Professional Documents

Culture Documents

BIR RR 2022-15 - Amending RR 2-98 & RR 11-2018 - Income Payments by Meralco and Other Distribution Utilities (DUs)

Uploaded by

nat_segovia0 ratings0% found this document useful (0 votes)

25 views3 pagesOriginal Title

BIR RR 2022-15 - Amending RR 2-98 & RR 11-2018 - Income Payments by Meralco and other Distribution Utilities (DUs)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views3 pagesBIR RR 2022-15 - Amending RR 2-98 & RR 11-2018 - Income Payments by Meralco and Other Distribution Utilities (DUs)

Uploaded by

nat_segoviaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

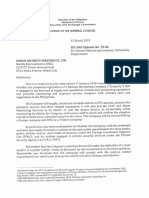

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE,

| DEC, 09 2022 |

LC jossanu) |

Date: November 22, 2022

REVENUE REGULATIONS NO. \5-2022

SUBJECT ; Further Amending Certain Provisions of Revenue Regulations (RR) No.

2-98 as Amended by RR No. 11-2018, Which Implemented the

Provisions of Republic Act 10963, Otherwise Known as Tax Reform for

Acceleration and Inclusion (TRAIN) Law, Relative to Some Changes in

the Rate of Creditable Withholding ‘Tax on Certain Income Payments

TO All Internal Revenue Officers and Others Concerned

Pursuant to the provisions of Section 244 of the National Internal Revenue Code and

the provisions of Republic Act No. 10963 otherwise known as the Tax Reform for

‘Acceleration and Inclusion(TRAIN)Law, these regulations are hereby promulgated to

implement the changes of creditable withholding tax rate under Section 57 of the Tax Code

which provided that " beginning January 1,2019, the rate of withholding shall not be less

than one percent(1%) but not more than fifteen percent(15%) of the income payment.”

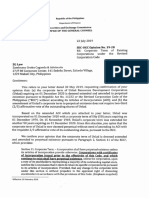

SECTION 1. Amendment. - Section 2 of RR 11-2018 on the amendments to Section

2.57.2 of RR 2-98, as amended, is hereby further amended to read as follows:

"SECTION 2.57.2. Income Payments Subject 10 Creditable

Withholding Tax and Rates Prescribed Thereon. -Except as herein

otherwise provided, there shall be withheld a creditable income tax at

the rates herein specified for each class of payee from the following

items of income payments to persons residing in the Philippines:

(A) woe

sor ox ax

(P) — MERALCO Payments on the following:

(1) MERALCO Refund arising from the ERC Case

No. 2020-043 RC Order promulgated on

February 19, 2021 and ERC Case Nos. 2010-069

RC, 2011-088 RC, 2012-054 RC, 2013-056 RC,

and 2014-029 RC Orders promulgated on April

@

2022 - On gross amount of refund given by

LLCO to non-residential customers -

fieen percent (15%)

Fi

2) interest income on the refund of meter deposits

determined, computed and paid in accordance

with the "Rules to Govern Refund of Meter

Deposits to Residential and Non-Residential

Customers,” as approved by the ERC under

Resolution No.12, Series of 2016, dated April 5,

2016 in:plementing Article 8 of the Magna Carta

for Residential Electricity Customers and ERC

Resolution No.2005-10 RM (Otherwise known

as DSOAR) dated January 18, 2006, exempting

all electricity consumers from the payment of

meter deposit.

On gross amount of interest paid directly to the

customers or applied against the customer's

billings:

() Residential and General Service customers

whose monthly electricity exceeds 200 kwh as

classified by MERALCO ~ Ten percent (102%)

Gi) Non-Residential Customers - Fifteen percent

as

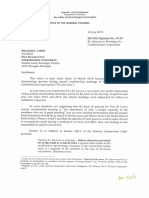

Interest income on the refund paid through direct payment

or application against customer’ billings by other electric

Distribution Utilities (DUs) in accordance with the rules

embodied in ERC Resolution No. 12, Series of 2016, dated

April 5, 2016, governing the refund of meter deposits which

‘was approved and adopted by ERC in compliance with the

mandate of Article 8 pf the Magna Carta for Residential

Electricity Customers and Article 3.4.2 of DSOAR,

exempting all electricity consumers, whether residential or

non-residential, from the payment of meter deposit.

