Professional Documents

Culture Documents

GST - Ii

Uploaded by

Gaurav vaidyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST - Ii

Uploaded by

Gaurav vaidyaCopyright:

Available Formats

KCES’s Institute of Management and

Research, Jalgaon

Subject: A 4.2

indirect taxes in India

BBA - SEM IV

Chapter 2 : - Goods & Service Tax (GST)-

II

Complied By: Miss. Manasi Bhangale

M. N. Bhangale – IMR Institute

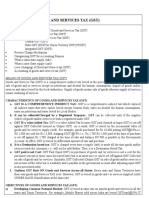

Types of GST

As per the newly implemented tax system, there are 4 different types

of GST:

1. Integrated Goods and Services Tax (IGST)

2. State Goods and Services Tax (SGST)

3. Central Goods and Services Tax (CGST)

4. Union Territory Goods and Services Tax (UTGST)

Difference Between Different Types Of GST

Transactions

Authority which is Priority of Tax Who is it collected which are

Types of GST

benefitted Credit use by? applicable (Goods

and Services)

Within a single

Central Central

CGST CGST IGST state, i.e.

Government Government

intrastate

Within a single

State State

SGST SGST IGST state, i.e.

Government Government

intrastate

Between two

Central

different states or

Government and Central

IGST IGST CGST SGST a state and a

State Government

Union Territory,

Government

i.e. interstate

Within a single

Union Territory Union Territory

UTGST/UGST UTGST IGST Union Territory

(UT) Government (UT) Government

(UT)

M. N. Bhangale – IMR Institute

1. Integrated Goods and Services Tax or IGST

The Integrated Goods and Services Tax or IGST is a tax under the GST

regime that is applied on the interstate (between 2 states) supply of

goods and/or services as well as on imports and exports. The IGST is

governed by the IGST Act. Under IGST, the body responsible for

collecting the taxes is the Central Government.

After the collection of taxes, it is further divided among the respective

states by the Central Government. For instance, if a trader from West

Bengal has sold goods to a customer in Karnataka worth Rs.5,000, then

IGST will be applicable as the transaction is an interstate transaction. If

the rate of GST charged on the goods is 18%, the trader will charge

Rs.5,900 for the goods. The IGST collected is Rs.900, which will be going

to the Central Government.

2. State Goods and Services Tax or SGST

The State Goods and Services Tax or SGST is a tax under the GST regime

which is applicable on intrastate (within the same state) transactions. In

case of intrastate supply of goods and/or services, both State GST and

Central GST are levied. However, the State GST or SGST is levied by the

state on the goods and/or services that are purchased or sold within

the state. It is governed by the SGST Act. The revenue earned through

SGST is solely claimed by the respective state government. For instance,

M. N. Bhangale – IMR Institute

if a trader from West Bengal has sold goods to a customer in West

Bengal worth Rs.5,000, then the GST applicable on the transaction will

be partly CGST and partly SGST. If the rate of GST charged is 18%, it will

be divided equally in the form of 9% CGST and 9% SGST. The total

amount to be charged by the trader, in this case, will be Rs.5,900. Out

of the revenue earned from GST under the head of SGST, i.e. Rs.450,

will go to the West Bengal state government in the form of SGST.

3. Central Goods and Services Tax or CGST

Just like State GST, the Central Goods and Services Tax of CGST is a tax

under the GST regime which is applicable on intrastate (within the

same state) transactions. The CGST is governed by the CGST Act. The

revenue earned from CGST is collected by the Central Government.

As mentioned in the above instance, if a trader from West Bengal has

sold goods to a customer in West Bengal worth Rs.5,000, then the GST

applicable on the transaction will be partly CGST and partly SGST. If the

rate of GST charged is 18%, it will be divided equally in the form of 9%

CGST and 9% SGST. The total amount to be charged by the trader, in

this case, will be Rs.5,900. Out of the revenue earned from GST under

the head of CGST, i.e. Rs.450, will go to the Central Government in the

form of CGST.

