Professional Documents

Culture Documents

Project finance EMBA assignment

Uploaded by

Ankit Singhal0 ratings0% found this document useful (0 votes)

1 views2 pagesPF

Original Title

Project Finance EMBA Global B10 Group Assignment guidelines (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPF

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views2 pagesProject finance EMBA assignment

Uploaded by

Ankit SinghalPF

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

PROJECT FINANCE EMBA GLOBAL B10

GROUP ASSIGNMENT

SUBMISSION DATE: Jan 28, 2023 in BB

1. According to you, what are the advantages of Cheniere’s current financing

approach for the Sabine Pass LNG liquefaction project?

Answer – Sabina Pass is subsidiary of Chenier and first facility that can export

as well as import LNG. We can identify Chenier’s financing approach and its

advantages as below –

1) In June 2010, Cheniere changed strategy & announced building LNG

liquefaction plant near Sabine Pass as well as converting facility into bi-

directional operations.

2) Cheniere came up with the strategy by entering into fixed price 20-year

purchase agreements (SPAs) with 4 customers covering an 16.0 mmtpa

for train 1 – 4 and commencing date of 1st delivery. Under this

agreement, all SPAs will pay fixed part of fee regardless of gas ever

produced or not that added $2.3 billion.

3) Cheniere-owned project company Sabine Liquefaction, secured US

Department of Energy approval to export up to 16 mtpa of LNG “to all

countries with which trade is permissible.” The approval was the first of

its kind and rendered Sabine Pass the first LNG export facility to be built

in the US.

4) Total cost to build Trains 1 to 4 were $9 to $10 billion before financing

and with financing it was $12 to $13 billion. Initially Cheniere Energy

Partners secured $2 billion in project equity for 1st 2 trains from two

sources. Cheniere invested $500 millions by purchasing shares in

subsidiary Sabine & rest of funds were financed by selling equities to

Singapore state investment firm Temasek & Asia based private equity

firm RRJ capital. Rest of equity arrives later in 2012 by Blackstone Group

LP and China investment bank (a state-owned firm purchased $1.5

billion worth of shares). The involvement of Blackstone was a positive

step in the market’s perception of the project and was a factor in helping

secure the debt piece of the financing.

5) Company followed aggressive funding strategy by securing loans &

building Trains from 1 to 4. As soon they get loan they complete

construction & remaining part of fund was secured via high yield bonds

or secured notes. These notes were also rated well. By 2013, all of

Sabrine Pass Liquefaction issues performed well trading above the

market rate that is coupled with robust high yield bond market & derth

of bonds in market.

6) Cheniere kept clause that contract with all 4 SPAs will be terminated on

any significant delay in construction of 1 - 4 Train facilities.

7) To save on construction costs, a Cheniere subsidiary, Sabine Pass

Liquefaction, LLC added liquefaction capacity to the site that already has

receiving terminals plus LNG storage and regasification equipment. This

approach creating infrastructure enabled Cheniere to mitigate the risk of

the Sabine Pass project thereby making it a more attractive proposition

for investors, lenders and government regulatory approval, a factor one

source described as “crucial to the project's successful close.”

2. Suppose you are a prospective investor,(E.g A Pension fund) planning to

invest in Bonds. Discuss the reasons for your investment/non-investment

of Cheniere’s latest May 2014 Sabine Pass Liquefaction bond issue? You

may highlight the drawbacks of the bond, for your non-investment

decision.

You might also like

- Ppptoolkit - Icrc.gov - NG-PPP Project Case StudiesDocument12 pagesPpptoolkit - Icrc.gov - NG-PPP Project Case StudiesPriyanka KumarNo ratings yet

- Constanino Project NameDocument4 pagesConstanino Project Namejo johnNo ratings yet

- Ras GasDocument17 pagesRas GasOm PrakashNo ratings yet

- Lecture - 1 - Introduction To International Project FinanceDocument75 pagesLecture - 1 - Introduction To International Project FinanceJoga RoxanaNo ratings yet

- Future Trends in LNG Project Finance - M FilippichDocument36 pagesFuture Trends in LNG Project Finance - M Filippichmichael_filippich2No ratings yet

- A) Staff RecommendationDocument24 pagesA) Staff RecommendationM-NCPPCNo ratings yet

- Freeport LNG Liquefaction Project: Macquarie CapitalDocument2 pagesFreeport LNG Liquefaction Project: Macquarie CapitalDaplet ChrisNo ratings yet

