Professional Documents

Culture Documents

Module 3

Uploaded by

Cassie HowardOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 3

Uploaded by

Cassie HowardCopyright:

Available Formats

MODULE 3 ACTIVITY 1

1. List down three a) areas or topics in Accountancy that interest you most

b) Three areas or topics in Accountancy that you believe you know best, and

c) Three theories, models, principles, or rules in Accountancy and other related

subjects which you believe are difficult to understand. As a guide, you may use the

matrix below:

a) Areas or topics in b) Areas or topics in c) Theories,

Accountancy that Accountancy that Models,

are interesting to you know best Principles, or

you Rules which are

difficult for you

1. Accounting Information Presentation of financial Monetary unit

system statements assumption

2. Employee benefits Financial instruments Matching Principle

3. Business Combinations Bank reconciliation IAS 12/PAS 12 Income

taxes

2. Choose one from each column above. State your reason(s) for choosing each of them.

As a guide, you may fill up the matrix below.

a) Areas or Topics b) Areas of Topics c) Theories,

in Accountancy in Accountancy models,

that are that you know Principles, or

interesting to best rules which

you are difficult for

you

Your Accounting Information Presentation of financial Matching Principle

most System statements

preferr

ed

choice

Reason The work of accountants It is critical for us to be Prepaid and Accrued

for and auditors is changing able to read and grasp Expenses are dealt

choosi dramatically as the these documents as with using the

ng accounting business accounting students. One Matching Principle.

becomes more of the most important When preparing

computerized. talents for prospective modifying entries,

Accounting professionals CPAs, investors, understanding the

are now viewed as entrepreneurs, and Matching Principle is

system managers, managers to have is the beneficial.

information analysts, ability to analyze a It's a bit confusing

and/or counselors, rather company's financial when to record a cost.

than performing many of health. Investors can When expenses are

the laborious activities better discover intriguing recorded too early, the

that are being done by prospects while avoiding Net Income is

computer systems. unnecessary risk, and understated. When

Accounting information professionals at all levels expenses are recorded

systems specialists can make more smart late, the Net Income is

typically work in business decisions using overstated. As you

accounting systems, this information. may expect, using this

systems design, approach wrong leads

accounting systems in financial statements

management, auditing, that are misleading.

consulting, and other

areas of accounting that

are related to systems.

3.Discuss your three choices and the reasons why you choose them with your groupmates.

Seek their opinion on the novelty and value of your choices. Come up with your own final

decision on which topic you will study.

You might also like

- Introduction To Systems Development and Systems AnalysisDocument45 pagesIntroduction To Systems Development and Systems AnalysisANISANo ratings yet

- Automatd Book KeepingDocument6 pagesAutomatd Book KeepingRocky LawajuNo ratings yet

- Accounting Information Systems Australasian 1st Edition Romney Solutions ManualDocument37 pagesAccounting Information Systems Australasian 1st Edition Romney Solutions ManualAlea NadaNo ratings yet

- Accounting System For ComputerDocument6 pagesAccounting System For ComputerRocky LawajuNo ratings yet

- Activity Sheet 1 Research InterestsDocument7 pagesActivity Sheet 1 Research InterestsMarco RegunayanNo ratings yet

- Fundamentals of Acct - I, Lecture Note - Chapter 4Document12 pagesFundamentals of Acct - I, Lecture Note - Chapter 4Kiya GeremewNo ratings yet

- Accounting Information Systems Australasian 1st Edition Romney Solutions ManualDocument38 pagesAccounting Information Systems Australasian 1st Edition Romney Solutions Manualgeralddiaznqmcrpgodk100% (21)

- Accounting Information System Term PaperDocument5 pagesAccounting Information System Term Paperafdtuwxrb100% (1)

- 01 - Managerial Accounting An OverviewDocument15 pages01 - Managerial Accounting An OverviewSa LaNo ratings yet

- 19697ipcc Acc Vol2 Chapter15Document4 pages19697ipcc Acc Vol2 Chapter15jsus22No ratings yet

- AIS Book Chapter 20 AnswerDocument8 pagesAIS Book Chapter 20 AnswerLina SorokinaNo ratings yet

- (Accounting Information System) : Module Duration: FEB 3 - March.12,2022Document9 pages(Accounting Information System) : Module Duration: FEB 3 - March.12,2022Gaba, Yna MarieNo ratings yet

- Module 4Document15 pagesModule 4Rico PagalanNo ratings yet

- 10 Tips To Get The Most From Your Spend Analysis SolutionDocument20 pages10 Tips To Get The Most From Your Spend Analysis SolutionSmriti GoelNo ratings yet

