Professional Documents

Culture Documents

4A Purchases Transactions

Uploaded by

Crest TineOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4A Purchases Transactions

Uploaded by

Crest TineCopyright:

Available Formats

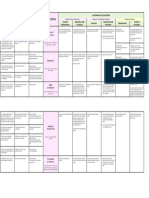

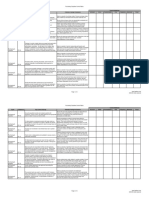

PURCHASES TRANSACTIONS

TESTS OF CONTROLS (IWORI) SUBSTANTIVE TESTS (VICTORIA)

Potential Audit Procedures Test ASSERTIONS Substantive test of transactions Substantive test of details of balances Analytical Procedures

Controls Potential Substantive Audit Substantive Audit

Misstatements of Controls Assertions Analytical Procedures

Misstatements Procedures Procedures

1. Approval of acquisitions is Purchases that did not occur may be Examine approval signature. Purchases that did not occur may be Examine underlying documents for Analytical procedures also provide evidence about the completeness of

evidenced by signatures on the recorded. recorded. Documents may be reused, authenticity and reasonableness. Scan purchases and accounts payable.

purchase order. and acquisitions may be recorded voucher register for large or unusual

Existence/ twice. items. Inspect acquired PPE. Trace Auditors compare current-year individual accounts payable and expense

inventory purchased to perpetual account balances with previous year balances, and they compare the ratios of

Occurrence records. Scan voucher register for the purchases to accounts payable and the ratios of AP to the current liabilities

2. A purchase requisition, PO, RR and Purchases that did not occur may be Observe procedure or examine file of duplicate payments. with previous year ratios.

VI are filed in support of each recorded. documents.

acquisition.

Recorded acquisitions are for items

that were acquired.

3. Documents are canceled so they Documents may be reused, and Examine cancellations on documents.

cannot be reused. acquisitions may be recorded twice.

4. Receiving reports and Vouchers are Purchases maybe unrecorded. Observe procedure. Purchases may be unrecorded. Trace a sequence of receiving reports All purchases and accounts payable 1. Test cutoff to determine whether

pre-numbered and accounted for. Account for a numerical sequence. to entries in the voucher register. Test transactions are recorded. purchases and accounts payable

cutoff. Account for a sequence of are recorded properly.

entries in the voucher register. 2. Reconcile accounts payable to

vendors’ statements and consider

the need for confirmations with

Completeness vendors.

3. Perform analytical procedures to

Acquisitions that occurred are test purchases and accounts

recorded. payable.

4. Perform a search for unrecorded

liabilities.

5. Receiving reports are pre- Purchase that are not legitimate Observe procedure.

numbered by persons having access business purchases may be recorded

Rights

only to a blind copy of purchase order and paid, or consigned goods may be & obligations

details. Consigned goods are readily recorded as a purchase.

identified.

Recorded acquisitions are the

entity’s purchases and liabilities.

6. For all goods shipped, goods are Client could overpay for goods or Examine voucher for signature Client could overpay for goods or Recompute invoices and compare Transactions are recorded at their 5. Verify the mathematical accuracy

counted and descriptions and services. indicating performance. services. invoice price to purchase order. proper amounts. of vouchers payable listing and

quantities are compared to quantities Valuation/ trace the balance to the general

and descriptions on sales orders and ledger.

shipping documents prior to shipping. Measurement

Acquisitions are recorded for the

proper amounts.

7. Chart of accounts adequately Purchases may be charged to wrong Examine chart of accounts. Purchases may be charged to wrong Check accuracy of accounts on Accounts payable are properly 6. Determine whether accounts are

describes accounts to be debited. accounts. Examine signature of employee

Presentation accounts. invoices by reference to chart of classified and disclosed. classified and disclosed in the FS in

Account coding is assigned by one performing check. & disclosure accounts. accordance with PFRS.

person and checked by another.

Acquisitions are recorded to result in

presentation and disclosure in

accordance with PFRS.

