Professional Documents

Culture Documents

HLF058 - BorrowersValidationSheetDeveloperAssisted - V02

Uploaded by

Glecy Anne B. BeronaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HLF058 - BorrowersValidationSheetDeveloperAssisted - V02

Uploaded by

Glecy Anne B. BeronaCopyright:

Available Formats

HQP-HLF-058

(V02, 02/2018)

BORROWER’S VALIDATION SHEET (BVS)

NAME OF BORROWER CONTACT DETAILS:

LAST NAME FIRST NAME NAME EXTENSION MIDDLE NAME Home

PRESENT HOME ADDRESS Cell Phone

Unit/Room No., Floor Building Name Lot No., Block No., Phase No., House No. Street Name

Business Tel No.

Subdivision Barangay Municipality/City Province/State/Country (if abroad) Zip Code

(indicate local line if any)

NAME OF DEVELOPER E-mail Address

SUBDIVISION/ PROJECT WHERE UNIT IS TO BE PURCHASED

PARTICULARS YES NO

1. Are you a Pag-IBIG member?

2. Do you wish to pursue your Pag-IBIG housing loan application filed through the developer?

3. Do you accept the property to your own satisfaction?

4. Have you been informed about the terms and conditions of your loan?

I hereby certify that the foregoing information/statement is true, correct, and complete. Likewise, I certify that I have

been reminded by the authorized Pag-IBIG Fund representative on Pag-IBIG policies on housing loan take-out, monthly

amortization, modes of payment and due date, penalty rate, and consequence of default.

__________________________________ ____________

Signature of Borrower Over Printed Name Date

O

FOR Pag-IBIG Fund USE ONLY

(Name of Borrower)

I hereby certify that _____________________________________ who has proven to me his/her identity through his/her

(Valid ID & ID Number) has appeared and has personally accomplished and signed before me this Borrower’s Validation

_____________________

Sheet together with the Loan and Mortgage Agreement (LMA), Deed of Absolute Sale (DOAS), Disclosure Statement on

Loan Transaction (DSLT) and Deed of Conditional Sale (DCS).

I further certify that I have verified his/her intent on availing of the Pag-IBIG Housing Loan. I have also explained him/her

of the following:

The borrower is covered by a Mortgage Redemption Insurance (MRI)/Sales Redemption Insurance (SRI) and the

property with Fire Insurance. The corresponding insurance premium shall form part of the monthly amortization.

The interest rate shall be subject to re-pricing depending on chosen re-pricing period.

If the Developer has a Collection Servicing Agreement (CSA) with Pag-IBIG Fund, the borrower shall pay directly

to the Developer, otherwise the borrower must pay only to accredited partner banks or authorized collection

partners identified in the Notice of Installment/Amortization.

The application of payment and treatment of amount paid in excess of the required monthly amortization.

In case of failure to pay on due date, a penalty equivalent to 1/20 of 1% of the amount due for every day of delay shall

be charged to the borrower.

Failure to pay 3 consecutive monthly amortizations shall constitute a default.

In case there has been a breach in the warranty and the developer fails to comply with the Notice of Deficiency, the

account shall be subject to buyback.

The account shall be converted from CTS to REM not later than 24 th month from takeout for accounts under Window

1 and Window 2, or 36th month from the date of loan takeout for accounts under Window 1 (Elite). (Include this

statement only if the housing application is under Developer with CTS Documentation)

The borrower can avail of a subsequent housing loan, provided that: 1) he/she is an active member of Pag-IBIG Fund

2) His housing account/s is/are updated; and 3) he/she has capacity to pay his/her obligation/s.

In case there would be discrepancy/ies in the documents signed, specifically for loan amount and amortization, he/she

shall be required to reappear personally at Pag-IBIG Fund to receive and sign the rectified copy of the document/s.

Effects of membership termination are based on the prevailing guidelines at the time of takeout.