- Introduction To Systems Development Systems Analysis: Suggested Answers To Discussion QuestionsDocument43 pagesIntroduction To Systems Development Systems Analysis: Suggested Answers To Discussion QuestionsAnton VitaliNo ratings yet

- Introduction To Systems Development Systems Analysis: Suggested Answers To Discussion QuestionsDocument43 pagesIntroduction To Systems Development Systems Analysis: Suggested Answers To Discussion QuestionsWassup WasabiNo ratings yet

- Chapter 01 - AnswerDocument19 pagesChapter 01 - AnswerOscar Antonio100% (2)

- Bis Assignment 1Document12 pagesBis Assignment 1Rejoice Chikutye ChakawaNo ratings yet

- Solutions Manual: Contemporary Issues in AccountingDocument23 pagesSolutions Manual: Contemporary Issues in AccountingSTU DOCNo ratings yet

- AIS Course OutlineDocument6 pagesAIS Course OutlineRajivManochaNo ratings yet

- Chapter 01 - AnswerDocument18 pagesChapter 01 - AnswerTJ NgNo ratings yet

- Am113 Module 1-PrelimDocument22 pagesAm113 Module 1-PrelimMaryjel SumambotNo ratings yet

- Making The Move From QuickBooksDocument17 pagesMaking The Move From QuickBooksWayne SchulzNo ratings yet

- What Are The Other Importance of Information Technology To Businesses?Document3 pagesWhat Are The Other Importance of Information Technology To Businesses?Aasvogel Felodese CarnivoraNo ratings yet

- MS1113 - Module 1 - Unit 3Document29 pagesMS1113 - Module 1 - Unit 3Akera PoloyaNo ratings yet

- Accounts TheoryDocument11 pagesAccounts TheoryCaramakr ManthaNo ratings yet

- Chapter 1Document31 pagesChapter 1Brenda MuseNo ratings yet

- Module 3 Recording Business Transactions of A Service Business in ACCO2143 ITDocument30 pagesModule 3 Recording Business Transactions of A Service Business in ACCO2143 ITjilliantrcieNo ratings yet

- BA2 Course NotesDocument230 pagesBA2 Course NotesОля Оляфка100% (1)

- ASAP M Tute06 Answers GuideDocument4 pagesASAP M Tute06 Answers GuideAndreea M.No ratings yet

- BSBINM501Document12 pagesBSBINM501ajayNo ratings yet

- Final Report On Cost Center. 6thDocument19 pagesFinal Report On Cost Center. 6thMilind GhateNo ratings yet

- Ethiopian Civil Service University College of Finance, Management and Development Department of Accounting and Finance C T: A I SDocument4 pagesEthiopian Civil Service University College of Finance, Management and Development Department of Accounting and Finance C T: A I SWagner AdugnaNo ratings yet

- The Data-Confident Internal Auditor: A Practical, Step-by-Step GuideFrom EverandThe Data-Confident Internal Auditor: A Practical, Step-by-Step GuideNo ratings yet

- 10114725Document23 pages10114725Bra Kofi TheophilusNo ratings yet

- System AnalysisDocument12 pagesSystem AnalysiskimizrchichanosNo ratings yet

- MIS Case StudiesDocument8 pagesMIS Case StudiesAmresh Mishra100% (1)

- Individual Assignment AccountingDocument4 pagesIndividual Assignment AccountingbejasleenkaurNo ratings yet

- Activity Sheet 1 Research Interests: Name of Group: Rturesearch1-Cbet-01-502A-Boysoverflower Members of The GroupDocument7 pagesActivity Sheet 1 Research Interests: Name of Group: Rturesearch1-Cbet-01-502A-Boysoverflower Members of The GroupAndrew Miguel SantosNo ratings yet

- This Chapter Answers The Researchers' Problems and Objectives Stated in The Chapter 1 of The Study and If These Are MetDocument4 pagesThis Chapter Answers The Researchers' Problems and Objectives Stated in The Chapter 1 of The Study and If These Are Metgeo023No ratings yet

- (Simkin, Rose y Norman, 2012, Pp. 4-9) Core Concepts of AISDocument6 pages(Simkin, Rose y Norman, 2012, Pp. 4-9) Core Concepts of AISCristian MsbNo ratings yet

- Module-1 BSAIS3B LUMAPAYROSALIEDocument10 pagesModule-1 BSAIS3B LUMAPAYROSALIEAlyssaNo ratings yet