You might also like

- Specific Further Audit ProceduresDocument4 pagesSpecific Further Audit ProceduresCattleyaNo ratings yet

- Test and ControlsDocument5 pagesTest and ControlsKristen HathcockNo ratings yet

- 2A Cash Receipts TransactionsDocument2 pages2A Cash Receipts TransactionsCrest TineNo ratings yet

- 1A Sales TransactionsDocument2 pages1A Sales TransactionsCrest TineNo ratings yet

- Transaction-Related Audit Objective Possible Internal Controls Common Tests of ControlsDocument3 pagesTransaction-Related Audit Objective Possible Internal Controls Common Tests of ControlsJustin DavenportNo ratings yet

- Davita - Dewardani - 182321069 Tugas Pengauditan KeuanganDocument4 pagesDavita - Dewardani - 182321069 Tugas Pengauditan KeuanganHAHAHA HIHIHINo ratings yet

- AEB15 SM C18 v3Document33 pagesAEB15 SM C18 v3Aaqib Hossain100% (1)

- Lê Viết Nhật Quang - 31221025758 aaDocument2 pagesLê Viết Nhật Quang - 31221025758 aaquangle.31221025758No ratings yet

- Presentation Audit of Acquisition and Payment CycleDocument38 pagesPresentation Audit of Acquisition and Payment CycleSyaffiq UbaidillahNo ratings yet

- A. Key Internal Control B. Transaction Related Audit Objectives C. Test of Control D. Substantive Test of TransactionDocument5 pagesA. Key Internal Control B. Transaction Related Audit Objectives C. Test of Control D. Substantive Test of TransactionRosanaDíazNo ratings yet

- Fixed AssetDocument2 pagesFixed AssetAnonymous fkQOAe2RNo ratings yet

- InventoryDocument16 pagesInventorybobocbanhNo ratings yet

- Audit Procedur ES Cash Accounts Receivable Accounts Payable InventoryDocument2 pagesAudit Procedur ES Cash Accounts Receivable Accounts Payable InventoryRoseyy GalitNo ratings yet

- Audit Scope Accounts Involved Audit ProcedureDocument12 pagesAudit Scope Accounts Involved Audit Procedurekarenmae intangNo ratings yet

- Sol18 Sebagian2Document11 pagesSol18 Sebagian2Chotimatul ChusnaaNo ratings yet

- Jawaban Chapter 18Document34 pagesJawaban Chapter 18Heltiana Nufriyanti75% (4)

- Purchase and Inventory: Dream HighDocument35 pagesPurchase and Inventory: Dream HighTrangMiNo ratings yet

- TOC and Substantive Test Cyle Expenditure and Disbursement CycleDocument6 pagesTOC and Substantive Test Cyle Expenditure and Disbursement CycleGirl langNo ratings yet

- Test of ControlDocument10 pagesTest of ControlShrividhyaNo ratings yet

- Auditing CycleDocument2 pagesAuditing CycletemedebereNo ratings yet

- Completeness CompletenessDocument6 pagesCompleteness CompletenessShavi GurugeNo ratings yet

- University of San Jose-Recoletos: Cabinas, Joshua James R. ACCTG 403: 3065 BSA-3Document3 pagesUniversity of San Jose-Recoletos: Cabinas, Joshua James R. ACCTG 403: 3065 BSA-3Joshua CabinasNo ratings yet

- 2.1 Audit of Sales and ReceivablesDocument2 pages2.1 Audit of Sales and ReceivablesNavsNo ratings yet

- Auditor's Response P2P CycleDocument8 pagesAuditor's Response P2P CycleMarwin AceNo ratings yet

- 13.performance of Substantive Testing and Summary of Results of Substantive TestingDocument3 pages13.performance of Substantive Testing and Summary of Results of Substantive TestingKen Aaron DelosReyes PedroNo ratings yet

- Audit of The Inventory and Warehousing CycleDocument10 pagesAudit of The Inventory and Warehousing Cyclenanda rafsanjaniNo ratings yet

- Applicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresDocument3 pagesApplicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresRosept ParnesNo ratings yet

- Business Processes - Part 2Document17 pagesBusiness Processes - Part 2Malinda NayanajithNo ratings yet

- Final Requirement in Auditing in Csis Environment: 1. Create A Data Flow Diagram of The Current SystemDocument3 pagesFinal Requirement in Auditing in Csis Environment: 1. Create A Data Flow Diagram of The Current SystemmaiaaaaNo ratings yet

- Risk Assessment TemplateDocument1 pageRisk Assessment TemplateYến Hoàng HảiNo ratings yet

- Substantive TestingDocument18 pagesSubstantive TestingMichelle SicangcoNo ratings yet

