Professional Documents

Culture Documents

CT Maf253 SS Aug2015

CT Maf253 SS Aug2015

Uploaded by

ALIA MAISARA MD AKHIROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CT Maf253 SS Aug2015

CT Maf253 SS Aug2015

Uploaded by

ALIA MAISARA MD AKHIRCopyright:

Available Formats

CONFIDENTIAL 1 AC/AUG 2015/MAF253

UNIVERSITI TEKNOLOGI MARA

COMMON TEST

ANSWER SCHEME

COURSE : FUNDAMENTAL FINANCIAL MANAGEMENT

COURSE CODE : MAF253

EXAMINATION : AUGUST 2015

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

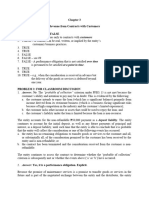

CONFIDENTIAL 2 AC/AUG 2015/MAF253

PART A

1. C 2. C 3. D 4. D 5. D

6. B 7. C 8. C 9. B 10. A

(10√ x 1 = 10 marks)

PART B

QUESTION 1

a.

i. Money market

Deals with short-term securities such as commercial paper, banker’s acceptance,

money market funds and certificates of deposits.√ Transactions usually take

place over the telephone.√.

ii. Capital market

Market where securities have a life of more than one year such as common

stock, preference stocks and bonds. √ It can be categorized into primary market

and secondary market √

(4√ x 1 = 4 marks)

b.

Profit maximization Shareholders’ wealth maximization

Does not consider the timing of returns√ Apply the principle of time value of money

√

Ignore risk and real world complexities Do consider risk when making decision. √

when making financial decisions√

Emphasized on short-term target√ Emphasize long-term returns√

(Any relevant answers accepted)

(6√ x 1 = 6 marks)

(Total: 10 marks)

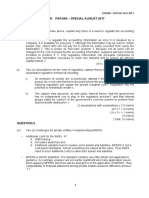

QUESTION 2

A.

a. CCC = 90√ + 38√ – 40√ = 88 days√

(4√ x ½ = 2 marks)

b. 38 days√ = AR/4000000√/360√ = RM422,222√

(4√ x ½ = 2 marks)

c. CCC = 360/6√ + 38√ - 40√ = 58 days√

(4√ x ½ = 2 marks)

d. Nature of business√, level of sales√ and credit and collection policies√

(Any relevant answers accepted)

(3√ x 1 = 3 marks)

B. a. Aggressive strategy √

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/AUG 2015/MAF253

ASSETS SOURCES OF FINANCING

Permanent assets RM200,000 √ Long-term financing RM220,000√

Permanent current assets RM30,000 √

Temporary assets RM70,000 √ Short-term financing RM80,000√

RM300,000 RM300,000

(6√ x ½ = 3 marks)

b. The firm finances all of its temporary assets and some of its permanent

current assets and fixed assets with short-term financing which includes

spontaneous sources. √ The other part of the permanent current assets and

fixed assets are financed by permanent sources, which also include

spontaneous sources. √

(2√ x 1 = 2 marks)

c. High risk of illiquidity (higher amount of installment) √ and high return (less

interest payment) √

(2√ x 1 = 2 marks)

C. The hedging principle is a moderate policy that matches assets and liabilities to

maturities. √ Permanent asset investments are financed with permanent sources,

and temporary investments are financed with temporary sources. √

(2√ x 1 = 2 marks)

(Total: 18 marks)

QUESTION 3

A. Unsecured loan are obtained without the borrower’s pledge of specific assets as

collateral. √

Secured sources involve the pledge of specific assets as collateral in the event the

borrower defaults in payment of principal or interest. √

(2√ x 1 = 2 marks)

B. a. 0.05 _√ x 360___ √ = 25.26%

(1-0.05) √ (90-15) √

(4√ x ½ = 2 marks)

b. Alternative 1

15%√ x 250,000√ x 90/360√ x 360

250,000√ – (15% x 250,000 x 90/360)√ – [(0.2 x 250,000)– 30,000]√ 90

= 17%√

Alternative 2

(250,000√ x 10%√ x 90/360)√+ (50,000√ x 5%√) x 360

250,000√ 90

= 14%√

(14√ x ½ = 7 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/AUG 2015/MAF253

c. Ramadhan Sdn Bhd should take an offer from the supplier and pay using line

of credit from Western Bank√. The cost only 14% compared with 17% offered

by Eastern Bank.√

(2√ x ½ = 1 mark)

