)

8.0% (£180,000)

5.5% (£123,750)

Total cost (146,250) (148,500) (144,000)

(b) Options (a) (b) (c)

Interest rate 7.50% 8.00% 5.50%

Take up option Y Y N

Interest cost % 7.30% 7.30% 5.50%

Interest cost = £4.5m x 6/12 = £2,250,000 x 7.3% (£164,250)

7.3% (£164,250)

5.5% (£123,750)

Premium (£4,500,000 x 0.2%) (£9,000) (£9,000) (£9,000)

Total cost (£173,250) (£173,250) (£132,750)

Copyright © ICAEW 2018. All rights reserved. Page 4 of 9

Professional Level – Financial Management - March 2018

(c) If interest rates increase then futures less costly than option.

If rates fall then option is lower cost.

For part 2.1 there were many very good answers with candidates demonstrating a thorough understanding

of the techniques involved. Those areas where candidates struggled were: (1) a failure to identify that the

company would sell interest rate futures (2) charging twelve months interest rather than six (3) using six

months, rather than three months, in the futures gain/loss calculation and (4) a failure to calculate the

option premium correctly (a very common error).

Total possible marks 13

Maximum full marks 13

2.2(a)

(1) Sterling weakens by 5%

Spot rate = €1.1764 x 0.95 = €1.1176

€1,700,000/1.1176 (£1,521,144)

(2) Forward contract

€

Spot rate 1.1764

plus: Forward contract discount 0.0059

1.1823

£

(£1,700,000)/1.1823 (1,437,875)

plus: Arrangement fee (4,600)

(£1,442,475)

(3) Money Market Hedge

Lend euros now (€1,700,000) (€1,700,000) (€1,666,667)

1 + (8%/4) 1.02

Convert at spot rate €1,666,667 (£1,416,752)

1.1764

Sterling borrowed at 6.6% pa (£1,416,752) x [1 + (6.6%/4)] (£1,440,128)

Part 2.2 was, overall, done well. The calculations in part (a) were good, but typical errors included (1)

choosing the wrong exchange rate (2) strengthening rather than (as required) weakening sterling and (3)

subtracting the forward contract fee from the overall cost of the transaction.

Total possible marks 7

Maximum full marks 7

Copyright © ICAEW 2018. All rights reserved. Page 5 of 9

Professional Level – Financial Management - March 2018

2.2(b)

In summary

At spot rate (€1,700,000/ 1.1764) (£1,445,087)

Sterling weakens by 5% (£1,521,144)

Forward contract (£1,442,475)

MMH (£1,440,128)

The forward rate suggests that the euro will weaken (sterling will strengthen, rather than weaken by 5%)

over the next three months. This is good for UK importers such as Hunt, as supplies would get cheaper.

MMH gives the lowest price, based on these rates, but if sterling is likely to strengthen then perhaps don’t

hedge at all (but there are no guarantees).

General points about the various methods

Directors’ attitude to risk is important

Foreign exchange risk management is an area of the syllabus that is examined regularly and so

candidates’ answers to the discussion in part (b) were disappointing. There was a lack of depth to the

candidates’ conclusions and too many commented, erroneously, that a forward contract discount meant

that sterling would be weakening.

Total possible marks 8

Maximum full marks 7

2.2(c)

OTC’s are, typically, purchased from a bank

OTC’s are tailor-made and so will lack negotiability

Traded options are for standardised amounts and can be traded and a profit/loss made

Traded options are not available in every currency

Part (c) was answered well.

Total possible marks 4

Maximum full marks 3

Copyright © ICAEW 2018. All rights reserved. Page 6 of 9

Professional Level – Financial Management - March 2018

Question 3

Total marks: 35

General comments

This question had the lowest average mark on the paper, but most candidates achieved a “pass” standard.

This was a five-part question that tested the candidates’ understanding of the investment decisions

element of the syllabus.

