Professional Documents

Culture Documents

PDFFile Aspx

Uploaded by

Jane Carpio MedinaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDFFile Aspx

Uploaded by

Jane Carpio MedinaCopyright:

Available Formats

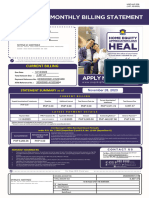

Housing Account No.

: 347005293512

______________________

Monthly Amortization/

Installment : PHP 4,953.13

______________________________

Due Date : every 28th of the month

______________________________

RANDY L. TORDILLO

*** *** ******* ********** ***** * **** ****** ******* ******

****

CURRENT BILLING

Due Date 07/28/2022

: _____________________

20,238.74

Total Amount Due : _____________________

Payment Reference No. :47347005293512222098

___________________

ATM Reference No. : 347005293512222096

_____________________

STATEMENT SUMMARY as of July 08, 2022

(Statement Due)

CURRENT BILLING

Current Amortization/

Unpaid Amortizations/ Instalments Penalties Additional Interest Total Amount Past due Total Amount Due

Installment

(For ___ to ___ )

(For PHP 426.22 PHP 0.00 PHP 15,285.61 PHP 4,953.13 20,238.74

PHP Apr 2022 to Jun 2022)PHP

PHP 14,859.39 PHP PHP PHP PHP

LATEST PAYMENT DETAILS

Payment Date PFR/ Transaction No. Applicable Month/s Amount Outstanding Balance** Advance Payment***

03/21/2022 P11271463 03/28/2022

_____ to _____ PHP

PHP 4,953.13 PHP

PHP 668,945.44 PHP PHP 0.00

For Borrowers Who Received Grace Period/s

under R.A. No. 11469 (Bayanihan I) and R.A. No. 11494 (Bayanihan II).

Important Notes on Accrued Interest:

Remaining Accrued 1. The accrued interest is NOT AN ADDITIONAL INTEREST or CHARGE. This refers only to the total interest portion of your regular monthly amortizations covered by

Accrued Interest the grace periods under the Bayanihan Laws.

Interest

2. The Bayanihan Laws were automatically applied for your benefit so that the INTEREST PORTION of your regular monthly amortizations did not immediately

become due. The interest portion may now be paid via installment or at the end of your loan term.

PHPPHP0.00 PHPPHP0.00 3. For borrowers who did not opt out, payment/s made for the INTEREST PORTION during the grace periods have been favorably treated as advance payment for

amortizations due after the grace period or applied to the principal amount of your loan.

PAYMENT REMINDERS

1. Please present this Billing Statement or the perforated card at the upper left part of this billing statement when paying at any Pag-IBIG

Accredited Collecting Partners. However, for payments made beyond the due date, corresponding penalties shall be charged to your (02) 8422-3000 local 6502

Tel.Nos.: ____________________

account. Email: ______________________

calambalmrd.lmd@pagibigfund.gov.ph

2. Payments made after the previous bill period’s due date may not be reflected in this bill. Ms. Dority G. Pastor / Mr.Gerry Polintan

Look for Mr./Ms. _____________

3. Please make all checks payable to Pag-IBIG Fund.

4. For payments made thru Post-Dated-Checks (PDCs), please deposit to the concerned bank the amount indicated on the PDCs

regardless of the total amount due indicated above.

5. Please notify us immediately of any changes in your billing address or other personal data.

6. This bill is considered accurate if no advice is received within 10 days from receipt.

7. Any unpaid portion of the loan shall be paid at the end of the term.

HOUSING ACCOUNT NO. 347005293512

TOTAL AMOUNT DUE PHP 20,238.74

RANDY L. TORDILLO TO BE FILLED UP BY THE BORROWER

*** *** ******* ********** ***** * **** ****** *******

****** **** Cash Payment

Check Payment

Check No.

Bank/Branch

IMPORTANT INFORMATION ABOUT YOUR HOUSING LOAN

1. Please ensure that payments for your Real Estate Tax are updated to avoid subjecting

your property to levies by the concerned local government unit and/or delays in the

transfer of the title in your name. Submit a photocopy of your updated Real Estate Tax

Receipt at any Pag-IBIG Fund office or email the scanned copy not later than June 30 of

each year.

2. Please provide us with a copy of the receipt/s, if there are payments not considered in

this Statement.

3. For excess payments that must be or intended to be applied to principal portion, said

amount shall be applied first to the Unpaid Interest (Long-Term Accounts Receivable).

Thereafter, any remaining excess payment shall be allocated on the said principal

portion.