M. N. Bhangale – IMR Institute

4. Union Territory Goods and Services Tax or UTGST

The Union Territory Goods and Services Tax or UTGST is the

counterpart of State Goods and Services Tax (SGST) which is levied on

the supply of goods and/or services in the Union Territories (UTs) of

India. The UTGST is applicable on the supply of goods and/or services in

Andaman and Nicobar Islands, Chandigarh, Daman Diu, Dadra and

Nagar Haveli, and Lakshadweep. The UTGST is governed by the UTGST

Act. The revenue earned from UTGST is collected by the Union Territory

government. The UTGST is a replacement for the SGST in Union

Territories. Thus, the UTGST will be levied in addition to the CGST in

Union Territories.

GST Council: Rights & Constitution of GST Council

GST council is a governing body to regulate and direct each and every

step for the implementation of goods and service tax in the nation with

decisions over tax rates and further implementation measures. GST

council assimilates suggestions and regulation into one form and

improvise the changes formally through notifications and circulars with

its departments and finance ministry.

M. N. Bhangale – IMR Institute

GST Council Constitution

According to Article 279A, it is on the part of the president to give the

order to constitute the council of GST within the 60 days from the 12th

September 2016 which is already notified by the Government.

Following are the designated personnel, who will form the GST Council

together:-

The Union Finance Minister who will be the chairman of the

council;

The Union Minister of State in charge of Revenue or Finance who

will be the member of council;

one member from each state who is minister in charge of finance

or taxation or any other minister and anyone of them will be vice

chairman of the GST council who will be mutually elected by

them.

Note

the secretary of revenue department will work as ex-officio

secretary to the GST council,

M. N. Bhangale – IMR Institute

the chairperson of central board of excise and customs will be the

permanent invitee in all the proceedings of the GST council who

will not have the voting rights.

Functions of the GST Council

The GST council will be supposed to make the recommendation to the

Union and State on the following matters:-

On subsuming of various taxes, cess, and surcharge in GST.

Details of services and goods that will be subjected to GST or

which will be exempted from GST.

On Threshold limit below which, services and goods will be

exempted from GST.

On GST rates including floor rate with bands of GST and any

special rate for time being to arrange resources to face any

natural calamity.

Making special provisions for the following states: Arunachal

Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya,

Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and

Uttarakhand.

On model law on GST, Principal of levy of GST and the principals

which will govern the place of Supply.

M. N. Bhangale – IMR Institute

Registration under GST

GST Registration is a process by which a taxpayer gets himself

registered under GST. Once a business is successfully registered, a

unique registration number is assigned to them known as the Goods

and Services Tax Identification Number (GSTIN). This is a 15-digit

number assigned by the central government after the taxpayers obtain

registration.

Who Is Eligible to Register Under GST?

All the businesses supplying goods whose turnover exceeds Rs 40

lakh in a financial year are required to register as a normal taxable

person. However, the threshold limit is Rs 10 lakh if you have a business

in north-eastern states, J&K, Himachal Pradesh and Uttarakhand.

The turnover limit is Rs 20 lakh, and in case of special category States,

Rs 10 lakh, for the service providers.

Documents Required for GST registration

Take a look at the list of documents that you will need for registering

your business under GST:

Permanent Account Number (PAN) of the applicant

Copy of the Aadhaar card

M. N. Bhangale – IMR Institute

Proof of business registration or incorporation certificate

Identity and address proof of promoters/directors with a

photograph

Bank account statement/cancelled cheque

Authorization letter/board resolution for authorized signatory

Digital signature

Procedure for GST Registration

The step-by-step procedure that individuals must follow to complete

GST Registration is mentioned below:

Step - 1: Visit the GST portal - https://www.gst.gov.in

Step - 2: Click on the ‘Register Now’ link which can be found

under the ‘Taxpayers’ tab

Step - 3: Select ‘New Registration’.

Step - 4: Fill the below-mentioned details:

Under the ‘I am a’ drop-down menu, select ‘Taxpayer’.

Select the respective state and district.

Enter the name of the business.

Enter the PAN of the business.

Enter the email ID and mobile number in the respective

boxes. The entered email ID and mobile number must be

active as OTPs will be sent to them.

