Professional Documents

Culture Documents

PFF022 LetterEmployerPenaltyCondonationUnregistered V04

Uploaded by

Guardian Angel02Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PFF022 LetterEmployerPenaltyCondonationUnregistered V04

Uploaded by

Guardian Angel02Copyright:

Available Formats

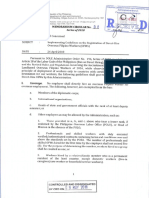

(For Unregistered Employer) HQP-PFF-022

(V04, 01/2022)

Pag-IBIG Fund

(Home Development Mutual Fund)

__________________

Date

________________________

________________________

________________________

Dear Sir/Madam:

As a result of our Membership Enforcement Activities, it was found that your

company is not registered as an employer with the Pag-IBIG Fund. In effect, your

employees are also not registered nor remitted of their mandatory Membership Savings

(MS) to the Fund. Pursuant to Section 23 (b) of Republic Act No. 9679, you are liable to

pay a penalty of 3% per month of the amounts payable from the date the contributions fall

due until paid, in addition to your employees’ unremitted MS and deprived dividends.

Nonetheless, please be advised that the Pag-IBIG Fund has adopted a new

Penalty Condonation Program to which you may apply subject to the terms and

conditions specified in the applicable guidelines.

Should you opt to avail of the program, you may accomplish the Application

for the New Penalty Condonation Program on Mandatory Monthly Savings (MS)

Remittances (HQP-PFF-397) which can be downloaded at www.pagibigfund.gov.ph

and submitted to this Pag-IBIG Fund Branch.

If you do not apply for Penalty Condonation, despite being qualified, you will

continue to incur penalties on the unremitted MS of your employees and the employer

counterpart. Non-payment of unremitted MS, including penalties, will make you

criminally liable for violation of R.A. 9679.

Should you have any query or matter that you would like to clarify regarding this

notice, please visit or call this Branch.

Very truly yours,

_______________________

(Name and Designation of

Authorized Signatory)

(Address and telephone number of Pag-IBIG Branch)

You might also like

- FLS020 HDMF Calamity Loan Application Form Aug 09 - 092809 - FDocument2 pagesFLS020 HDMF Calamity Loan Application Form Aug 09 - 092809 - FRochelle Esteban100% (2)

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- SLF143 MemorandumAgreementEmployersSTLVirtual V02Document7 pagesSLF143 MemorandumAgreementEmployersSTLVirtual V02Chell Dela Peña CruzNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Questions To HDMF With AnswersDocument8 pagesQuestions To HDMF With AnswersAbby ReyesNo ratings yet

- Noa HLF895Document2 pagesNoa HLF895gazzie rayNo ratings yet

- Noa Hlf895Document2 pagesNoa Hlf895gazzie rayNo ratings yet

- HLF058 - BorrowersValidationSheetDeveloperAssisted - V02Document1 pageHLF058 - BorrowersValidationSheetDeveloperAssisted - V02Glecy Anne B. Berona67% (15)

- Employee Benefits: How to Make the Most of Your Stock, Insurance, Retirement, and Executive BenefitsFrom EverandEmployee Benefits: How to Make the Most of Your Stock, Insurance, Retirement, and Executive BenefitsRating: 5 out of 5 stars5/5 (1)

- IOM Pag-IBIG Fund Calamity Loan and Multi-Purpose LoanDocument2 pagesIOM Pag-IBIG Fund Calamity Loan and Multi-Purpose LoanjeffNo ratings yet

- ACFrOgADh2syoDXW-jWSqKzVC 5eZZBXr7jbuOF46stqMvkrPMM-s3obbGvWu1GtoIU77bh BJ Au6DhmfRC60pPSfHZxfNAaL8ibRpJgcCQwjgB-V2Ba5L8Sz4lFOgDocument2 pagesACFrOgADh2syoDXW-jWSqKzVC 5eZZBXr7jbuOF46stqMvkrPMM-s3obbGvWu1GtoIU77bh BJ Au6DhmfRC60pPSfHZxfNAaL8ibRpJgcCQwjgB-V2Ba5L8Sz4lFOgAxelrossjohnedmar Ronda Bautista RamiroNo ratings yet