The scenario here was based around a UK property company that builds low-cost houses for sale and for

rent. The company had the opportunity to invest in a new development of 500 identical low-energy houses

on one of its vacant sites. The company planned to use a house-building firm to construct the houses over

a two year period. Part 3.1 was worth 18 marks and required candidates to make use of the information

given and calculate the NPV of the proposed investment. Parts 3.2 and 3.3, for four marks and five marks

respectively, tested candidates’ proficiency with, and understanding of, sensitivity analysis. They were

required to make sensitivity calculations and then comment on them. Part 3.4 was worth four marks and

here candidates were asked to compare the strengths and weaknesses of sensitivity analysis with those of

simulation. In part 3.5, again for four marks, candidates had to explain the concept of real options and to

identify two real options that could apply to the development in question.

3.1

2018 2019 2020 2021 2022-38

Y0 Y1 Y2 Y3 Y4-20

£’000 £’000 £’000 £’000 £’000

Construction costs (19,000) (19,000) (19,000)

Land clearance (1,400)

Sales 25,500 25,500

Rental income (W1) 1,040 2,079 2,079

Bad debts (W1) (16) (31) (31)

New staff (46) (92) (92)

Extra costs (W1) (31) (62) (62)

Tax (W2) 238 (2,882) (3,042) (322) (322)

Green machine 0 (1,200) 100

Tax on machine (W3) 0 37 30 120

Total cash flows (20,162) 2,455 4,434 1,792

1,572

6% factors (W4) 1.000 0.943 0.890 0.840

8.801

PV (20,162) 2,316 3,947 1,504 13,831

NPV 1,436

The development produces a positive NPV and so should be accepted as it will enhance shareholder

wealth.

Workings

W1 Rental income (Y2) = 175 x £5,940 = £1,039,500

Bad debts (Y2) = 1.5% x £1,039,500 = £15,592

Extra costs (Y2) = 3% x £1,039,500 = £31,185

Rental income (Y3) = 350 x £5,940 = £2,079,000

Bad debts (Y3) = 1.5% x £2,079,000 = £31,185

Extra costs (Y3) = 3% x £2,079,000 = £62,370

Copyright © ICAEW 2018. All rights reserved. Page 7 of 9

Professional Level – Financial Management - March 2018

W2 2018 2019 2020 2021 2022-38

Y0 Y1 Y2 Y3 Y4-20

£’000 £’000 £’000 £’000 £’000

Construction (75/500 x £57m) (8,550) (8,550)

Land clearance (1,400)

Sales 25,500 25,500

Rental income 1,040 2,079 2,079

Bad debts (16) (31) (31)

New staff (46) (92) (92)

Extra costs (31) (62) (62)

Taxable (loss)/profit (1,400) 16,950 17,897 1,894 1,894

Tax at 17% 238 (2,882) (3,042) (322) (322)

W3 2019 2020 2021

Y1 Y2 Y3

£’000 £’000 £’000

Green machine cost/WDV 1,200 984 807

WDA (18%)/Balancing allowance (216) (177) (707)

WDV/Sale price 984 807 100

Tax saving (17% x WDA) 37 30 120

W4

6% annuity factor for Y4-Y20 Y20 11.470 OR 10.477

Y4 (2.673) x 0.840

8.797 8.801

Part 3.1 was a difficult NPV calculation and so it was good to see that, overall, candidates did well here.

The main areas of difficulty were: (1) the tax calculation for the allowable building costs (2) the timing of

the cash flows and (3) the need to include cash flows (and then discount them) for Years 4 to 20.

Total possible marks 18

Maximum full marks 18

3.2

Y1 Y2 Total

£’000 £’000 £’000

Sales 25,500 25,500

Tax (4,335) (4,335)

Total cash flows 21,165 21,165

6% factors 0.943 0.890

PV 19,967 18,837 38,804

Sensitivity 1,436 = 3.7%

38,804

Minimum selling price = (£340,000 – 3.7%) £327,420

Part 3.2 was also done well, but some candidates used the price per house figure rather than the total

sales figure and so will have lost marks.