- Lab Iii Audit of Sales and Collection Cycle: I. TujuanDocument8 pagesLab Iii Audit of Sales and Collection Cycle: I. TujuanyenitaNo ratings yet

- Summary of AssertionsDocument8 pagesSummary of AssertionsJurry AngaoNo ratings yet

- 3A Cash Payments TransactionsDocument2 pages3A Cash Payments TransactionsCrest TineNo ratings yet

- Vouching Summary PDFDocument7 pagesVouching Summary PDFAjay GiriNo ratings yet

- Vouching Summary NotesDocument6 pagesVouching Summary NotesVikram KumarNo ratings yet

- Substantive ProcedureDocument8 pagesSubstantive ProcedureGoldaNo ratings yet

- Auditing The Production CycleDocument5 pagesAuditing The Production CycleTiana Ling Jiunn LiNo ratings yet

- Purchase Controls QuestionnaireDocument3 pagesPurchase Controls QuestionnaireMarieJoiaNo ratings yet

- Lab 4Document8 pagesLab 4valen martaNo ratings yet

- AP.3401 Audit of InventoriesDocument8 pagesAP.3401 Audit of InventoriesMonica GarciaNo ratings yet

- Audit PPT (Reading Version)Document23 pagesAudit PPT (Reading Version)Saradindu Chakraborty0% (1)

- Business Processes - Part 1Document15 pagesBusiness Processes - Part 1Malinda NayanajithNo ratings yet

- Purchases & PayablesDocument12 pagesPurchases & Payablesrsn_surya100% (2)

- BSSOXPurchasing&Payables Control MatrixDocument2 pagesBSSOXPurchasing&Payables Control MatrixDivine GraceNo ratings yet

- AP 1901 Inventories PDFDocument8 pagesAP 1901 Inventories PDFToni Rhys ArguellesNo ratings yet

- Audit of InventoriesDocument3 pagesAudit of Inventoriesbartabatoes rerunNo ratings yet

- Chapter 10. Tests of ControlsDocument25 pagesChapter 10. Tests of Controlsreeem312477No ratings yet

- 19d (12-00) Develop The Audit Program - InventoryDocument4 pages19d (12-00) Develop The Audit Program - InventoryTran AnhNo ratings yet

- Lead Schedule: E V C R&O P&D O M C P&DDocument4 pagesLead Schedule: E V C R&O P&D O M C P&DChristian Dela CruzNo ratings yet

- Audit AssertionsDocument1 pageAudit AssertionsDevice Factory UnlockNo ratings yet

- Lab 3Document10 pagesLab 3valen martaNo ratings yet

- Audit of Inventories: The Use of Assertions in Obtaining Audit EvidenceDocument9 pagesAudit of Inventories: The Use of Assertions in Obtaining Audit EvidencemoNo ratings yet

- Revenue CycleDocument10 pagesRevenue CycleMart BanaresNo ratings yet

- Chapter 12 Audit Procedures - ppt179107590Document8 pagesChapter 12 Audit Procedures - ppt179107590Clar Aaron BautistaNo ratings yet

- MMPresentation HCLDocument23 pagesMMPresentation HCLrajpriiyer100% (1)

- Ap 12345Document29 pagesAp 12345Diane RoallosNo ratings yet

- Auditing Problems Ocampo/Cabarles AP.1901-Audit of Inventories OCTOBER 2015Document8 pagesAuditing Problems Ocampo/Cabarles AP.1901-Audit of Inventories OCTOBER 2015AngelouNo ratings yet

- 4.1 Inventory ProceduresDocument1 page4.1 Inventory ProceduresChristine JotojotNo ratings yet

- 7 Financing and InvestingDocument1 page7 Financing and InvestingCrest TineNo ratings yet

- 7B Notes PayablesDocument2 pages7B Notes PayablesCrest TineNo ratings yet

- 7C SheDocument2 pages7C SheCrest TineNo ratings yet

- 7A InvestmentsDocument1 page7A InvestmentsCrest TineNo ratings yet

- 6 Production CycleDocument1 page6 Production CycleCrest TineNo ratings yet

- 3 Disbursement CycleDocument1 page3 Disbursement CycleCrest TineNo ratings yet

- 3A Cash Payments TransactionsDocument2 pages3A Cash Payments TransactionsCrest TineNo ratings yet

- What Is Stock Market?: (Bursa Saham Malaysia)Document9 pagesWhat Is Stock Market?: (Bursa Saham Malaysia)Halim ZulkifliNo ratings yet

