Professional Documents

Culture Documents

FBE 421 Spring 2023 - Module 5A

Uploaded by

Nima Attar0 ratings0% found this document useful (0 votes)

6 views6 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views6 pagesFBE 421 Spring 2023 - Module 5A

Uploaded by

Nima AttarCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

Financial Analysis & Valuation

Assessing the Quality of Earnings

(and remaining items)

FBE 421 – Scott Abrams – Spring 2023

42

Techniques for Financial Analysis

Financial health

Common size financial statements

Ratio Analysis

Analysis of the statement of cash flows

Off balance-sheet exposure

Performance Evaluation

ROE and the DuPont analysis

ROIC

FCF vs. Earnings

Analysis of revenue growth

Risk analysis

Quality of management

FBE 421 – Scott Abrams – Spring 2023

43

Cash Flow is King (or is it earnings?)

Performance Evaluation

Ideally we want both CF and earnings, but earnings gets the emphasis

Equity Valuation

Both are used again, but CF gets the emphasis

FBE 421 – Scott Abrams – Spring 2023

44

Are Reported Earnings Important? How Do We

Assess the Quality of Earnings?

Firms create value by implementing projects that have positive NPV

Managerial decision making is complicated by near-term earnings and performance

pressures. It is not unusual for managers to pass up positive-NPV investments that would

temporarily reduce their firm’s earnings

“You can’t grow long-term if you can’t eat short-term.” - Jack Welch, former long-time CEO

of GE

Short-term earnings goals may incorrectly influence investment decisions

Managers take their firm’s earnings numbers very seriously and are aware of how a major

investment influences their reported earnings in the short run as well as the long run.

Cash flows of an investment are almost never evenly distributed over the life of a project.

The quality of earnings can be assessed by the degree to which a firm’s accounting profit

has support in cash flow (ratio of cash flow from operating activities to net income)

FBE 421 – Scott Abrams – Spring 2023

45

Earnings Manipulation

A careful analysis of a firm’s financial statements can also help uncover

evidence of earnings manipulation by the firm’s management.

Earnings are sometimes manipulated by managers to paint a rosier picture of

firm performance.

In some instances, the manipulation is simply designed to smooth out reported

earnings, while in others it is designed to fraudulently disguise the firm’s true

performance.

100 straight quarters of rising earnings per share at General Electric (GE) under the

leadership of CEO Jack Welch

Worldcom’s earning manipulation through capitalizing costs that should have been

expensed in the current period

FBE 421 – Scott Abrams – Spring 2023

46

Can we rely on current earnings as a good

predictor of future earnings?

Check for areas of accounting flexibility

revenue recognition, expense recognition, inventories, PP&E, goodwill

The firm’s particular circumstances?

Material non-recurring gains and losses?

Material changes in receivables and inventory?

Major differences between CFO and net income?

Change in gross margins?

Changes in other expense relationships?

Discretionary cash expenditures slowed down?

FBE 421 – Scott Abrams – Spring 2023

47

Can we rely on current earnings as a good

predictor of future earnings?

Is the firm capitalizing items that are normally expensed by other firms in the

industry?

Material risks, uncertainties or contingencies that might negatively affect future

earnings?

Non-standard audit report?

Unusual pattern in segment numbers? In quarter-to quarter numbers?

Are the firm’s sales dependent on a single customer? Are its costs dependent on a

relationship with a single supplier?

Sales backlog?

Payables building up? Debt building up?

FBE 421 – Scott Abrams – Spring 2023

48

Tricks management can use to distort financial

performance

Overstating revenues

Understating operating costs

Misuse of restructuring charges

Selective triggering of one-time gains

Hiding debt

Changing accounting estimates

FBE 421 – Scott Abrams – Spring 2023

49

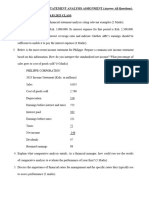

Example ~ using restructuring costs to smooth

earnings

Year 1 2 3 4

Cash flow from operations

before cash paid for restructuring 1.0 1.2 5.0 0.3

Less: cash paid for

restructuring ‐ ‐ ‐ (2.0)

CFO 1.0 1.2 5.0 (1.7)

Restructuring costs accrual (balance) ‐ ‐ (3.5) 3.5

Net income 1.0 1.2 1.5 1.8

FBE 421 – Scott Abrams – Spring 2023

50

Earnings & Accounting Manipulation ~

Notable cases:

Waste Management (1998): reported fake earnings of $1.7B by manipulating

depreciation

Enron (2001): kept debt off the balance sheet

Worldcom (2002): $3.8B in fraud; capitalized expenditures that should have been

expensed, inflated revenues with fake accounting entries

FBE 421 – Scott Abrams – Spring 2023

53

Analysis of Growth

Increasing market share

Raising prices

Selling new products or services

Acquiring another company

Favorable currency effects

Accounting change

FBE 421 – Scott Abrams – Spring 2023

54

Assess the Quality of Management

Overview Turnover

Character Strategy

Experience Candor in Disclosures

FBE 421 – Scott Abrams – Spring 2023

55

You might also like

- FBE 529 Spring 2020 Lecture 5 PDFDocument16 pagesFBE 529 Spring 2020 Lecture 5 PDFJIAYUN SHENNo ratings yet

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsFrom EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsNo ratings yet

- Facebook Inc. (FB) : 2 - AttractiveDocument6 pagesFacebook Inc. (FB) : 2 - AttractiveCarlos TresemeNo ratings yet

- BBM 314 Assignment - Feb 2024Document1 pageBBM 314 Assignment - Feb 2024stacyrockie2030No ratings yet

- Q1 2023 Earnings Presentation - FINALDocument10 pagesQ1 2023 Earnings Presentation - FINALChinnakannan ENo ratings yet

- First Solar, Inc. (FSLR) : 3 - NeutralDocument6 pagesFirst Solar, Inc. (FSLR) : 3 - NeutralCarlos TresemeNo ratings yet

- Advanced Accounting 6th Edition Jeter Solutions ManualDocument35 pagesAdvanced Accounting 6th Edition Jeter Solutions Manuallanguor.shete0wkzrt100% (21)

- Acc Gr12 June 2009 Answer Sheets BlankDocument18 pagesAcc Gr12 June 2009 Answer Sheets BlankSam ChristieNo ratings yet

- Advanced Accounting 6th Edition Jeter Solutions Manual PDFDocument24 pagesAdvanced Accounting 6th Edition Jeter Solutions Manual PDFHeni Fernandes FransiskaNo ratings yet

- Objective: Frs3 Reporting Financial PerformanceDocument34 pagesObjective: Frs3 Reporting Financial PerformanceeugeneNo ratings yet

- 05 Ratios and Trend AnalysisDocument11 pages05 Ratios and Trend AnalysisHaris IshaqNo ratings yet

- AA vs BB Financial AnalysisDocument4 pagesAA vs BB Financial AnalysisYogirajsinh GohilNo ratings yet

- DCF-Valuation-Course-Notes-365-Financial-AnalystDocument12 pagesDCF-Valuation-Course-Notes-365-Financial-AnalystArice BertrandNo ratings yet

- Basic AccountingDocument25 pagesBasic Accountingmohammed irfanNo ratings yet

- 1.financial Statment InterpretaionDocument7 pages1.financial Statment InterpretaionRana Ammar waheedNo ratings yet

- Noer Rachmadhani H - 1810523011 - Week 10 AssignmentDocument9 pagesNoer Rachmadhani H - 1810523011 - Week 10 AssignmentSajakul SornNo ratings yet

- Q4 2022 Earnings Presentation FINAL 2.6.23 2pm v4Document11 pagesQ4 2022 Earnings Presentation FINAL 2.6.23 2pm v4Chinnakannan ENo ratings yet

- Earnings Per Share and DividendsDocument29 pagesEarnings Per Share and DividendsAbdullah KhalidNo ratings yet

- Annual Report - 16-17 PDFDocument124 pagesAnnual Report - 16-17 PDFCipitz0% (1)

- AOL TW DCF ValuationDocument3 pagesAOL TW DCF ValuationShubham SharmaNo ratings yet

- Performance Measurement: OutlineDocument17 pagesPerformance Measurement: OutlineLưu Hồng Hạnh 4KT-20ACNNo ratings yet

- Business Analysis and Valuation 3 4Document23 pagesBusiness Analysis and Valuation 3 4Budi Yuda PrawiraNo ratings yet

- Rating Update For Apple Inc: Stock Downgraded To Above Average From GoodDocument3 pagesRating Update For Apple Inc: Stock Downgraded To Above Average From Gooda pNo ratings yet

- Annual Report 2020 21Document213 pagesAnnual Report 2020 21AATMIK SHARMANo ratings yet

- Financial Analysis & Valuation Cash Flow Statement GuideDocument20 pagesFinancial Analysis & Valuation Cash Flow Statement GuideNima AttarNo ratings yet

- Q2 FY23 Performance ReviewDocument48 pagesQ2 FY23 Performance ReviewDennis AngNo ratings yet

- Options As A Strategic Investment PDFDocument5 pagesOptions As A Strategic Investment PDFArjun Bora100% (1)

- TMA Guide for Advanced Accounting ConceptsDocument5 pagesTMA Guide for Advanced Accounting ConceptsF190962 Muhammad Hammad KhizerNo ratings yet

