Professional Documents

Culture Documents

7B Notes Payables

Uploaded by

Crest TineOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7B Notes Payables

Uploaded by

Crest TineCopyright:

Available Formats

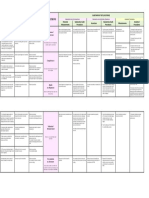

NOTES PAYABLE

ASSERTIONS Substantive Audit Procedures

Existence/ 1. Confirm notes with lenders, including the principal amount, interest rate,

Occurrence interest payments, due date, collateral, and other terms.

Recorded notes payable actually 2. Determine whether proceeds of notes are recorded and used as the BODs

exist. intended.

3. Perform analytical procedures.

Completeness 4. Reconcile interest expense to notes payable and compare interest expense

for the current period with that for the previous year.

All notes payable are recorded.

5. Review standard bank confirmations to determine that all loans are

recorded.

Rights 6. Read the loan agreement for terms and conditions that should be disclosed

and for pledging of assets.

& obligations

Recorded notes payable represent

obligations of the entity.

Valuation/ 7. Recalculate the portion of notes currently due, interest expense, interest

payments and accrued payments; foot the schedule of notes payable.

Measurement

Notes payable are valued properly.

Presentation 8. Review the FS and perform analytical procedures to determine whether

accounts are classified and disclosed in accordance with PFRS.

& disclosure

Notes payable are recorded to

result in presentation and

disclosure in accordance with

PFRS.

You might also like

- Substantive Tests of Receivables and SalesDocument4 pagesSubstantive Tests of Receivables and SalesKeith Joshua Gabiason100% (1)

- Commercial Lending Audit ProgramDocument13 pagesCommercial Lending Audit Programromuel31No ratings yet

- Audit Program-Long Term DebtDocument11 pagesAudit Program-Long Term DebtRoemi Rivera Robedizo100% (3)

- 09 - Cash and Bank BalancesDocument4 pages09 - Cash and Bank BalancesAqib SheikhNo ratings yet

- Audit ProgramDocument16 pagesAudit Programanon_806011137100% (4)

- Consumer Lending Audit Program For ACUIADocument8 pagesConsumer Lending Audit Program For ACUIAMisc EllaneousNo ratings yet

- Audit of Other Items of Statement of Financial PositionDocument13 pagesAudit of Other Items of Statement of Financial PositionArlyn Pearl PradoNo ratings yet

- Chapter 15 Audit of Other Items of Statement of Financial PositionDocument13 pagesChapter 15 Audit of Other Items of Statement of Financial PositionMiaNo ratings yet

- Lesson 6 - Liabilities - Substantive Tests of Details of BalancesDocument30 pagesLesson 6 - Liabilities - Substantive Tests of Details of BalancesNiña YastoNo ratings yet

- Chapter 10 Audit of The Financing CycleDocument17 pagesChapter 10 Audit of The Financing CycleCASTILLO, MA. CHEESA D.No ratings yet

- 05 - Long Term Loans and AdvancesDocument5 pages05 - Long Term Loans and AdvancesAqib SheikhNo ratings yet

- Substantive Testing For Deposit LiabilitiesDocument3 pagesSubstantive Testing For Deposit LiabilitiesChristian PerezNo ratings yet

- Chapter 15 Debt and EquityDocument4 pagesChapter 15 Debt and EquityMahmood KarimNo ratings yet

- Prepaymentsand ReceivablesDocument3 pagesPrepaymentsand ReceivablesAsim JavedNo ratings yet

- 08 - Advances, Deposits, Prepayments and Other ReceivablesDocument4 pages08 - Advances, Deposits, Prepayments and Other ReceivablesAqib SheikhNo ratings yet

- Internal Control Measures For LiabilitiesDocument2 pagesInternal Control Measures For LiabilitiesLyanna Mormont100% (1)

- BorrowingsDocument8 pagesBorrowingsStephen Paul EscañoNo ratings yet

- Chapter 21 - Audit of The Capital Acquisition and Repayment CycleDocument5 pagesChapter 21 - Audit of The Capital Acquisition and Repayment CycleRaymond GuillartesNo ratings yet

- Audit Program: Provision Against Long Term Deposits Against UtilitiesDocument4 pagesAudit Program: Provision Against Long Term Deposits Against UtilitiesAqib SheikhNo ratings yet

- Chapter 18: Audit of Long-Term Liabilities: Review QuestionsDocument11 pagesChapter 18: Audit of Long-Term Liabilities: Review Questionstrixia nuylesNo ratings yet

- Audit of Liabilities: Lecture Notes For Accounting 15Document15 pagesAudit of Liabilities: Lecture Notes For Accounting 15Joanne Pauline Ochea100% (2)

- Acctg 9a - CH 9 OnwardsDocument5 pagesAcctg 9a - CH 9 OnwardsDonalyn BannagaoNo ratings yet

- AP.3407 Audit of LiabilitiesDocument6 pagesAP.3407 Audit of LiabilitiesMonica GarciaNo ratings yet

- Other Assets: Audit ObjectivesDocument5 pagesOther Assets: Audit ObjectivesIvoryBriginoNo ratings yet

- Topic 5c - Audit of Shareholders' Equity and Long Term LiabilityDocument14 pagesTopic 5c - Audit of Shareholders' Equity and Long Term LiabilityLANGITBIRUNo ratings yet

- Audit of Financial Cycle Chapter 10Document19 pagesAudit of Financial Cycle Chapter 10jeric rotasNo ratings yet