- Availability of Ship FinanceDocument2 pagesAvailability of Ship FinanceTaru SawhneyNo ratings yet

- Chad-Cameroon Oil Pipeline Project FinancingDocument13 pagesChad-Cameroon Oil Pipeline Project FinancingavijeetboparaiNo ratings yet

- EquateDocument6 pagesEquateAshutosh KumarNo ratings yet

- Hif Implementation and StructureDocument27 pagesHif Implementation and StructuremayorladNo ratings yet

- Project Appraisal and FinanceDocument14 pagesProject Appraisal and FinanceVicky NsNo ratings yet

- Cursul 1 - Introducere in Finantarea ProiectelorDocument27 pagesCursul 1 - Introducere in Finantarea ProiectelorAna-Maria IonescuNo ratings yet

- Case Study - ExpresswayDocument8 pagesCase Study - ExpresswayVNo ratings yet

- Report - Kakinada Deep Water PortDocument4 pagesReport - Kakinada Deep Water PortAnirban Mandal0% (1)

- Pf-1-Term 5-BKFSDocument31 pagesPf-1-Term 5-BKFSAasif KhanNo ratings yet

- PFI Article PLL Kochi LNG Case StudyDocument8 pagesPFI Article PLL Kochi LNG Case StudytmharishNo ratings yet

- HKDL Group 4Document16 pagesHKDL Group 4RAHUL DASNo ratings yet

- Case Project FinanceDocument9 pagesCase Project FinanceaamritaaNo ratings yet

- ALBA Pot Line 5 Expansion ProjectDocument9 pagesALBA Pot Line 5 Expansion ProjectRishi Bajaj100% (1)

- Canadian Power Market AnalysisDocument11 pagesCanadian Power Market AnalysisMuhammad ImranNo ratings yet

- Annexure Deal NoteDocument2 pagesAnnexure Deal Note7gs7gnc48tNo ratings yet

- New Haven Parking Garage Project Update September 2010Document2 pagesNew Haven Parking Garage Project Update September 2010Kwegyirba CroffieNo ratings yet

- 1 Pre Read For Introductions To Project FinancingDocument4 pages1 Pre Read For Introductions To Project FinancingChanchal MisraNo ratings yet

- Financing Strategies for Large LNG Export ProjectsDocument12 pagesFinancing Strategies for Large LNG Export ProjectsMegha BepariNo ratings yet

- Cheniere Energy, Inc.: Anatol Feygin Executive Vice President and Chief Commercial OfficerDocument16 pagesCheniere Energy, Inc.: Anatol Feygin Executive Vice President and Chief Commercial Officerben100% (1)

- Disclaimer Opinion (Attachment) - FinalDocument2 pagesDisclaimer Opinion (Attachment) - FinalFierDaus MfmmNo ratings yet

- Procurement Method in ConstructionDocument17 pagesProcurement Method in ConstructionwordssmithNo ratings yet

- A. Dept of Economic Affairs, Ministry of Finance, Govt of IndiaDocument5 pagesA. Dept of Economic Affairs, Ministry of Finance, Govt of IndiaaparajitatNo ratings yet

- Availability Payment - PortDocument11 pagesAvailability Payment - PortrachmanmuhammadariefNo ratings yet

- Brief On Jaipur Ph-Ii ProjectDocument2 pagesBrief On Jaipur Ph-Ii ProjectsawantNo ratings yet

- SIFTI - Revised 1Document7 pagesSIFTI - Revised 1Leilani JohnsonNo ratings yet

- Project Financing: Chapter One: Araffy Meidy Rizky 13409001 Annisa Shinantya 13409006 Muthia Astari 13409011Document24 pagesProject Financing: Chapter One: Araffy Meidy Rizky 13409001 Annisa Shinantya 13409006 Muthia Astari 13409011Neni BangunNo ratings yet

- EOI Land Based LNG Terminal April 20 2014Document3 pagesEOI Land Based LNG Terminal April 20 2014HOUELNo ratings yet

- April 17 Ask The Nwmo - Bilingual - MH2-WEBDocument1 pageApril 17 Ask The Nwmo - Bilingual - MH2-WEBNetNewsLedger.comNo ratings yet

- Chapter Four-Part Ii: Accounting For Governmental FundsDocument30 pagesChapter Four-Part Ii: Accounting For Governmental FundsabateNo ratings yet

- Primer On Project FinancingDocument2 pagesPrimer On Project FinancingShubh DixitNo ratings yet