- Management Compensation-Group 9 EditDocument25 pagesManagement Compensation-Group 9 EditBeto SiahaanNo ratings yet

- Ccba Finance WayDocument12 pagesCcba Finance WayTehone TeketelewNo ratings yet

- Interpretation of Financial Statements & Ratio AnalysisDocument35 pagesInterpretation of Financial Statements & Ratio Analysisamitsinghslideshare50% (2)

- Cash Flow ExcelDocument8 pagesCash Flow Excelkaushal talukderNo ratings yet

- Bab 9 AkmDocument44 pagesBab 9 Akmcaesara geniza ghildaNo ratings yet

- Market Multiple Valuation Models-Mod - 4Document20 pagesMarket Multiple Valuation Models-Mod - 4Ravichandran RamadassNo ratings yet

- Financial Reporting Conceptual Framework Reading MaterialDocument5 pagesFinancial Reporting Conceptual Framework Reading MaterialAmbarish ChatterjeeNo ratings yet

- Accounts-Annual Report-Group 7 20231030 102533 0000Document63 pagesAccounts-Annual Report-Group 7 20231030 102533 0000Akshar VekariyaNo ratings yet

- Q1 FY23 Performance ReviewDocument49 pagesQ1 FY23 Performance ReviewDennis AngNo ratings yet

- F2 May 2011 PEGDocument10 pagesF2 May 2011 PEGForeign GraduateNo ratings yet

- The Analysis of The Statement of Shareholders'EquityDocument24 pagesThe Analysis of The Statement of Shareholders'EquityShihab HasanNo ratings yet

- Cases Topic 1 2021 Intl Fin RepDocument10 pagesCases Topic 1 2021 Intl Fin Repyingqiao.panNo ratings yet

- Financial Modelling Bootcamp Part 2: Modelling December 2022Document17 pagesFinancial Modelling Bootcamp Part 2: Modelling December 2022Darren WongNo ratings yet

- 1.2.1 Financial Performance RatiosDocument135 pages1.2.1 Financial Performance RatiosGary ANo ratings yet

- Franchisee'S Ratio Analysis: Ratio Formula Year Ended 2019 2020 2021 2022 2023 Profitability RatiosDocument3 pagesFranchisee'S Ratio Analysis: Ratio Formula Year Ended 2019 2020 2021 2022 2023 Profitability RatiosDonna BatoNo ratings yet

- H05. Statement of Changes in EquityDocument3 pagesH05. Statement of Changes in EquityMaryrose SumulongNo ratings yet

- Financials VTL - Merged - RemovedDocument15 pagesFinancials VTL - Merged - Removedmuhammadasif961No ratings yet

- Building A High Performanc E Culture at IdfcDocument11 pagesBuilding A High Performanc E Culture at IdfcDipanjan SenguptaNo ratings yet

- Goodwill Webcast Slides EnglishDocument17 pagesGoodwill Webcast Slides EnglishAngel ONo ratings yet

- Unit 2 - Practical Case Class 4. Esmaca SaDocument3 pagesUnit 2 - Practical Case Class 4. Esmaca SaScribdTranslationsNo ratings yet

- 4-Ch 4 - IFRS-wDocument19 pages4-Ch 4 - IFRS-wFAEETNo ratings yet

- Financial PlanningDocument10 pagesFinancial PlanningMuhammad Abbas SandhuNo ratings yet

- 3.5 Assignment Mini Case StudyDocument8 pages3.5 Assignment Mini Case StudyStudy BuddiesNo ratings yet

- Financial Report for CEO-AmazonDocument7 pagesFinancial Report for CEO-AmazonMaina PeterNo ratings yet

- AR21 Financial Report CompensationDocument34 pagesAR21 Financial Report CompensationOlya DanyloNo ratings yet

- Multi Subject Assessment SummaryDocument16 pagesMulti Subject Assessment SummaryRSM PakistanNo ratings yet

- KB Financial Group 2023 - 1Q - FactbookDocument67 pagesKB Financial Group 2023 - 1Q - FactbookscheenouraNo ratings yet

- Assignment Brief APDocument4 pagesAssignment Brief APmudassar saeed100% (1)

- Presentation of FS & Its' AuditingDocument27 pagesPresentation of FS & Its' AuditingTeamAudit Runner GroupNo ratings yet

- Business Restructuring Led To Negativity Profitability: Result UpdateDocument8 pagesBusiness Restructuring Led To Negativity Profitability: Result UpdateraguramrNo ratings yet

- Introduction To Financial Statement Analysis: by Prof Arun Kumar Agarwal, ACA, ACS IBS, GurgaonDocument13 pagesIntroduction To Financial Statement Analysis: by Prof Arun Kumar Agarwal, ACA, ACS IBS, GurgaonPRACHI DASNo ratings yet