4. A penalty of 1/20 of one percent of the amount due shall be charged for every day of

delay in payment. If the loan is covered by the two-tiered interest rate structure, the

higher interest rate shall be charged for payments beyond the due date.

5. You shall be considered in default if you fail to pay three (3) consecutive monthly

amortizations/installments and/or monthly membership savings and other obligations

under the loan. Default will lead to the cancellation of your CTS/DCS or foreclosure of

your mortgage.

6. In case your account is already in default, any payments made shall not exempt you from

cancellation of your CTS/DCS or foreclosure of your mortgage, except if your account has

been fully updated or fully paid.

7. You may visit our Online Housing Loan Verification at www.pagibigfund.gov.ph to verify

payments made to the Fund, to view, and to print this billing statement.

8. In compliance with Republic Act No. 9510 (Credit Information System Act), please be

advised that we are required to submit and share from time to time your basis credit

data including updates or corrections there to the Credit Information Corporation (CIC).

THANK YOU FOR YOUR PROMPT PAYMENT

You might also like

- Foreclosure Rescue ScamsDocument44 pagesForeclosure Rescue ScamsrichdebtNo ratings yet

- MOHELA Statement InformationDocument3 pagesMOHELA Statement InformationDavid TaylorNo ratings yet

- Billingstatement - Franz Johann D. CeñidozaDocument2 pagesBillingstatement - Franz Johann D. Ceñidozajuan tamadNo ratings yet

- Can Mers Foreclose or Assign MortgageDocument35 pagesCan Mers Foreclose or Assign Mortgagecfinley19100% (1)

- 411DPFHZ539384 Foreclosure LetterDocument3 pages411DPFHZ539384 Foreclosure LetterSaikiran VeepuriNo ratings yet

- CFPB - Draft Periodic Mortgage Statement PDFDocument1 pageCFPB - Draft Periodic Mortgage Statement PDFtrustar14No ratings yet

- Foreclosure 19-17-26Document3 pagesForeclosure 19-17-26adityaNo ratings yet

- Monthly Billing Statement: Account InformationDocument2 pagesMonthly Billing Statement: Account Informationarianne Dela cruz100% (1)

- NEw IC 38 Question Bank 366Document58 pagesNEw IC 38 Question Bank 366Kit Cat83% (6)

- Payment Information Summary of Account ActivityDocument8 pagesPayment Information Summary of Account ActivityElizabeth Marie MendelsohnNo ratings yet

- BillingStatement - ROY H. TORRESDocument2 pagesBillingStatement - ROY H. TORRESAldrei TorresNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Account Information: Danielle D. PascuaDocument2 pagesAccount Information: Danielle D. PascuaKaye AnnNo ratings yet

- BillingStatement 315028328217Document2 pagesBillingStatement 315028328217Renier Palma CruzNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicemozo dingdongNo ratings yet

- Test Bank For Investments 12th Edition Zvi Bodie Alex Kane Alan MarcusDocument39 pagesTest Bank For Investments 12th Edition Zvi Bodie Alex Kane Alan MarcusAddison Rogers100% (35)

- BillingStatement - KAY MARK C. ORIO PDFDocument2 pagesBillingStatement - KAY MARK C. ORIO PDFOiro Kram YakNo ratings yet

- HLF058 - BorrowersValidationSheetDeveloperAssisted - V02Document1 pageHLF058 - BorrowersValidationSheetDeveloperAssisted - V02Glecy Anne B. Berona67% (15)

- New Borrowers Validation SheetDocument1 pageNew Borrowers Validation SheetalecksgodinezNo ratings yet

- Promissory Note With Restructuring Agreement Promissory NoteDocument5 pagesPromissory Note With Restructuring Agreement Promissory NoteJomarc Cedrick GonzalesNo ratings yet

- E-Statement of Account: Hans Rudolf Begonte TamidlesDocument4 pagesE-Statement of Account: Hans Rudolf Begonte TamidlesKal LymNo ratings yet

- Yu V PCIBDocument2 pagesYu V PCIBChilzia RojasNo ratings yet

- Account Closure and Term Deposit Premature Withdrawal FormDocument2 pagesAccount Closure and Term Deposit Premature Withdrawal FormSonali SarkarNo ratings yet

- Borrower 'S Validation Sheet (BVS) : Bria Homes, IncDocument1 pageBorrower 'S Validation Sheet (BVS) : Bria Homes, IncJayGee DolorNo ratings yet

- Oblicon DigestsDocument19 pagesOblicon DigestsSGTNo ratings yet

- BillingStatement 364024053214Document2 pagesBillingStatement 364024053214MARY JERICA OCUPENo ratings yet

- BillingStatement 364023989216Document2 pagesBillingStatement 364023989216rojieprietoNo ratings yet

