Professional Documents

Culture Documents

Adamson University Intermediate Accounting 1 - Cash Equivalents Prof. Judith Francisco - Luna

Uploaded by

Xander MerzaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adamson University Intermediate Accounting 1 - Cash Equivalents Prof. Judith Francisco - Luna

Uploaded by

Xander MerzaCopyright:

Available Formats

Adamson University

Intermediate Accounting 1 - Cash Equivalents

Prof. Judith Francisco – Luna

Cash equivalents are short-term, highly liquid investments that are both

a. readily convertible to known amounts of cash, and

b. so near their maturity that they present insignificant risk of changes in value because of

changes in interest rates.

Generally, only investments with original maturities of three months or less should

qualify as cash equivalents.

Original maturity means original maturity to the enterprise holding the investment,

meaning maturity from the date of acquisition by the enterprise.

Examples of Cash Equivalents

1. Treasury Bills.

2. Central Bank certificates of indebtedness.

3. SEC registered commercial papers.

Not all investments that qualify are required to be treated as cash equivalents. An

enterprise shall establish a policy concerning which short term, highly liquid investments that

satisfy the definition are treated as cash equivalents.

For instance, an enterprise whose operations consists largely of investing in short term,

highly liquid investments might decide that all these items will be treated as investments rather

than cash equivalents.

A change in such policy is a change in accounting principle that shall be effected by

restating financial statements for earlier years presented for comparative purposes.

Question:

Which is not a cash equivalent?

a. Three-month Central Bank treasury bill.

b. Three-year Treasury note purchased three months from maturity.

c. Treasury note purchased three years ago when its remaining maturity is three months.

d. None of the above.

Answer: C

The Treasury note purchased three years ago is not a cash equivalent even if its

remaining maturity is three months.

Original maturity means maturity from the date of acquisition by the enterprise.

You might also like

- Module 3 Investment ManagementDocument17 pagesModule 3 Investment ManagementJennica CruzadoNo ratings yet

- Lesson 1 Cash and Cash EquivalentsDocument10 pagesLesson 1 Cash and Cash EquivalentsRica Lei N. DomingoNo ratings yet

- Intermediate Accounting 1a Cash and Cash EquivalentsDocument8 pagesIntermediate Accounting 1a Cash and Cash EquivalentsGinalyn FormentosNo ratings yet

- Definition of 'Short-Term Investments': Cash and Cash Equivalents Are The Most LiquidDocument3 pagesDefinition of 'Short-Term Investments': Cash and Cash Equivalents Are The Most LiquidHazel San JuanNo ratings yet

- CashDocument26 pagesCashLj SzeNo ratings yet

- Nature of Cash AccountDocument10 pagesNature of Cash AccountLorena PernatoNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsJladySilhoutte100% (3)

- Money Market Instruments in PakistanDocument3 pagesMoney Market Instruments in PakistanAsif PharmacistNo ratings yet

- Manajemen 28-3Document8 pagesManajemen 28-3Theresiana DeboraNo ratings yet

- Intermediate Accounting NOTESDocument5 pagesIntermediate Accounting NOTESIanne Kristie QuiderNo ratings yet

- Cash PDFDocument10 pagesCash PDFGabriel JonNo ratings yet

- Financial Reporting Standards Council: A Committee of TheDocument15 pagesFinancial Reporting Standards Council: A Committee of TheYtb AccntNo ratings yet

- Assessment Task 1 (IA)Document4 pagesAssessment Task 1 (IA)Jonalyn BañegaNo ratings yet

- Investment Decisions - Chapter - 1 UpdatedDocument15 pagesInvestment Decisions - Chapter - 1 UpdatedAvinash RajeshNo ratings yet

- C and CE NotesDocument4 pagesC and CE NotesFrancine PimentelNo ratings yet

- Compiled by Birhanu M (MBA-Finance) Page 1Document9 pagesCompiled by Birhanu M (MBA-Finance) Page 1Nigussie BerhanuNo ratings yet

