0% found this document useful (0 votes)

3K views10 pagesBBA 1.4 Chapter 1 Notes 1

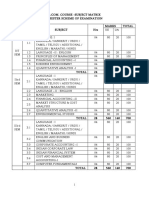

This document outlines the syllabus for the Fundamentals of Accounting course at North Maharashtra University. It includes the course objectives, which are to study fundamental accounting concepts and develop a foundation for higher accounting studies. The syllabus covers topics such as the introduction to accounting, the basics of accounting including the double-entry system, recording transactions, preparing final accounts, conceptual frameworks, and corporate banking. The syllabus allocates 60 hours of lectures across these topics and includes both theoretical and practical components. References for additional reading materials are also provided.

Uploaded by

Gaurav vaidyaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

3K views10 pagesBBA 1.4 Chapter 1 Notes 1

This document outlines the syllabus for the Fundamentals of Accounting course at North Maharashtra University. It includes the course objectives, which are to study fundamental accounting concepts and develop a foundation for higher accounting studies. The syllabus covers topics such as the introduction to accounting, the basics of accounting including the double-entry system, recording transactions, preparing final accounts, conceptual frameworks, and corporate banking. The syllabus allocates 60 hours of lectures across these topics and includes both theoretical and practical components. References for additional reading materials are also provided.

Uploaded by

Gaurav vaidyaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd