Professional Documents

Culture Documents

New Paradigms in Public Economics: IT-Driven Development & Participatory State Policies

Uploaded by

Sheldon JosephOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Paradigms in Public Economics: IT-Driven Development & Participatory State Policies

Uploaded by

Sheldon JosephCopyright:

Available Formats

New Paradigms in Public Economics: The Changing perspective

Introduction:

Basically, to Maximize the welfare of the citizens. Require to clarify the

distinction between Normative and Positive roles.

Normative: what the state should do to maximize welfare.

Positive: what the state actually does.

The normative role on the basis of fundamental economic principles attempts to

outline what the Government, should do to reduce market imperfections. This

role though is affected by the political constitution of a country.

There is a close relationship between a market economy and the democratic

process.

In a market economy, individuals vote with their money.

In the democratic process, they cast their votes in accordance with their

political goals.

Current economic policies are a slave to past government thinking.

Green Keynesianism

Beyond Standard Policy Paradigms

Revival of Keynes

Current preoccupation with environmental issues

Inherent conflict (EV vehicles)

Development powered by IT

• Information is power and an informed citizenry is the eternal strength of a

democracy’ Hence AI & Big Data-driven policies.

• Economists at universities across the country have collaborated in developing

a new theory of public economic policy that puts knowledge at the center of

our understanding of welfare ( Aadhar Pan card E-rupee)

• Covid-18 pandemic-contact tracing, hotspots, management of hospitals etc.

Participatory State Policies

• People have the leadership to make economic revitalization a priority, the

culture to mesh that objective with their academic mission, the legal flexibility

to mix and match assets and brainpower with the private sector, and the

resources to make it all work.

Need-based, market-driven State Intervention

• The statist model of Welfare characterized by the predominant role of the

state in initiating, financing, fostering and directing welfare schemes is now

OUT.

• The State is shifting its role to that of a facilitator.

Globalization dominated Development

• the doctrine of Globalization is being abandoned and the charges of

‘economic colonization’ has started dominating public economic thinking

in Third World nations. Regulated liberalization of national economy will

expedite the pace & volume of Government actions in the public space.

States to Reinstate Agriculture

• A new approach is needed that recognizes the multiple functions of

agriculture for overall welfare: triggering GDP growth in early stages,

reducing poverty, narrowing income disparities, providing food security,

and delivering environmental services.

• Governments and donors have neglected these functions of agriculture

over the last 25 years, with negative impacts on Welfare

The Current Indian Perspectives- A collage of Models

Inclusive Growth

Post Pandemic policies

Mundell Fleming model

IT-Powered development

Sustainable development

Challenges Up-front on the Taxation side:

1. Leaky Bucket Phenomenon:

Arthur Okun introduced the Leaky Bucket Phenomenon. Okun believed that

wealth transfers by taxation from the relatively rich to the relatively poor are

an appropriate policy for the government. But he recognized the loss of

efficiency inherent in the redistribution process. In Equality and Efficiency: The

Big Tradeoff Okun introduced the metaphor of the leaky bucket, which has

become famous among economists. He wrote: "The money must be carried

from the rich to the poor in a leaky bucket. Some of it will simply disappear in

transit, so the poor will not receive all the money that is taken from the rich."

2. The Laffer Curve:

Arthur B. Laffer maintained that economic

expansion could be achieved without

government budget deficits.

The Laffer curve shows the tax rate at which

government tax revenue is maximized, after

which it declines. It illustrates the

relationship between average tax rates and

total tax revenue and shows that above a

certain average rate of tax, total tax

revenue will fall.

The Laffer curve implies that there is a

maximum amount of tax that a government can raise, therefore there is a

ceiling to the level of public goods which can be provided.

You might also like

- Impact of Black-MoneyDocument26 pagesImpact of Black-MoneyDevikaSharma100% (2)

- Public Finance Lecture NotesDocument40 pagesPublic Finance Lecture NotesSenelwa Anaya100% (2)

- BlackRock Global Outlook 2023 1669983816Document16 pagesBlackRock Global Outlook 2023 1669983816Alberto Villanueva PuccioNo ratings yet

- Public ExpenditureDocument6 pagesPublic ExpenditureNaruChoudhary0% (1)

- Economic System: Planned EconomyDocument8 pagesEconomic System: Planned EconomyHossain Mohammad Abin100% (2)

- Introduction of Public Fiscal AdministrationDocument5 pagesIntroduction of Public Fiscal Administrationmitzi samsonNo ratings yet

- Public FinanceDocument87 pagesPublic FinanceMichelle Rotairo100% (1)

- Public Finance Week 2Document30 pagesPublic Finance Week 2Letsah BrightNo ratings yet