Total possible marks 4

Maximum full marks 4

Copyright © ICAEW 2018. All rights reserved. Page 8 of 9

Professional Level – Financial Management - March 2018

3.3

Y0 Y1 Y2 Total

£’000 £’000 £’000 £’000

Incremental construction costs (35,000) 19,000 19,000

Tax on costs (£8.55m x 3/57 x 17%) (77) (76)

Total cash flows (35,000) 18,923 18,924

6% factors 1.000 0.943 0.890

PV (35,000) 17,844 16,842 (314)

The NPV would decrease by £314,000 and so it is less likely that Bishop’s board would proceed with the

development.

Part 3.3 was a more difficult proposition and candidates’ answers here were very variable. Those who

produced a set of calculations revised from part 3.1 scored well, but too many produced a discussion

rather than calculations.

Total possible marks 5

Maximum full marks 5

3.4

Sensitivity analysis

It facilitates subjective judgment (by management for example)

It identifies areas that are critical to the success of a project, e.g. sales volume, materials price

It is relatively straightforward

But

It assumes that changes to variables can be made independently

It ignores probability

It does not point to a correct decision

Simulation

More than one variable at a time can be changed

It takes probabilities into account

But

It is not a technique for making a decision

It can be time consuming and expensive

Certain assumptions that need to be made could be unreliable

Part 3.4 was, overall, done well and a majority of candidates scored full marks.

Total possible marks 6

Maximum full marks 4

3.5

NPV analysis only considers cash flows related directly to a project. A project with a negative NPV could

be accepted for strategic reasons. This is because of (real) options associated with a project that outweigh

the negative NPV.

With regard to the Garthwick development there could be (TWO only required):

Follow-on options – future development of mixed (rental/private) developments.

Growth options – Bishop could build a few properties and then build more later, if necessary.

Flexibility options – Bishop could sell some of its rented properties rather than rent them and vice versa.

Abandonment options – Bishop could sell all the properties and quit the development after two years.

Timing options – Bishop could delay the start of the clearance and development.

In part 3.5 most candidates were able to identify examples of real options from the scenario, but too few

explained the more general issue of real options, i.e. that of turning a negative NPV into a positive one.

Total possible marks 4

Maximum full marks 4

Copyright © ICAEW 2018. All rights reserved. Page 9 of 9

You might also like

- AFM - Mock Exam Answers - Dec18Document21 pagesAFM - Mock Exam Answers - Dec18David LeeNo ratings yet

- Mark Plan and Examiner'S Commentary: Total Marks: General CommentsDocument11 pagesMark Plan and Examiner'S Commentary: Total Marks: General CommentsPAul De BorjaNo ratings yet

- PL FM S17 Student Mark Plan FINAL For Web v2Document9 pagesPL FM S17 Student Mark Plan FINAL For Web v2IQBAL MAHMUDNo ratings yet

- Midland Energy's Cost of Capital CalculationsDocument5 pagesMidland Energy's Cost of Capital CalculationsOmar ChaudhryNo ratings yet

- Cost of Capital AnalysisDocument7 pagesCost of Capital Analysisswarna dasNo ratings yet

- FE (201312) Paper II - Answer PDFDocument12 pagesFE (201312) Paper II - Answer PDFgaryNo ratings yet

- Midland Energy Case StudyDocument5 pagesMidland Energy Case StudyLokesh GopalakrishnanNo ratings yet

- Mark Plan and Examiner'S Commentary: Total Marks: General CommentsDocument10 pagesMark Plan and Examiner'S Commentary: Total Marks: General Commentscima2k15No ratings yet

- Epdgm Term 2 Alliance University: Corporate FinanceDocument4 pagesEpdgm Term 2 Alliance University: Corporate FinanceGeorgekutty GeorgeNo ratings yet

- BSR3B AO1 2018 Final - ModeratedDocument8 pagesBSR3B AO1 2018 Final - Moderatedsabelo.j.nkosi.5No ratings yet

- CALCULATING PROJECT NPVDocument13 pagesCALCULATING PROJECT NPVmuhammad osamaNo ratings yet

