Professional Documents

Culture Documents

Activity

Uploaded by

Emem ReomalesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity

Uploaded by

Emem ReomalesCopyright:

Available Formats

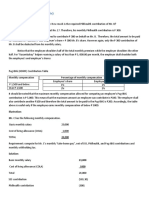

CHAPTER 6 – ACTIVITY / ASSIGNMENT

1. Susan Dimagiba presented to you the following income for the year:

Basic salary P 900,000

Withholding tax on basic salary 300,000

Directors Fee 200,000

Business income:

Retail business 250,000

Apartment rent (net) 190,000

Business expenses 125,000

Cash dividend:

From a domestic corporation 50,000

From a resident corporation 50,000

Stock dividend from a domestic corporation 25,000

Interest from savings deposit 20,000

Royalties from book publications 50,000

Prizes from contest won 50,000

PCSO winnings 50,000

13th month pay 100,000

Christmas bonus 30,000

Mid-year bonus 50,000

Damages received from injuries and sickness 85,000

Proceeds from the life insurance coverage of his

deceased father 300,000

Determine the following:

a. Gross income subject to graduated rate.

ANSWER: P 1,675,000

Solution:

Basic salary P 900,000

Directors Fee 200,000

Business income:

Retail business 250,000

Apartment rent (net) 190,000

Cash Dividend:

From a Resident Corporation 50,000

P1,590,000

13th month pay P 100,000

Christmas Bonus 25,000

Mid-year Bonus 50,000

P 175,000

(90,000)

85,000

P 85,000

P1,675,000

b. Total final taxes on passive income

ANSWER: P 34,000

Cash dividend:

From a domestic corporation (50,000*10%) P 5,000

Interest from savings deposit (20,000*20%) 4,000

Royalties from book publications (50,000*10%) 5,000

Prizes from contest won (50,000*20%) 10,000

PCSO winnings (50,000*20%) 10,000

Total final taxes on passive income P34,000

c. Total income not subject to tax

ANSWER: P 505,000

Stock dividend from a domestic corporation P 25,000

Christmas Bonus ( De minimis ) 5,000

13th month pay and other benefit P90,000 threshold 90,000

Damages received from injuries and sickness 85,000

Proceeds from the life insurance coverage of his 300,000

deceased father

Total income not subject to tax P 505,000

d. Income tax due

ANSWER:

P 126,500

Basic salary P 900,000

Directors Fee 200,000

Business income:

Retail business 250,000

Apartment rent (net) 190,000

Cash Dividend:

From a Resident Corporation 50,000

P1,590,000

Excess of 13th month pay and other benefit 85,000

P 90,000 threshold

Taxable income P1,675,000

Income tax due

In first P 800,000 P 130,000

In excess of 800,000 (875,000*30%) 262,500

P 392,500

Less: Withholding Salary (300,000)

P 92,500

Final taxes on Passive Income 34,000

Income Tax Due P 126,500

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Activity / Assignment: Answer and SolutionDocument3 pagesActivity / Assignment: Answer and SolutionMa. Alexandria Palma0% (1)

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- Learning Activity 3 - Inc TaxDocument3 pagesLearning Activity 3 - Inc TaxErica FlorentinoNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Compensation Income - (250,000 - 400,000) : Dazai OsamuDocument5 pagesCompensation Income - (250,000 - 400,000) : Dazai OsamuGideon Tangan Ines Jr.No ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Basic Acco VariousDocument26 pagesBasic Acco VariousJasmine Acta100% (1)

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- Taxation Suggested SolutionsDocument3 pagesTaxation Suggested SolutionsSteven Mark MananguNo ratings yet

- ASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationDocument4 pagesASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationElaiza Jayne PongaseNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Problem 1Document3 pagesProblem 1Shiene MedrianoNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Activity 1Document4 pagesActivity 1Louisa de VeraNo ratings yet

- Reviewer Fabm2Document3 pagesReviewer Fabm2Mark LappayNo ratings yet

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- HecoDocument1 pageHecoasan023No ratings yet

- INCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Document7 pagesINCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Erlle AvllnsaNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- ABM5 PT5 Group#2Document4 pagesABM5 PT5 Group#2Ronald DominguezNo ratings yet

- Quiz On Income TaxationDocument4 pagesQuiz On Income TaxationLenard Josh Ingalla100% (1)

- Deductions ExamplesDocument25 pagesDeductions ExamplesKezNo ratings yet

- Application - Regular Income Tax On Individuals and CorporationsDocument8 pagesApplication - Regular Income Tax On Individuals and CorporationsElla Marie Lopez0% (1)

- He Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeDocument15 pagesHe Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeEarl Daniel RemorozaNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Philhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationDocument5 pagesPhilhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationMaraiah InciongNo ratings yet

- Presented by Archana Gupta 0221031 Bharat Gaikwad 0221023Document12 pagesPresented by Archana Gupta 0221031 Bharat Gaikwad 0221023Bharat GaikwadNo ratings yet

- Partnership DissolutionDocument9 pagesPartnership DissolutionArieza MontañoNo ratings yet

- Golpo 10 Task Performance 1.taxationDocument13 pagesGolpo 10 Task Performance 1.taxationNin JahNo ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- Taxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Document4 pagesTaxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Beatrice ReynanciaNo ratings yet

- Activities No. 2Document5 pagesActivities No. 2Joshua Cabinas60% (5)

- 1.) Answer: 1 050 000: Prelim Bring Home ExamDocument12 pages1.) Answer: 1 050 000: Prelim Bring Home ExamMary Joy CabilNo ratings yet

- TEAM C ActivityDocument7 pagesTEAM C ActivityPatrick MedinaNo ratings yet

- 10 Task PerformanceDocument5 pages10 Task Performancejeffersam31No ratings yet

- Solutions For Problem 1Document4 pagesSolutions For Problem 1spongebob SquarepantsNo ratings yet

- Question 1 Answer:A: Partnership OperationsDocument7 pagesQuestion 1 Answer:A: Partnership OperationsSharmaineMirandaNo ratings yet

- TabbelDocument2 pagesTabbelLyra EscosioNo ratings yet

- Income Tax ExercisesDocument3 pagesIncome Tax ExercisesLaguna HistoryNo ratings yet

- Income Taxation - Regular Income Tax 2Document5 pagesIncome Taxation - Regular Income Tax 2Drew BanlutaNo ratings yet

- 10 TP 1 Income Tax San LuisDocument9 pages10 TP 1 Income Tax San Luislenlen100% (1)

- Tax 2Document8 pagesTax 2Genel Christian DeypalubosNo ratings yet

- INCOME TAX Part 3Document2 pagesINCOME TAX Part 3honeylove uNo ratings yet

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- P6 3Document5 pagesP6 3Neil RyanNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Assignno3 Incometax-LiwagjaicelberniceDocument3 pagesAssignno3 Incometax-LiwagjaicelberniceShane KimNo ratings yet

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- Proceeds of Property Insurance (BV 4,000,000)Document11 pagesProceeds of Property Insurance (BV 4,000,000)zeref dragneelNo ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- Chapter 9 Taxation of CorporationsDocument4 pagesChapter 9 Taxation of CorporationsElizabethNo ratings yet

- Income Tax (Santos)Document1 pageIncome Tax (Santos)Ian SantosNo ratings yet

- Lecture 3Document22 pagesLecture 3ahmed qazzafiNo ratings yet

- Quiz On Tax On CompensationDocument3 pagesQuiz On Tax On CompensationMaster GTNo ratings yet

- Taxation Final Pre-Board - SolutionsDocument14 pagesTaxation Final Pre-Board - SolutionsMischievous MaeNo ratings yet

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- Taxation CompressDocument3 pagesTaxation CompressJulie BagaresNo ratings yet

- INCOME TAX Part 2Document1 pageINCOME TAX Part 2honeylove uNo ratings yet

- Contract of Lease 23B TRION 3 MADELAINE MATEODocument7 pagesContract of Lease 23B TRION 3 MADELAINE MATEOChad VillaverdeNo ratings yet