- Understanding Public Expenditure: Meaning, Classification, Objectives & EffectsDocument25 pagesUnderstanding Public Expenditure: Meaning, Classification, Objectives & EffectsAbas Mohamed SidowNo ratings yet

- Public Finance (MA in Economics)Document139 pagesPublic Finance (MA in Economics)Karim Virani91% (11)

- Economics Planning (MA in Economics)Document52 pagesEconomics Planning (MA in Economics)Karim Virani0% (1)

- Public ExpenditureDocument15 pagesPublic ExpenditureVikas Singh100% (1)

- A New Economic Order - The Global Enrichment of Nations and their PeoplesFrom EverandA New Economic Order - The Global Enrichment of Nations and their PeoplesNo ratings yet

- 301 Public ExpenditureDocument72 pages301 Public ExpenditureZannath HabibNo ratings yet

- 11 Advanced Taxation Aau MaterialDocument129 pages11 Advanced Taxation Aau MaterialErmi ManNo ratings yet

- Article On Effects of Public ExpenditureDocument11 pagesArticle On Effects of Public Expendituretanmoydebnath474No ratings yet

- M1 Introduction To Public Finance-1Document14 pagesM1 Introduction To Public Finance-1chachagiNo ratings yet

- LECTURE 1 Introduction Background of Public Fiscal AdministrationDocument62 pagesLECTURE 1 Introduction Background of Public Fiscal AdministrationLeah FlorentinoNo ratings yet

- LECTURE 1 Part1Document69 pagesLECTURE 1 Part1Leah FlorentinoNo ratings yet

- Social Security, Protection: Electricity, Water Supply, Railways, Heavy Electrical Atomic EnergyDocument46 pagesSocial Security, Protection: Electricity, Water Supply, Railways, Heavy Electrical Atomic EnergyYoseph KassaNo ratings yet

- Public Finance II Year PDFDocument18 pagesPublic Finance II Year PDFerekNo ratings yet

- SPL - 4 - Chap - 01 - Public FinanceDocument7 pagesSPL - 4 - Chap - 01 - Public FinanceShaikh imran RazeenNo ratings yet

- Reading Material - Unit-1 and 2Document33 pagesReading Material - Unit-1 and 2Nokia PokiaNo ratings yet

- Economic System: Characteristics of Planned EconomyDocument9 pagesEconomic System: Characteristics of Planned Economydxtyle-1No ratings yet

- Chapter - Ii Theories of Public Expenditure and Economic Reforms in IndiaDocument16 pagesChapter - Ii Theories of Public Expenditure and Economic Reforms in IndiaVibhu VikramadityaNo ratings yet

- PG & Research Department of Economics Subject Name PUBLIC FINANCES Staff Name Dr. R.Malathi Class: Iii B.A EconomicsDocument32 pagesPG & Research Department of Economics Subject Name PUBLIC FINANCES Staff Name Dr. R.Malathi Class: Iii B.A EconomicsManishNo ratings yet

- Pahs 053 - Public FinanceDocument69 pagesPahs 053 - Public Financerichardanakwa1xNo ratings yet

- Fiscal AdministrationDocument3 pagesFiscal AdministrationWyrlo Binamira Dela CruzNo ratings yet

- Trends in Public Finance (E)Document7 pagesTrends in Public Finance (E)Ayushi JadonNo ratings yet

- ECN 312 Intro. To PF NoteDocument11 pagesECN 312 Intro. To PF NoteAmoo Damilola GiftNo ratings yet

- I Study of Public Fiscal Joshua Alfonso PuatoDocument15 pagesI Study of Public Fiscal Joshua Alfonso PuatoCalooocan City - OSEC Data CenterNo ratings yet

- Public Finance: Revenue and Expenditure: Arya SalimDocument12 pagesPublic Finance: Revenue and Expenditure: Arya SalimImpact JournalsNo ratings yet

- DISKUSIDocument8 pagesDISKUSIDelli YaniiNo ratings yet

- Public Finance Lecture NotesDocument26 pagesPublic Finance Lecture NotesAssfaw KebedeNo ratings yet

- SEC 332/BEC 432 Lecturer: M.C. MulengaDocument26 pagesSEC 332/BEC 432 Lecturer: M.C. MulengaMiyanda Hakauba HayombweNo ratings yet

- Meaning of Public FinanceDocument7 pagesMeaning of Public Financemahammadshaheer603No ratings yet

- Unit 2-Allocation, Distribution and StabilisationDocument63 pagesUnit 2-Allocation, Distribution and Stabilisationironman73500No ratings yet

- DEBATE Government InterventionDocument7 pagesDEBATE Government InterventionMarie Gianena SenadorNo ratings yet