- BillingStatement 315017330518Document2 pagesBillingStatement 315017330518Willy LumbresNo ratings yet

- PDFFile AspxDocument2 pagesPDFFile AspxMYRNA (MONTEJO) MARTINEZNo ratings yet

- BillingStatement 316301227818-1Document2 pagesBillingStatement 316301227818-1mzncapistranoNo ratings yet

- BillingStatement 349006125115Document2 pagesBillingStatement 349006125115Francis Jave TabernillaNo ratings yet

- BillingStatement 388005728118Document2 pagesBillingStatement 388005728118john philip OcapanNo ratings yet

- BillingStatement - JO-ANN V. ESTEBANDocument2 pagesBillingStatement - JO-ANN V. ESTEBANJo-Ann Chan ValleNo ratings yet

- Account Information: Elmer V. BellezaDocument2 pagesAccount Information: Elmer V. BellezaEl GuerreroNo ratings yet

- BillingStatement - BENEDICK G. DALIDADocument2 pagesBillingStatement - BENEDICK G. DALIDALizette AlbolerasNo ratings yet

- BillingStatement - LOLITA P. AREVALO - 2Document2 pagesBillingStatement - LOLITA P. AREVALO - 2Franco Evale YumulNo ratings yet

- Monthly Billing Statement: Ma Katherine Dela Cruz PantojaDocument4 pagesMonthly Billing Statement: Ma Katherine Dela Cruz Pantojamaria katherine pantojaNo ratings yet

- Foreclosure 17-39-07Document3 pagesForeclosure 17-39-07Yogesh SarangNo ratings yet

- Foreclosure 12 24 05Document3 pagesForeclosure 12 24 05Sunil LaygudeNo ratings yet

- Foreclosure 20 58 16Document3 pagesForeclosure 20 58 16Bio AllianceNo ratings yet

- Foreclosure 14 07 11Document3 pagesForeclosure 14 07 11Muhammed Yazeen PMNo ratings yet

- Foreclosure Letter - 20 - 26 - 49Document3 pagesForeclosure Letter - 20 - 26 - 49B. Srini VasanNo ratings yet

- Fixed Deposit FormDocument2 pagesFixed Deposit FormNikita JainNo ratings yet

- Disposal Instruction For Handling Foreign Inward RemittancesDocument3 pagesDisposal Instruction For Handling Foreign Inward Remittancessishir chandraNo ratings yet

- PDF FileDocument2 pagesPDF FileRowena PiniliNo ratings yet

- Term Deposit FormDocument2 pagesTerm Deposit FormVishnu VNo ratings yet

- DocumentaryDocument2 pagesDocumentaryJessly Jeon Montefalco DelegeroNo ratings yet

- Tgecc Loan FormDocument3 pagesTgecc Loan FormShiela May HerreraNo ratings yet

- BillingStatement - NICEO SIANEMAR C. MORENODocument2 pagesBillingStatement - NICEO SIANEMAR C. MORENOTroy MorenoNo ratings yet

- Foreclosure Letter 20-05-40Document3 pagesForeclosure Letter 20-05-40G Pavan KumarNo ratings yet

- PDS Equity Home Financing IDocument10 pagesPDS Equity Home Financing IsyahnooraimanNo ratings yet

- Globe Bill 927599321-1Document2 pagesGlobe Bill 927599321-1emzthineNo ratings yet

- Foreclosure LetterDocument3 pagesForeclosure Letterprem.sNo ratings yet

- Í - /J9È9Â Caballero Jobelââââââ G Ç/?) 86xî Mr. Jobel Gesim CaballeroDocument2 pagesÍ - /J9È9Â Caballero Jobelââââââ G Ç/?) 86xî Mr. Jobel Gesim CaballeroClyde BarcastNo ratings yet

- StatementDocument10 pagesStatementchefrinkuNo ratings yet

- FD Form RevisedDocument2 pagesFD Form RevisedAshutosh TiwariNo ratings yet

- Ang Alamat NG UlolDocument2 pagesAng Alamat NG UlolMaroden Sanchez GarciaNo ratings yet

- Ramesh GPF Old StatementDocument2 pagesRamesh GPF Old StatementSHARANUNo ratings yet

- BillingStatement - GENEVIEVE G. ANDAS PDFDocument2 pagesBillingStatement - GENEVIEVE G. ANDAS PDFGenevieve AndasNo ratings yet

- Foreclosure Letter - 20 - 49 - 45Document3 pagesForeclosure Letter - 20 - 49 - 45Suman KumarNo ratings yet