- Module 004 Accounting For Cash: Definition, Nature and Composition of Cash and Cash Equivalents CashDocument12 pagesModule 004 Accounting For Cash: Definition, Nature and Composition of Cash and Cash Equivalents CashLee-chard EboeboNo ratings yet

- 05 Cash Cash EquivalentsDocument54 pages05 Cash Cash EquivalentsFordan Antolino83% (12)

- ReviewerDocument67 pagesReviewerKyungsoo DohNo ratings yet

- UntitledDocument6 pagesUntitledThelma DancelNo ratings yet

- Part One: Money and Capital Market: Chapter Four Financial Markets in The Financial SystemDocument22 pagesPart One: Money and Capital Market: Chapter Four Financial Markets in The Financial SystemSeid KassawNo ratings yet

- Chapter Four FinalDocument18 pagesChapter Four FinalSeid KassawNo ratings yet

- Quiz 3 MidtermDocument4 pagesQuiz 3 MidtermAlicia Dawn A. OlimbaNo ratings yet

- Quiz 3 MidtermDocument4 pagesQuiz 3 MidtermAlicia Dawn A. OlimbaNo ratings yet

- Working Capital ManagementDocument10 pagesWorking Capital Managementsincere sincereNo ratings yet

- FIN AC 1 - Module 3Document4 pagesFIN AC 1 - Module 3Ashley ManaliliNo ratings yet

- TUESDAYDocument13 pagesTUESDAYBryan Red AngaraNo ratings yet

- Cash & Cash EquivalentsDocument34 pagesCash & Cash EquivalentsStudent Core GroupNo ratings yet

- Chapter 6 - Cash Management: Learning ObjectivesDocument5 pagesChapter 6 - Cash Management: Learning Objectives132345usdfghjNo ratings yet

- Week 02 - 01 - Module 04 - Accounting For CashDocument12 pagesWeek 02 - 01 - Module 04 - Accounting For Cash지마리No ratings yet

- 05 Cash Cash EquivalentsDocument25 pages05 Cash Cash Equivalentscherylsujede4No ratings yet

- Chapter 2 Cash and Cash EquivalentsDocument12 pagesChapter 2 Cash and Cash EquivalentslorieferpaloganNo ratings yet

- (Lecture 6 & 7) - Sources of FinanceDocument21 pages(Lecture 6 & 7) - Sources of FinanceAjay Kumar TakiarNo ratings yet

- Chapter Three Financial Markets in The Financial System: 3.1 Organization and Structure of MarketsDocument7 pagesChapter Three Financial Markets in The Financial System: 3.1 Organization and Structure of MarketsSeid KassawNo ratings yet

- Working Capital ManagementDocument9 pagesWorking Capital ManagementEmmanuelNo ratings yet

- Topic 5 - Cash and Cash Equivalent - Rev (Students)Document31 pagesTopic 5 - Cash and Cash Equivalent - Rev (Students)Novian Dwi Ramadana0% (1)

- Reviewer 5Document8 pagesReviewer 5Kindred Wolfe100% (1)

- Reviewer Accounting - CrisaDocument12 pagesReviewer Accounting - Crisamiracle123No ratings yet

- 222WC2Document10 pages222WC2Cattyyy Delos ReyesNo ratings yet

- Financial Accounting and Reporting - Cash and Cash EquivalentsDocument6 pagesFinancial Accounting and Reporting - Cash and Cash EquivalentsLuisitoNo ratings yet

- Money MarketDocument4 pagesMoney MarketHaris HussainNo ratings yet

- Cashand Cash Equivalents101Document38 pagesCashand Cash Equivalents101Wynphap podiotanNo ratings yet

- Topic 2 Bank Accounts and Credit SecuritiesDocument37 pagesTopic 2 Bank Accounts and Credit SecuritiescontactitsshunNo ratings yet

- Investment and Portfolio Mngt. Learning Module 2Document6 pagesInvestment and Portfolio Mngt. Learning Module 2Aira AbigailNo ratings yet