- Fundamental Analysis: Capital MarketsDocument19 pagesFundamental Analysis: Capital MarketsIT GAMINGNo ratings yet

- Projecting Financials & ValuationsDocument88 pagesProjecting Financials & ValuationsPratik ModyNo ratings yet

- Hull OFOD10e MultipleChoice Questions Only Ch08Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch08Kevin Molly KamrathNo ratings yet

- Module-3 Types of Financial ServicesDocument141 pagesModule-3 Types of Financial Serviceskarthik karthikNo ratings yet

- Modern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank 1Document27 pagesModern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank 1george100% (43)

- ch03 Acct1 7e TKDocument22 pagesch03 Acct1 7e TKSharun RavishankarNo ratings yet

- IAS 33 Earnings Per ShareDocument24 pagesIAS 33 Earnings Per ShareAbdul RehmanNo ratings yet

- Material of As 28Document48 pagesMaterial of As 28emmanuel JohnyNo ratings yet

- Operating ExposureDocument31 pagesOperating ExposureMai LiênNo ratings yet

- COVID19 KDV 2022 8EMS T3 CASE STUDY 8p3dykDocument6 pagesCOVID19 KDV 2022 8EMS T3 CASE STUDY 8p3dykmarelie eksteenNo ratings yet

- Corporations in Financial Difficulty: Multiple Choice QuestionsDocument27 pagesCorporations in Financial Difficulty: Multiple Choice QuestionsDieter LudwigNo ratings yet

- Chapter (6) Products of The Financial Reporting ProcessDocument39 pagesChapter (6) Products of The Financial Reporting Processرهف عبد الله100% (1)

- Icbp LK TW Ii 2017Document116 pagesIcbp LK TW Ii 2017DS ReishenNo ratings yet

- HHS - Why Did Nordstjernan Start The "Resistance Movement Against IFRS"?Document26 pagesHHS - Why Did Nordstjernan Start The "Resistance Movement Against IFRS"?NordstjernanNo ratings yet

- RB Answers CH13Document4 pagesRB Answers CH13Nayden GeorgievNo ratings yet

- Working Capital Management: BY: Subhankar SamalDocument10 pagesWorking Capital Management: BY: Subhankar SamalSubhankar SamalNo ratings yet

- Assignment 3 Risk and ReturnDocument2 pagesAssignment 3 Risk and ReturnQurat SaboorNo ratings yet

- Inventories With Lower Cost, Without Sacrificing Its QualityDocument4 pagesInventories With Lower Cost, Without Sacrificing Its QualityMark Lyndon YmataNo ratings yet

- AsadDocument2 pagesAsadRajib Ali100% (2)

- Scope of Work V04 - Sample 26-06-2020Document2 pagesScope of Work V04 - Sample 26-06-2020arunjoshi12345No ratings yet

- Statement Profit Loss StandaloneDocument1 pageStatement Profit Loss Standalonesubham not a nameNo ratings yet

- Valuation of Fixed Income SecuritiesDocument37 pagesValuation of Fixed Income Securitiesaksh02007No ratings yet

- Fico Assessment and Its Impact On Stock Pricing: Submitted To DR. SushmitaDocument17 pagesFico Assessment and Its Impact On Stock Pricing: Submitted To DR. SushmitaSiddharth AgarwalNo ratings yet

- Sales & Receivables JournalDocument2 pagesSales & Receivables JournalriyadiNo ratings yet

- Strategic Cost Management Exercises 12369Document2 pagesStrategic Cost Management Exercises 12369Arlene Diane OrozcoNo ratings yet

- Corporate Finance - Mock ExamDocument8 pagesCorporate Finance - Mock ExamLưu Quỳnh MaiNo ratings yet

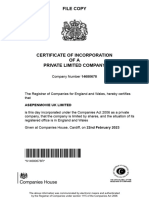

- Asepenmovie Uk LimitedDocument7 pagesAsepenmovie Uk LimitedMed AnouarNo ratings yet

- Part 2 Corp Finance II (Stocks & Bonds) - Sol 27 Jan 2024Document62 pagesPart 2 Corp Finance II (Stocks & Bonds) - Sol 27 Jan 2024Tess PetancioNo ratings yet

- Dividend Policy WGDocument6 pagesDividend Policy WG20BBA137No ratings yet