The payment of real property tax after the loan take out shall be shouldered by the borrower. The official receipt of

real property tax paid for the preceding year shall be submitted to Pag-IBIG Fund not later than June 30 of the

current year and every year thereafter. The payment of real property tax is an obligation imposed by Sections

246 to 250 of Republic Act No. 7160, known as the Local Government Code of 1991. Failure to pay on time will

be a ground for the Municipality/City of (Name of Municipality/City) to impose an interest per month on the realty

tax due, and to sell your property to settle your tax delinquency.

In case of full payment, the taxes and other cost for transfer of title from Pag-IBIG Fund to borrower shall be for

the latter’s account. (Include this statement only if the housing application is under Developer with DCS

Documentation)

_________________________________ ____________________________

Signature of Pag-IBIG Fund’s Authorized Place where validation was held

Representative Over Printed Name Date: _____________

Remarks:

You might also like

- 2018 Borrower's Validation Sheet - BvsDocument1 page2018 Borrower's Validation Sheet - BvsAr Ar67% (6)

- BVS Form PDFDocument1 pageBVS Form PDFHar RizNo ratings yet

- Borrower 'S Validation Sheet (BVS) : Bria Homes, IncDocument1 pageBorrower 'S Validation Sheet (BVS) : Bria Homes, IncJayGee DolorNo ratings yet

- New Bvs FormDocument1 pageNew Bvs FormTraxex ShyunshinNo ratings yet

- Certificate of Final Electrical Inspection - 0Document3 pagesCertificate of Final Electrical Inspection - 0RM DulawanNo ratings yet

- Malasakit Form PDFDocument2 pagesMalasakit Form PDFMakki Andre Antonio67% (3)

- Imap Good Standing LDS ChapterDocument7 pagesImap Good Standing LDS ChapterAlibasher MacalnasNo ratings yet

- Annual Pensioners Information Revalidation (Apir) Form: Pension TypeDocument1 pageAnnual Pensioners Information Revalidation (Apir) Form: Pension TypeJefferson Ballad67% (3)

- Request PSA and CENOMAR on behalfDocument1 pageRequest PSA and CENOMAR on behalfJAY CADAY0% (1)

- Barangay Certificate of Acceptance: To Whom It May ConcernDocument2 pagesBarangay Certificate of Acceptance: To Whom It May ConcernPoblacion 04 San Luis100% (1)

- Inventory and Inspection Report of Unserviceable PropertyDocument6 pagesInventory and Inspection Report of Unserviceable PropertyNestorJepolanCapiñaNo ratings yet

- Authorization LetterDocument1 pageAuthorization LetterRegineDagumanFuellas100% (1)

- Pag-Ibig Salary Loan Form PDFDocument3 pagesPag-Ibig Salary Loan Form PDFtandangmark75% (52)

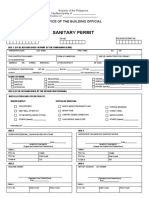

- Sanitary Permit PDFDocument2 pagesSanitary Permit PDFRebecca Leyson100% (5)

- Deped School Form 137-ADocument4 pagesDeped School Form 137-APrince Yahwe Rodriguez100% (1)

- For Agency Remittance Advice: FORM E. List of Employees With Changes / Correction in Their Personal DataDocument1 pageFor Agency Remittance Advice: FORM E. List of Employees With Changes / Correction in Their Personal DataKarissa100% (5)

- Application For Provident Benefits (Apb) Claim: Type or Print EntriesDocument2 pagesApplication For Provident Benefits (Apb) Claim: Type or Print Entriesglenn padernal50% (2)

- BIR Tin Application (Form 1902)Document2 pagesBIR Tin Application (Form 1902)Mara Martinez74% (27)

- Certificate of Acceptance (Goods & Deliveries)Document1 pageCertificate of Acceptance (Goods & Deliveries)Stephanie Payumo50% (2)

- Guidelines and Implementing RulesDocument1 pageGuidelines and Implementing RulesDonita Rose Najera Nuestro67% (3)

- 0605Document2 pages0605Kath Rivera60% (42)