- Chapter 7 Governmental AccountingDocument6 pagesChapter 7 Governmental Accountingmohamad ali osmanNo ratings yet

- PUBLIC FINANCE LECTUREDocument5 pagesPUBLIC FINANCE LECTUREEfren ChanNo ratings yet

- Monetary and Fiscal ReportDocument14 pagesMonetary and Fiscal ReportShoaib AbbasNo ratings yet

- Unit 1-Introduction To Public FinanceDocument35 pagesUnit 1-Introduction To Public Financeironman73500No ratings yet

- Eae 313 Public Finance Topic One Sept 2022Document11 pagesEae 313 Public Finance Topic One Sept 2022Nereah DebrahNo ratings yet

- Module 3 - IMDocument41 pagesModule 3 - IMDHWANI DEDHIANo ratings yet

- 8 Main Canons of Public ExpenditureDocument12 pages8 Main Canons of Public ExpenditureLala100% (2)

- 575 Role of Govt. in Economic PlanningDocument11 pages575 Role of Govt. in Economic PlanningNishi JangirNo ratings yet

- Macro G5Document12 pagesMacro G5Jenny NitafanNo ratings yet

- Public Finance Lecture 1Document8 pagesPublic Finance Lecture 1johane charumbiraNo ratings yet

- EC0-PF Mid Sem NotesDocument71 pagesEC0-PF Mid Sem NotesSindhu ,No ratings yet

- Planning Under Mixed EconomyDocument10 pagesPlanning Under Mixed EconomySurendra PantNo ratings yet

- Public Finance CH1 - PrintDocument6 pagesPublic Finance CH1 - PrintWegene Benti UmaNo ratings yet

- Its All in the Price: A Business Solution to the EconomyFrom EverandIts All in the Price: A Business Solution to the EconomyNo ratings yet

- PF Notes Chapter 7Document8 pagesPF Notes Chapter 7uah346No ratings yet

- Chapter One Public Finance and TaxationDocument44 pagesChapter One Public Finance and Taxationabrhamdemissie1221No ratings yet

- BA PIYUSHDocument3 pagesBA PIYUSHhunnybunnyy45No ratings yet

- Public Finance Chapter 1 SummaryDocument56 pagesPublic Finance Chapter 1 SummarySindhu ,No ratings yet

- 1) How Inflation Can Be Prevented and Controlled? Is Inflation Good or Bad? Inflation Can Be Controlled byDocument3 pages1) How Inflation Can Be Prevented and Controlled? Is Inflation Good or Bad? Inflation Can Be Controlled byNethaji BKNo ratings yet

- Fiscal Policy V UNIT-1Document10 pagesFiscal Policy V UNIT-1madhumithaNo ratings yet

- Public FinanceDocument24 pagesPublic Financekakshit320No ratings yet

- Political Philosophies of PFM and Government Intervention in MarketsDocument70 pagesPolitical Philosophies of PFM and Government Intervention in MarketscostaNo ratings yet

- PFT HandOutDocument14 pagesPFT HandOutyechale tafereNo ratings yet

- A U-Turn on the Road to Serfdom: Prospects for Reducing the Size of the StateFrom EverandA U-Turn on the Road to Serfdom: Prospects for Reducing the Size of the StateNo ratings yet

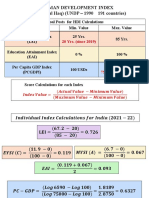

- 1.1 HDI and MDIDocument5 pages1.1 HDI and MDISheldon JosephNo ratings yet

- Rationale For State InterventionDocument3 pagesRationale For State InterventionSheldon JosephNo ratings yet

- Arrow New DocumentDocument2 pagesArrow New DocumentSheldon JosephNo ratings yet

- Vicious cycles trap poor nations in povertyDocument3 pagesVicious cycles trap poor nations in povertySheldon JosephNo ratings yet

- 1.1a GDIDocument3 pages1.1a GDISheldon JosephNo ratings yet

- 1.0 Eco Growth Vs Eco DevelopmentDocument7 pages1.0 Eco Growth Vs Eco DevelopmentSheldon JosephNo ratings yet

- Role of The Government in Organized Society IIDocument2 pagesRole of The Government in Organized Society IISheldon JosephNo ratings yet

- Arrow New DocumentDocument2 pagesArrow New DocumentSheldon JosephNo ratings yet

- 1.4 Human Capital FormationDocument5 pages1.4 Human Capital FormationSheldon JosephNo ratings yet

- Social Welfare CriteriaDocument8 pagesSocial Welfare CriteriaSheldon JosephNo ratings yet

- Classification of GoodsDocument3 pagesClassification of GoodsSheldon JosephNo ratings yet

