Professional Documents

Culture Documents

CPAR Additional-Notes

Uploaded by

Rembrant MarthyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CPAR Additional-Notes

Uploaded by

Rembrant MarthyCopyright:

Available Formats

Corporate Liquidation

(Workback Problem)

A Statement of Realization and Liquidation has been prepared for HIJ Co. The details

are given below:

Assets to be Realized 180,000 Liabilities assumed 150,000

Assets Acquired 120,000 Liabilities not liquidated 195,000

Assets Realized 165,000 Supplementary credits 330,000

Liabilities to be 240,000 Supplementary Charges 210,000

Liquidated

In the SORAL, the total of the debit side is lower than the total of the credit side by

P36,000. The ending balance of Capital Stock and Retained Earnings are P300,000 and

(P255,000), respectively.

A = L + SHE / Estate Equity BEGINNING

240,000 (Liabilities) + 9,000 (Estate Equity) = 249,000 Total Assets - 180,000

(Non-Cash Assets) = 69,000 (Cash)

A = L + SHE / Estate Equity END

195,000 (Liabilities) + 45,000 (Estate Equity) = 240,000 Total Assets - 51,000

(Non-Cash Assets Not Realized) = 189,000 (Cash)

NOTE: in SORAL / Periodic Report

Retained Earnings with DEBIT balance is either Deficit or Retained Deficit

SHE with CREDIT balance is also known as Estate Equity

SHE with DEBIT balance is either Estate Deficit or Estate Deficiency

NOTE: in SOFA / Preliminary or Planning Report

Excess of Total Liabilities over Total Assets at estimated realizable

value is also known as Estimated Deficiency

THEREFORE:

ESTATE Deficiency is NOT the same with ESTIMATED Deficiency

Compute for the following:

1. Beginning balance of cash 69,000

2. Estate equity/(deficit) beginning (300,000 - 291,000 ) 9,000

3. Ending balance of cash. (reconciliation from beginning to end) 189,000

Estate Equity, ending balance 45,000 (300,000 - 255,000)

DR

Debit Credit

To be realized Realized

180,000 165,000

Increase in assets Not Realized

120,000 51,000

Liquidated To be liquidated

195,000 240,000

Not liquidated Increase in liabilities

195,000 150,000

Supplementary Charges Supplementary Credit

210,000 330,000

900,000 936,000

36,000 Net Income

(Efficiency/Technique Problem)

KLM Corporation provided the following balances in December 1, 2022:

Cash 22,000 Accounts payable 238,000

Accounts 140,000 Wages payable 100,000

receivable

Inventories 240,000 Tax payable 140,000

Notes receivable 312,000 Note payable 260,000

Equipment 1,024,000 Mortgage payable 700,000

Share capital 480,000

_______ Deficit/(Debit RE) (180,000)

Total 1,738,000 Total 1,738,000

In the Statement of Realization and Liquidation the following data were ascertained

for the month of September:

● From the existing accounts receivable at the beginning of the month, P80,000 was

collected at book value; P40,000 of the remaining balance from the existing

receivable at the beginning of the month will be collected in the following month

and the rest were worthless.

● 75% of the inventories were sold for P260,000. (perpetual system) As a

consequence, the amount will increase the available for settlement to unsecured

claims this period.

● P227,200 of the recorded notes receivable on September 1 were collected at the

same amount and the rest were worthless; the entire accrued interest on the notes

receivable were all collected during the month.

● Equipment was sold for P780,000.

● Administrative expenses of P44,800 were incurred.

● Additional credit sales amounting to P56,000 were made for the remaining

inventories (perpetual system)

● Interests accrued for the month were for as follows: note receivable P11,200, note

payable P26,000 and mortgage payable P84,000.

● The mortgage payable and the related liability were paid.

● Unsecured priority claims were paid including taxes.

● The remaining non-cash assets are to be realized the following month and the

remaining liabilities are to be paid the following month.

1. Compute the profit or (loss) of the trustee in the Statement of Realization

and Liquidation during the period (416,400)

2. Compute the cash balance at December 31, 2022 311,600

A = L - Estate Deficit or Estate Deficiency

Cash 311,600

AR 96,000

Total Asset = Total Liabilities - Estate Deficit/Estate Deficiency

407,600 = 524,000 (116,400)

(Workback Problem)

KDC Corporation is undergoing liquidation. The trustee of KDC Corp. presented

the following information:

Assets amounting to P1,000,000 are available to unsecured liabilities without priority.

Assets amounting to P880,000 represents assets originally not pledged to any liabilities.