- Audit of The Capital Acquisition and Repayment CycleDocument7 pagesAudit of The Capital Acquisition and Repayment Cyclerezkifadila2No ratings yet

- Audit ProgramDocument9 pagesAudit ProgramChris Ian TagsipNo ratings yet

- Audit of LiabilitiesDocument5 pagesAudit of LiabilitiesLea VillamorNo ratings yet

- Verification of LiabilitiesDocument7 pagesVerification of Liabilitiesfaith olaNo ratings yet

- I. General Information: Audit Program: Treasury Audit ProgramDocument17 pagesI. General Information: Audit Program: Treasury Audit ProgramChinh Le DinhNo ratings yet

- E-AP-1 - Short Term Deposits Prepayments and Other ReceivablesDocument6 pagesE-AP-1 - Short Term Deposits Prepayments and Other ReceivablesAung Zaw HtweNo ratings yet

- Current LiabilitiesDocument2 pagesCurrent LiabilitiesPrio DebnathNo ratings yet

- Substantive Test of LiabilitiesDocument60 pagesSubstantive Test of Liabilitiesjulia4razoNo ratings yet

- Audit ProgrammeDocument7 pagesAudit ProgrammeRifath Ahmed A & CNo ratings yet

- Audit II 7new - 3Document15 pagesAudit II 7new - 3Muktar Xahaa100% (1)

- Substantive Procedures SheetDocument28 pagesSubstantive Procedures SheetMohanrajNo ratings yet

- Arens Auditing16e SM 22Document20 pagesArens Auditing16e SM 22김현중No ratings yet

- Audit Liability 01 Chapter 7Document4 pagesAudit Liability 01 Chapter 7Ma Teresa B. CerezoNo ratings yet

- Substantive Audit For AssetsDocument7 pagesSubstantive Audit For AssetsHenry MapaNo ratings yet

- AP Lesson 2Document13 pagesAP Lesson 2Joanne RomaNo ratings yet

- Audit of LiabilitiesDocument5 pagesAudit of LiabilitiesGille Rosa Abajar100% (1)

- Reporting Under Lfar PDFDocument50 pagesReporting Under Lfar PDFSHAHNo ratings yet

- Investment - Audit Program - HandoutsDocument2 pagesInvestment - Audit Program - HandoutsRoquessa Michel R. IgnaligNo ratings yet

- Audit ProgrammeDocument12 pagesAudit ProgrammeCA Nagendranadh TadikondaNo ratings yet

- Auditing Problems Usl PDFDocument226 pagesAuditing Problems Usl PDFmusic niNo ratings yet

- Auditing Operations and Completing The AuditDocument15 pagesAuditing Operations and Completing The AuditVatchdemonNo ratings yet

- Audit of Cash PDFDocument11 pagesAudit of Cash PDFRyan Prado AndayaNo ratings yet

- Auditing Problems: Audit of ReceivablesDocument4 pagesAuditing Problems: Audit of ReceivablesMa. Trixcy De VeraNo ratings yet

- E-AP-6 - Bills Discounted and PurchasedDocument3 pagesE-AP-6 - Bills Discounted and PurchasedAung Zaw HtweNo ratings yet

- Concepts and PrinciplesDocument13 pagesConcepts and PrinciplesJonafhel RaguinNo ratings yet

- In Testing Transactions, The Auditor Is Concerned With Tests ofDocument1 pageIn Testing Transactions, The Auditor Is Concerned With Tests ofMarieNo ratings yet

- In Testing Transactions, The Auditor Is Concerned With Tests ofDocument1 pageIn Testing Transactions, The Auditor Is Concerned With Tests ofMarieNo ratings yet

- Audit of CashDocument25 pagesAudit of CashCHRISTINE TABULOGNo ratings yet

- Auditing Lecture Notes 04172022Document16 pagesAuditing Lecture Notes 04172022Abegail Cadacio100% (2)

- Establish and Maintain Cash and Accrual Accounting SystemDocument49 pagesEstablish and Maintain Cash and Accrual Accounting SystemMulugeta GebinoNo ratings yet

- Chapter 9 Audit of Items of Financial StatementsDocument8 pagesChapter 9 Audit of Items of Financial StatementsDPSRUNo ratings yet

- Customized Audit Work Program - Audit Work Program - Interest Expense Subsidiary/Department: DateDocument2 pagesCustomized Audit Work Program - Audit Work Program - Interest Expense Subsidiary/Department: DateChinh Le DinhNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- 7 Financing and InvestingDocument1 page7 Financing and InvestingCrest TineNo ratings yet

- 7C SheDocument2 pages7C SheCrest TineNo ratings yet

- 6 Production CycleDocument1 page6 Production CycleCrest TineNo ratings yet

- 7A InvestmentsDocument1 page7A InvestmentsCrest TineNo ratings yet

- 4A Purchases TransactionsDocument2 pages4A Purchases TransactionsCrest TineNo ratings yet

- 3 Disbursement CycleDocument1 page3 Disbursement CycleCrest TineNo ratings yet

- 1A Sales TransactionsDocument2 pages1A Sales TransactionsCrest TineNo ratings yet

- 3A Cash Payments TransactionsDocument2 pages3A Cash Payments TransactionsCrest TineNo ratings yet

- 2A Cash Receipts TransactionsDocument2 pages2A Cash Receipts TransactionsCrest TineNo ratings yet