- Problems On Cost of Equity Capital Structure Dividend Policy and Restructuring PrintDocument41 pagesProblems On Cost of Equity Capital Structure Dividend Policy and Restructuring Printmiradvance studyNo ratings yet

- Aswath Damodara - Talk - PPT PDFDocument34 pagesAswath Damodara - Talk - PPT PDFRavi OlaNo ratings yet

- Executive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Document12 pagesExecutive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Navin N Meenakshi ChandraNo ratings yet

- Exercises + Answers - The Cost of CapitalDocument6 pagesExercises + Answers - The Cost of CapitalWong Yong Sheng Wong100% (1)

- Efficient market insider dealing regulationsDocument9 pagesEfficient market insider dealing regulationsBadihah Mat SaudNo ratings yet

- Group 2 Marriott SlideDocument47 pagesGroup 2 Marriott SlideIbraheem RabeeNo ratings yet

- The Cost of Capital ExplainedDocument56 pagesThe Cost of Capital ExplainedAndayani SalisNo ratings yet

- Corporate Finance Study Guide Spring 2013 Part 2Document20 pagesCorporate Finance Study Guide Spring 2013 Part 2Ehab M. Abdel HadyNo ratings yet

- FIN 202 Homework 4 QuestionsDocument5 pagesFIN 202 Homework 4 QuestionsmosesNo ratings yet

- Corporate Finance 4b WACCDocument25 pagesCorporate Finance 4b WACCMeghana ErapagaNo ratings yet

- Cost ofDocument14 pagesCost ofrajjoNo ratings yet

- Bsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDocument6 pagesBsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDerek LowNo ratings yet

- Suggested Answer - Syl12 - Dec13 - Paper 14 Final Examination: Suggested Answers To QuestionsDocument18 pagesSuggested Answer - Syl12 - Dec13 - Paper 14 Final Examination: Suggested Answers To QuestionsMudit AgarwalNo ratings yet

- Solution Maf603 Jun 2019Document11 pagesSolution Maf603 Jun 2019Hadi DahalanNo ratings yet

- Solved Problem 14.1: The Above Is Obtained Using The Following StepsDocument3 pagesSolved Problem 14.1: The Above Is Obtained Using The Following StepsArjun Jaideep BhatnagarNo ratings yet

- Solution To Case 12: What Are We Really Worth?Document4 pagesSolution To Case 12: What Are We Really Worth?khalil rebato100% (1)

- DDM CAPM ECM Cost of EquityDocument5 pagesDDM CAPM ECM Cost of EquityDevia SuswodijoyoNo ratings yet

- DDM CAPM ECM Cost of EquityDocument5 pagesDDM CAPM ECM Cost of Equitynatya lakshitaNo ratings yet

- Case StudyDocument4 pagesCase StudyTabish Iftikhar Syed100% (1)

- The Cost of CapitalDocument45 pagesThe Cost of CapitalBabasab Patil (Karrisatte)No ratings yet

- Encana Corporation: The Cost of Capital: Ivey Case No. 907N02 A) Cost of Equity Dividend Growth ModelDocument5 pagesEncana Corporation: The Cost of Capital: Ivey Case No. 907N02 A) Cost of Equity Dividend Growth ModelAninda DuttaNo ratings yet

- Group 3 project analyzes Nike's cost of capitalDocument14 pagesGroup 3 project analyzes Nike's cost of capitalMuhammad MBA65No ratings yet

- Chapter 12 - ET3Document6 pagesChapter 12 - ET3anthony.schzNo ratings yet

- MAS.M-1405 Cost of Capital Straight ProblemsDocument12 pagesMAS.M-1405 Cost of Capital Straight ProblemsralphalonzoNo ratings yet

- Solution: P8 / (P96.50 - P2.38) 8.5%Document4 pagesSolution: P8 / (P96.50 - P2.38) 8.5%Edrielle100% (1)

- Mergers and Acquisitions Module 5 Practice QuestionsDocument18 pagesMergers and Acquisitions Module 5 Practice QuestionsAli HussainNo ratings yet

- Final Practice Questions and SolutionsDocument12 pagesFinal Practice Questions and Solutionsshaikhnazneen100No ratings yet