Unpaid liabilities are as follows: administrative expenses: P168,000; taxes: P144,000

and wages: P256,000. Accounts payable and notes payable totaled P1,440,000. No

assets were pledged on the said liabilities. Estimated payment to fully secured creditors

and partially secured creditors amounts to P1,112,000 and P1,152,000 respectively.

The expected recovery percentage is 40%.

Compute the estimated amount of assets pledged to fully secured creditors

1,800,000

Compute the estimated amount to be paid to all creditors

3,408,000

Solution:

Net Free Assets P 1,000,000

Add: With Priority 568,000

Total Free Assets P 1,568,000

Less: Assets Not Pledged (880,000)

Free Portion P 688,000

Add: Payment to Fully Secured 1,112,000

Assets Pledged to Fully P 1,800,000

Estimated Payment to All Creditors

Fully Secured Creditors P1,112,000

Partially Secured Creditors 1,152,000

Unsecured with Priority 568,000

Unsecured without Priority P 576,000 (1,440,000 x 40%)

P3,408,000

Alternative Computation 1:

Assets Pledged to Fully P1,800,000

*Assets Pledged to Partially 728,000

Free Assets (not pledged) 880,000 P3,408,000

Net Free Assets P1,000,000

Divided by Recovery % 40%

Unsecured Liabilities P2,500,000

Less: Without Priority (1,440,000)

Unsecured Portion P1,060,000*

Estimated Payment to Partially Secured P1,152,000

Less: (1,060,000 x 40%) ( 424,000)

*Assets Pledged to Partially 728,000

Alternative Computation 2:

Fully Secured Liabilities P1,112,000

Partially Secured Liabilities 1,788,000

Unsecured with Priority 568,000

Unsecured without Priority 1,440,000

Total Liabilities P4,908,000

Less: Estimated Deficiency (1,500,000)

Total assets at realizable value 3,408,000

You might also like

- Cash to Accrual ConversionDocument24 pagesCash to Accrual ConversionSteffany RoqueNo ratings yet

- CMA Part2 EssaysDocument128 pagesCMA Part2 EssaysSandeep Sawan100% (1)

- Problem 1-5 Multiple choice (IAADocument34 pagesProblem 1-5 Multiple choice (IAARengeline LucasNo ratings yet

- Lesson 6 - Cash Flows PDFDocument40 pagesLesson 6 - Cash Flows PDFChy B80% (5)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 1 Far Answer KeyDocument25 pages1 Far Answer KeyAngelie0% (1)

- Solution Manual For Strategic Management A Competitive Advantage Approach Concepts Cases 15 e 15th Edition Fred R David Forest R DavidDocument13 pagesSolution Manual For Strategic Management A Competitive Advantage Approach Concepts Cases 15 e 15th Edition Fred R David Forest R DavidChristinaVillarrealfdqs100% (45)

- 2012-Tcot-008-S.o.w-001 Rev.2Document150 pages2012-Tcot-008-S.o.w-001 Rev.2denyNo ratings yet

- Corporate Liquidation ProcessDocument45 pagesCorporate Liquidation ProcessGlenda CordovaNo ratings yet

- CORPORATE LIQUIDATION & ESTATE ACCOUNTING GUIDEDocument6 pagesCORPORATE LIQUIDATION & ESTATE ACCOUNTING GUIDEJean Ysrael Marquez100% (1)

- Corp Liq HandoutDocument14 pagesCorp Liq HandoutJesh Raz100% (12)

- 8905 Corporate Liquidation Answers PDFDocument14 pages8905 Corporate Liquidation Answers PDFJamaica David100% (2)

- 2.1 ExamplesDocument4 pages2.1 ExamplesDM Buenconsejo100% (1)

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- Oct 4 - LectureDocument4 pagesOct 4 - LectureCarl Dhaniel Garcia SalenNo ratings yet

- Prelim Exam - ACTG6257 Intermediate Accounting 3Document22 pagesPrelim Exam - ACTG6257 Intermediate Accounting 3Kitchie Rose Dala CruzNo ratings yet

- Corp Liquidation - QuizDocument5 pagesCorp Liquidation - QuizKj Banal0% (1)

- Corporate Liquidation Home Office and Branch Accounting ProblemsDocument5 pagesCorporate Liquidation Home Office and Branch Accounting ProblemsJustine CruzNo ratings yet

- AcctgDocument11 pagesAcctgsarahbee100% (2)

- Deed of Conditional SaleDocument2 pagesDeed of Conditional SaleJustin Mikhael Abraham100% (1)