(Total: 12 marks)

END OF SUGGESTED SOLUTION

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Revenue From Contracts With Customers: Problem 1: True or FalseDocument12 pagesRevenue From Contracts With Customers: Problem 1: True or FalsePaula Bautista88% (8)

- Elliot Wave For Advanced UsersDocument9 pagesElliot Wave For Advanced UsersRazif Bahsir67% (6)

- Homework 6.2 and 6.11Document5 pagesHomework 6.2 and 6.11abcNo ratings yet

- Audit Program For Property, Plant and Equipment Agency Name: Balance Sheet DateDocument7 pagesAudit Program For Property, Plant and Equipment Agency Name: Balance Sheet DateZosimo Solano100% (3)

- Solution Maf503 - Jan 2018Document8 pagesSolution Maf503 - Jan 2018anis izzatiNo ratings yet

- Maf 603 Suggested Solutions Solution 1Document5 pagesMaf 603 Suggested Solutions Solution 1anis izzatiNo ratings yet

- Chapter 4 - Solution ManualDocument74 pagesChapter 4 - Solution ManualSuhud0% (1)

- CT MAF253 2016 Jan SSDocument4 pagesCT MAF253 2016 Jan SSHaniff HamzahNo ratings yet

- CT MAF253 2017 Jan SSDocument4 pagesCT MAF253 2017 Jan SSHaniff HamzahNo ratings yet

- CT MAF253 2018 Apr SSDocument4 pagesCT MAF253 2018 Apr SSHaniff HamzahNo ratings yet

- CT Maf253 SS Feb2015Document3 pagesCT Maf253 SS Feb2015ALIA MAISARA MD AKHIRNo ratings yet

- 2014 FTX2000S Final 29 October 2014 Solution-1Document6 pages2014 FTX2000S Final 29 October 2014 Solution-1crctun001No ratings yet

- Far410 Test Oct 2018 - SolutionDocument3 pagesFar410 Test Oct 2018 - Solution2022478048No ratings yet

- SOLUTION MAF503 - JUN 2015 AmmendDocument8 pagesSOLUTION MAF503 - JUN 2015 Ammendanis izzatiNo ratings yet

- Ans KMKTDocument13 pagesAns KMKTsyahmiafndiNo ratings yet

- Q Test FAR570 Jan 2022Document6 pagesQ Test FAR570 Jan 2022fareen faridNo ratings yet

- Test 2 Aud339 Jan2021 SS Updated PDFDocument5 pagesTest 2 Aud339 Jan2021 SS Updated PDFNUR LYANA INANI AZMINo ratings yet

- MAF253 SS Common Test May 2022Document7 pagesMAF253 SS Common Test May 2022Nurfatihah JohariNo ratings yet

- Suggested Solution Maf653 June 2016Document9 pagesSuggested Solution Maf653 June 2016ANo ratings yet

- MAF603 2016 June SolutionDocument8 pagesMAF603 2016 June Solutionanis izzati100% (1)

- Solution Maf603 Feb 2021 PDFDocument10 pagesSolution Maf603 Feb 2021 PDFHadi DahalanNo ratings yet

- Solution Maf503 - Jun 2018Document8 pagesSolution Maf503 - Jun 2018anis izzati100% (1)

- Suggested Solution (Revised) Expected Return IDocument8 pagesSuggested Solution (Revised) Expected Return IMujahid IslamNo ratings yet

- Chapter 20 AnswerDocument11 pagesChapter 20 AnswerjennyNo ratings yet

- Mark Scheme (Results) Summer 2015: Pearson Edexcel IAL Accounting (WAC02/01) Unit 2 Corporate and Management AccountingDocument18 pagesMark Scheme (Results) Summer 2015: Pearson Edexcel IAL Accounting (WAC02/01) Unit 2 Corporate and Management Accountingraiyan rahmanNo ratings yet

- Short-Term Sources For Financing Current AssetsDocument11 pagesShort-Term Sources For Financing Current AssetsAlexandra TagleNo ratings yet

- Financial ManagementDocument6 pagesFinancial ManagementJoseph PhaustineNo ratings yet

- Chapter 20 - AnswerDocument11 pagesChapter 20 - AnswerLove FreddyNo ratings yet

- ANSWERS For ExercisesDocument13 pagesANSWERS For ExercisesAlia HazwaniNo ratings yet

- MAF603 2017 July SolutionDocument7 pagesMAF603 2017 July Solutionanis izzatiNo ratings yet