- Group2 Marriott V6Document54 pagesGroup2 Marriott V6Ibraheem RabeeNo ratings yet

- Sample Ques MidsDocument8 pagesSample Ques MidsWaasfaNo ratings yet

- Finance Exam Jan - 2017Document9 pagesFinance Exam Jan - 2017mrdirriminNo ratings yet

- Dhruvraj Devda FinalDocument5 pagesDhruvraj Devda FinalranammeetNo ratings yet

- Lec 13 HandoutDocument53 pagesLec 13 Handout賴永岫No ratings yet

- Wacc SolutionsDocument8 pagesWacc SolutionssrassmasoodNo ratings yet

- 402 - FSV - Suggested Solutions - 2018 November (Revised)Document13 pages402 - FSV - Suggested Solutions - 2018 November (Revised)Thema ThushsNo ratings yet

- Growth of Corporation Occurs Through 1. Internal Expansion That Is Growth 2. MergersDocument8 pagesGrowth of Corporation Occurs Through 1. Internal Expansion That Is Growth 2. MergersFazul Rehman100% (1)

- Chapter 3 Cost of CapitalDocument15 pagesChapter 3 Cost of Capitalfirst breakNo ratings yet

- Midlands Case StudyDocument5 pagesMidlands Case Studyjvbd dsvsdvNo ratings yet

- Financial Management Theory and Practice 2nd Edition Brigham Solutions ManualDocument24 pagesFinancial Management Theory and Practice 2nd Edition Brigham Solutions Manualexsect.drizzlezu100% (16)

- Toyota's WACC Analysis and Strategies to Lower Cost of CapitalDocument9 pagesToyota's WACC Analysis and Strategies to Lower Cost of CapitalDavid OwitiNo ratings yet

- Reference Asnwer 2Document3 pagesReference Asnwer 2Kyle Lee UyNo ratings yet

- How to use the DCF model tutorialDocument9 pagesHow to use the DCF model tutorialTanya SinghNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- Weighted Average Cost of CapitalDocument9 pagesWeighted Average Cost of CapitalTrixia Mae MorarengNo ratings yet

- Calculating WACC and growth rateDocument12 pagesCalculating WACC and growth raterajjoNo ratings yet

- Case Study Practice QuestionDocument8 pagesCase Study Practice QuestionSashin NaidooNo ratings yet

- Syndicate 7 - Nike Inc. Cost of CapitalDocument8 pagesSyndicate 7 - Nike Inc. Cost of CapitalAnthony Kwo100% (1)

- BlackRock's Guide to Fixed-Income Risk ManagementFrom EverandBlackRock's Guide to Fixed-Income Risk ManagementBennett W. GolubNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- It Governance TechnologyDocument5 pagesIt Governance TechnologyIQBAL MAHMUDNo ratings yet

- IT GOVERNANCE: KEY CONCEPTSDocument2 pagesIT GOVERNANCE: KEY CONCEPTSLaskar REAZNo ratings yet

- IT GOVERNANCE: KEY CONCEPTSDocument2 pagesIT GOVERNANCE: KEY CONCEPTSLaskar REAZNo ratings yet

- Ca Ipcc - ItDocument82 pagesCa Ipcc - ItIQBAL MAHMUDNo ratings yet

- 7 - IT - GOVERNANCE May June 2019Document2 pages7 - IT - GOVERNANCE May June 2019Abdullah al MahmudNo ratings yet

- Strategy and Business Chapter 1 Self-TestDocument177 pagesStrategy and Business Chapter 1 Self-TestIQBAL MAHMUDNo ratings yet

- It Governance Technology-Chapter 01Document4 pagesIt Governance Technology-Chapter 01IQBAL MAHMUDNo ratings yet

- It Governance Technology-03Document4 pagesIt Governance Technology-03IQBAL MAHMUDNo ratings yet

- It Governance Technology-02Document5 pagesIt Governance Technology-02IQBAL MAHMUDNo ratings yet