- Rationale For State InterventionDocument3 pagesRationale For State InterventionSheldon JosephNo ratings yet

- IS Curve 1Document3 pagesIS Curve 1Sheldon JosephNo ratings yet

- Economic Policy UncertaintyDocument2 pagesEconomic Policy UncertaintySheldon JosephNo ratings yet

- LM Curve 1Document2 pagesLM Curve 1Sheldon JosephNo ratings yet

- Phillips Curve and Okun's LawDocument3 pagesPhillips Curve and Okun's LawSheldon JosephNo ratings yet

- Essential Accounting Concepts and Principles ExplainedDocument2 pagesEssential Accounting Concepts and Principles ExplainedNavi MobeNo ratings yet

- Setting The Rules Dean BakerDocument11 pagesSetting The Rules Dean BakerOccupyEconomicsNo ratings yet

- Impact of Covid-19Document59 pagesImpact of Covid-19Md Mostafijur RahmanNo ratings yet

- Sri Lanka Concludes Initial Restricted Discussions With Ad Hoc Group of BondholdersDocument19 pagesSri Lanka Concludes Initial Restricted Discussions With Ad Hoc Group of BondholdersAdaderana OnlineNo ratings yet

- LAWDocument4 pagesLAWCatherine SelladoNo ratings yet

- Factura - Ad 245676 - Sempo Trans S.R.L.Document2 pagesFactura - Ad 245676 - Sempo Trans S.R.L.serban popescuNo ratings yet

- Modernization Theory by RostowDocument16 pagesModernization Theory by RostowYeshey JamtshoNo ratings yet

- Pak Plas For Web PDFDocument160 pagesPak Plas For Web PDFHusnain ArifNo ratings yet

- Drilling and Blasting Activities at Senakin Mine ProjectDocument18 pagesDrilling and Blasting Activities at Senakin Mine ProjectSlamet SetyowibowoNo ratings yet

- Pemerintah Kabupaten Penajam Paser Utara Dinas Ketahanan PanganDocument3 pagesPemerintah Kabupaten Penajam Paser Utara Dinas Ketahanan PanganMustofiNo ratings yet

- Tiqets Voucher 471645509Document9 pagesTiqets Voucher 471645509nitsan2005No ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearVivek SinghNo ratings yet

- Millennium Development and Sustainable Development GoalsDocument5 pagesMillennium Development and Sustainable Development GoalsPrgya SinghNo ratings yet

- Written Assignment Solution Unit 6Document6 pagesWritten Assignment Solution Unit 6Emmanuel Gift Bernard100% (1)

- GCI Analysis South Korea 17 Aug 22 2035 HrsDocument30 pagesGCI Analysis South Korea 17 Aug 22 2035 HrsaartiNo ratings yet

- Tax HavensDocument28 pagesTax HavensAgha WaseemNo ratings yet

- Kajal Sip 1Document48 pagesKajal Sip 1Kajal NagraleNo ratings yet

- 40 Years of SADC-Enhancing Regional Cooperation and Integration-English..Document171 pages40 Years of SADC-Enhancing Regional Cooperation and Integration-English..Avumile MshoshoNo ratings yet

- Concept of Corporate Governance DefinedDocument8 pagesConcept of Corporate Governance DefinedPrashant singhNo ratings yet

- Class 8 Profit and LossDocument1 pageClass 8 Profit and LossPoojitha PottiNo ratings yet

- Complete Packing List - Mujeeb Belt - 10-Mar-2023Document3 pagesComplete Packing List - Mujeeb Belt - 10-Mar-2023Muhammad AfzalNo ratings yet

- Shell Global Brand Essentials Assessment - Assessor Manual - FINAL 13.04.2022 (GBW Version)Document54 pagesShell Global Brand Essentials Assessment - Assessor Manual - FINAL 13.04.2022 (GBW Version)Liz RamosNo ratings yet

- EU Commission raises no objections to State aid casesDocument16 pagesEU Commission raises no objections to State aid casesjaimeNo ratings yet

- Semester V Dse Options 2023-24 (Responses)Document26 pagesSemester V Dse Options 2023-24 (Responses)AshveerNo ratings yet

- Ride Details Bill DetailsDocument3 pagesRide Details Bill DetailsPraveen latteNo ratings yet

- Philippine Interest Rate Response to Estimated World RateDocument8 pagesPhilippine Interest Rate Response to Estimated World Ratekim cheNo ratings yet

- USDA Export Sales Report - Current and Recent HistoryDocument2 pagesUSDA Export Sales Report - Current and Recent HistoryPhương NguyễnNo ratings yet

- A Comparative Financial PerformanceDocument60 pagesA Comparative Financial Performanceब्राह्मण विभोरNo ratings yet