Professional Documents

Culture Documents

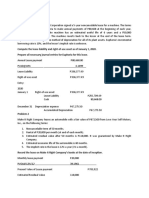

Operating Lease - Lessee: Problem 1

Uploaded by

Xander MerzaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Operating Lease - Lessee: Problem 1

Uploaded by

Xander MerzaCopyright:

Available Formats

OPERATING LEASE - LESSEE On January 1, 2020, Glenn Company

Problem 1 Signed a 10-year operating lease for office

space at P960,000 per year.

On December 1, 2020, Lloyd Company

leased office space for five years at a The lease included a provision for

monthly rental of P600,000. On the same additional rent of 5% annual company

date, the entity paid the lessor the sales in excess of P5,000,000.

following amount:

The sales for the year ended December

Bonus to obtain lease 31, 2020 total P6,000,000

First month’s rent

Last month’s rent Upon execution of the lease, the entity

Security deposit refundable at lease paid P240,000 as a bonus for the lease.

expiration

Installation of new walls and offices What is the rent expense for the year

ended December 31, 2020?

What total amount of the expenses

relating to utilization of the office space Answer: 1,034,000

should be reported for 2020?

Answer : 665,000

Problem 2

Problem 4

On July 1, 2020, Melvin Company leased

office space for 5 years at P150,000 a Lester Company leases and operates a

month, On that date the entity paid the retail store. The following information

lessor the following relates to the lease for the current year:

I. The store lease, an operating

Rent security deposit lease, calls for the lease

II. Additional rent is computed at

350,000 6% of net sales over P3,000,000 up to

First month’s rent P6,000,000 and 5% of net sales

over P6,000,000, per calendar year.

150,000 III. Net sales for the current year

Last month’s rent amount to P9,000,000.

IV. The entity paid executory costs

150,000 to the lessor for property taxes of

Nonrefundable reimbursement to lessor P120,000 and insurance of

for modification to the leased premises P50,000

900,000

What total amount of the expense should

What portion of payments to the lessor be reported for the year?

should be deferred on December 31,

2020? Answer: 680,000

Answer: 1,310,000 Problem 5 - Lease free

Problem 3 As an inducement to enter a lease, Eris

Company, a lessor, granted Topson

Company, a lessee, nine months of free

rent under a 5 year operating lease. On July 1, 2016, Peter Company leased

office premises for a three-year period at

The lease was effective on July 1, 2020 an annual rental of P360,000 payable on

and provided for monthly rental of July 1 each year. The first rent payment

P100,000 to begin April 1, 2021. was made July 1, 2016

In the income statement for the year Additionally on July 1, 2016, the entity

ended June 30, 2021 what amount should paid P240,000 as a lease bonus to obtain

be reported as rent expense. a three year lease instead of the lessor’s

unusual term of six years

Answer: 1,020,000

On December 31, 2016, what amount

Problem 6 should be reported a prepaid rent?

Sky Company leased a building for 20 Answer: 380,000

years with effect from January 1, 2016.

The useful life of the building is 40 years. Problem 9

As part of the negotiations for the lease,

the lessor granted Sky a rent- free period. As an incentive to enter a four-year

operating lease for a warehouse,

Annual rentals of P1,600,000 are payable Francheska Company received an upfront

in advance on January 1, commencing cash of P60,000 upon signing an

2018. agreement at the beginning of current

year. The annual rental is P1,115,000

What amount of rent expense should be

recognized for the year ended December What amount should be recognized as

31, 2016 lease expense for the current year?

Answer: 1,440,000 Answer: 1,100,000

Problem 7

On October 1, 2016 Pammy Company

leased office space at a monthly rental of

P300,000 for 10 years expiring September

30, 2026

As an inducement for Pammy to enter

into the lease, the lessor permitted

Pammy to occupy the premises rent-free.