- Question - Analysis Audit and Assurance Application LevelDocument28 pagesQuestion - Analysis Audit and Assurance Application LevelIQBAL MAHMUDNo ratings yet

- Summary of Audit & Assurance Application Level - Self Test With Immediate AnswerDocument72 pagesSummary of Audit & Assurance Application Level - Self Test With Immediate AnswerIQBAL MAHMUDNo ratings yet

- Summary of Business Strategy Application Level Interactive Questions With Immediate AnswerDocument118 pagesSummary of Business Strategy Application Level Interactive Questions With Immediate AnswerIQBAL MAHMUDNo ratings yet

- Summary of Business - Strategy - Application - Level - Question - Bank - With Immediate AnswersDocument221 pagesSummary of Business - Strategy - Application - Level - Question - Bank - With Immediate AnswersIQBAL MAHMUDNo ratings yet

- Summary of Business Strategy Application Level - Worked ExampleDocument47 pagesSummary of Business Strategy Application Level - Worked ExampleIQBAL MAHMUDNo ratings yet

- Summary of Audit & Assurance Application Level - Interactive Questions With Immediate AnswersDocument46 pagesSummary of Audit & Assurance Application Level - Interactive Questions With Immediate AnswersIQBAL MAHMUDNo ratings yet

- Assurance engagement due diligenceDocument22 pagesAssurance engagement due diligenceIQBAL MAHMUDNo ratings yet

- Summary of Audit & Assurance - Application - Level - Question - Bank - With Immediate AnswersDocument161 pagesSummary of Audit & Assurance - Application - Level - Question - Bank - With Immediate AnswersIQBAL MAHMUDNo ratings yet

- Blockchain's Potential for Bangladesh's Digital EconomyDocument10 pagesBlockchain's Potential for Bangladesh's Digital EconomyIQBAL MAHMUDNo ratings yet

- Question Analysis - Business Strategy Application LevelDocument24 pagesQuestion Analysis - Business Strategy Application LevelIQBAL MAHMUDNo ratings yet

- Ca Ipcc - ItDocument82 pagesCa Ipcc - ItIQBAL MAHMUDNo ratings yet

- Indirect Tax L 2Document6 pagesIndirect Tax L 2IQBAL MAHMUDNo ratings yet

- Solution Tax Question (Application Level)Document6 pagesSolution Tax Question (Application Level)IQBAL MAHMUDNo ratings yet

- Inestment Appraisal Synopsis 1 2Document8 pagesInestment Appraisal Synopsis 1 2IQBAL MAHMUDNo ratings yet

- Professional and Advanced Level Oct 2019Document20 pagesProfessional and Advanced Level Oct 2019IQBAL MAHMUDNo ratings yet

- Order #0002396: Professional - BST Item ListDocument1 pageOrder #0002396: Professional - BST Item ListIQBAL MAHMUDNo ratings yet

- National Blockchain Strategy - BangladeshDocument49 pagesNational Blockchain Strategy - BangladeshnakibosmanNo ratings yet

- Inestment Appraisal Synopsis 1 2Document8 pagesInestment Appraisal Synopsis 1 2IQBAL MAHMUDNo ratings yet

- Paper - 6: Information Systems Control and Audit Questions Information Systems ConceptsDocument37 pagesPaper - 6: Information Systems Control and Audit Questions Information Systems ConceptsSagar BhandariNo ratings yet

- Chapter-06 (Most Important)Document23 pagesChapter-06 (Most Important)IQBAL MAHMUDNo ratings yet

- IT GOVERNANCE: KEY CONCEPTSDocument2 pagesIT GOVERNANCE: KEY CONCEPTSLaskar REAZNo ratings yet

- Financial Statements AnalysisDocument97 pagesFinancial Statements AnalysisAshutosh Kumar Dubey0% (1)

- JP Morgan and Chase CoDocument23 pagesJP Morgan and Chase CoAjith VNo ratings yet

- Technical Notice: Distribution in Specie of The Issued Shares of Wharf REICDocument3 pagesTechnical Notice: Distribution in Specie of The Issued Shares of Wharf REICEdwin ChanNo ratings yet

