Professional Documents

Culture Documents

FM Bba Iii 1

Uploaded by

Nazif SamdaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM Bba Iii 1

Uploaded by

Nazif SamdaniCopyright:

Available Formats

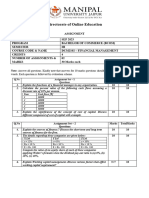

Roll No. ……………………….

RNB GLOBAL UNIVERSITY, BIKANER

BBA-III SEMESTER SESSIONAL EXAMINATION-II,OCTOBER 2021

11005200– FINANCIAL MANAGEMENT

Time: 90 Minutes Maximum Marks: 30

Instructions :

1) Write your roll no. on the top immediately on receipt of this question paper.

2) In Sec-A each question carries2 marks, attempt any 5 questions, answer theory questions in minimum 150

words.

3) In Sec-B each question carries 5 marks, attempt any two questions, answer in minimum 300 words.

4) In Sec-C, each question carries10 marks, attempt any one question, answer in minimum 650-700 words

Draw Charts/Diagrams/Figures/Flowcharts etc. Wherever applicable/possible.

5) Word Limit is not applicable for Numerical based Questions.

6) In case of over attempted questions, the answer with highest marks will be considered.

7) Write the word “END” at the finish of the last attempted answer & cross the remaining pages.

SECTION-A 10

Q.1 Illustrate the concept of average cost of capital with the help of an example?

Q.2 Briefly explain the importance of cost of equity capital?

Q.3 Why are the capital investments important?

Q.4 What is the relation between the payback period and the quality of project?

Q.5 XYZ & Co. issues 2,000 10% preference shares of Rs100 each at Rs 95 each. Calculate the cost of

preference shares.

Q.6 ABC Ltd plans to issue 1, 00,000 new equity share of Rs. 10 each at par. The floatation costs are

expected to be 5% of the share price. The company pays a dividend of Rs. 1 per share and the

growth rate in dividend is expected to be 5%. Compute the cost of new issue share.

SECTION-B 10

Q.7 A company issues 1, 00,000 12% preference share of Rs. 10 each. Calculate the cost of

preference capital if it is redeemable after 10 years.

a) At par b) at 10 % premium(2+3=5 Marks)

Q.8 A company issued 10,000, 15 % preference share of Rs. 10 each, Cost of issue is Rs. 1 per share.

Calculate cost of capital, of these shares are not issued (a) at par , (b) at 5% premium, and (c) at

8% discount.(1+2+2=5Marks)

Q.9 Briefly explain and illustrate the concept of time ‘value of money’.

BBA-III- Sessional Examination II – 2021-11005200 Page 1 of 2

SECTION-C 10

Q.10 Calculate the cost of weighted average cost of capital from the following information given

below:

Source of Funds Amount(Rs) After Tax cost %

Debt 4000000 4.5

Preference shares 2000000 9.0

Equity Shares 6000000 11.0

Retained Earnings 8000000 10.0

Q.11 Define the concept of capital budgeting. Discuss in detail with the help of examples non

discounted techniques of budgeting.(5+5=10 Marks)

BBA-III- Sessional Examination II – 2021-11005200 Page 2 of 2

You might also like

- Use of Statistical Tables PermittedDocument2 pagesUse of Statistical Tables PermittedPAVAN KUMARNo ratings yet

- Let's Practise: Maths Workbook Coursebook 6From EverandLet's Practise: Maths Workbook Coursebook 6No ratings yet

- BBA III-Banking Theory & Practices-QP IIDocument2 pagesBBA III-Banking Theory & Practices-QP IINazif SamdaniNo ratings yet

- FM PP 1 PDFDocument3 pagesFM PP 1 PDFRavichandraNo ratings yet

- Assignment_DCM2102_Financial Management_Bcom 3_Set-1 and 2_Sep 2023Document2 pagesAssignment_DCM2102_Financial Management_Bcom 3_Set-1 and 2_Sep 2023arinkalsotra19042003No ratings yet

- Advanced Financial Management Elective PaperDocument3 pagesAdvanced Financial Management Elective PaperRamakrishna NagarajaNo ratings yet

- BCOE - 143 E DoneDocument4 pagesBCOE - 143 E DoneAmit YadavNo ratings yet

- P1 Question December 2019Document7 pagesP1 Question December 2019S.M.A AwalNo ratings yet

- Bcoe-143 DoneDocument4 pagesBcoe-143 Donevaishnav v kunnathNo ratings yet

- PAF-KIET Aviation Finance Assignment 1Document2 pagesPAF-KIET Aviation Finance Assignment 1Rumaisa HamidNo ratings yet

