Professional Documents

Culture Documents

Partnership Formation and Operation

Uploaded by

Arden LlantoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Formation and Operation

Uploaded by

Arden LlantoCopyright:

Available Formats

No. 125 Brgy.

San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : icarecpareview@gmail.com

PARTNERSHIP FORMATION

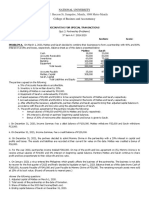

Problem 1: On January 1, 20x1, Rody and Noy formed a partnership. Rody and Noy contributed the

following assets at formation:

Rody Noy

Cash 25,000 37,500

Inventory 18,750

Building 50,000

Equipment 18,750

The building is subject to a P12,500 mortgage, which was assumed by the partnership. They share profit

and loss in the ratio of 60:40 to Rody and Noy, respectively.

Req. 1: What amount should be recorded as capital of Rody and Noy at the formation of the partnership,

respectively?

Req. 2: Assuming Rody will invest (withdraw) cash so that his capital balance will equal to his profit and

loss ratio, what is the total asset of the partnership after formation?

Problem 2: Moses and Joshua decided to combine their business to form partnership on October 1, 20x1.

They agreed to divide profit and loss at a ratio of 55:45 for Moses and Joshua, respectively. The balance

sheet for Moses and Joshua on September 30, 20x1 are presented below:

Accounts Moses Joshua

Cash 112,500 67,500

Accounts Receivable 270,000 225,000

Allowance for doubtful accounts (6,000) (7,500)

Notes Receivable 75,000

Merchandise Inventory 240,000 180,000

Office supplies 40,500

Equipment 150,000

Accumulated Depreciation - equipment (67,500)

Furniture 180,000

Accumulated depreciation - furniture (30,000)

Total Assets 739,500 690,000

Accounts Payable 199,500 150,000

Notes Payable 75,000

Capital 465,000 540,000

Total Liabilities and Capital 739,500 690,000

Moses and Joshua contributed their business to the partnership with the following adjustments:

1. Uncollectible accounts of P9,000 for Moses is to be provided and a 5% allowance is to be recognized

in the books of Joshua.

2. Moses’s inventory amounting to P15,000 is considered worthless and Joshua’s agree to value its

inventory to P187,500.

3. Prepaid asset of P15,000 on Moses books and Rent payable of P12,000 on the books of Joshua should

be recognized.-

4. Interest of 15% on the notes receivable dated August 1, 20x1 should be accrued.

5. The unused office supplies amounted to P30,000

6. The equipment has an agreed value of 75,000

7. The furniture has a market value of P135,000

8. Interest of 10% on notes payable dated July 1, 20x1 should be accrued.

9. Joshua has unrecorded patent of 60,000 to be recognized in Joshua’s books.

Joshua will invest cash necessary to have 60% interest in the partnership.

What is the amount of addition cash of investment of Joshua?

1|P a g e RFERRER/RLACO/AT ANG /PDEJESUS

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : icarecpareview@gmail.com

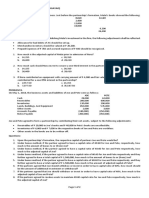

Problem 3: On June 30, 20x1, J, the sole proprietor of J Co,, expands the company and establish a

partnership, with P and D. The partners plan to share profits and losses as follows: J 50%; P 25% and D

25%. They also agree that the beginning capital balances of the partnership will reflect the same

relationship.

J asked P to join the partnership because his many business contracts are expected to be valuable during

the expansion. P is also contributing P28,000 cash. D is contributing P11,000 cash and marketable securities

costing P42,000 to D but are currently worth P57,500.

J’s investment in the partnership is the J Co. he plans to pay off the notes with his personal assets. The other

partners have agreed that partnership will assume the accounts payable. The statement of financial position

for the J Co follows:

J Company

Balance Sheet

June. 30, 20x1

Assets

Cash 10,000

Accounts Receivable 48,000

Inventory 72,000

Equipment (net of accumulated depreciation of P20,000) 70,000

Total Assets 200,000

Liabilities and Capital

Accounts Payable 53,000

Notes Payable 62,000

J, capital 85,000

Total Liabilities and Capital 200,000

The partners agree that the inventory is worth P85,000, and the equipment is worth half its original cost,

and the allowance established for doubtful accounts is correct.