- Laibin B Power ProjectDocument14 pagesLaibin B Power ProjectManka SrivastavaNo ratings yet

- Goldman v. Richmond (2019) Count 2 Documents: Consolidated Questions & ResponsesDocument122 pagesGoldman v. Richmond (2019) Count 2 Documents: Consolidated Questions & ResponsesActivate VirginiaNo ratings yet

- Development and Execution of First Offshore WO CampaignDocument8 pagesDevelopment and Execution of First Offshore WO CampaignAnthony BovellNo ratings yet

- Staff Report: SUBJECT: Funding Modification For Highway 101 Ellwood/Hollister Interchange Project, ColdDocument13 pagesStaff Report: SUBJECT: Funding Modification For Highway 101 Ellwood/Hollister Interchange Project, ColdmarcmcginnesNo ratings yet

- Epc Mode Vs PPP Mode For National HighwaysDocument3 pagesEpc Mode Vs PPP Mode For National HighwaysHimanshu Patel100% (1)

- Us$ 480 Million White Oil Pipeline Project: The Major Financing Being Arranged by A Consortium of Local BanksDocument2 pagesUs$ 480 Million White Oil Pipeline Project: The Major Financing Being Arranged by A Consortium of Local Bankszulfiqar haiderNo ratings yet

- Wall 288 E. Hastings BC HousingDocument18 pagesWall 288 E. Hastings BC HousingBob MackinNo ratings yet

- Ar Ticles: "State of The Ar T: An Analysis of Por Tfolio Power Project Financing,"Document6 pagesAr Ticles: "State of The Ar T: An Analysis of Por Tfolio Power Project Financing,"Sky walkingNo ratings yet

- OIG Response Letter Chairman Smith Summit 04-29-2016 (3) (2) (1) (1) (1) (1) - 2Document3 pagesOIG Response Letter Chairman Smith Summit 04-29-2016 (3) (2) (1) (1) (1) (1) - 2Bob BerwynNo ratings yet

- Ocean Carriers Capsize Vessel Investment AnalysisDocument5 pagesOcean Carriers Capsize Vessel Investment AnalysisflwgearNo ratings yet

- Blcok-3 MCO-7 Unit-3Document24 pagesBlcok-3 MCO-7 Unit-3Tushar SharmaNo ratings yet

- Investing in The Construction IndustryDocument8 pagesInvesting in The Construction IndustryJonathan SantiagoNo ratings yet

- DOTDPPPResponse2 5 19Document6 pagesDOTDPPPResponse2 5 19mcooperkplcNo ratings yet

- PM PROJECT FINANCINGDocument13 pagesPM PROJECT FINANCINGAnurag SinghNo ratings yet

- New Moran Nov. 15 ReportDocument51 pagesNew Moran Nov. 15 ReportvtburbNo ratings yet

- PAWCM PPT 3 - Principles of Project FinanceDocument44 pagesPAWCM PPT 3 - Principles of Project FinanceYashodhan JoshiNo ratings yet

- Project Finance: R Venkatesh Chief Manager & Faculty State Bank Academy GurgaonDocument54 pagesProject Finance: R Venkatesh Chief Manager & Faculty State Bank Academy GurgaontrikantNo ratings yet

- BIMBSec - Oil Gas News Flash 20120709Document3 pagesBIMBSec - Oil Gas News Flash 20120709Bimb SecNo ratings yet

- HAKAASTON road construction supplyDocument9 pagesHAKAASTON road construction supplyRiska Ilmii ImranNo ratings yet

- Philippines: Management of Contingent Liabilities Arising from Public-Private Partnership ProjectsFrom EverandPhilippines: Management of Contingent Liabilities Arising from Public-Private Partnership ProjectsNo ratings yet

- Future Carbon Fund: Delivering Co-Benefits for Sustainable DevelopmentFrom EverandFuture Carbon Fund: Delivering Co-Benefits for Sustainable DevelopmentNo ratings yet

- Guidelines for Wind Resource Assessment: Best Practices for Countries Initiating Wind DevelopmentFrom EverandGuidelines for Wind Resource Assessment: Best Practices for Countries Initiating Wind DevelopmentNo ratings yet

- Visa OpenRiskManagementDocument111 pagesVisa OpenRiskManagementIsyanul RiwaldiNo ratings yet

- Problems For CFA Level I: Accounting Income and Assets: The Accrual ConceptDocument8 pagesProblems For CFA Level I: Accounting Income and Assets: The Accrual ConceptSumbal ZafarNo ratings yet