- ESG Matters May 5th 2020Document36 pagesESG Matters May 5th 2020FredericoNo ratings yet

- Tutorial FIN645 PYQDocument2 pagesTutorial FIN645 PYQJuu Scully DavidNo ratings yet

- Assignment 2: What Do You Mean by Portfolio Investment Process, How Does Is Co Relate With Fundamental Analysis?Document2 pagesAssignment 2: What Do You Mean by Portfolio Investment Process, How Does Is Co Relate With Fundamental Analysis?Naveen RecizNo ratings yet

- Work Sheet Computation of Income Under The Head "Capital Gains"Document4 pagesWork Sheet Computation of Income Under The Head "Capital Gains"Vishal SarkarNo ratings yet

- ACC501 - Final Term Papers 02Document17 pagesACC501 - Final Term Papers 02RanoRoseNo ratings yet

- Ratio Analysis of Fuel Company-3Document21 pagesRatio Analysis of Fuel Company-3Zakaria ShuvoNo ratings yet

- InvesmentDocument5 pagesInvesmentMaricar San AntonioNo ratings yet

- Project Rating Matrix TemplateDocument5 pagesProject Rating Matrix TemplateDhakshana MurthiNo ratings yet

- Lecture Handout No. 2 Risk and DiversificationDocument9 pagesLecture Handout No. 2 Risk and DiversificationJessa ArellagaNo ratings yet

- SEC and Menzgold - A Fresh PerspectiveDocument2 pagesSEC and Menzgold - A Fresh PerspectiveSam ObuobiNo ratings yet

- Enero - ACC 222 Exercise - FS AnalysisDocument4 pagesEnero - ACC 222 Exercise - FS AnalysisregineNo ratings yet

- Itpm Online Educational Video CoursesDocument17 pagesItpm Online Educational Video CoursesAlex ReyNo ratings yet

- Project Report On Yes BankDocument73 pagesProject Report On Yes BankAnuja Nalavade43% (7)

- COA Cir No. 2017-004-Annexes D-FDocument53 pagesCOA Cir No. 2017-004-Annexes D-Fcrizalde m. de diosNo ratings yet

- Advertising L&TDocument80 pagesAdvertising L&TsaiyuvatechNo ratings yet

- A Study On Mutual Funds As Investment Options: Chapter - 1 Introduction To Indian Financial SystemDocument47 pagesA Study On Mutual Funds As Investment Options: Chapter - 1 Introduction To Indian Financial SystemDeepti ShroffNo ratings yet

- Credit Transaction Digest 1Document1 pageCredit Transaction Digest 1Michelle Jude TinioNo ratings yet

- Liquidity RatioDocument2 pagesLiquidity RatioThea DagunaNo ratings yet

- Factoring and ForfaitingDocument21 pagesFactoring and ForfaitingDilip RajNo ratings yet

- Life Insurance in India: Strategic Shifts in A Dynamic IndustryDocument4 pagesLife Insurance in India: Strategic Shifts in A Dynamic IndustrysatishcreativeNo ratings yet

- Analyzing Financial Statements for Liquidity and FlexibilityDocument2 pagesAnalyzing Financial Statements for Liquidity and FlexibilityRovee PagaduanNo ratings yet

- Red Rose EnterpriseDocument3 pagesRed Rose Enterprisefatin batrisyiaNo ratings yet

- Phillips4e Appendix DDocument23 pagesPhillips4e Appendix DGaurav SharmaNo ratings yet

- Credit Suisse's Guide To Global Tradable and Benchmark Index ProductsDocument115 pagesCredit Suisse's Guide To Global Tradable and Benchmark Index ProductsHeathcliff NyambiyaNo ratings yet

- Financial Statement AnalysisDocument19 pagesFinancial Statement AnalysisMohammad Ajmal AnsariNo ratings yet

- EquityDocument92 pagesEquitySen RinaNo ratings yet

- Financial Sector Analysis 2011-2015Document253 pagesFinancial Sector Analysis 2011-2015alizaNo ratings yet