- Full Download Government and Not For Profit Accounting Concepts and Practices 7th Edition Granof Test BankDocument19 pagesFull Download Government and Not For Profit Accounting Concepts and Practices 7th Edition Granof Test Bankwelked.gourami8nu9d100% (23)

- Instruction For Trust Account: Aristocapital New Account ContactDocument11 pagesInstruction For Trust Account: Aristocapital New Account ContactАлександр ЛебедевNo ratings yet

- Cost APProachDocument40 pagesCost APProachMANNAVAN.T.N100% (1)

- Last-Minute Tips For RFBT (October 2018) : ObligationsDocument6 pagesLast-Minute Tips For RFBT (October 2018) : ObligationsEve Grace SohoNo ratings yet

- Interview Questions and Answers For Freshers in Chemical EngineeringDocument4 pagesInterview Questions and Answers For Freshers in Chemical EngineeringAkash BodekarNo ratings yet

- 2 Full 5-4a 5-4bDocument82 pages2 Full 5-4a 5-4banurag sonkarNo ratings yet

- Value Drivers - What Makes An Organisation ValuableDocument3 pagesValue Drivers - What Makes An Organisation ValuablePatrick Ow100% (1)

- Negotiable Instrument Act 1881Document29 pagesNegotiable Instrument Act 1881Anonymous WtjVcZCgNo ratings yet

- Free Credit Score and Report - Free Monthly Credit CheckDocument3 pagesFree Credit Score and Report - Free Monthly Credit CheckSagar Chandra KhatuaNo ratings yet

- Programs Input Class9Document7 pagesPrograms Input Class9Ayush ShawNo ratings yet

- AF2108 Week 1-4 StudentDocument6 pagesAF2108 Week 1-4 Studentw.leeNo ratings yet

- Capital Structure of Banking Companies in IndiaDocument21 pagesCapital Structure of Banking Companies in IndiaAbhishek Soni43% (7)

- Business PlanDocument5 pagesBusiness PlanColegiul de Constructii din HincestiNo ratings yet

- XEROXDocument25 pagesXEROXSALONY METHINo ratings yet

- Project On Partnership Accounting PDFDocument17 pagesProject On Partnership Accounting PDFManish ChouhanNo ratings yet

- Financial Reporting and Analysis: - Session 2-Professor Raluca Ratiu, PHDDocument87 pagesFinancial Reporting and Analysis: - Session 2-Professor Raluca Ratiu, PHDDaniel YebraNo ratings yet

- General Credit v. Alsons DigestDocument2 pagesGeneral Credit v. Alsons Digestershaki100% (4)

- Mba 410: Commercial Banking Credit Units: 03 Course ObjectivesDocument6 pagesMba 410: Commercial Banking Credit Units: 03 Course ObjectivesakmohideenNo ratings yet

- Wealth Management Services of HDFC BankDocument63 pagesWealth Management Services of HDFC BankSURYA100% (1)

- Valuation Methods From Technology InnovationDocument1 pageValuation Methods From Technology InnovationMiguel Angel Herrera TriviňoNo ratings yet

- Vinati OrganicsDocument6 pagesVinati OrganicsNeha NehaNo ratings yet

- Revew ExercisesDocument40 pagesRevew Exercisesjose amoresNo ratings yet

- DepositoryDocument29 pagesDepositoryChirag VaghelaNo ratings yet

- Cover Cek MaybankDocument2 pagesCover Cek MaybankArifa HasnaNo ratings yet

- Patrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTDocument12 pagesPatrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTJohnrick RabaraNo ratings yet

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership FirmDark SoulNo ratings yet

- Mutual Funds PerformanceDocument7 pagesMutual Funds PerformanceAli RazaNo ratings yet

- Case 2 - Revenue and Expense RecognitionDocument4 pagesCase 2 - Revenue and Expense RecognitionRizwan MushtaqNo ratings yet

- Firma Solok Indah: DECEMBER, 2016 Debit Credit Vat-In Freight in Invoice NO Merchandise Inventory Account PayableDocument45 pagesFirma Solok Indah: DECEMBER, 2016 Debit Credit Vat-In Freight in Invoice NO Merchandise Inventory Account PayableBento HartonoNo ratings yet