M. N. Bhangale – IMR Institute

Enter the image that is shown on the screen and click on

‘Proceed’.

Step - 5: On the next page, enter the OTP that was sent to the

email ID and mobile number in the respective boxes.

Step - 6: Once the details have been entered, click on ‘Proceed’.

Step - 7: You will be shown the Temporary Reference Number

(TRN) on the screen. Make a note of the TRN.

Step - 8: Visit the GST portal again and click on ‘Register’ under

the ‘Taxpayers’ menu.

Step - 9: Select ‘Temporary Reference Number (TRN)’.

Step - 10: Enter the TRN and the captcha details.

Step - 11: Click on ‘Proceed’.

Step - 12: You will receive an OTP on your email ID and registered

mobile number. Enter the OTP on the next page and click on

‘Proceed’.

Step - 13: The status of your application will be available on the

next page. On the right side, there will be an Edit icon, click on

it.

Step - 14: There will be 10 sections on the next page. All the

relevant details must be filled, and the necessary documents

must be submitted. The list of documents that must be

uploaded are mentioned below:

M. N. Bhangale – IMR Institute

Photographs

Business address proof

Bank details such as account number, bank name, bank

branch, and IFSC code.

Authorization form

The constitution of the taxpayer.

Step - 15: Visit the ‘Verification’ page and check the declaration,

then submit the application by using one of the below

mentioned methods:

By Electronic Verification Code (EVC). The code will be

sent to the registered mobile number.

By e-Sign method. An OTP will be sent to the mobile

number linked to the Aadhaar card.

In case companies are registering, the application must

be submitted by using the Digital Signature Certificate

(DSC).

Step - 16: Once completed, a success message will be shown on

the screen. The Application Reference Number (ARN) will be

sent to the registered mobile number and email ID.

Step - 17: You can check the status of the ARN on the GST portal.

M. N. Bhangale – IMR Institute

GST Rate Structure

Slab Popular Goods Popular Services

Rates

5% Frozen vegetables, Newspaper printing,

Fertilizers, Spices, Takeaway Food, Restaurants

Plastic waste

12% Ghee, Nuts, Fruits, Temporary basis IP rights,

Pouches, purses and Building construction for

Handbags sale

18% Washing Machine, Outdoor Catering, IT

Camera, Shampoo services, Telecom services

28% Sunscreen, Cinema, Food/Drinks/Stay at

Motorcycles, Pan AC Five Star Hotels

Masala

M. N. Bhangale – IMR Institute

You might also like

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- GST in IndiaDocument12 pagesGST in IndiaRahul ChaturvediNo ratings yet

- Agl Better Bills Sample Bill NecfDocument3 pagesAgl Better Bills Sample Bill Necfmdimamulislam325No ratings yet

- Taxation 2018 7 SEMDocument51 pagesTaxation 2018 7 SEMKSLU Students100% (1)

- SAP MM Interview Question by TagSkillsDocument8 pagesSAP MM Interview Question by TagSkillsGopalNo ratings yet

- Types of GST: Presented BY Kowsalya.SDocument8 pagesTypes of GST: Presented BY Kowsalya.SKowsiNo ratings yet

- Types of GST Authority Which Is Benefitted Priority of Tax Credit Use Who Is It Collected By? Transactions Which Are Applicable (Goods and Services)Document2 pagesTypes of GST Authority Which Is Benefitted Priority of Tax Credit Use Who Is It Collected By? Transactions Which Are Applicable (Goods and Services)Kruttika MohapatraNo ratings yet

- Taxguru - In-Dual GST Model GST Structure in IndiaDocument9 pagesTaxguru - In-Dual GST Model GST Structure in IndiahumanNo ratings yet

- Taxes Levied Under GSTDocument11 pagesTaxes Levied Under GSTParth BindalNo ratings yet

- What Is SGST CGST & IGST?Document2 pagesWhat Is SGST CGST & IGST?Filing BuddyNo ratings yet