- Uberita, C. - MA Solutions Manual (2005)Document227 pagesUberita, C. - MA Solutions Manual (2005)Elisabeth Henanger100% (1)

- Dss and Tps Case Assignment - Mansi VishnoiDocument5 pagesDss and Tps Case Assignment - Mansi VishnoiIsmail shaikhNo ratings yet

- Session7&8 BuildingInformationSystemsDocument53 pagesSession7&8 BuildingInformationSystemsSauravNo ratings yet

- Table 4.1: Business Value of Enhanced Decision MakingDocument20 pagesTable 4.1: Business Value of Enhanced Decision MakingGabrielle Joshebed AbaricoNo ratings yet

- Activity 3Document2 pagesActivity 3Jean Rose DayoNo ratings yet

- Booklet Int. To AccountingDocument51 pagesBooklet Int. To Accountingsamuel debebeNo ratings yet

- Mark Jayson T. Penafiel Prof. Leandro C. Fua BSA 4-1 Chapter 8 (Even) Review QuestionsDocument5 pagesMark Jayson T. Penafiel Prof. Leandro C. Fua BSA 4-1 Chapter 8 (Even) Review QuestionsJeonghan YoonNo ratings yet

- Case Study On System AnalysisDocument45 pagesCase Study On System AnalysisAdnan AryanNo ratings yet

- Programmed Decisions Are Made Using A Rule, Procedure, or Quantitative Method. ForDocument3 pagesProgrammed Decisions Are Made Using A Rule, Procedure, or Quantitative Method. ForannNo ratings yet

- Work the System: The Simple Mechanics of Making More and Working Less | Summary & Key TakeawaysFrom EverandWork the System: The Simple Mechanics of Making More and Working Less | Summary & Key TakeawaysRating: 4.5 out of 5 stars4.5/5 (8)

- XBRL Reporting: Samantha Tio Wai Yin May Jeremy YeoDocument21 pagesXBRL Reporting: Samantha Tio Wai Yin May Jeremy YeoneocherylNo ratings yet

- Controls and AIS Chapter SolutionsDocument21 pagesControls and AIS Chapter Solutionsisabelarrellaga100% (1)

- Knight's Microsoft Business Intelligence 24-Hour Trainer: Leveraging Microsoft SQL Server Integration, Analysis, and Reporting Services with Excel and SharePointFrom EverandKnight's Microsoft Business Intelligence 24-Hour Trainer: Leveraging Microsoft SQL Server Integration, Analysis, and Reporting Services with Excel and SharePointRating: 3 out of 5 stars3/5 (1)

- Harvard Business Review on Aligning Technology with StrategyFrom EverandHarvard Business Review on Aligning Technology with StrategyRating: 3.5 out of 5 stars3.5/5 (4)

- Questionnaire DraftDocument3 pagesQuestionnaire DraftCassie HowardNo ratings yet

- ICC Module PDFDocument51 pagesICC Module PDFCassie HowardNo ratings yet

- Topic3 ActivityDocument7 pagesTopic3 ActivityCassie HowardNo ratings yet

- Assessment 1Document4 pagesAssessment 1Cassie HowardNo ratings yet

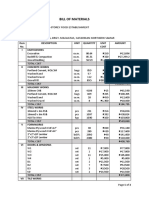

- Bill of MaterialsDocument3 pagesBill of MaterialsCassie HowardNo ratings yet

- Module 2Document7 pagesModule 2Cassie HowardNo ratings yet

- Chapter 4Document12 pagesChapter 4Cassie HowardNo ratings yet

- Media 77Document1 pageMedia 77Cassie HowardNo ratings yet

- Final Exam Afar 3 2022Document10 pagesFinal Exam Afar 3 2022Cassie HowardNo ratings yet

- LocalDocument4 pagesLocalCassie HowardNo ratings yet

- QuestionnaireDocument6 pagesQuestionnaireCassie HowardNo ratings yet

- ACKNOWLEDGEMENTDocument2 pagesACKNOWLEDGEMENTCassie HowardNo ratings yet

- QUIZ 1 Absorption CostingDocument1 pageQUIZ 1 Absorption CostingJohn Carlo CruzNo ratings yet

- Quiz 1 Topic 1 and 2Document6 pagesQuiz 1 Topic 1 and 2Cassie HowardNo ratings yet

- QuestionnaireDocument6 pagesQuestionnaireCassie HowardNo ratings yet

- Module 3 - Purposive CommunicationDocument14 pagesModule 3 - Purposive CommunicationCassie HowardNo ratings yet