On gross amount of interest paid directly to the customers

or applied against the customer's billings:

(i) Residential and General Service customers whose

monthly electricity consumption exceeds 200 kwh =

as classified hy the concermed DU -Ten percent

(10%)

Gi) Non-Residential Customers - Fifteen percent (15%)

(Rx

wor ora

SECTION 2. Repealing Clause. - All existing rules and regulations or parts thereof

which are inconsistent with the provisions of these regulations are hereby revoked.

SECTION3. Effectivity. - These regulations are effective beginning

Rec. 2, 2022

c 6G

BENJAMIN E. DIOKNO

Secretary of Finance

Recommending Approval: DEC 02 2022

10D. LI ‘UL JR.

lissioner of Internal Revenue

000206

You might also like

- RMC No. 8-2024 Annex ADocument1 pageRMC No. 8-2024 Annex Anat_segovia100% (1)

- Affidavit of GuardianshipDocument1 pageAffidavit of Guardianshipnat_segoviaNo ratings yet

- 2019OpinionNo19 06Document3 pages2019OpinionNo19 06nat_segoviaNo ratings yet

- Affidavit of No Rental3Document2 pagesAffidavit of No Rental3nat_segoviaNo ratings yet

- Affidavit of Seller-Non-tenancy (Residential Property)Document1 pageAffidavit of Seller-Non-tenancy (Residential Property)nat_segoviaNo ratings yet

- RMO No. 22-2023 Prescribes The Revised Non-Disclosure Agreement FormDocument1 pageRMO No. 22-2023 Prescribes The Revised Non-Disclosure Agreement FormMrs Pokemon MasterNo ratings yet

- RMC No. 71-2023 Annex A.1.1Document1 pageRMC No. 71-2023 Annex A.1.1Ron Andi RamosNo ratings yet

- Affidavit of Seller-Non-tenancy (Agricultural)Document1 pageAffidavit of Seller-Non-tenancy (Agricultural)nat_segoviaNo ratings yet

- 2019OpinionNo19 28Document2 pages2019OpinionNo19 28nat_segoviaNo ratings yet

- 2019OpinionNo19 25Document3 pages2019OpinionNo19 25nat_segoviaNo ratings yet

- 2019OpinionNo19 17Document4 pages2019OpinionNo19 17nat_segoviaNo ratings yet

- 2019OpinionNo19 38Document2 pages2019OpinionNo19 38nat_segoviaNo ratings yet

- 2019OpinionNo19 26Document3 pages2019OpinionNo19 26nat_segoviaNo ratings yet

- 2019OpinionNo19 31Document3 pages2019OpinionNo19 31nat_segoviaNo ratings yet

- 2019OpinionNo19 32Document3 pages2019OpinionNo19 32nat_segoviaNo ratings yet

- 2019OpinionNo19 30Document5 pages2019OpinionNo19 30nat_segoviaNo ratings yet

- 2019OpinionNo19 46Document3 pages2019OpinionNo19 46nat_segoviaNo ratings yet

- 2019OpinionNo19 56Document4 pages2019OpinionNo19 56nat_segoviaNo ratings yet

- Summary HLURB Design StandardsDocument1 pageSummary HLURB Design Standardsnat_segoviaNo ratings yet

- 2019OpinionNo19 37Document5 pages2019OpinionNo19 37nat_segoviaNo ratings yet

- 2019OpinionNo19 39Document4 pages2019OpinionNo19 39nat_segoviaNo ratings yet

- 2019OpinionNo19 43Document3 pages2019OpinionNo19 43nat_segoviaNo ratings yet

- 2019OpinionNo19 53Document3 pages2019OpinionNo19 53nat_segoviaNo ratings yet

- HLURB BR-2018-976 - Ratifying To Extend Escrow Servicing To Accredited BanksDocument4 pagesHLURB BR-2018-976 - Ratifying To Extend Escrow Servicing To Accredited Banksnat_segoviaNo ratings yet

- Application - Registration - Business - Firms (DHSUD)Document1 pageApplication - Registration - Business - Firms (DHSUD)nat_segovia0% (1)

- Requirements For Registration and LTS of Subdivision Project (Updated) - 1Document5 pagesRequirements For Registration and LTS of Subdivision Project (Updated) - 1nat_segoviaNo ratings yet

- 2019OpinionNo19 47Document2 pages2019OpinionNo19 47nat_segoviaNo ratings yet

- 2019OpinionNo19 51Document7 pages2019OpinionNo19 51nat_segoviaNo ratings yet

- Application - Registration - Real - Estate - Brokers (DHSUD)Document1 pageApplication - Registration - Real - Estate - Brokers (DHSUD)nat_segoviaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)