Professional Documents

Culture Documents

Accounting 2

Uploaded by

TITCHIE PLAZOS0 ratings0% found this document useful (0 votes)

5 views1 pageTecson Company leased equipment to Trinidad Company for 8 years starting January 1, 2020. The equipment was purchased by Tecson on December 29, 2019 for P4,800,000. The present value of the 8 annual lease payments of P900,000 discounted at 10% is P5,280,000. The gross profit on sale for 2020 is P480,000, calculated as the present value of lease payments less the cost of the equipment.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTecson Company leased equipment to Trinidad Company for 8 years starting January 1, 2020. The equipment was purchased by Tecson on December 29, 2019 for P4,800,000. The present value of the 8 annual lease payments of P900,000 discounted at 10% is P5,280,000. The gross profit on sale for 2020 is P480,000, calculated as the present value of lease payments less the cost of the equipment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageAccounting 2

Uploaded by

TITCHIE PLAZOSTecson Company leased equipment to Trinidad Company for 8 years starting January 1, 2020. The equipment was purchased by Tecson on December 29, 2019 for P4,800,000. The present value of the 8 annual lease payments of P900,000 discounted at 10% is P5,280,000. The gross profit on sale for 2020 is P480,000, calculated as the present value of lease payments less the cost of the equipment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

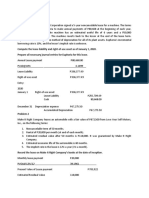

1. Tecson Company leased equipment to Trinidad Company on January 1, 2020.

The lease is for an eight-year period expiring December 31, 2026. The first of

eight annual payments of P900,000 was made on January 1, 2020. The entity

had purchased the equipment on December 29, 2019 for P4,800,000. The

lease is appropriately accounted for as a sales type lease. The present value

on January 1, 2020 of all rent payments over the lease term discounted at a

10% interest rate was P5,280,000. What is the gross profit on sale for 2020?

SOLUTION:

Present value of rentals – sales revenue 5,280,000

Cost of sales (4,800,000)

Gross profit on sale 480,000

You might also like

- Chapter 32Document13 pagesChapter 32LorraineMartinNo ratings yet

- Chapter 15 and 16 IA Valix Sales Type LeaseDocument13 pagesChapter 15 and 16 IA Valix Sales Type LeaseMiko ArniñoNo ratings yet

- Special TopicsDocument77 pagesSpecial TopicsPeter BanjaoNo ratings yet

- Special TopicsDocument89 pagesSpecial TopicsPeter Banjao100% (3)

- Activity Chapter 7: Ans. 245,000 and 79,950 SolutionDocument3 pagesActivity Chapter 7: Ans. 245,000 and 79,950 SolutionRandelle James Fiesta50% (4)

- ALL Quiz Ia 3Document29 pagesALL Quiz Ia 3julia4razoNo ratings yet

- 07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. BaulDocument5 pages07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. Baulkrisha millo50% (2)

- Chapter 15,16, & 17 IA Valix Sales Type LeaseDocument15 pagesChapter 15,16, & 17 IA Valix Sales Type LeaseMiko ArniñoNo ratings yet

- Use The Following Information To Answer Items 1 To 4Document4 pagesUse The Following Information To Answer Items 1 To 4Chris Jay LatibanNo ratings yet

- Operating Lease - Lessee: Problem 1Document2 pagesOperating Lease - Lessee: Problem 1Xander MerzaNo ratings yet

- Final May 2019 C4Document22 pagesFinal May 2019 C4sweya juliusNo ratings yet

- Answers - Lessor Accounting and SLBDocument10 pagesAnswers - Lessor Accounting and SLBPoru SenpiiNo ratings yet

- LeasesDocument1 pageLeasesIm NayeonNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- Benedict Company Leased Equipment To Mark Inc On January 1: Unlock Answers Here Solutiondone - OnlineDocument1 pageBenedict Company Leased Equipment To Mark Inc On January 1: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- IA2Document14 pagesIA2Sitio BayabasanNo ratings yet

- Toaz - Info Valix Problems Shedocx PRDocument30 pagesToaz - Info Valix Problems Shedocx PRDaniella Mae ElipNo ratings yet

- Lessor Discussion U PDFDocument4 pagesLessor Discussion U PDFadmiral spongebobNo ratings yet

- Assignment Problems On LeasesDocument4 pagesAssignment Problems On LeasesEllah Sharielle SantosNo ratings yet

- Sample Problems LBM, Depreciation, Impairment LossDocument10 pagesSample Problems LBM, Depreciation, Impairment LossKenneth M. GonzalesNo ratings yet