- BUAD425 Lab (AB Testing) QuestionsDocument3 pagesBUAD425 Lab (AB Testing) QuestionsNima AttarNo ratings yet

- Point72 ApplicationDocument2 pagesPoint72 ApplicationNima AttarNo ratings yet

- Financial Analysis & Valuation Cash Flow Statement GuideDocument20 pagesFinancial Analysis & Valuation Cash Flow Statement GuideNima AttarNo ratings yet

- FJ Labs Investment MemoDocument2 pagesFJ Labs Investment MemoNima AttarNo ratings yet

- 1 - Experience CriteriaDocument23 pages1 - Experience CriteriaMandeep PruthiNo ratings yet

- Phar MoreDocument25 pagesPhar MoreAlexandrei OrioNo ratings yet

- Wirecardinfo 109Document19 pagesWirecardinfo 109Silver Snow WolfNo ratings yet

- CV Asma PicDocument3 pagesCV Asma PicjointariqaslamNo ratings yet

- How To Report Income Tax and Why Is It So ImportantDocument10 pagesHow To Report Income Tax and Why Is It So ImportantBerliana CristinNo ratings yet

- Assignment Energy ManagementDocument2 pagesAssignment Energy ManagementNabilahJasmi0% (1)

- PCW Transfer PricingDocument269 pagesPCW Transfer PricingThiago Pereira da Silva100% (1)

- Declaration and Table of ContentDocument6 pagesDeclaration and Table of Contentsamuel debebeNo ratings yet

- Dwnload Full Information Technology Auditing 3rd Edition Hall Test Bank PDFDocument35 pagesDwnload Full Information Technology Auditing 3rd Edition Hall Test Bank PDFalexanderstec100% (8)

- COA Employee Handbook GuideDocument85 pagesCOA Employee Handbook GuideBilly Nortyu73% (11)

- Generally Accepted Auditing StandardsDocument3 pagesGenerally Accepted Auditing StandardsISHIEYVONNE DELOSSANTOSNo ratings yet

- VA Logistics Assistant SC5, MogadishuDocument2 pagesVA Logistics Assistant SC5, MogadishuAbdiNo ratings yet

- Blake MorrisonDocument4 pagesBlake MorrisonAnonymous jF8rU5No ratings yet

- The Impactof Record Keeping Onthe Performanceof Selected Smalland MediumDocument14 pagesThe Impactof Record Keeping Onthe Performanceof Selected Smalland MediumMila MercadoNo ratings yet

- 1 DI144 2007-01-01 (Α) of 2012 for the Authorisation and Operating Conditions of CIFsDocument26 pages1 DI144 2007-01-01 (Α) of 2012 for the Authorisation and Operating Conditions of CIFsPetros JosephidesNo ratings yet

- EMS LA Activity WorkbookDocument75 pagesEMS LA Activity WorkbookArati Gupta100% (2)

- Accounting Question BanksDocument130 pagesAccounting Question BanksLinh Trần Khánh100% (1)

- Data Screening - StatWikiDocument6 pagesData Screening - StatWikiDaniel JCNo ratings yet

- Accounting PhaseDocument3 pagesAccounting PhaseFaithful FighterNo ratings yet

- ISO 22301 Gap Analysis Service Description v2Document5 pagesISO 22301 Gap Analysis Service Description v2fiorell@2009No ratings yet

- 6-GL and FR CycleDocument6 pages6-GL and FR Cyclehangbg2k3No ratings yet

- Principles of Financial Accounting 1Document6 pagesPrinciples of Financial Accounting 1Amonie ReidNo ratings yet

- CFAP SYLLABUS SUMMER 2023Document31 pagesCFAP SYLLABUS SUMMER 2023shajar-abbasNo ratings yet

- Chapter 2Document2 pagesChapter 2Jao FloresNo ratings yet

- CAG Report No. 8 of 2016-17Document85 pagesCAG Report No. 8 of 2016-17Ansu Kumar YadavNo ratings yet

- CAclubindia News - CSR - Auditors' Responsibility To Qualify in Audit ReportDocument2 pagesCAclubindia News - CSR - Auditors' Responsibility To Qualify in Audit ReportMahaveer DhelariyaNo ratings yet

- Managerial Accounting Chapter 1 Study GuideDocument26 pagesManagerial Accounting Chapter 1 Study GuideceilhynNo ratings yet

- Example Engagement Letter PDFDocument3 pagesExample Engagement Letter PDFCharmaigne Dela CruzNo ratings yet

- Summer Training ReportDocument42 pagesSummer Training ReportNitin KumarNo ratings yet

- Free Resumes Sample TemplateDocument12 pagesFree Resumes Sample Template19karim88100% (1)