- Product Disclosure Sheet Apr 22Document13 pagesProduct Disclosure Sheet Apr 22Admin SMKPekanKBNo ratings yet

- Corporate Insolvency Resolution Process Insolvency and Bankruptcy Code (IBC)Document36 pagesCorporate Insolvency Resolution Process Insolvency and Bankruptcy Code (IBC)Prajwal WakhareNo ratings yet

- TermLoanASBProductDisclosureSheet IDocument8 pagesTermLoanASBProductDisclosureSheet IamirulNo ratings yet

- SP 9xk3wmxaMu2mjIdXb9MSq43fDjtahKqbfcvFLSJoos0g9zhA 32kduu9DYKAnQjlXanYRegot6UUQ iIHywDocument5 pagesSP 9xk3wmxaMu2mjIdXb9MSq43fDjtahKqbfcvFLSJoos0g9zhA 32kduu9DYKAnQjlXanYRegot6UUQ iIHywwwwthemanth6No ratings yet

- HLF058 - BVS - Da - V03Document1 pageHLF058 - BVS - Da - V03Mhirro Ace Roy PortilloNo ratings yet

- Bank of Baroda NEFT FORMDocument1 pageBank of Baroda NEFT FORMAshish ParmarNo ratings yet

- Transaction Conversion FormDocument1 pageTransaction Conversion FormROQUE JAY BROCENo ratings yet

- Time Value of Money: All Rights ReservedDocument43 pagesTime Value of Money: All Rights ReservedAnonymous f7wV1lQKRNo ratings yet

- Perla Compania vs. RamoleteDocument9 pagesPerla Compania vs. RamoleteIrene Leah C. RomeroNo ratings yet

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxreemaNo ratings yet

- Credit - From RecentDocument5 pagesCredit - From RecentRemNo ratings yet

- Diff Between Normal & Islamic Banking in MaldeevDocument2 pagesDiff Between Normal & Islamic Banking in MaldeevAfroza KhanNo ratings yet

- Fulcher, James (2015) Capitalism - A Very Short IntroductionDocument11 pagesFulcher, James (2015) Capitalism - A Very Short Introductionpandujb213No ratings yet

- Basics of Commercial Banking: SecuritiesDocument9 pagesBasics of Commercial Banking: SecuritiesLeo Sandy Ambe CuisNo ratings yet

- Capacity To ContractDocument10 pagesCapacity To ContractEsha bansalNo ratings yet

- Review On LiteratureDocument7 pagesReview On LiteratureJenifer SathaNo ratings yet

- IC 38 IRDA Exam Question Bank PDF For Life Insurance - Ambitious BabaDocument30 pagesIC 38 IRDA Exam Question Bank PDF For Life Insurance - Ambitious BabaPrince DipuNo ratings yet

- SME Business Loan - Application FormDocument2 pagesSME Business Loan - Application FormChiqu Lending Corp.No ratings yet

- The Big Short IIDocument35 pagesThe Big Short IIflagella1337No ratings yet

- NSBCI vs. PNB PDFDocument60 pagesNSBCI vs. PNB PDFJohn Paul VillaflorNo ratings yet

- Sbi SynopsisDocument7 pagesSbi SynopsisvenkibgvNo ratings yet

- 2 Bar Exam Questions Civil Law Review 1 PropertyDocument22 pages2 Bar Exam Questions Civil Law Review 1 PropertyYadirf LiramyviNo ratings yet

- Study On Loans & Advances at Muslim Co-Operative Bank by Arif MujawarDocument67 pagesStudy On Loans & Advances at Muslim Co-Operative Bank by Arif MujawarPrakash Hajare100% (2)

- Credit Guide and Privacy v3Document5 pagesCredit Guide and Privacy v3Promila SikkaNo ratings yet

- Real Estate Mortgage: Jocelyn B. LebananDocument4 pagesReal Estate Mortgage: Jocelyn B. LebananEduard MantacNo ratings yet

- Oblicon - Cases 13-24Document17 pagesOblicon - Cases 13-24ace lagurinNo ratings yet

- Guingona, Jr. v. City Fiscal of Manila - 1985Document2 pagesGuingona, Jr. v. City Fiscal of Manila - 1985martina lopezNo ratings yet

- 1-Gregorio Araneta Inc V TuazonDocument19 pages1-Gregorio Araneta Inc V TuazonRen A EleponioNo ratings yet

- PMG HouseholdBudget1Document1 pagePMG HouseholdBudget1Fred AlmaNo ratings yet

- 2017 (GR. No. 206343 Land Bank vs. Musni)Document13 pages2017 (GR. No. 206343 Land Bank vs. Musni)BG KellianNo ratings yet