- Assignment Set - 1 QuestionsDocument2 pagesAssignment Set - 1 QuestionsTushar AhujaNo ratings yet

- Bachelor of Commerce: Bcoc - 137: Corporate AccountingDocument4 pagesBachelor of Commerce: Bcoc - 137: Corporate Accountingsubhaa DasNo ratings yet

- ADL 13 Ver2+Document9 pagesADL 13 Ver2+DistPub eLearning Solution100% (1)

- MBA Advance Financial Management exam questionsDocument4 pagesMBA Advance Financial Management exam questionsNishaTripathiNo ratings yet

- Bcom 3rd Sem Assignments 2020 21Document14 pagesBcom 3rd Sem Assignments 2020 21mahamaamir60No ratings yet

- Bangladesh University exam questions on corporate financeDocument3 pagesBangladesh University exam questions on corporate financeRahman NiloyNo ratings yet

- UntitledDocument1 pageUntitledSaraswathy ArunachalamNo ratings yet

- MCS-035-Accountancy and Financial ManagementDocument5 pagesMCS-035-Accountancy and Financial ManagementShainoj KunhimonNo ratings yet

- CBU Distance Learning Exam Questions on Financial ManagementDocument9 pagesCBU Distance Learning Exam Questions on Financial ManagementMabvuto PhiriNo ratings yet

- DBA 320 Exam DecDocument12 pagesDBA 320 Exam DecMabvuto PhiriNo ratings yet

- Cost Accounting 2 Question PaperDocument6 pagesCost Accounting 2 Question PaperSajithaNo ratings yet

- P1.PROO - .L Question CMA September 2022 ExaminationDocument7 pagesP1.PROO - .L Question CMA September 2022 ExaminationS.M.A AwalNo ratings yet

- BCOC-131 Assignment 2020-21 (English)Document4 pagesBCOC-131 Assignment 2020-21 (English)Ankit KumarNo ratings yet

- P1 Question JUNE 2020Document6 pagesP1 Question JUNE 2020S.M.A AwalNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument8 pagesThis Paper Is Not To Be Removed From The Examination HallsPaul DavisNo ratings yet

- CUI Lahore Campus Spring 2020 Terminal Exam Process Economics QuestionsDocument2 pagesCUI Lahore Campus Spring 2020 Terminal Exam Process Economics QuestionsHashmi AshmalNo ratings yet

- 7ACCN018W - Exam May 2020 (MODIFIED 7 April 2020)Document11 pages7ACCN018W - Exam May 2020 (MODIFIED 7 April 2020)hazyhazy9977No ratings yet

- 7ACCN018W - Exam July 2020 (MODIFIED 19 MAY 2020)Document11 pages7ACCN018W - Exam July 2020 (MODIFIED 19 MAY 2020)hazyhazy9977No ratings yet

- Unit 2 Assignment Managing Financial Resources & Decisions SamDocument9 pagesUnit 2 Assignment Managing Financial Resources & Decisions SamBenNo ratings yet

- Assessment 1 October 2021 POCFDocument2 pagesAssessment 1 October 2021 POCFAakanksha ChughNo ratings yet

- 401 Epm QP NDDocument2 pages401 Epm QP NDvipul rathodNo ratings yet

- B.Com 2019-22 Semester – IV End Semester Examination, 2021 FIN203-02: Business FinanceDocument4 pagesB.Com 2019-22 Semester – IV End Semester Examination, 2021 FIN203-02: Business FinanceDeval DesaiNo ratings yet

- Mba202 - Financial ManagementDocument3 pagesMba202 - Financial ManagementArvind KNo ratings yet

- AssignmentsDocument7 pagesAssignmentspratikshakurhade04No ratings yet

- sFikv8tLO3DuTOB3I8bY--4762Document2 pagessFikv8tLO3DuTOB3I8bY--4762dipusharma4200No ratings yet

- MM ZG627 Ec-2r First Sem 2017-2018Document1 pageMM ZG627 Ec-2r First Sem 2017-2018UDAYAN BIPINKUMAR SHAHNo ratings yet

- FNCE10002 Principles of Finance Semester 2, 2019 Sample Final ExamDocument3 pagesFNCE10002 Principles of Finance Semester 2, 2019 Sample Final ExamC A.No ratings yet

- Imt 59Document3 pagesImt 59Prabhjeet Singh GillNo ratings yet

- Assignment: Approximately of 400 Words. Each Question Is Followed by Evaluation SchemeDocument2 pagesAssignment: Approximately of 400 Words. Each Question Is Followed by Evaluation SchemePuja KumariNo ratings yet

- Papc QP 3Document2 pagesPapc QP 3ಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- QP 2nd YearDocument13 pagesQP 2nd YearAmalsudheeshNo ratings yet