- Week 5 Workshop Solutions - Short-Term Debt MarketsDocument3 pagesWeek 5 Workshop Solutions - Short-Term Debt MarketsMengdi ZhangNo ratings yet

- 3B A01 2022 Suggested Solution - Post Moderation - AMDocument5 pages3B A01 2022 Suggested Solution - Post Moderation - AMsabelo.j.nkosi.5No ratings yet

- CHAPTER 14 - AnswerDocument10 pagesCHAPTER 14 - AnswerKlare HayeNo ratings yet

- Chapter 3 Revenue From Contracts With CustomersDocument4 pagesChapter 3 Revenue From Contracts With CustomersbwimeeeNo ratings yet

- SOLUTION MAF603 - JAN 2018 Without TickDocument8 pagesSOLUTION MAF603 - JAN 2018 Without Tickanis izzatiNo ratings yet

- Solution Maf503 - Jun 2016 AmmendDocument10 pagesSolution Maf503 - Jun 2016 Ammendanis izzatiNo ratings yet

- 252 PMP ® Exam Practice Test and Study Guide: Profit/LossDocument13 pages252 PMP ® Exam Practice Test and Study Guide: Profit/Lossobee1234No ratings yet

- Maf253 - SS - July 2021Document11 pagesMaf253 - SS - July 2021Shazrul FadzlyNo ratings yet

- FAR160 JUNE 2019 Q2 COMPANY-answer Madam CheckedDocument3 pagesFAR160 JUNE 2019 Q2 COMPANY-answer Madam CheckedNur Anis AqilahNo ratings yet

- Solution Far560 - Jul 2017Document8 pagesSolution Far560 - Jul 2017MUHAMAD MUKHAIRI MUHAMAD HANIFAHNo ratings yet

- Chapter 39 - Teacher's ManualDocument14 pagesChapter 39 - Teacher's ManualHohoho100% (1)

- Solution Set 1 Maf603 Feb 2022 Bedah Ahmad 1Document10 pagesSolution Set 1 Maf603 Feb 2022 Bedah Ahmad 1Aina SaffiyahNo ratings yet

- 4.4 Solution Maf653 - Jan 2018Document7 pages4.4 Solution Maf653 - Jan 2018Arfah Hanum II0% (1)

- Suggested Solution Far 660 - Special August 2017Document6 pagesSuggested Solution Far 660 - Special August 2017Nur ShahiraNo ratings yet

- Solution Financial Management Nov 2010Document5 pagesSolution Financial Management Nov 2010samuel_dwumfourNo ratings yet

- SFM Compiler 4th Edition Volume 1Document329 pagesSFM Compiler 4th Edition Volume 1Pooja MakhijaniNo ratings yet

- Ratio Solutions 1Document18 pagesRatio Solutions 1Kani Utsini DimaNo ratings yet

- Tugas Kel Menkeu 2 Deadline Sabtu 30 Jul 2022Document10 pagesTugas Kel Menkeu 2 Deadline Sabtu 30 Jul 2022Siska TriandriyaniNo ratings yet

- Chapter 17 - Short-Term Credit For Financiang Current AssetsDocument12 pagesChapter 17 - Short-Term Credit For Financiang Current Assetslou-92450% (4)

- Types of Ratio Calculation IADocument2 pagesTypes of Ratio Calculation IANur AthirahNo ratings yet

- Futures ExcercisesDocument5 pagesFutures ExcercisesZain Ahmad KhanNo ratings yet

- C 10: T T Q: Hapter HE Money Market Extbook UestionsDocument6 pagesC 10: T T Q: Hapter HE Money Market Extbook UestionsMalinga LungaNo ratings yet

- 3-Ifn3 031210073 Assignment2Document9 pages3-Ifn3 031210073 Assignment2May MsNo ratings yet

- Chapter 6-Receivables-Additional Concepts: Carrying Amount 148,000Document2 pagesChapter 6-Receivables-Additional Concepts: Carrying Amount 148,000Monica MonicaNo ratings yet

- Ca Final SFM Super 100 Class 6 To 10 1Document32 pagesCa Final SFM Super 100 Class 6 To 10 1Deepsikha maitiNo ratings yet

- Chapter 17 - Answer - noPWDocument13 pagesChapter 17 - Answer - noPWNami TsuruokaNo ratings yet

- Chapter 5 Decision TheoryDocument43 pagesChapter 5 Decision TheoryTamiru BeyeneNo ratings yet