- Sworn statement of accountabilityDocument1 pageSworn statement of accountabilityJohn Paul AloyNo ratings yet

- Rai Work Experience SheetDocument2 pagesRai Work Experience Sheetmark langcayNo ratings yet

- CS Form No. 7 Clearance Form 1Document5 pagesCS Form No. 7 Clearance Form 1Mark Cañete PunongbayanNo ratings yet

- Deped Form 137 SHS PDFDocument2 pagesDeped Form 137 SHS PDFCharline A. Radislao100% (7)

- Endorsement: To: Engr. Christopher M. Edjic, PH., DDocument1 pageEndorsement: To: Engr. Christopher M. Edjic, PH., DHaier Koppel Skyworth100% (3)

- National Food Authority certifies official phone callsDocument1 pageNational Food Authority certifies official phone callsREGIONAL DIRECTOR SOUTHERN TAGALOG100% (1)

- 2023 Bulacan Holidays Rev.2Document2 pages2023 Bulacan Holidays Rev.2Martin Del MundoNo ratings yet

- PRC Oath Form or Panunumpa NG Propesyonal FormDocument2 pagesPRC Oath Form or Panunumpa NG Propesyonal Formjepisangsum92% (26)

- BrrweshousngapplctnsheetDocument1 pageBrrweshousngapplctnsheetvivid.aubergineNo ratings yet

- New Borrowers Validation SheetDocument1 pageNew Borrowers Validation SheetalecksgodinezNo ratings yet

- HLF058 - BVS - Da - V03Document1 pageHLF058 - BVS - Da - V03Mhirro Ace Roy PortilloNo ratings yet

- NEW BVS FORM 01.31.2023 A4Document1 pageNEW BVS FORM 01.31.2023 A4Mary Grace Sagum MengoteNo ratings yet

- HLF058 Bvs-Da V03Document1 pageHLF058 Bvs-Da V03James CaberaNo ratings yet

- BVS Form 2022Document1 pageBVS Form 2022Atibroc Neyadnis MariaginaNo ratings yet

- Apply for Moratorium on Pag-IBIG STL PaymentsDocument2 pagesApply for Moratorium on Pag-IBIG STL PaymentsJhonson MedranoNo ratings yet

- Policy Fund Withdrawal FormDocument2 pagesPolicy Fund Withdrawal FormJulius Harvey Prieto BalbasNo ratings yet

- MyCitihomes-REPAF FormDocument2 pagesMyCitihomes-REPAF Formleslie duranNo ratings yet

- RA - Sentrina Alaminos 03052021 For Altered SDP - FinalDocument2 pagesRA - Sentrina Alaminos 03052021 For Altered SDP - FinalJoseph Leviste BarrionNo ratings yet

- Policy Fund Withdrawal Form: FWP/FSC CodeDocument2 pagesPolicy Fund Withdrawal Form: FWP/FSC CodeEra gasperNo ratings yet

- Billingstatement - Franz Johann D. CeñidozaDocument2 pagesBillingstatement - Franz Johann D. Ceñidozajuan tamadNo ratings yet

- Booking Form CP-1 (1)Document2 pagesBooking Form CP-1 (1)R SampathNo ratings yet

- Pag-Ibig Loyalty Card Plus Account Holder'S Contact Details Change Request FormDocument1 pagePag-Ibig Loyalty Card Plus Account Holder'S Contact Details Change Request FormBreahziel ParillaNo ratings yet

- New Business Pre-Submission ChecklistDocument2 pagesNew Business Pre-Submission ChecklistCherrie Mae CongsonNo ratings yet

- Godrej 24Document77 pagesGodrej 24Rohan BagadiyaNo ratings yet

- Conformity on new housing loan cross-default policyDocument1 pageConformity on new housing loan cross-default policyjonathan magdatoNo ratings yet

- Surrender Form PDFDocument2 pagesSurrender Form PDFL.BISHORJIT MEITEINo ratings yet