- Bfi 4301 Financial Management Paper 1Document10 pagesBfi 4301 Financial Management Paper 1Paul AtariNo ratings yet

- Finance Management PDFDocument3 pagesFinance Management PDFAnn HammondNo ratings yet

- Assignment 2 PDFDocument10 pagesAssignment 2 PDFvamshiNo ratings yet

- Assignment 2Document10 pagesAssignment 2নীল জোছনাNo ratings yet

- BCOC-137 Assignment 2021-22 (English)Document4 pagesBCOC-137 Assignment 2021-22 (English)mohit vermaNo ratings yet

- Faculty - Computer Sciences and Mathematic - 2022 - Session 1 - Degree - Asc637Document5 pagesFaculty - Computer Sciences and Mathematic - 2022 - Session 1 - Degree - Asc637Atifah RozlanNo ratings yet

- Exam I October 2021Document9 pagesExam I October 2021miguelNo ratings yet

- 5533-Financial AccountingDocument9 pages5533-Financial Accountingharoonsaeed12No ratings yet

- Assignment Drive SPRING 2015 Program Mba/ Mbads/ Mbaflex/ Mbahcsn3/ Pgdban2 Semester II Subject Code & Name MB0045 Financial Management BK Id B1628 Credits 4 Marks 60Document3 pagesAssignment Drive SPRING 2015 Program Mba/ Mbads/ Mbaflex/ Mbahcsn3/ Pgdban2 Semester II Subject Code & Name MB0045 Financial Management BK Id B1628 Credits 4 Marks 60SarlaJaiswalNo ratings yet

- Assignment Drive SPRING 2015 Program Mba/ Mbads/ Mbaflex/ Mbahcsn3/ Pgdban2 Semester II Subject Code & Name MB0045 Financial Management BK Id B1628 Credits 4 Marks 60Document3 pagesAssignment Drive SPRING 2015 Program Mba/ Mbads/ Mbaflex/ Mbahcsn3/ Pgdban2 Semester II Subject Code & Name MB0045 Financial Management BK Id B1628 Credits 4 Marks 60Raju PalanivelNo ratings yet

- Advanced Financial Management conceptsDocument4 pagesAdvanced Financial Management conceptsRamakrishna NagarajaNo ratings yet

- Postal Test Papers_P10_Intermediate_Syllabus 2012 Cost & Management Accountancy Test Paper—II/10/CMA/2012/T-1 ueDocument22 pagesPostal Test Papers_P10_Intermediate_Syllabus 2012 Cost & Management Accountancy Test Paper—II/10/CMA/2012/T-1 ueGajju ChautalaNo ratings yet

- 2012 Ii PDFDocument23 pages2012 Ii PDFMurari NayuduNo ratings yet

- Dr. Ambedkar Institute of Technology, Bangalore - 560 056Document3 pagesDr. Ambedkar Institute of Technology, Bangalore - 560 0561DA18EE013Gagana B.RNo ratings yet

- MBA Financial Management Assignment SolutionsDocument2 pagesMBA Financial Management Assignment SolutionsSujal SNo ratings yet

- Investment Appraisal Questions 2-1Document8 pagesInvestment Appraisal Questions 2-1Olajumoke SanusiNo ratings yet

- Transport Form 2021Document2 pagesTransport Form 2021Nazif SamdaniNo ratings yet

- Presentation Skills & Audience Analysis TipsDocument4 pagesPresentation Skills & Audience Analysis TipsNazif SamdaniNo ratings yet

- 01-03-21 Take Home Assignment 1Document1 page01-03-21 Take Home Assignment 1Nazif SamdaniNo ratings yet

- BBA I Financial Accounting 11007400Document2 pagesBBA I Financial Accounting 11007400Nazif SamdaniNo ratings yet

- BBA 3rd Sem. Business Law - Set 2Document2 pagesBBA 3rd Sem. Business Law - Set 2Nazif SamdaniNo ratings yet

- BBA II Ability Skill Enhancement Paper 2Document3 pagesBBA II Ability Skill Enhancement Paper 2Nazif SamdaniNo ratings yet

- 21-07-2022-Unit I-Introduction To Advertising-Meaning - Its Role and FunctionsDocument8 pages21-07-2022-Unit I-Introduction To Advertising-Meaning - Its Role and FunctionsNazif SamdaniNo ratings yet

- BBA 3rd Sem. Business Law - Set 2Document2 pagesBBA 3rd Sem. Business Law - Set 2Nazif SamdaniNo ratings yet

- Finals (3. LP) Termination and RepairDocument4 pagesFinals (3. LP) Termination and RepairAmelyn Goco MañosoNo ratings yet