October 1 to December 31, 2016

For the year ended December 31, 2016,

what amount should be reported as rent

expense

Answer: 877,500

Problem 8

You might also like

- Real Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsFrom EverandReal Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsNo ratings yet

- Special TopicsDocument89 pagesSpecial TopicsPeter Banjao100% (3)

- Special TopicsDocument77 pagesSpecial TopicsPeter BanjaoNo ratings yet

- INTAC3 McsDocument10 pagesINTAC3 Mcsrachel banana hammockNo ratings yet

- Operating Lease Vs Finance LeaseDocument5 pagesOperating Lease Vs Finance LeasexjammerNo ratings yet

- Lessor Sample ProbDocument24 pagesLessor Sample ProbCzarina Jean ConopioNo ratings yet

- Toaz - Info Valix Problems Shedocx PRDocument30 pagesToaz - Info Valix Problems Shedocx PRDaniella Mae ElipNo ratings yet

- ALL Quiz Ia 3Document29 pagesALL Quiz Ia 3julia4razoNo ratings yet

- Intermediate Accounting 2 Finals SolvingsDocument24 pagesIntermediate Accounting 2 Finals SolvingsColeen BiocalesNo ratings yet

- Orca Share Media1577676507201Document4 pagesOrca Share Media1577676507201Jayr BVNo ratings yet

- Ap 301Document4 pagesAp 301Christine Jane AbangNo ratings yet

- On January 1, 2-WPS OfficeDocument4 pagesOn January 1, 2-WPS OfficeSanta-ana Jerald JuanoNo ratings yet

- Lessor Discussion U PDFDocument4 pagesLessor Discussion U PDFadmiral spongebobNo ratings yet

- IA2Document14 pagesIA2Sitio BayabasanNo ratings yet

- Lease Receivable Lease Liability Lease Receivable Lease LiabilityDocument1 pageLease Receivable Lease Liability Lease Receivable Lease LiabilityAnne Liezel PradoNo ratings yet

- 1Document76 pages1darlene floresNo ratings yet

- Problem Set 8. Finance LeaseDocument7 pagesProblem Set 8. Finance LeaseitsBlessedNo ratings yet

- Leases: Lease Part 1Document10 pagesLeases: Lease Part 1ZyxNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument14 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- LeasesDocument3 pagesLeasesAngelica Rome EnriquezNo ratings yet

- Assignment Problems On LeasesDocument4 pagesAssignment Problems On LeasesEllah Sharielle SantosNo ratings yet

- Lease Practical Accounting ProblemsDocument2 pagesLease Practical Accounting ProblemsCamille BonaguaNo ratings yet

- Assignment Ppfrs 16Document3 pagesAssignment Ppfrs 16Joseph DoctoNo ratings yet

- Financial Accounting II RequirementDocument27 pagesFinancial Accounting II RequirementAnonymousNo ratings yet

- Case 1Document10 pagesCase 1Shawn VerzalesNo ratings yet

- (Pfrs/Ifrs 16) LeasesDocument11 pages(Pfrs/Ifrs 16) LeasesBromanineNo ratings yet

- Financial Accounting Part 2Document5 pagesFinancial Accounting Part 2Christopher Price0% (1)

- Accounting 8 - ReviewerDocument4 pagesAccounting 8 - ReviewerAshley David AligonsaNo ratings yet

- Leases PS GoodsDocument4 pagesLeases PS GoodsDissentNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- SPQ 003 Employee Benefits, Leases, and Other LiabilitiesDocument3 pagesSPQ 003 Employee Benefits, Leases, and Other LiabilitiesmarygraceomacNo ratings yet

- Finance Lease LesseeDocument11 pagesFinance Lease LesseeAngel Queen Marino SamoragaNo ratings yet

- CUP VI - Financial Accounting and ReportingDocument17 pagesCUP VI - Financial Accounting and ReportingRonieOlarte0% (1)

- Modaud2 Unit 6 Audit of Leases t31516 FinalDocument3 pagesModaud2 Unit 6 Audit of Leases t31516 Finalmimi96No ratings yet

- Quizzes Midterm To Finals OnlyDocument40 pagesQuizzes Midterm To Finals OnlyMikasa MikasaNo ratings yet

- Leases Set CDocument12 pagesLeases Set CbessmasanqueNo ratings yet

- Franchise Problems For DiscussionDocument4 pagesFranchise Problems For DiscussionRAGASA, John Carlo R.No ratings yet