- Monthly Billing Statement: Account InformationDocument2 pagesMonthly Billing Statement: Account Informationarianne Dela cruz100% (1)

- Housing Loan Restructuring Program DetailsDocument5 pagesHousing Loan Restructuring Program DetailsAnna HansenNo ratings yet

- HLF576 ApplicationMoratoriumHLAmortizationPayments V01Document2 pagesHLF576 ApplicationMoratoriumHLAmortizationPayments V01ivyNo ratings yet

- Short-Term Loan Remittance Form (STLRF) : HQP-SLF-017Document2 pagesShort-Term Loan Remittance Form (STLRF) : HQP-SLF-017Jo Sh100% (1)

- virtualpagibighlrPN HLF818.Aspxli DFFF358BA443D0EBF0D9FCBDocument5 pagesvirtualpagibighlrPN HLF818.Aspxli DFFF358BA443D0EBF0D9FCBGlenda B. MendozaNo ratings yet

- Customer Declaration FormDocument2 pagesCustomer Declaration FormAbhinanth Mj90% (10)

- AAF103 OTBPublicAuctionIndividual V02Document2 pagesAAF103 OTBPublicAuctionIndividual V02Sana Smashing ButtNo ratings yet

- Maturity Form: Policy InformationDocument2 pagesMaturity Form: Policy Informationroodra singh ranawatNo ratings yet

- PAG IBIgDocument2 pagesPAG IBIgdocgilbertNo ratings yet

- Application Form For Business Permit Office of The City Mayor Business Permit & Licensing DivisionDocument2 pagesApplication Form For Business Permit Office of The City Mayor Business Permit & Licensing Divisionvivian deocampoNo ratings yet

- Promissory Note With Restructuring Agreement Promissory NoteDocument5 pagesPromissory Note With Restructuring Agreement Promissory NoteJomarc Cedrick GonzalesNo ratings yet

- PFF022 LetterEmployerPenaltyCondonationUnregistered V04Document1 pagePFF022 LetterEmployerPenaltyCondonationUnregistered V04Guardian Angel02No ratings yet

- BillingStatement 315028328217Document2 pagesBillingStatement 315028328217Renier Palma CruzNo ratings yet

- Bio-Data FormDocument1 pageBio-Data Formkyope1765% (946)

- M-2 DoneDocument22 pagesM-2 DoneGlecy Anne B. Berona100% (1)

- Physical Education 2nd Year Exam 2021Document1 pagePhysical Education 2nd Year Exam 2021Glecy Anne B. Berona100% (1)

- Physical Education 2nd Year Exam 2021Document1 pagePhysical Education 2nd Year Exam 2021Glecy Anne B. Berona100% (1)

- PerDev Q1 W1 KnowingOneself-1Document18 pagesPerDev Q1 W1 KnowingOneself-1Glecy Anne B. Berona100% (1)

- READING 3BsDocument9 pagesREADING 3BsGlecy Anne B. BeronaNo ratings yet

- Reformina V Tomol, JR Facts:: Which Amended Act 2655 (Usury Law) Which Raised The Legal Interest Fro 6%Document2 pagesReformina V Tomol, JR Facts:: Which Amended Act 2655 (Usury Law) Which Raised The Legal Interest Fro 6%Annabelle BustamanteNo ratings yet

- R92-97 CASE 2. Caniza vs. CADocument7 pagesR92-97 CASE 2. Caniza vs. CAJessica AbadillaNo ratings yet

- (KG) VALERIO Vs REFRESCADocument2 pages(KG) VALERIO Vs REFRESCAJake KimNo ratings yet

- The Sales of Goods Act (1930)Document44 pagesThe Sales of Goods Act (1930)swatishetNo ratings yet

- CommercialDocument77 pagesCommercialGNo ratings yet

- Ra 6552 PDFDocument2 pagesRa 6552 PDFjackie delos santosNo ratings yet

- Legal Aspect of BusinessDocument146 pagesLegal Aspect of Businesssumitkjham100% (1)