- Financial Analysis Nestle Malaysia Berhad For The Year 2019 A) Liquidity RatiosDocument13 pagesFinancial Analysis Nestle Malaysia Berhad For The Year 2019 A) Liquidity RatiosRawan NaderNo ratings yet

- Risk-Adjusted Lending Conditions: An Option Pricing ApproachFrom EverandRisk-Adjusted Lending Conditions: An Option Pricing ApproachNo ratings yet

- Road Map to Developing a Regional Risk Transfer Facility for CARECFrom EverandRoad Map to Developing a Regional Risk Transfer Facility for CARECNo ratings yet

- Project Management: Achieving Project Bottom-Line Succe$$From EverandProject Management: Achieving Project Bottom-Line Succe$$No ratings yet

- Bookkeeping NCIII Reviewer PDFDocument33 pagesBookkeeping NCIII Reviewer PDFChona BontigaoNo ratings yet

- Chap018 Management FinanciarDocument49 pagesChap018 Management FinanciaralkazumNo ratings yet

- IAS 41 Agriculture Sets Out The Accounting For Agricultural ActivityDocument3 pagesIAS 41 Agriculture Sets Out The Accounting For Agricultural ActivityZes ONo ratings yet

- Business Plan Report of Nari SringarDocument31 pagesBusiness Plan Report of Nari SringarAakriti SapkotaNo ratings yet

- DutchDocument28 pagesDutchSazidul Islam PrantikNo ratings yet

- 2022 Ebmv301 TM2 MemoDocument7 pages2022 Ebmv301 TM2 MemoSouthNo ratings yet

- COL Guide - How Stock Index Funds Can Help You Start Investing PDFDocument4 pagesCOL Guide - How Stock Index Funds Can Help You Start Investing PDFjohn ford ignaligNo ratings yet

- Brooks Financial Mgmt14 PPT Ch02Document37 pagesBrooks Financial Mgmt14 PPT Ch02Asylkhan NursultanNo ratings yet

- Market Maker SEBI GuidelineDocument3 pagesMarket Maker SEBI GuidelinerajendrachotiaNo ratings yet

- HW 1Document3 pagesHW 1chrislmcNo ratings yet

- Unilever Pakistan Limited Annual Report 2015 Tcm1267 479876 enDocument71 pagesUnilever Pakistan Limited Annual Report 2015 Tcm1267 479876 enHaris ButtNo ratings yet

- Chapter 7 Primer On Cash Flow ValuationDocument37 pagesChapter 7 Primer On Cash Flow ValuationK60 Phạm Thị Phương AnhNo ratings yet

- Key Features of A Company 1. Artificial PersonDocument19 pagesKey Features of A Company 1. Artificial PersonVijayaragavan MNo ratings yet

- CF AGE SM Ch17Document10 pagesCF AGE SM Ch17SK (아얀)No ratings yet

- Quiz Black Scholes ModelDocument3 pagesQuiz Black Scholes ModelMark AdrianNo ratings yet

- The New Option Secret - Volatility - David L. CaplanDocument354 pagesThe New Option Secret - Volatility - David L. CaplanSybil Azur100% (1)

- Daily Market Analysis & ChecklistDocument1 pageDaily Market Analysis & ChecklistAkash BiswalNo ratings yet

- Ques 1Document2 pagesQues 1Renuka SharmaNo ratings yet

- HFF Hedge FundsDocument34 pagesHFF Hedge Fundsaba3abaNo ratings yet

- BDM of 12.10.2015 - Buyback Program, Sell Up and PayoutDocument5 pagesBDM of 12.10.2015 - Buyback Program, Sell Up and PayoutBVMF_RINo ratings yet

- Ross FCF 9ce Chapter 10Document35 pagesRoss FCF 9ce Chapter 10Kevin WroblewskiNo ratings yet

- Financial LeverageDocument22 pagesFinancial LeverageDenyiel YambaoNo ratings yet

- Retained EarningsDocument2 pagesRetained EarningsNoel Alberto OmandapNo ratings yet

- Supported Fields in The Ticket Min DerDocument3 pagesSupported Fields in The Ticket Min Dermanny_calaveraNo ratings yet

- External Sources of FinanceDocument18 pagesExternal Sources of FinanceMonika ThakurNo ratings yet

- Treasury Bills, Bonds & NotesDocument23 pagesTreasury Bills, Bonds & NotesEd Leen ÜNo ratings yet