- Guide To CGST, SGST and IGST: Inter-State Vs Intra-StateDocument6 pagesGuide To CGST, SGST and IGST: Inter-State Vs Intra-StateSuman IndiaNo ratings yet

- A Study On Impact of GST On Indian Economy: Chirag RanaDocument4 pagesA Study On Impact of GST On Indian Economy: Chirag RanaPratyasha SarkarNo ratings yet

- GST TableDocument1 pageGST Tableshreshtha0008No ratings yet

- 1) What Is GST? What Are The Various Tax Subsumed Under GST?Document2 pages1) What Is GST? What Are The Various Tax Subsumed Under GST?Nethaji BKNo ratings yet

- Dual GST (Goods and Services Tax) in IndiaDocument1 pageDual GST (Goods and Services Tax) in IndiaWelcome 1995No ratings yet

- Chapter 6 - GSTDocument3 pagesChapter 6 - GSTchovvNo ratings yet

- GST Definition, Objective, Framework, Action Plan & Scope: Historical Background of GSTDocument6 pagesGST Definition, Objective, Framework, Action Plan & Scope: Historical Background of GSTRamapriyaiyengarNo ratings yet

- Mrunal Lecture 16 @Document21 pagesMrunal Lecture 16 @BASIC LIFENo ratings yet

- Law of Taxation Unit 3 To 5 by Praveen B SDocument56 pagesLaw of Taxation Unit 3 To 5 by Praveen B SSona SharmaNo ratings yet

- History of GST in IndiaDocument4 pagesHistory of GST in IndiaGiridharManiyedathNo ratings yet

- GST Unit 1-5Document21 pagesGST Unit 1-5Joshua StarkNo ratings yet

- Introduction To GST: 1. What Is GST? When Is GST Expected To Be Implemented?Document1 pageIntroduction To GST: 1. What Is GST? When Is GST Expected To Be Implemented?JItNo ratings yet

- Guide To CGSTDocument12 pagesGuide To CGSTSunil RAYALASEEMA GRAPHICSNo ratings yet

- India Is Currently Going Through Major Reforms in Its Overall Economic SectorsDocument2 pagesIndia Is Currently Going Through Major Reforms in Its Overall Economic Sectors777priyankaNo ratings yet

- Ques 1:: Domestic ConsumptionDocument13 pagesQues 1:: Domestic ConsumptionMegha JoshiNo ratings yet

- CTP AssignmentDocument10 pagesCTP AssignmentANIL KUMARNo ratings yet

- GST: Impact On Indian Economy: PallavikapilaDocument3 pagesGST: Impact On Indian Economy: PallavikapilaVishal kumarNo ratings yet

- Finance Activity in Sap MMDocument27 pagesFinance Activity in Sap MMAnilGawandNo ratings yet

- Goods and Service Tax Act, 2017Document4 pagesGoods and Service Tax Act, 2017shivani yadavNo ratings yet

- Earlier The Constitution Empowered The Central Government To Levy Excise Duty On Manufacturing and Service Taxes On The Supply of ServicesDocument3 pagesEarlier The Constitution Empowered The Central Government To Levy Excise Duty On Manufacturing and Service Taxes On The Supply of ServicesIshu SinghNo ratings yet

- Project 3Document17 pagesProject 3Hemant MandalNo ratings yet

- Chapter 1: Introduction To GSTDocument3 pagesChapter 1: Introduction To GSTsnehalNo ratings yet

- GSTDocument7 pagesGSTKeertiNo ratings yet

- Structure of GSTDocument9 pagesStructure of GSTHiteshi AggarwalNo ratings yet

- LLB Taxation Law Unit-3 Part - 1-1 PDFDocument44 pagesLLB Taxation Law Unit-3 Part - 1-1 PDFravi kumarNo ratings yet

- Ashish TaxDocument20 pagesAshish TaxAshish RajNo ratings yet

- Prospectus of GST in IndiaDocument12 pagesProspectus of GST in IndiaDr.P. Siva RamakrishnaNo ratings yet

- What Is SGST, CGST, IGST and UTGSTDocument17 pagesWhat Is SGST, CGST, IGST and UTGSTCA Naveen Kumar BalanNo ratings yet