Req. 1: What is the capital of J after formation of the partnership using bonus method?

Req. 2: What is the capital of P after formation of the partnership using revaluation method?

PARTNERSHIP OPERATION

Problem 1: Pam and Drix formed a partnership in 20x1 to operate a bookkeeping services. Pam contributed

the initial capital while Drix managed the business. With the assistance of their consultants, they have

arrived at the following agreement:

1. Each partner is allowed to withdraw P1,000 in cash from business every month. Any withdrawal in

excess of that figure will be accounted for as a direct reduction to the partners’ capital balance.

2. Partnership profits and losses will be allocated each year according to the following plan:

- Interest of 15% will be accrued by each partner based on the monthly average capital balance for

the year.

- As the managing partner, Drix is to receive credit for a bonus equal to 20% of the year’s net income.

- Any remaining profit or loss will be divided equally between the two partners.

Pam and Drix begin the year of 20x1 with capital balances of P150,000 and P30,000, respectively. On April

1 of the year, Pam invested additional P8,000 cash in the business, while on July 1, Drix withdraws P6,000

in excess of the specified drawing allowance. The partnership reports net income of P30,000 for 20x1.

The amount of capital balances of Pam and Drix on December 31, 20x1 will be:

Problem 2: Marie and Paz are partners in manufacturing business located in Manila. Their profit and loss

agreement contains the following provisions:

1. Salaries of P35,000 and P40,000 for Marie and Paz, respectively.

2. A bonus to Marie equal to 10% of net income after the bonus

3. Interest on weighted average capital at the rate of 8%. Annual drawings in excess of P20,000 are

considered to be a reduction of capital for purposes of this calculation.

4. Profit and loss percentages of 40% and 60% for Marie and Paz, respectively

2|P a g e RFERRER/RLACO/AT ANG /PDEJESUS

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : icarecpareview@gmail.com

Capital and drawing activity of the partners for the year 20x1 are as follows:

Marie Paz

Beginning balance 120,000 60,000

April 1. 20,000

June 1. (15,000) (20,000)

Sept 1. 30,000

Nov 1. (15,000) 40,000

Assuming net income for 20x1 of P132,000, how much profit should be allocated to each partner?

Problem 3: Marie, Paz and Love formed partnership on January 1, 20x1. The contribution of the partners

are as follows: Marie P300,000; Paz P250,000 and Love P450,000. The following are the agreements of

the partners:

- Monthly salary to Marie, Paz and Love of P5,000 each.

- Bonus to Marie of 10% of net income after interest and bonus

- Interest of 5% based on the capital contribution. The interest is treated as expense as per

agreement of the partners.

The net income of the partnership in year 20x1 is P264,000. What is the total income of Marie received

from the partnership?

Problem 4: John and Earl formed a partnership on May 1, 20x1. John invested P350,000 cash while Earl

invested equipment’s with book value of P600,000 and fair value of P450,000. On September 1, 20x1, John

invested additional cash of P50,000. On October 31, 20x1, Earl withdrew cash against his capital amounting

to P20,000. The partners agree on the following:

Monthly salary allowances of P2,500 and P3,000 to John and Earl, respectively. The salary allowance

is treated as expense

12% interest based on beginning capital.

25% bonus on profit after bonus to partner John.

The interest allowance is withdrawn by the partners in anticipation of profit share. The income summary

has a credit balance amounting to P125,000.

Req. 1: The total share in net income of partner Earl in the partnership is:

Req. 2: What is the capital balance of partner John on December 31, 20x1?