- IFM - Investment in Pag-IBIG MP2 FINALDocument14 pagesIFM - Investment in Pag-IBIG MP2 FINALRona Faith TanduyanNo ratings yet

- Pag Ibig 2Document8 pagesPag Ibig 2ramilynn bulgarNo ratings yet

- Promissory Note With Restructuring Agreement Promissory NoteDocument5 pagesPromissory Note With Restructuring Agreement Promissory NoteJomarc Cedrick GonzalesNo ratings yet

- Borrower 'S Validation Sheet (BVS) : Bria Homes, IncDocument1 pageBorrower 'S Validation Sheet (BVS) : Bria Homes, IncJayGee DolorNo ratings yet

- Promissory Note With Restructuring Agreement Promissory NoteDocument5 pagesPromissory Note With Restructuring Agreement Promissory NoteAnna HansenNo ratings yet

- Application For Penalty Condonation: (For Financially Distressed Employers Due To Covid-19 PandemicDocument2 pagesApplication For Penalty Condonation: (For Financially Distressed Employers Due To Covid-19 PandemicCrizetteTarcenaNo ratings yet

- RCMPAYMEDocument1 pageRCMPAYMELenin Rey PolonNo ratings yet

- Offerletter364433 AL PASCUALDocument16 pagesOfferletter364433 AL PASCUALJurel PascualNo ratings yet

- PFF250 RequestUpgradeMembershipSavingsDocument1 pagePFF250 RequestUpgradeMembershipSavingsajcn060492No ratings yet

- PFF250 AuthoritytoDeduct V01 FillablesDocument1 pagePFF250 AuthoritytoDeduct V01 FillablesTerence Eunice CeñirNo ratings yet

- PFF250 RequestUpgradeMembershipSavings V02Document1 pagePFF250 RequestUpgradeMembershipSavings V02roque roe igotNo ratings yet

- Paycheck Protection Program: Business Legal Name ("Borrower") DBA or Tradename, If ApplicableDocument3 pagesPaycheck Protection Program: Business Legal Name ("Borrower") DBA or Tradename, If ApplicableJanon Fisher100% (2)

- PFF250 RequestUpgradeMembershipSavings V02Document1 pagePFF250 RequestUpgradeMembershipSavings V02ajcn060492No ratings yet

- PFF418 ResettingEmployersAUAAOVirtualPassword V01Document1 pagePFF418 ResettingEmployersAUAAOVirtualPassword V01ajcn060492No ratings yet

- C3892637 - RAKSHITHK S - OfferLetter-1 PDFDocument6 pagesC3892637 - RAKSHITHK S - OfferLetter-1 PDFmithuncyNo ratings yet

- Contract To SellDocument5 pagesContract To SellvicentemariscalNo ratings yet

- MC 08 2018Document8 pagesMC 08 2018genevieve santosNo ratings yet

- PFF250 RequestUpgradeMembershipSavings V02Document1 pagePFF250 RequestUpgradeMembershipSavings V02bayombongumcNo ratings yet

- Offer LetterDocument6 pagesOffer LetterKennet AlphyNo ratings yet

- Memo Understanding DoleDocument2 pagesMemo Understanding DoleChristine SambranaNo ratings yet

- PR - Penalty Condonation For Employers1Document1 pagePR - Penalty Condonation For Employers1Edwin QuitorianoNo ratings yet

- SLF001 MultiPurposeLoanApplicationForm (MPLAF) V01Document2 pagesSLF001 MultiPurposeLoanApplicationForm (MPLAF) V01mitzi_0350% (2)