- CIF Ningbo Port, ChinaDocument3 pagesCIF Ningbo Port, ChinaFantania BerryNo ratings yet

- Ansarada Document IndexDocument4 pagesAnsarada Document IndexThanhNo ratings yet

- Indicate The Best Answer in The Following QuestionsDocument1 pageIndicate The Best Answer in The Following QuestionsZiya KhanNo ratings yet

- Andhra Pradesh Rights in Land and Pattadar Pass Books Rules, 1989Document23 pagesAndhra Pradesh Rights in Land and Pattadar Pass Books Rules, 1989raju6340% (1)

- XXXXXXDocument3 pagesXXXXXXTANISHQNo ratings yet

- Buslaw 1: de La Salle University Comlaw DepartmentDocument47 pagesBuslaw 1: de La Salle University Comlaw DepartmentRina TugadeNo ratings yet

- ) Complaint To Enjoin) Foreclosure, For) Declaratory Relief, ForDocument6 pages) Complaint To Enjoin) Foreclosure, For) Declaratory Relief, ForJames TsakanikasNo ratings yet

- Commercial Law ReviewerDocument328 pagesCommercial Law ReviewerelagomaanNo ratings yet

- Express Credit Vs VelascoDocument10 pagesExpress Credit Vs VelascoFelicity PageNo ratings yet

- SM Land, Inc. v. Bases Conversion and Development Authority, GR No. 203655, March 18, 2015Document3 pagesSM Land, Inc. v. Bases Conversion and Development Authority, GR No. 203655, March 18, 2015Maya Sin-ot ApaliasNo ratings yet

- ASIAN ALCOHOL CORPORATION vs. NLRCDocument3 pagesASIAN ALCOHOL CORPORATION vs. NLRCMonica FerilNo ratings yet

- SCOTTH OLM ESMUSIC.COM FREE CREATIVE COMMONS LICENSEDocument4 pagesSCOTTH OLM ESMUSIC.COM FREE CREATIVE COMMONS LICENSEOctavio ChonNo ratings yet

- CORAZON KO v. VIRGINIA DY ARAMBURO GR No. 190995, Aug 09, 2017 Co-Ownership, Sale, Void vs. Voidable Sale, Prescription - PINAY JURISTDocument6 pagesCORAZON KO v. VIRGINIA DY ARAMBURO GR No. 190995, Aug 09, 2017 Co-Ownership, Sale, Void vs. Voidable Sale, Prescription - PINAY JURISTDJ MikeNo ratings yet

- Company Law MCQ For CA Inter PDFDocument57 pagesCompany Law MCQ For CA Inter PDFArun ManojNo ratings yet

- Ownership Dispute Over Rizal PropertyDocument6 pagesOwnership Dispute Over Rizal PropertyEric Villa100% (2)

- Sales ReviewerDocument39 pagesSales ReviewerJude JacildoNo ratings yet

- Incorporation of Companies BCLDocument19 pagesIncorporation of Companies BCLMinahil ImranNo ratings yet

- Extrajudicial Settlement of Estate SampleDocument2 pagesExtrajudicial Settlement of Estate Sampleyano_08100% (2)

- Court Upholds Venue for Settlement of EstateDocument8 pagesCourt Upholds Venue for Settlement of EstateMark Gabriel B. MarangaNo ratings yet

- Parental Consent Form For Youth Summit 2022 FinalDocument1 pageParental Consent Form For Youth Summit 2022 FinalRomel BesinNo ratings yet

- Lease Agreement: - of Legal Age, Filipino, and With Residence and Postal Address at BrgyDocument3 pagesLease Agreement: - of Legal Age, Filipino, and With Residence and Postal Address at BrgyMayveriiNo ratings yet

- Oblicon CasesDocument39 pagesOblicon CasesNikitaNo ratings yet

- 171 Contract Act Bankers LienDocument208 pages171 Contract Act Bankers LienSaddy ButtNo ratings yet