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- 8905 Corporate Liquidation Answers PDFDocument14 pages8905 Corporate Liquidation Answers PDFYADAO, EloisaNo ratings yet

- CORPORATE LIQUIDATION QUESTIONSDocument29 pagesCORPORATE LIQUIDATION QUESTIONSreno100% (5)

- Corporate Liquidation Practical ExercisesDocument3 pagesCorporate Liquidation Practical ExercisesRoderica RegorisNo ratings yet

- Lotus Income StatementDocument6 pagesLotus Income StatementJoseph AsisNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- Corporate Liquidation - Theory and ProblemsDocument20 pagesCorporate Liquidation - Theory and ProblemsCarl Dhaniel Garcia SalenNo ratings yet

- 9405 - Corporate LiquidationDocument4 pages9405 - Corporate LiquidationKenneth Anthony BalitayoNo ratings yet

- Additional Cash Flow Problems QuestionsDocument3 pagesAdditional Cash Flow Problems QuestionsChelle HullezaNo ratings yet

- ULOb - Lets AnalyzeDocument2 pagesULOb - Lets Analyzealmira garciaNo ratings yet

- AFAR - 2.0 5.0 - Corp Liq and Hob - ASSESSMENTDocument5 pagesAFAR - 2.0 5.0 - Corp Liq and Hob - ASSESSMENTMakisa YuNo ratings yet

- Bba F&a Notes & ProbDocument5 pagesBba F&a Notes & ProbMouly ChopraNo ratings yet

- Financial AccountingDocument6 pagesFinancial AccountingFernando Alcantara100% (1)

- AFAR Corporate LiquidationDocument4 pagesAFAR Corporate LiquidationAndres, Rebecca PaulaNo ratings yet

- Cash FlowDocument6 pagesCash FlowKailaNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Answer: PH P 1,240: SolutionDocument18 pagesAnswer: PH P 1,240: SolutionadssdasdsadNo ratings yet

- Assignment Bus. CombiDocument49 pagesAssignment Bus. CombiAe AsisNo ratings yet

- BS & Is (Questions)Document7 pagesBS & Is (Questions)Dale JimenoNo ratings yet

- Chapter 4Document17 pagesChapter 4RBNo ratings yet

- Answers in AbmDocument6 pagesAnswers in AbmJEANNE DENISSE MENDOZANo ratings yet

- FA2 - SFP and SCI-Answers 1Document5 pagesFA2 - SFP and SCI-Answers 1Angel AtirazanNo ratings yet

- Exam in Taxation Exam in Taxation: Business Tax (Naga College Foundation) Business Tax (Naga College Foundation)Document29 pagesExam in Taxation Exam in Taxation: Business Tax (Naga College Foundation) Business Tax (Naga College Foundation)jhean dabatosNo ratings yet

- Palmones, Jayhan Grace M. QuizDocument6 pagesPalmones, Jayhan Grace M. QuizjayhandarwinNo ratings yet

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- Cash Flow Statement StudentDocument60 pagesCash Flow Statement StudentJanine MosatallaNo ratings yet

- Module+2+-+Assignment+on+SFP+and+Notes+to+FS Bettina+Flores 3A8Document5 pagesModule+2+-+Assignment+on+SFP+and+Notes+to+FS Bettina+Flores 3A8Bettina Alec Francesca FloresNo ratings yet

- Dapitan Corporation general ledger trial balance analysisDocument6 pagesDapitan Corporation general ledger trial balance analysisLyka Kristine Jane PacardoNo ratings yet

- Exercise 10 Statement of Cash Flows - 054935Document3 pagesExercise 10 Statement of Cash Flows - 054935Hoyo VerseNo ratings yet

- IA3 - REVIEWER - Internediate 3Document38 pagesIA3 - REVIEWER - Internediate 3Mujahad QuirinoNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- Topic 2 - Af09101 - Financial StatementsDocument42 pagesTopic 2 - Af09101 - Financial Statementsarusha afroNo ratings yet

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Consolidation at Subsequent DateDocument7 pagesConsolidation at Subsequent DateJulie Mae Caling MalitNo ratings yet

- Corporate Liquidation Practical Accounting IIDocument4 pagesCorporate Liquidation Practical Accounting IIJalieha Mahmod100% (2)

- FINANCIAL INSTRUMENTSDocument17 pagesFINANCIAL INSTRUMENTSKevin James Sedurifa OledanNo ratings yet

- Module 10 Financial StatementsDocument17 pagesModule 10 Financial StatementsChristine CariñoNo ratings yet