- Suraj TybmsDocument6 pagesSuraj Tybmsdrawback979No ratings yet

- Jyoti Rawat Bsev (Bba - A)Document22 pagesJyoti Rawat Bsev (Bba - A)JyotiNo ratings yet

- GST IntroductionDocument13 pagesGST IntroductionAnjali Krishna SNo ratings yet

- SLS Pune Presentation 17.08.17Document68 pagesSLS Pune Presentation 17.08.17Sanyam MishraNo ratings yet

- Need For Introducing GSTDocument4 pagesNeed For Introducing GSTTarshit NekkantiNo ratings yet

- GST Project Raghav, Shubham, KanavDocument5 pagesGST Project Raghav, Shubham, KanavRAGHAV JAGGANo ratings yet

- GST Fast Track Notes PDFDocument69 pagesGST Fast Track Notes PDFJayadeepNo ratings yet

- Goods and Service TaxDocument12 pagesGoods and Service TaxprachiNo ratings yet

- GST Question Bank-CA Cs HubDocument63 pagesGST Question Bank-CA Cs Hubhcsharma19670% (1)

- Introduction To Good and Service TaxDocument35 pagesIntroduction To Good and Service TaxShubham KuberkarNo ratings yet

- Complete GST NotesDocument102 pagesComplete GST Noteslawsaba6No ratings yet

- 2.1 Method of Collecting Data Primary DataDocument8 pages2.1 Method of Collecting Data Primary Datadeepak sipaniNo ratings yet

- Introduction To Goods and Services Tax (GST)Document6 pagesIntroduction To Goods and Services Tax (GST)Tax NatureNo ratings yet

- GST AssignmentDocument16 pagesGST AssignmentDroupathyNo ratings yet

- Introduction To Goods and Services Tax (GST)Document7 pagesIntroduction To Goods and Services Tax (GST)Anjali PawarNo ratings yet

- Christ RespondentDocument8 pagesChrist RespondentShekharNo ratings yet

- UTGST - Salient FeaturesDocument9 pagesUTGST - Salient Featureskoushiki mishraNo ratings yet

- Guru Nanak International Public School: Conomics Project OnDocument42 pagesGuru Nanak International Public School: Conomics Project OnRohit NagarNo ratings yet

- An Ultimate Guide To Goods and Service Tax (GST)Document6 pagesAn Ultimate Guide To Goods and Service Tax (GST)bfinservNo ratings yet

- Week 4 Day 2: Salient Features of GST ObjectivesDocument2 pagesWeek 4 Day 2: Salient Features of GST Objectivestina tanwarNo ratings yet

- GST NotesDocument22 pagesGST NotesSARATH BABU.YNo ratings yet

- Module 4Document11 pagesModule 4Suryansh Kumar AroraNo ratings yet

- Introduction To GSTDocument16 pagesIntroduction To GSTkomil bogharaNo ratings yet

- CGSTDocument7 pagesCGSTstudentNo ratings yet

- BBA 1.4 Chapter 1 Notes 1Document10 pagesBBA 1.4 Chapter 1 Notes 1Gaurav vaidyaNo ratings yet

- Business & ProfessionDocument10 pagesBusiness & ProfessionGaurav vaidyaNo ratings yet

- Unit 2 Human Resource PlanningDocument18 pagesUnit 2 Human Resource PlanningGaurav vaidyaNo ratings yet

- A 4.5 FM Notes UNIT 1-2-3Document28 pagesA 4.5 FM Notes UNIT 1-2-3Gaurav vaidyaNo ratings yet

- A 4.3 HRM Unit 4-5Document34 pagesA 4.3 HRM Unit 4-5Gaurav vaidyaNo ratings yet

- A Lack of CapitalDocument1 pageA Lack of CapitalGaurav vaidyaNo ratings yet

- Elements of Financial Strategies in CompaniesDocument2 pagesElements of Financial Strategies in CompaniesGaurav vaidyaNo ratings yet

- Gaurav Internship Project ReportDocument38 pagesGaurav Internship Project ReportGaurav vaidyaNo ratings yet