- BrrweshousngapplctnsheetDocument1 pageBrrweshousngapplctnsheetvivid.aubergineNo ratings yet

- Pag-IBIG Salary Loan EligibilityDocument1 pagePag-IBIG Salary Loan EligibilityMykel OtaydeNo ratings yet

- Poea 08-18Document8 pagesPoea 08-18rehnegibbNo ratings yet

- Promissory Note With Restructuring Agreement Promissory NoteDocument5 pagesPromissory Note With Restructuring Agreement Promissory NoteArthur AguilarNo ratings yet

- Bonus Loan FormDocument2 pagesBonus Loan FormPATCOMC CooperativeNo ratings yet

- virtualpagibighlrPN HLF818.Aspxli DFFF358BA443D0EBF0D9FCBDocument5 pagesvirtualpagibighlrPN HLF818.Aspxli DFFF358BA443D0EBF0D9FCBGlenda B. MendozaNo ratings yet

- POLICY SERVICING REQUEST 2 - With StandardDocument3 pagesPOLICY SERVICING REQUEST 2 - With Standardsarwar shamsNo ratings yet

- AAF103 OTBPublicAuctionIndividual V02Document2 pagesAAF103 OTBPublicAuctionIndividual V02Sana Smashing ButtNo ratings yet

- Noa HLF817Document1 pageNoa HLF817Rhea J MagbanuaNo ratings yet

- Authority To Deduct: Lizardbear Tasking, IncDocument1 pageAuthority To Deduct: Lizardbear Tasking, IncVice GandaNo ratings yet

- Digital Marketing Agreement 2018Document4 pagesDigital Marketing Agreement 2018Ruliani Putri SinagaNo ratings yet

- Emerson Rosaupan Calamity LoanDocument3 pagesEmerson Rosaupan Calamity LoanErere RosaupanNo ratings yet

- New Bvs FormDocument1 pageNew Bvs FormTraxex ShyunshinNo ratings yet

- Form BK 2Document2 pagesForm BK 2benitotarayao0No ratings yet

- Application For The New Penalty Condonation Program On Mandatory Monthly Savings (MS) RemittancesDocument2 pagesApplication For The New Penalty Condonation Program On Mandatory Monthly Savings (MS) RemittancesCrizetteTarcena100% (1)

- New Borrowers Validation SheetDocument1 pageNew Borrowers Validation SheetalecksgodinezNo ratings yet

- Citizens Charter - Short-Term Loan - December 2016Document12 pagesCitizens Charter - Short-Term Loan - December 2016AbbyNo ratings yet

- Notice To The Public: CIAP Circular No. - Series of 2020Document7 pagesNotice To The Public: CIAP Circular No. - Series of 2020danna Grace MalinaoNo ratings yet

- PagIbig SLF001 MultiPurposeLoanApplicationForm (MPLAF) 065Document2 pagesPagIbig SLF001 MultiPurposeLoanApplicationForm (MPLAF) 065gosmiley100% (1)

- SLF143 MemorandumAgreementEmployersOnlineSTL V01Document5 pagesSLF143 MemorandumAgreementEmployersOnlineSTL V01avinmanzanoNo ratings yet

- Notice of RetrenchmentDocument1 pageNotice of Retrenchmentsam espinasNo ratings yet

- SLF143 MemorandumAgreementEmployersSTLVirtual V02Document7 pagesSLF143 MemorandumAgreementEmployersSTLVirtual V02Jerome Formalejo50% (2)

- Safety Data Sheet: Section 1. IdentificationDocument10 pagesSafety Data Sheet: Section 1. IdentificationAnonymous Wj1DqbENo ratings yet

- Ottawa County May ElectionDocument7 pagesOttawa County May ElectionWXMINo ratings yet

- Model-Checking: A Tutorial Introduction: January 1999Document26 pagesModel-Checking: A Tutorial Introduction: January 1999Quý Trương QuangNo ratings yet