- How To Value A CompanyDocument120 pagesHow To Value A CompanyAbhishek kushawahaNo ratings yet

- Merger Is A Voluntary Amalgamation of Two Firms On Roughly Equal Terms Into One New Legal EntityDocument6 pagesMerger Is A Voluntary Amalgamation of Two Firms On Roughly Equal Terms Into One New Legal EntityLawal Idris AdesholaNo ratings yet

- Work Sheet Computation of Income Under The Head "Capital Gains"Document4 pagesWork Sheet Computation of Income Under The Head "Capital Gains"Vishal SarkarNo ratings yet

- Op Risk MGTDocument64 pagesOp Risk MGTDrAkhilesh TripathiNo ratings yet

- SHE Answer KeyDocument29 pagesSHE Answer KeyTerence Jeff Tamondong100% (1)

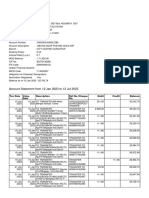

- Account Statement From 12 Jan 2023 To 12 Jul 2023Document10 pagesAccount Statement From 12 Jan 2023 To 12 Jul 2023SouravDeyNo ratings yet

- MYOB Sample QuestionsDocument10 pagesMYOB Sample QuestionsKay BMNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument2 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii83% (40)

- Submitted To: Ms Sukhwinder Kaur Submitted By: Megha Tah (T1901B46)Document34 pagesSubmitted To: Ms Sukhwinder Kaur Submitted By: Megha Tah (T1901B46)vijaybaliyanNo ratings yet

- China's Growing Online Interior Design Platform MarketDocument2 pagesChina's Growing Online Interior Design Platform MarketSon HaNo ratings yet

- Auto Car Insurance OnlineDocument11 pagesAuto Car Insurance OnlinetigervijayNo ratings yet

- De Minimis Benifit AssignmentDocument9 pagesDe Minimis Benifit AssignmentJoneric RamosNo ratings yet

- Finance and Treasury Centre Incentive: Singapore Economic Development Board ("EDB") WWW - Edb.gov - SGDocument2 pagesFinance and Treasury Centre Incentive: Singapore Economic Development Board ("EDB") WWW - Edb.gov - SGK58-ANH 2-KTDN NGUYỄN THỊ PHƯƠNG THẢONo ratings yet

- Cash JournalDocument7 pagesCash JournalASHOKA GOWDANo ratings yet

- Women's Financial Capabilities in Chiplun CityDocument7 pagesWomen's Financial Capabilities in Chiplun CityAnagha PranjapeNo ratings yet

- The Evolution of Accounting Theory and Its Role in SocietyDocument36 pagesThe Evolution of Accounting Theory and Its Role in SocietyAhmadYaseen100% (2)

- Financial Accounting 1: Chapter 2 Preparation of Journal, Ledger and Trail BalanceDocument21 pagesFinancial Accounting 1: Chapter 2 Preparation of Journal, Ledger and Trail BalanceCabdiraxmaan GeeldoonNo ratings yet

- Important Questions From CS Exam From Company Law Part-I Dec 2015Document25 pagesImportant Questions From CS Exam From Company Law Part-I Dec 2015shivani jindal100% (1)

- Igcse Maths Topical Questions - PercentagesDocument14 pagesIgcse Maths Topical Questions - PercentagesBhagwan KaurNo ratings yet

- Tiob SyllabusDocument134 pagesTiob SyllabusFred Raphael Ilomo83% (6)

- Ajanta PharmaDocument18 pagesAjanta Pharmaumesh.raoNo ratings yet

- Issue ManagementDocument30 pagesIssue Managementmohanbkp100% (2)

- CNX It IndexDocument13 pagesCNX It IndexHeather CurtisNo ratings yet

- Session 6 SlidesDocument24 pagesSession 6 SlidesJay AgrawalNo ratings yet

- Objectives of AuditingDocument22 pagesObjectives of AuditingArjun M JimmyNo ratings yet

- Acumen's Vision for the Future of Impact InvestingDocument51 pagesAcumen's Vision for the Future of Impact InvestingBassel HassanNo ratings yet

- Understanding Accounting Principles and GAAPDocument8 pagesUnderstanding Accounting Principles and GAAPNitish BatraNo ratings yet

- Ghassan George Ojeil: Financial Analysis/ReportingDocument2 pagesGhassan George Ojeil: Financial Analysis/ReportingElie DiabNo ratings yet