- Gaurav ReportDocument39 pagesGaurav ReportGaurav vaidyaNo ratings yet

- Mythbusters of GSTDocument3 pagesMythbusters of GSTkamaljeet kaur MaanNo ratings yet

- Ks TCKDocument1 pageKs TCKajay gairolaNo ratings yet

- What Is Excise DutyDocument2 pagesWhat Is Excise DutyPraful SharmaNo ratings yet

- Taxation - Reviewer TaskDocument3 pagesTaxation - Reviewer TaskLaguna HistoryNo ratings yet

- Quality Irrigation: Fifty One Thousand Thirty Rupees OnlyDocument1 pageQuality Irrigation: Fifty One Thousand Thirty Rupees OnlyAfzalpatelNo ratings yet

- Pesco Online BillDocument2 pagesPesco Online BillMuhammad ShoaibNo ratings yet

- My Doggy Ate My Homework Poem by Dave CrawleyDocument6 pagesMy Doggy Ate My Homework Poem by Dave Crawleyagbhqfuif100% (1)

- The Globalization of Economic RelationsDocument55 pagesThe Globalization of Economic RelationsMark Anthony LegaspiNo ratings yet

- July 1-3613311284991 - BM2333I004319657Document9 pagesJuly 1-3613311284991 - BM2333I004319657Jihoon BongNo ratings yet

- Changes in GST Relevant For GST Audit of FY 21-22 - YS - RKSDocument13 pagesChanges in GST Relevant For GST Audit of FY 21-22 - YS - RKSkabathulla shaikNo ratings yet

- HDFC Fees For DEMAT TransactionsDocument1 pageHDFC Fees For DEMAT TransactionsPAWAN KAMALESHNo ratings yet

- Power Plant Economics - Consolidated - Question - BankDocument4 pagesPower Plant Economics - Consolidated - Question - BankpadmanathanNo ratings yet

- Export Promotional Schemes and Benefits Applicable For UnboxRobotics - PresentationDocument8 pagesExport Promotional Schemes and Benefits Applicable For UnboxRobotics - PresentationSunil MateNo ratings yet

- BA122 SummaryDocument6 pagesBA122 SummaryJaiavave LinogonNo ratings yet

- Principle of Unjust EnrichmentDocument3 pagesPrinciple of Unjust EnrichmentAanchal KashyapNo ratings yet

- Assignment TwoDocument3 pagesAssignment TwoBetsy SeyoumNo ratings yet

- Tax Evasion VS Tax AvoidanceDocument5 pagesTax Evasion VS Tax AvoidanceJeth KebengNo ratings yet

- Charges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids CardDocument5 pagesCharges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids Cardrose thomsan thomsanNo ratings yet

- February 2023 NewsLetterDocument23 pagesFebruary 2023 NewsLetterSabrina CanoNo ratings yet

- Eco211 Answer (Mohamad Ilyas, Ba1143b)Document2 pagesEco211 Answer (Mohamad Ilyas, Ba1143b)5B Mohamad Ilyas bin ZamariNo ratings yet

- Economics Essay CIGEDocument8 pagesEconomics Essay CIGERidhan RiyalNo ratings yet

- Bill April 21Document1 pageBill April 21Lakshay SharmaNo ratings yet

- Bill DetailDocument1 pageBill DetailDuraisamyNo ratings yet

- VAT NotesDocument21 pagesVAT NotesiBEAYNo ratings yet

- Ekurhuleni Schedule 2 of Electricity Tariffs 2023 24Document37 pagesEkurhuleni Schedule 2 of Electricity Tariffs 2023 24Mike BarkerNo ratings yet

- IOP InvoiceDocument1 pageIOP InvoiceTeuku Budi AuliaNo ratings yet

- Community Engagement in AfricaDocument2 pagesCommunity Engagement in AfricaAshutosh TulsyanNo ratings yet

- Fee Acknowledgement - Academic Session:2022-23: Form No.:22651356Document1 pageFee Acknowledgement - Academic Session:2022-23: Form No.:22651356haleyNo ratings yet