3|P a g e RFERRER/RLACO/AT ANG /PDEJESUS

You might also like

- Exercise 1-1 To 1-5Document5 pagesExercise 1-1 To 1-5Jennette ToNo ratings yet

- BusCom AssetAcquisitionDocument5 pagesBusCom AssetAcquisitionDanna Claire0% (1)

- Resa Afar 2205 Quiz 1Document16 pagesResa Afar 2205 Quiz 1Rafael BautistaNo ratings yet

- Quiz - Quiz 2 Partnership Dissolution and Liquidation AnswersDocument15 pagesQuiz - Quiz 2 Partnership Dissolution and Liquidation AnswersKent Zirkai CidroNo ratings yet

- PWC Consolidation Equity Method Accounting Guide 2019Document361 pagesPWC Consolidation Equity Method Accounting Guide 2019Gilberto Herrera100% (2)

- P2Document40 pagesP2Michiko Kyung-soonNo ratings yet

- Practical Accounting P-2Document7 pagesPractical Accounting P-2KingChryshAnneNo ratings yet

- ACCTSPTRANS All About PartnershipDocument7 pagesACCTSPTRANS All About PartnershipShailene David0% (1)

- Reviewer On Partnership Problems - Q2 PDFDocument3 pagesReviewer On Partnership Problems - Q2 PDFAdrian Montemayor33% (3)

- Chapter 11 - She Part 2Document4 pagesChapter 11 - She Part 2XienaNo ratings yet

- FM 475 Final ExamDocument7 pagesFM 475 Final Examabccd11No ratings yet

- Activity Partnership Formation and OperationDocument8 pagesActivity Partnership Formation and OperationSharon AnchetaNo ratings yet

- Set A - Prelim Exam in COGM6Document5 pagesSet A - Prelim Exam in COGM6kaii 1234No ratings yet

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- Acco 30103 Partnership Formation and Operations 04-2022Document3 pagesAcco 30103 Partnership Formation and Operations 04-2022Zyrille Corrine GironNo ratings yet

- Act. Partnership AccountDocument10 pagesAct. Partnership AccountPaupau100% (1)

- Partnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyDocument11 pagesPartnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyJoyce Ann Cortez100% (2)

- Partnership-Accounting NotesDocument30 pagesPartnership-Accounting NotesCarl Dhaniel Garcia SalenNo ratings yet

- AFAR - PartnershipDocument19 pagesAFAR - PartnershipAlisonNo ratings yet

- Advacc Quiz On PartnershipDocument10 pagesAdvacc Quiz On PartnershipCzaeshel Edades0% (2)

- Partnership RequirementDocument6 pagesPartnership RequirementAlyssa Marie Miguel100% (1)

- AFAR001 PartnershipDocument11 pagesAFAR001 PartnershipLen Charisse SiocoNo ratings yet

- Accounting QuizDocument5 pagesAccounting QuizLloyd Lameon0% (1)

- Partnership FormationDocument9 pagesPartnership FormationRujean Salar AltejarNo ratings yet

- Partnership Accounting With AnsDocument22 pagesPartnership Accounting With Ansjessica amorosoNo ratings yet

- AFAR04-03 Corporate LiquidationDocument3 pagesAFAR04-03 Corporate LiquidationArcii BarbaNo ratings yet

- AFAR04-10 Business Combination Date of AcquisitionDocument3 pagesAFAR04-10 Business Combination Date of AcquisitioneildeeNo ratings yet

- Reviewer For AccountingDocument5 pagesReviewer For AccountingAnnie RapanutNo ratings yet

- AFAR 1 Exams 2020Document7 pagesAFAR 1 Exams 2020RJ Kristine DaqueNo ratings yet

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- Assignment 1 Accounting Cycle For Service Business Part 2Document3 pagesAssignment 1 Accounting Cycle For Service Business Part 2Iya GarciaNo ratings yet

- AST Seatwork - 05 15 2021Document6 pagesAST Seatwork - 05 15 2021Joshua UmaliNo ratings yet

- Farparcor 2 Chapter 1 Exercises Problem AnswersDocument10 pagesFarparcor 2 Chapter 1 Exercises Problem AnswersWillnie Shane LabaroNo ratings yet