- A7 Audit of Intangible AssetsDocument4 pagesA7 Audit of Intangible AssetsKezNo ratings yet

- INTAC3 McsDocument10 pagesINTAC3 Mcsrachel banana hammockNo ratings yet

- Aje 1bsa Abm1Document7 pagesAje 1bsa Abm1Ej UlangNo ratings yet

- XXX FilesDocument1 pageXXX FilesMaya JuanNo ratings yet

- Case 1Document10 pagesCase 1Shawn VerzalesNo ratings yet

- Lease Practical Accounting ProblemsDocument2 pagesLease Practical Accounting ProblemsCamille BonaguaNo ratings yet

- Investment Property & Other InvestmentsDocument3 pagesInvestment Property & Other InvestmentsElla MontefalcoNo ratings yet

- 2023 Tutorials Capital Allow & RecoupmtDocument10 pages2023 Tutorials Capital Allow & RecoupmtNchafie AsemahleNo ratings yet

- 1Document76 pages1darlene floresNo ratings yet

- Financial Accounting II RequirementDocument27 pagesFinancial Accounting II RequirementAnonymousNo ratings yet

- Accounts TEST 3 Q1669011546Document4 pagesAccounts TEST 3 Q1669011546Sachin SHNo ratings yet

- Leases: Lease Part 1Document10 pagesLeases: Lease Part 1ZyxNo ratings yet

- ACC111 Finals ExaminationDocument4 pagesACC111 Finals ExaminationVan De LeonNo ratings yet

- FAR MOCK Edited PDFDocument21 pagesFAR MOCK Edited PDFKorinth BalaoNo ratings yet

- Guided Exercise1Document2 pagesGuided Exercise1Kim Nicole ReyesNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Intangible AssetsDocument2 pagesIntangible AssetsNicole Allyson AguantaNo ratings yet

- 118.2 - Illustrative Examples - IFRS15 Part 2Document2 pages118.2 - Illustrative Examples - IFRS15 Part 2Ian De DiosNo ratings yet

- SynthesisDocument19 pagesSynthesisMej AgaoNo ratings yet

- 12 Acctg Ed 1 - Notes Receivable PDFDocument17 pages12 Acctg Ed 1 - Notes Receivable PDFNath BongalonNo ratings yet

- On January 1, 2-WPS OfficeDocument4 pagesOn January 1, 2-WPS OfficeSanta-ana Jerald JuanoNo ratings yet

- S - Adjusting Entry ProblemsDocument4 pagesS - Adjusting Entry ProblemsYusra PangandamanNo ratings yet

- LeasesDocument3 pagesLeasesAngelica Rome EnriquezNo ratings yet

- Adjusting EntriesDocument8 pagesAdjusting EntriesYusra PangandamanNo ratings yet

- Dado BpsDocument6 pagesDado BpsmcannielNo ratings yet

- CHAPTER 12: Events After Reporting Period: Problem 1Document3 pagesCHAPTER 12: Events After Reporting Period: Problem 1Mark IlanoNo ratings yet

- Assignment Ppfrs 16Document3 pagesAssignment Ppfrs 16Joseph DoctoNo ratings yet

- BCOM - Accounting 3Document6 pagesBCOM - Accounting 3Ntokozo Siphiwo Collin DlaminiNo ratings yet

- IA PPE (Unit Test)Document10 pagesIA PPE (Unit Test)Nina MarieNo ratings yet

- Audit PpeDocument4 pagesAudit Ppenicole bancoroNo ratings yet

- Ass6-2 2Document1 pageAss6-2 2Kath LeynesNo ratings yet

- Finals Q1 - Investment in Equity PDFDocument4 pagesFinals Q1 - Investment in Equity PDFCzerielle QueensNo ratings yet

- With AnswersDocument2 pagesWith AnswersIm NayeonNo ratings yet

- Test 2 2019Document8 pagesTest 2 2019Koti KatishiNo ratings yet

- Current LiabilitiesDocument3 pagesCurrent LiabilitiesniknakslimNo ratings yet

- Far Project PrefiDocument16 pagesFar Project PrefiMarjorie PagsinuhinNo ratings yet

- Lessor Sample ProbDocument24 pagesLessor Sample ProbCzarina Jean ConopioNo ratings yet

- Tutorial 11Document2 pagesTutorial 11Vidya IntaniNo ratings yet

- ACCT203 LeaseDocument4 pagesACCT203 LeaseSweet Emme100% (1)