- Speech and language disorders explainedDocument22 pagesSpeech and language disorders explainedJaren NadongNo ratings yet

- Friends discuss comedy and plan to see a comic showDocument2 pagesFriends discuss comedy and plan to see a comic showПолина НовикNo ratings yet

- English Reviewer Subject-Verb Agreement Exercise 1Document3 pagesEnglish Reviewer Subject-Verb Agreement Exercise 1Honeybel EmbeeNo ratings yet

- Intro To Rhetorical FunctionDocument28 pagesIntro To Rhetorical FunctiondianNo ratings yet

- Sinha-Dhanalakshmi2019 Article EvolutionOfRecommenderSystemOv PDFDocument20 pagesSinha-Dhanalakshmi2019 Article EvolutionOfRecommenderSystemOv PDFRui MatosNo ratings yet

- Chapter 22 Managing Personal Communications - Direct and Database Marketing and Personal SellingDocument17 pagesChapter 22 Managing Personal Communications - Direct and Database Marketing and Personal SellingBrian Duela100% (1)

- Post Graduate Medical (Government Quota) Course Session:2021 - 2022 List of Candidates Allotted On - 04.03.2022 (Round 2)Document104 pagesPost Graduate Medical (Government Quota) Course Session:2021 - 2022 List of Candidates Allotted On - 04.03.2022 (Round 2)Aravind RaviNo ratings yet

- Awareness on Waste Management of StudentsDocument48 pagesAwareness on Waste Management of StudentsJosenia Constantino87% (23)

- Client Hunting HandbookDocument105 pagesClient Hunting Handbookc__brown_3No ratings yet

- Protein Expression HandbookDocument118 pagesProtein Expression HandbookLuis Arístides Torres SánchezNo ratings yet

- Kantha PurDocument200 pagesKantha PurGayuNo ratings yet

- g10 Ntot Physics em SpectrumDocument50 pagesg10 Ntot Physics em Spectrumapi-283862617100% (5)

- Intellectual DisabilitiesDocument23 pagesIntellectual DisabilitiesKim SorianoNo ratings yet

- Fuellas Vs CadanoDocument4 pagesFuellas Vs CadanoMutyaAlmodienteCocjinNo ratings yet

- The Next Form of DemocracyDocument313 pagesThe Next Form of DemocracyVanderbilt University Press100% (2)

- GW and MM Firmware UpgradesDocument11 pagesGW and MM Firmware UpgradesRohit GuptaNo ratings yet

- Chronic Renal FailureDocument1 pageChronic Renal Failurejj_cuttingedges100% (2)

- Oblicon Chap 1 5Document15 pagesOblicon Chap 1 5Efrean BianesNo ratings yet

- ManpowerGroup Total Employment Management Solution PDFDocument1 pageManpowerGroup Total Employment Management Solution PDFAMERICO SANTIAGONo ratings yet

- JVC Mini DV and S-VHS Deck Instruction Sheet: I. Capturing FootageDocument3 pagesJVC Mini DV and S-VHS Deck Instruction Sheet: I. Capturing Footagecabonedu0340No ratings yet

- Zomer Development Company, Inc Vs Special 20th Division of CADocument20 pagesZomer Development Company, Inc Vs Special 20th Division of CACJNo ratings yet

- Latex Rubber Fetishcmmwv PDFDocument5 pagesLatex Rubber Fetishcmmwv PDFFetishLeggings57No ratings yet

- Global Maritime DSDocument1 pageGlobal Maritime DSAngga PurwantoNo ratings yet

- Tadimalla Bala ChaitanyaDocument4 pagesTadimalla Bala ChaitanyaTADIMALLA BALA CHAITANYANo ratings yet

- Hill Et Al 2013 Evol Hum BehavDocument8 pagesHill Et Al 2013 Evol Hum BehavMike WillieNo ratings yet

- Metro Concast Steel Corporation vs. Allied Bank CorporationDocument13 pagesMetro Concast Steel Corporation vs. Allied Bank CorporationGab CarasigNo ratings yet

- Humanistic & Behavioural Approches To Counseling: Lekshmi Priya.K.B 2 MSC Applied PsychologyDocument49 pagesHumanistic & Behavioural Approches To Counseling: Lekshmi Priya.K.B 2 MSC Applied PsychologyAnand ChoubeyNo ratings yet

- ?PMA 138,39,40,41LC Past Initials-1Document53 pages?PMA 138,39,40,41LC Past Initials-1Saqlain Ali Shah100% (1)

- Les Colorants Textiles Et Methodes de TraitementDocument31 pagesLes Colorants Textiles Et Methodes de TraitementFATIMA ZAHRA KANOUN ALAOUINo ratings yet