- P 1Document4 pagesP 1Kenneth Bryan Tegerero TegioNo ratings yet

- Activity Chapter 7: Ans. 245,000 and 79,950 SolutionDocument3 pagesActivity Chapter 7: Ans. 245,000 and 79,950 SolutionRandelle James Fiesta50% (4)

- DocxDocument119 pagesDocxRene Lopez100% (1)

- Lease and Accounting For Income Tax DrillsDocument3 pagesLease and Accounting For Income Tax DrillsmarygraceomacNo ratings yet

- Use The Following Information To Answer Items 1 To 4Document4 pagesUse The Following Information To Answer Items 1 To 4Chris Jay LatibanNo ratings yet

- August 20 DiscussionDocument26 pagesAugust 20 DiscussionJOSCEL SYJONGTIANNo ratings yet

- 24U Lease Accounting StudentDocument17 pages24U Lease Accounting Studentvee viajeroNo ratings yet

- Assignment 02 Leases - Solution - OportoDocument4 pagesAssignment 02 Leases - Solution - OportoDevina OportoNo ratings yet

- Far Project PrefiDocument16 pagesFar Project PrefiMarjorie PagsinuhinNo ratings yet

- Great DepressionDocument5 pagesGreat DepressionDarrelNo ratings yet

- Chapter 11 FinAcc2Document13 pagesChapter 11 FinAcc2Kariz Codog0% (2)

- 07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. BaulDocument5 pages07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. Baulkrisha millo50% (2)

- Seatwork On LeasesDocument1 pageSeatwork On Leasesmitakumo uwuNo ratings yet

- Answer: C - 465,000Document9 pagesAnswer: C - 465,000kyle G50% (2)

- Set A Leases Problem SERANADocument6 pagesSet A Leases Problem SERANASherri BonquinNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument11 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionGabrielleNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument15 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionGabrielle100% (1)

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- Discussion Problems - Lessor AccountingDocument4 pagesDiscussion Problems - Lessor AccountingangelapearlrNo ratings yet

- Lease Problem With SolutionDocument19 pagesLease Problem With SolutionJeane Mae Boo100% (1)

- Problem 4Document6 pagesProblem 4jhobsNo ratings yet

- 10 Gross Profit Variance Analysis - Supplement LectureDocument3 pages10 Gross Profit Variance Analysis - Supplement LectureXander MerzaNo ratings yet

- Winning Through Effective, Global Talent-The Changing Role of Strategic HRM in Int. BusinessDocument23 pagesWinning Through Effective, Global Talent-The Changing Role of Strategic HRM in Int. BusinessXander MerzaNo ratings yet

- BASTRCSX - Module 1Document67 pagesBASTRCSX - Module 1Xander MerzaNo ratings yet

- Environmental GovernanceDocument68 pagesEnvironmental GovernanceXander MerzaNo ratings yet

- Collateral For Loan Applications.: Receivable FinancingDocument3 pagesCollateral For Loan Applications.: Receivable FinancingXander MerzaNo ratings yet

- Debt Investments - Answers - Ac&fvociDocument9 pagesDebt Investments - Answers - Ac&fvociXander MerzaNo ratings yet

- CFAS Soln Man 2020 Edition 3Document3 pagesCFAS Soln Man 2020 Edition 3Xander MerzaNo ratings yet

- Adamson University Intermediate Accounting 1 - Cash Equivalents Prof. Judith Francisco - LunaDocument1 pageAdamson University Intermediate Accounting 1 - Cash Equivalents Prof. Judith Francisco - LunaXander MerzaNo ratings yet

- Corporation 1Document110 pagesCorporation 1Xander MerzaNo ratings yet

- Research Problem & Its Objectives: Elements of Chapter 1Document22 pagesResearch Problem & Its Objectives: Elements of Chapter 1Xander MerzaNo ratings yet

- Review of Related LiteratureDocument13 pagesReview of Related LiteratureXander MerzaNo ratings yet

- Human RightsDocument37 pagesHuman RightsXander MerzaNo ratings yet

- Unit 4 - Joint and Mutual WillsDocument12 pagesUnit 4 - Joint and Mutual WillsAndré Le Roux100% (1)

- FMTA Housing Report Overview FinalDocument4 pagesFMTA Housing Report Overview FinalMichael LaxerNo ratings yet