- ACCCOB Garcia - Learning Module 2 1Document54 pagesACCCOB Garcia - Learning Module 2 1Sid Damien TanNo ratings yet

- PartnershipDocument10 pagesPartnershipJasmine Marie Ng Cheong50% (2)

- 1st PREBOARD EXAMINATION - AFAR STUDENTS PDFDocument16 pages1st PREBOARD EXAMINATION - AFAR STUDENTS PDFAANo ratings yet

- 1 Partneship Formation PDFDocument7 pages1 Partneship Formation PDFSienna PrcsNo ratings yet

- CMPC 131 1-Partneship-FormationDocument7 pagesCMPC 131 1-Partneship-FormationGab IgnacioNo ratings yet

- Partnership Problem SetDocument8 pagesPartnership Problem SetMary Rose ArguellesNo ratings yet

- Partnership Formation - Activity PDFDocument2 pagesPartnership Formation - Activity PDFWilliam TabuenaNo ratings yet

- Unit 1 - Partnership-AccountingDocument3 pagesUnit 1 - Partnership-AccountingChristine Alysza AnquilanNo ratings yet

- Handouts 1 Partnership AccountingDocument5 pagesHandouts 1 Partnership AccountingRozel MontevirgenNo ratings yet

- Partnership Formation Activity 1 January 28 2023Document12 pagesPartnership Formation Activity 1 January 28 2023Jerlyn SaynoNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Local Media1577402990991204520Document3 pagesLocal Media1577402990991204520KsUnlockerNo ratings yet

- Topic 10 - Practice ProblemsDocument2 pagesTopic 10 - Practice ProblemsAnna Mariyaahh DeblosanNo ratings yet

- ACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Document3 pagesACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Zyrille Corrine GironNo ratings yet

- 0 - AFAR.002 Partnership Dissolution and Liquidation - 2106158851 PDFDocument9 pages0 - AFAR.002 Partnership Dissolution and Liquidation - 2106158851 PDFIan RanilopaNo ratings yet

- The Professional CPA Review SchoolDocument24 pagesThe Professional CPA Review SchoolKYLE LEIGHZANDER VICENTENo ratings yet

- MIDTERM EXAM SpecTransDocument7 pagesMIDTERM EXAM SpecTransEidel PantaleonNo ratings yet

- Partnership FormationDocument5 pagesPartnership FormationMary Elisha PinedaNo ratings yet

- AFAR Set CDocument12 pagesAFAR Set CRence GonzalesNo ratings yet

- ACC 100 Partnership FormationDocument3 pagesACC 100 Partnership FormationAlfred DalaganNo ratings yet

- Partnership Formation (Problems) : Group 2 (Buruelo, Castro)Document5 pagesPartnership Formation (Problems) : Group 2 (Buruelo, Castro)Celine Marie AntonioNo ratings yet

- Discussion 001Document2 pagesDiscussion 001TRIXIE KIM BADILLOSNo ratings yet

- Afar Assign 1Document8 pagesAfar Assign 1버니 모지코No ratings yet

- Partnership Formation 001Document20 pagesPartnership Formation 001Ma Teresa B. Cerezo50% (2)

- Partnership & Business CombinationDocument32 pagesPartnership & Business CombinationJason Bautista100% (1)

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- 1 Formation 1Document7 pages1 Formation 1martinfaith958No ratings yet

- Afar - Partnership Formation - BagayaoDocument2 pagesAfar - Partnership Formation - BagayaoRejay VillamorNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Day 2Document8 pagesDay 2Arden LlantoNo ratings yet

- Partnership-Liquidation CompressDocument1 pagePartnership-Liquidation CompressArden LlantoNo ratings yet

- AFAR 03 Partnership DissolutionDocument2 pagesAFAR 03 Partnership DissolutionArden LlantoNo ratings yet

- AFAR 05 Corporate LiquidationDocument2 pagesAFAR 05 Corporate LiquidationArden LlantoNo ratings yet