- Quality Management of Audit Work - ISQM 1&2Document12 pagesQuality Management of Audit Work - ISQM 1&2Cassie HowardNo ratings yet

- NS1 UserManual EN V1.2Document31 pagesNS1 UserManual EN V1.2T5 TecnologiaNo ratings yet

- Chiba International, IncDocument15 pagesChiba International, IncMiklós SzerdahelyiNo ratings yet

- Computerised Project Management PDFDocument11 pagesComputerised Project Management PDFsrishti deoli50% (2)

- Festival Implementation PlanDocument5 pagesFestival Implementation Planapi-318058589No ratings yet

- Chemistry For PhotographersDocument184 pagesChemistry For PhotographersBahar ShoghiNo ratings yet

- Portfolio Sandwich Game Lesson PlanDocument2 pagesPortfolio Sandwich Game Lesson Planapi-252005239No ratings yet

- Mechanical Power FormulaDocument9 pagesMechanical Power FormulaEzeBorjesNo ratings yet

- Val Ed SyllabusDocument25 pagesVal Ed Syllabusroy piamonteNo ratings yet

- Compressed Air Source BookDocument128 pagesCompressed Air Source Bookgfollert100% (1)

- Dbe Bes100 ZZ XXXX YyyDocument3 pagesDbe Bes100 ZZ XXXX Yyyjavierdb2012No ratings yet

- Merchant Accounts Are Bank Accounts That Allow Your Business To Accept Card Payments From CustomersDocument43 pagesMerchant Accounts Are Bank Accounts That Allow Your Business To Accept Card Payments From CustomersRohit Kumar Baghel100% (1)

- 10.ULABs Presentation Camiguin FinalDocument55 pages10.ULABs Presentation Camiguin FinalKaren Feyt MallariNo ratings yet

- Fabrication Daily Progress: No DescriptionDocument4 pagesFabrication Daily Progress: No DescriptionAris PurniawanNo ratings yet

- S L Dixon Fluid Mechanics and Thermodynamics of TurbomachineryDocument4 pagesS L Dixon Fluid Mechanics and Thermodynamics of Turbomachinerykuma alemayehuNo ratings yet

- Toeic VocabularyDocument10 pagesToeic VocabularyBrian Niblo80% (5)

- Digital-To-Analog Converter - Wikipedia, The Free EncyclopediaDocument8 pagesDigital-To-Analog Converter - Wikipedia, The Free EncyclopediaAnilkumar KubasadNo ratings yet

- A Study On Awareness of Mutual Funds and Perception of Investors 2Document89 pagesA Study On Awareness of Mutual Funds and Perception of Investors 2Yashaswini BangeraNo ratings yet

- BERKLYNInformation SheetDocument6 pagesBERKLYNInformation SheetvillatoreubenNo ratings yet

- Topic 3 Module 2 Simple Annuity (Savings Annuity and Payout Annuity)Document8 pagesTopic 3 Module 2 Simple Annuity (Savings Annuity and Payout Annuity)millerNo ratings yet

- Standards Guide 1021 1407Document8 pagesStandards Guide 1021 1407Anjur SiNo ratings yet

- Belimo ARB24-SR Datasheet En-UsDocument2 pagesBelimo ARB24-SR Datasheet En-Usian_gushepiNo ratings yet

- CP AssignmentDocument5 pagesCP AssignmentMSSM EngineeringNo ratings yet

- User Manual - Wellwash ACDocument99 pagesUser Manual - Wellwash ACAlexandrNo ratings yet

- Ga-z68p-Ds3 v2.x eDocument104 pagesGa-z68p-Ds3 v2.x ejohnsonlimNo ratings yet

- AppendixA LaplaceDocument12 pagesAppendixA LaplaceSunny SunNo ratings yet

- Esp 1904 A - 70 TPH o & M ManualDocument50 pagesEsp 1904 A - 70 TPH o & M Manualpulakjaiswal85No ratings yet

- Chapter-4 Conditional and Iterative Statements in PythonDocument30 pagesChapter-4 Conditional and Iterative Statements in Pythonashishiet100% (1)

- Annexure I Project Details DateDocument4 pagesAnnexure I Project Details DateAshish SinghaniaNo ratings yet

- DWDMDocument41 pagesDWDMKarthik KompelliNo ratings yet

- Comparison of Offline and Online Partial Discharge For Large Mot PDFDocument4 pagesComparison of Offline and Online Partial Discharge For Large Mot PDFcubarturNo ratings yet