- 8 Ways To Reduce Housing CostDocument10 pages8 Ways To Reduce Housing CostTanveerNo ratings yet

- #380 Krey Bedore Reservation AgreementDocument1 page#380 Krey Bedore Reservation AgreementBrandonBedoreNo ratings yet

- 1 Rent AgreementDocument3 pages1 Rent AgreementAmit A KulkarniNo ratings yet

- Mablethorpe Lincs Brochure MIPDocument6 pagesMablethorpe Lincs Brochure MIPMark I'AnsonNo ratings yet

- TW Disbursement TrackerDocument253 pagesTW Disbursement TrackerRohit GabaNo ratings yet

- En Mongolia 06Document39 pagesEn Mongolia 06Sandeep DasNo ratings yet

- Brochure y Planímetro en InglésDocument7 pagesBrochure y Planímetro en InglésAndres BejaranoNo ratings yet

- Amhara Lease ZIKRE-hig DenbDocument69 pagesAmhara Lease ZIKRE-hig DenbEyob67% (6)

- Common Hold and Leasehold Reform Act 2002 PDFDocument2 pagesCommon Hold and Leasehold Reform Act 2002 PDFTinaNo ratings yet

- Ashish Kumar Rauniyar BT + Cons.Document3 pagesAshish Kumar Rauniyar BT + Cons.Mritunjai SinghNo ratings yet

- Housing Typology: Semester 9 Batch A Department of Architecture, T.K.M.C.E. Faculty: Miria Rose JacobDocument10 pagesHousing Typology: Semester 9 Batch A Department of Architecture, T.K.M.C.E. Faculty: Miria Rose JacobSREYAS K MNo ratings yet

- Landlord Tenant Booklet English 1 10 PDFDocument47 pagesLandlord Tenant Booklet English 1 10 PDFBenito MosesNo ratings yet

- Edpm LeaseDocument2 pagesEdpm LeaseKALI LAWRENCENo ratings yet

- Deed of Donation: of The Two Involved Parties in This AgreementDocument2 pagesDeed of Donation: of The Two Involved Parties in This AgreementSaleras Sto RosarioNo ratings yet

- Karnataka Rent Control Act, 2001Document43 pagesKarnataka Rent Control Act, 2001Latest Laws TeamNo ratings yet

- Quadel Assisted Housing Manager Training and CertificationDocument6 pagesQuadel Assisted Housing Manager Training and CertificationQuadel Consulting CorporationNo ratings yet

- Commercial Real Estate Lease With Option To PurchaseDocument6 pagesCommercial Real Estate Lease With Option To PurchaseRocketLawyer50% (4)

- Property Law OutlineDocument34 pagesProperty Law Outlinecflash94No ratings yet

- List of Rental Flats TISSstudents 2016Document11 pagesList of Rental Flats TISSstudents 2016Indushekhar JhaNo ratings yet

- Land Laws Including Tenure and Tenancy SystemDocument41 pagesLand Laws Including Tenure and Tenancy SystemAnkita ChawlaNo ratings yet

- Draft A Lease Deed For Lease of A Immovable PropertyDocument3 pagesDraft A Lease Deed For Lease of A Immovable PropertyBusiness Law Group CUSBNo ratings yet

- Deed of PartitionDocument2 pagesDeed of PartitionRagul SivanandNo ratings yet

- Extrajudicial Settlement of EstateDocument6 pagesExtrajudicial Settlement of EstateSarah NengascaNo ratings yet

- Sample Deed of Usufruct Over A Real Property PDFDocument5 pagesSample Deed of Usufruct Over A Real Property PDFNur Azlin IsmailNo ratings yet

- Anderson County Delinquent Tax SaleDocument4 pagesAnderson County Delinquent Tax SaleGreenville News100% (1)

- T1473-Property LawDocument7 pagesT1473-Property LawKEVIN MATHEWNo ratings yet

- Housing For All:: Western Center On Law & Poverty's Affordable Housing ManualDocument10 pagesHousing For All:: Western Center On Law & Poverty's Affordable Housing ManualWestern Center on Law & PovertyNo ratings yet

- Glossary 5Document1 pageGlossary 5rudra8pandey.8shivamNo ratings yet