- IA 2020 Valix - Chapter 4 Accounts ReceivableDocument26 pagesIA 2020 Valix - Chapter 4 Accounts ReceivableArden LlantoNo ratings yet

- Read Free For 30 Days: User SettingsDocument3 pagesRead Free For 30 Days: User SettingsArden LlantoNo ratings yet

- Book Summary FDocument5 pagesBook Summary Fireti ajayiNo ratings yet

- UKAF1083 FA2 - Sept 2017 Adapted A.Q1 B.Q1a B.Q2aDocument7 pagesUKAF1083 FA2 - Sept 2017 Adapted A.Q1 B.Q1a B.Q2a--bolabolaNo ratings yet

- Waterfall Analysis - 1X Liquidation PreferenceDocument9 pagesWaterfall Analysis - 1X Liquidation PreferenceMonish KartheekNo ratings yet

- EntrepreneurshipDocument31 pagesEntrepreneurshipSEERAT IMTIAZNo ratings yet

- Far Qualifying ExaminationDocument30 pagesFar Qualifying ExaminationAlvin BaternaNo ratings yet

- Accounting Theory: Text and Readings: Richard G. Schroeder Myrtle Clark Jack CatheyDocument39 pagesAccounting Theory: Text and Readings: Richard G. Schroeder Myrtle Clark Jack CatheyNur Kumala DewiNo ratings yet

- Role and Importance of Capital Market in IndiaDocument9 pagesRole and Importance of Capital Market in IndiaMukul Babbar50% (4)

- Accounting & Finance PDFDocument3 pagesAccounting & Finance PDFIslam MohsenNo ratings yet

- Using The Books Review CenterDocument31 pagesUsing The Books Review CentercarlaNo ratings yet

- Week 9 PPT 9 - Statement of Cash FlowsDocument23 pagesWeek 9 PPT 9 - Statement of Cash FlowsAmel Surya GumilangNo ratings yet

- Multiple Choice Questions: Paper-Bch 2.2: Corporate AccountingDocument2 pagesMultiple Choice Questions: Paper-Bch 2.2: Corporate AccountingRenuka SharmaNo ratings yet

- FS - Chapter 5Document14 pagesFS - Chapter 5Cha MaderazoNo ratings yet

- Accounting For Business Combinations: A Guide ToDocument254 pagesAccounting For Business Combinations: A Guide ToLayu MycNo ratings yet

- TutorialDocument4 pagesTutorialSims LauNo ratings yet

- Accounts & Adv Account BookDocument308 pagesAccounts & Adv Account Bookvishnuverma100% (1)

- Investment Banking - 02092021Document4 pagesInvestment Banking - 02092021rishabh jainNo ratings yet

- Accounting Cycle Exercises IDocument58 pagesAccounting Cycle Exercises IMd Mobasshir Iqubal100% (1)

- Exercise Cost of CapitalDocument7 pagesExercise Cost of CapitalUmair Shekhani100% (2)

- Shareholder Activism Research SpotlightDocument21 pagesShareholder Activism Research SpotlightStanford GSB Corporate Governance Research InitiativeNo ratings yet

- CMA Data For Bank Loan ProposalDocument29 pagesCMA Data For Bank Loan Proposalshardaashish0055% (11)

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument80 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeReinch ClossNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- The Role of Ratio Analysis in Business Decisions A Case Study of O. Jaco Bros. Ent. (Nig.) LTD., Aba, Abia StateDocument112 pagesThe Role of Ratio Analysis in Business Decisions A Case Study of O. Jaco Bros. Ent. (Nig.) LTD., Aba, Abia StateIbrahim Olasunkanmi AbduLateefNo ratings yet

- Accounting EquationDocument14 pagesAccounting EquationDindin Oromedlav LoricaNo ratings yet

- Chapter 7 - Finanacial Project ApprisalDocument46 pagesChapter 7 - Finanacial Project ApprisalDomach Keak RomNo ratings yet