- Money Market Securities - : Certificates of Deposit (CDS)Document4 pagesMoney Market Securities - : Certificates of Deposit (CDS)Crisha-mae JavillonarNo ratings yet

- 1.accounting Concepts and ConventionDocument6 pages1.accounting Concepts and ConventionAkhil ManojNo ratings yet

- Chapter 6 - Money MarketsDocument47 pagesChapter 6 - Money MarketsBeah Toni PacundoNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document15 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Asset-V1 - VIT BMT1005 2020 Type@asset block@Week-11-Annuity-MaterialDocument7 pagesAsset-V1 - VIT BMT1005 2020 Type@asset block@Week-11-Annuity-MaterialAYUSH GURTU 17BEC0185No ratings yet

- Cash and Marketable SecuritiesDocument4 pagesCash and Marketable SecuritiesIrish NicolasNo ratings yet

- Module 1.1Document13 pagesModule 1.1Althea mary kate MorenoNo ratings yet

- Cash and Cash EquivalentsDocument15 pagesCash and Cash EquivalentsVon Rother Celoso DiazNo ratings yet

- Working Capital Management: Answers To End-Of-Chapter QuestionsDocument27 pagesWorking Capital Management: Answers To End-Of-Chapter QuestionsMiftahul FirdausNo ratings yet

- Ae 18 Financial MarketsDocument4 pagesAe 18 Financial Marketsnglc srzNo ratings yet

- Working Capital CashDocument6 pagesWorking Capital CashNiña Rhocel YangcoNo ratings yet

- Chapter 3Document8 pagesChapter 3yosef mechalNo ratings yet

- Cash - NotesDocument2 pagesCash - NotesAdri SampangNo ratings yet

- FM11 CH 22 Instructors ManualDocument6 pagesFM11 CH 22 Instructors ManualFahad AliNo ratings yet

- Topic 5 - Cash and Cash Equivalent - Rev (Students)Document31 pagesTopic 5 - Cash and Cash Equivalent - Rev (Students)RomziNo ratings yet

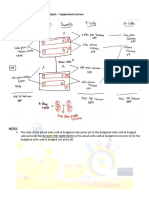

- 10 Gross Profit Variance Analysis - Supplement LectureDocument3 pages10 Gross Profit Variance Analysis - Supplement LectureXander MerzaNo ratings yet

- Winning Through Effective, Global Talent-The Changing Role of Strategic HRM in Int. BusinessDocument23 pagesWinning Through Effective, Global Talent-The Changing Role of Strategic HRM in Int. BusinessXander MerzaNo ratings yet

- Environmental GovernanceDocument68 pagesEnvironmental GovernanceXander MerzaNo ratings yet

- Operating Lease - Lessee: Problem 1Document2 pagesOperating Lease - Lessee: Problem 1Xander MerzaNo ratings yet

- BASTRCSX - Module 1Document67 pagesBASTRCSX - Module 1Xander MerzaNo ratings yet

- CFAS Soln Man 2020 Edition 3Document3 pagesCFAS Soln Man 2020 Edition 3Xander MerzaNo ratings yet

- Debt Investments - Answers - Ac&fvociDocument9 pagesDebt Investments - Answers - Ac&fvociXander MerzaNo ratings yet

- Collateral For Loan Applications.: Receivable FinancingDocument3 pagesCollateral For Loan Applications.: Receivable FinancingXander MerzaNo ratings yet

- Research Problem & Its Objectives: Elements of Chapter 1Document22 pagesResearch Problem & Its Objectives: Elements of Chapter 1Xander MerzaNo ratings yet

- Review of Related LiteratureDocument13 pagesReview of Related LiteratureXander MerzaNo ratings yet

- Corporation 1Document110 pagesCorporation 1Xander MerzaNo ratings yet

- Human RightsDocument37 pagesHuman RightsXander MerzaNo ratings yet