- Isabela State University: Republic of The Philippines Roxas, IsabelaDocument17 pagesIsabela State University: Republic of The Philippines Roxas, IsabelaMarinette MedranoNo ratings yet

- Appendix h6 Diffuser Design InvestigationDocument51 pagesAppendix h6 Diffuser Design InvestigationVeena NageshNo ratings yet

- Mil Tos (1ST Quarter)Document3 pagesMil Tos (1ST Quarter)Rhea Carillo100% (14)

- 12 - Community OutreachDocument3 pages12 - Community OutreachAdam ThimmigNo ratings yet

- SAP HR and Payroll Wage TypesDocument3 pagesSAP HR and Payroll Wage TypesBharathk Kld0% (1)

- Barclays Personal Savings AccountsDocument10 pagesBarclays Personal Savings AccountsTHNo ratings yet

- PRIMARY Vs Secondary Vs TertiaryDocument1 pagePRIMARY Vs Secondary Vs TertiaryIshi Pearl Tupaz100% (1)

- Income Tax - MidtermDocument9 pagesIncome Tax - MidtermThe Second OneNo ratings yet

- The Little MermaidDocument6 pagesThe Little MermaidBobbie LittleNo ratings yet

- Akebono NVH White PaperDocument4 pagesAkebono NVH White Paperapi-3702571100% (1)

- Datasheet d801001Document6 pagesDatasheet d801001Hammad HussainNo ratings yet

- Thermo Exam QuestionsDocument4 pagesThermo Exam QuestionssiskieoNo ratings yet

- Beamer Example: Ethan AltDocument13 pagesBeamer Example: Ethan AltManh Hoang VanNo ratings yet

- RK3066 Mid PDFDocument17 pagesRK3066 Mid PDFSharon MurphyNo ratings yet

- IOTA Observers Manual All PagesDocument382 pagesIOTA Observers Manual All PagesMarcelo MartinsNo ratings yet

- Keepa ApiDocument55 pagesKeepa ApiQazi Sohail AhmadNo ratings yet

- Train Collision Avoidance SystemDocument4 pagesTrain Collision Avoidance SystemSaurabh GuptaNo ratings yet

- World War 1 NotesDocument2 pagesWorld War 1 NotesSoarSZNNo ratings yet

- BEGONTES, MESSY PORTFOLIO BATCH 2023 Episode 1-7Document34 pagesBEGONTES, MESSY PORTFOLIO BATCH 2023 Episode 1-7Messy S. BegontesNo ratings yet

- Nestle IndiaDocument74 pagesNestle IndiaKiranNo ratings yet

- Roundtracer Flash En-Us Final 2021-06-09Document106 pagesRoundtracer Flash En-Us Final 2021-06-09Kawee BoonsuwanNo ratings yet

- D'Shawn M. Haines: 423 East Fox Trail, Williamstown, NJ 08094 (856) 366-7049Document2 pagesD'Shawn M. Haines: 423 East Fox Trail, Williamstown, NJ 08094 (856) 366-7049dshawnNo ratings yet

- B. Tech. - CSE - R13-Syllabus JntuaDocument132 pagesB. Tech. - CSE - R13-Syllabus JntuaVasim AkramNo ratings yet

- 16.3 - Precipitation and The Solubility Product - Chemistry LibreTextsDocument14 pages16.3 - Precipitation and The Solubility Product - Chemistry LibreTextsThereNo ratings yet

- Noten - Detective Conan - Case ClosedDocument2 pagesNoten - Detective Conan - Case ClosedBLU-NYTE GamingNo ratings yet

- Sample Barista Offer LetterDocument2 pagesSample Barista Offer LetterMohammed Albalushi100% (2)

- 08 BQ - PADSB - Elect - P2 - R2 (Subcon Empty BQ)Document89 pages08 BQ - PADSB - Elect - P2 - R2 (Subcon Empty BQ)Middle EastNo ratings yet