- Corporate LiquidationDocument2 pagesCorporate LiquidationKristienalyn De Asis33% (3)

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- Cash Flow StatementDocument18 pagesCash Flow Statementriya SharmaNo ratings yet

- HRM Assignment 1Document7 pagesHRM Assignment 1Rachel RegoNo ratings yet

- Strategic Marketing Plan of NagadDocument26 pagesStrategic Marketing Plan of Nagadhojega100% (1)

- Polytechnic University of the Philippines Advanced Financial Accounting and Reporting Part 2 Assessment ExamDocument9 pagesPolytechnic University of the Philippines Advanced Financial Accounting and Reporting Part 2 Assessment ExamBazinga HidalgoNo ratings yet

- Megersa Business Plan. Mba 2024Document26 pagesMegersa Business Plan. Mba 2024Megersa100% (1)

- Sixty First Annual Report 2012-13Document131 pagesSixty First Annual Report 2012-13Ishanvi AgarwalNo ratings yet

- Deed of Conditional Sale ReaperDocument2 pagesDeed of Conditional Sale ReaperRandolf Forster DeeNo ratings yet

- Credit Card Application Form: Personal InformationDocument5 pagesCredit Card Application Form: Personal InformationHansi PereraNo ratings yet

- Internal Control and Control Risk HandoutsDocument38 pagesInternal Control and Control Risk Handoutsumar shahzadNo ratings yet

- Aaron Kent - Resume 2022Document2 pagesAaron Kent - Resume 2022Emeka MarcusNo ratings yet

- How Israel Helped To Spawn HamasDocument7 pagesHow Israel Helped To Spawn HamasChrysthian ChrisleyNo ratings yet

- A Study The Compatative of Income Tax For Partnership Firm With Reference To KDMC AreaDocument49 pagesA Study The Compatative of Income Tax For Partnership Firm With Reference To KDMC AreaTasmay EnterprisesNo ratings yet

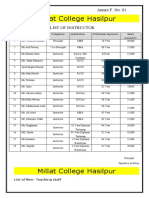

- Millat College Hasilpur: Annex F. No. 01Document3 pagesMillat College Hasilpur: Annex F. No. 01Hashim IjazNo ratings yet

- 5S mottos and methods for workplace organizationDocument2 pages5S mottos and methods for workplace organizationJsham100% (1)

- Tata Motors Group Corporate Presentation 2023Document46 pagesTata Motors Group Corporate Presentation 2023Vikram KatariaNo ratings yet

- PayU Case StudyDocument7 pagesPayU Case Studyajit jogiNo ratings yet

- AFAR IFRS SME Quizzers Acoldnerdlion PDFDocument10 pagesAFAR IFRS SME Quizzers Acoldnerdlion PDFCarl Emerson GalaboNo ratings yet

- Ummary of Study Objectives: 96 The Recording ProcessDocument5 pagesUmmary of Study Objectives: 96 The Recording ProcessYun ChandoraNo ratings yet

- Galfar MS 000-ZX-E-77758Document22 pagesGalfar MS 000-ZX-E-77758Ramaraju RNo ratings yet

- Chapter 7 Customer-Driven Marketing Strategy: Creating Value For Target CustomersDocument9 pagesChapter 7 Customer-Driven Marketing Strategy: Creating Value For Target CustomersNhi ThuầnNo ratings yet

- PD Mitra Account LedgersDocument8 pagesPD Mitra Account LedgersBirul KesNo ratings yet

- Vendor List For Instrumentation Items VeDocument5 pagesVendor List For Instrumentation Items VeSriramsriram SriramNo ratings yet

- Quiz of MGT211Document19 pagesQuiz of MGT211Aman KhanNo ratings yet

- Rice Machinery Safety ProceduresDocument34 pagesRice Machinery Safety ProceduresRommel Tipaklong CorpuzNo ratings yet

- The End of Bureaucracy: How Haier is Building a New Management ModelDocument11 pagesThe End of Bureaucracy: How Haier is Building a New Management ModelWendel RharaelNo ratings yet

- Tool Test 2023 Aug Middle East - Seema - DataDocument1 pageTool Test 2023 Aug Middle East - Seema - DataMohammad AslamNo ratings yet

- Game TheoryDocument16 pagesGame TheoryVivek Kumar Gupta100% (1)

- Final Examination TT For Cert & Dip - Feb 2023Document3 pagesFinal Examination TT For Cert & Dip - Feb 2023wilfredNo ratings yet